Millard County Trustee Deed Form (Utah)

All Millard County specific forms and documents listed below are included in your immediate download package:

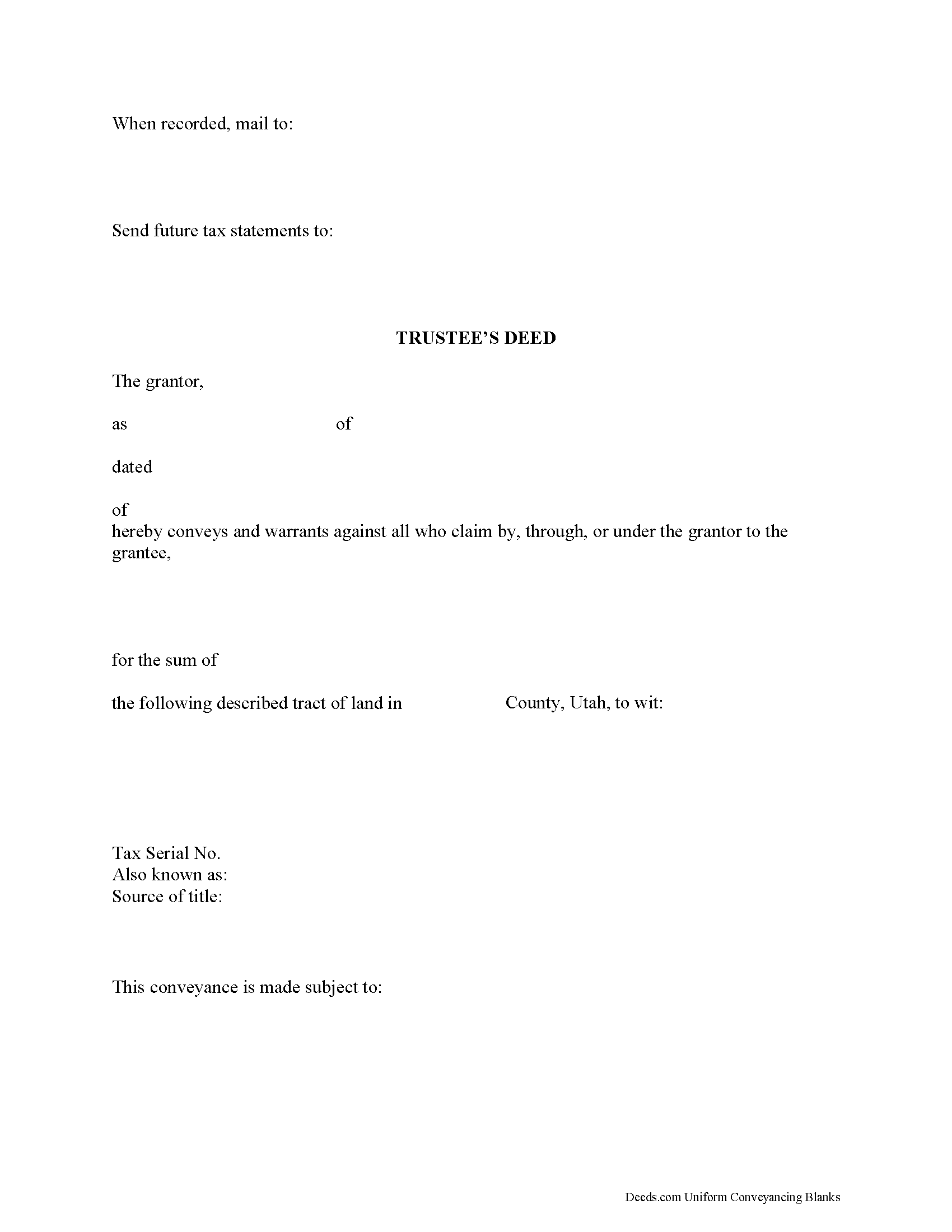

Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Millard County compliant document last validated/updated 10/21/2024

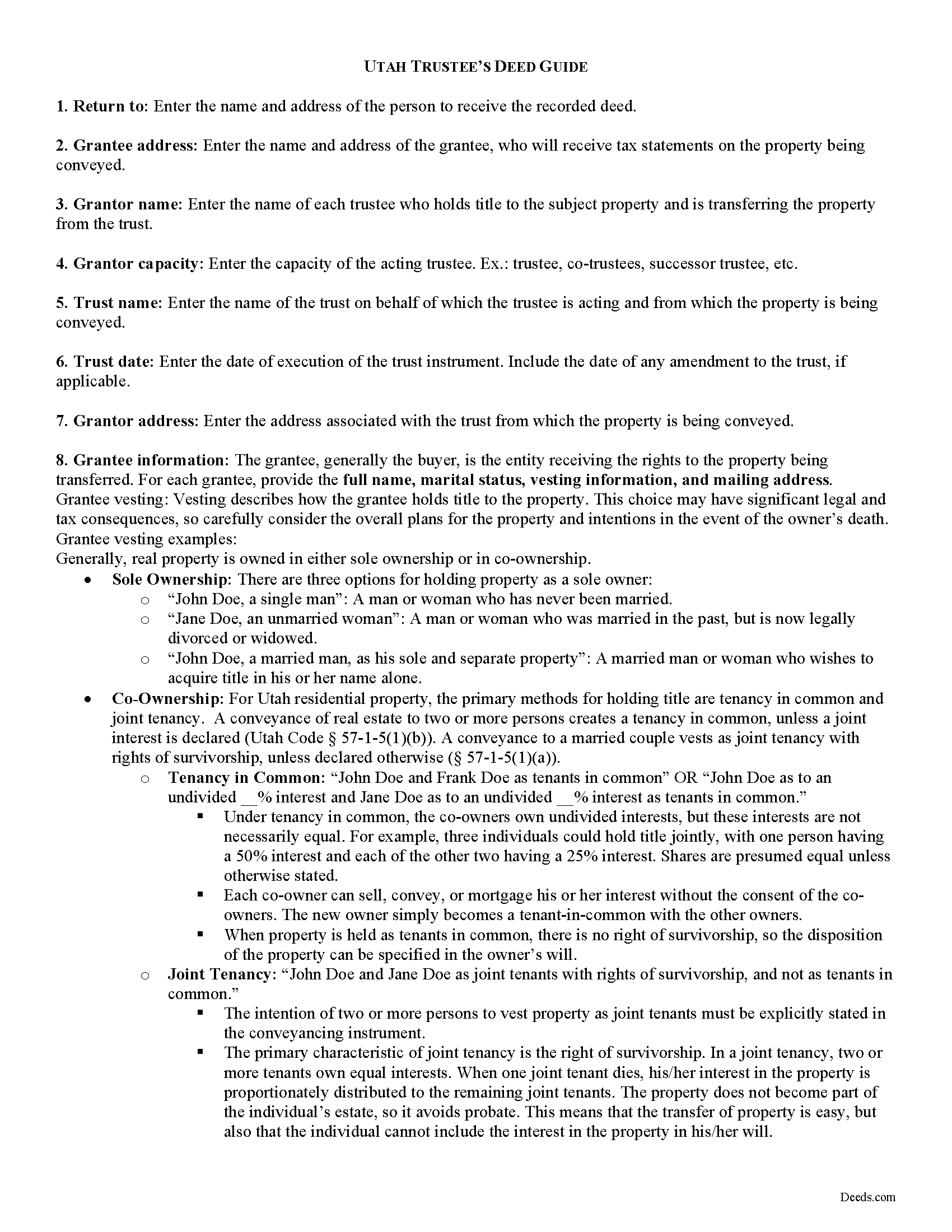

Trustee Deed Guide

Line by line guide explaining every blank on the form.

Included Millard County compliant document last validated/updated 12/10/2024

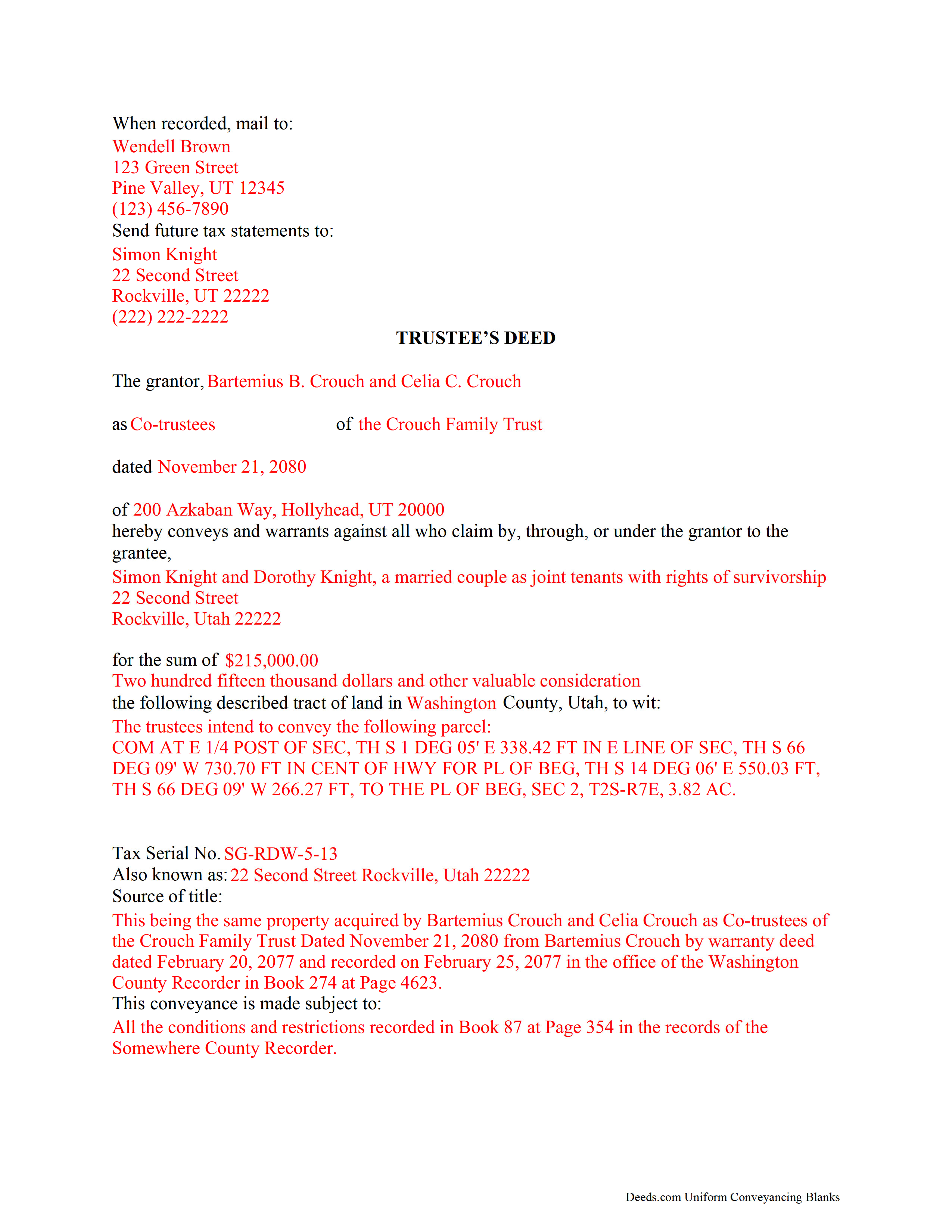

Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

Included Millard County compliant document last validated/updated 11/7/2024

The following Utah and Millard County supplemental forms are included as a courtesy with your order:

When using these Trustee Deed forms, the subject real estate must be physically located in Millard County. The executed documents should then be recorded in the following office:

Millard County Recorder

Courthouse - 50 South Main St, Fillmore, Utah 84631

Hours: 8:00 to 5:00 M-F

Phone: (435) 743-6210

Local jurisdictions located in Millard County include:

- Delta

- Fillmore

- Garrison

- Hinckley

- Holden

- Kanosh

- Leamington

- Lynndyl

- Meadow

- Oak City

- Scipio

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Millard County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Millard County using our eRecording service.

Are these forms guaranteed to be recordable in Millard County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Millard County including margin requirements, content requirements, font and font size requirements.

Can the Trustee Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Millard County that you need to transfer you would only need to order our forms once for all of your properties in Millard County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Utah or Millard County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Millard County Trustee Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Transferring Real Property to and from Living Trusts in Utah

The Utah Uniform Trust Code, codified at Utah Code 75-7, governs trusts in Utah. A trust is an alternate method of holding title to property. In a trust arrangement, one person (the settlor) transfers property to another (the trustee), who administers the trust for the benefit of a third (the beneficiary). A transfer of property to a trustee during the settlor's lifetime results in a living (inter vivos) trust, and a transfer to a trustee pursuant to the terms of a settlor's will creates a testamentary trust.

A trust is valid only when the settlor has a capacity to create the trust and indicates an intention to do so; the trust has a definite beneficiary; the trustee has duties to perform; and the same person is not both sole trustee and sole beneficiary of the trust ( 75-7-402). The trust must be created for lawful purposes that are possible to achieve and for the benefit its beneficiaries ( 75-7-404).

A living trust is an estate planning tool allowing the settlor to determine how his assets will be distributed without the oversight of the probate court upon his death. The trust is governed by a trust instrument, a (typically) unrecorded document executed by the settlor that outlines the scope of the trust and the trust's terms. The settlor may concurrently transfer assets into the trust and/or transfer property into the trust at a later date.

In order to convey real property into trust, the settlor executes a deed titling property in the name of the trustee on behalf of the trust. Regarding real property transferred into trust, the deed of transfer requires recitation of the name and address of the trustee, and the name and date of the trust ( 75-7-816). Alternately, the trust instrument, signed by the grantor, may be recorded in the appropriate county recorder's office.

Unless otherwise limited by the terms in the trust instrument, the trustee holds the power to sell property held in trust ( 75-7-814(1)(b)). Because the trustee holds legal title to real property as the trust's administrator, the trustee executes a deed to convey interest to real property out of the trust. A trustee's deed to convey real property from a living trust is a form of special warranty deed, named after the executing party. Apart from conveying fee simple interest in the subject property to the grantee, a special warranty deed contains the grantor's covenants that the property is free from encumbrances by the grantor, and the grantor promises to warrant and defend the property's title against lawful claims arising from persons claiming by, through, or under the grantor (but none other).

The trustee's deed requires the basic information of the trust, including the name and date of trust instrument and the trustee's name and address. As with all conveyances of real property, the trustee's deed should include a legal description of the subject property. The deed must be signed by the granting party and notarized before it is recorded, if applicable, in the appropriate county. All requirements for form and content of documents pertaining to real property should be met before the document is recorded.

Recipients of a trustee's deed may require further proof of the trust's existence and the trustee's authority to transfer real property on behalf of the trust (See 75-7-1013 on certificates of trust). The information contained within this article is not a substitute for legal guidance. Consult a lawyer for regarding living trusts and conveyances of real property interests in the State of Utah, as each situation is unique.

(Utah TD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Millard County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Millard County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

James M.

August 30th, 2022

Just what I needed to help clear ownership of what has been deeded to be by inheritance

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elma Jean B.

June 11th, 2023

My experience was great! Thank you, ejb

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nancy N.

February 12th, 2022

Very easy to use. Appreicate the sample filled out forms and the guide book. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas W.

September 15th, 2019

A great way to access form knowledge

Thank you!

Maggie C.

April 29th, 2020

Easy to use fantastic website. Immediately found the Sheriff's Deed I needed.

Thank you!

elizabeth m.

April 22nd, 2020

Wonderful service, forms were great. Completed and ready for recording. Will check back in after recorded.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda M.

February 25th, 2022

Quick easy

Thank you!

Gordon W.

April 7th, 2022

Nice forms but it sure would have been nice to be able to at least print the guide and the example so that I don't spend all of my time bouncing back and forth between windows on a laptop.

Thank you for your feedback. We really appreciate it. Have a great day!

William J. T.

July 9th, 2019

Satisfied with downloaded documents.

Thank you!

Vickie M.

April 24th, 2022

The website was easy to use even for me with little computer knowledge.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Doreen P.

December 13th, 2018

I have uploaded 2 documents for E recording, I have searched thinking it would prompt me to a business customer service contact info tel no. ? I am concerned as to the fees related to the recording of both instruments? please advise? thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Carolyn L.

February 17th, 2021

Easy and quick and reasonable!

Thank you for your feedback. We really appreciate it. Have a great day!