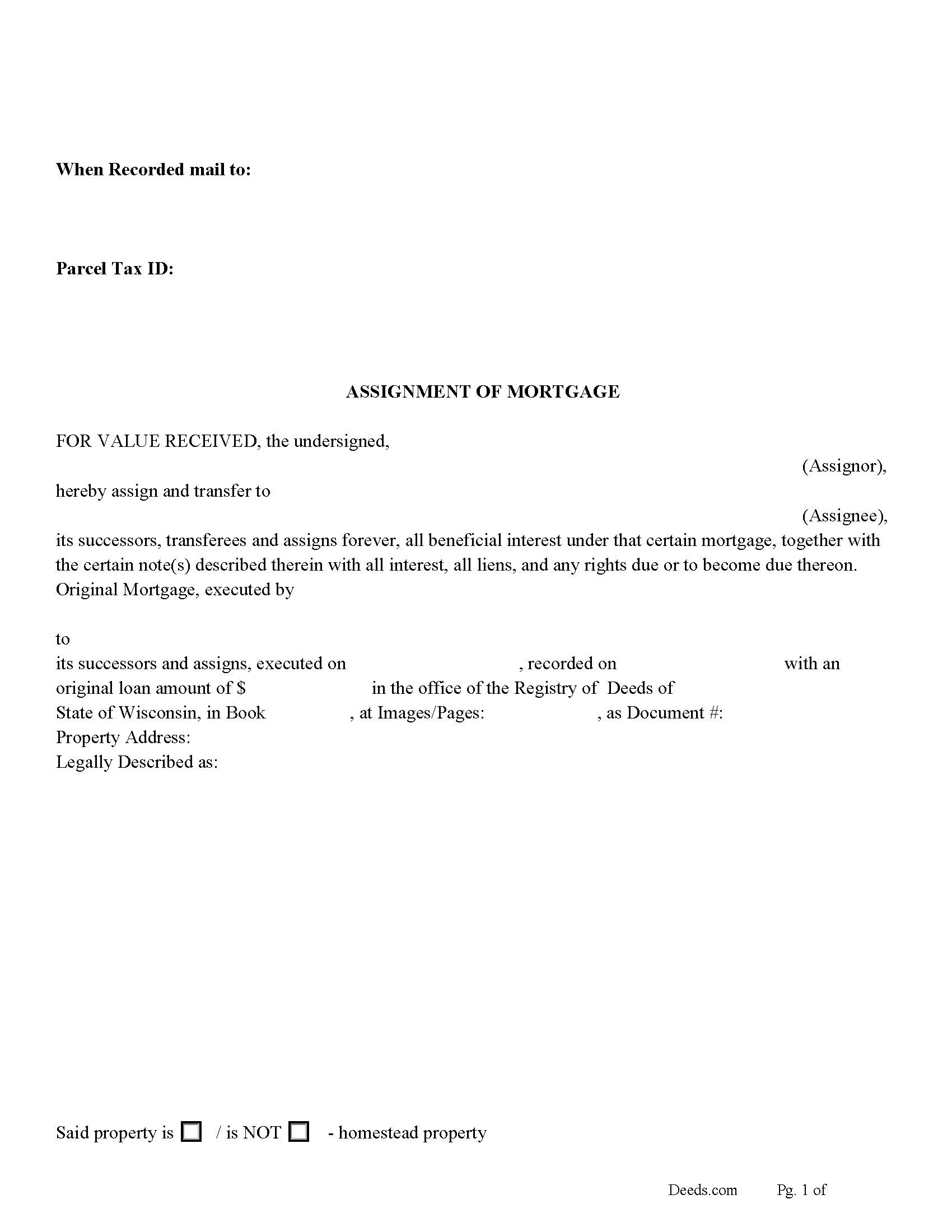

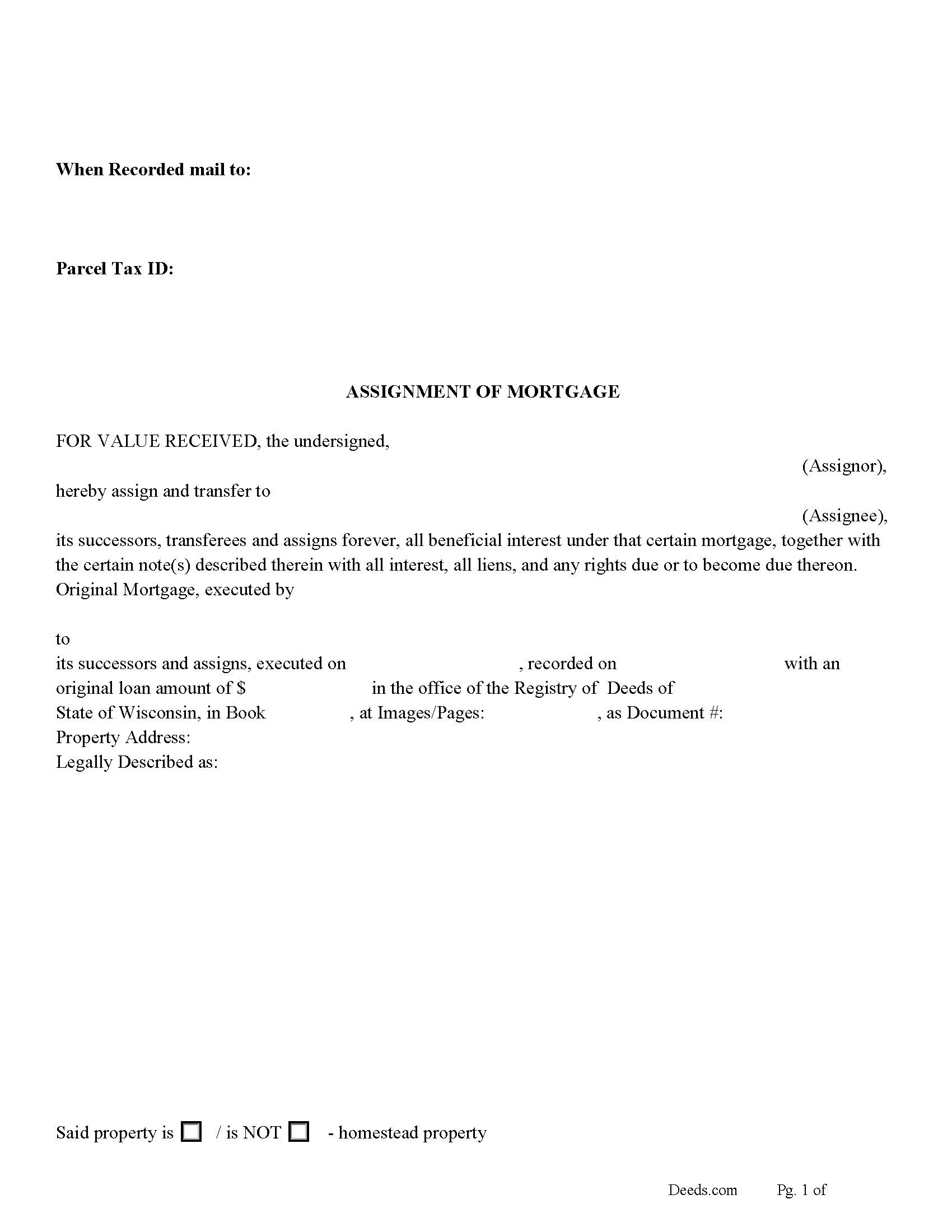

Download Wisconsin Assignment of Mortgage Legal Forms

Wisconsin Assignment of Mortgage Overview

Use this form to transfer/assign a previously recorded mortgage, frequently used when an existing mortgage has been sold. In this form the current holder/assignor of the mortgage assigns it to another party/assignee. To protect lien rights this form is recorded in the Wisconsin Registry of Deeds in the County where the property is located.

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, Wisconsin recording numbers, changes in loan, etc. Included are "Notice of Assignment of Mortgage" forms.

The Truth and lending act requires that borrowers be notified when their mortgage debt has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

Section 404 of the Act amends Section 131 of "Truth in Lending Act" to add a new subsection (g) which provides that, in addition to other disclosures required by the TILA, not later than 30 days after the date on which a mortgage loan is sold or otherwise transferred or assigned to a third party, the creditor that is the new owner or assignee of the debt shall notify the borrower in writing of the transfer. The notice must include the identity, address and telephone number of the new creditor; the date of the transfer; how to reach an agent or party having authority to act on behalf of the new creditor; the location of the place where transfer of ownership of the debt is recorded; and any other relevant information regarding the new creditor.

(Wisconsin AOM Package includes form, guidelines, and completed example)For use in Wisconsin only.