Ritchie County Grant Deed Form (West Virginia)

All Ritchie County specific forms and documents listed below are included in your immediate download package:

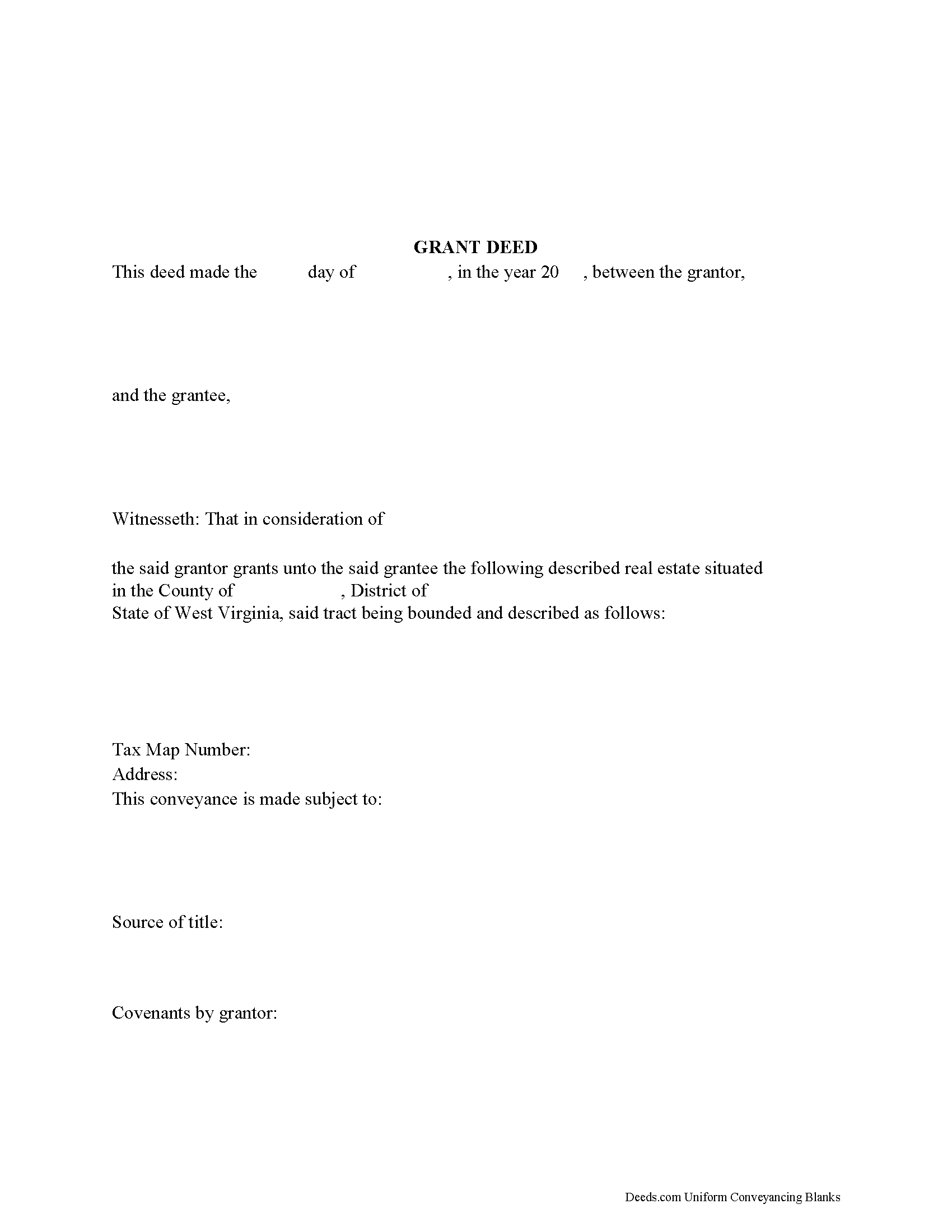

Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Ritchie County compliant document last validated/updated 12/17/2024

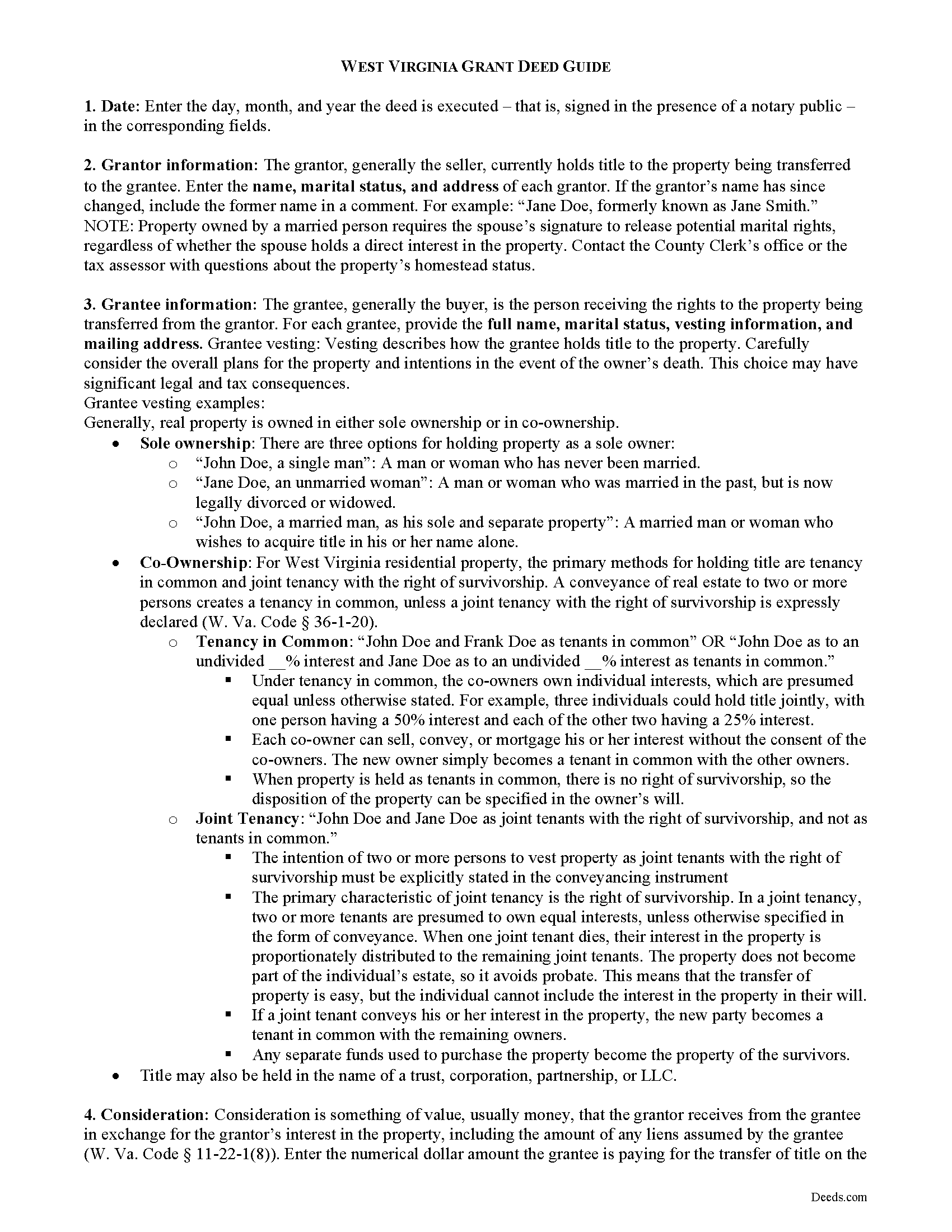

Grant Deed Guide

Line by line guide explaining every blank on the form.

Included Ritchie County compliant document last validated/updated 11/18/2024

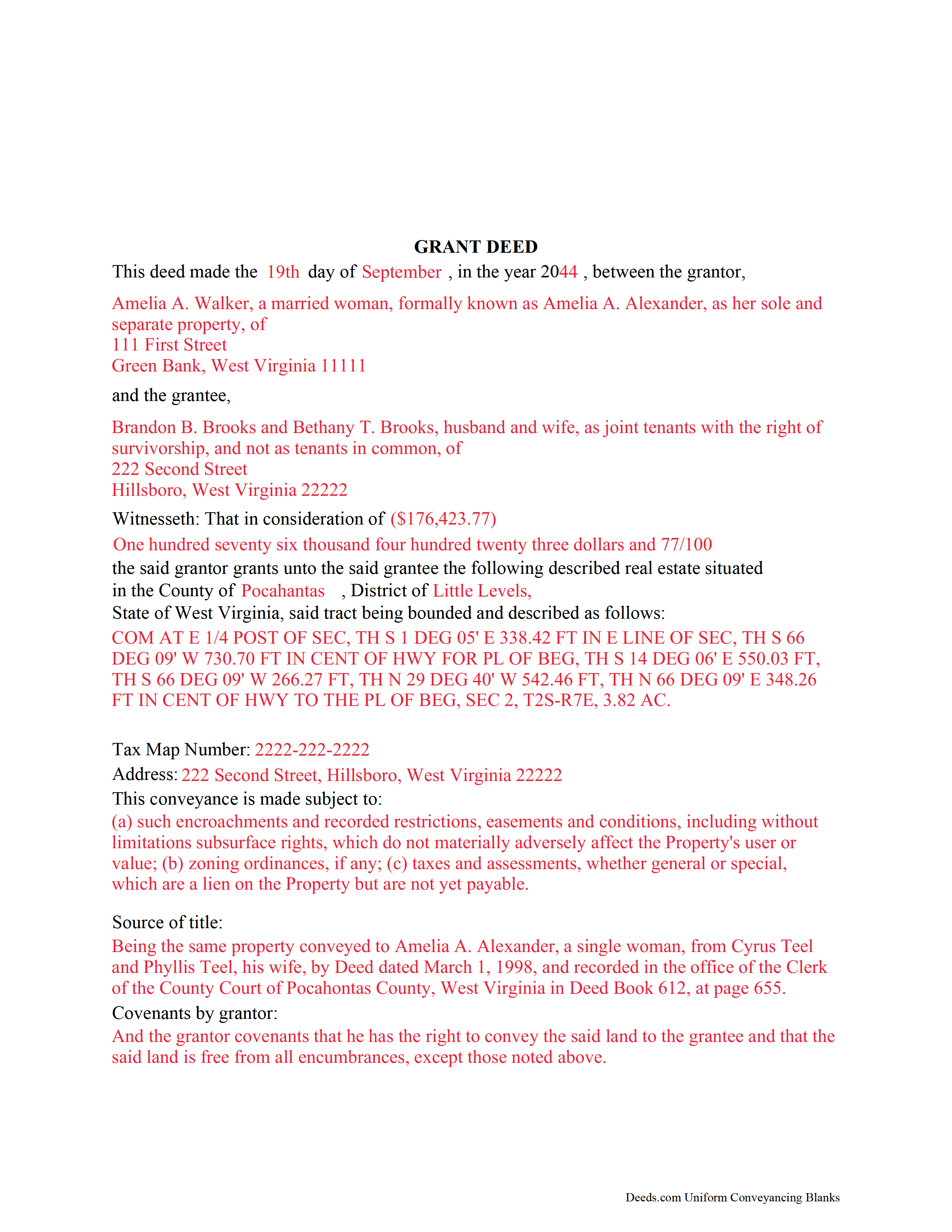

Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

Included Ritchie County compliant document last validated/updated 11/20/2024

The following West Virginia and Ritchie County supplemental forms are included as a courtesy with your order:

When using these Grant Deed forms, the subject real estate must be physically located in Ritchie County. The executed documents should then be recorded in the following office:

Ritchie County Clerk

115 E Main St, Rm 201, Harrisville, West Virginia 26362

Hours: 8:00 to 4:00 M-F

Phone: (304) 643-2164 Ext 221

Local jurisdictions located in Ritchie County include:

- Auburn

- Berea

- Cairo

- Ellenboro

- Harrisville

- Macfarlan

- Pennsboro

- Petroleum

- Pullman

- Smithville

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Ritchie County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Ritchie County using our eRecording service.

Are these forms guaranteed to be recordable in Ritchie County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Ritchie County including margin requirements, content requirements, font and font size requirements.

Can the Grant Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Ritchie County that you need to transfer you would only need to order our forms once for all of your properties in Ritchie County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by West Virginia or Ritchie County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Ritchie County Grant Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In West Virginia, title to real property can be transferred from one party to another using a grant deed.

A statutory form for conveying real property is codified at West Virginia Code Section 36-3-5, with room to customize the form as needed for the situation. Typical covenants of a grant deed include that the grantor has not previous sold the interest now being conveyed and that the premises are free from encumbrances, excepting those noted in the instrument. Statutory covenants are codified at W. Va. Code 36-4, and require specific language in the body of the deed.

To be valid and to provide a quality public record, the section of the deed that details the words and terms of conveyance (granting clause) must name both the grantor and grantee. It also includes a legal description detailed enough to identify the specific parcel within its district.

The granting party must sign the deed in the presence of a notary public. Property owned by a married person requires the spouse's signature to release potential marital rights, regardless of whether the spouse holds a direct interest in the property.

Deeds in this state are void as to creditors and subsequent purchasers for valuable consideration without notice until it is recorded in the county where the property is located (W. Va. Code 40-1-9). In other words, record it or it didn't happen.

To record a grant deed with a county clerk in West Virginia, the instrument must meet state and county requirements of form and content for documents pertaining to an interest in real property. Deeds recorded in West Virginia are subject to a transfer tax based on the purchase price (consideration) listed on the deed, or, if no consideration is listed, the fair market value of the property. Transfers with no consideration require a Declaration of Consideration or Value. All recorded deeds must be accompanied by a Sales Listing Form.

If the grantor is not a West Virginia resident, tax withholding pursuant to W. Va. Code Section 11-21-71b is also required.

Consult a lawyer with questions about grant deeds, or for any other issues related to real property in West Virginia.

(West Virginia Grant Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Ritchie County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Ritchie County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4443 Reviews )

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shihei W.

December 12th, 2024

Loved every step of the process, from the detail explanation of the services/products provided, to the inclusive packet that comes with my purchase of the trust certification form.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Jamie P.

December 9th, 2024

Got it next business day in the morning. Saved me phone call and perhaps a trip to courthouse. Very pleased.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Patricia D.

January 22nd, 2019

It worked great- I had a little trouble at first with the site, figuring out where to do what, but the form was much better than the one we purchased at Staples, loved being able to fill out with the computer. We did need the other form as per the screen prior to ordering but couldn't figure out which one. The ladies at the recorders were great too.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert B.

June 28th, 2019

Fast and easy and Jefferson County Colorado excepted the forms.

Thank you!

Sara W.

November 9th, 2020

Got the legal forms, they worked. Nothing exciting but that probably a good thing.

Thank you Sara, we appreciate you.

Frank R.

January 20th, 2020

Our notary. Marie was prompt, courteous and professional. Would definitely use again and reccomend

Thank you for your feedback. We really appreciate it. Have a great day!

Frank W.

November 15th, 2022

would be nice to be able to see what I am purchasing before I paid

Thank you!

Jerry B.

May 14th, 2023

Easy to use and fully comprehensive.

Thank you for your feedback Jerry, we appreciate you.

Alvera A.

May 6th, 2023

Very easy to find my documents, download and print them!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Missie R.

June 17th, 2020

Very fast and professionally handled.

Thank you!

Mary L M.

November 1st, 2022

Your website was very helpful & easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Donna D.

March 20th, 2020

Easy to use. Good information. Would use again.

Thank you!

tim r.

August 15th, 2019

easy sight and extra forms that I can use any time

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Don B.

November 2nd, 2020

This was my first experience with Deeds. Web site instructions are detailed and easy to understand. This was a smooth process. Highly recommend to anyone.

Thank you for your feedback. We really appreciate it. Have a great day!