Wetzel County Deed of Trust and Promissory Note Form (West Virginia)

All Wetzel County specific forms and documents listed below are included in your immediate download package:

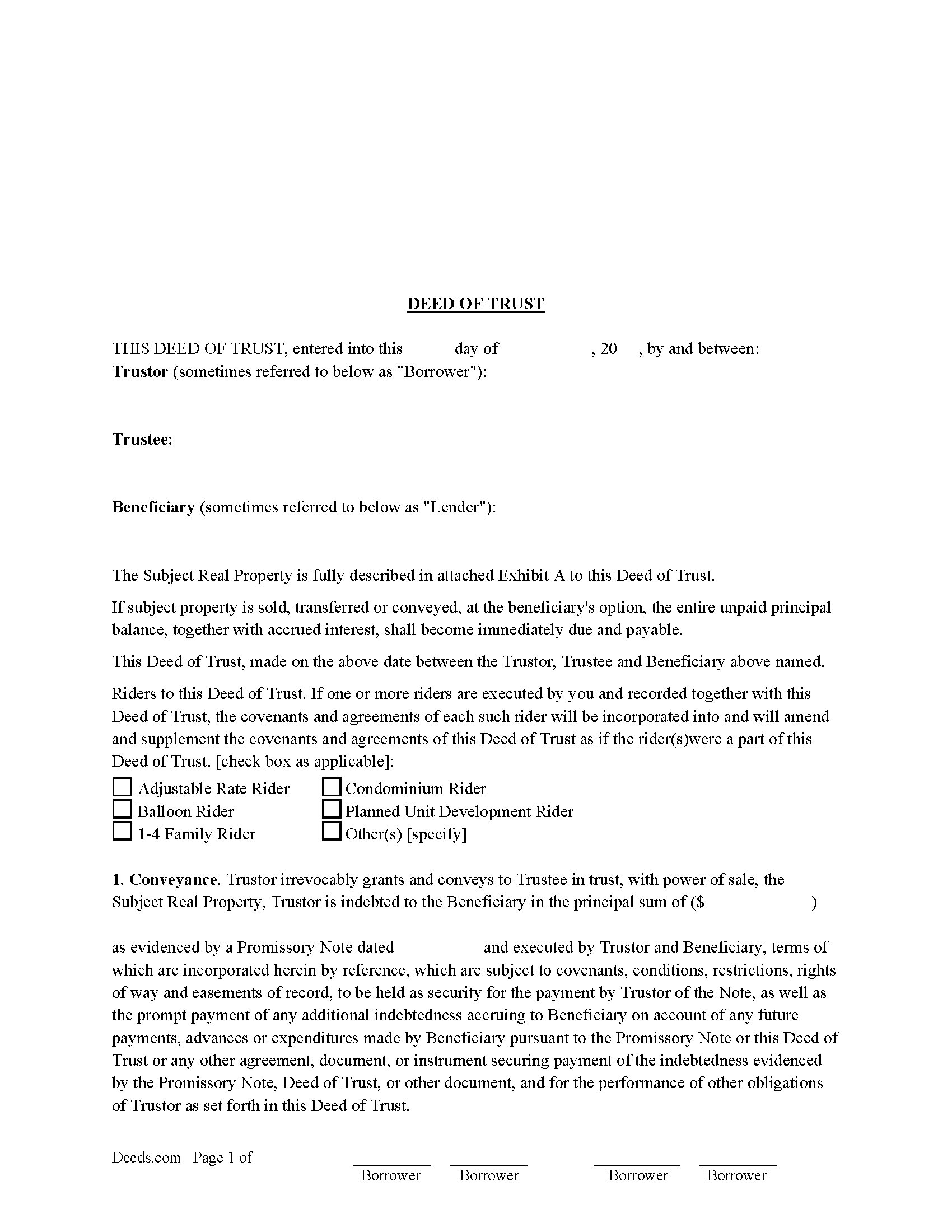

Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Wetzel County compliant document last validated/updated 10/30/2024

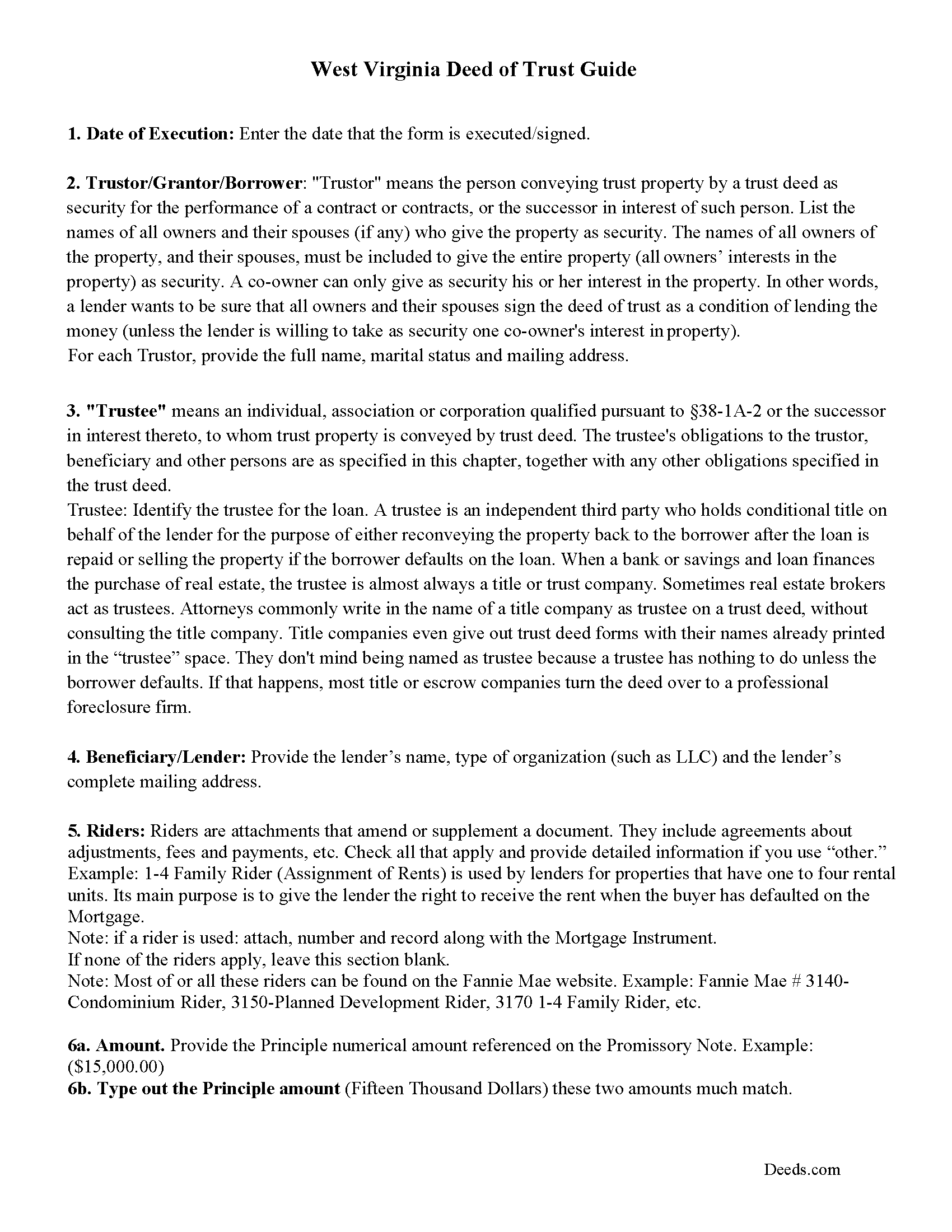

Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

Included Wetzel County compliant document last validated/updated 12/2/2024

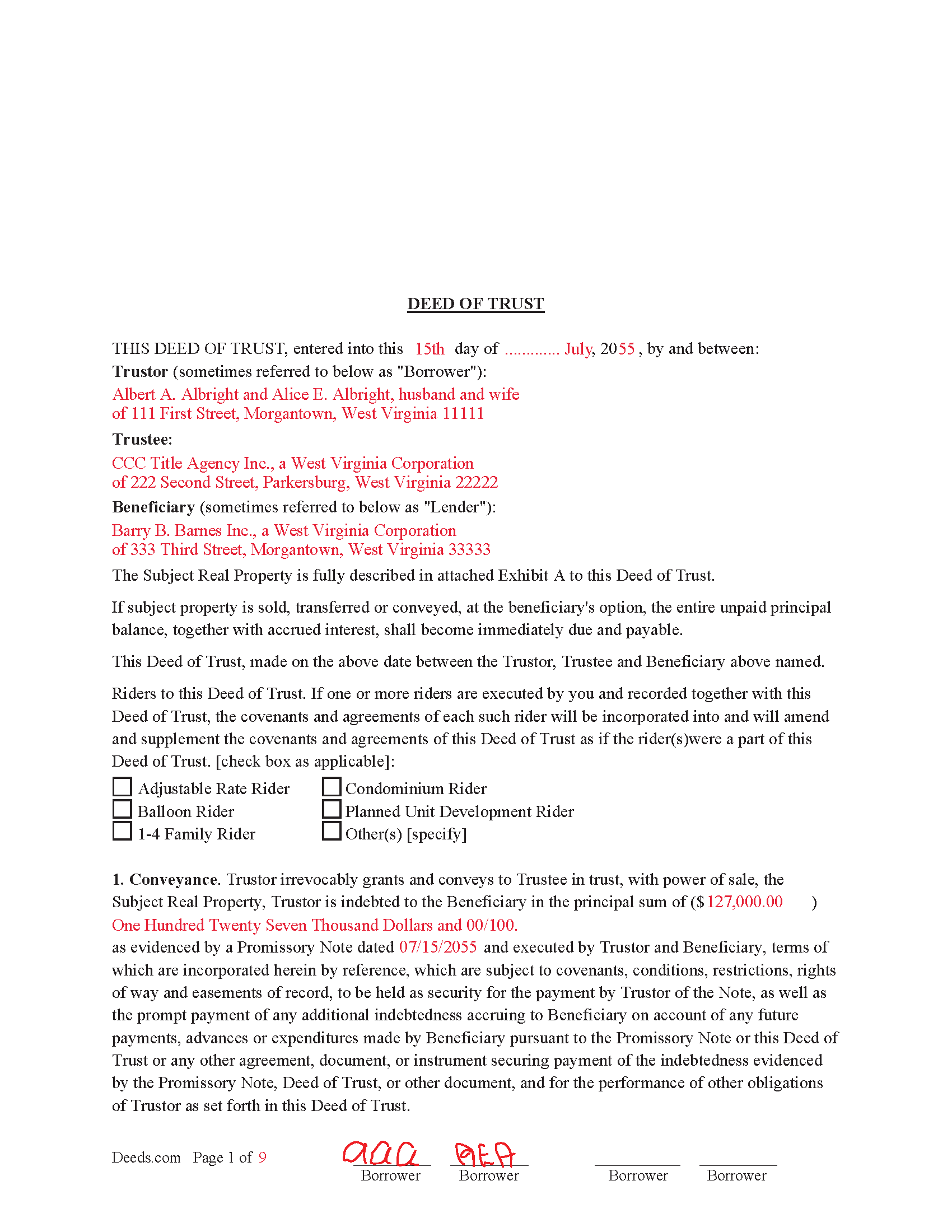

Completed Example of the Deed of Trust Document

Example of a properly completed form for reference.

Included Wetzel County compliant document last validated/updated 9/11/2024

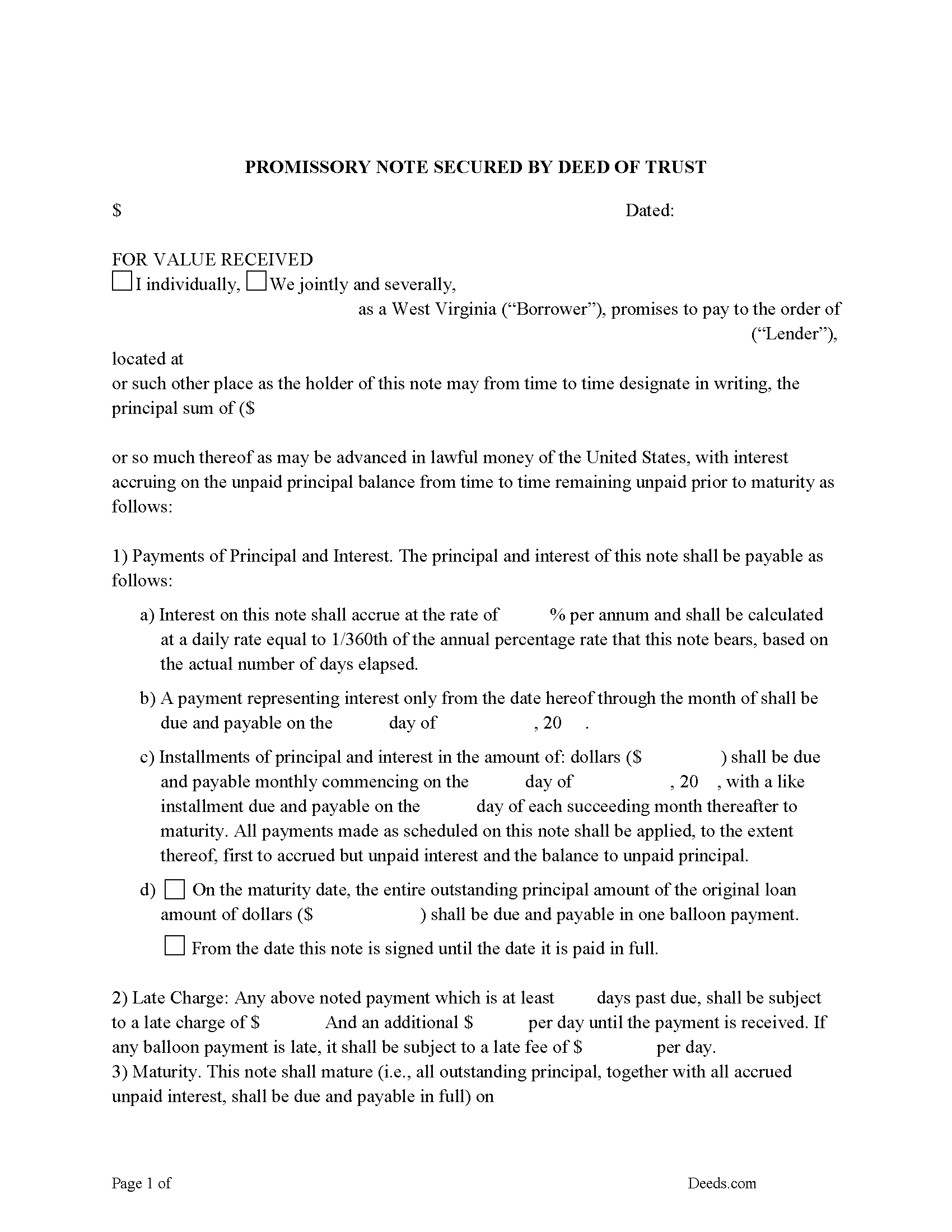

Promissory Note Form

Note that is secured by the Deed of Trust.

Included Wetzel County compliant document last validated/updated 11/8/2024

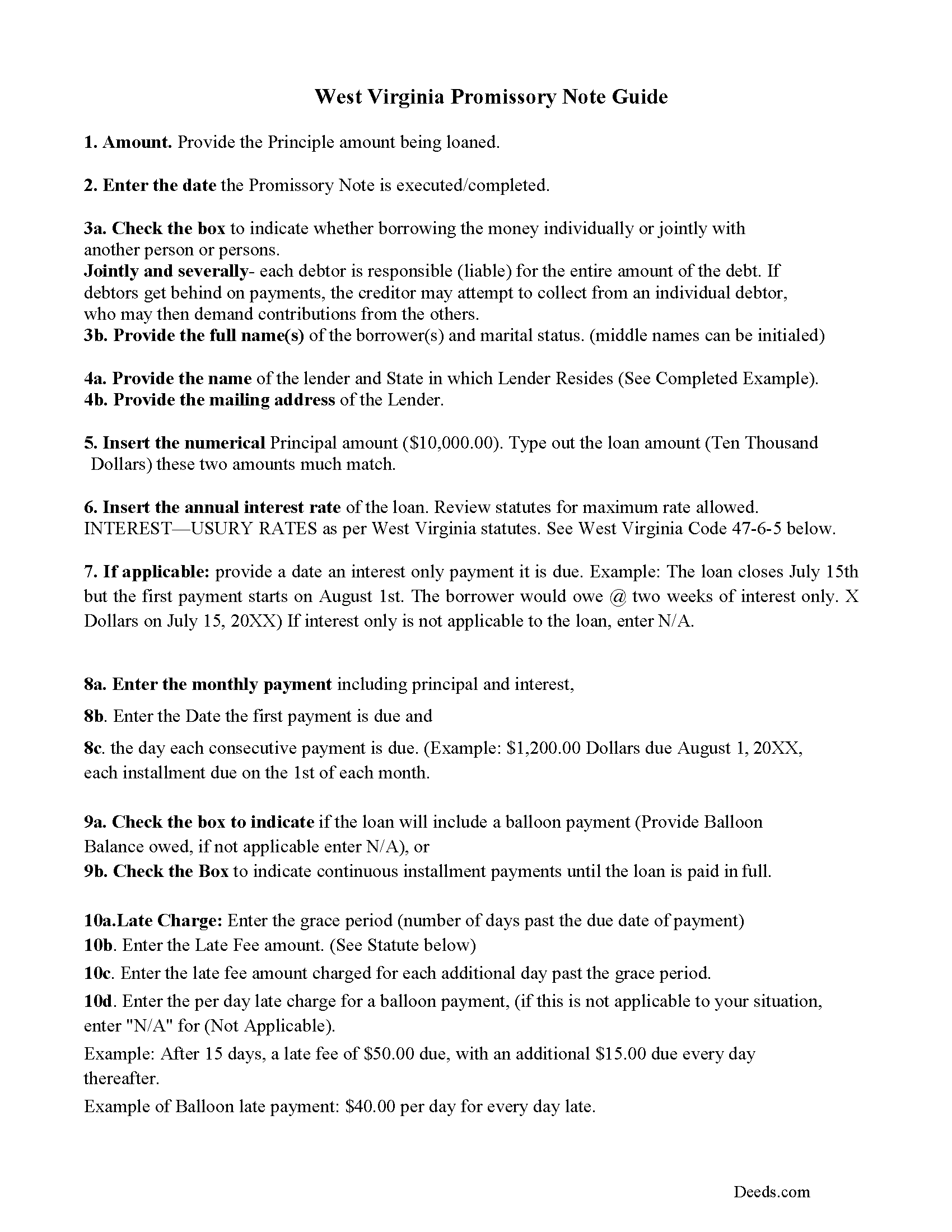

Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Included Wetzel County compliant document last validated/updated 12/20/2024

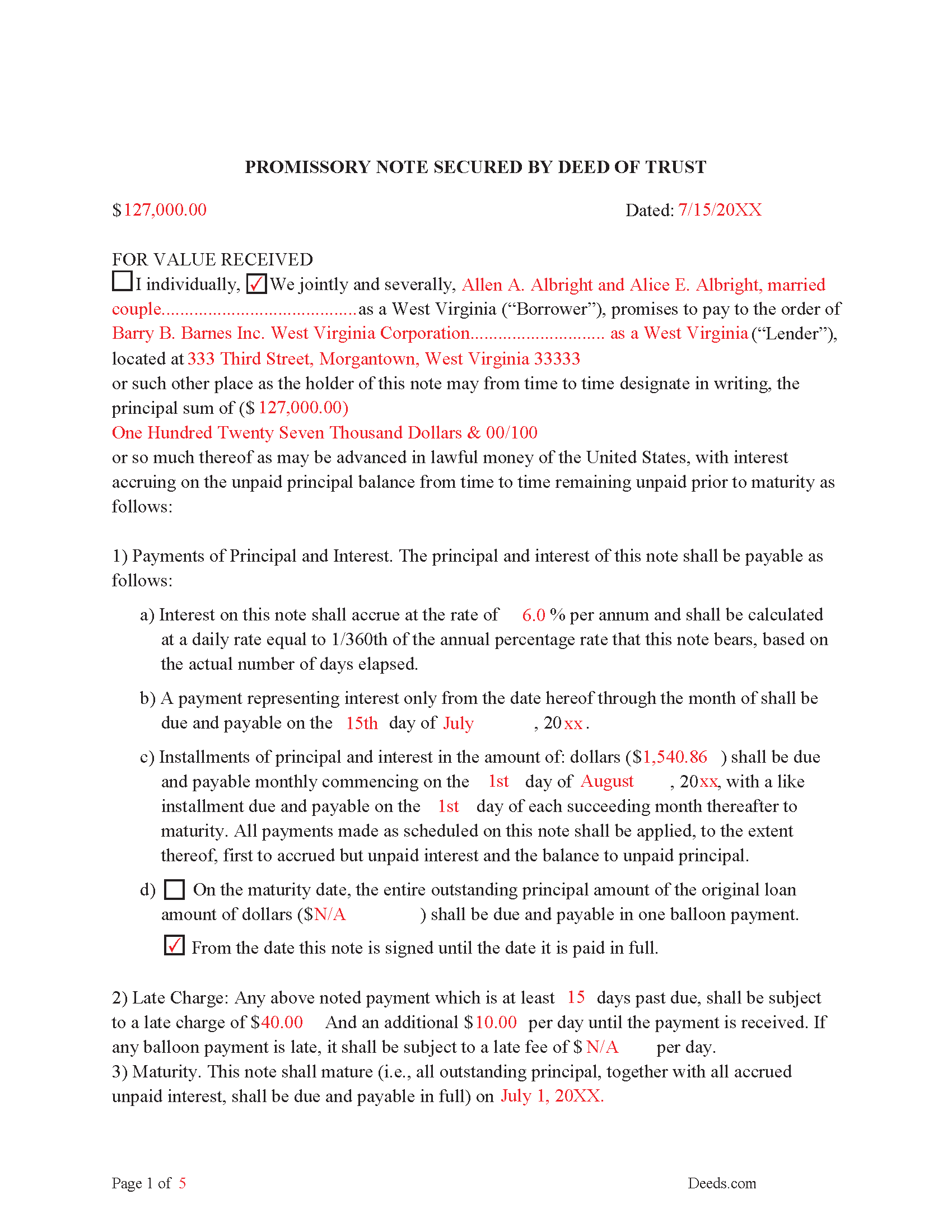

Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

Included Wetzel County compliant document last validated/updated 11/27/2024

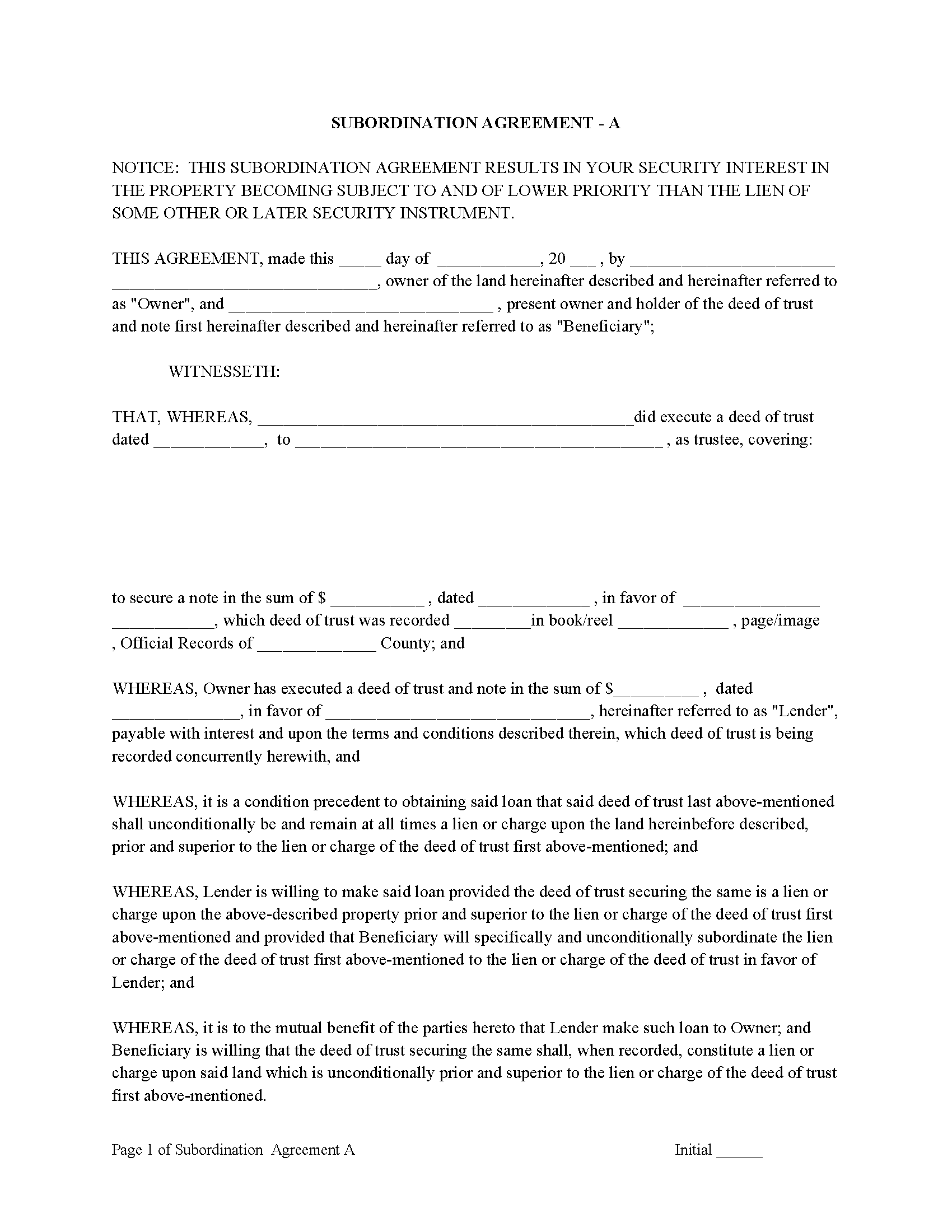

Subordination Agreements

Used to place priority on claim of debt. Included are 4 clauses for unique situations. If needed, add to Deed of Trust as an addendum or rider.

Included Wetzel County compliant document last validated/updated 12/11/2024

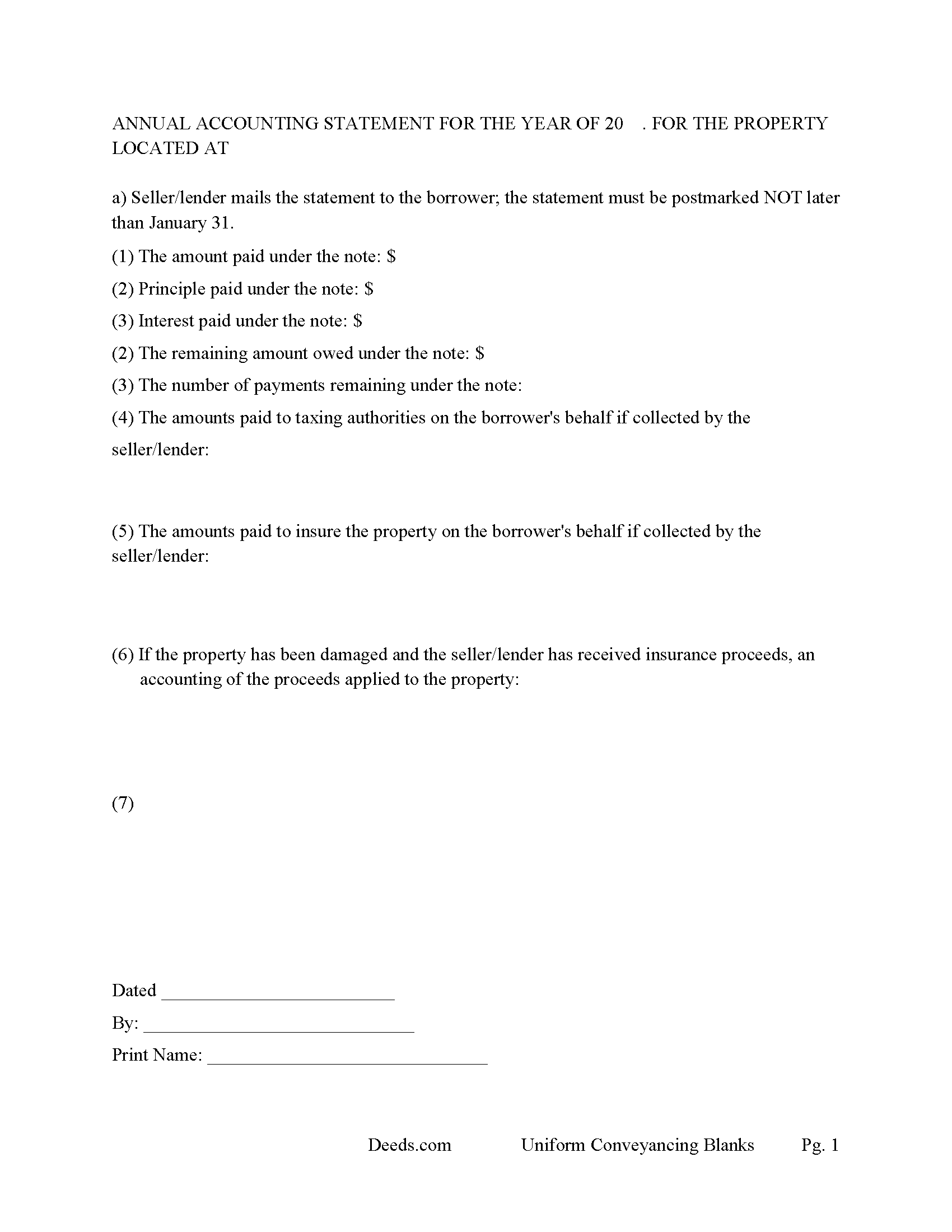

Annual Accounting Statement

Mail to borrower for fiscal year reporting.

Included Wetzel County compliant document last validated/updated 10/8/2024

The following West Virginia and Wetzel County supplemental forms are included as a courtesy with your order:

When using these Deed of Trust and Promissory Note forms, the subject real estate must be physically located in Wetzel County. The executed documents should then be recorded in the following office:

Wetzel County Office

200 Main St / PO Box 156, New Martinsville, West Virginia 26155-1264

Hours: 9:00 to 4:30 Mo - We, Fr; Th until 4:00; Sa 9:00 to 12:00

Phone: (304) 455-8224

Local jurisdictions located in Wetzel County include:

- Big Run

- Burton

- Folsom

- Hundred

- Jacksonburg

- Littleton

- New Martinsville

- Paden City

- Pine Grove

- Porters Falls

- Reader

- Smithfield

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Wetzel County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Wetzel County using our eRecording service.

Are these forms guaranteed to be recordable in Wetzel County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wetzel County including margin requirements, content requirements, font and font size requirements.

Can the Deed of Trust and Promissory Note forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Wetzel County that you need to transfer you would only need to order our forms once for all of your properties in Wetzel County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by West Virginia or Wetzel County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Wetzel County Deed of Trust and Promissory Note forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

There are three parties in this Deed of Trust:

1- The Trustor (Borrower)

2- Beneficiary (Lender) and a

3- Trustee (Neutral Third Party)

Basic Concept. The Trustor (Borrower) conveys property title to a Trustee (Neutral Party). A Trustee or beneficiary/Lender can take action against any person for damages.

In West Virginia, a Deed of Trust (DOT) is the most commonly used instrument to secure a loan. If the DOT has a "Power of Sale" clause, foreclosure can be done non-judicially, saving time and expense, because the trustee doesn't require the court's involvement. This process is called a Trustee Sale. Explained in WV Statute 38-1-3. "Sales under trust deeds."

Proceeds of Trustee Sale: After deducting all costs, fees and expenses of Trustee and of this trust, including the cost of evidence of title in connection with the sale and reasonable attorney's fees, trustee shall apply the proceeds of sale to payment of all sums then secured hereby and all other sums due under the terms hereof, with accrued interest, and the remainder, if any, to the persons legally entitled thereto or as provided by W. VA. ARTICLE 1, 38-1-7.

(38-1-2. Form of deed of trust; memorandum of deed of trust may be recorded.) This Form is fully formatted for W.VA. recording requirements.

Promissory Note secured by Deed of Trust.

In general, the lender can charge 6% with no written contract and 8% with a written contract. Exceptions are made, see W. VA. Statute 47-6-5, "Legal rate of interest".

Terms:

A- Principle Owed and Maturity Date of Loan

B- Payments - Traditional Installment or installments with a Balloon Payment.

C- Late Payments: So much $ owed after X number of days, plus $ for each day after.

D- Default Rate: If payment is at least 30 days past due, then the principal balance shall bear interest at default rate of $$$.

E- Overdue Loan Fee: In addition to any other remedies available to Lender if this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee.

F- Default Terms: If any of the following events of default occur, this Note and any other obligations of the Borrower to the Lender, shall become due immediately, without demand or notice:

1) the failure of the Borrower to pay the principal and any accrued interest when due;

2) the filing of bankruptcy proceedings involving the Borrower as a debtor;

3) the application for the appointment of a receiver for the Borrower;

4) the making of a general assignment for the benefit of the Borrower's creditors;

5) the insolvency of the Borrower;

6) a misrepresentation by the Borrower to the Lender for the purpose of obtaining or extending credit.

7) In addition, the Borrower shall be in default if there is a sale, transfer, assignment, or any other disposition of any real estate pledged as collateral for the payment of this Note, or if there is a default in any security agreement which secures this Note.

G- Venue: If legal action is required, Lender provides the County of such actions.

This package can be used for financing of residential property, a condominium, a small office building and rental property (up to 4 units). A Promissory Note secured by a Deed of Trust with strong default terms can be beneficial to the Lender. This form has terms and conditions defined by W. VA. Statutes, for use in W. VA only.

(West Virginia DOT Package includes forms, guidelines, and completed examples)

Our Promise

The documents you receive here will meet, or exceed, the Wetzel County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wetzel County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4446 Reviews )

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Michael L.

June 15th, 2022

Very helpful and efficient

Thank you!

Deirdre M.

July 11th, 2022

Thank for you guidance to amend & correct & recover my home with evidence you provide in Dead Fraud. I'll keep you updated.

Thank you!

Charles C.

November 2nd, 2020

I found this site to be very easy to use . I found and printed what I needed in just a few minutes after getting on the sit . Good work setting up this site . Thank you .

Thank you!

ROBERET D.

November 18th, 2021

after a poor start was able to get to the forms

page and find what I was looking for and every thing worked good. Just getting to the right area was a struggle but we made thanks

Bob

Thank you for your feedback. We really appreciate it. Have a great day!

Diane J.

October 20th, 2021

Worked great very quick and easy without the sample model for my state would have been difficult for me thank's

Thank you for your feedback. We really appreciate it. Have a great day!

Byron M.

June 17th, 2021

Very easy to sign up. Very quick to respond for payment once uploaded. Great communication.

More expensive than other recording services.

Thank you for your feedback. We really appreciate it. Have a great day!

Annie R.

December 7th, 2019

Excellent service. Documents easy to understand and use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Curtise L.

September 15th, 2021

Excellent experience. Quickly responded and was able to get us exactly what we needed!

Thank you!

JUDITH-DIAN W.

June 28th, 2023

I didn't have any problem downloading and filling out the form on my computer and printing it yesterday. I didn't know what to put for "Source of Title". I called the county recording office; they didn't know either and said to leave it blank. I got the form notarized at my bank and took it in to the recording office. They checked it, accepted it, I paid a fee, and it's done. So easy. My children will appreciate that I've done this. Added note: You do have one typo on your form--you left out 'at'. It should read: "You should carefully read all information at the end of this form."

Thank you for your feedback. We really appreciate it. Have a great day!

Barry C.

March 8th, 2019

prompt, complete and efficient process --- kudos to you

Thank you so much Barry. Have a great day!

William M.

May 22nd, 2021

On multiple tries, I could not get validation mail through my Yahoo email address. I tried Gmail, worked the first time. The rest of the process was super easy and fast.

Thank you!

Larry R.

December 8th, 2020

I appreciate the opportunity to take care of business without the hassle of parking, security checks and lines. It was all done quickly and easily.

Thank you!