Duchesne County Gift Deed Form (Utah)

All Duchesne County specific forms and documents listed below are included in your immediate download package:

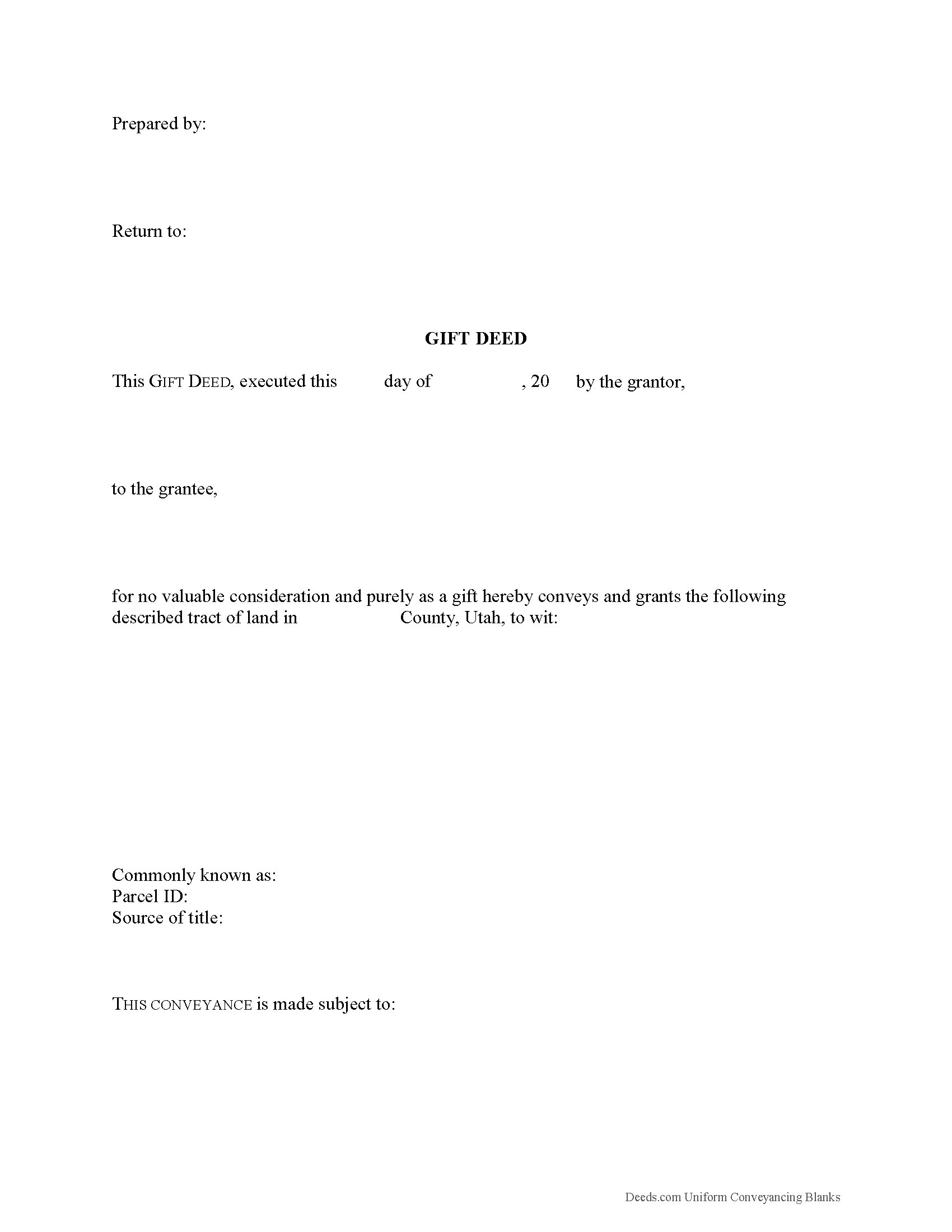

Gift Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Duchesne County compliant document last validated/updated 12/11/2024

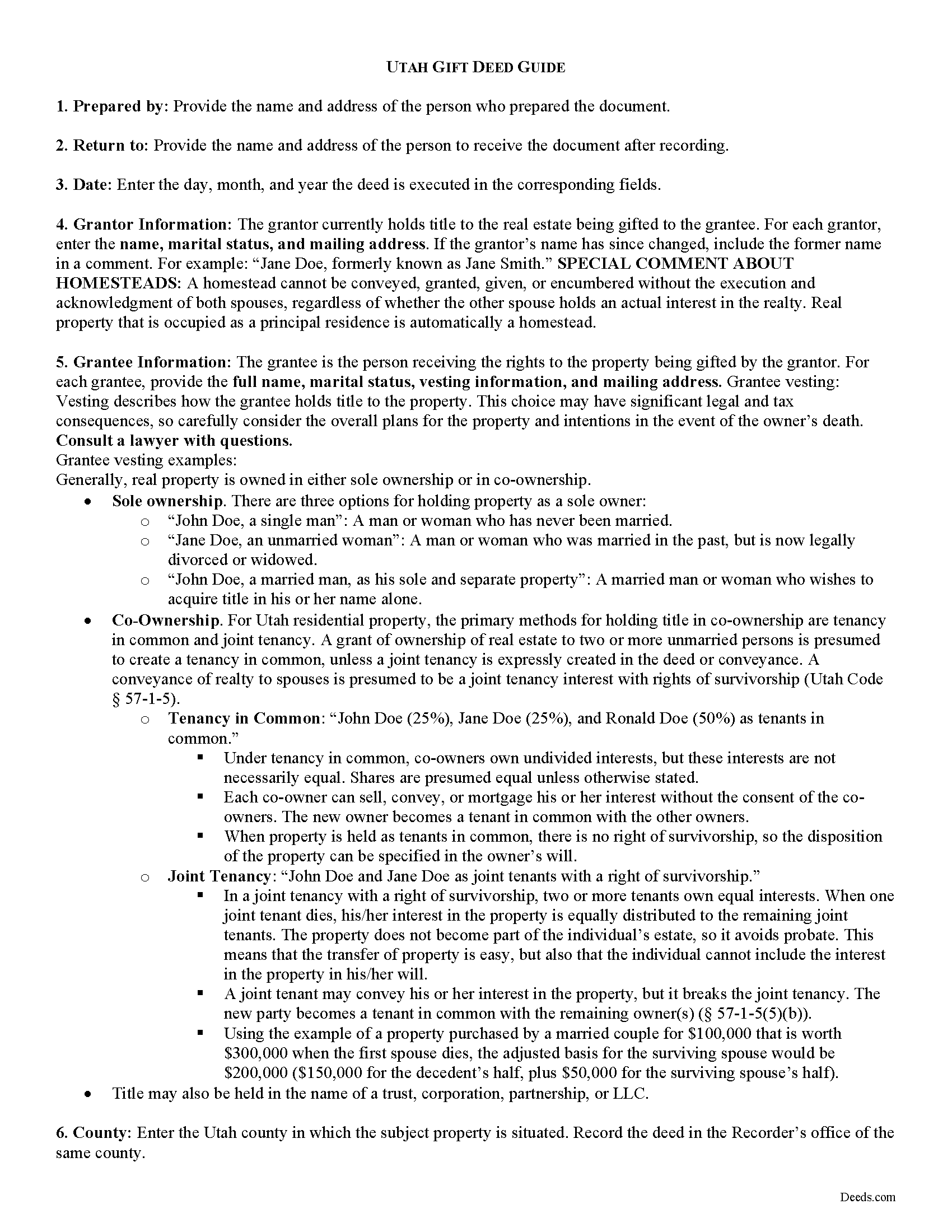

Gift Deed Guide

Line by line guide explaining every blank on the form.

Included Duchesne County compliant document last validated/updated 11/15/2024

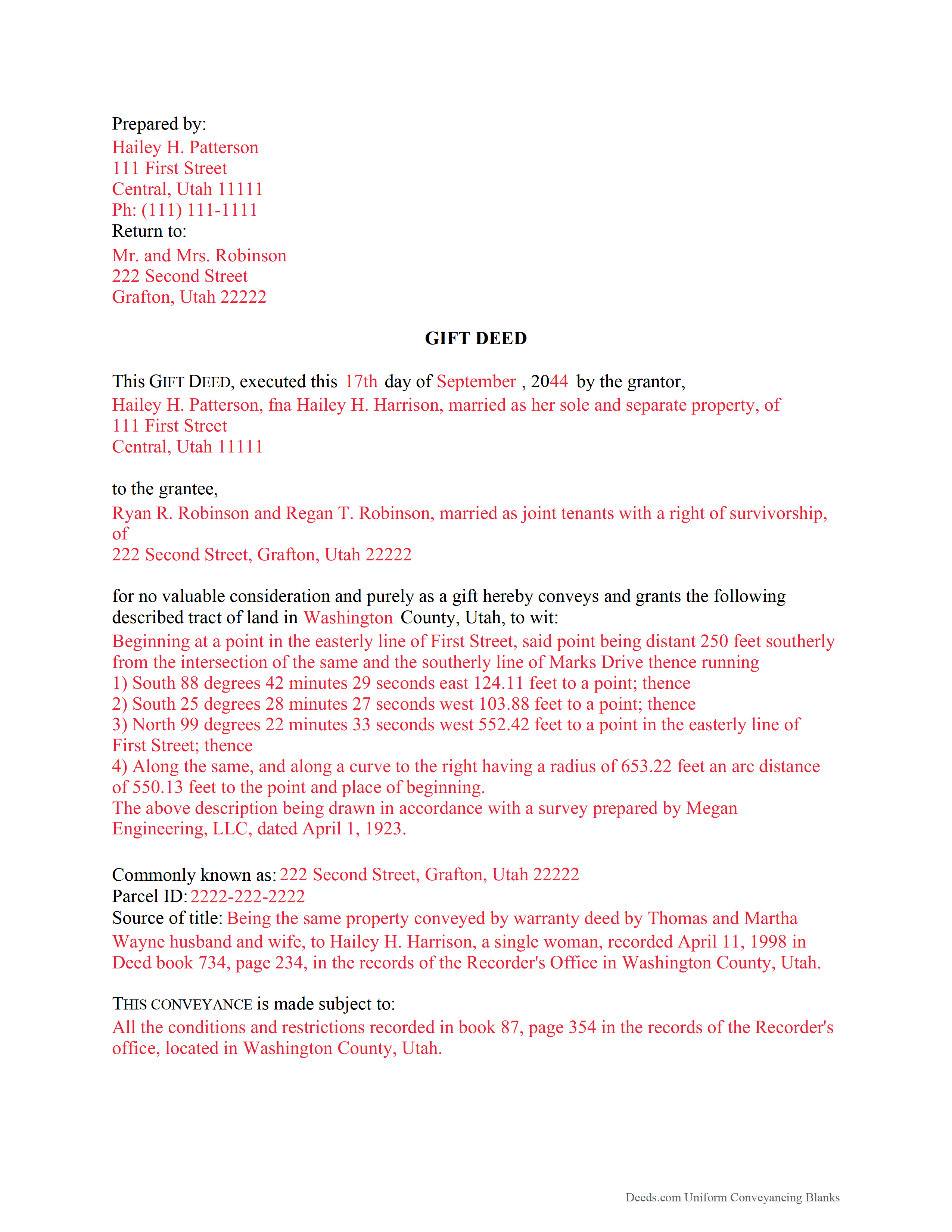

Completed Example of the Gift Deed Document

Example of a properly completed form for reference.

Included Duchesne County compliant document last validated/updated 9/17/2024

The following Utah and Duchesne County supplemental forms are included as a courtesy with your order:

When using these Gift Deed forms, the subject real estate must be physically located in Duchesne County. The executed documents should then be recorded in the following office:

Duchesne County Recorder

734 N Center St / PO Box 916, Duchesne, Utah 84021

Hours: 8:30 to 5:00 M-F

Phone: (435) 738-1166

Local jurisdictions located in Duchesne County include:

- Altamont

- Altonah

- Bluebell

- Duchesne

- Fruitland

- Hanna

- Mountain Home

- Myton

- Neola

- Roosevelt

- Tabiona

- Talmage

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Duchesne County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Duchesne County using our eRecording service.

Are these forms guaranteed to be recordable in Duchesne County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Duchesne County including margin requirements, content requirements, font and font size requirements.

Can the Gift Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Duchesne County that you need to transfer you would only need to order our forms once for all of your properties in Duchesne County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Utah or Duchesne County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Duchesne County Gift Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). A gift deed typically transfers real property between family or close friends. Gift deeds are also used to donate to a non-profit organization or charity. The deed serves as proof that the transfer is indeed a gift and without consideration (any conditions or form of compensation).

Valid deeds must meet the following requirements: The grantor must intend to make a present gift of the property, the grantor must deliver the property to the grantee, and the grantee must accept the gift. A gift deed must contain language that explicitly states no consideration is expected or required, because any ambiguity or reference to consideration can make the deed contestable in court. A promise to transfer ownership in the future is not a gift, and any deed that does not immediately transfer the interest in the property, or meet any of the aforementioned requirements, can be revoked [1].

A lawful gift deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Utah residential property, the following types of joint ownership are recognized: tenancy in common and joint tenancy. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common, unless a joint tenancy is expressly created in the deed or conveyance. A conveyance of realty to spouses is presumed to be a joint tenancy interest with rights of survivorship (Utah Code 57-1-5).

As with any conveyance of real estate, a gift deed requires a complete legal description of the parcel. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. Record the completed deed, and if water rights are associated with the property, submit a water rights addendum pursuant to Utah Code 57-3-109 (see Utah Division of Water Rights website for forms).

The IRS implements a Federal Gift Tax on any transfer of property from one individual to another with no consideration, or consideration that is less than the full market value. In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. This means that if a gift is valued below $15,000, a federal gift tax return (Form 709) does not need to be filed. However, if the gift is something that could possibly be disputed by the IRS -- such as real property -- a grantor may benefit from filing a Form 709 [2].

In Utah, there is no state gift tax. For questions regarding state taxation laws, consult a tax specialist. Gifts of real property in Utah are, however, subject to the federal gift tax. The grantor is responsible for paying the tax; however, if the grantor does not pay the gift tax, the grantee will be held liable [1].

With gifts of real property, the recipient of the gift (grantee) is not required to declare the amount of the gift as income, but if the property accrues income after the transaction, the recipient is responsible for paying the requisite state and federal income taxes [3].

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a lawyer with any questions about gift deeds or other issues related to the transfer of real property. For questions regarding federal and state taxation laws, consult a tax specialist.

[1]

https://nationalparalegal.edu/public_documents/courseware_asp_files/realProperty/PersonalProperty/InterVivosGifts.asp

[2] http://msuextension.org/publications/FamilyFinancialManagement/MT199105HR.pdf

[3] https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes

(Utah Gift Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Duchesne County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Duchesne County Gift Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

GARY K.

April 28th, 2021

I AM THRILLED THAT I FOUND YOU. I HAVE BOOKMARKED YOU FOR THE FUTURE. I USED YOU FOR A LIS PENDENS AND IT WAS EASY TO FOLLOW AND FILL IN.I WILL HIGHLY RECOMMEND YOU TO MY ASSOCIATES. THANK YOU

Thank you!

Richard A.

June 24th, 2020

Great product. It would be better if the document files were not embedded within other files. It made downloading a little confusing. The titles of the forms did not match exactly word for word, which required a lot of back and forth to make sure I had downloaded the proper document. What would be great is if once you download a document, the hyperlink changed color, or somehow denoted the document had been downloaded. Just a suggestion. You have my email address if you have questions. STILL! Five stars for you guys. I would not let that hiccup dissuade me from buying any form package from you guys. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Michael C.

November 20th, 2022

No Search feature on the site? How do I look for forms?

Thank you for your feedback. We really appreciate it. Have a great day!

Kurt P.

November 20th, 2020

I like the basics. The one thing I would recommend changing would be, something that tells me I have actually have submitted my package, or that I can leave at any time without needing to click on a "Submit" button.

Thank you for your feedback. We really appreciate it. Have a great day!

Scott W.

March 31st, 2020

Wow! That was easy! I was expecting a more difficult process. Upload your docs and wait for a response. Which was minutes later. I would give it 6 stars.

Thank you for your kind words Scott, glad we could help.

Carol O.

April 3rd, 2023

Easy process as I had an example of my other property deeds to work from plus my most current Real Estate Tax forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael H.

January 8th, 2021

Very straightforward website. Helpful in getting county specific documents.

Thank you!

George Y.

June 24th, 2021

Thought it was great, no issues. Very convenient especially dealing with difficult municipalities and a post COVID world. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas C.

July 31st, 2021

This platform made electronic filing of a lien easy and quick. I was able to accomplish everything from my laptop and phone, and the fees were reasonable. I would recommend deeds.com for efiling property related documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert M.

September 14th, 2021

Great service. Easy to use and affordable.

Thank you!

Natalie F.

April 13th, 2020

So convenient and easy to use! Will definitely recommend to anyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cedric H.

April 6th, 2022

The Guide and Example documents included were a great help completing the form on my own.

Thank you!