Morgan County Quitclaim Deed Form (West Virginia)

All Morgan County specific forms and documents listed below are included in your immediate download package:

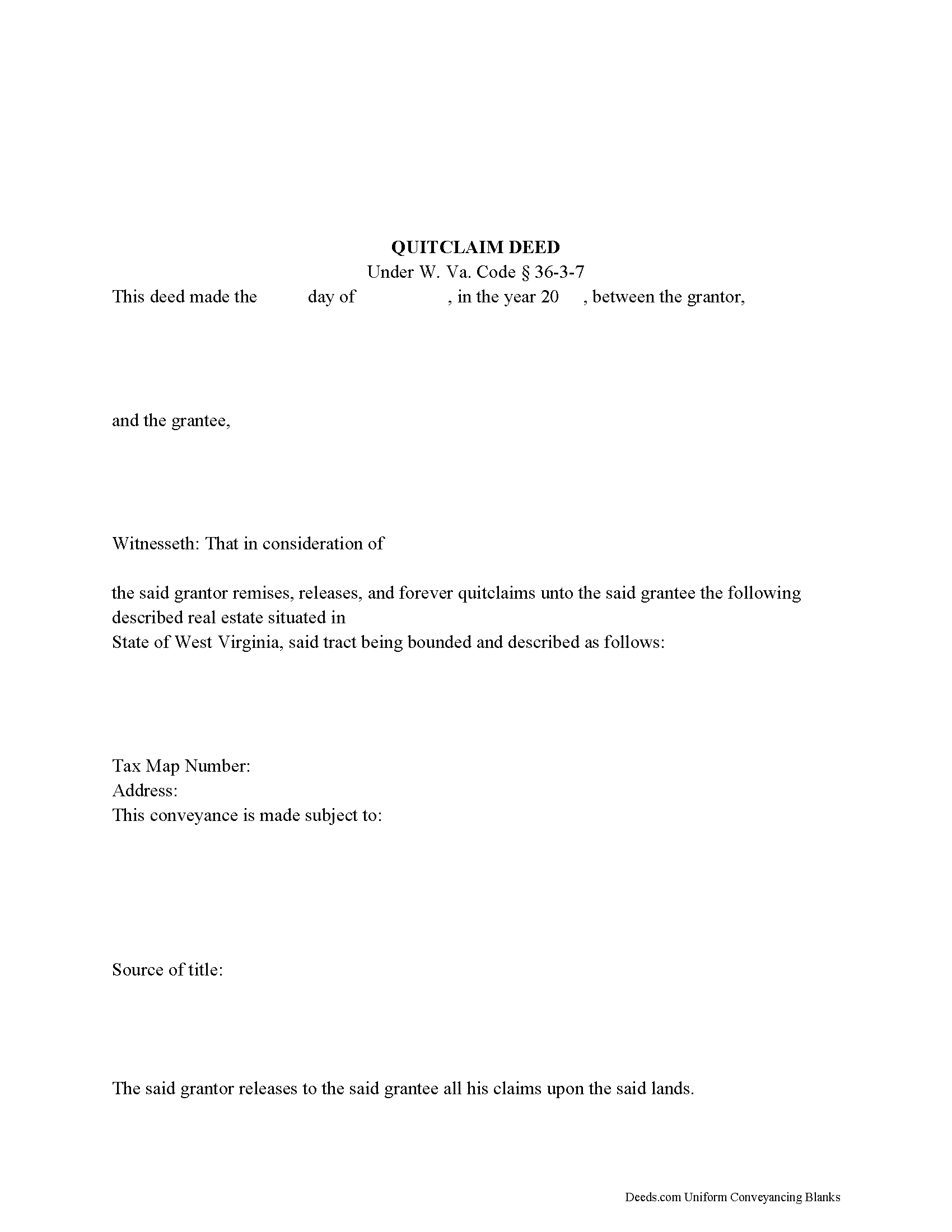

Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all West Virginia recording and content requirements.

Included Morgan County compliant document last validated/updated 7/22/2024

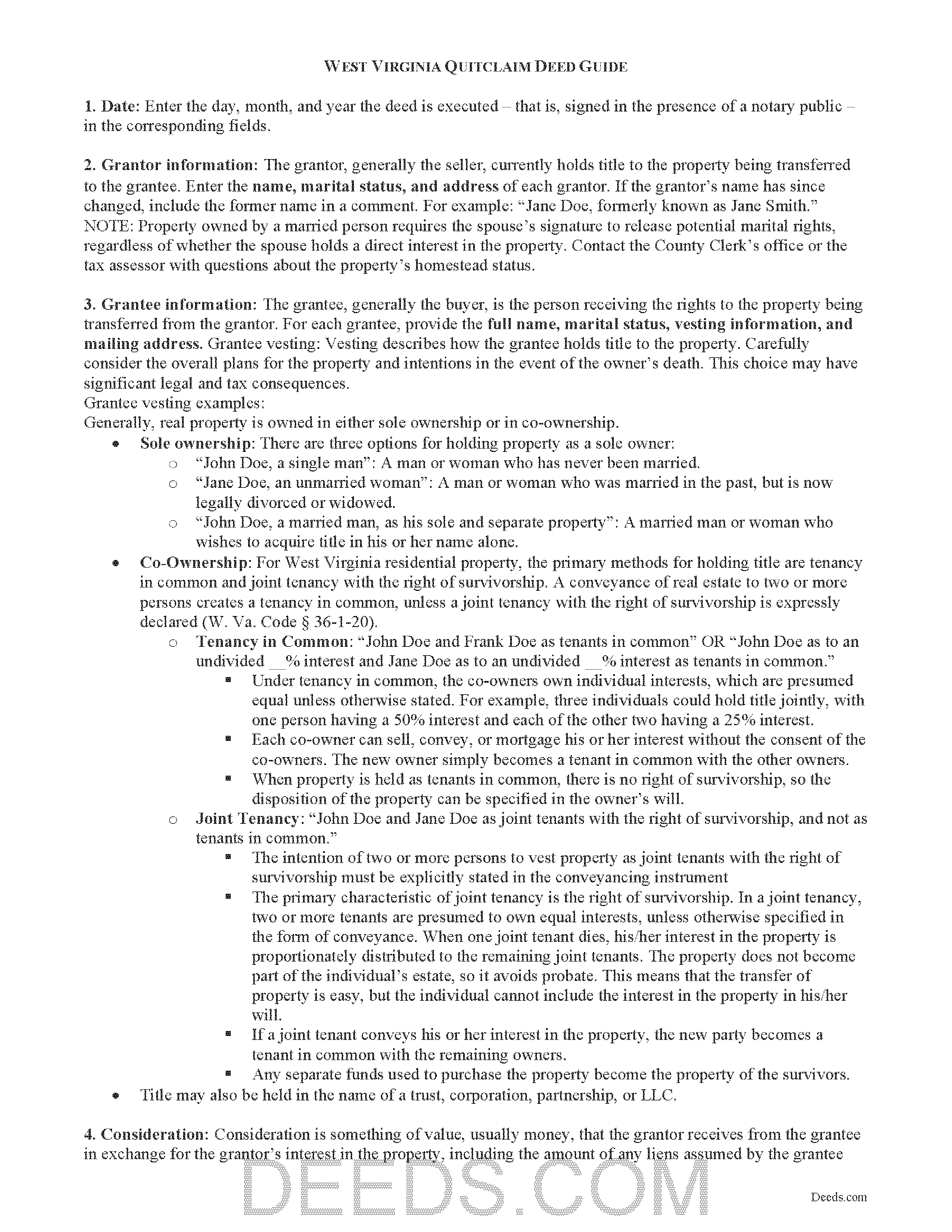

Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

Included Morgan County compliant document last validated/updated 9/11/2024

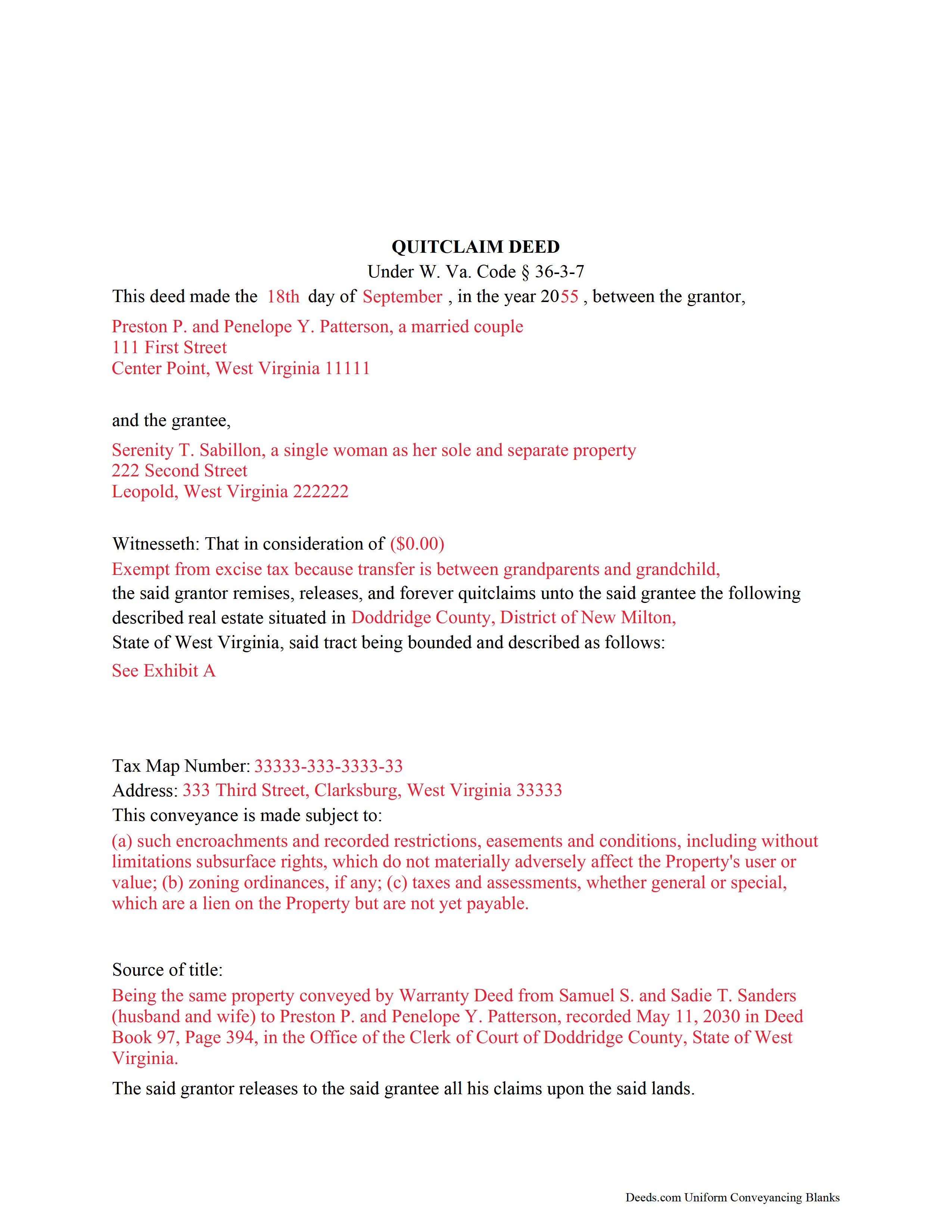

Completed Example of the Quitclaim Deed Document

Example of a properly completed West Virginia Quitclaim Deed document for reference.

Included Morgan County compliant document last validated/updated 5/20/2024

The following West Virginia and Morgan County supplemental forms are included as a courtesy with your order:

When using these Quitclaim Deed forms, the subject real estate must be physically located in Morgan County. The executed documents should then be recorded in the following office:

Morgan County Clerk

77 Fairfax St, Rm 102, Berkeley Springs, West Virginia 25411

Hours: 9:00 to 5:00 M-F

Phone: (304) 258-8547

Local jurisdictions located in Morgan County include:

- Berkeley Springs

- Great Cacapon

- Paw Paw

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Morgan County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Morgan County using our eRecording service.

Are these forms guaranteed to be recordable in Morgan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Morgan County including margin requirements, content requirements, font and font size requirements.

Can the Quitclaim Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Morgan County that you need to transfer you would only need to order our forms once for all of your properties in Morgan County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by West Virginia or Morgan County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Morgan County Quitclaim Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

West Virginia Code Section 36-3-5 establishes a statutory form for conveying real property in West Virginia.

When a deed contains the words for release codified at Section 36-3-7, the deed is construed to convey whatever right, title, and interest the grantor has in the premises granted, "as if it set forth that the grantor or releasor hath remised, released, and forever quitted claim."

Quitclaim deeds provide the least amount of protection for the grantee (buyer) because they contain no warranty of title. A quitclaim deed, therefore, is a common manner of conveyance for clearing title or when adding or removing parties from the deed.

To be valid and to provide a quality public record, both the grantor and grantee must be named in the section of the deed that details the words and terms of conveyance (conveyancing clause). In addition, the property must be able to be identified by inclusion of a legal description, including the district in which the parcel is located.

The granting party must sign the deed in the presence of a notary public. Property owned by a married person requires the spouse's signature to release potential marital rights, regardless of whether the spouse holds a direct interest in the property.

A quitclaim deed in this state is void as to creditors and subsequent purchasers for valuable consideration without notice until it is recorded in the county where the property is located (W. Va. Code 40-1-9). To record a quitclaim deed with a county clerk in West Virginia, the instrument must meet state and county requirements of form and content for documents pertaining to an interest in real property. All recorded deeds must be accompanied by a Sales Listing Form.

Deeds recorded in West Virginia are subject to a transfer tax based on the purchase price (consideration) listed on the deed, or, if no consideration is listed, the fair market value of the property. For deeds having no consideration, a Declaration of Consideration or Value is required.

Consult a lawyer with questions about quitclaim deeds or for any other issues related to transferring real property in West Virginia.

(West Virginia QD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Morgan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Morgan County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Johnny A.

December 15th, 2018

My complete name is

Johnny Alicea Rodriguez

And the DEED is on my half brother and mine name.

Jimmy Dominguez and myself

Thanks

Tonya B.

September 9th, 2021

Easy process. Thanks for making this resource available.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Warren B.

June 11th, 2022

Outstanding. There is nothing worse than finding the correct forms or having to hire an atty to do what most people can do on their own. I cant speak for all but these forms are fairly easy. The addition of guides and supplement forms are excellent. I just saved quite a bit of money with your site. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephen D.

July 18th, 2023

Excellent service!

Thank you!

John Y.

January 21st, 2019

Too much money for a form!

Thank you!

Lisa C.

December 5th, 2023

Thank you. Very easy!

We are delighted to have been of service. Thank you for the positive review!

katherine a.

July 20th, 2021

loved the ease of use for the forms.

went on line to find out about Adobe Reader, too. Had a test to see if I had it. Took few seconds. Then on to ordering and downloading which took only 5 minutes for the three forms I wanted.

Thanks, Katie Anderson

Thank you for your feedback. We really appreciate it. Have a great day!

Joyce D.

January 27th, 2019

Good after I figured out the form process. Hopefully I won't be charged for two as I redid the request thinking I might have made a mistake in the first request.

Thank you for your feedback Joyce. We have reviewed your account and there have been no duplicate orders submitted. Have a great day!

Lisa W.

May 25th, 2022

The easiest thing to use ever. Amazing and extremely prompt support. They get the job done with all the information you might need

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David K.

March 16th, 2023

Price seemed high (~$28) for just some forms (especially because we may not actually use the forms), but it beats navigating the Hawaii state and Honolulu county websites for forms. It would be better if a single button push would download all 7 or 8 forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Shellie J.

February 19th, 2020

Documents are great and easy to use, just wish there was a page helping to know where to mail documents to with an amount since it tells you mailing in is an option.

Thank you for your feedback. We really appreciate it. Have a great day!

David C.

February 7th, 2021

I found it pretty easy to navigate, all worked well. Need a better example of excise tax. Lastly, your link in the email to get to this page doesn't work :)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!