Mason County Conditional Waiver and Release of Claim upon Final Payment Form (Washington)

All Mason County specific forms and documents listed below are included in your immediate download package:

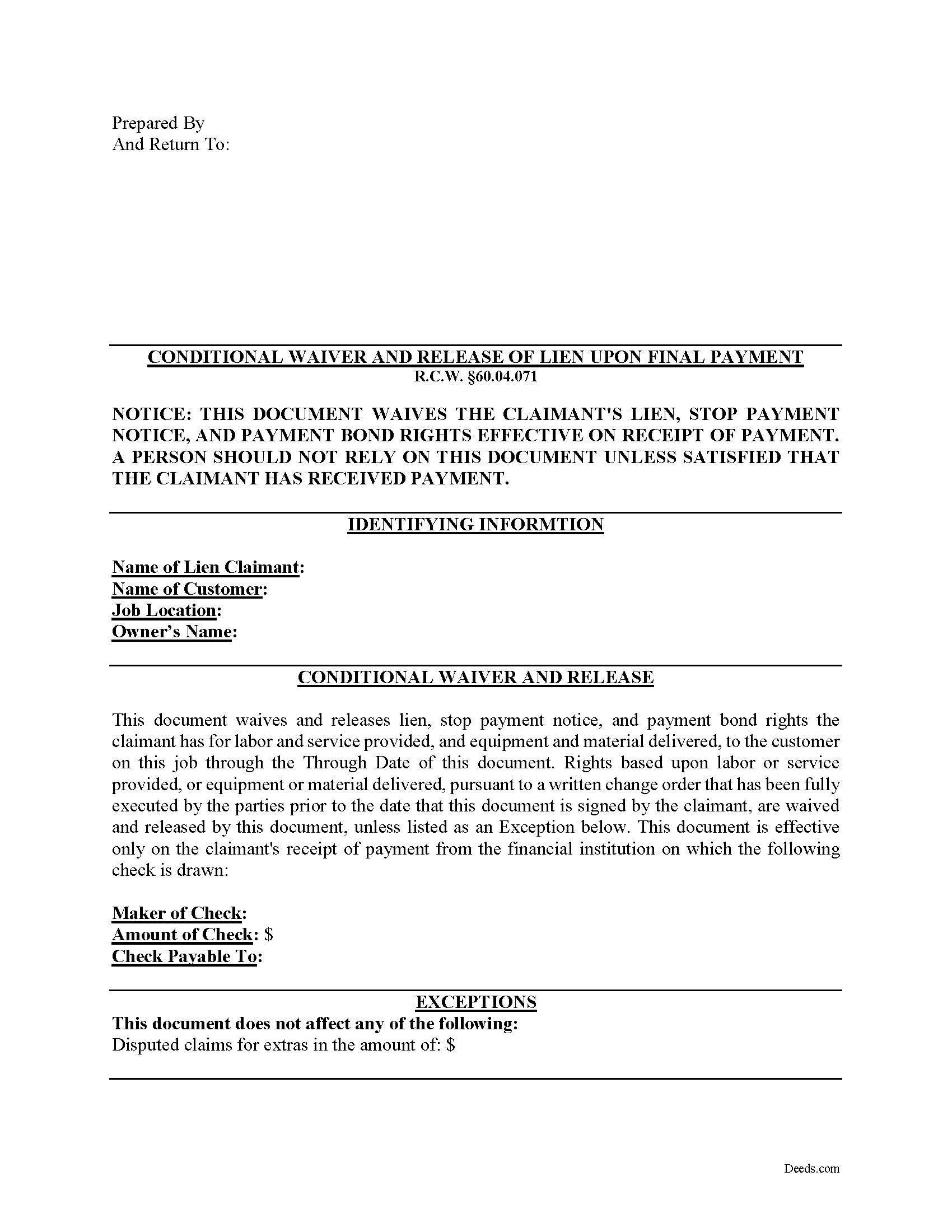

Conditional Waiver and Release of Claim upon Final Payment Form

Fill in the blank Conditional Waiver and Release of Claim upon Final Payment form formatted to comply with all Washington recording and content requirements.

Included Mason County compliant document last validated/updated 11/13/2024

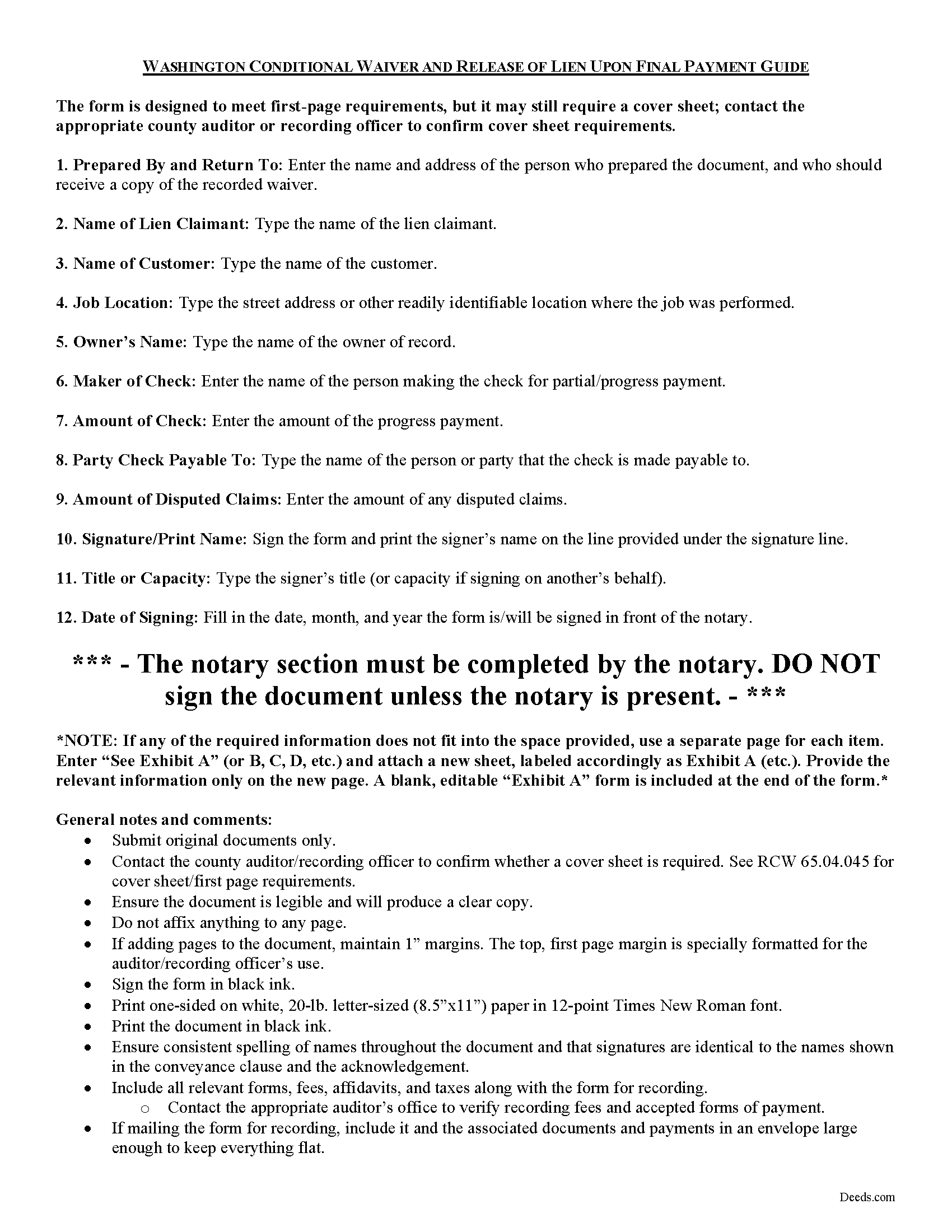

Conditional Waiver and Release of Claim upon Final Payment Guide

Line by line guide explaining every blank on the form.

Included Mason County compliant document last validated/updated 4/19/2024

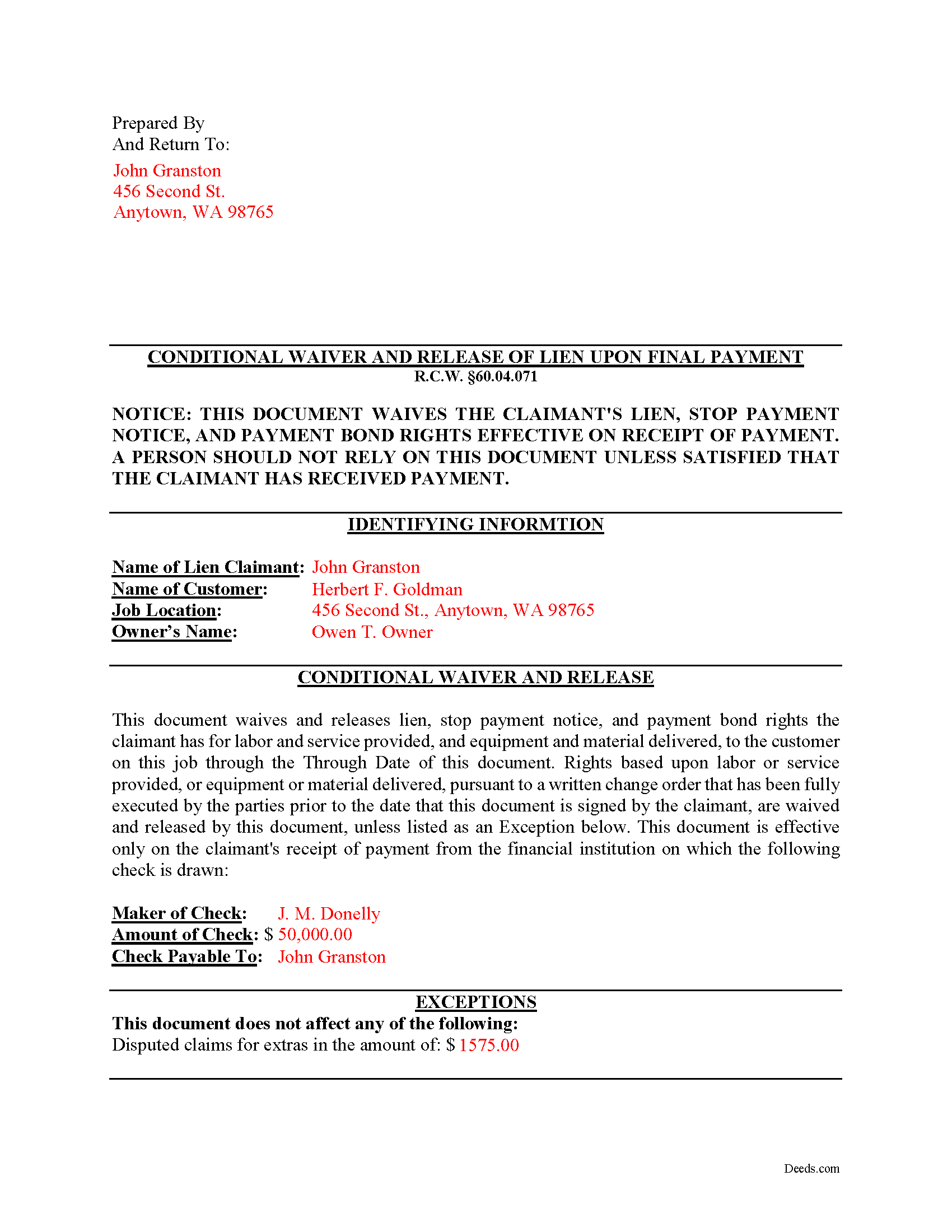

Completed Example of the Conditional Waiver and Release of Claim upon Final Payment Document

Example of a properly completed form for reference.

Included Mason County compliant document last validated/updated 9/13/2024

The following Washington and Mason County supplemental forms are included as a courtesy with your order:

When using these Conditional Waiver and Release of Claim upon Final Payment forms, the subject real estate must be physically located in Mason County. The executed documents should then be recorded in the following office:

Mason County Auditor: Recording

411 N 5th St / PO Box 400, Shelton, Washington 98584

Hours: Monday through Friday 9:00am - 4:00pm

Phone: (360) 427-9670 Ext. 467

Local jurisdictions located in Mason County include:

- Allyn

- Belfair

- Grapeview

- Hoodsport

- Lilliwaup

- Matlock

- Shelton

- Tahuya

- Union

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Mason County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Mason County using our eRecording service.

Are these forms guaranteed to be recordable in Mason County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mason County including margin requirements, content requirements, font and font size requirements.

Can the Conditional Waiver and Release of Claim upon Final Payment forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Mason County that you need to transfer you would only need to order our forms once for all of your properties in Mason County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Washington or Mason County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Mason County Conditional Waiver and Release of Claim upon Final Payment forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Contractors who have already recorded a lien against real property may use a conditional waiver and release of claim upon final payment to surrender their reserved lien rights in exchange for, or to encourage, payment on a balance due.

Washington law requires a lien release upon payment and acceptance of the amount due to the lien claimant and upon the demand of the owner or the person making payment. R.C.W. 60.04.071. If a claimant fails to provide a waiver or release when one is due, the owner can pursue legal action to compel deliverance of the release and if the court determines the delay was unjustified, the court can, in addition to ordering the deliverance of the release, award the costs of the action including reasonable attorneys' fees and any damages. Id.

Given in exchange for full or partial payments, mechanic's lien waivers can be useful at various points during the construction/improvement process. Waivers can also lead to confusion, however, and issuing the wrong kind of waiver (or issuing one too early) can cause dire consequences for the mechanic's lien claimant. Washington's statutes do not provide for any required forms of lien waivers, but contractors may issue their own lien releases, generally under R.C.W. 60.04.071.

There are four main types of lien waivers to choose from, depending on the circumstances of the job. These include: (1) Conditional Waiver and Release of Claim of Lien upon Progress Payment, (2) Conditional Waiver and Release of Claim of Lien upon Final Payment, (3) Unconditional Waiver and Release of Claim of Lien upon Progress Payment, and (4) Unconditional Waiver and Release of Claim of Lien upon Final Payment.

A conditional waiver becomes effective when the payment clears the bank. As such, contractors use this kind of waiver while waiting for payment, or if they need confirmation about the payment method (such as a check). Unconditional waivers take effect when delivered to the property owner. If a lien claimant issues an unconditional waiver and the owner fails to pay or the check bounces, the person receiving the waiver may be freed from all or part of the mechanic's lien obligation without the proper payment. In these situations, the only other remedy may be a costly lawsuit.

Regardless of the terms, waivers must at least identify the claimant, the owner or person responsible for payment, payment amount, the relevant dates, and include the claimant's signature.

Contact an attorney with questions about lien waivers or any other issue relating to liens in Washington.

Our Promise

The documents you receive here will meet, or exceed, the Mason County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mason County Conditional Waiver and Release of Claim upon Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael W.

November 16th, 2021

So far the web site and the tools are a pleasure to use. The price is reasonable. If only getting rid of this timeshare in Mashpee Massachusetts (that I have owned for over thirty years) was this easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

wendy w.

October 19th, 2022

Excellent

Thank you!

Michael D.

June 14th, 2024

Quick and easy!

Thank you!

Irma G.

April 30th, 2021

Although I did not use the forms yet, it appears very easy to understand and navigate.

Thank you for your feedback. We really appreciate it. Have a great day!

Sandra G.

January 3rd, 2019

We were referred to the site by banking friend. It does take time to read through and figure out what a person needs, form-wise, to accomplish the goal. Once that was decided, check out and the download was very easy. What a great savings in cost and time.

Thank you Sandra, glad we could help. Also, please thank your friend for us. Have a wonderful day.

Tracey T.

January 20th, 2022

I downloaded the Lady Bird deed. The process was quick and easy to download. Just select your county, fill out the form. You will need the property description from your original deed. In my case I had to go downtown Wayne County (Detroit). (Make an appt online). 1st you will have to get the property tax certified to ensure all taxes are paid to date (5th floor at the Wayne County Treasurer office). Give them the form you just filled out and they will stamp certified $5. After that take the form to the Register of Deeds (7th floor) appt needed. $18. Make sure it is properly notarized and all signatures completed. Once approved, they will scan it, stamp it, give it back with a receipt and mail a copy also. All Done. Worked beautifully. My co worker go a lawyer and paid over $250. I just used deeds.com and total for forms and going downtown with notarizing was less than $40 Yea!

Thank you for your feedback. We really appreciate it. Have a great day!

Christopher G.

July 23rd, 2019

Great service and very easy to complete

Thank you for your feedback. We really appreciate it. Have a great day!

Ron E.

September 25th, 2019

Flawless. I ordered the forms needed, along with completed samples. I filled them out, and I was on my way to the recorders office. I would use deeds.com without hesitation.

Thank you for your feedback. We really appreciate it. Have a great day!

Charles K.

December 23rd, 2021

So far it has been a good experience. I am working on getting a beneficiary deed.

Thank you for your feedback. We really appreciate it. Have a great day!

James S.

December 2nd, 2020

It worked great. But it turns out I didn't need it.

Thank you!

Billy R.

May 18th, 2021

Thank you...........easy process........Billy C

Thank you!

Angeline P.

April 29th, 2020

Great service! I downloaded the Quit Claim Deed package and I'm so grateful I did. It contained detailed directions on how to fill out all the forms, an example of a finalized copy, and excellent customer service. Also, if you choose to use their digital service, they will digitally submit the documents into the County Recorder's Office for you. Going through DEEDS.COM for the service I chose saved me over $300. Recording my new deed was a breeze. Thank you again DEEDS.com!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!