Orleans County Gift Deed Form (Vermont)

All Orleans County specific forms and documents listed below are included in your immediate download package:

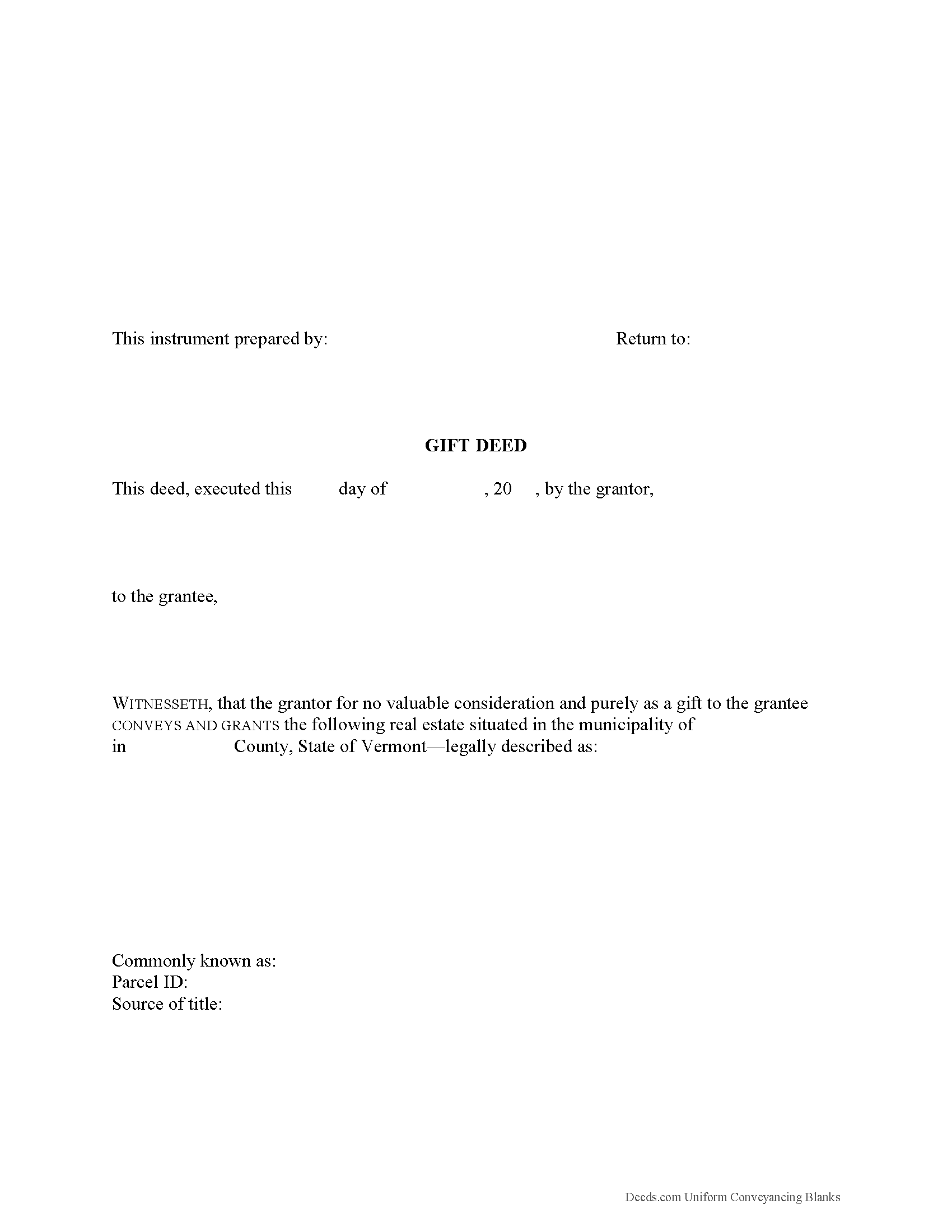

Gift Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Orleans County compliant document last validated/updated 10/16/2024

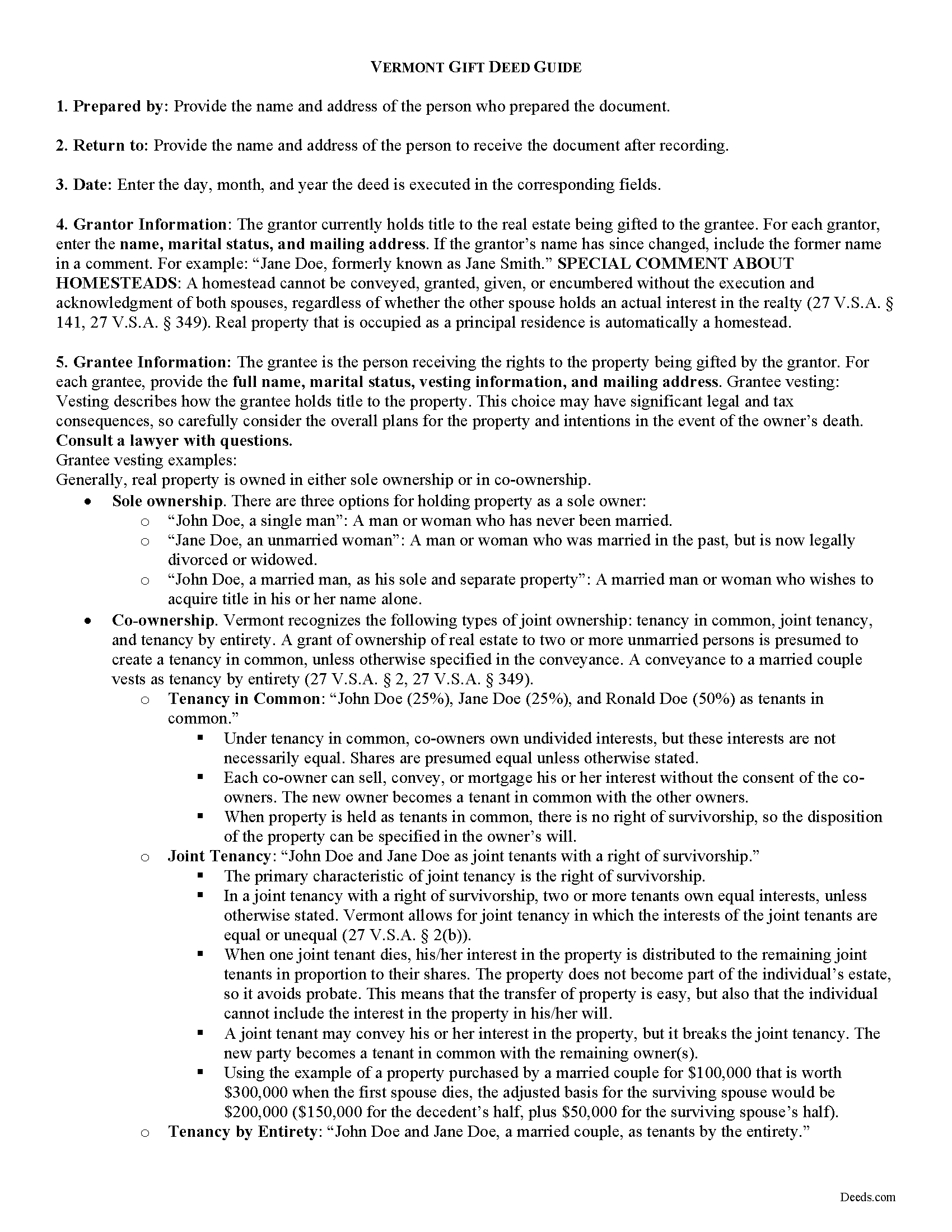

Gift Deed Guide

Line by line guide explaining every blank on the form.

Included Orleans County compliant document last validated/updated 7/3/2024

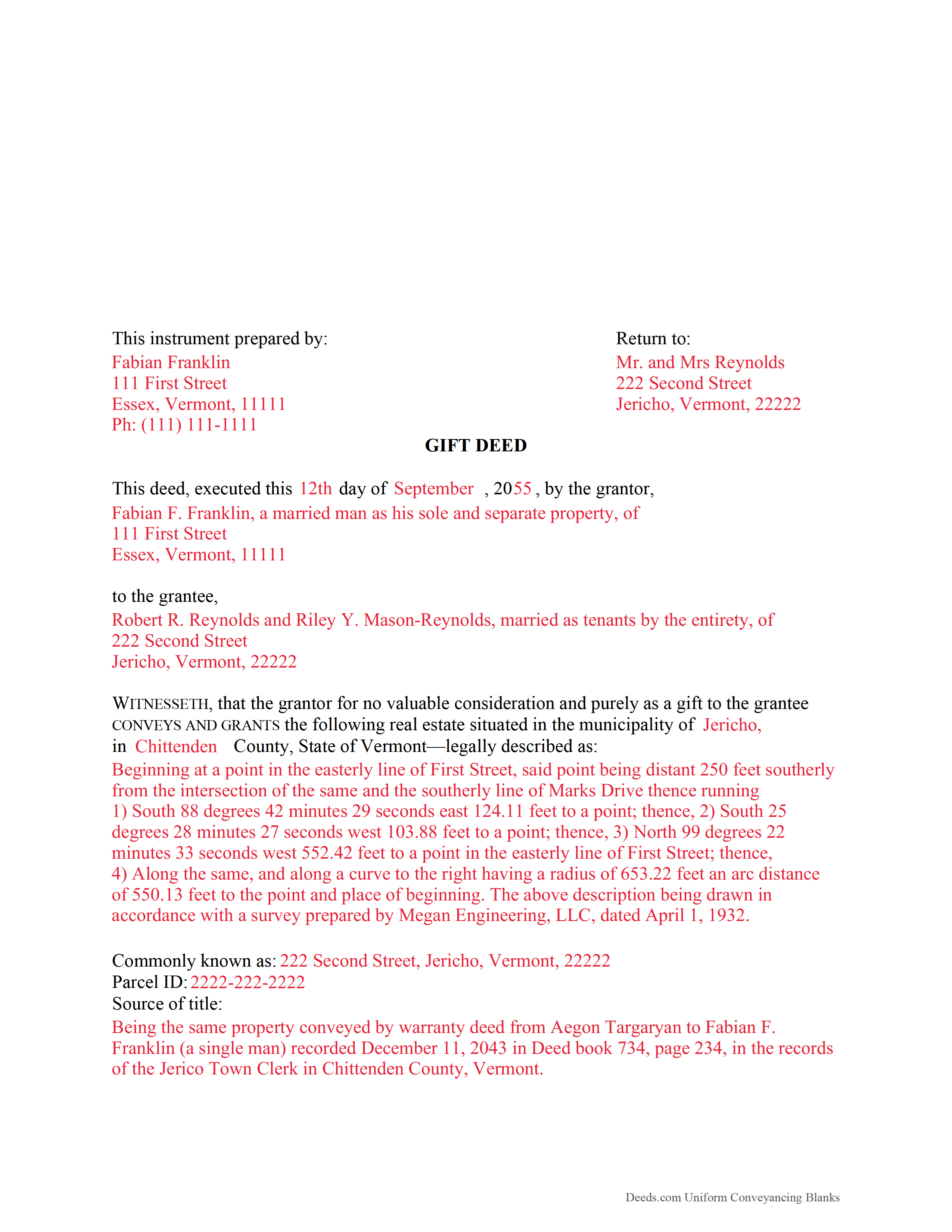

Completed Example of the Gift Deed Document

Example of a properly completed form for reference.

Included Orleans County compliant document last validated/updated 11/6/2024

The following Vermont and Orleans County supplemental forms are included as a courtesy with your order:

When using these Gift Deed forms, the subject real estate must be physically located in Orleans County. The executed documents should then be recorded in one of the following offices:

Town Clerk of Albany

827 Main St / PO Box 284, Albany, Vermont 05820

Hours: Tu & Th 9:00 to 4:00; We 9:00 to 7:00

Phone: (802) 755-6100

Town Clerk of Barton

34 Main St, Barton, Vermont 05822

Hours: M - Th 7:30 to 4:00 & Fr 7:30 to noon

Phone: (802) 525-6222

Town Clerk of Brownington

622 Schoolhouse Rd, Brownington / PO Box 66, Orleans, Vermont 05860

Hours: Mo-Th 9:00 to 4:00

Phone: (802) 754-8401

Town Clerk of Charleston

5063 VT Rte 105, West Charleston, Vermont 05872

Hours: M, Tu & Th 8:00 to 3:00

Phone: (802) 895-2814

Town Clerk of Coventry

168 Main St / PO Box 104, Coventry, Vermont 05825

Hours: M, Tu, Th, F 8:00 to 12:00; W 4:00 to 7:00; 3rd Sat 9:00 to 2:00

Phone: (802) 754-2288

Town Clerk of Craftsbury

85 S Craftsbury Rd / PO Box 55, Craftsbury, Vermont 05826

Hours: Tu - Fr 8:30 to 4:00

Phone: (802) 586-2823

Town Clerk of Derby

124 Main St, Derby, Vermont 05829

Hours: Mo - Th 7:00 to 5:00

Phone: (802) 766-4906

Town Clerk of Glover

51 Bean Hill, Glover, Vermont 05839

Hours: M - Th 8:00 to 4:00

Phone: (802) 525-6227

Town Clerk of Greensboro

81 Laurendon Ave / PO Box 119, Greensboro, Vermont 05841

Hours: Mo - Th 9:00 to 4:00

Phone: (802) 533-2911

Town Clerk of Holland

120 School Rd, Holland, Derby Line, Vermont 05830-8961

Hours: Mo, Tu, Th 8:00 to 4:30

Phone: (802) 895-4440

Town Clerk of Irasburg

161 Route 58 East / PO Box 51, Irasburg, Vermont 05845

Hours: Mo-We 9:00 to 3:00 & Th 9:00 to 6:00

Phone: (802) 754-2242

Town Clerk of Jay

1036 VT Route 242, Jay, Vermont 05859

Hours: Mo-Th 7:00 to 4:00; We until noon

Phone: (802) 988-2996

Town Clerk of Lowell

2170 VT Rte 100, Lowell, Vermont 05847

Hours: M-Th 9:00 to 2:30

Phone: (802) 744-6559

Town Clerk of Morgan

41 Meade Hill Rd / PO Box 45, Morgan, Vermont 05853

Hours: Mo & Th 8:00 to 4:00; Tu & We 8:00 to 3:00

Phone: (802) 895-2927

City of Newport: Clerk

222 Main St, Newport, Vermont 05855

Hours: Mo-Fr 8:00 to 4:30

Phone: (802) 334-2112

Town of Newport: Clerk

102 Vance Hill Rd / PO Box 85, Newport Ctr, Vermont 05857

Hours: Mo-Th 7:00 to 4:30

Phone: (802) 334-6442

Town Clerk of Troy

142 Main St, North Troy, Vermont 05859

Hours: Mo-Th 9:00 to 5:00

Phone: (802) 988-2663

Town Clerk of Westfield

38 School St, Westfield, Vermont 05874

Hours: Mo-Th 8:00 to 4:00

Phone: (802) 744-2484

Town Clerk of Westmore

54 Hinton Hill Rd, Orleans, Vermont 05860

Hours: Mo-Th 8:30 to 4:00

Phone: (802) 525-3007

Local jurisdictions located in Orleans County include:

- Albany

- Barton

- Beebe Plain

- Coventry

- Craftsbury

- Craftsbury Common

- Derby

- Derby Line

- East Charleston

- Glover

- Greensboro

- Greensboro Bend

- Irasburg

- Lowell

- Morgan

- Newport

- Newport Center

- North Troy

- Orleans

- Troy

- West Charleston

- West Glover

- Westfield

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Orleans County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Orleans County using our eRecording service.

Are these forms guaranteed to be recordable in Orleans County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Orleans County including margin requirements, content requirements, font and font size requirements.

Can the Gift Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Orleans County that you need to transfer you would only need to order our forms once for all of your properties in Orleans County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Vermont or Orleans County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Orleans County Gift Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Gifting of Real Estate in Vermont

A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). A gift deed typically transfers real property between family or close friends. Gift deeds are also used to donate to a non-profit organization or charity. The deed serves as proof that the transfer is indeed a gift and without consideration (any conditions or form of compensation).

In order for a gift deed to be valid they must meet the following requirements: The grantor must intend to make a present gift of the property, the grantor must deliver the property to the grantee, and the grantee must accept the gift. A gift deed must contain language that explicitly states no consideration is expected or required, because any ambiguity or reference to consideration can make the deed contestable in court. A promise to transfer ownership in the future is not a gift, and any deed that does not immediately transfer the interest in the property, or meet any of the aforementioned requirements, can be revoked [1].

A lawful gift deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. Vermont recognizes the following types of joint ownership: tenancy in common, joint tenancy, and tenancy by entirety. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common, unless otherwise specified in the conveyance. A conveyance to a married couple vests as tenancy by entirety (27 V.S.A. 2, 27 V.S.A. 349). In Vermont, an instrument may create a joint tenancy in which the interests of the joint tenants are equal or unequal (27 V.S.A 2).

As with any conveyance of real estate, a gift deed requires a complete legal description of the parcel. In Vermont, a deed that refers to a survey revised or prepared after July 1, 1988 may be recorded only if it is accompanied by the survey to which it refers, or cites the volume and page in the land records showing where the survey has been previously recorded (27 V.S.A. 341). Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. Record the completed deed, and file a copy of Act 250 Disclosure Statement with the Town Clerk, who shall record it in the land records (10 V.S.A. 6007).

The fee for recording a real estate document in Vermont, the fees are $10 per page for all documents recorded. Copies of recorded documents are $1 per page. Certified copies are $1, plus the per page costs (32 V.S.A. 1671).

All deeds conveying property with or without consideration must have a Vermont Property Transfer Tax Return (32 V.S.A. 9602). There is a $10 filing fee for this form. When filling out the Transfer Tax Return form, make sure that section B is accurate and clearly printed. This information provides data needed to update that parcel's owner information for all city departments. Do not send property tax payments with documents to be recorded. Those payments should go directly to the Treasurer's Department (32 V.S.A. 9602).

The grantor is responsible for paying the Federal Gift Tax. The IRS implements a Federal Gift Tax on any transfer of property from one individual to another with no consideration, or consideration that is less than the full market value. In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. This means that if a gift is valued below $15,000, a federal gift tax return (Form 709) does not need to be filed. However, if the gift is something that could possibly be disputed by the IRS -- such as real property -- a grantor may benefit from filing a Form 709 [2].

In Vermont, there is no state gift tax. For questions regarding state taxation laws, consult a tax specialist. Gifts of real property in Vermont are, however, subject to the federal gift tax. The grantor is responsible for paying the federal gift tax; however, if the grantor does not pay the gift tax, the grantee will be held liable [1].

With gifts of real property, the recipient of the gift (grantee) is not required to declare the amount of the gift as income, but if the property accrues income after the transaction, the recipient is responsible for paying the requisite state and federal income taxes [3].

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a lawyer with any questions about gift deeds or other issues related to the transfer of real property. For questions regarding federal and state taxation laws, consult a tax specialist.

[1]

https://nationalparalegal.edu/public_documents/courseware_asp_files/realProperty/PersonalProperty/InterVivosGifts.asp

[2] http://msuextension.org/publications/FamilyFinancialManagement/MT199105HR.pdf

[3] https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes

(Vermont Gift Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Orleans County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Orleans County Gift Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

irene a.

February 8th, 2019

good forms thanks, irene

Thank you Irene.

Molly A.

April 12th, 2020

Super easy to download and Deeds dot com had the documents I was looking for and set up in a manner that the County Government office would accept.

Nice!

Thank you, Deeds!

Thank you for your feedback. We really appreciate it. Have a great day!

Anthony C.

September 20th, 2019

I am filing a Personal Representative Deed. Haven't used the forms yet but the package sent is comprehensive and appears easy to follow. A bit help to someone who has never done this.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James C.

February 5th, 2019

An excellent resource for users.

Thank you!

Lisa D.

May 2nd, 2023

Great service, would be nice if it provided an address to send this to once completed!

Thank you for your feedback. We really appreciate it. Have a great day!

William H.

July 18th, 2023

It was quick and easy to download the forms I need to modify a property deed. No problems n the least.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Daniel L.

September 25th, 2023

so far appears to meet my needs!

Thank you for your feedback. We really appreciate it. Have a great day!

Jackson J.

April 19th, 2022

Thank you very much for all your help its always a pleasure to continue working with you thanks again.

Thank you for your feedback. We really appreciate it. Have a great day!

FLORIN D.

December 3rd, 2020

Excellent service, will use in the future and will recommend to anyone that needs to record documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jackson J.

June 4th, 2019

Thank you for your help the website is simple and easy to use and dealing with this county for the 1st time there were a few things i was not too sure about but your staff was prompt and responsive and anytime there was a glitch we were promptly able to resolve the issue until the deed was accepted and recorded by the county great service thanks again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

BARBARA S.

November 22nd, 2020

Easy to use; great back-up documentation; reasonably priced.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kevin M.

May 14th, 2019

All I can say is WOW. They were so fast and professional. I received my copy of my deed that same day I requested it. There was some confusion on my part but within minutes it was explained.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!