Ohio Documents

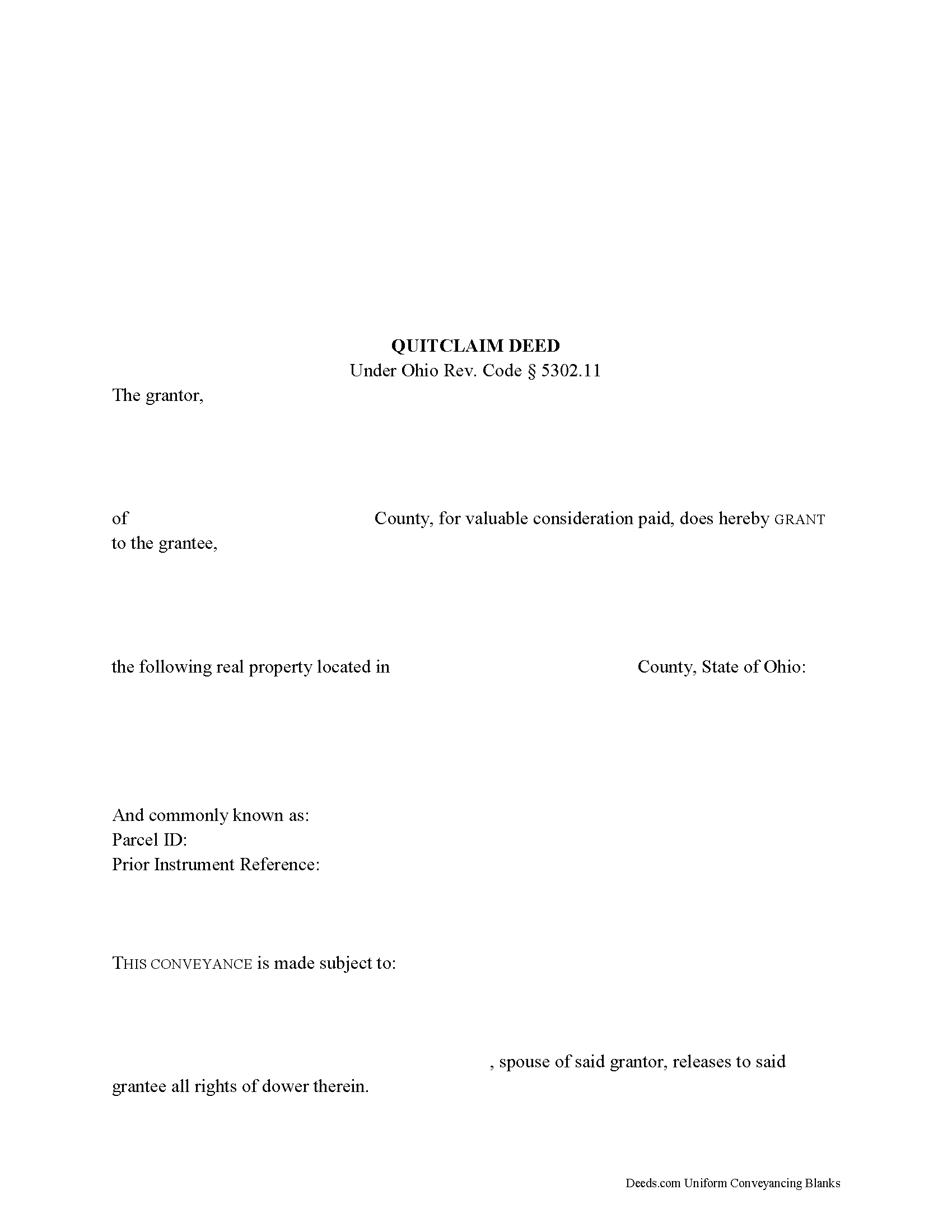

Quitclaim Deed

In Ohio, title to real property can be transferred from one party to another by executing a quitclaim deed. Quitclaim deeds are statutory in Ohio under Ohio Rev. Code Section 5302.11, and they convey all the right, title, and interest of the grantor to and in the property (Ohio Rev. Code Section 5302.11). This type of deed "simply conveys whatever interest exists when the deed is executed (transferred) and delivered," and does not guarantee that the grantor has "good title or ownership."

Quitclaim deeds offer no warranties of title and provide the least amount of protection for the grantee (buyer). Generally reserved for divorces, clearing titles, and transfers of property between family members, quitclaim deeds do not offer the same assurances as general warranty deeds, which convey real property with the most guarantees of title, or limited warranty deeds, which only contain a promise to defend the title against claims that arose during the time the grantor held title to the property.

In Ohio, a lawful quitclaim deed includes the grantor's full name, mailing address, and marital status; the statement "for valuable consideration paid"; and the grantee's full name, mailing ad... More Information about the Ohio Quitclaim Deed

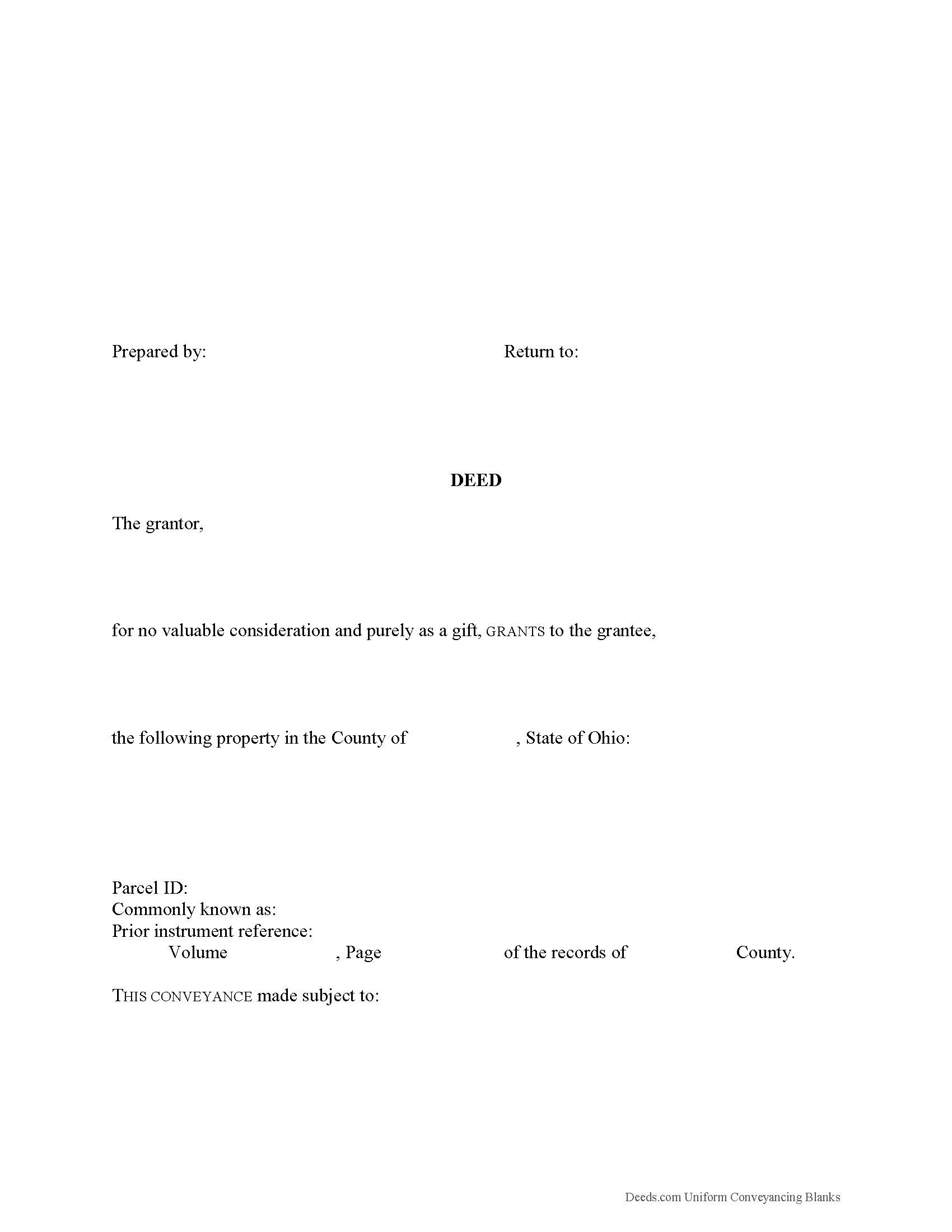

Gift Deed

Gifts of Real Property in Ohio

Gift deeds convey title to real property from one party to another with no exchange of consideration, monetary or otherwise. Often used to transfer property between family members or to gift property as a charitable act or donation, these conveyances occur during the grantor's lifetime. Gift deeds must contain language that explicitly states that no consideration is expected or required. Ambiguous language, or references to any type of consideration, can make the gift deed contestable in court.

A lawful gift deed includes the grantor's full name, marital status, and mailing address, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Ohio residential property, the primary methods for holding title are tenancy in common and survivorship tenancy. An estate conveyed to two or more people is considered a tenancy in common, unless a survivorship tenancy is declared (Ohio Rev. Code Section 5302.20(a)).

As with any conveyance of realty, a gift deed requires a complete legal d... More Information about the Ohio Gift Deed

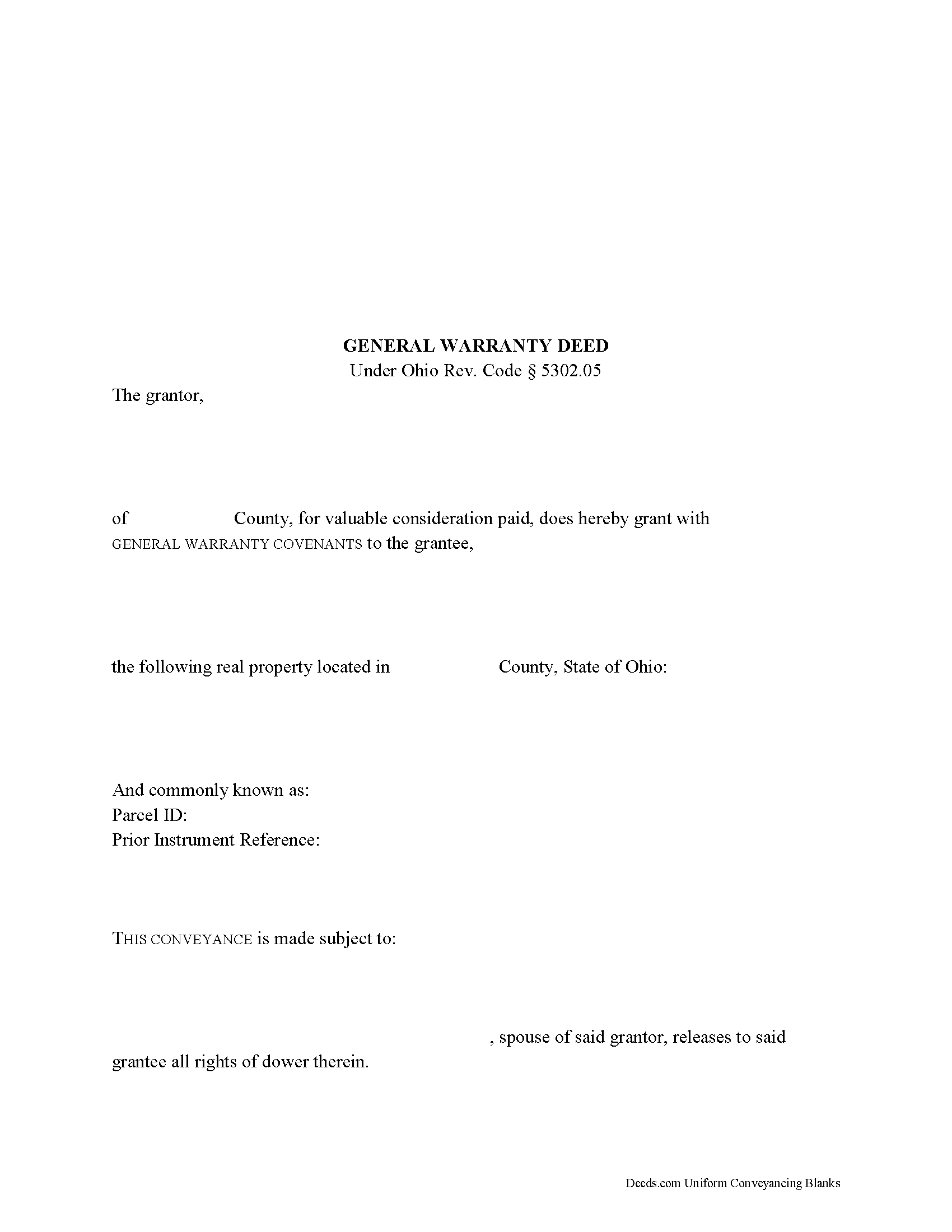

Warranty Deed

In Ohio, title to real property can be transferred from one party to another by executing a general warranty deed. A general warranty deed conveys fee simple interest in real property to the named grantee with the most assurance of title.

General warranty deeds are statutory in Ohio under Ohio Rev. Code Section 5302.05. When a deed is in this form and contains the specific language "with general warranty covenants," the implied covenants warrant that the grantor holds title to the property and has good right to convey it; that the property is free from encumbrances (with the exception of any noted in the deed); and that the grantor will defend the title against all lawful claims (Ohio Rev. Code Section 5302.05).

General warranty deeds offer the highest level of protection for grantees (buyers). This warranty of title is greater than that of a limited or special warranty deed, which guarantees the title only against claims that arose during the time the grantor held title to the property, or a quitclaim deed, which offers no warranties of title.

A lawful general warranty deed includes the grantor's full name, mailing address, and marital status; the statement "for valuabl... More Information about the Ohio Warranty Deed

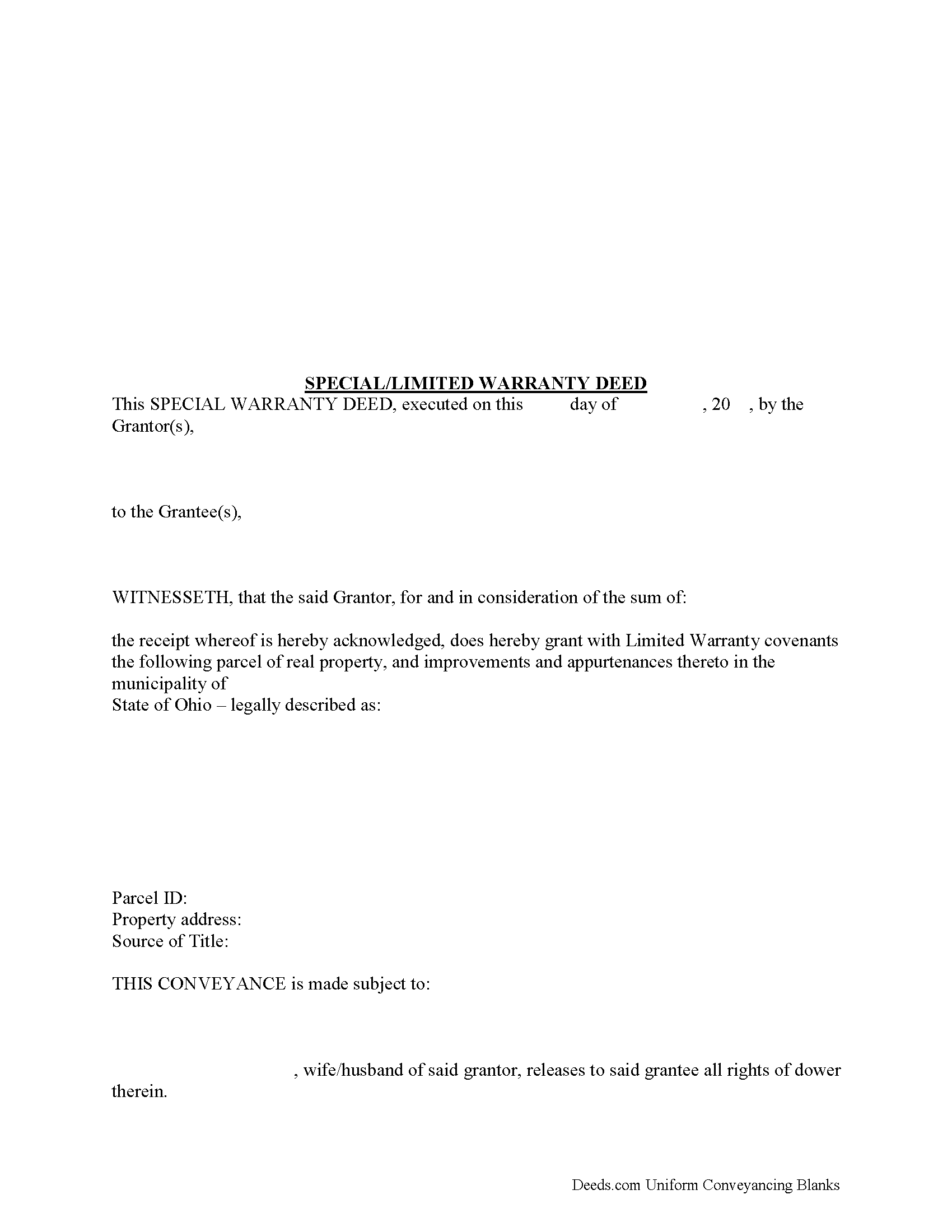

Special Warranty Deed

A limited warranty deed is a real estate deed in writing that can be used in Ohio to convey title to real property for both residential and commercial transactions. The grantor in a limited warranty deed covenants to the grantee that at the time of delivery of the deed, the premises were free from all encumbrances made by the grantor, and that the grantor warrants and will defend the same to the grantee against the lawful claims and demands of all persons claiming by, through, or under the grantor, but against none other. The statutory form for a limited warranty deed is offered in section 5302.07 of the Ohio Revised Code. This form is sufficient for a conveyance of real property with limited warranty; however, the use of the statutory form is not mandatory.

A limited warranty deed must be signed and acknowledged by the grantor in order to be presented for recordation. The signing should be acknowledged before a judge or clerk of a court of record in Ohio, a county auditor, county engineer, notary public, or mayor. The official taking acknowledgments should also certify such acknowledgments and subscribe their name to the certificate of acknowledgment (5301.01). All limited war... More Information about the Ohio Special Warranty Deed

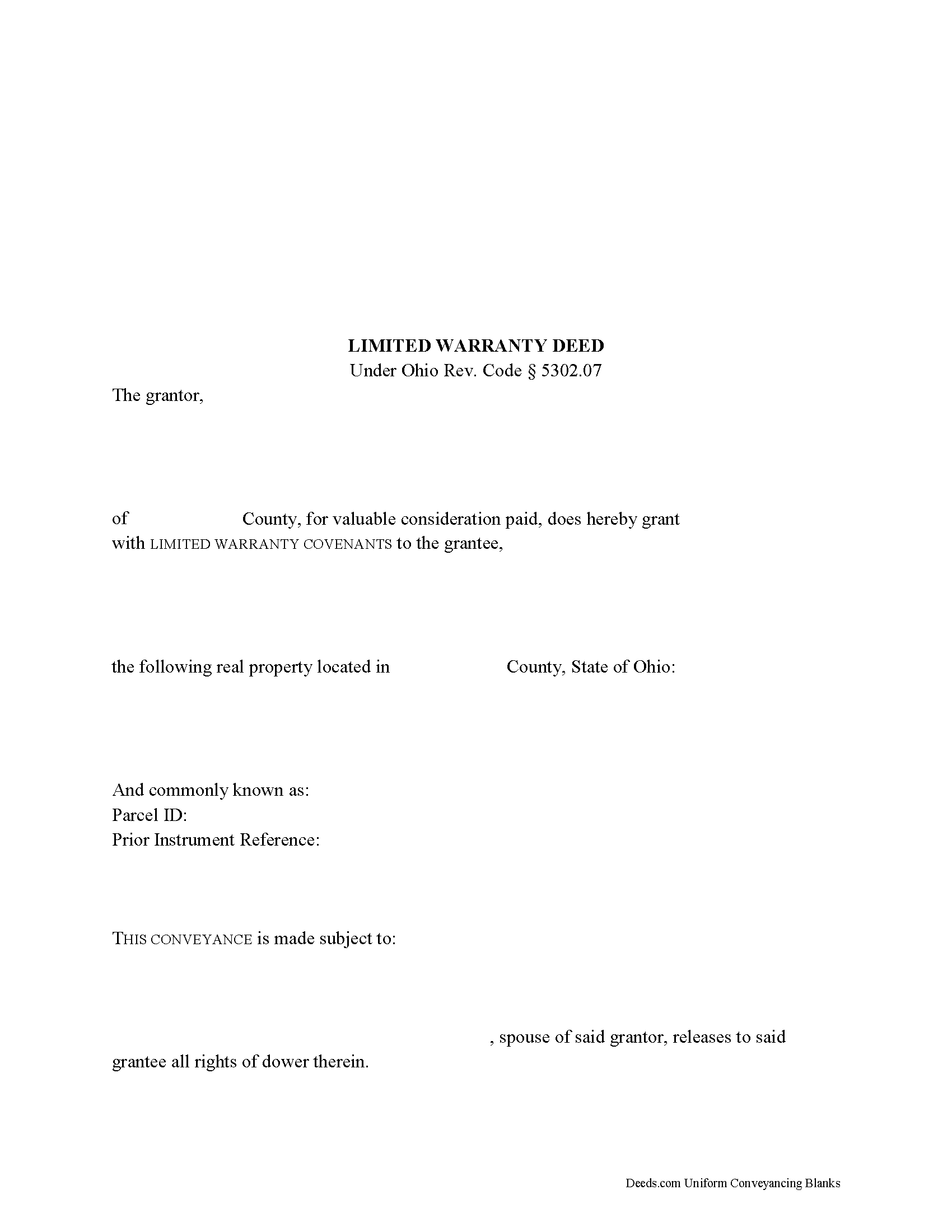

Limited Warranty Deed

In Ohio, title to real property can be transferred from one party to another by executing a limited warranty deed.

Limited warranty deeds are statutory in Ohio under Ohio Rev. Code Section 5302.07, and contain the implied covenants that the grantor holds title to the property and has good right to convey it; that the property is free from encumbrances "made by the grantor" during the time that he or she held title to the property (with the exception of any noted in the deed); and that the grantor will defend the title against "the lawful claims and demands of all persons claiming by, through, or under the grantor, but against none other" (Ohio Rev. Code Section 5302.07).

A lawful limited warranty deed includes the grantor's full name, mailing address, and marital status; the statement "for valuable consideration paid"; and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Ohio residential property, the primary methods for holding title are tenancy in common and survivorship tenancy. An estate conveyed to two o... More Information about the Ohio Limited Warranty Deed

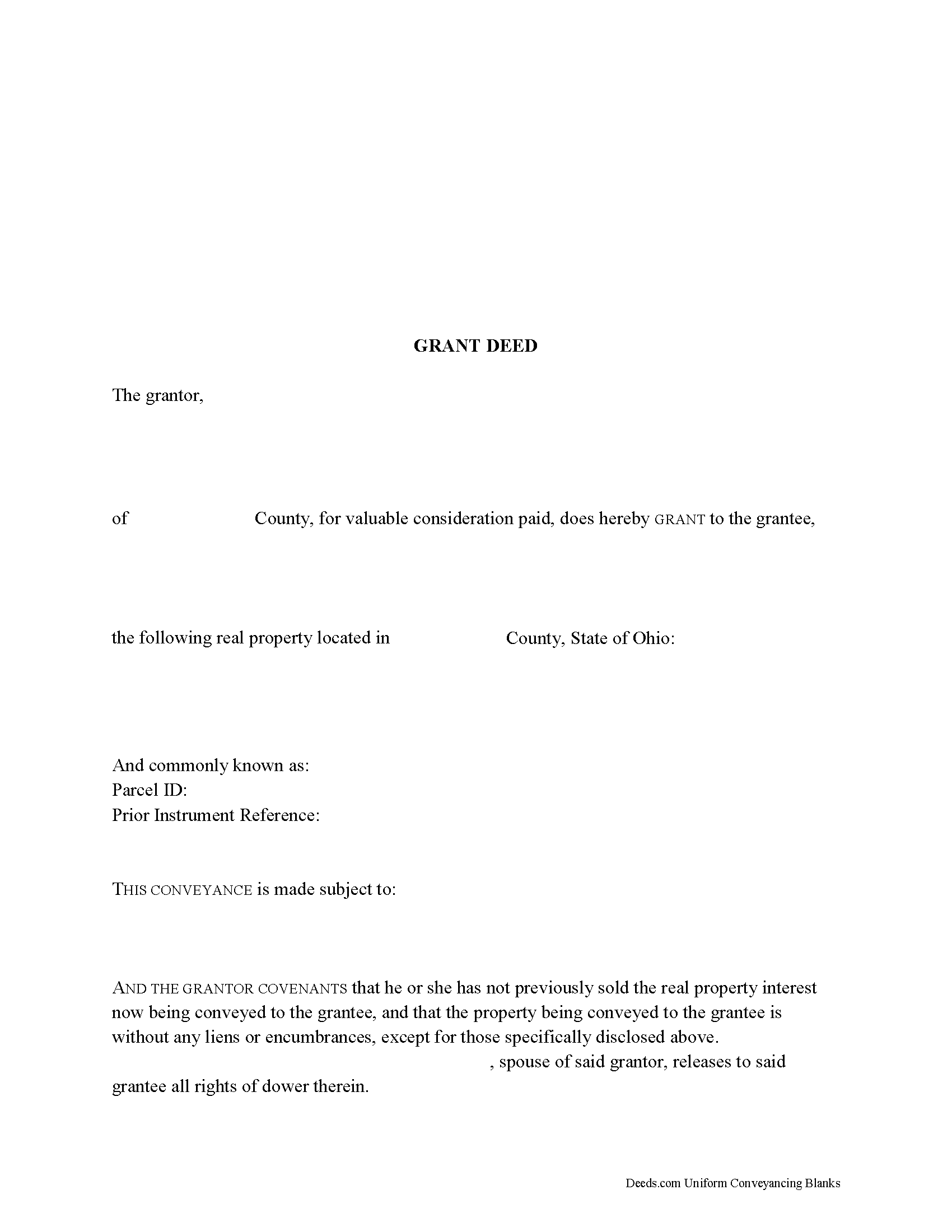

Grant Deed

In Ohio, title to real property can be transferred from one party to another by executing a grant deed. A standard grant deed conveys an interest in real property to the named grantee with covenants that the title is free of any encumbrances (except for those stated in the deed) and that the grantor holds an interest in the property and is free to convey it. These covenants should be explicitly made in the text of the deed.

In Ohio, a lawful grant deed includes the grantor's full name, mailing address, and marital status; the statement "for valuable consideration paid"; and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership.

For Ohio residential property, the primary methods for holding title in co-ownership are tenancy in common and survivorship tenancy. An estate conveyed to two or more people is considered a tenancy in common, unless a survivorship tenancy is declared (Ohio Rev. Code Section 5302.20(a)).

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel. Contact... More Information about the Ohio Grant Deed

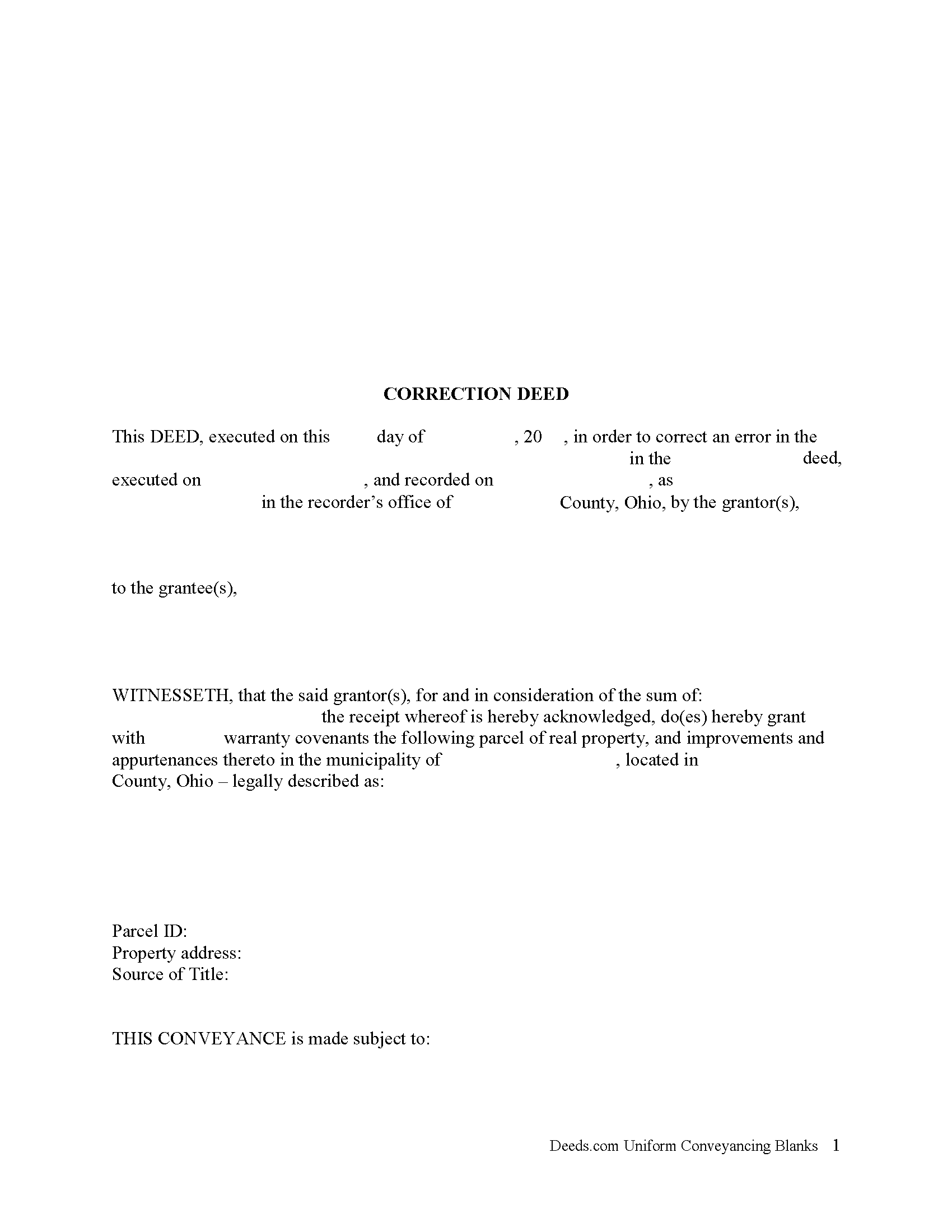

Correction Deed

In Ohio, a deed can be corrected either by re-recording the prior deed with corrections made directly on it, or by recording a new deed, called correction or corrective deed. In both cases, the reason for the correction, the recording number and execution/recording dates need to be stated. The choice between the two options may depend on county preference or the nature of the defect. Correction in general is only effective when it clarifies or completes the title of the prior deed. Altering the nature of the document by means of a correction deed is not advisable.

Thus, correcting the name or missing initial in the grantor's or grantee's name, the grantee's tax address, a minor error in the acknowledgement or even in the legal description can all be achieved through a correction deed. If the grantor re-acknowledges the corrected deed, errors of omission can be resolved as well, as can the marital status and spousal release and more serious errors in the legal description.

The Ohio Bar Association publishes guidelines for title standards and advise to never use a correction deed in order to add or delete a grantee, to make major changes in the legal description, such as a chan... More Information about the Ohio Correction Deed

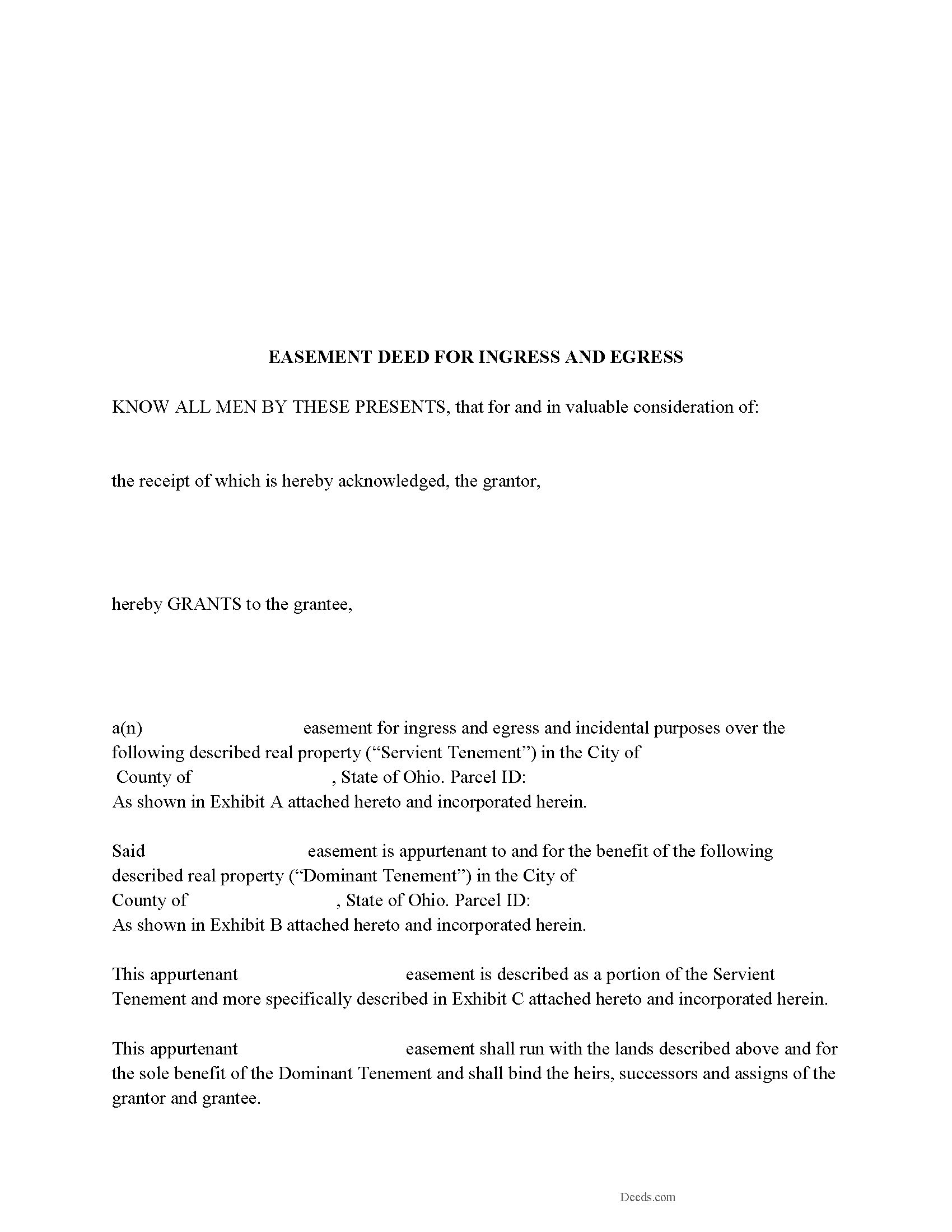

Easement Deed

An easement is created to give one person the use of another person's real property for a specific purpose. Easements are granted for various reasons, which may include a right-of-way, for utility purposes, or for environmental reasons. The easement deed is the legal instrument which creates the right of use. In a conveyance of real estate or of any interest therein in Ohio, all easements, rights, privileges, and appurtenances belonging to the granted estate are included in the conveyance, unless the deed states otherwise (5302.04).

Any person may grant a solar access easement for the purpose of ensuring adequate access of a solar energy collection device to sunlight. Solar access easements are created in writing and are subject to the same conveyancing and recording requirements as other easements (5301.63). Conservation and agricultural easements may also be granted in Ohio. Conservation and agricultural easements are also created in writing and are subject to the same requirements as other instruments conveying interests in land (5301.68).

An easement deed is a real property instrument which must be signed by the grantor in order to be recorded. The grantor's signature sh... More Information about the Ohio Easement Deed

Termination of Easement

Use this form to release, terminate, extinguish a previously recorded document that involves access to and from a property.

Documents such as:

1. Easement Deeds or Agreements (An easement is a non-possessory interest in land, granting the right to use someone else's property for a specific purpose, like a driveway or utility line)

2. Access Roads

3. Right of Ways

4. Utility Easements (Power, Gas, Water, Sewer, Etc.)

5. Drainage Easements

This document allows the owner of the land, burdened by the access and the party that benefits from the access, to sign an agreement releasing the property from such access, ... More Information about the Ohio Termination of Easement

Mineral Deed

The General Mineral Deed in Ohio transfers oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes the oil, gas and other minerals of every kind and nature. It also transfers any and all rights to receive royalties, overriding royalties, net profits interests or other payments out of or with respect to those oil, gas and other minerals. The Grantor can stipulate the percentage of Mineral Rights the Grantee will receive and is made subject to any rights existing under any valid and subsisting oil and gas lease or leases of record.

This general mineral deed gives the grantee the right to access, for the purpose of mining, drilling, exploring, operating and developing said lands for oil, gas, and other minerals, and storing handling, transporting and marketing of such.

In this document the Grantor Warrants and will defend said Title to Grantee. Use of this document has a permanent effect on your rights to the property, if you are not completely sure of what you are executing seek the advice of a legal professional.

(Ohio Mineral Deed Package includes form, guidelines, and com... More Information about the Ohio Mineral Deed

Mineral Deed with Quitclaim Covenants

The General Mineral Deed in Ohio Quitclaims oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes the oil, gas and other minerals of every kind and nature. The Grantor can stipulate the percentage of Mineral Rights the Grantee will receive.

This general mineral deed gives the grantee the right to access, for the purpose of mining, drilling, exploring, operating and developing said lands for oil, gas, and other minerals, and storing handling, transporting and marketing of such.

The seller, or grantor Quitclaims the mineral rights and does NOT accept responsibility to any discrepancy of title (This assignment is without warranty of title, either express or implied)

Uses: Mineral deeds with quitclaim are often used in situations where the grantor wants to quickly release any interest they might have in mineral rights, such as in settling estates, resolving disputes, clearing up uncertainties about ownership in a title's history or when mineral rights have previously been severed or fragmented from surface rights and cloud a title, making it difficult to transfer property. R... More Information about the Ohio Mineral Deed with Quitclaim Covenants

Ohio Limited Power of Attorney for Real Property

This is a LIMITED power of attorney for real property. What is a limited power of attorney? A "limited power of attorney" gives the agent authority to conduct a specific act. For example, a person might use a limited power of attorney to sell and/or purchase a home in another state by delegating authority to another person to handle the transaction locally. Such a power could be "limited" to selling and/or purchasing a home/property or to other specified acts. This form includes a "Special Instructions" section where the principal can further define or limit the Agent's powers.

When the Agent is authorized to transfer interest in real property by (a power of attorney), it (shall be signed, acknowledged, and certified as provided in section 5301.01 of the Revised Code.) (1337.01)

(No deed executed by a person acting for another, under a power of attorney, acknowledged, and recorded, is invalid or defective because he, instead of his principal, is named in such deed as such attorney as grantor; nor because his name, as such attorney, is subscribed to such deed, instead of the name of his principal; nor because the certificate of acknowledgment, instead of setting forth that the... More Information about the Ohio Ohio Limited Power of Attorney for Real Property

General Durable Power of Attorney

Use this Power of Attorney in Ohio to authorize any or all of the following:

(A) Real property transactions.

(B) Tangible personal property transactions.

(C) Stock and bond transactions.

(D) Commodity and option transactions.

(E) Banking and other financial institution transactions.

(F) Business operating transactions.

(G) Insurance and annuity transactions.

(H) Estate, trust, and other beneficiary transactions.

(I) Claims and litigation.

(J) Personal and family maintenance.

(K) Benefits from Social Security

(L) Retirement plan transactions.

(M) Tax matters.

(N) Gifting.

(O) Revocation - This Power Attorney may be revoked by me at any time by providing written notice to my Attorney-in-fact, in any reasonable manner.

SPECIAL INSTRUCTIONS:

On the following lines you may give special instructions limiting or extending the powers granted to your agent.

CHOICE OF LAW. This power of attorney will be governed by the laws of the state of Ohio without regard for conflicts of laws principals. It was executed in the state of Ohio and is intended to be valid in all jurisdictions of the United States of America and all foreign nations.

Formatted for recor... More Information about the Ohio General Durable Power of Attorney

Mortgage Instrument and Promissory Note

These forms are used for financing residential property, condominiums, rental units, small commercial, vacant land, and planned unit developments. They include special provisions and exhibit pages making them adaptable and flexible for unique situations. Ohio recognizes dower rights, which means that if a married man or woman owns an interest in real property, his or her spouse holds a 1/3 interest in the property, Review Oh. statute 2103.02. Dower rights can become problematic when it comes to mortgages. Oftentimes, banks require a release of dower if only one spouse is on the promissory note. Otherwise, if the paying spouse defaults, a spouse may be able to enforce their dower rights if the spouse is not on the deed. This mortgage can release rights of dower if applicable to the situation. These forms have stringent default terms, typical uses - lender who is financing investment property, owner financing, etc.

(Ohio Mortgage Package includes forms, guidelines, and completed examples) For use in Ohio only.

... More Information about the Ohio Mortgage Instrument and Promissory Note

Assignment of Mortgage

Use this form to assign and transfer an existing mortgage to another party, this is often done when a mortgage has been sold. This form is considered (by a separate instrument).

5301.28 Release of mortgage - assignment.

When the mortgagee of property within this state, or the party to whom the mortgage has been assigned, either (by a separate instrument), or in writing on that mortgage, or on the margin of the record of the mortgage, which assignment, if in writing on the mortgage or on the margin of the record of the mortgage, need not be acknowledged, receives payment of any part of the money due the holder of the mortgage, and secured by the mortgage, and enters satisfaction or a receipt for the payment, either on the mortgage or its record, that satisfaction or receipt, when entered on the record, or copied on the record from the original mortgage by the county recorder, will release the mortgage to the extent of the receipt. In all cases when a mortgage has been assigned in writing on that mortgage, the recorder shall copy the assignment from the original mortgage upon the margin of the record of the mortgage before the satisfaction or receipt is entered upon the record ... More Information about the Ohio Assignment of Mortgage

Release and Satisfaction of Mortgage

Use this form to release a mortgage when it has been fully satisfied/paid in full. Ohio also allows marginal notations on the existing mortgage which also serves as a release. Some counties only allow the recording of separate instruments, such as a "release of mortgage" form or an original mortgage instrument bearing the proper endorsement. This form is considered a release by (separate instrument).

(5301.28 Release of mortgage - assignment.)

(When the mortgagee of property within this state, or the party to whom the mortgage has been assigned, either by a separate instrument, or in writing on that mortgage, or on the margin of the record of the mortgage, which assignment, if in writing on the mortgage or on the margin of the record of the mortgage, need not be acknowledged, receives payment of any part of the money due the holder of the mortgage, and secured by the mortgage, and enters satisfaction or a receipt for the payment, either on the mortgage or its record, that satisfaction or receipt, when entered on the record, or copied on the record from the original mortgage by the county recorder, will release the mortgage to the extent of the receipt. In all cases when a mortg... More Information about the Ohio Release and Satisfaction of Mortgage

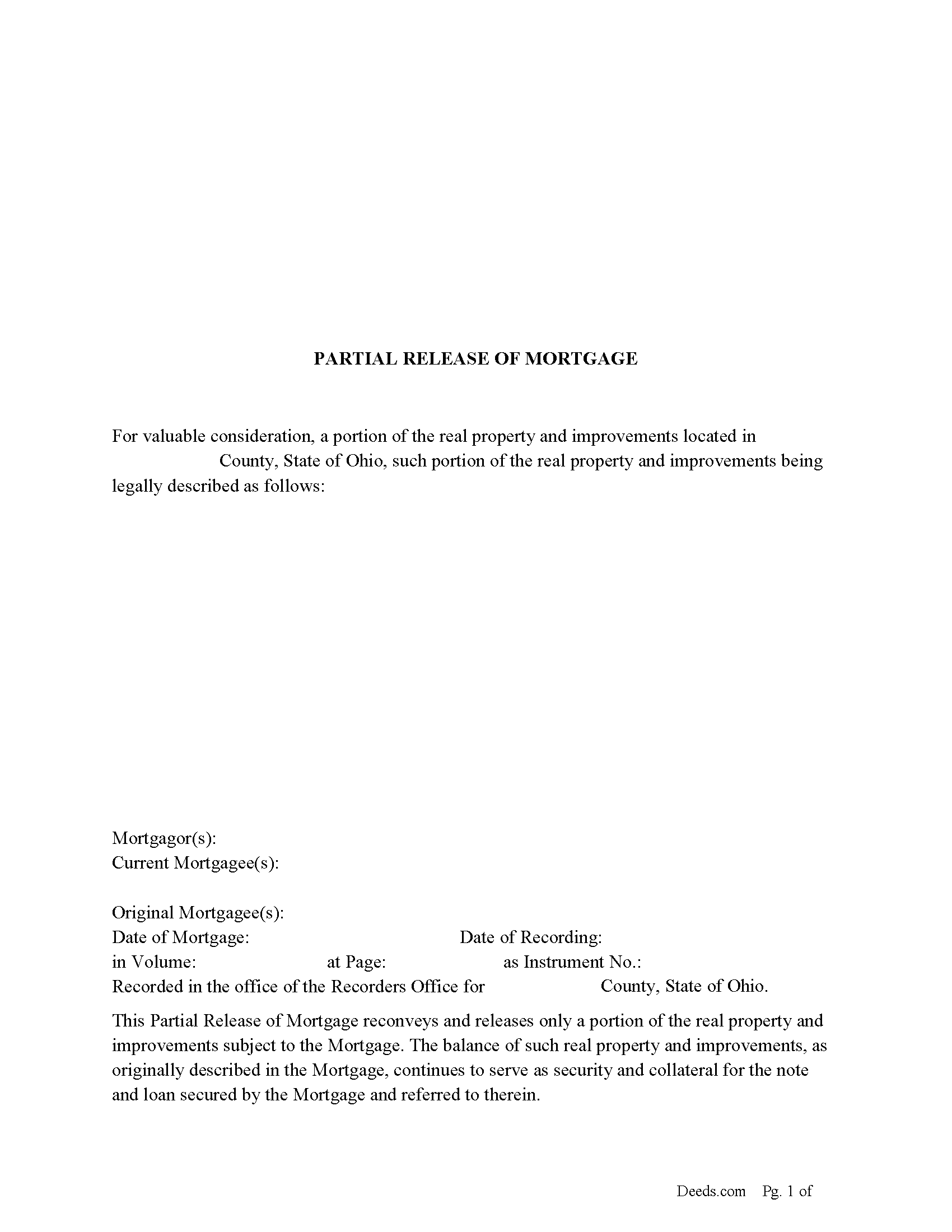

Partial Release of Mortgage

Use this form to release only a portion of the real property and improvements subject to the Mortgage. For example: A mortgage is $200,000.00 and covers 5 condominiums. The borrower says, "I have one sold and would like to put the proceeds towards the mortgage to reduce the debt". In this case the lender might think, "Yes this makes since" or let's say the borrower owes on 5 lots with a mortgage of $100,000.00 but has since paid down the mortgage to $40,000.00. and wants to sell a lot, the lender might think, "This is a good risk I will release this lot." In both cases the lender is only releasing the subject condo or lot and the full lien remains on the existing properties. This form would be considered a partial release by (separate instrument). See Oh statute 5301.32 below.

5301.31 Assignment or partial release in margin of original record.

Except in counties in which a separate instrument is required to assign or partially release a mortgage as described in section 5301.32 of the Revised Code, a mortgage may be assigned or partially released by the holder of the mortgage, by writing the assignment or partial release on the original mortgage or upon the margin of the record... More Information about the Ohio Partial Release of Mortgage

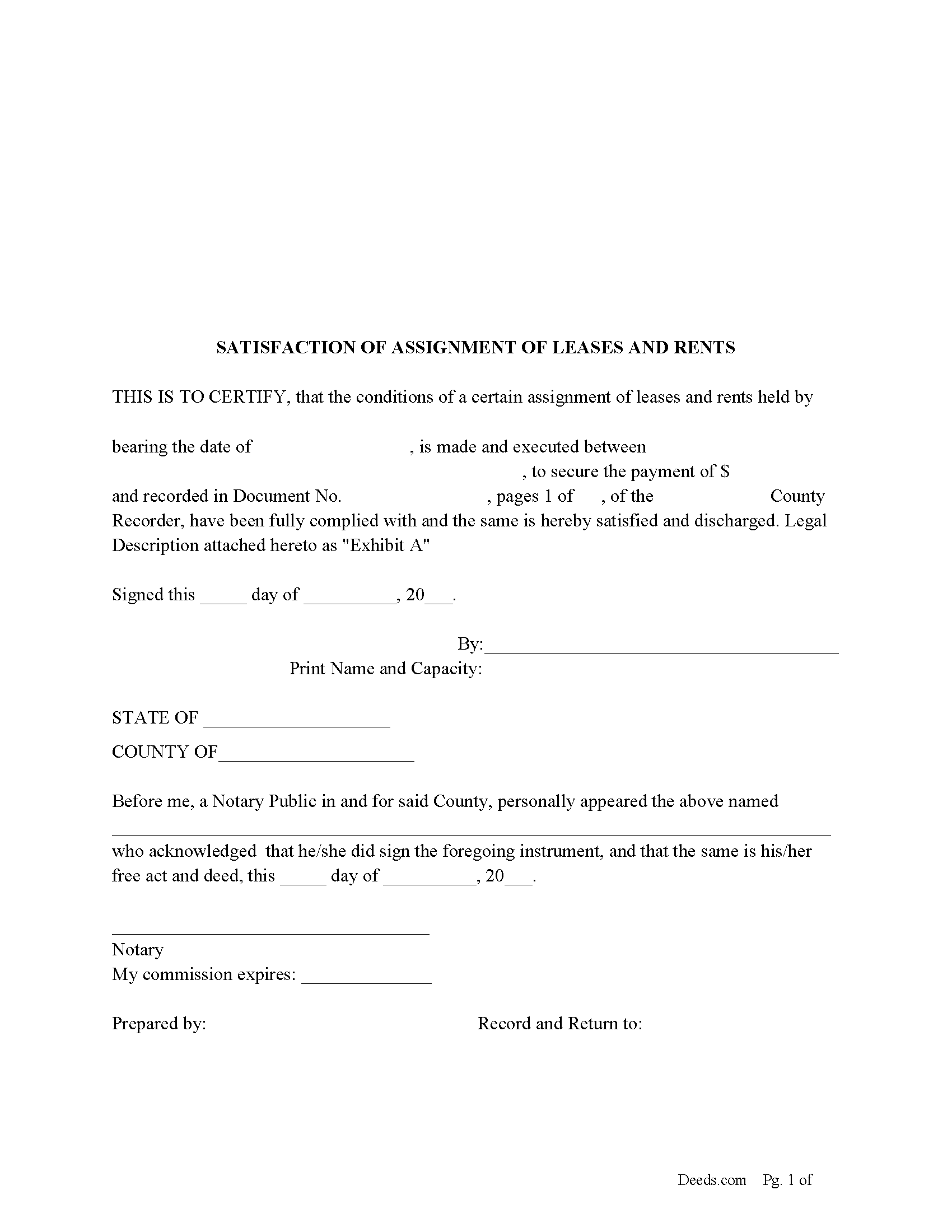

Satisfaction of Assignment of Leases and Rents

An Assignment of Leases and Rents is a recorded document used as security to protect a debt. When the debt has been fulfilled this form is recorded by the holder of the "Assignment of Leases and Rents" to discharge the document. There are several ways to release/discharge an assignment of leases and rents in Ohio, this one is (by Separate Instrument) (Oh statute 5301.33)

5301.33 Cancellation, release, and assignment of leases.

Except in counties where deeds or other separate instruments are required as provided in this section, a lease, whether or not renewable forever, that is recorded in any county recorder's office, may be canceled or partially released by the lessor and lessee, or assigned by either of them, by writing the cancellation, partial release, or assignment on the original lease, or upon the margin of the record of the original lease, and by signing it. That cancellation, partial release, or assignment need not be acknowledged, but if written on the margin of the record, the signing shall be attested to by the county recorder. The assignment by the lessee, whether it is upon the lease, or upon the margin of the record of the lease, or by separate instrument, sha... More Information about the Ohio Satisfaction of Assignment of Leases and Rents

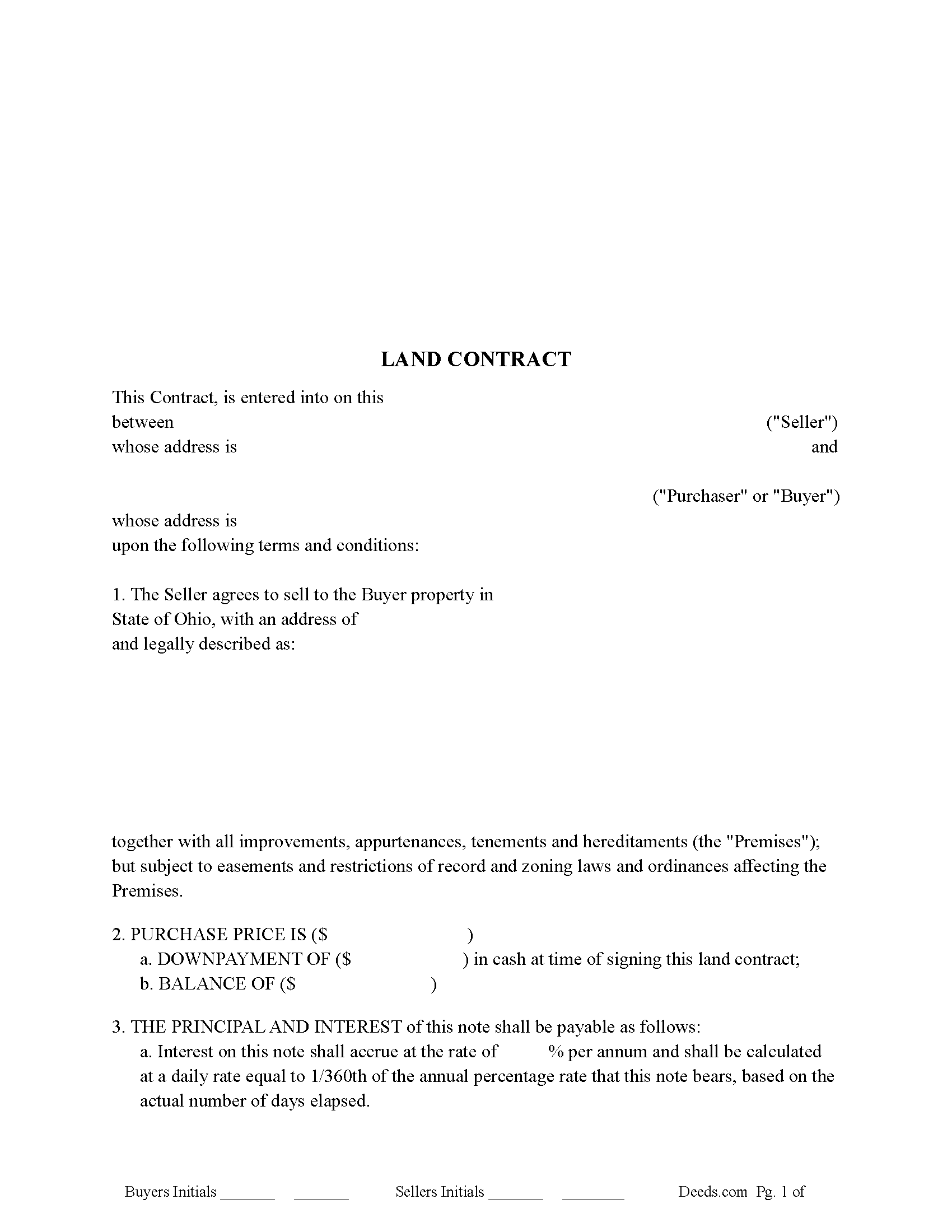

Land Contract

An "Ohio Land Contract," also known as a “Land installment Contract”, is a form of seller financing used to purchase real estate. This arrangement is particularly useful for buyers who may not qualify for traditional mortgage financing from banks or other financial institutions. In Ohio, land contracts are governed by specific statutes that outline the rights and responsibilities of both the seller and the buyer.

Chapter 5313. of the OH. Revised Code (A) "Land installment contract" means an executory agreement which by its terms is not required to be fully performed by one or more of the parties to the agreement within one year of the date of the agreement and under which the vendor agrees to convey title in real property located in this state to the vendee and the vendee agrees to pay the purchase price in installment payments, while the vendor retains title to the property as security for the vendee's obligation. Option contracts for the purchase of real property are not land installment contracts.

Overview of an Ohio Land Contract

A land contract is essentially an agreement between a seller (vendor) and a buyer (vendee) where the seller provides the financing for the purc... More Information about the Ohio Land Contract

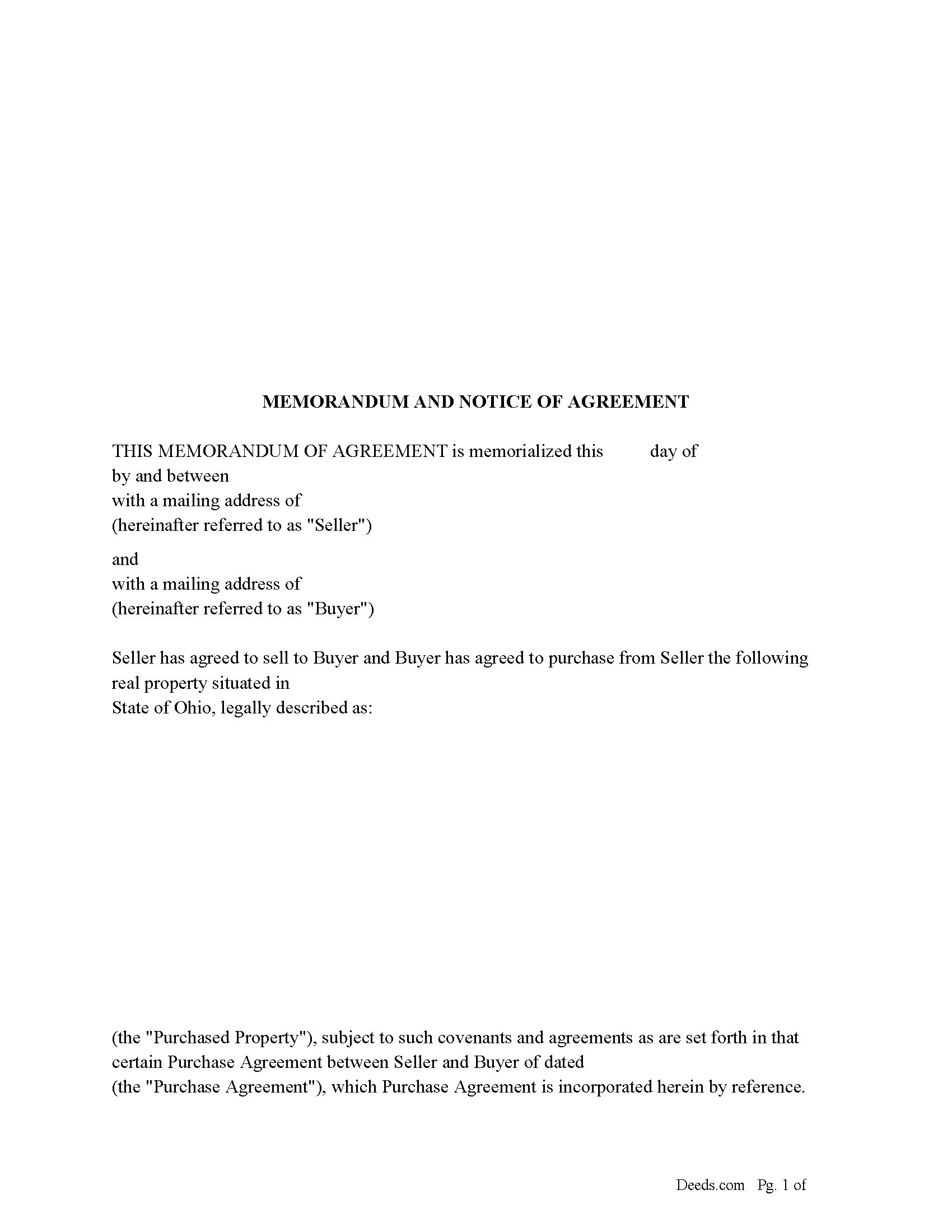

Memorandum and Notice of Agreement

A "Memorandum of Purchase Agreement" commonly referred to as a "Memorandum of Agreement" (MOA), "Memorandum of Contract" (MOC) or "Memorandum of Understanding" (MOU) in the context of real estate, is used primarily as a means to provide public notice of an equitable interest in a real estate transaction without disclosing the full details of the purchase agreement. This document is particularly useful in transactions where the buyer and seller have agreed to terms but the final closing and transfer of the deed have not yet occurred. By recording this memorandum with the county recorder's office, the buyer establishes a public record of their interest in the property, which can protect against subsequent claims or liens by third parties.

Key Purposes of a Memorandum of Purchase Agreement:

1. Notice of Equitable Interest: The memorandum serves as notice to the public that the buyer has an equitable interest in the property due to the purchase agreement. This is important in protecting the buyer’s interest against claims by other parties who might otherwise be unaware of the agreement.

2. Protection During the Closing Process: Real estate transactions can involve a lengthy ... More Information about the Ohio Memorandum and Notice of Agreement

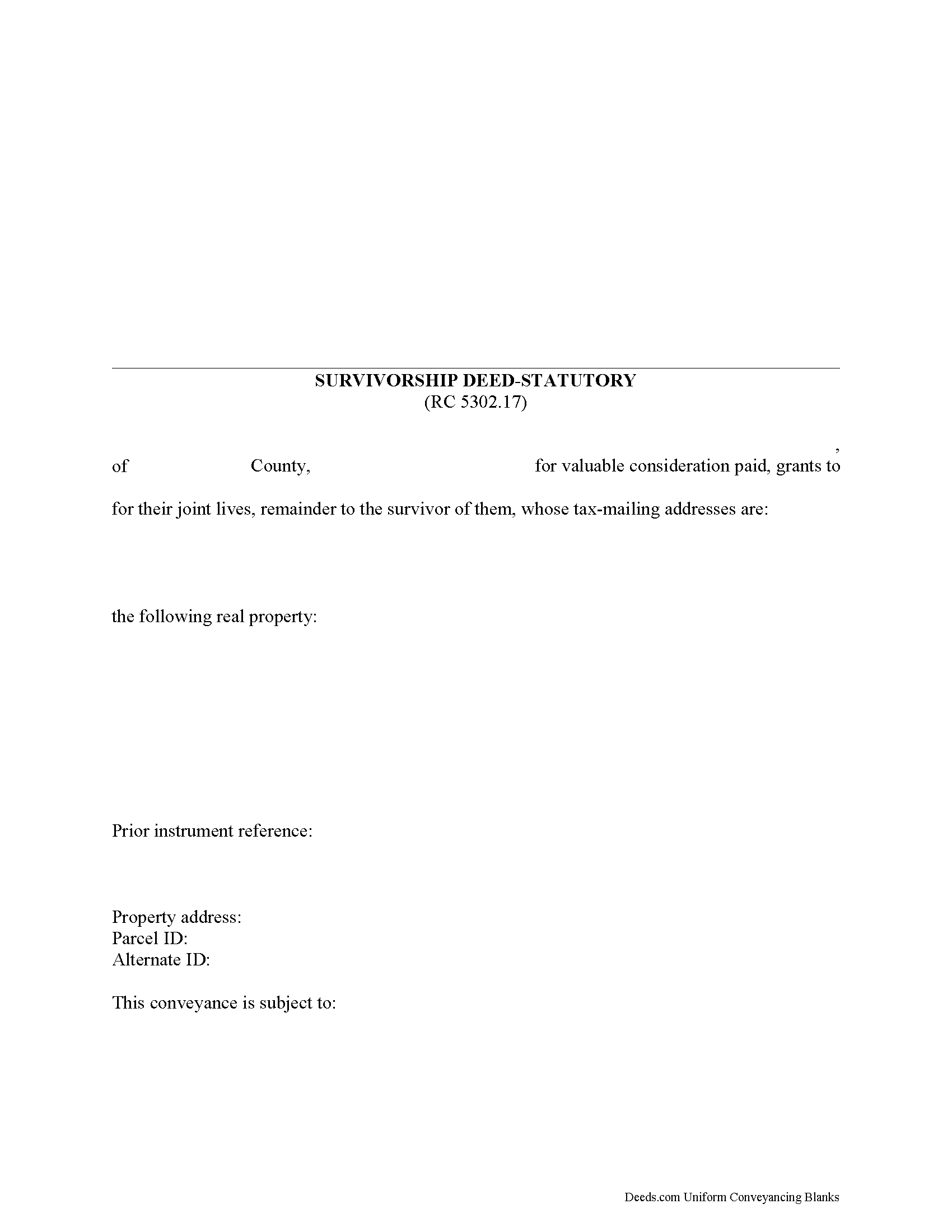

Survivorship Deed

Use this form to create a survivorship joint tenancy in Ohio real property. The Ohio Revised Code Section 5302.17 states that a "deed conveying any interest in real property to two or more persons . . . creates a survivorship tenancy in the grantees, and upon the death of any of the grantees, vests the interest of the decedent in the survivor, survivors, or the survivor's or survivors' separate heirs and assigns."

Once executed and recorded, this deed immediately conveys ownership from the grantor to the grantees. To retain a shared ownership interest in the property, the grantor simply conveys the property to herself and the other intended co-tenants.

(Ohio Survivorship Deed Package includes form, guidelines, and completed example)... More Information about the Ohio Survivorship Deed

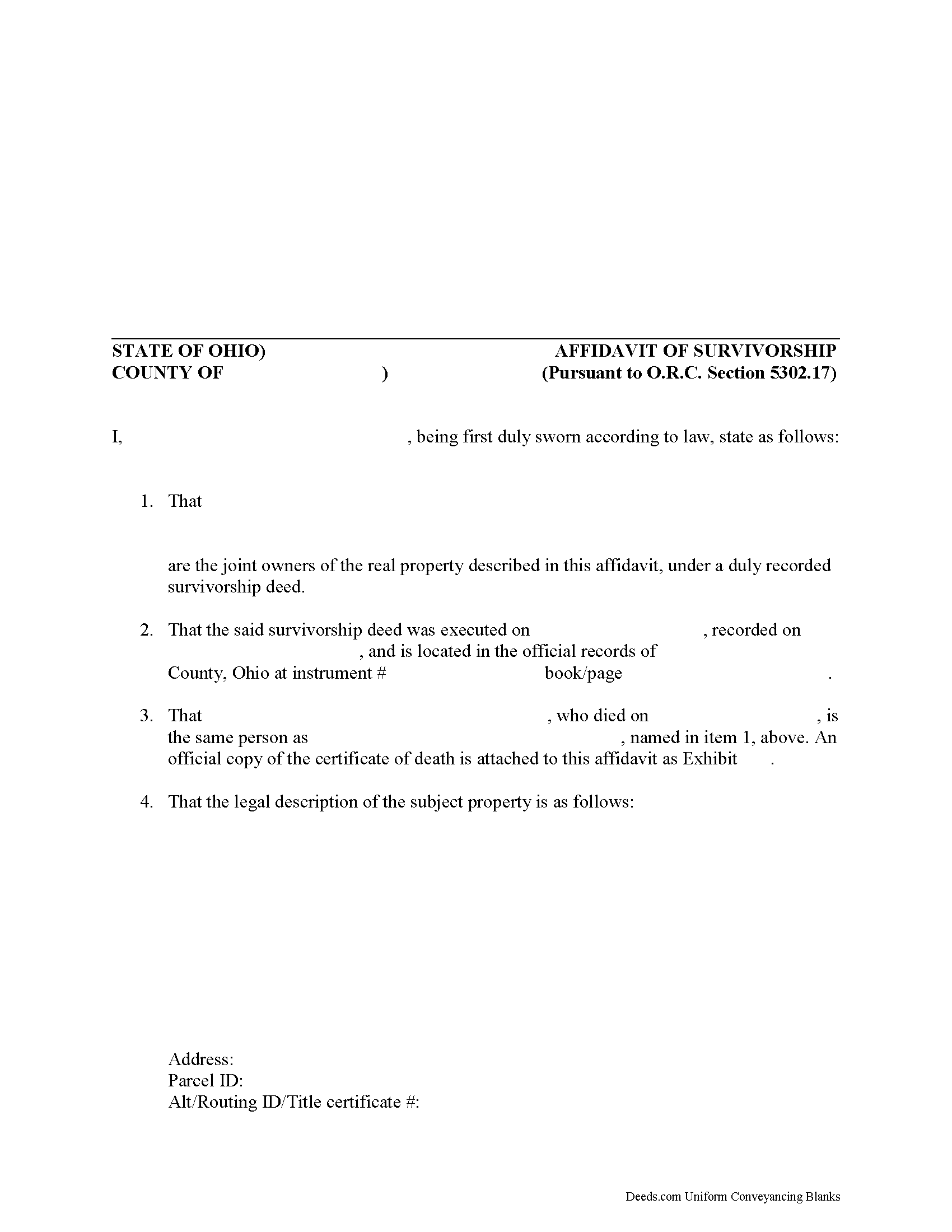

Affidavit of Survivorship

When correctly executed and recorded along with the copy of the death certificate and any other required documentation, this Affidavit of Survivorship form transfers a deceased survivorship joint tenant's ownership interest in Ohio real property to the surviving tenants.

(Ohio Affidavit of Survivorship Package includes form, guidelines, and completed example)... More Information about the Ohio Affidavit of Survivorship

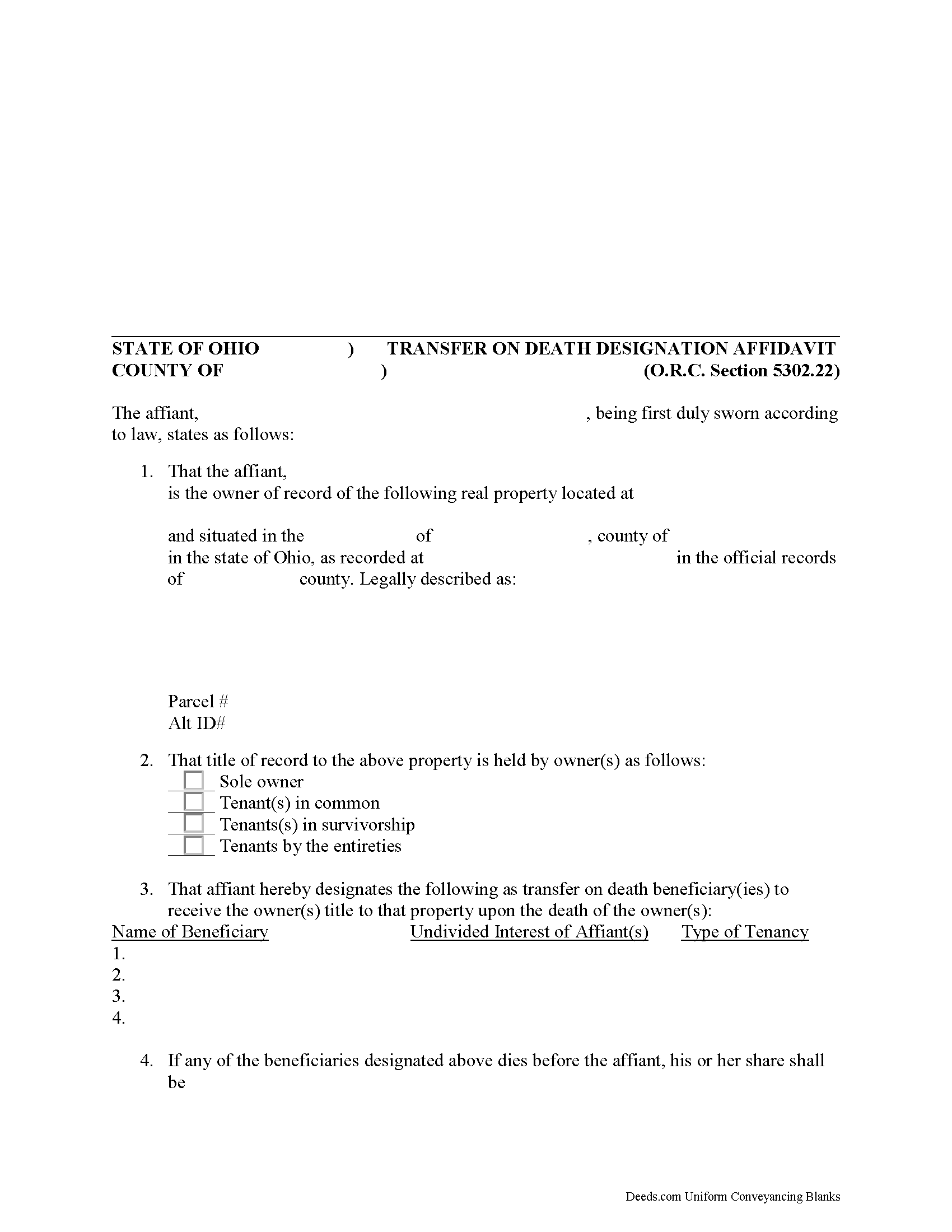

Transfer on Death Designation Affidavit

Authorized under section 5302.22 of the Ohio Revised Code, the Transfer on Death Designation Affidavit (TDDA) allows owners of real estate situated in Ohio to plan the conveyance of their property to designated beneficiaries after their death. The conveyance occurs separately from a will and without the need for probate. These instruments are known in other states as transfer on death deeds, beneficiary deeds, or Lady Bird deeds, and all fall under the heading of Non-probate Transfers on Death.

TDDAs are useful estate planning tools, because unlike "regular" deeds (warranty, grant, quitclaim, etc.), which permanently transfer the owner's interest in the property, the grantor retains full ownership and control of the property while alive, and may change the beneficiaries, modify the terms, or even sell the property with no restriction or penalty. This flexibility is possible because the grantor accepts no consideration from any of the beneficiaries.

In addition to meeting all state and local standards for recorded documents, TDDAs must include a statement by "the individual executing the affidavit that the individual is the person appearing on the record of the real propert... More Information about the Ohio Transfer on Death Designation Affidavit

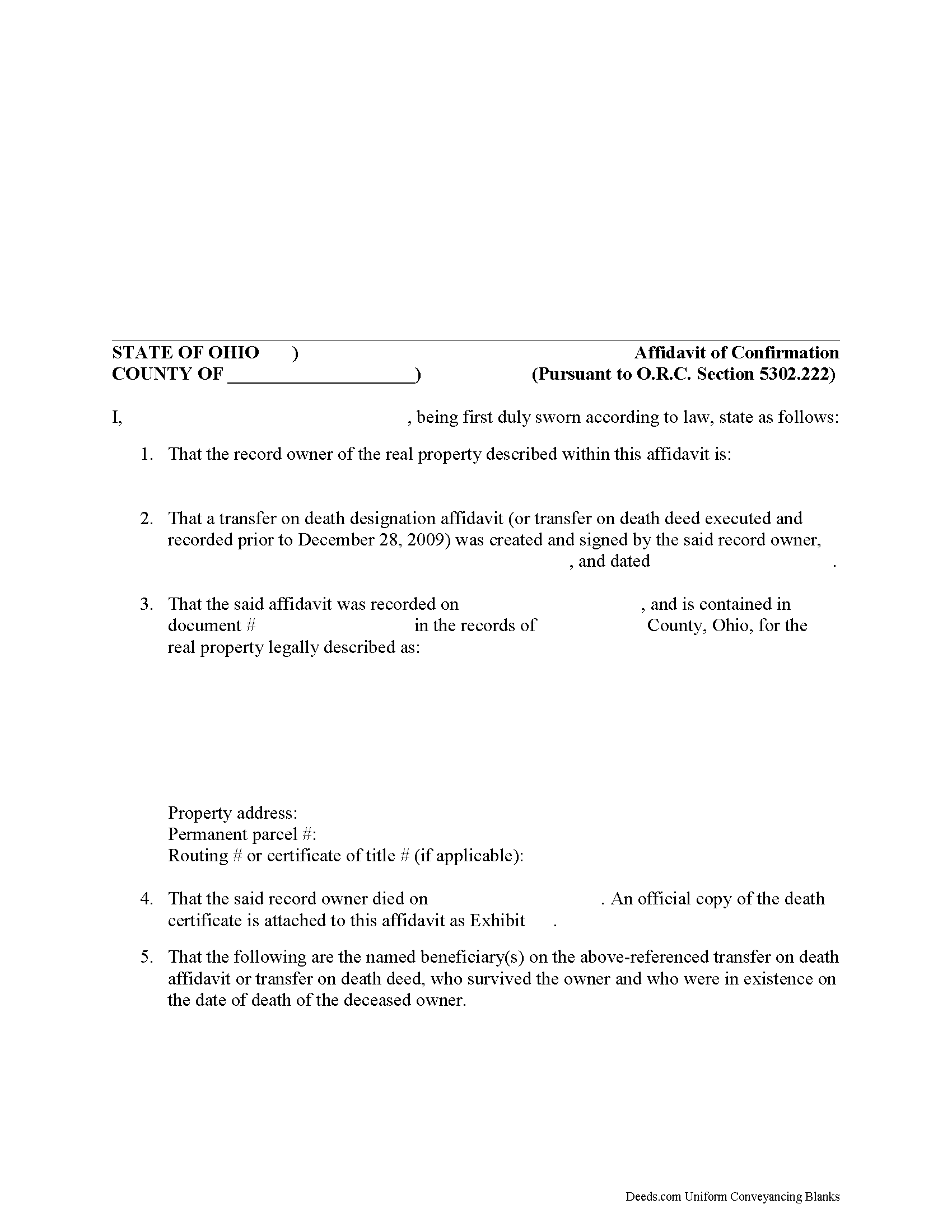

Affidavit of Confirmation

Use this form to finalize the conveyance started under an Ohio transfer on death deed or transfer on death designation affidavit.

In addition to finalizing the transfer of property rights, the recording process provides public notice that the ownership status has changed and preserves the chain of title (ownership history). See O.R.C. 5302.222

(Ohio Affidavit of Confirmation Package includes form, guidelines, and completed example)... More Information about the Ohio Affidavit of Confirmation

Trustee Deed

Ohio Trustee's Deed

Ohio Revised Code Section 5302.09 outlines the general form of a deed for use by individuals serving as fiduciaries, including trustees. A fiduciary is a person who is appointed to manage someone else's assets, often for the benefit of a third party.

Trustee's deeds are used in trust administration to convey real property out of a trust. A settlor creates a trust, typically for estate planning purposes, and funds it with assets that can include both real and personal property. The trustee controls the trust's assets for the settlor, according to the terms of the trust document. If the settlor directs the trustee to transfer real property out of the trust, the trustee executes a trustee's deed; the settlor is not involved in the conveyance. This is useful because leaving the settlor's name off the transfer it maintains his/her privacy.

In Ohio, the basic trustee's deed is similar to a quitclaim deed, in that it offers no warranty of title. Depending on the situation, the trustee might add guarantees to bring the deed in line with special warranty or warranty deeds.

The trustee's deed must fulfill all requirements for instruments affecting real proper... More Information about the Ohio Trustee Deed

Fiduciary Deed

Ohio Fiduciary Deed for Executors and Administrators

Probate is the legal process of settling and distributing a decedent's estate according to the terms of a probated will or laws of intestate succession. In the context of estate administration, a fiduciary is either an executor (when named in a will) or an administrator (when the decedent dies without a will or does not name an executor) assigned by the court of common pleas to administer the decedent's estate.

If the estate's assets are insufficient to pay debts, the fiduciary may need to sell the decedent's property. Fiduciaries must obtain the court's permission to sell assets from the estate, unless authorized or directed by the decedent's will.

In Ohio, executors and administrators use fiduciary deeds to convey real property from an estate to a purchaser pursuant to a court order. A fiduciary deed is a statutory form (R.C. 5302.09) containing fiduciary covenants that the grantor is the duly appointed, qualified, and acting fiduciary, and that he or she is authorized to make the sale and conveyance of the within described real property. Additionally, the grantor covenants with the grantee that in the proceedings of t... More Information about the Ohio Fiduciary Deed

Notice of Commencement

Under Ohio Revised Code 1311.04, an owner of real property must serve notice on any potential lien claimant. The form of notice is called a Notice of Commencement. The purpose of the Notice of Commence is to protect property owners and provide notice to any potential lien claimant that the project is commencing.

Prior to the performance of any labor or work or the furnishing of any materials for an improvement on real property which may give rise to a mechanics lien under sections 1311.01 to 1311.22 of the Revised Code, the owner, part owner, or lessee who contracts for the labor, work, or materials shall record, in the office of the county recorder for each county in which the real property to be improved is located, a notice of commencement in substantially the form specified by 1311.04(A)(1).

The Notice of Commencement includes the names and addresses of all owners, part-owners, and lessees attached to the project, a description of the property, a description of the improvement, names and addresses of all contractors, and information for any lenders or sureties. Then complete the following steps:

1) File the notice of commencement with the county recorder's office in th... More Information about the Ohio Notice of Commencement

Notice of Furnishing

A Notice of Furnishing is a type of preliminary lien notice that must be served on a property owner with whom the claimant does not have a direct contract. Serve the Notice after beginning to furnish the labor and materials on a construction job. This notice is a required step toward securing lien rights, but only for those who supply materials. O.R.C. 1311.05(G). Even labor-only contractors should send the notice, however, to give the owner a clear picture of what was furnished and by whom, as well as to help establish priority if payment disputes ever arise.

A subcontractor or material supplier who performs labor or work or furnishes material in furtherance of an improvement to real property and who wishes to preserve the subcontractor's or material supplier's lien rights shall serve a notice of furnishing, if any person has recorded a Notice of Commencement. O.R.C. 1311.05(A). Therefore, only serve the Notice of Furnishing after a Notice of Commencement has been filed by the owner or his or her agent in accordance with O.R.C. 1311.04.

The notice is a relatively straightforward document that contains the owner's and contractor's names and addresses, the name and address of... More Information about the Ohio Notice of Furnishing

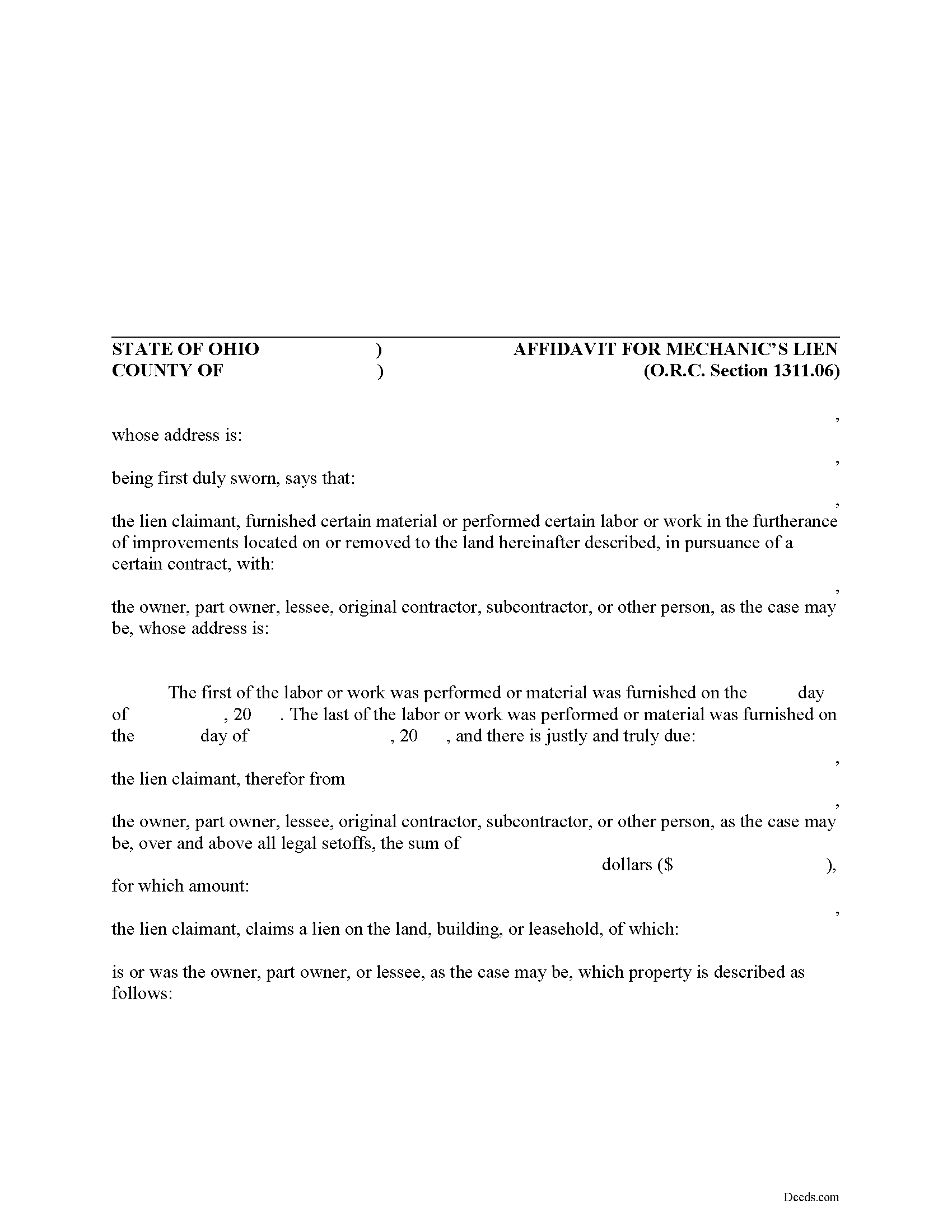

Affidavit for Mechanic Lien

Mechanic's Liens are used to encumber the title to an owner's property (real estate) when a contractor, materials supplier, or other laborer such as a subcontractor has not been paid for labor, materials, or equipment provided. In Ohio, this is accomplished by filing an Affidavit of Mechanic's Lien with the county recording office in the county where the property is located.

Any person, or the person's agent, who wishes to claim a mechanic's lien, shall make and file for record in the office of the county recorder in the counties in which the improved property is located, an affidavit showing the amount due over and above all legal setoffs, a description of the property to be charged with the lien, the name and address of the person to or for whom the labor or work was performed or material was furnished, the name of the owner, part owner, or lessee, if known, the name and address of the lien claimant, and the first and last dates that the lien claimant performed any labor or work or furnished any material to the improvement giving rise to the claimant's lien. Ohio Revised Code 1311.06(A).

If the affidavit is recorded, the omission or inaccuracy of any address in the affidav... More Information about the Ohio Affidavit for Mechanic Lien

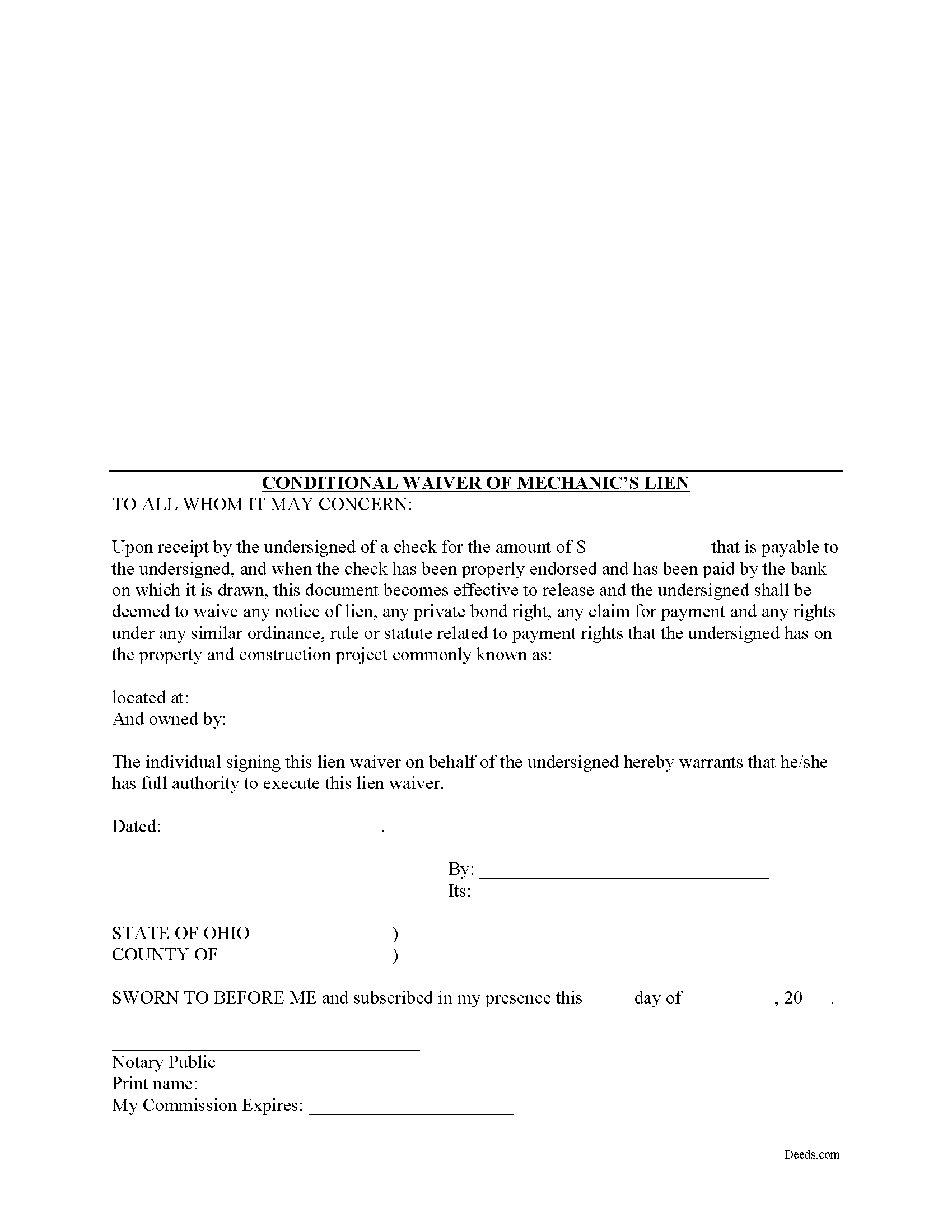

Conditional Lien Waiver

Ohio's mechanic's lien law does not provide for a statutory lien waiver form, but Ohio courts recognize elective lien waivers under principles of contract law. The waivers identify the claimant, the party responsible for paying, the project, relevant dates, and the amount paid. Sign the completed waiver in front of a notary, then record it in the land records of the county where the project is located.

In general, a lien waiver is used to release an owner's property from a lien claim, either in full or in part, and either conditional, meaning the payment must clear the bank prior to waiving lien rights, or unconditional, meaning that the claimant waives the lien immediately, regardless of whether or not the payment clears the bank.

For instance, if the customer owes $5,000.00 on a construction job and remits a partial payment of $2,500.00, the payor may request a waiver that states he or she has paid that amount and in turn the claimant will give up the right to a lien for $2,500.00 of the total amount. If the check has not yet cleared the bank, use a conditional waiver that is only effective upon actual receipt of payment.

Each case is unique, and the lien law is compl... More Information about the Ohio Conditional Lien Waiver

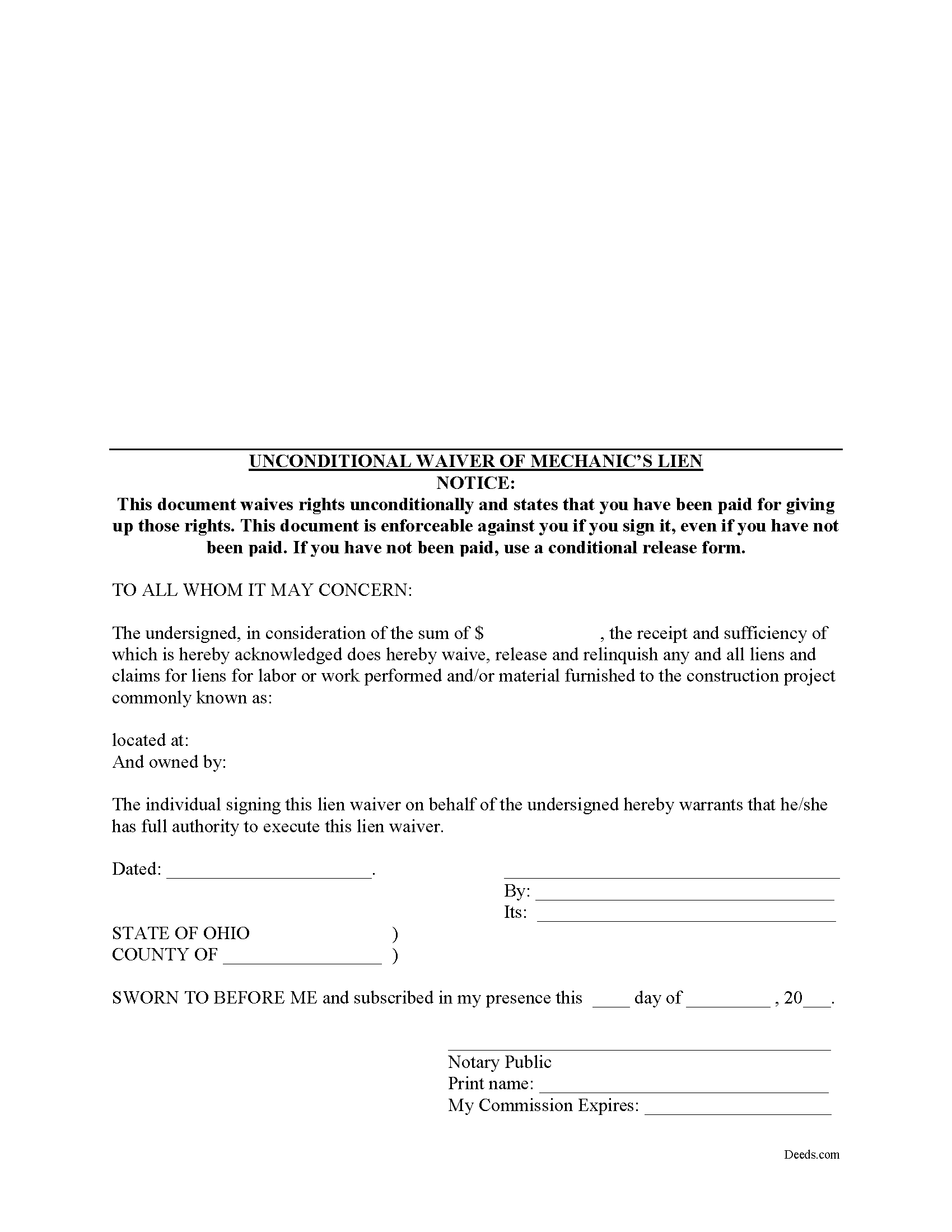

Unconditional Lien Waiver

Ohio's mechanic's lien law does not provide for a statutory lien waiver form, but Ohio courts recognize elective lien waivers under principles of contract law. The waivers identify the claimant, the party responsible for paying, the project, relevant dates, and the amount paid. Sign the completed waiver in front of a notary, then record it in the land records of the county where the project is located.

In general, a lien waiver is used to release an owner's property from a lien claim, either in full or in part, and either conditional, meaning the payment must clear the bank prior to waiving lien rights, or unconditional, meaning that the claimant waives the lien immediately, regardless of whether or not the payment clears the bank.

For instance, if the customer owes $5,000.00 on a construction job and remits a partial payment of $2,500.00, the payor may request a waiver that states he or she has paid that amount and in turn the claimant will give up the right to a lien for $2,500.00 of the total amount. If the check has not yet cleared the bank, use a conditional waiver that is only effective upon actual receipt of payment. If the payment is confirmed, use the unconditional... More Information about the Ohio Unconditional Lien Waiver

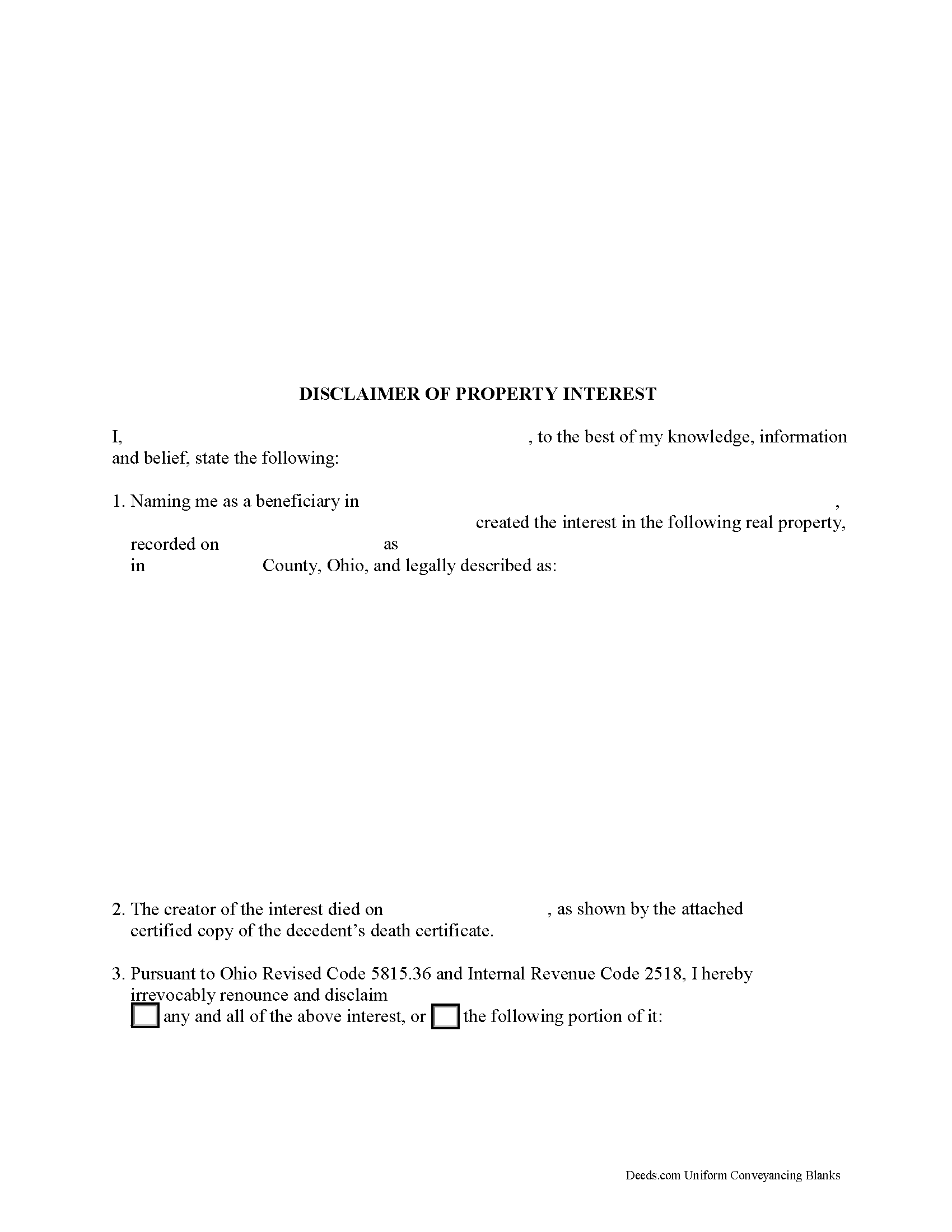

Disclaimer of Interest

A beneficiary of an interest in property in Ohio can disclaim all or part of a bequeathed interest in, or power over, that property under Ohio Revised Code 5815.36, as long as it has not been accepted through actions that indicate ownership or through a written waiver of the right to disclaim (Sec. J).

The written disclaimer must identify the donative instrument, which is the document that established the interest, such as a will or a transfer on death designation affidavit. The disclaimer also must contain a description of the disclaimed interest and a declaration of the disclaimer and its extent (Sec. B (3)). It must be signed by the disclaimant or a legally authorized representative

Depending on the donative instrument, the disclaimer must be filed, recorded and/or delivered pursuant to 5815.36 Sec. F as follows.

* If the interest is created by a non-testamentary instrument, including a transfer on death designation affidavit, the disclaimer must be delivered to the trustee or other person who holds legal title or possession of the property.

* In the case of an interest in real estate a transfer on death designation affidavit, the disclaimer must be filed with the... More Information about the Ohio Disclaimer of Interest

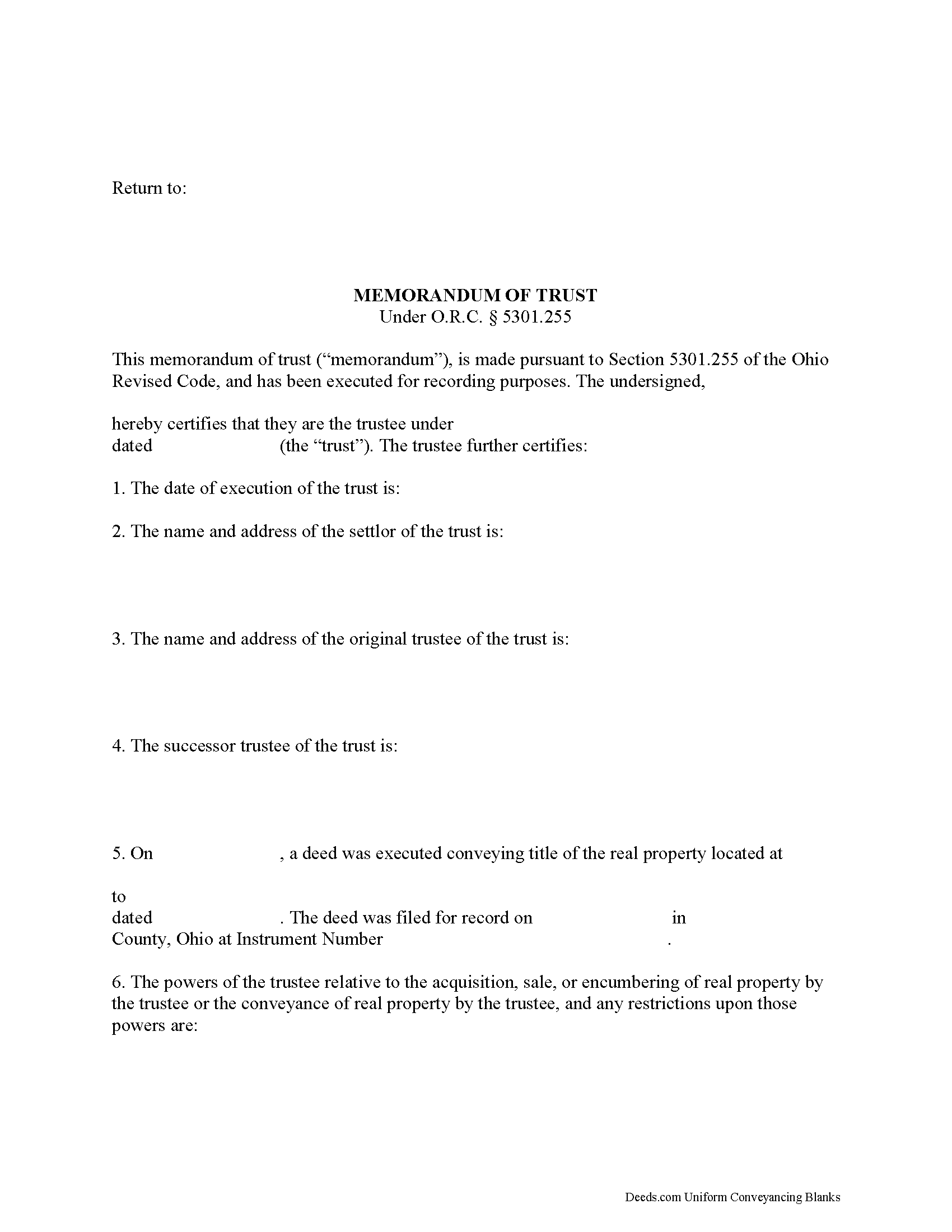

Memorandum of Trust

Ohio Memorandum of Trust

Under O.R.C. 5301.255, the memorandum of trust is a document that certifies a trustee has the authority to act on behalf of an existing trust. The trustee is the person or entity who holds title to a trust's assets on behalf of a settlor. A trustee might furnish a memorandum of trust upon the request of a lending institution or other third party in lieu of the trust document.

The memorandum is an abstract of the trust document, containing only relevant information about the trust, such as the identity and powers or restriction of powers of the trustee relative to real property, the name of the trust's settlor, and the name and date of the trust. The identity of any party having a beneficial interest in the trust is not disclosed. The memorandum might also quote relevant sections of the trust document directly.

Like all recorded documents concerning real property, the memorandum must also contain a legal description of the real property subject to the trust, the property's parcel identification number, and information about the prior deed granting title to the trustee. The document is executed and acknowledged by the trustee in front of a notary be... More Information about the Ohio Memorandum of Trust

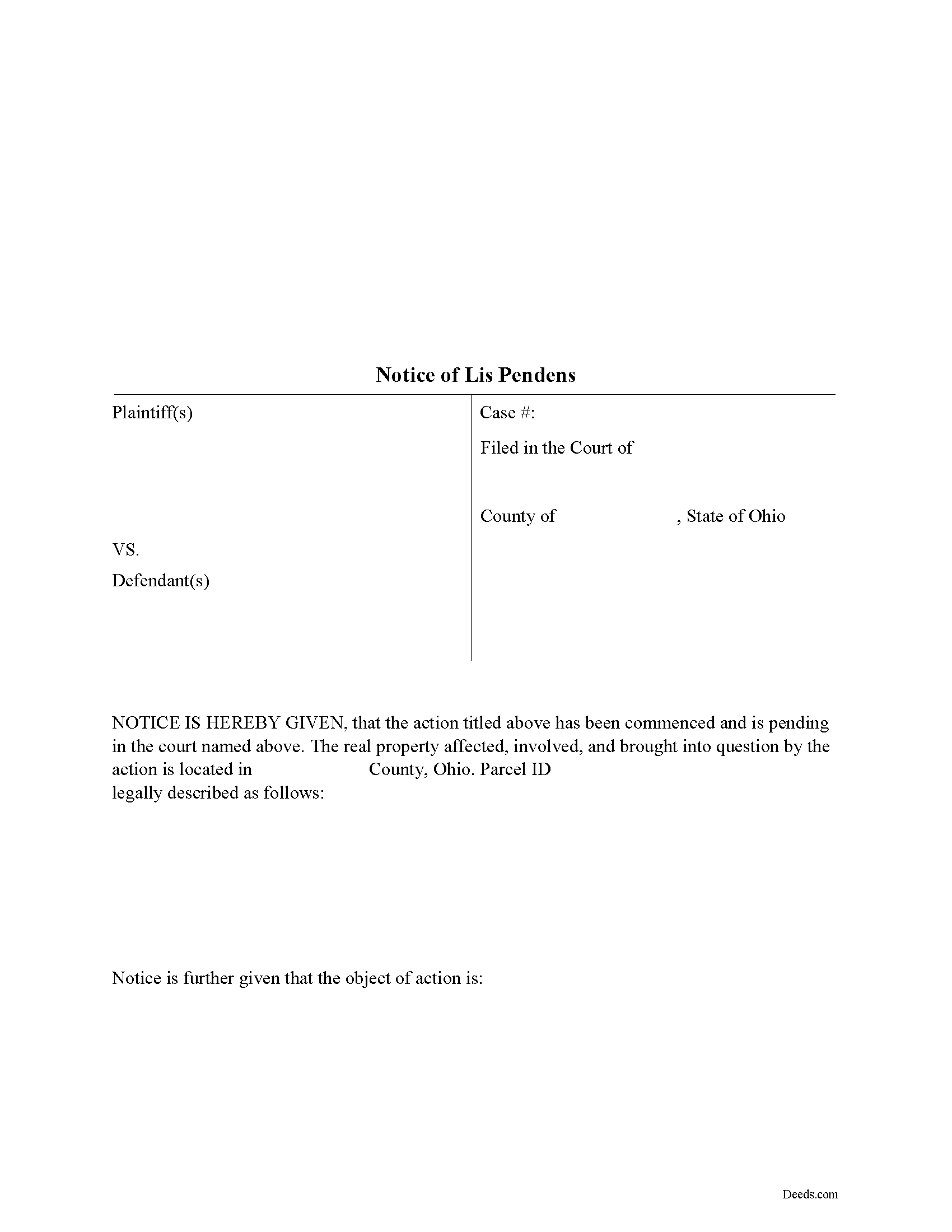

Lis Pendens

Lis pendens, Latin for "suit pending," is written notice that a lawsuit has been filed which concerns the title to, or interest in, a specific parcel of real property. The notice alerts potential lenders or buyers that the title to the property has come into question because of the pending legal action.

Ohio's statutes do not provide much guidance regarding lis pendens. Sections 2703.26-27 of the Ohio Revised Code discuss recording locations for the notice and restrict property transfers while the title is subject to lawsuit. Section 5309.58 clarifies the same details for registered land. Be aware that even in jurisdictions (like Ohio) where lis pendens is a common law doctrine, many disputes concern whether the notice is sufficient for any effect. Take time to understand the rules, get a comprehensive title search before purchasing any real estate, and please speak to an attorney for clarification.

If the property is unregistered land, and the lawsuit is filed in the same county in which all of the property is located, lis pendens attaches upon the initial filing of a complaint relating to the ownership of real property and a description of the property in the complaint. An... More Information about the Ohio Lis Pendens

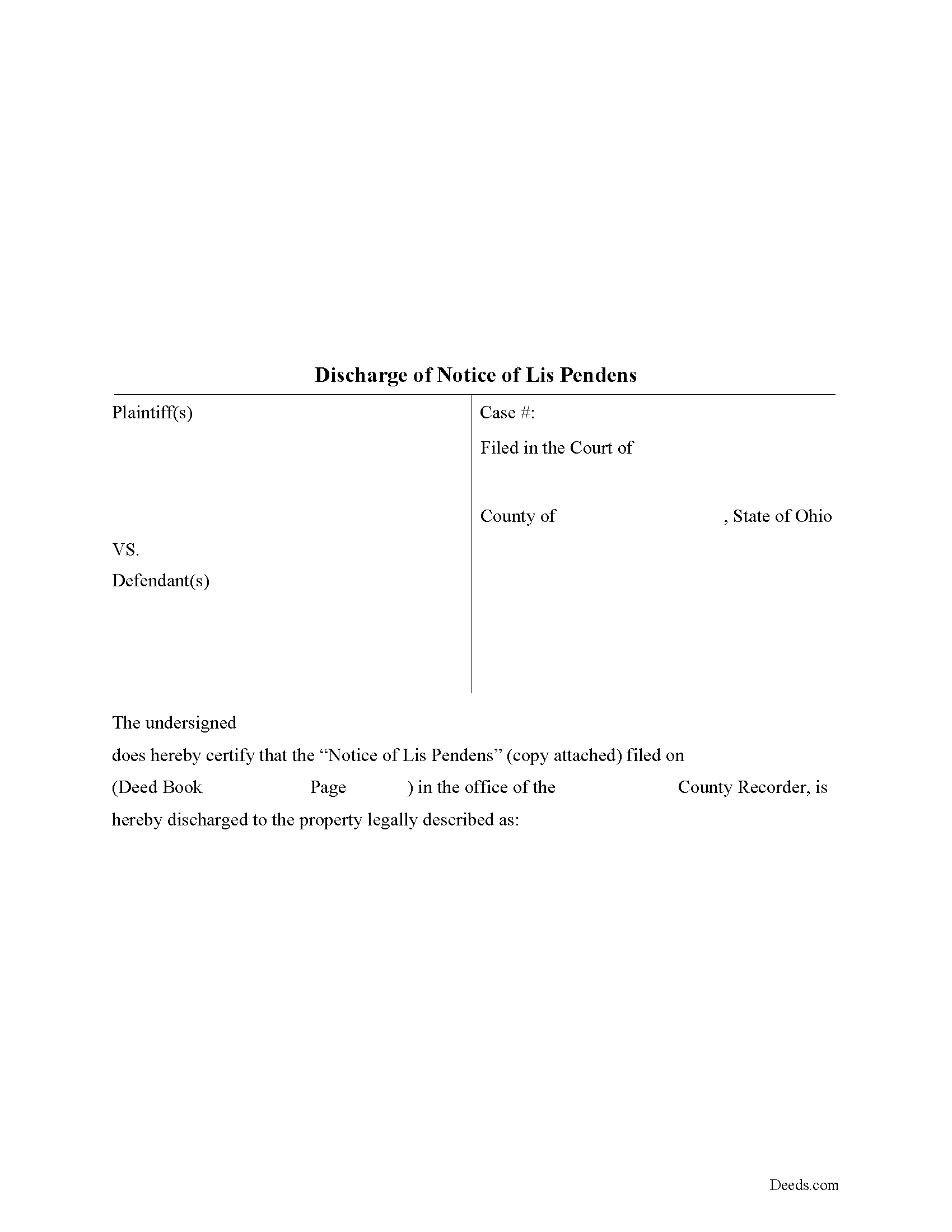

Lis Pendens Discharge

Discharging Lis Pendens in Ohio

Lis pendens, Latin for "suit pending," is written notice that a lawsuit has been filed which concerns the title to, or interest in, a specific parcel of real property. The notice alerts potential lenders or buyers that the title to the property has come into question because of the pending legal action.

Ohio's statutes do not provide much guidance regarding lis pendens. Sections 2703.26-27 of the Ohio Revised Code discuss recording locations for the notice and restrict property transfers while the title is subject to lawsuit. Section 5309.58 clarifies the same details for registered land.

Once a lis pendens is filed, what about removing it? The process varies by state, but in general, removal happens one of two ways: expungement (removal) or discharge. Expungement requires a judicial directive to cancel the notice. The judge's order gets recorded, according to state and local requirements, and anything else necessary for the specific situation. For discharge, the party who filed the original notice completes and records a document that officially withdraws the complaint.

The discharge form identifies the parties, the property subject to ... More Information about the Ohio Lis Pendens Discharge