Franklin County Executor Deed Form (Vermont)

All Franklin County specific forms and documents listed below are included in your immediate download package:

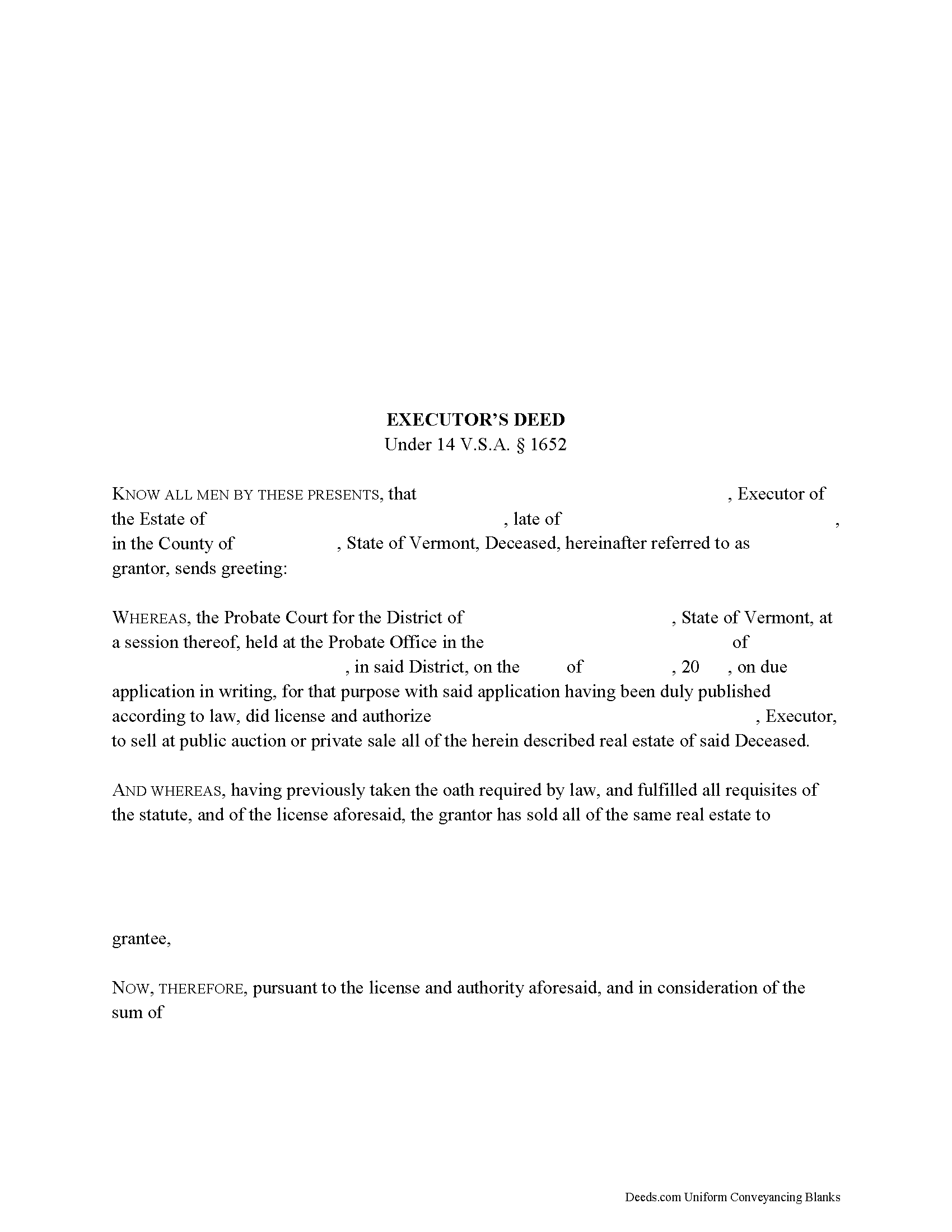

Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Franklin County compliant document last validated/updated 9/12/2024

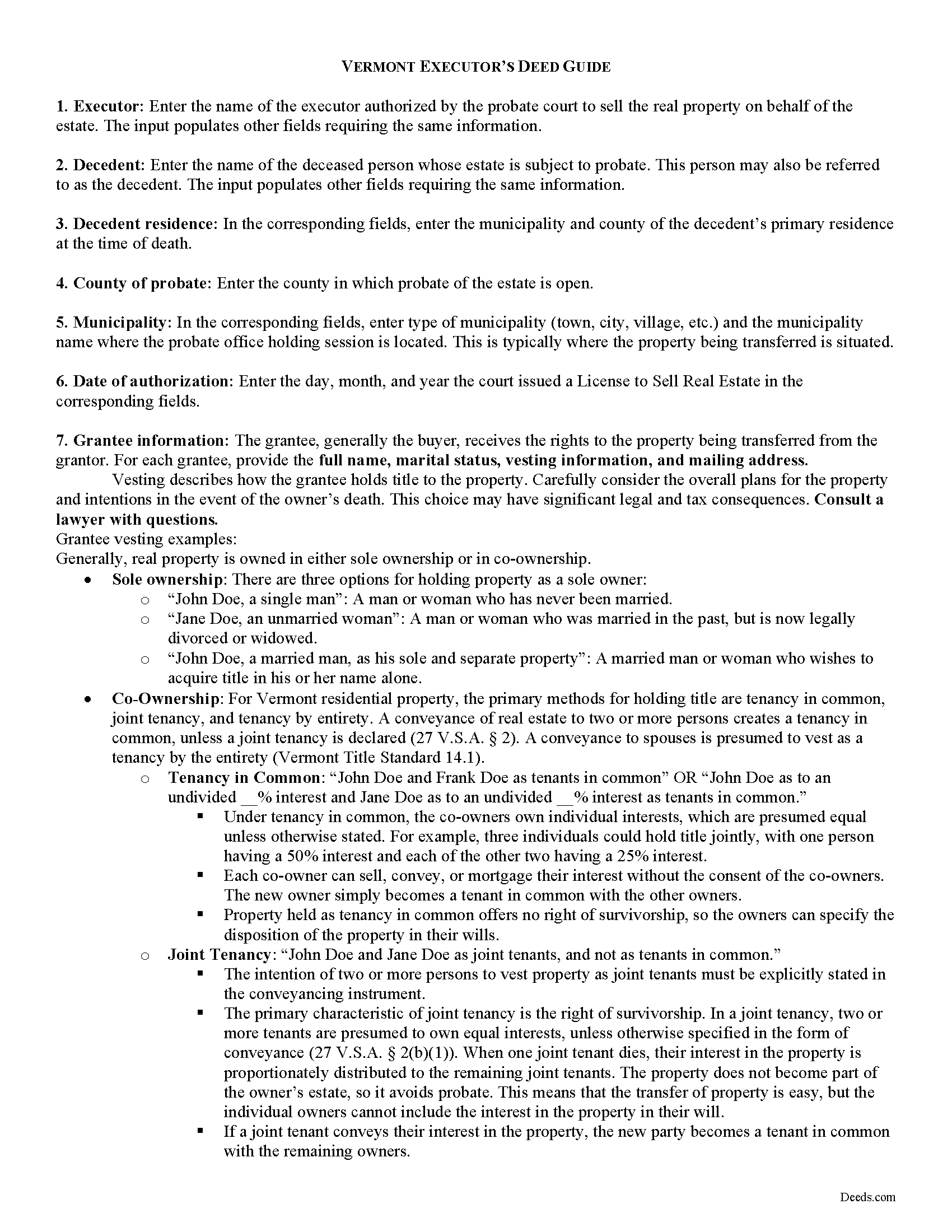

Executor Deed Guide

Line by line guide explaining every blank on the form.

Included Franklin County compliant document last validated/updated 12/20/2024

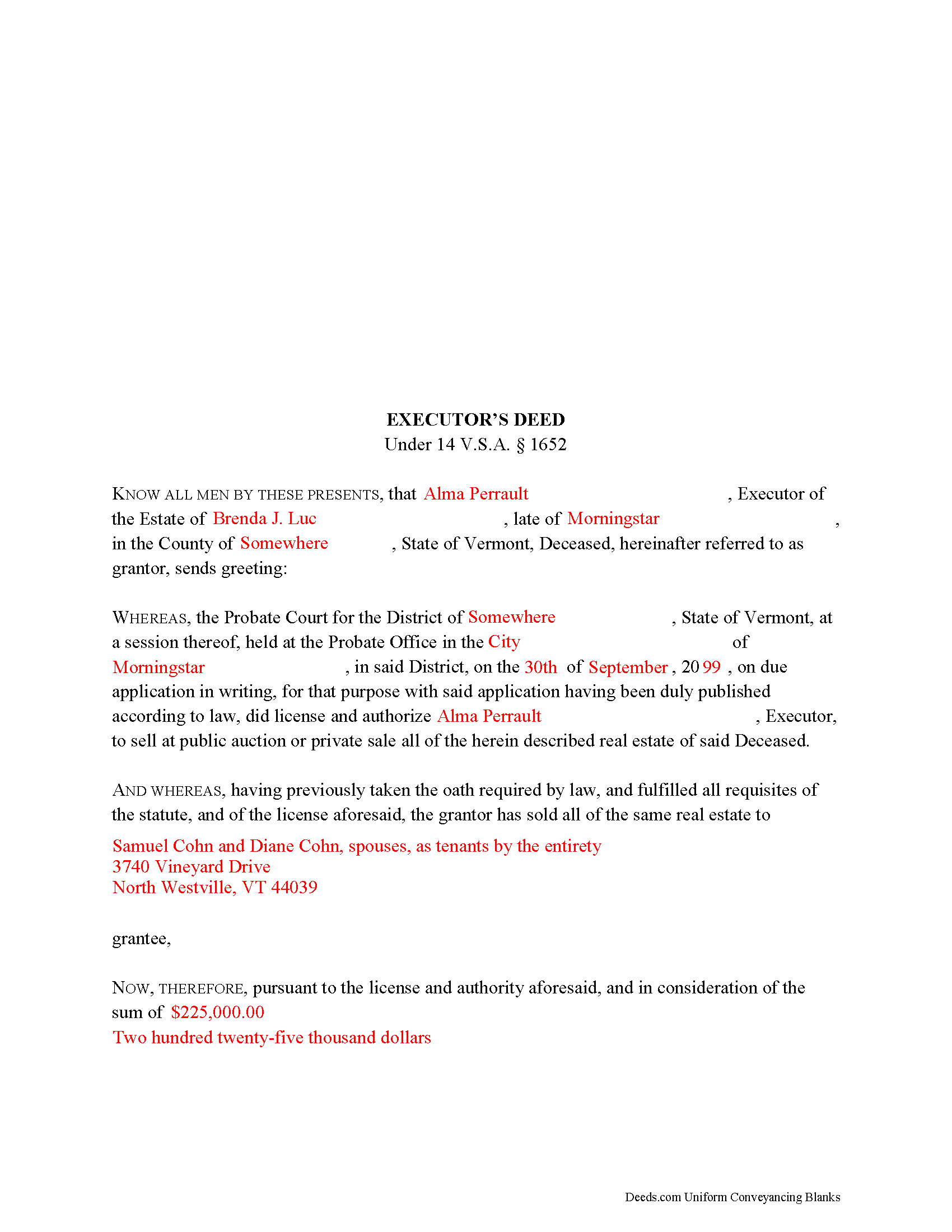

Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

Included Franklin County compliant document last validated/updated 10/22/2024

The following Vermont and Franklin County supplemental forms are included as a courtesy with your order:

When using these Executor Deed forms, the subject real estate must be physically located in Franklin County. The executed documents should then be recorded in one of the following offices:

Town Clerk of Bakersfield

40 E Bakersfield Rd / PO Box 203, Bakersfield, Vermont 05441

Hours: M - F 9:00 to 12:00 & 7:00 to 8:00

Phone: (802) 827-4495

Town Clerk of Berkshire

4454 Watertower Rd, Enosburgh, Vermont 05450

Hours: M & Tu 8-12, 1-5; W & Th 9-12, 1-4

Phone: (802) 933-2335

Town Clerk of Enosburgh

239 Main St / PO Box 465, Enosburgh Falls, Vermont 05450

Hours: M - F 8:00 to 3:30

Phone: (802) 933-4421

Town Clerk of Fairfax

12 Buck Hollow Rd, Fairfax, Vermont 05454

Hours: M - F 9:00 to 4:00; 1st & 3rd Mon 6:00 to 8:00

Phone: (802) 849-6111

Town Clerk of Fairfield

25 North Rd / PO Box 5, Fairfield, Vermont 05455

Hours: M, Tu, Th, F 8:00 to 3:00; W 10:30 to 5:30

Phone: (802) 827-3261 x1

Town Clerk of Fletcher

215 Cambridge Rd, Cambridge, Vermont 05444

Hours: M 8 - 3:30 & 6:30 - 8:30; Tu - Th 8 to 3:30

Phone: (802) 849-6616

Town Clerk of Franklin

5167 Main St / PO Box 82, Franklin, Vermont 05457

Hours: M, Tu, F 8:30 to 3:30; W 8:30 to noon; Th 8:30 to 6:00

Phone: (802) 285-2101

Town Clerk of Georgia

47 Town Common Rd N, St. Albans, Vermont 05478

Hours: M-F 8:00 - 4:00

Phone: (802) 524-3524

Town Clerk of Highgate

2996 VT Route 78 / PO Box 189, Highgate Ctr, Vermont 05459

Hours: M-F 8:30 to 12 & 1:00 to 4:30

Phone: (802) 868-4697 X201

Town Clerk of Montgomery

98 Main St / PO Box 356, Montgomery, Vermont 05471

Hours: M 8-12 & 1-6; Tu, Th, F 8-12 & 1-4

Phone: (802) 326-4719

Town Clerk of Richford

94 Main St / PO Box 236, Richford, Vermont 05476

Hours: M - Th 8:00 - 5:00; F 8:00 - noon

Phone: (802) 848-7751 x3

City of St. Albans Clerk

100 N Main St / PO Box 867, St. Albans, Vermont 05478-0867

Hours: M-F 7:30 - 4:30; last Sat 9:00 - 12:00

Phone: (802) 524-1501 x264

Town of St. Albans Clerk

579 Lake Rd, St. Albans Town / PO Box 37, St. Albans Bay, Vermont 05481

Hours: M-F 8:00 - 4:00

Phone: (802) 524-2415

Town Clerk of Sheldon

1640 Main St / PO Box 66, Sheldon, Vermont 05483

Hours: M 8:00 to 6:00 & Tu-F 8:00 to 3:00

Phone: (802) 933-2524 x3

Town Clerk of Swanton

1 Academy St / PO Box 711, Swanton, Vermont 05488

Hours: M-F 7:00 to 5:00

Phone: (802) 868-4421

Local jurisdictions located in Franklin County include:

- Bakersfield

- East Berkshire

- East Fairfield

- Enosburg Falls

- Fairfield

- Franklin

- Highgate Center

- Highgate Springs

- Montgomery

- Montgomery Center

- Richford

- Saint Albans

- Saint Albans Bay

- Sheldon

- Sheldon Springs

- Swanton

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Franklin County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Franklin County using our eRecording service.

Are these forms guaranteed to be recordable in Franklin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Franklin County including margin requirements, content requirements, font and font size requirements.

Can the Executor Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Franklin County that you need to transfer you would only need to order our forms once for all of your properties in Franklin County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Vermont or Franklin County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Franklin County Executor Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Probate is the court-supervised process of settling an estate and distributing the remaining assets to beneficiaries following a property owner's death. An executor is a personal representative named in the decedent's will to administer his estate.

By operation of law, the title of a decedent passes to her devisees or heirs upon death, subject to a lien of the personal representative for payment of debts, expenses of administration, and other expenses legally chargeable against the estate.

If the decedent's debts outweigh his assets, the executor must sell property from the estate. Personal representatives of an estate may not sell real property without first obtaining a license from the probate division of the superior court. Following petition by the executor, the Register of the probate court executes and records the license in the land records of the town or city where the property to be sold is situated.

Following a sale of real property, the executor executes and records an executor's deed under 14 V.S.A. 1652. The deed contains covenants of special warranty, whereby the executor warrants to defend the title against claims stemming from the time the decedent held title to the property, but not before. The executor also covenants that he is lawfully seized of the property and has been authorized by the court to convey it.

A deed by executor also recites facts about the probated estate, such as the location where it is opened, the date of petition for license to sell, the probate docket number, and a reference to the location where the license is on record. The deed should also meet all state and local standards for content and format of recorded conveyances of real property, such as the grantee's name, address, and vesting information, the consideration the grantee is paying for the transfer of title, a legal description of the property conveyed, the source of the decedent's title to the property, and a list of any restrictions on the property.

The executor must sign the deed in the presence of a notary public or other authorized officer before recording in the appropriate town or city clerk's office. At the time of recording, submit a Vermont Property Transfer Tax Return, with tax remitted to the Vermont Department of Taxes, unless exempt under 32 V.S.A. 9603. In general, anyone who sells property in Vermont that was held by the seller for less than six years is required to file a Vermont Land Gains Tax Return (Form LGT-178) within 30 days of the sale, even if no tax is due.

Contact a lawyer with questions about probate procedures and executor's deeds in Vermont, as each situation is unique.

(Vermont Executor Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Franklin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Franklin County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Edith W.

February 4th, 2020

I was very pleased to be able to get all the legal forms, with instructions, I need to file a beneficiary deed specific to my county in one place. The downloads went smoothly. Deeds.com has saved me time and money by offering this service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eric L.

June 28th, 2021

This is a great service. The fact that there are no recurring fees and all of the supporting documents as well as the main warranty deed is another excellent feature. Highly recommend

Thank you for your feedback. We really appreciate it. Have a great day!

Oldemar T.

June 23rd, 2020

You guys simplified my life. You offer very convenient services. Thank you.

Thank you!

Karen C.

July 28th, 2022

Easily find and print forms necessary for peace of mind.

Thank you for your feedback. We really appreciate it. Have a great day!

Tawnya P.

November 2nd, 2022

I can't believe I haven't found Deeds.com sooner. They made my job so much easier!! They make recording documents effortless. I'm so grateful.

Thank you for your feedback. We really appreciate it. Have a great day!

RICKY N.

July 10th, 2020

Fast Speedy great communication worry-free

Thank you!

Sandra H.

February 26th, 2019

I am a retired attorney. I chanced upon this website while looking for a Florida Lady Bird Deed Form. It conforms to Florida Law and was exactly what I needed. The forms are easy to obtain and even easier to use and print out.

Thank you so much Sandra, we really appreciate your feedback.

Donna C.

April 1st, 2022

Easy to use.

Thank you!

John S.

June 29th, 2021

Your service is refreshingly clear, simple, and free of superfluous claims or unnecessary marketing. And, more affordable than other online legal document providers I've looked at. So nice! I forgot I had used it some years ago for another deed so glad you are still around for this time.

Thank you for the kind words John. Have a fantastic day!

Anne J.

September 25th, 2023

I could not be happier with the service. Shortly after I uploaded my documents, my package was prepared and invoiced. It was only minutes before the document was recorded with the County I selected and returned to me with their seal for download.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James A.

June 11th, 2019

As advertised.

Thank you!

Jackson J.

April 19th, 2022

Thank you very much for all your help its always a pleasure to continue working with you thanks again.

Thank you for your feedback. We really appreciate it. Have a great day!