Download Utah Trustee Deed Legal Forms

Utah Trustee Deed Overview

Transferring Real Property to and from Living Trusts in Utah

The Utah Uniform Trust Code, codified at Utah Code 75-7, governs trusts in Utah. A trust is an alternate method of holding title to property. In a trust arrangement, one person (the settlor) transfers property to another (the trustee), who administers the trust for the benefit of a third (the beneficiary). A transfer of property to a trustee during the settlor's lifetime results in a living (inter vivos) trust, and a transfer to a trustee pursuant to the terms of a settlor's will creates a testamentary trust.

A trust is valid only when the settlor has a capacity to create the trust and indicates an intention to do so; the trust has a definite beneficiary; the trustee has duties to perform; and the same person is not both sole trustee and sole beneficiary of the trust ( 75-7-402). The trust must be created for lawful purposes that are possible to achieve and for the benefit its beneficiaries ( 75-7-404).

A living trust is an estate planning tool allowing the settlor to determine how his assets will be distributed without the oversight of the probate court upon his death. The trust is governed by a trust instrument, a (typically) unrecorded document executed by the settlor that outlines the scope of the trust and the trust's terms. The settlor may concurrently transfer assets into the trust and/or transfer property into the trust at a later date.

In order to convey real property into trust, the settlor executes a deed titling property in the name of the trustee on behalf of the trust. Regarding real property transferred into trust, the deed of transfer requires recitation of the name and address of the trustee, and the name and date of the trust ( 75-7-816). Alternately, the trust instrument, signed by the grantor, may be recorded in the appropriate county recorder's office.

Unless otherwise limited by the terms in the trust instrument, the trustee holds the power to sell property held in trust ( 75-7-814(1)(b)). Because the trustee holds legal title to real property as the trust's administrator, the trustee executes a deed to convey interest to real property out of the trust. A trustee's deed to convey real property from a living trust is a form of special warranty deed, named after the executing party. Apart from conveying fee simple interest in the subject property to the grantee, a special warranty deed contains the grantor's covenants that the property is free from encumbrances by the grantor, and the grantor promises to warrant and defend the property's title against lawful claims arising from persons claiming by, through, or under the grantor (but none other).

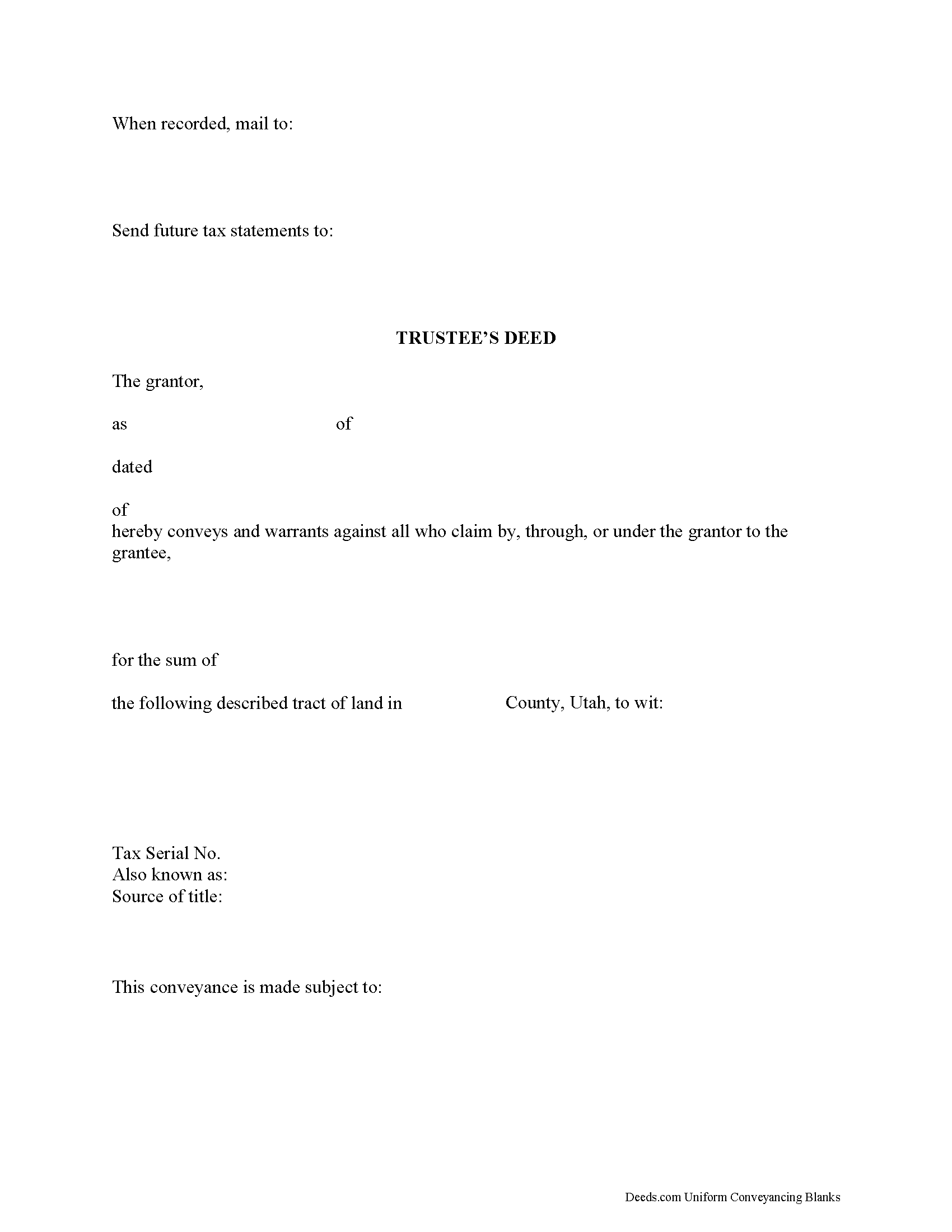

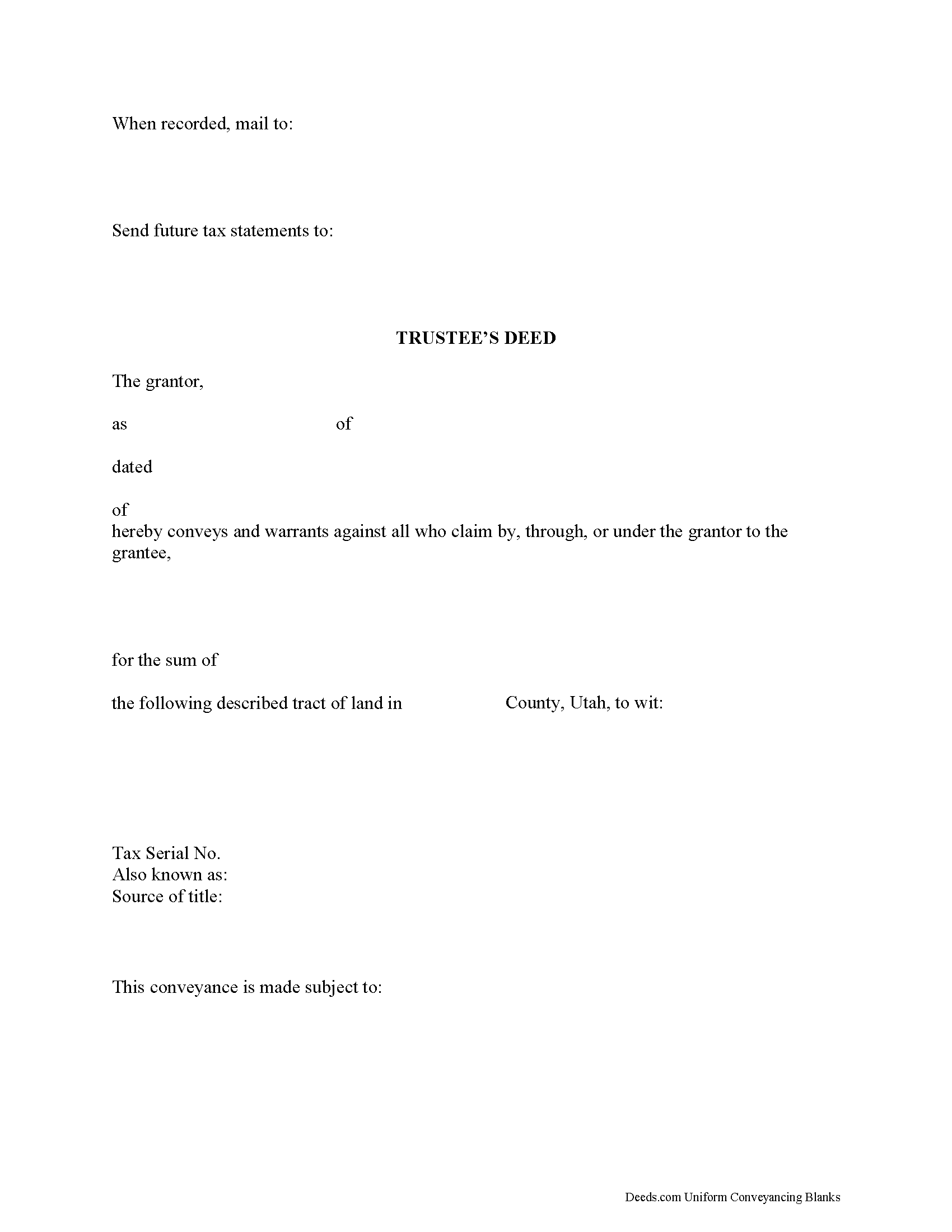

The trustee's deed requires the basic information of the trust, including the name and date of trust instrument and the trustee's name and address. As with all conveyances of real property, the trustee's deed should include a legal description of the subject property. The deed must be signed by the granting party and notarized before it is recorded, if applicable, in the appropriate county. All requirements for form and content of documents pertaining to real property should be met before the document is recorded.

Recipients of a trustee's deed may require further proof of the trust's existence and the trustee's authority to transfer real property on behalf of the trust (See 75-7-1013 on certificates of trust). The information contained within this article is not a substitute for legal guidance. Consult a lawyer for regarding living trusts and conveyances of real property interests in the State of Utah, as each situation is unique.

(Utah TD Package includes form, guidelines, and completed example)