Stevens County Transfer on Death Revocation Form (Washington)

All Stevens County specific forms and documents listed below are included in your immediate download package:

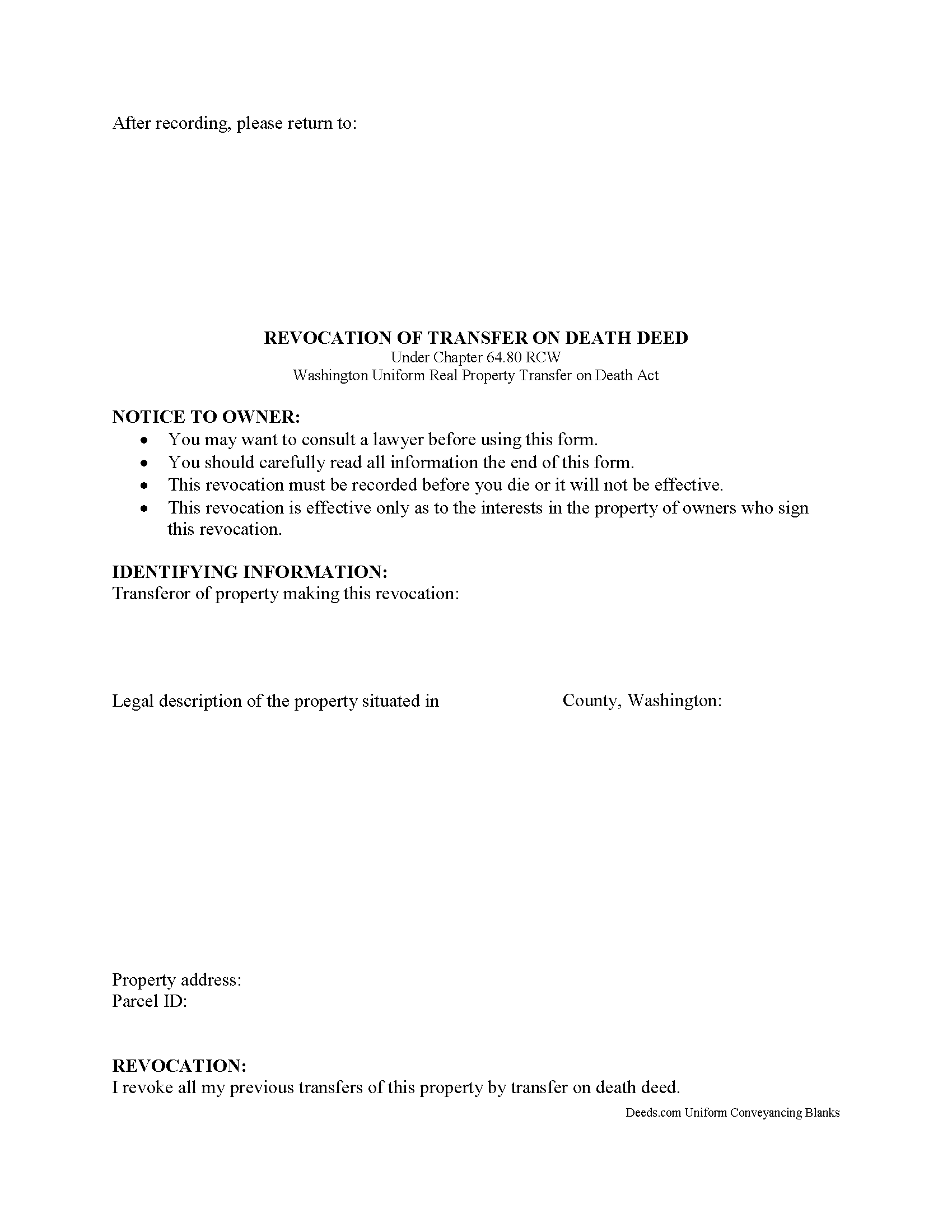

Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Stevens County compliant document last validated/updated 12/23/2024

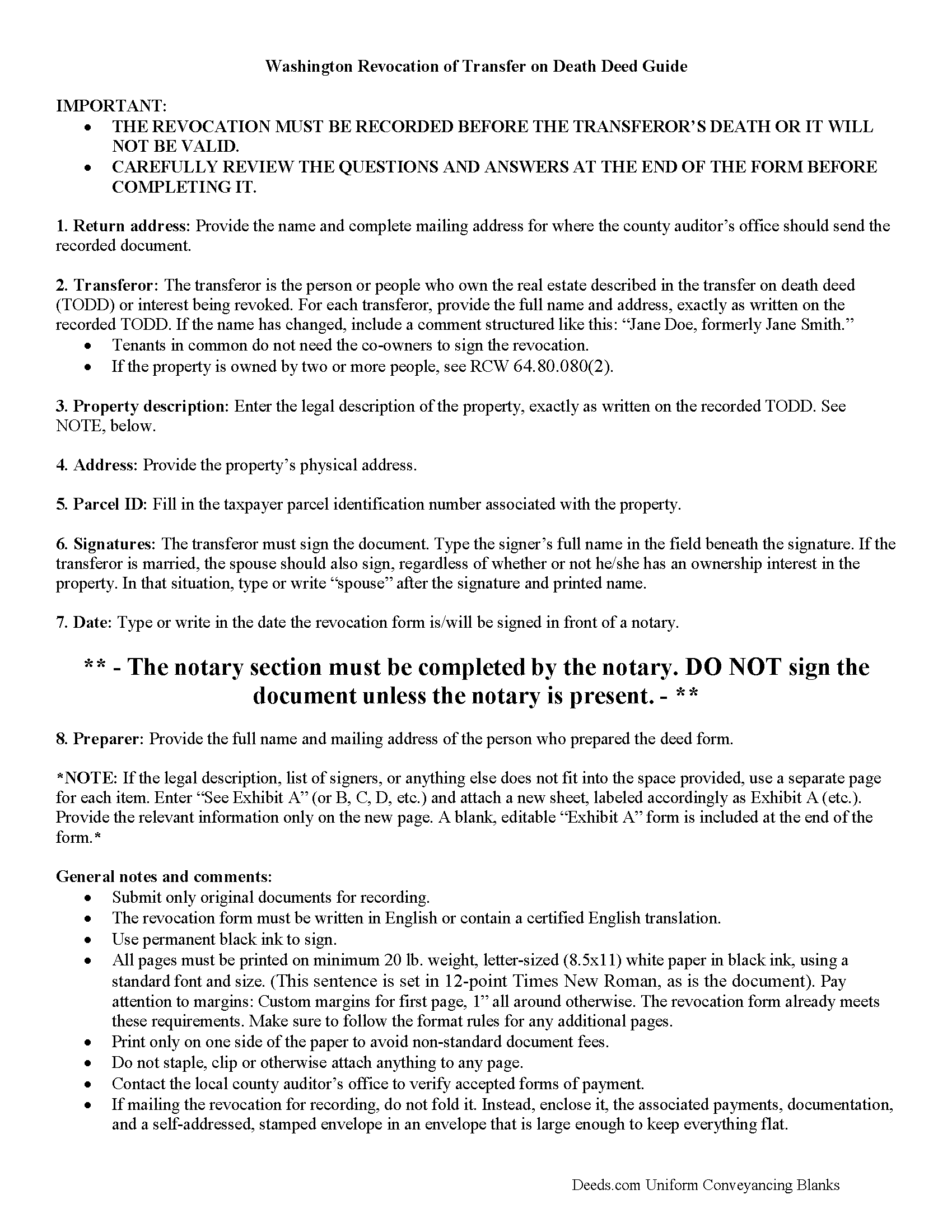

Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

Included Stevens County compliant document last validated/updated 12/2/2024

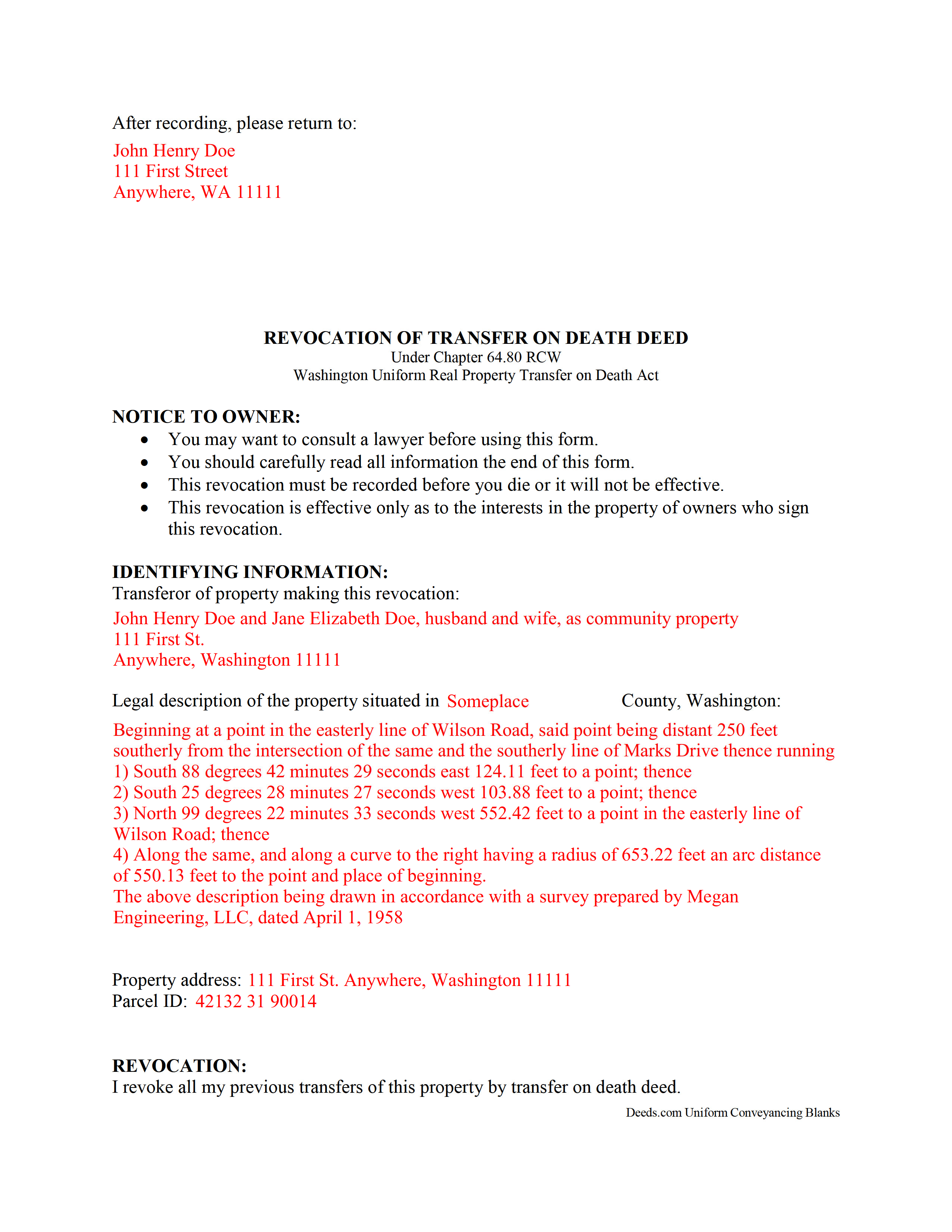

Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

Included Stevens County compliant document last validated/updated 11/28/2024

The following Washington and Stevens County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Revocation forms, the subject real estate must be physically located in Stevens County. The executed documents should then be recorded in the following office:

Stevens County Auditor: Recording

215 S Oak St, Rm 106, Colville, Washington 99114

Hours: Monday through Friday 8:00am – 4:30pm

Phone: (509) 684-7512

Local jurisdictions located in Stevens County include:

- Addy

- Chewelah

- Clayton

- Colville

- Evans

- Ford

- Fruitland

- Gifford

- Hunters

- Kettle Falls

- Loon Lake

- Marcus

- Northport

- Rice

- Springdale

- Tumtum

- Valley

- Wellpinit

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Stevens County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Stevens County using our eRecording service.

Are these forms guaranteed to be recordable in Stevens County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Stevens County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Revocation forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Stevens County that you need to transfer you would only need to order our forms once for all of your properties in Stevens County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Washington or Stevens County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Stevens County Transfer on Death Revocation forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Revoking a Transfer on Death Deed in Washington

Earlier this year, the Washington legislature voted to join with an increasing number of states and adopt the Uniform Real Property Transfer on Death Act (URPTODA). The law is found at Chapter 64 of the Revised Code of Washington, and went into effect on June 12, 2014. This act allows owners of real property in the state to control the distribution of what is often their most significant asset, their real estate, by executing and recording a transfer on death deed (TODD).

Revocation is an important feature of transfer on death deeds because it allows the owner/transferor to easily respond to a change in circumstances. This option explains why TODDs do not require consideration or notice (64.80.070). At 64.80.080, the statute outlines the three methods available for changing or revoking a recorded transfer on death deed, by executing and recording:

- a new TODD

- a revocation form

- a deed (example: warranty deed) that conveys title to someone else and expressly revokes all or part of the TODD

To preserve a clear chain of title, it makes sense to file a revocation form when changing a previously recorded transfer on death deed or selling the property outright. This extra step will add an end point for the potential transfer, simplifying future title searches prior to selling or mortgaging the property.

Since each situation is unique, contact an attorney with specific questions or for complex circumstances.

(Washington TODR Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Stevens County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Stevens County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4449 Reviews )

Daniel B.

December 24th, 2024

easy to use and upload.

We are delighted to have been of service. Thank you for the positive review!

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Lane C.

March 2nd, 2023

The documents worked perfectly! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Kenny H.

January 14th, 2020

The forms are extremely helpful. They could use some updating. Promissory note "...in the form of cash, check or money order." is a bit outdated. My note is with my son and we have an automatic bank transfer set up for payments. He could Venmo me. There are many other options and likely to be more changes in the future, so I know this is difficult to maintain.

Thank you for your feedback. We really appreciate it. Have a great day!

Charles C.

January 30th, 2019

Using an I pad and cannot type on form that was downloaded. I do not have a computer

Charles

Thank you for your feedback Charles. You might want to make sure you have the Adobe app on your Ipad: https://itunes.apple.com/us/app/adobe-fill-sign/id950099951?mt=8

Edward M.

October 3rd, 2022

Thank you very much

Very satisfied

Thank you for your feedback. We really appreciate it. Have a great day!

Nola B.

May 18th, 2021

I like the form except the title should be ENHANCED LIFE ESTATE DEED and not Quit Claim Deed

Thank you for your feedback. We really appreciate it. Have a great day!

Remon W.

January 26th, 2021

Excellent and fast service. I will be using this site as needed in the future.

Thank you Remon, we appreciate you.

Hans S.

April 22nd, 2022

This is my first time using this service so having not yet filed the documents I purchased, I will say that I am impressed at how comprehensive the instructions are that accompany the document I purchased.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan M.

July 13th, 2019

I was able to download a lot of forms that I need, will be going back to day to search for records so I can fill in the blanks. A great website for forms - It was easy to find what I needed and download! Thanks!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jeramy A.

March 8th, 2019

Excellent source of information and forms. Deeds.com had exactly what I've been looking for and even had guides to filling out the forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jackqueline S.

August 25th, 2020

I received my property deed quickly. All pertinent information required was received in less than 30 minutes.

Thank you for your feedback. We really appreciate it. Have a great day!

Veronica S.

June 4th, 2020

Very convenient and quick. I will definitely use it again.

Thank you!

Arthur S.

July 19th, 2019

It is great and fast you get 5 stars from me

We appreciate your business and value your feedback. Thank you. Have a wonderful day!