Klickitat County Correction Deed Form (Washington)

All Klickitat County specific forms and documents listed below are included in your immediate download package:

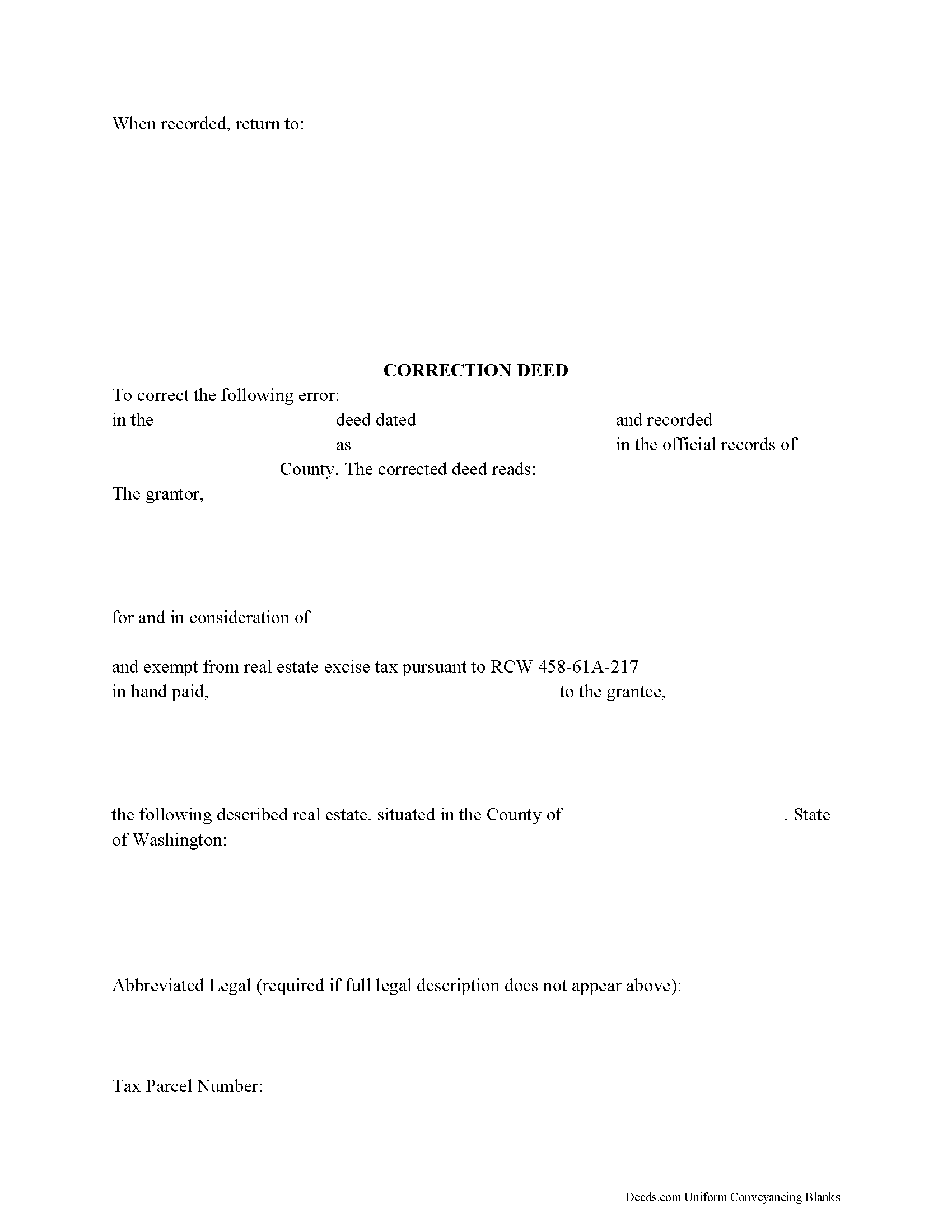

Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Klickitat County compliant document last validated/updated 7/9/2024

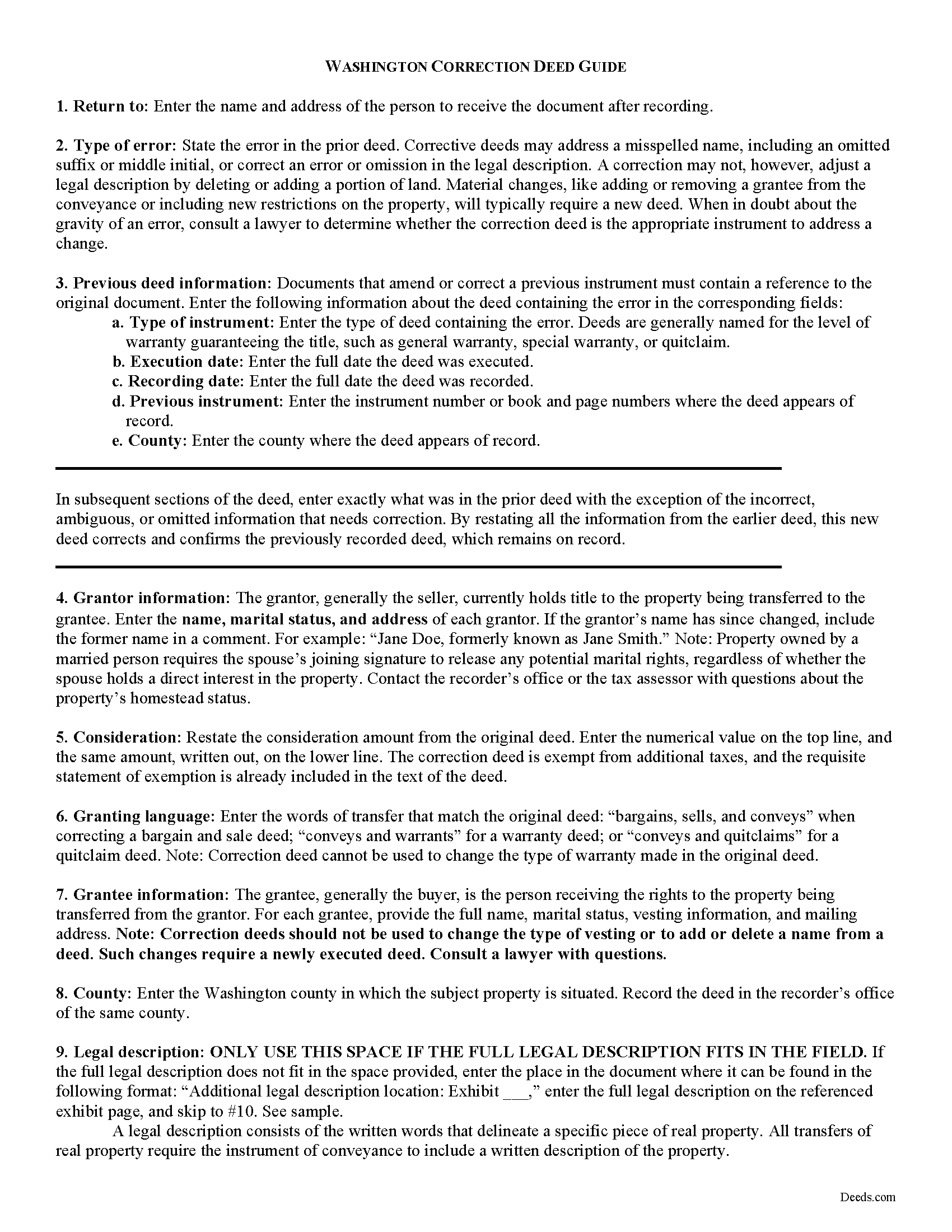

Correction Deed Guide

Line by line guide explaining every blank on the form.

Included Klickitat County compliant document last validated/updated 9/10/2024

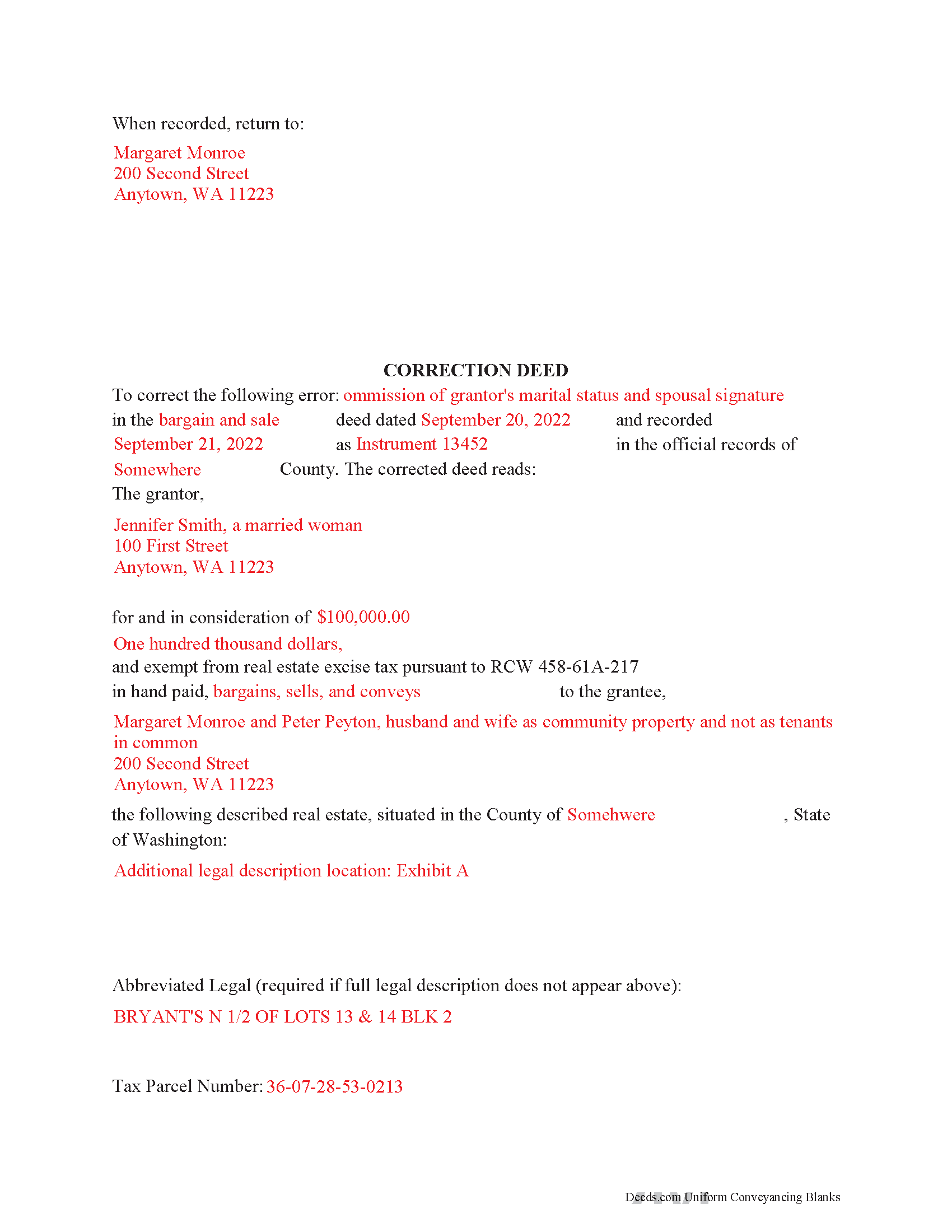

Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

Included Klickitat County compliant document last validated/updated 8/13/2024

The following Washington and Klickitat County supplemental forms are included as a courtesy with your order:

When using these Correction Deed forms, the subject real estate must be physically located in Klickitat County. The executed documents should then be recorded in the following office:

Klickitat County Auditor: Recording

205 S Columbus Ave, Stop 2, Goldendale, Washington 98620

Hours: 8:30 a.m. to 5:00 p.m.

Phone: (509) 773-4001

Local jurisdictions located in Klickitat County include:

- Appleton

- Bickleton

- Bingen

- Centerville

- Dallesport

- Glenwood

- Goldendale

- Husum

- Klickitat

- Lyle

- Roosevelt

- Trout Lake

- Wahkiacus

- White Salmon

- Wishram

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Klickitat County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Klickitat County using our eRecording service.

Are these forms guaranteed to be recordable in Klickitat County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Klickitat County including margin requirements, content requirements, font and font size requirements.

Can the Correction Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Klickitat County that you need to transfer you would only need to order our forms once for all of your properties in Klickitat County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Washington or Klickitat County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Klickitat County Correction Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Use the corrective deed to correct an error in a previously recorded bargain and sale, warranty, or quitclaim deed in Washington State.

Once a deed has been recorded, it cannot be changed and remains part of the public record. It is possible, however, to amend that record by adding a newly executed deed. The method used depends upon the reasons for changing. For corrections of minor errors or omissions, a new correction deed or re-recording of the original deed will suffice. For larger errors or to include/omit a name from the existing deed, a standard conveyance, such as a warranty or quitclaim deed, may be more appropriate.

When re-recording the existing deed, use a cover sheet to reference the prior recording number, the reason for re-recording and the corrected information. The cover sheet, which is often provided by the county, must contain the following information: return address, document title or titles, reference numbers to other documents (here: the prior deed), names of grantors and grantees, entire or abbreviated legal description, assessor's property tax parcel number or account number.

A cleaner option for amending an error is the correction deed, especially in light of Washington State's strict legibility requirements and zero tolerance for any information spilling onto the margins of the document. By restating all the information from the earlier deed, this new deed of correction will reference and confirm the previously recorded deed, which remains on record. After identifying the type of error and identifying the earlier deed, enter exactly what was in that deed with the exception of the false, ambiguous or omitted information that needs to be corrected.

In both correction scenarios, submit a new excise tax affidavit, which must state the prior excise tax recording number. When filling out the affidavit, use exemption code WAC 458-61A-217, which also calls for "the recorded document number for the prior transaction" and an explanation for the re-recording.

(Washington CD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Klickitat County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Klickitat County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jim F.

April 9th, 2024

Site was easy to navigate and helped me to quickly locate the documents I was searching for. Thank you!

Your appreciative words mean the world to us. Thank you.

Charles S.

July 7th, 2021

Quick and easy. Highly recommend. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Lydia E.

December 16th, 2021

Very intuitive to use and comprehensive enough for the most complex of cases.

Thank you!

cora c.

December 30th, 2021

ALTHOUGH IT TOOK A LITTLE LONGER THAN EXPECTED TO RECEIVE AN INVOICE TO ALLOW ME TO PAY THE REQUIRED FEES AND HAVE MY DOCUMENT SUBMITTED FOR RECORDING, I REALLY APPRECIATED THE SERVICE AND PROMPT RESPONSES TO MY MESSAGES, SEEKING ASSISTANCE. THANK YOU SO MUCH!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas V.

January 7th, 2019

Easy to use. Accomplished my goal

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ted C.

May 7th, 2021

Everything was straight forward. I think I was able to accomplish my objective.

Thank you!

Goran L.

August 1st, 2020

Fast and convenient.

Thank you for your feedback. We really appreciate it. Have a great day!

Gloria S.

October 31st, 2019

I needed a Contest of Lien form and was told by our County Department that the forms could be obtained online. The whole process of paying and receiving a PDF re-usable form was user friendly and the items that came with the purchase;the directions about filling out the form ect., were a fantastic addition for the price of the document. Happy customer!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tom B.

December 18th, 2020

I ended up loading the same file twice and was unable to delete one of them. I did send e request in to have one deleted and I did get a response back that only one file was processed. This was done in a timely manner but required more additional time. It would have been nice to be able to delete the file myself and finish the process at the same time. Other than this every thing did go very well. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Craig L.

May 11th, 2021

So far so good. I will let you know after a successful recordation of the deed.

Thank you!

Joseph R.

February 17th, 2021

So easy to use. I like the way they kept me informed to the progress being made on my filing. If the occasion occurs I'll definitely use them again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robin F.

November 9th, 2022

Very Convenient and easy to use

We appreciate your business and value your feedback. Thank you. Have a wonderful day!