Rock County Warranty Deed Form (Wisconsin)

All Rock County specific forms and documents listed below are included in your immediate download package:

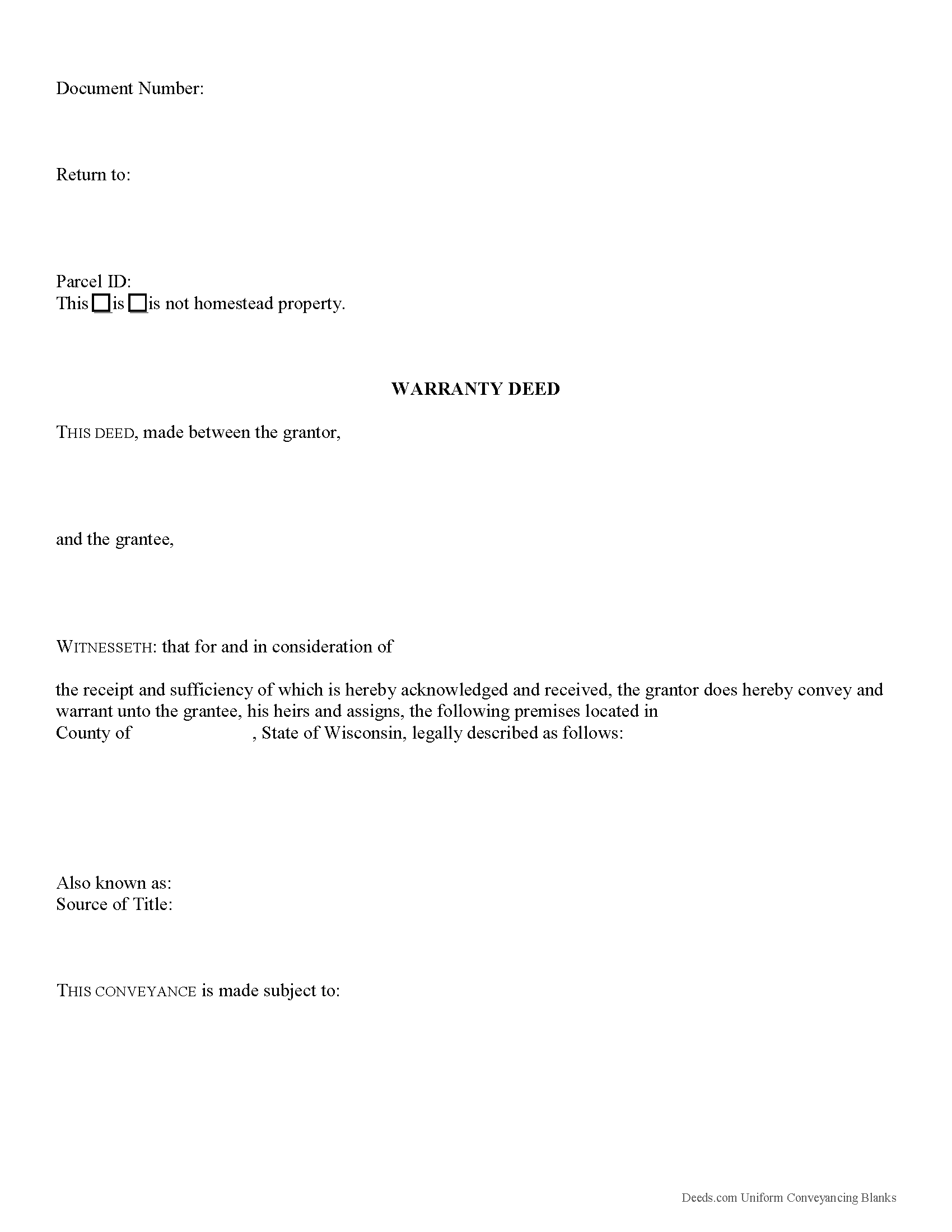

Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Rock County compliant document last validated/updated 11/26/2024

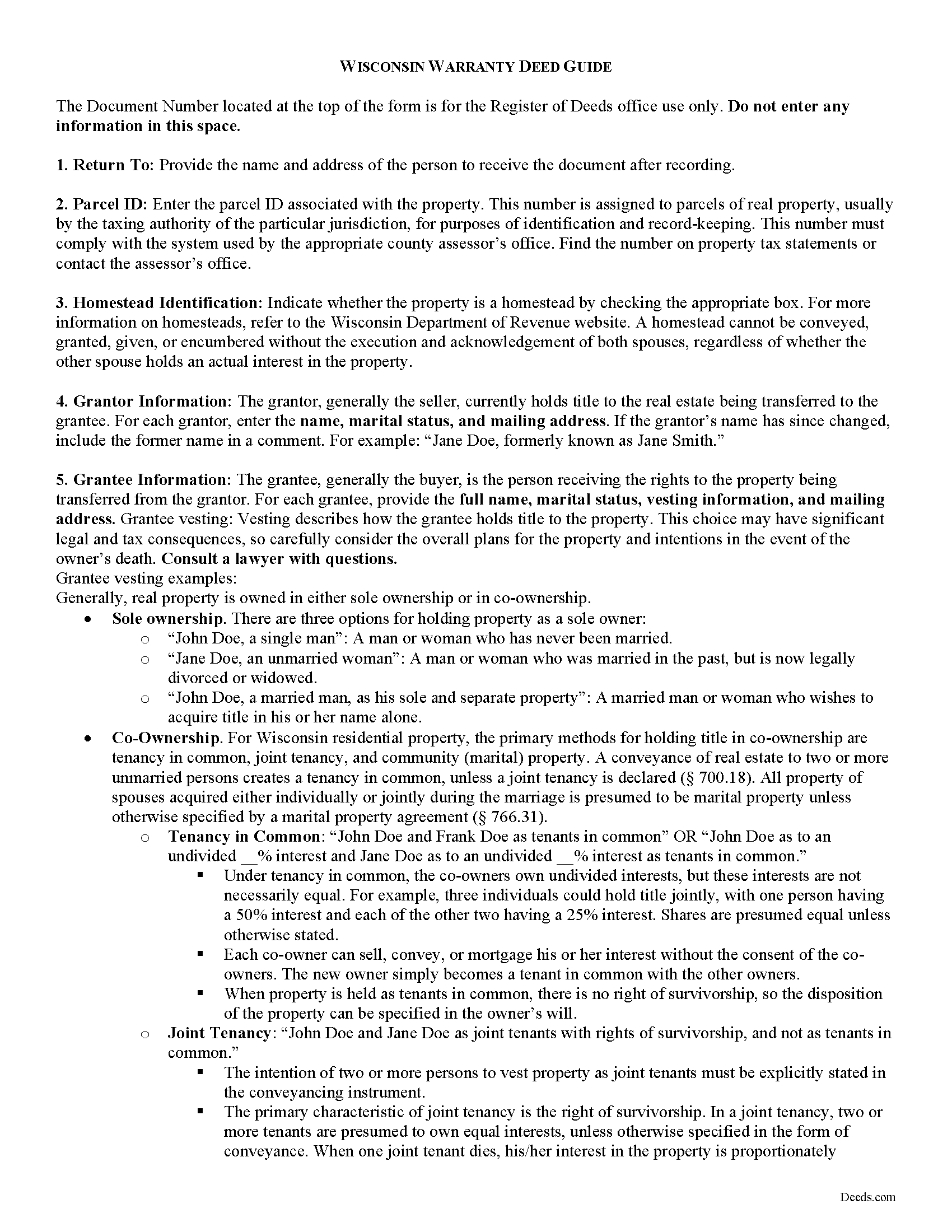

Warranty Deed Guide

Line by line guide explaining every blank on the form.

Included Rock County compliant document last validated/updated 10/16/2024

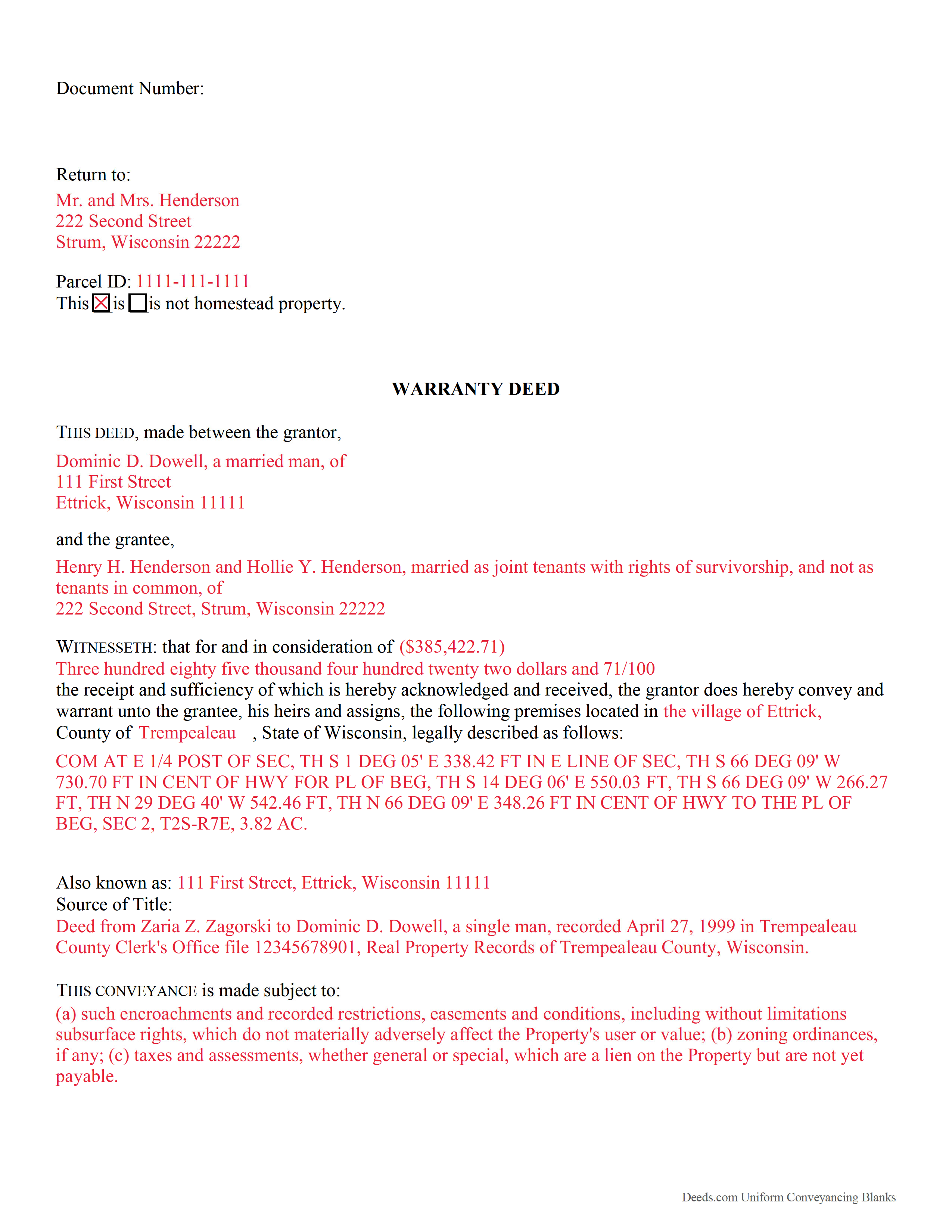

Completed Example of the Warranty Deed Document

Example of a properly completed form for reference.

Included Rock County compliant document last validated/updated 10/30/2024

The following Wisconsin and Rock County supplemental forms are included as a courtesy with your order:

When using these Warranty Deed forms, the subject real estate must be physically located in Rock County. The executed documents should then be recorded in the following office:

Rock County Register of Deeds

Courthouse - 51 South Main St, Janesville, Wisconsin 53545

Hours: Monday - Friday 8:00 am - 5:00 pm

Phone: (608) 757-5650

Local jurisdictions located in Rock County include:

- Afton

- Avalon

- Beloit

- Clinton

- Edgerton

- Evansville

- Footville

- Hanover

- Janesville

- Milton

- Orfordville

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Rock County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Rock County using our eRecording service.

Are these forms guaranteed to be recordable in Rock County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rock County including margin requirements, content requirements, font and font size requirements.

Can the Warranty Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Rock County that you need to transfer you would only need to order our forms once for all of your properties in Rock County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Wisconsin or Rock County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Rock County Warranty Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In Wisconsin, title to real property can be transferred from one party to another using a warranty deed. When recorded, a warranty deed conveys an interest in real property to the named grantee with full warranties of title.

A warranty deed offers the most assurance of title. This assurance is greater than that of a limited or special warranty deed, which guarantees the title only against claims that arose during the time the grantor held title to the property, or a quitclaim deed, which offers no warranties of title.

As defined in section 706.10(5) of the Wisconsin Statutes, a warranty deed conveys real property in fee simple to the grantee and contains covenants by the grantor that he or she holds title to the property and has "good right to convey the same land or its title." The grantor guarantees that the property is "free from all encumbrance" and that he or she will "guarantee and defend the title and quiet possession of the land against all lawful claims whatever originating prior to the conveyance" (706.10(5)). A warranty deed is recognizable by the terms "convey and warrant," but no warranties are implied in Wisconsin, so theses covenants must be explicitly stated in the deed (706.10(6)).

In addition to meeting all state and local standards for recorded documents, a lawful warranty deed includes the grantor's full name, mailing address, and marital status, the consideration given for the transfer, and the grantee's full name, marital status, vesting, and mailing address. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Wisconsin residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy, and community (marital) property. A conveyance of real estate to two or more unmarried persons creates a tenancy in common, unless a joint tenancy is declared (700.18). All property of spouses acquired either individually or jointly during the marriage is presumed to be marital property unless otherwise specified by a marital property agreement (766.31).

In Wisconsin, when a conveyance is presented to the Register of Deeds for recording, it must be accompanied by a receipt that evidences completion of a Wisconsin Real Estate Transfer Return. The real estate transfer fee is levied based on either the consideration made for the transfer or the current fair market value of the real property, as reflected on the form (77.22(1)). Submit the form electronically via the Wisconsin Department of Revenue website. All conveyances require a completed form or an exemption stated on the face of the deed. Find a list of exempt documents at 77.25.

As with any conveyance of realty, a warranty deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The finished copy of the deed must be signed by the grantor and notarized. Additionally, the grantor's spouse must join in signing to release rights of homestead, regardless of whether he or she holds an actual interest in the property conveyed. Record the original completed deed, along with any additional materials, at the Register of Deeds office of the county where the property is located. Contact the same office to verify recording fees and accepted forms of payment.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a Wisconsin lawyer with any questions related to the transfer of real property.

(Wisconsin WD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Rock County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rock County Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4437 Reviews )

Jubal T.

November 27th, 2024

This is the most comprehensive, helpful real estate tool I have seen. I was at first worried because the 330# didn’t have live operators but I received messages in my account as quickly as a conversation had by text and was able to download a deed and record it the same day in a county 1,300 miles away. Highly recommended!

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Michael S.

November 27th, 2024

Recording a Warranty Deed with Mohave County AZ was easy and efficient by using Deeds.com. I will be using their service for all of my e-filing going forward. Thank you Deeds.com!!!!

We are delighted to have been of service. Thank you for the positive review!

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Iryna D.

March 31st, 2020

Exelent work!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Fernando C.

April 13th, 2019

I was able to get what I needed!! Easy and fast!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

AHMED E.

August 23rd, 2019

5 stars

Thank you!

Tracy B.

March 20th, 2020

I was happy with the way this worked and the quick responses. Unfortunately, my documents could not be pulled.

I will use this service again in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis E.

March 21st, 2019

Easy to complete form. Examples were very helpful in using correct verbiage for form. Also way less expensive than the $500 an attorney wanted to charge me for doing the very same thing!!!

Thanks Dennis, we appreciate you taking the time to leave your feedback.

Patricia J.

October 31st, 2021

No word "Download" so had a little trouble figuring out how to download, but finally figured it out.

Thank you for your feedback. We really appreciate it. Have a great day!

Glenda W.

April 22nd, 2021

It is a very helpful and awesome website. I was so glad to hear

about it. It is very convenient and saves money as well. I'm sure I will be using it again in the future. Thumbs up to deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Bobby Y.

June 7th, 2024

I like the content and the availability to conduct valuable business online

Thank you!

Robert E B.

May 7th, 2021

Easy to use!

Thank you!

Kris S.

July 15th, 2021

Being a real estate agent I know just enough about legal documents to get in trouble. Thankfully the pros here know what they are doing.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan S.

February 9th, 2021

I just started using Deeds.com but so far it has been a very easy and pleasant experience. I work in the area of family law and I was thrilled to find a service that offers the recoding of deeds via e-recording.

Glad we could be of service Susan, thank you for your kind words. Have an amazing day!

Maxine P.

August 24th, 2020

This is so amazing and I truly thank you for what I needed for my documents. This is a great company and will take care of what you needs.

Thank you for your feedback. We really appreciate it. Have a great day!