Door County Transfer on Death to Beneficiary Form (Wisconsin)

All Door County specific forms and documents listed below are included in your immediate download package:

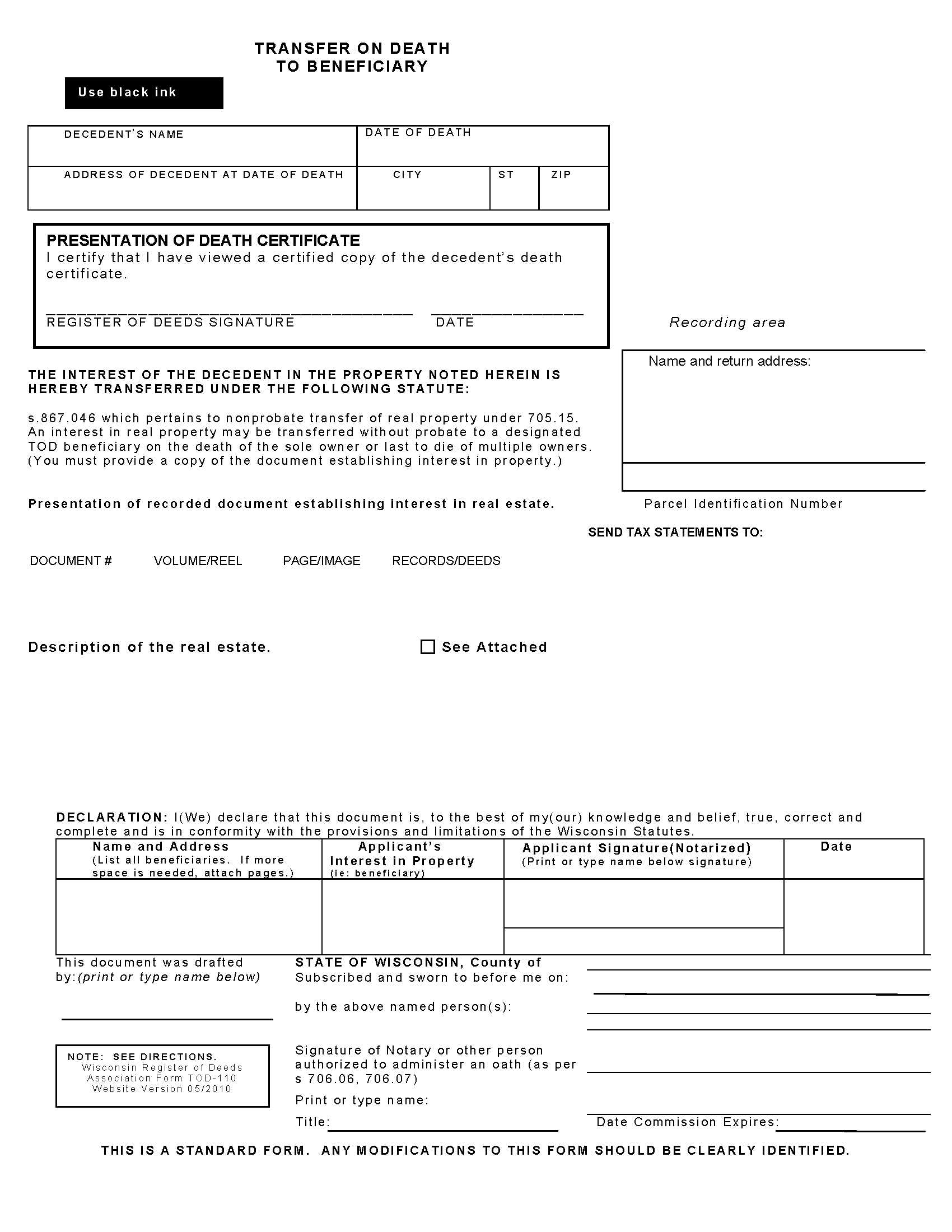

Transfer on Death to Beneficiary Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Door County compliant document last validated/updated 10/11/2024

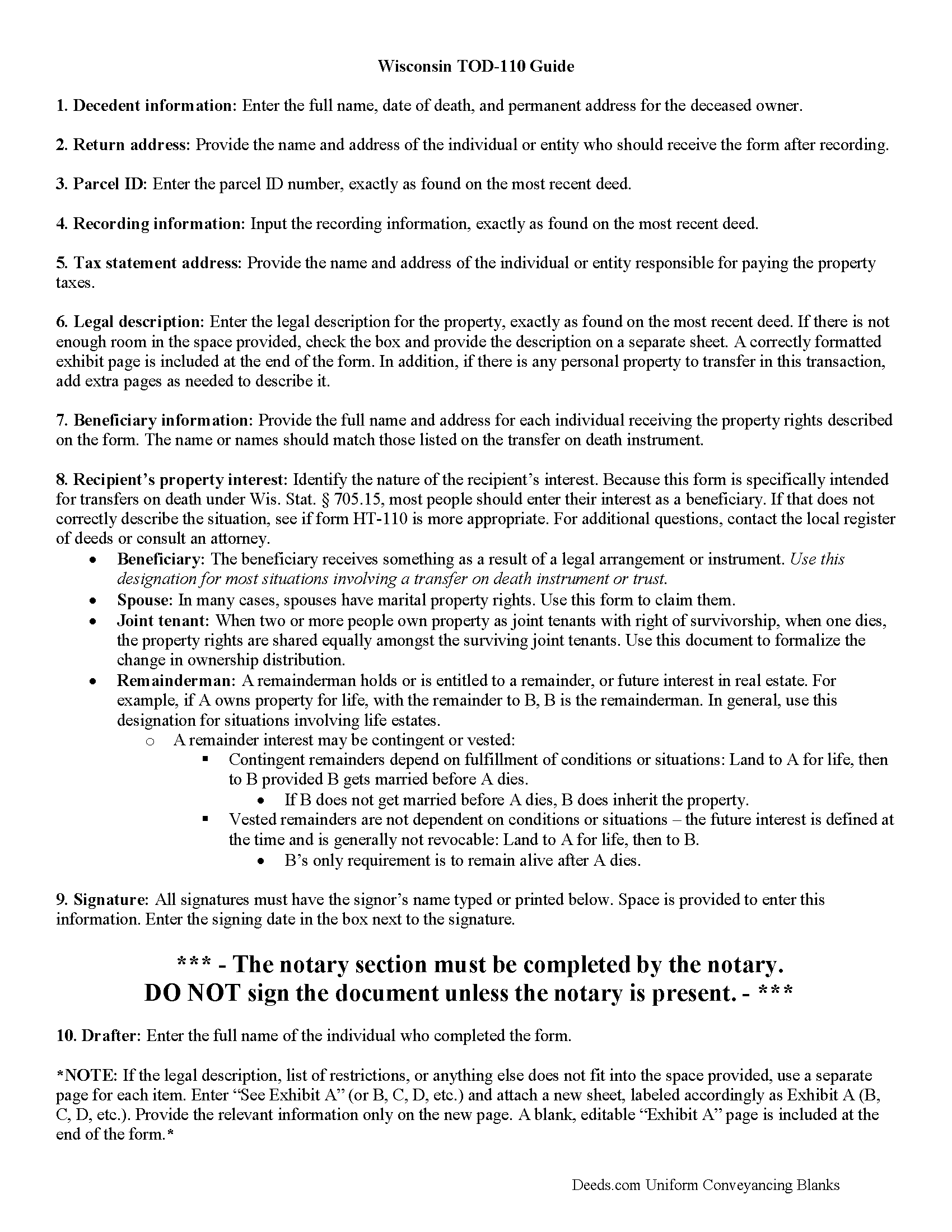

Transfer on Death to Beneficiary Guide

Line by line guide explaining every blank on the form.

Included Door County compliant document last validated/updated 10/28/2024

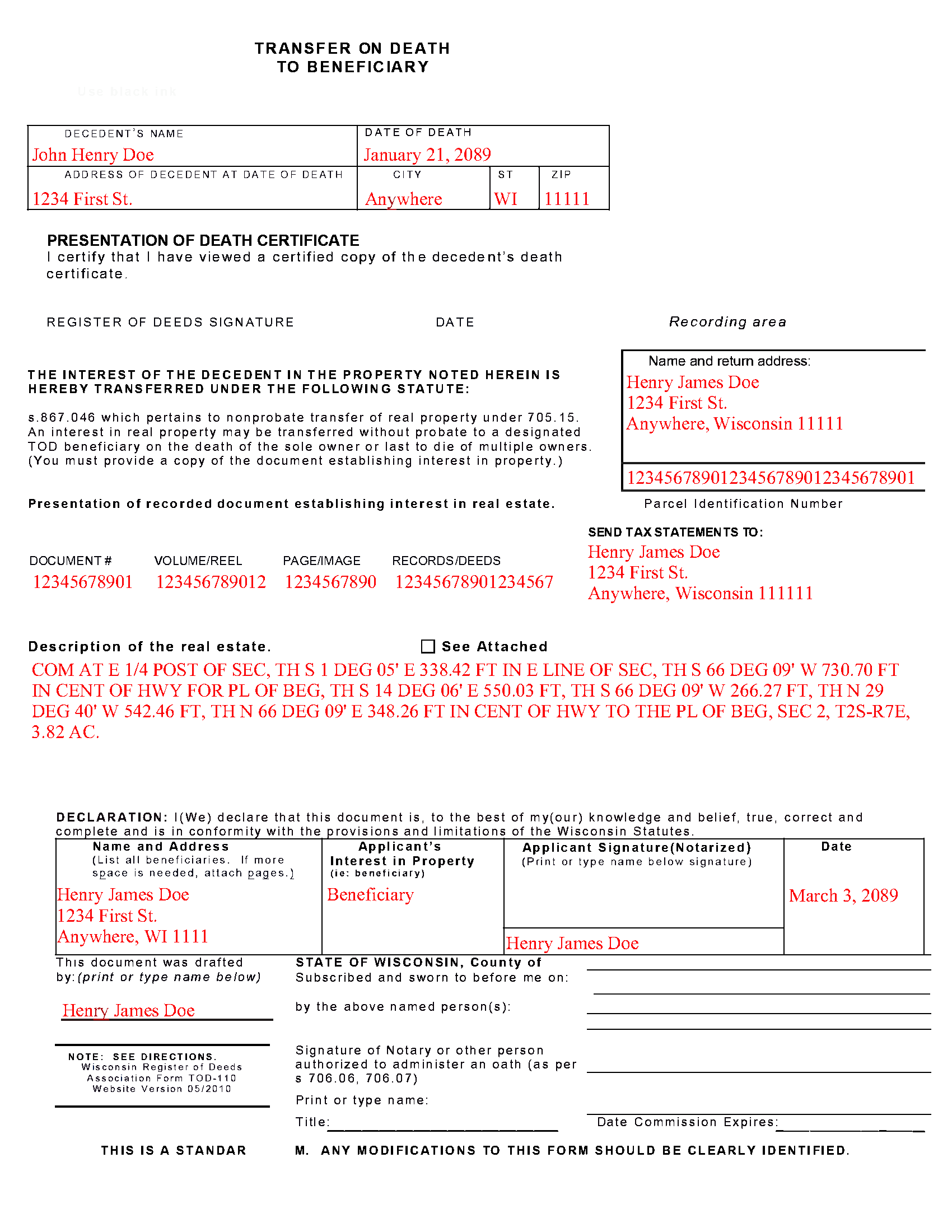

Completed Example of the Transfer on Death to Beneficiary Document

Example of a properly completed form for reference.

Included Door County compliant document last validated/updated 9/10/2024

The following Wisconsin and Door County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death to Beneficiary forms, the subject real estate must be physically located in Door County. The executed documents should then be recorded in the following office:

Door County Register

421 Nebraska St, Sturgeon Bay, Wisconsin 54235

Hours: Monday - Friday 8:00am - 4:30pm

Phone: (920) 746-2270

Local jurisdictions located in Door County include:

- Baileys Harbor

- Brussels

- Egg Harbor

- Ellison Bay

- Ephraim

- Fish Creek

- Forestville

- Maplewood

- Sister Bay

- Sturgeon Bay

- Washington Island

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Door County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Door County using our eRecording service.

Are these forms guaranteed to be recordable in Door County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Door County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death to Beneficiary forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Door County that you need to transfer you would only need to order our forms once for all of your properties in Door County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Wisconsin or Door County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Door County Transfer on Death to Beneficiary forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Transfer to Beneficiary -- TOD-110

Completing the Change of Property Rights from a Wisconsin Transfer on Death Deed

When a grantor/owner of real estate under a Wisconsin transfer on death deed dies, the named beneficiary or beneficiaries gain the rights to the property by function of law. Even though this transfer is, in theory, automatic, the best way to ensure accurate and up-to-date ownership records is to file a completed and notarized transfer on death to beneficiary form TOD-110 with the register of deeds for the county where the land is located. By recording this document, the new owner formalizes the transfer and provides public notice of the new status.

(Wisconsin TOD to Beneficiary Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Door County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Door County Transfer on Death to Beneficiary form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4437 Reviews )

Jubal T.

November 27th, 2024

This is the most comprehensive, helpful real estate tool I have seen. I was at first worried because the 330# didn’t have live operators but I received messages in my account as quickly as a conversation had by text and was able to download a deed and record it the same day in a county 1,300 miles away. Highly recommended!

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Michael S.

November 27th, 2024

Recording a Warranty Deed with Mohave County AZ was easy and efficient by using Deeds.com. I will be using their service for all of my e-filing going forward. Thank you Deeds.com!!!!

We are delighted to have been of service. Thank you for the positive review!

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Thomas K.

July 25th, 2020

I never did this before and I found the service easy however confusing about the process and expectations. I had a trust prepared and needed to record our home deed to the trust. Now that I am almost finished waiting for the Maricopa county record the deed it seems so easy.

Thank you!

Lois S.

June 8th, 2020

This website made it easy to quickly research what was recorded/released on the title of my home.

Thank you for your feedback. We really appreciate it. Have a great day!

David W.

March 21st, 2019

Excellent service! Questions were answered promptly, and the entire process was easy and fast. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

RICHARD H.

October 29th, 2020

Wonderful

Thank you!

Judith F.

May 6th, 2022

The form I needed was perfect!

Thank you!

Leslie P.

October 16th, 2021

Fantastic deed forms, formatting was spot on, nice not to have to worry about it considering how picky our clerk is. Great job you guys and gals!

Thank you for the kind words Leslie!

James I.

March 3rd, 2023

It worked out very well.

Got the form(s) with

clear instructions.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sally Ann C.

November 16th, 2019

Thank you for your service. It seems to have worked, I printed a document purporting to be the Deed I needed. I was somewhat disappointed though - I was expecting something as impressive as the Title Search, which goes back to 1828 and includes Millard Fillmore, admittedly not one of our most celebrated Presidents. But I am happy to have what I have, and thank you again!

peace -

SAVC

Thank you for your feedback. We really appreciate it. Have a great day!

Lawrence W.

January 17th, 2019

Great so Far!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Monica M.

September 15th, 2020

I was very impressed with the quick responses I received from my questions. Usually when forced to communicate via email, responses aren't received right away. Thank you for being on top of things.

Thank you!

Richard O.

June 2nd, 2020

Thank you for providing this service. It was quick and easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Warren R.

April 24th, 2020

Nice service at a fair price. Website is not very user oriented. Messages accumulate in the messages area but are not emailed to the client. If you used the service regularly, it would be more understandable but for a first time or occasional user, the site can be time consuming.

Thank you!