Brown County Transfer on Death to Beneficiary Form (Wisconsin)

All Brown County specific forms and documents listed below are included in your immediate download package:

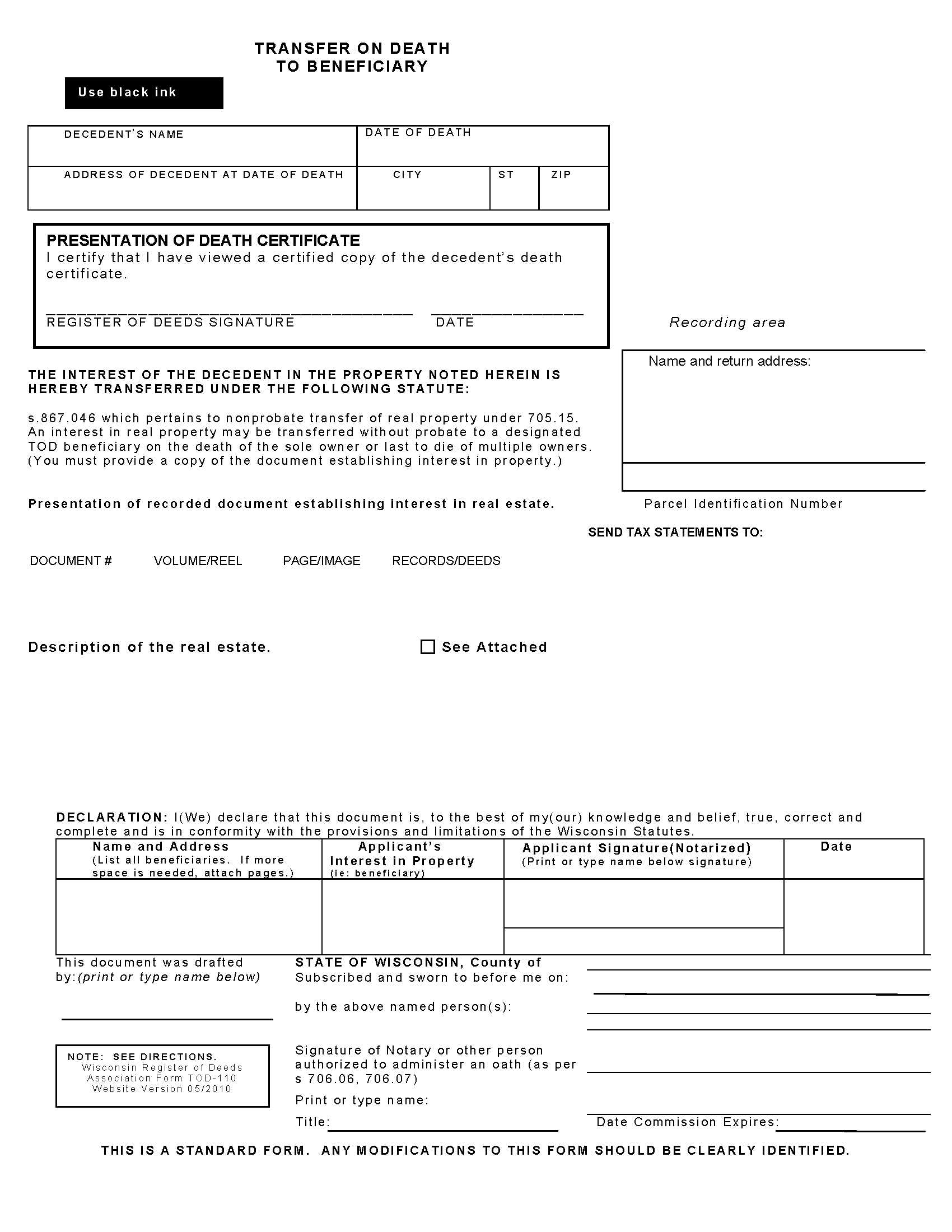

Transfer on Death to Beneficiary Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Brown County compliant document last validated/updated 10/11/2024

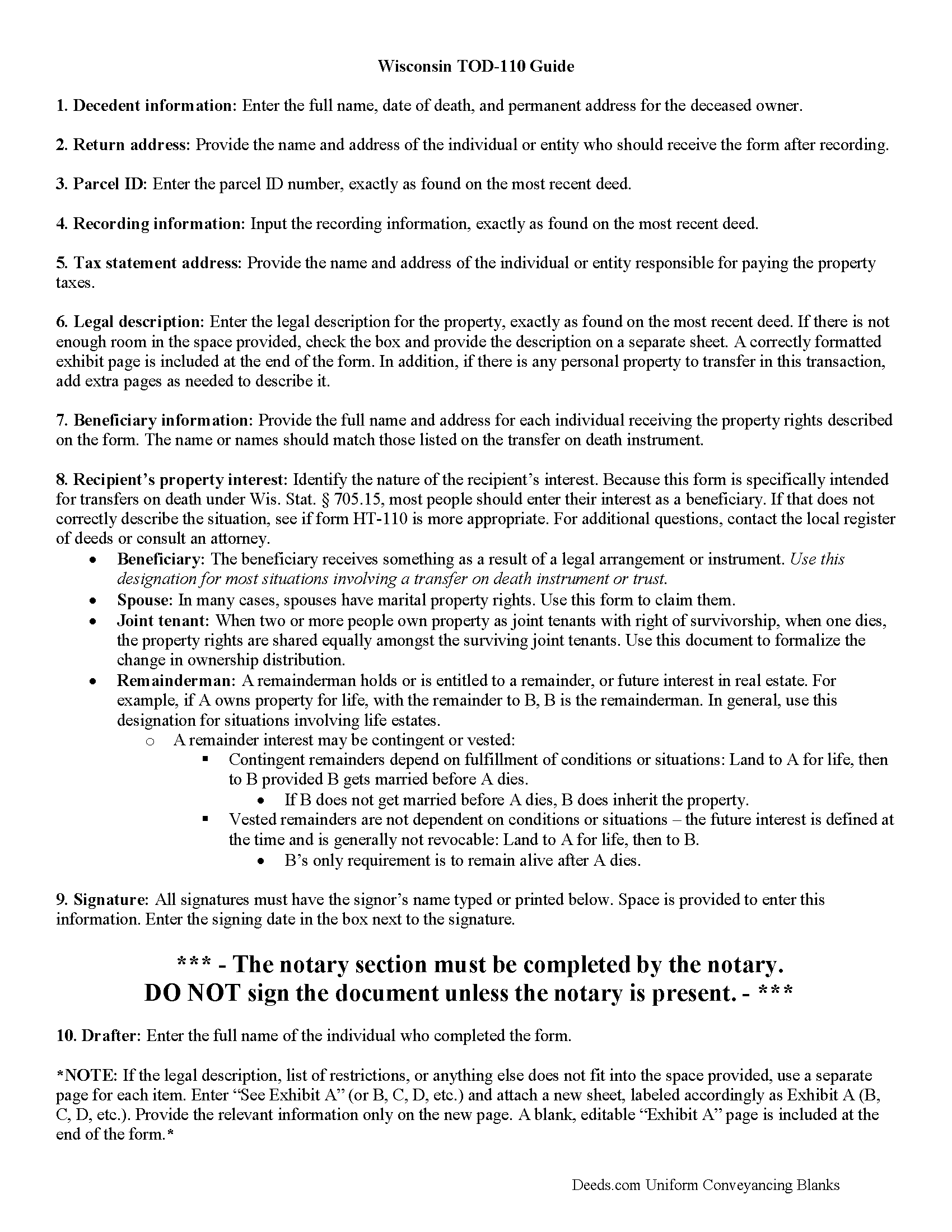

Transfer on Death to Beneficiary Guide

Line by line guide explaining every blank on the form.

Included Brown County compliant document last validated/updated 10/28/2024

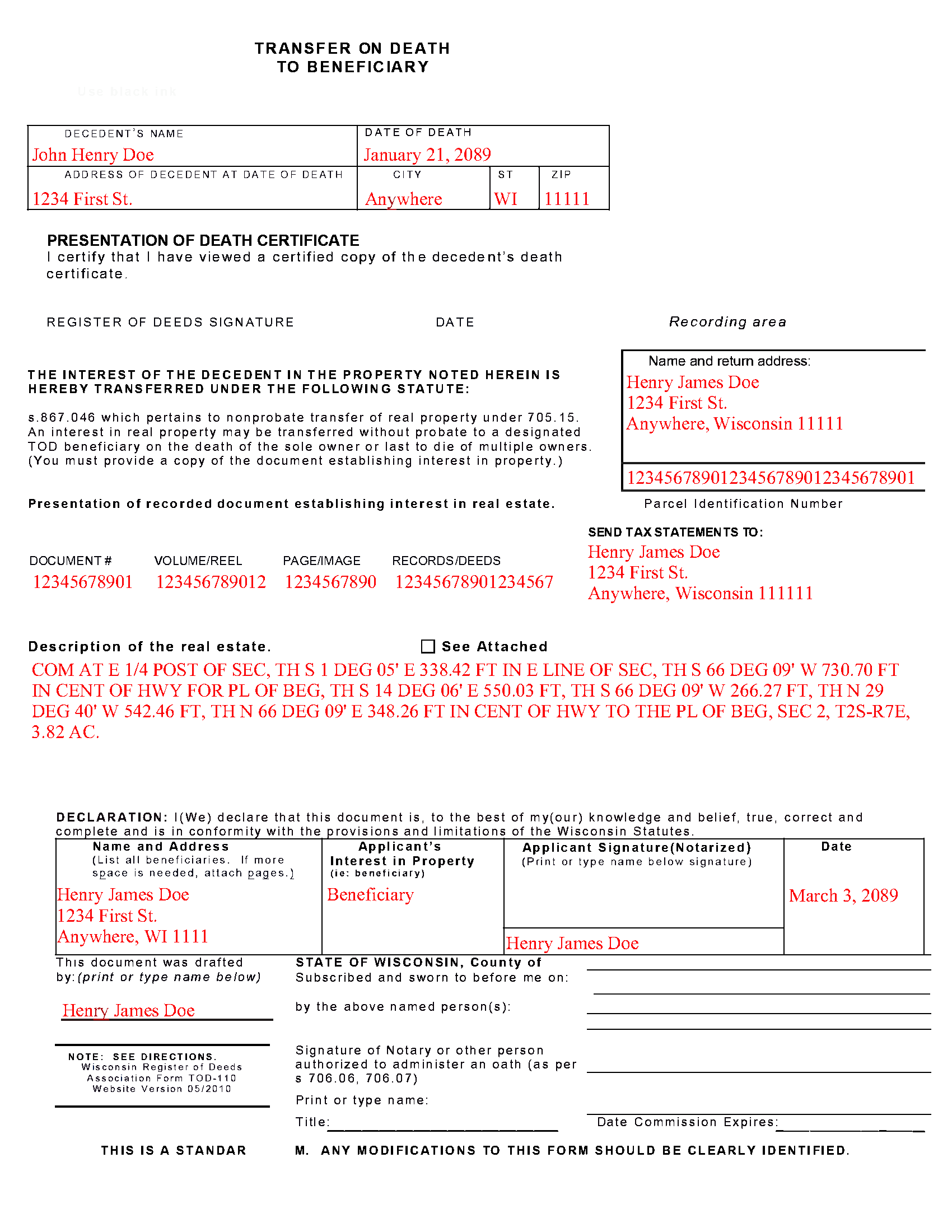

Completed Example of the Transfer on Death to Beneficiary Document

Example of a properly completed form for reference.

Included Brown County compliant document last validated/updated 9/10/2024

The following Wisconsin and Brown County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death to Beneficiary forms, the subject real estate must be physically located in Brown County. The executed documents should then be recorded in the following office:

Register of Deeds

305 East Walnut St / PO Box 23600, Green Bay, Wisconsin 54301 / 54305-3600

Hours: Monday - Friday 8:00 am - 4:30 pm, Real Estate Recording 8:00 a.m. - 4:00 p.m.

Phone: (920) 448-4470

Local jurisdictions located in Brown County include:

- De Pere

- Denmark

- Green Bay

- Greenleaf

- New Franken

- Oneida

- Pulaski

- Suamico

- Wrightstown

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Brown County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Brown County using our eRecording service.

Are these forms guaranteed to be recordable in Brown County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Brown County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death to Beneficiary forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Brown County that you need to transfer you would only need to order our forms once for all of your properties in Brown County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Wisconsin or Brown County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Brown County Transfer on Death to Beneficiary forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Transfer to Beneficiary -- TOD-110

Completing the Change of Property Rights from a Wisconsin Transfer on Death Deed

When a grantor/owner of real estate under a Wisconsin transfer on death deed dies, the named beneficiary or beneficiaries gain the rights to the property by function of law. Even though this transfer is, in theory, automatic, the best way to ensure accurate and up-to-date ownership records is to file a completed and notarized transfer on death to beneficiary form TOD-110 with the register of deeds for the county where the land is located. By recording this document, the new owner formalizes the transfer and provides public notice of the new status.

(Wisconsin TOD to Beneficiary Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Brown County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Brown County Transfer on Death to Beneficiary form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4437 Reviews )

Jubal T.

November 27th, 2024

This is the most comprehensive, helpful real estate tool I have seen. I was at first worried because the 330# didn’t have live operators but I received messages in my account as quickly as a conversation had by text and was able to download a deed and record it the same day in a county 1,300 miles away. Highly recommended!

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Michael S.

November 27th, 2024

Recording a Warranty Deed with Mohave County AZ was easy and efficient by using Deeds.com. I will be using their service for all of my e-filing going forward. Thank you Deeds.com!!!!

We are delighted to have been of service. Thank you for the positive review!

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Nancy R.

October 25th, 2024

Deeds.com is very precise, helpful and friendly. I found the form I needed without any effort and everything worked perfect and smooth. I recommend it 100%. rnThank you.

We are delighted to have been of service. Thank you for the positive review!

EILEEN K.

March 17th, 2022

I received my product in great condition and it works ok.

Thankyou!!!

Thank you!

Richard A.

June 24th, 2020

Great product. It would be better if the document files were not embedded within other files. It made downloading a little confusing. The titles of the forms did not match exactly word for word, which required a lot of back and forth to make sure I had downloaded the proper document. What would be great is if once you download a document, the hyperlink changed color, or somehow denoted the document had been downloaded. Just a suggestion. You have my email address if you have questions. STILL! Five stars for you guys. I would not let that hiccup dissuade me from buying any form package from you guys. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

David Q.

April 14th, 2020

Very easy...great service.

Thank you!

Wanda C.

August 20th, 2020

Site is very well laid out and easy to use. My only issue is that it wouldn't allow me to change my password, so I'm stuck with the "temporary" one. Not a big deal, but I would have preferred to change it.

Thank you for your feedback. We really appreciate it. Have a great day!

Laurie B.

June 23rd, 2021

You have made this process so simple - I can see it would have been complicated and frustrating without Deeds.com. Thank you!

Thank you!

Daniel R.

December 6th, 2021

Could have had Clerk's certification of mailing form after it is recorded. Not fatal, but I did have to resort to reading the statute as well.

Thank you!

Evelia G.

January 4th, 2019

I love this guide. Thank you for having this available.

Thanks so much for your feedback Evelia, have a fantastic day!

Ming W.

December 22nd, 2020

couldn't believe how efficient and perfect job you have done!! I will recommend your website to all friends.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael M.

June 14th, 2022

Amazing time saver, fantastic resource if you have an idea of what you are looking for and you can read. No one is going to hold your hand so be prepared to do the research yourself... it is DIY after all.

Thanks for the kind words Michael. Have a wonderful day.

Kathleen M.

December 29th, 2023

I am very happy with this service

Your kind words have brightened our teams day! Thank you for the positive feedback.

Cindy H.

January 16th, 2021

It was easy and quick. Such a pleasure to use since we live out of town. So convenient. Definitely would recommend.

Thank you for your feedback. We really appreciate it. Have a great day!