Carbon County Transfer on Death Deed Form (Wyoming)

All Carbon County specific forms and documents listed below are included in your immediate download package:

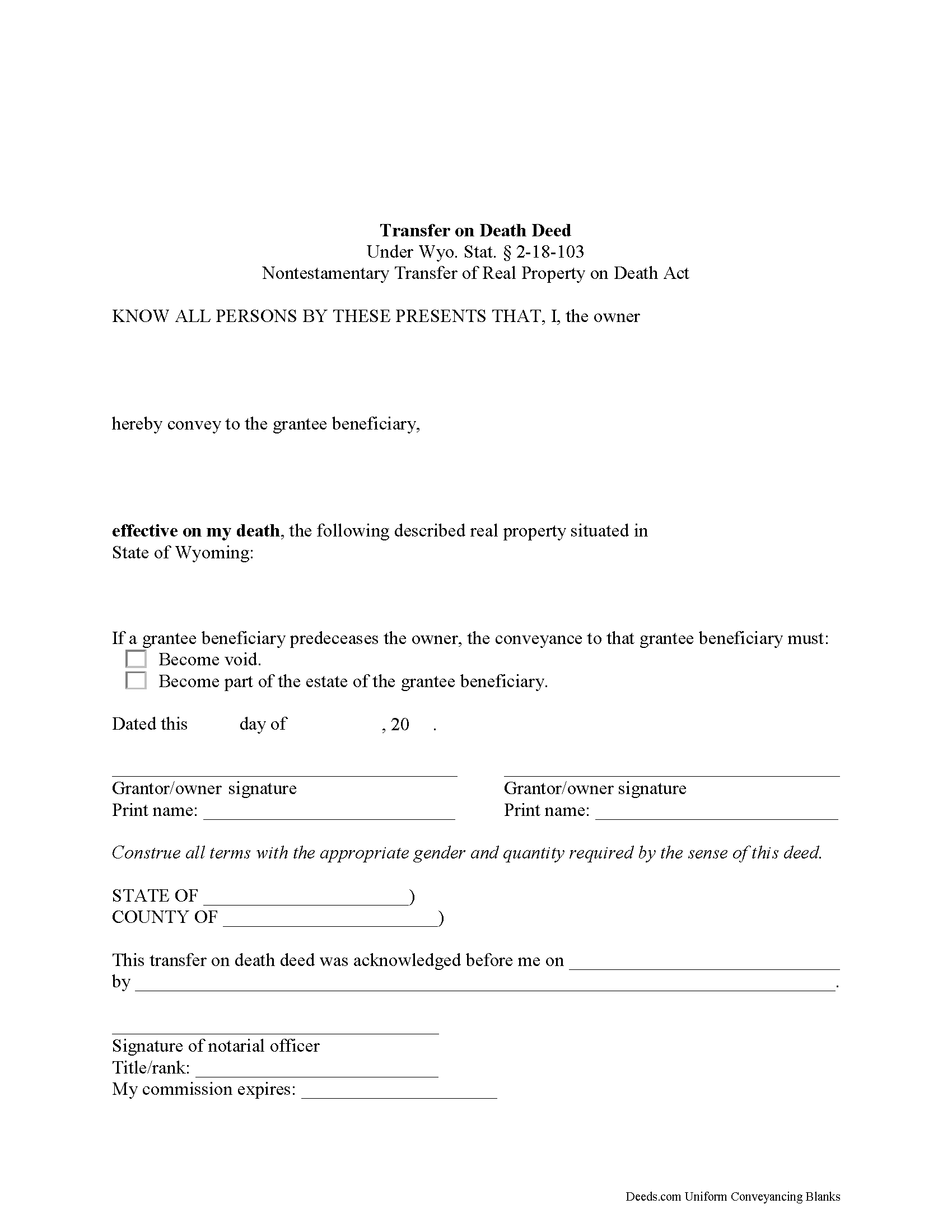

Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Carbon County compliant document last validated/updated 10/2/2024

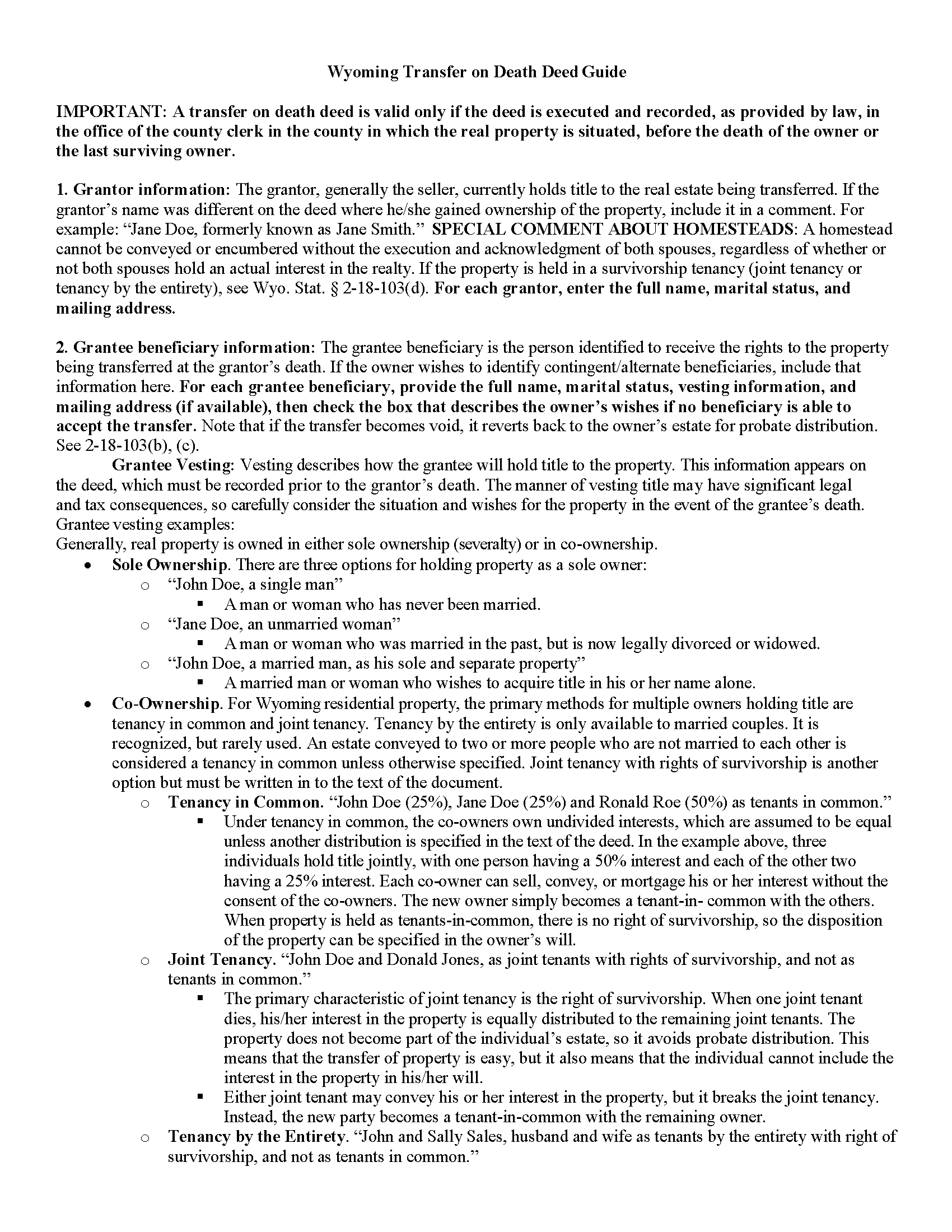

transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

Included Carbon County compliant document last validated/updated 3/19/2024

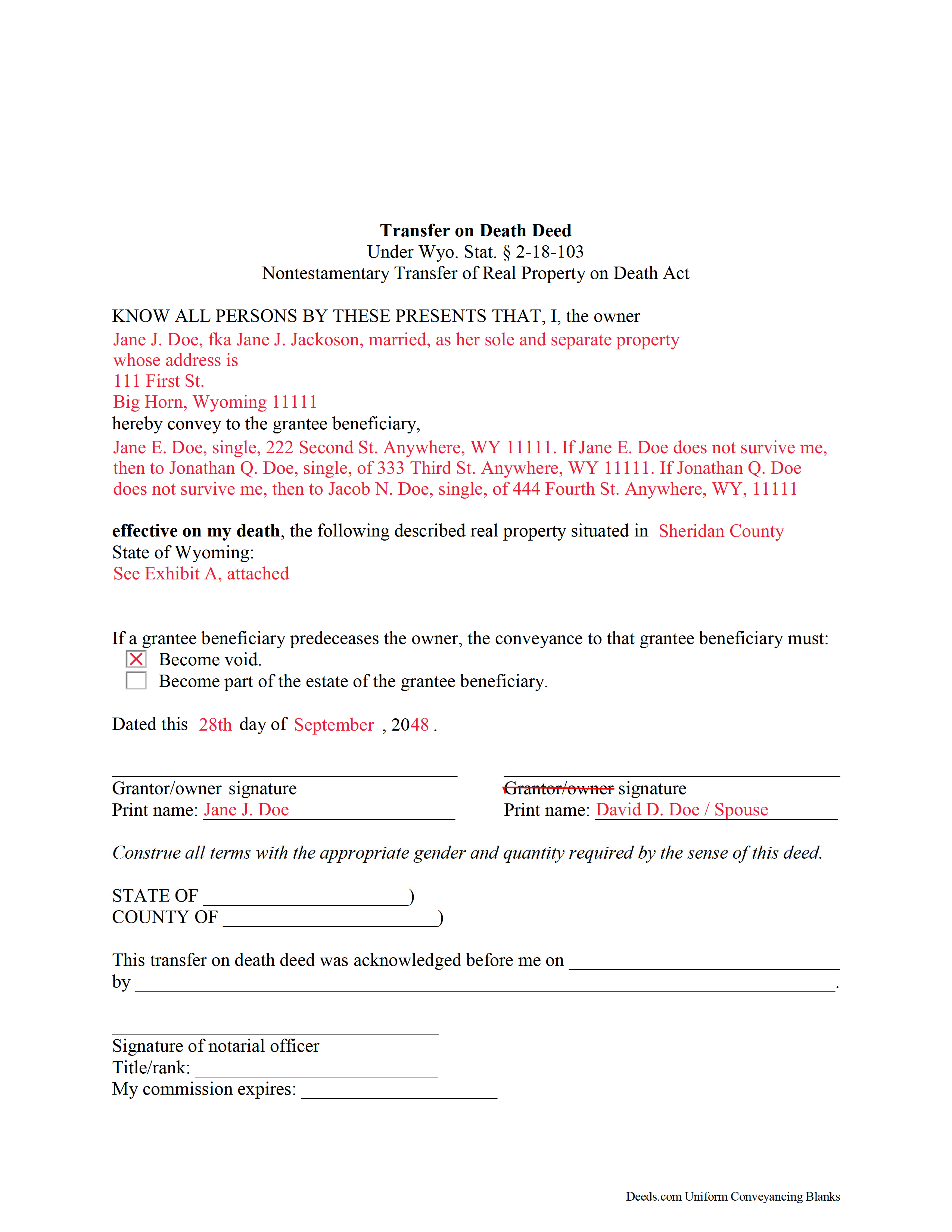

Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

Included Carbon County compliant document last validated/updated 8/8/2024

The following Wyoming and Carbon County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Deed forms, the subject real estate must be physically located in Carbon County. The executed documents should then be recorded in the following office:

Carbon County Clerk

Courthouse - 415 West Pine, Rawlins, Wyoming 82301

Hours: Monday - Friday 8:00am - 5:00pm

Phone: (307) 328-2677

Local jurisdictions located in Carbon County include:

- Baggs

- Dixon

- Elk Mountain

- Encampment

- Hanna

- Medicine Bow

- Rawlins

- Saratoga

- Savery

- Shirley Basin

- Sinclair

- Walcott

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Carbon County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Carbon County using our eRecording service.

Are these forms guaranteed to be recordable in Carbon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Carbon County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Carbon County that you need to transfer you would only need to order our forms once for all of your properties in Carbon County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Wyoming or Carbon County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Carbon County Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Wyoming's Non-testamentary Transfer of Real Property on Death Act went into effect on July 1, 2013. Find it at Sections 2-18-101-106 of the Wyoming Statutes.

A transfer on death deed is valid only if it is lawfully executed and recorded in the office of the county clerk for the county in which the real property is situated, before the death of the owner or the last surviving owner. See 2-18-103(d) for the rules concerning joint property owners, or contact an attorney for additional clarification.

By using transfer on death deeds (TODDs), people who own real estate in Wyoming have access to a flexible tool that allows them to direct what happens to their land after they die, independent from a will, and without the need for probate. As defined at 2-18-103, a TODD conveys the owner's interest in real property, subject to any debts or obligations in place during the owner's lifetime, to a designated grantee beneficiary. Note that, in addition to the providing the information required by the statutory form, TODDs must meet all state and local standards regarding format and content.

Until death, though, owners retain absolute interest in and control over the property, including the power to sell it to someone else, to change the terms of the future transfer, or to revoke the transfer outright, without notice to or permission from the beneficiary. This feature is important because it allows owners to respond to changes with minimal expense.

There are three primary ways to revoke a recorded transfer on death deed. Owners simply execute and record either

-a statutory revocation document;

-a new statutory transfer on death deed; or

-a traditional deed, such as a warranty or quitclaim deed, transferring the property to another party.

Modifications are fairly simple, but it is important to make sure that any other estate documents, such as wills, reflect the same wishes. Otherwise, the conflicts could lead to unnecessary delays and expenses.

Overall, Wyoming's transfer on death deeds can be a useful part of a comprehensive estate plan. Even so, they may not be appropriate for everyone. Please consult an attorney with specific questions or for complex situations.

(Wyoming TODD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Carbon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Carbon County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen W.

May 16th, 2020

It provided the forms I could not find elsewhere.

Thank you.

Thank you!

Karen C.

November 22nd, 2019

Quick and easy download. Got everything I needed. I would recommend deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Paul D.

July 24th, 2019

Easy to use! The forms were perfect and everything was explained well! Will use again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William G M.

October 10th, 2019

This site is very easy to use.

Thank you!

JAMES E.

November 22nd, 2020

Easy to use and excellent software.

Thank you!

Lauren D.

May 13th, 2019

Prompt and helpful

Thank you!

FRANK D.

September 28th, 2019

Excellent software along with my other Will/Trust programs. I always use your program regarding deeds.

Thank you!

Todd W.

September 3rd, 2020

Communication is hard. The reps need to be empowered and encouraged to call the customers when necessary. They encourage 300 dpi resolution and under 2 MB PDF file, which is not even possible with our scanner. They made a vague comment about a legal description looking abbreviated but did not explain. They refused to call me. They said the county said "Image is light please darken", but the image looked fine to me. Maybe not their fault, but they refused to help work with the county on that for me. I followed their suggestion though and re-scanned at 300 dpi, but they misunderstood me and did not re-submit it right away. Over 48 hours later, it's still not recorded yet. I hope it will be today.

Thank you for your feedback Todd.

Frank C.

January 10th, 2023

Great experience and online account service

Thank you for your feedback. We really appreciate it. Have a great day!

JOHN S.

October 16th, 2021

They had everything for a living trust but the form to transfer your house into the living trust

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tracey M.

August 9th, 2022

Using Deeds.com was unbelievably quick and easy to file a deed restriction with our local county office. From uploading the initial file to deeds.com, to having a fully recorded document was right on one hour - and all from the comfort of my home.

I found your service was easy to use and your staff were very quick in responding to my filing. I will definitely use and recommend deeds.com in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

franklin m.

October 14th, 2020

good format, helpful instructions

Thank you!