Prince William County Conditional Lien Waiver on Final Payment Form (Virginia)

All Prince William County specific forms and documents listed below are included in your immediate download package:

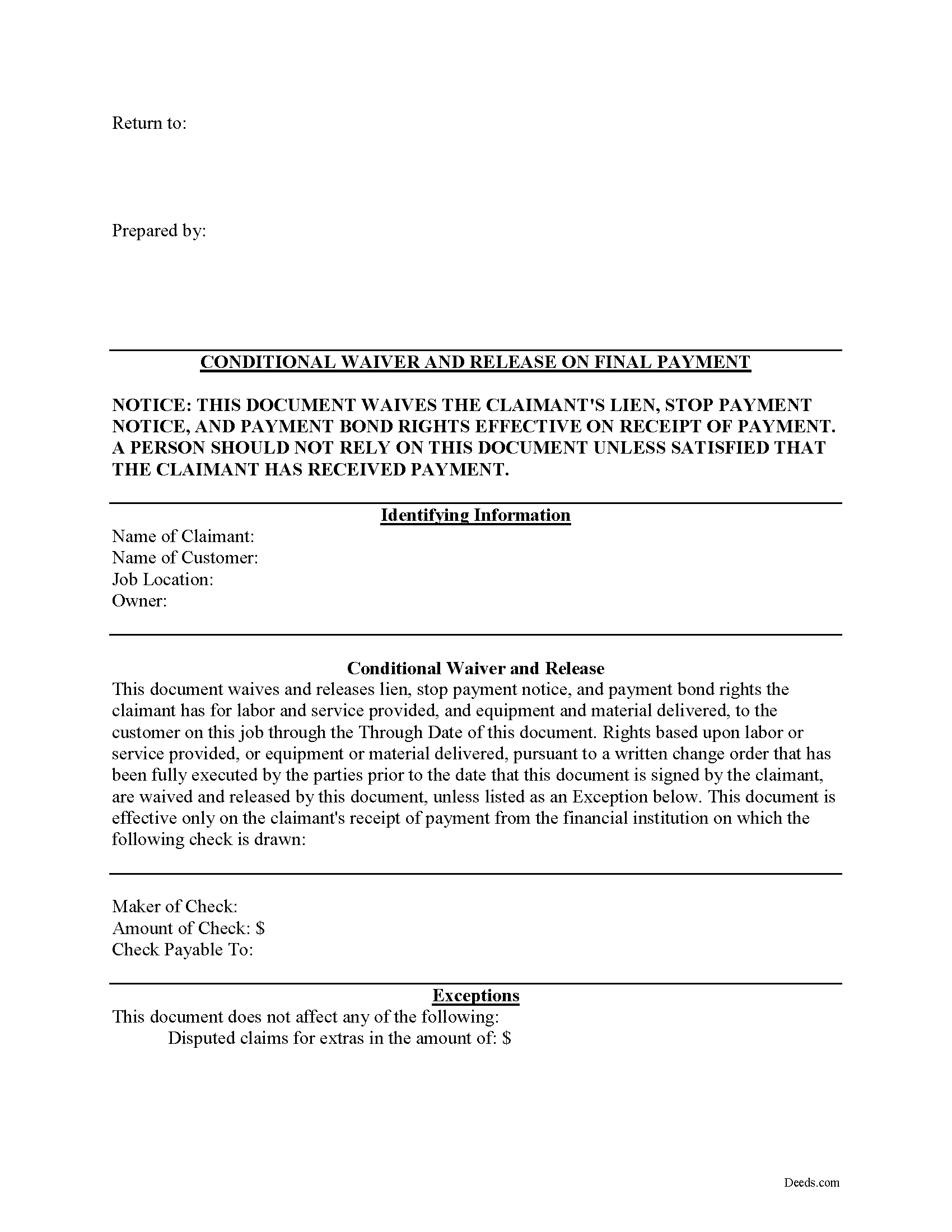

Conditional Lien Waiver on Final Payment Form

Fill in the blank Conditional Lien Waiver on Final Payment form formatted to comply with all Virginia recording and content requirements.

Included Prince William County compliant document last validated/updated 12/6/2024

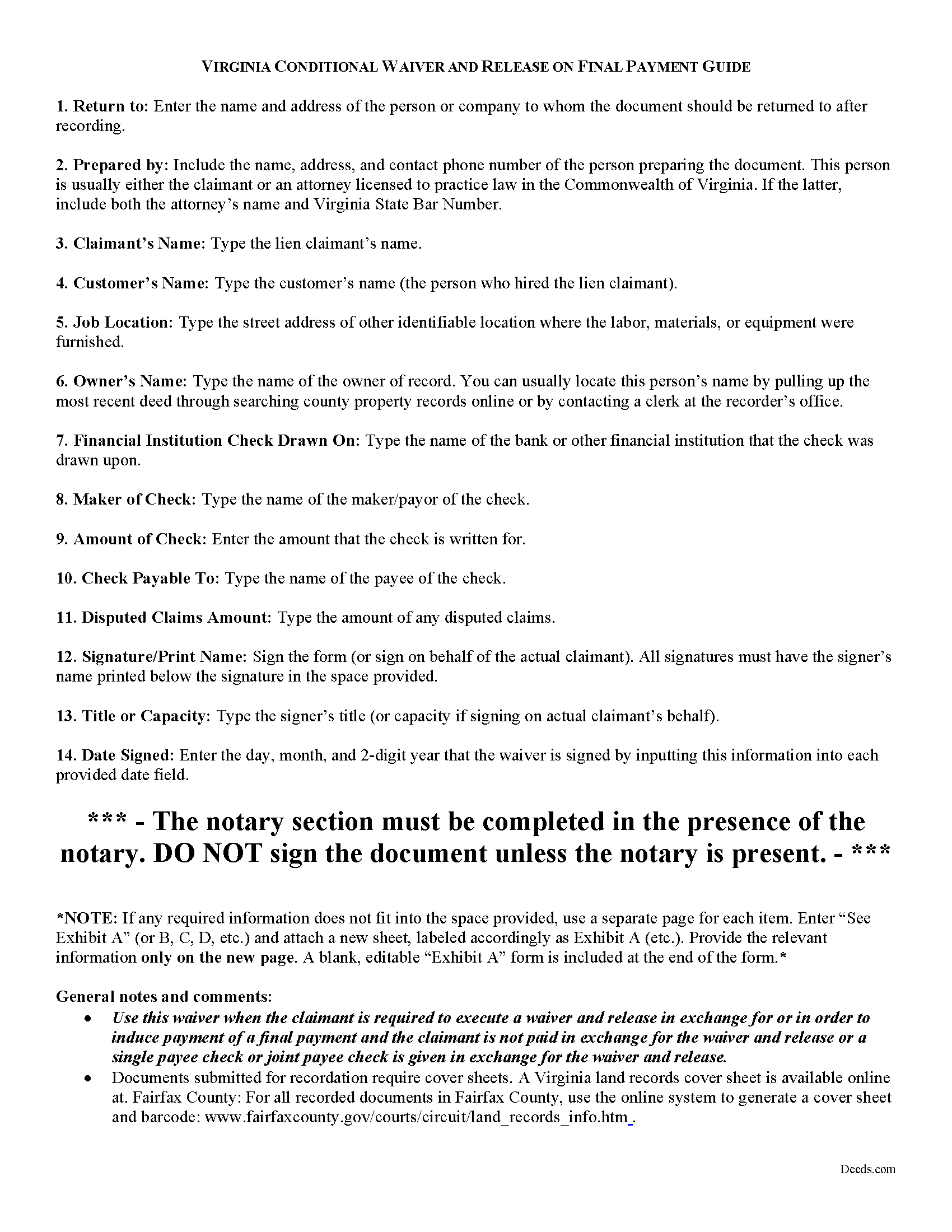

Conditional Lien Waiver on Final Payment Guide

Line by line guide explaining every blank on the form.

Included Prince William County compliant document last validated/updated 12/5/2024

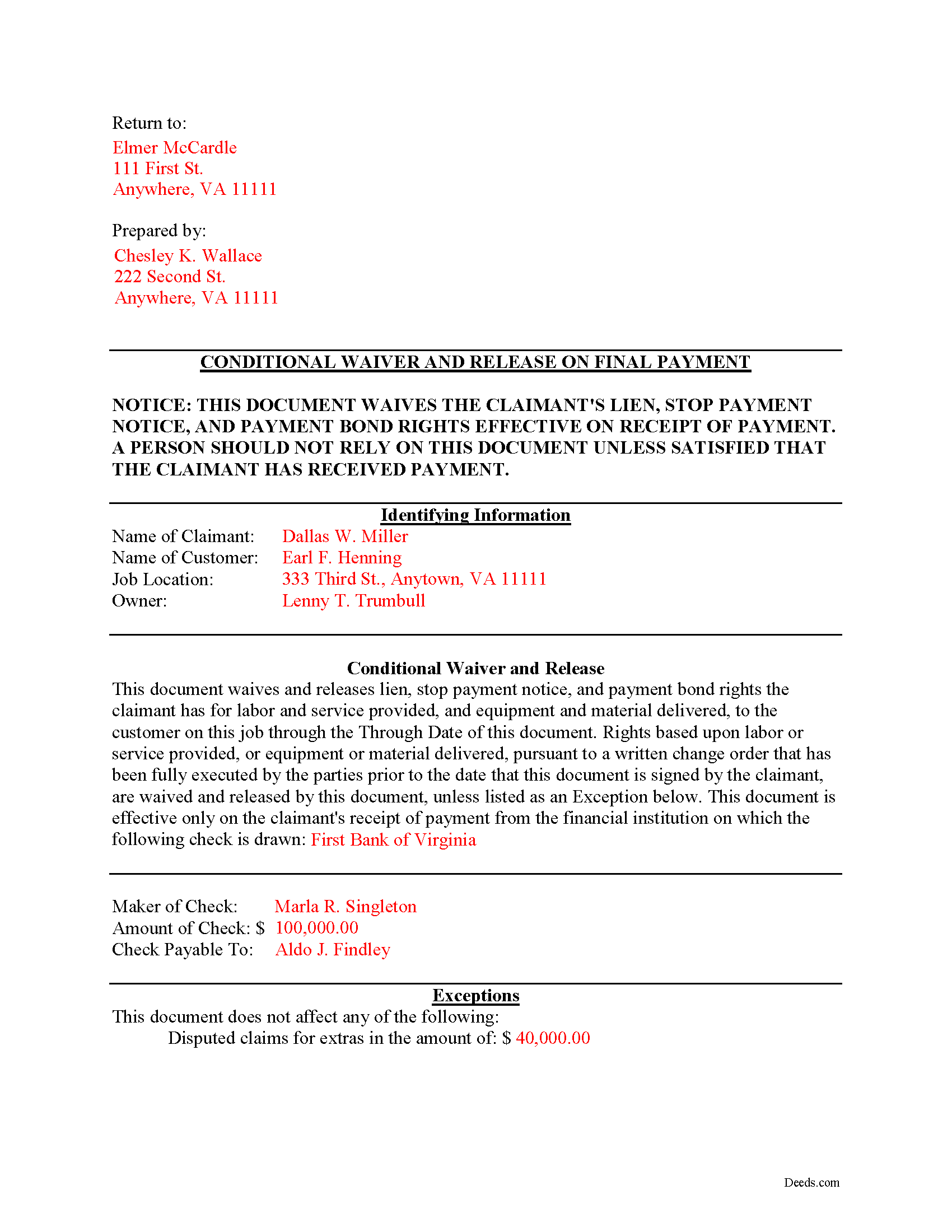

Completed Example of the Conditional Lien Waiver on Final Payment Document

Example of a properly completed form for reference.

Included Prince William County compliant document last validated/updated 8/26/2024

The following Virginia and Prince William County supplemental forms are included as a courtesy with your order:

When using these Conditional Lien Waiver on Final Payment forms, the subject real estate must be physically located in Prince William County. The executed documents should then be recorded in the following office:

Land Records/Clerk of Circuit Court

Judicial Center - 9311 Lee Ave, Rm 300, Manassas, Virginia 20110

Hours: 8:30 to 5:00 Monday through Friday / Recording until 4:00

Phone: (703) 792-6035

Local jurisdictions located in Prince William County include:

- Bristow

- Catharpin

- Dumfries

- Gainesville

- Haymarket

- Manassas

- Nokesville

- Occoquan

- Quantico

- Triangle

- Woodbridge

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Prince William County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Prince William County using our eRecording service.

Are these forms guaranteed to be recordable in Prince William County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Prince William County including margin requirements, content requirements, font and font size requirements.

Can the Conditional Lien Waiver on Final Payment forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Prince William County that you need to transfer you would only need to order our forms once for all of your properties in Prince William County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Virginia or Prince William County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Prince William County Conditional Lien Waiver on Final Payment forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Lien waivers are quid-pro-quo arrangements between contractors and owners. The purpose of such waivers is to induce payment from an owner in return for the contractor waiving some or all available mechanic's lien rights. If the correct waivers are used, they offer advantages for both a contractor and owner.

In Virginia, any right to file or enforce any mechanics' lien may be waived in whole or in part at any time by any person entitled to such lien, except that a subcontractor, lower-tier subcontractor, or material supplier may not waive or diminish his lien rights in a contract in advance of furnishing any labor, services, or materials. Va. Code 43-3(C). A provision that waives or diminishes a subcontractor's, lower-tier subcontractor's, or material supplier's lien rights in a contract executed prior to providing any labor, services, or materials is null and void. Id.

The Virginia legislature does not mandate a required form of a lien waiver, so common law principles of contract allow for the parties to use any form that clearly spells out their intentions. Note that it is a felony for any person to knowingly present a waiver form to an owner, his agent, contractor, lender, or title company for the purpose of obtaining funds or title insurance if the person forges or signs the form without authority. Va. Code. 43-13.1.

Waivers fall under two broad categories of "conditional" and "unconditional," and there are two subcategories of waivers for a "partial" or "final" payment. Each type comes with benefits and risks, so take care to use the correct form for the situation.

A conditional waiver depends on the actual receipt of payment, so use a conditional waiver when a party pays with a check but the claimant doubts whether it might clear. Therefore, if the check doesn't clear the bank, it is still possible to claim a lien down the line. This type of waiver offers greater protection to the contractor.

Use a full waiver on final payment when the fees/debt is completely paid. So, this might be the appropriate form for a situation where the owner submitted a check for the balance due, but the claimant wants to preserve the right to claim a lien until after the check clears the bank.

In this way, waivers can facilitate the flow of business and encourage prompt payment without any unnecessary holdups.

This article is provided for informational purposes only and should not be relied upon a substitute for the advice of an attorney. For any questions about Virginia lien waivers, please speak with a lawyer.

Our Promise

The documents you receive here will meet, or exceed, the Prince William County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Prince William County Conditional Lien Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard B.

April 27th, 2023

Excellent! I was able to complete the documents especially using the instructions as a guide. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michelle J.

June 11th, 2022

I believe this is great! It protects the residents from theft of property. Proud of what Wayne County is doing.

Thank you!

Christine M.

September 8th, 2021

Forms were top notch, easy to complete, printed beautifully, recorded with no revisions. Highly recommend for anyone preparing their own deeds.

Thank you for the kind words Christine. Have an amazing day!

Timothy K.

April 7th, 2021

Excellent service. Fast turnaround within one day. Reasonable pricing for services.

Thank you!

Betty A.

March 2nd, 2022

You've made it very easy to download the form I needed. Thank you.

Thank you!

Andre W.

June 24th, 2020

I was very please with their professionalism and dedication. The young lady that was working with me was AWESOME. i could not thank her enough.

Thank you!

Doreen P.

December 13th, 2018

I have uploaded 2 documents for E recording, I have searched thinking it would prompt me to a business customer service contact info tel no. ? I am concerned as to the fees related to the recording of both instruments? please advise? thank you

Thank you for your feedback. We really appreciate it. Have a great day!

A. S.

February 27th, 2019

First, I am glad that you gave a blank copy, an example copy, and a 'guide'. It made it much easier to do. Overall I was very happy with your products and organization... however, things got pretty confusing and I have a pretty 'serious' law background in Real Estate and Civil law. With that said, I spent about 10+ hours getting my work done, using the Deed of Trust and Promissory note from you and there were a few problems: First, it would be FANTASTIC if you actually aligned your guide to actually match the Deed or Promissory Note. What I mean is that if the Deed says 'section (E)' then your guide shouldn't be 'randomly' numbered as 1,2,3, for advice/instructions, but should EXACTLY match 'section (E)'. Some places you have to 'hunt' for what you are looking for, and if you did it based on my suggestion, you wouldn't need to 'hunt' and it would avoid confusion. 2nd: This one really 'hurt'... you had something called the 'Deed of Trust Master Form' yet you had basically no information on what it was or how to use it. The only information you had was a small section at the top of the 'Short Form Deed of Trust Guide'. Holy Cow, was that 'section' super confusing. I still don't know if I did it correctly, but your guide says only put a return address on it and leave the rest of the 16 or so page Deed of Trust beneath it blank... and then include your 'Deed of Trust' (I had to assume the short form deed that I had just created) as part of it. I had to assume that I had to print off the entire 17 page or so title page and blank deed. I also had to assume that the promissory note was supposed to be EXHIBIT A or B on the Short Form Deed. It would be great if someone would take a serious look at that short section in your 'Short Form Deed of Trust Guide' and realize that those of us using your products are seriously turning this into a county clerk to file and that most of us, probably already have a property that has an existing Deed... or at least can find one in the county records if necessary... and make sure that you make a distinction between the Deed for the property that already exists, versus the Deed of Trust and Promissory note that we are trying to file. Thanks.

Thank you for your feedback. We'll have staff review the document for clarity. Have a great day!

Patrick S.

March 4th, 2019

Excellent!

Thank you!

Melanie W.

October 23rd, 2022

I used deeds.com to complete a gift deed for transferring a house to our son. Finding the correct form and completing it correctly was extremely easy due to wonderful explanations and examples provided with the purchase of the form. The registrar filing the deed told me she was impressed with the work we did. An attorney would have charged $150 so the $28.00 was well worth the money.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen K.

July 5th, 2019

The forms were correct and the instructions and Completed sample were very helpful. I filled it out and filed it at the county office, they didn't question anything. Thank you.

Thank you!

Gina B.

March 30th, 2023

This website is reliable and informative. So glad I can across this website. They provide a wide range of documents that are always provided on the recording county website. Thanks!

Thank you!