Patrick County Trustee Deed Form (Virginia)

All Patrick County specific forms and documents listed below are included in your immediate download package:

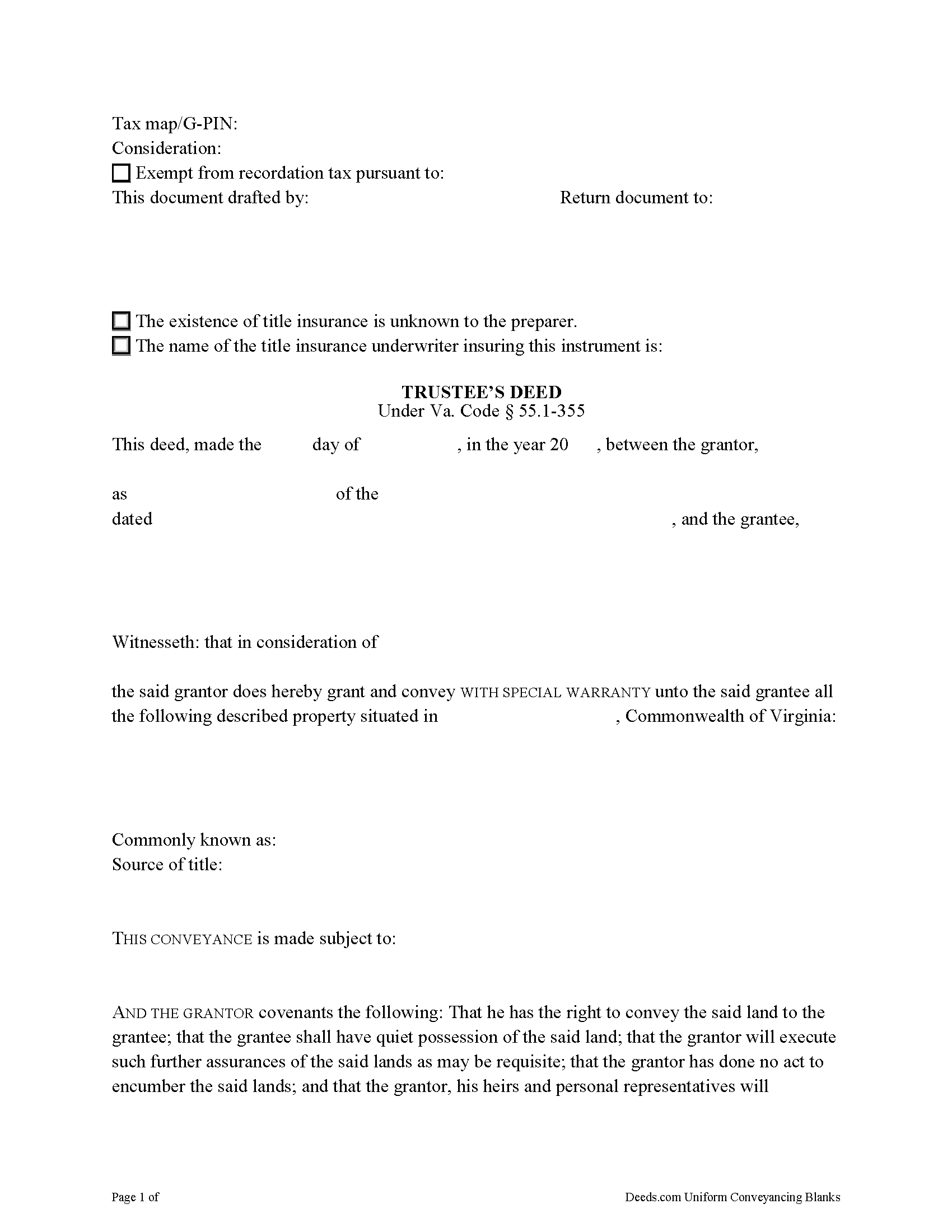

Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Patrick County compliant document last validated/updated 7/19/2024

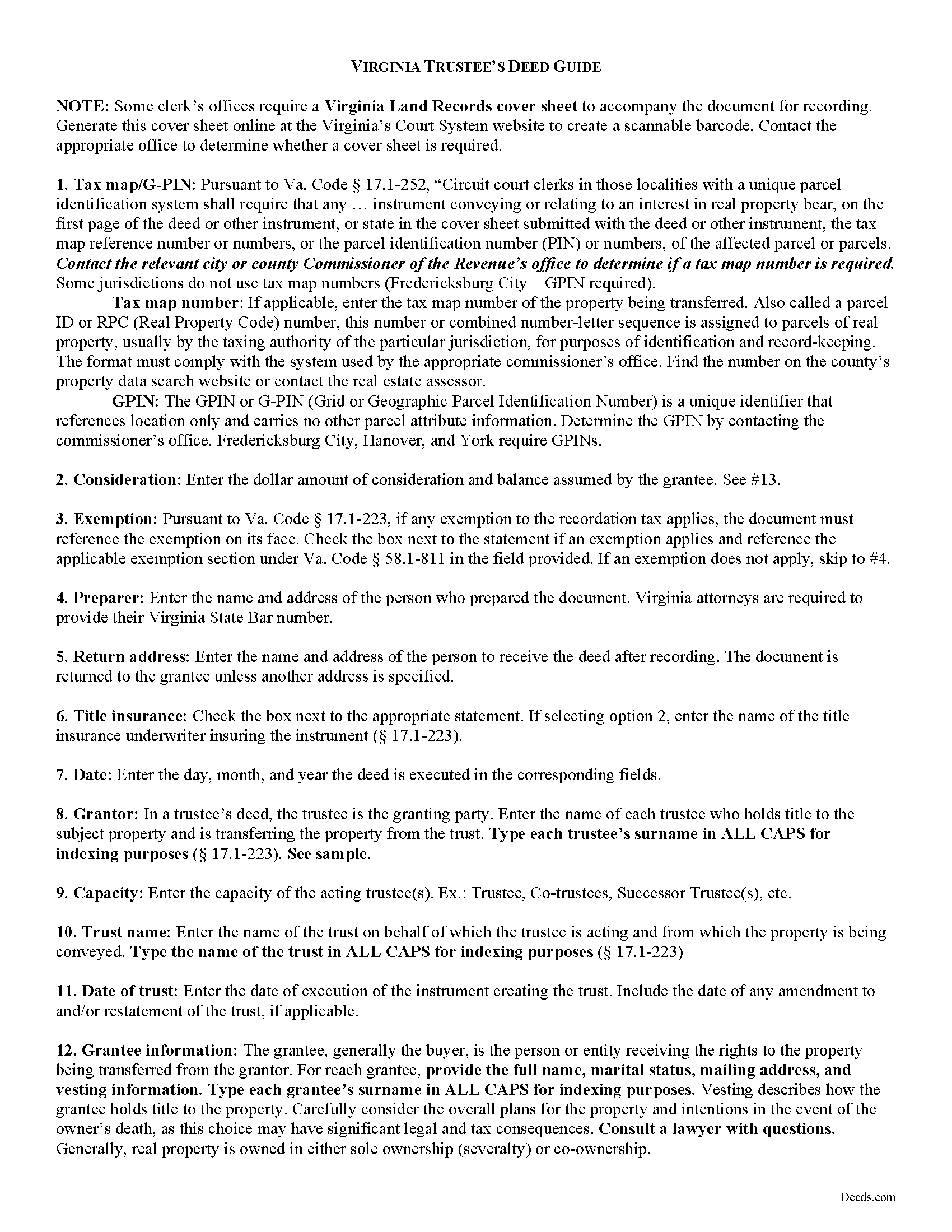

Trustee Deed Guide

Line by line guide explaining every blank on the form.

Included Patrick County compliant document last validated/updated 7/18/2024

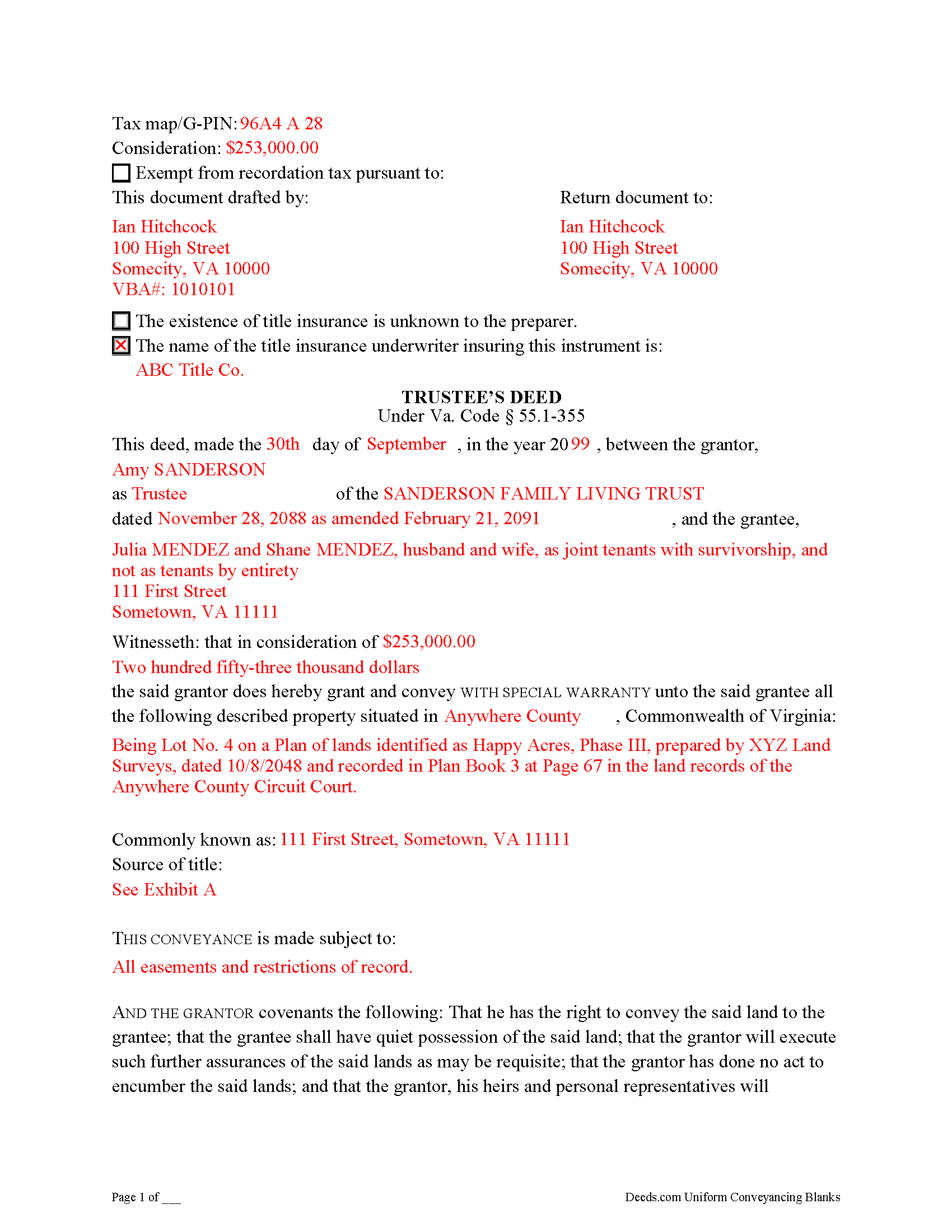

Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

Included Patrick County compliant document last validated/updated 9/10/2024

The following Virginia and Patrick County supplemental forms are included as a courtesy with your order:

When using these Trustee Deed forms, the subject real estate must be physically located in Patrick County. The executed documents should then be recorded in the following office:

Patrick County Clerk of Court

101 West Blue Ridge St / PO Box 148, Stuart, Virginia 24171-0148

Hours: Monday through Friday 9:00am – 5:00pm

Phone: (276) 694-7213

Local jurisdictions located in Patrick County include:

- Ararat

- Claudville

- Critz

- Meadows Of Dan

- Patrick Springs

- Stuart

- Vesta

- Woolwine

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Patrick County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Patrick County using our eRecording service.

Are these forms guaranteed to be recordable in Patrick County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Patrick County including margin requirements, content requirements, font and font size requirements.

Can the Trustee Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Patrick County that you need to transfer you would only need to order our forms once for all of your properties in Patrick County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Virginia or Patrick County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Patrick County Trustee Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Transferring Real Property from a Living Trust Using a Virginia Trustee's Deed

A trustee's deed conveys interest in real property held in a living (inter vivos) trust. The deed is named for the granting party, the trustee, who holds legal title to property contributed to the trust by the trust's settlor. A settlor is any person who creates or contributes property to a trust by transferring it to another. Property held in trust is administered by the trustee for the benefit of a trust beneficiary. In most living trusts, the settlor designates himself as trustee and names a successor, who will take over fiduciary duties upon the settlor's death or incapacitation.

The trust is established by a written instrument executed by the settlor and governed by the Uniform Trust Code, codified in Virginia at Va. Code Ann. 64.2-7. The trust instrument contains the terms of the trust and sets forth the settlor's estate plan. The document names the trustees and enumerates the trustee's powers in acting on behalf of the trust, and designates the trust beneficiary or beneficiaries. Generally, the settlor designates himself as the living trust's beneficiary during his lifetime, and identifies another in the trust instrument who will receive the benefit of the trust's assets upon his death.

Trustees rely on the terms of the trust instrument and statutory trustee powers to convey property held in trust. A deed executed by trustee to convey real property from a trust typically carries a special warranty covenant of title. This means that the grantor promises to warrant and defend the property for the grantee "against the claims and demands of the grantor, and all persons claiming or to claim by, through, or under him" (Va. Code Ann. 55.1-355). Because the trustee is acting "in a fiduciary capacity," a narrower covenant than a general warranty is offered "to warrant title [only] during the time they had legal possession of it" [1].

A trustee's deed requires additional information because the grantor is acting in a fiduciary capacity. When real property is held in trust, the assets vest in the name of the trustee on behalf of the trust. Therefore, the trustee's deed names the acting trustee, the trust, and the date of the trust when reciting the grantor's information. The trustee's deed should comply with the statutory form for deeds and satisfy recording requirements for documents pertaining to interest in real property in Virginia (55.1-300, 17.1-223 et seq.). A trustee may provide a certification of trust under 64.2-804 to confirm the trust's existence and his authority to convey real property.

Before recording the deed in the independent city or county wherein the subject property is located, the deed must be signed by each acting trustee and acknowledged in the presence of a notary public.

(Virginia TD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Patrick County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Patrick County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert h.

February 25th, 2019

excellent and simple to use. Great price for this.

Thank you Robert! We really appreciate your feedback.

Marcia D.

March 16th, 2023

Excellent... This website was awesome. Exactly what I was looking for.

Thank you!

Beverly D.

January 12th, 2021

Thank You, Job well done. So nice not to have to leave house and drive all over to record these documents. Very satisfied.

Thank you for your feedback. We really appreciate it. Have a great day!

JANET D.

October 19th, 2019

was good choice for me but did not realize notary had to witness all 3 signatures at the same luckily had extra copy to be signed in her presence

Thank you!

Christine S.

September 14th, 2021

One stop shopping for your Deed needs. Downloaded the forms and filled them out with ease following the step by step instructions. Saved me hundreds of dollars for not having to hire an attorney to do the exact same thing.

Thank you for your feedback. We really appreciate it. Have a great day!

Paulette O.

March 24th, 2021

I love this! I wish there was one for a simple personal will.

Thank you!

Vernon A L.

March 23rd, 2022

They are forms....no magic there. I still have to round up the details.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

irene a.

February 8th, 2019

good forms thanks, irene

Thank you Irene.

VALETA J.

April 15th, 2022

Easy to navigate

Thank you!

David K.

April 4th, 2019

Excellent instructions to guide one through the warranty deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Marcus W.

July 14th, 2022

I was very pleased and satisfied with the ease of use, expeditious turnaround and costs involved to eRecord my documentation to the Probate Court. I live in another city and state and your service allowed me to get what I needed done. in a matter of a few hours from the time I submitted my package for filing, within an hour. I received noted and stamped confirmation from the county clerks office the document was now on file with them. I highly recommend Deeds.com and will be utilizing your online services for any future legal documentation.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gertrude F.

April 24th, 2022

I like that DEEDS.com has a variety of forms tht I may need. However, I was disappointed that I am not able to save the PDF forms after I fill in the spaces. If I need to edit anything, I have to go back to the blank form and redo the whole thing. Perhap I am doing something wrong.

Thank you!