Walker County Preliminary Notice to Owner and Original Contractor Form (Texas)

All Walker County specific forms and documents listed below are included in your immediate download package:

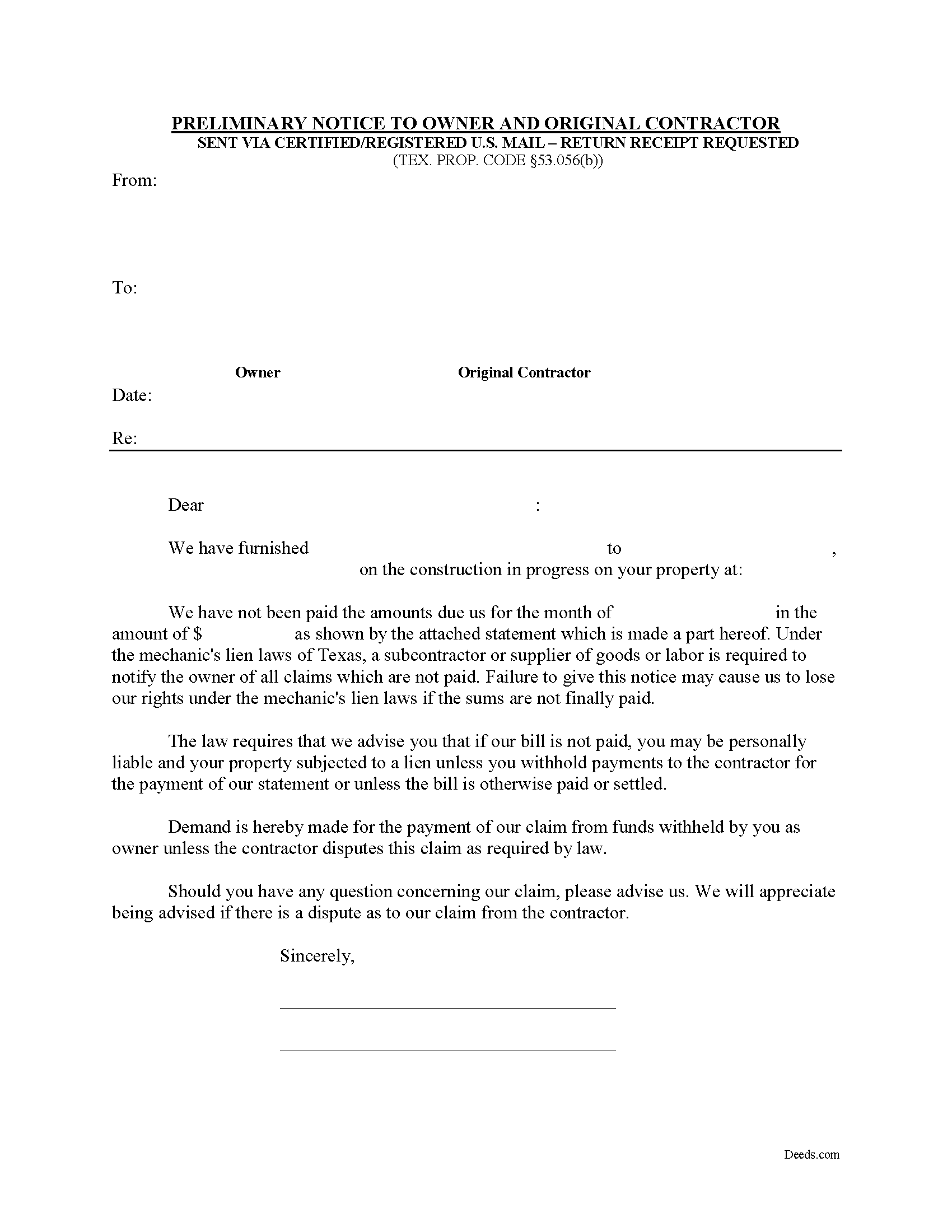

Preliminary Notice to Owner and Original Contractor Form

Fill in the blank Preliminary Notice to Owner and Original Contractor form formatted to comply with all Texas recording and content requirements.

Included Walker County compliant document last validated/updated 4/1/2024

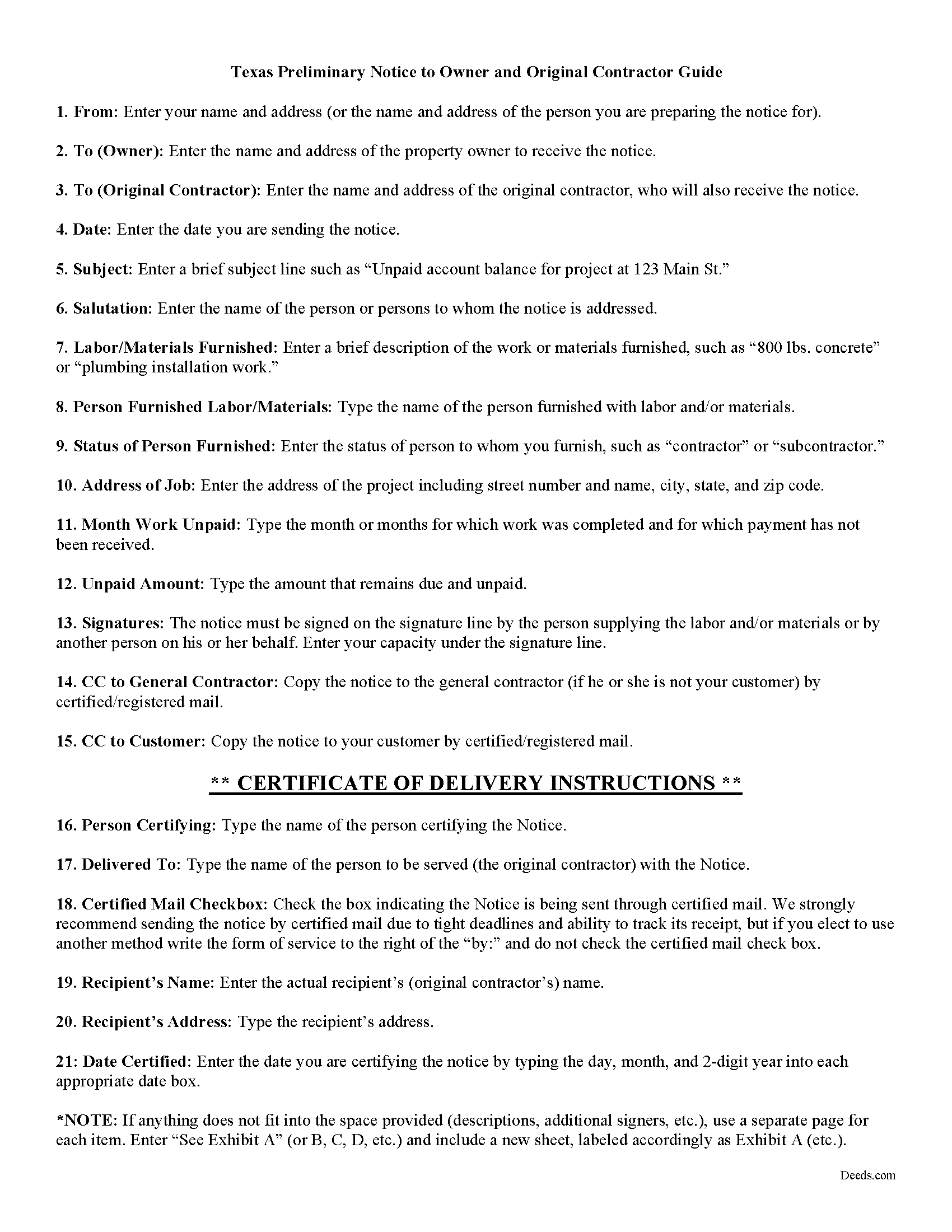

Preliminary Notice to Owner and Original Contractor Guide

Line by line guide explaining every blank on the Preliminary Notice to Owner and Original Contractor form.

Included Walker County compliant document last validated/updated 11/18/2024

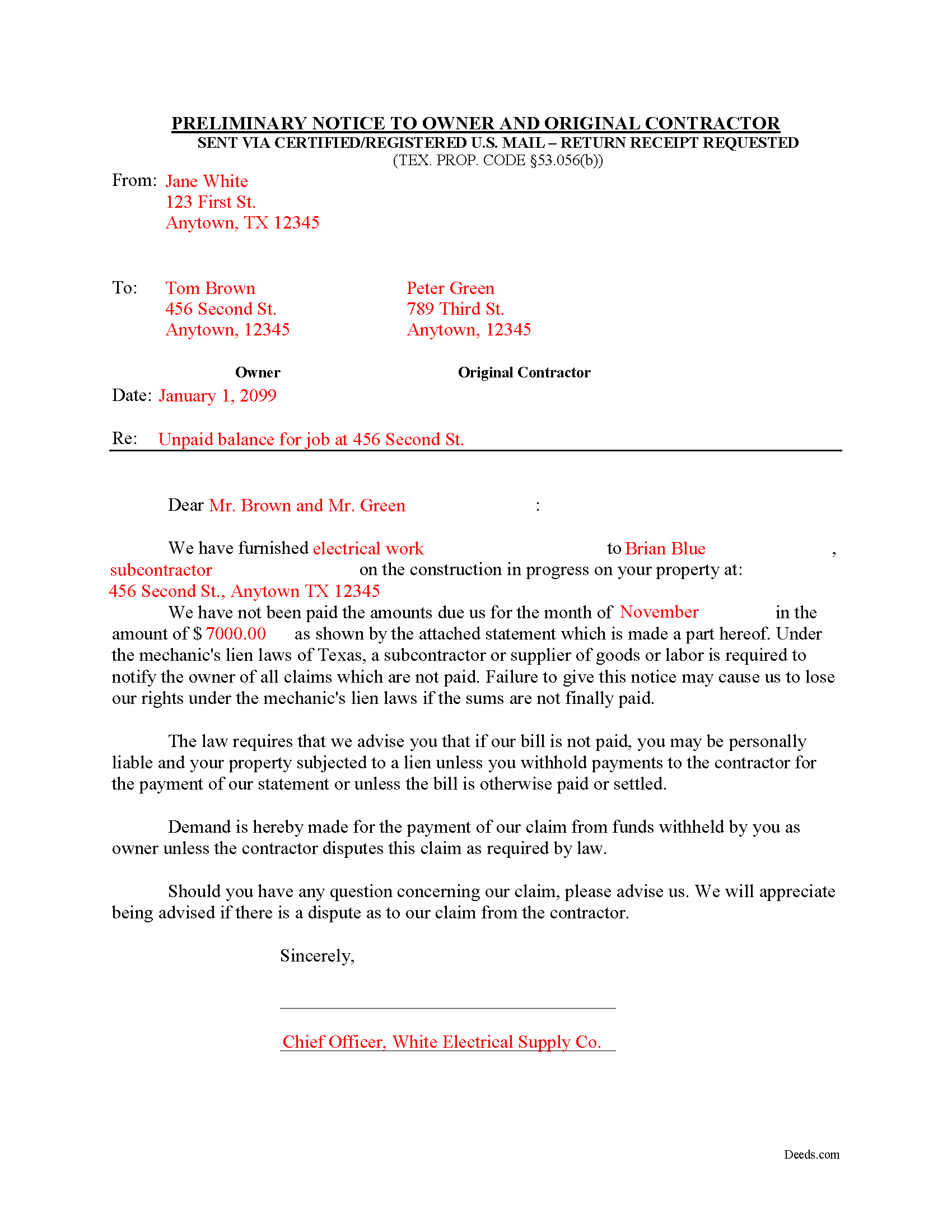

Completed Example of the Preliminary Notice to Owner and Original Contractor Document

Example of a properly completed Texas Preliminary Notice to Owner and Original Contractor document for reference.

Included Walker County compliant document last validated/updated 12/13/2024

The following Texas and Walker County supplemental forms are included as a courtesy with your order:

When using these Preliminary Notice to Owner and Original Contractor forms, the subject real estate must be physically located in Walker County. The executed documents should then be recorded in the following office:

County Clerk: Recording Division

Courthouse - 1100 University Ave, Suite 201, Huntsville, Texas 77320

Hours: Monday - Friday 8:00am - 12:00 & 1:00 - 4:30pm

Phone: (936) 436-4903

Local jurisdictions located in Walker County include:

- Dodge

- Huntsville

- New Waverly

- Riverside

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Walker County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Walker County using our eRecording service.

Are these forms guaranteed to be recordable in Walker County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Walker County including margin requirements, content requirements, font and font size requirements.

Can the Preliminary Notice to Owner and Original Contractor forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Walker County that you need to transfer you would only need to order our forms once for all of your properties in Walker County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Texas or Walker County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Walker County Preliminary Notice to Owner and Original Contractor forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Texas Third Month Notice

Under Texas lien law, all claimants other than the original contractor must provide preliminary notice to establish a claim for a valid mechanic's lien. TEX. PROP. CODE 53.056(a).

A mechanic's lien is an encumbrance on an owner's title, used to guarantee payment to builders, contractors, and construction businesses which build or repair structures, by using the property where the work was completed as a form of collateral. Suppliers of materials and subcontractors may also claim a mechanic's lien. The lien ensures that the workmen are paid before anyone else if the property subject to the lien is eventually foreclosed upon.

Texas requires prelien notice to be served on the owner and other interested parties before filing and recording a mechanic's lien. The type of project (whether residential or commercial) determines what kind of prelien notice must be served. Prelien notices serve two purposes: to protect the interests of subcontractors and suppliers, and to give property owners a defense against having to pay twice for parts of the same project.

If the lien claim arises from a debt incurred by the original contractor, the claimant must give notice to the owner or reputed owner, with a copy to the original contractor, in accordance with 53.056(b). TEX. PROP. CODE 53.056(c). The document identifies the parties, the project, date and type of service/materials, amount billed, and balance due. Attach an invoice to clarify more specific details.

Deliver the notice to the original contractor must be given no later than the 15th day of the second month following each month in which all or part of the claimant's labor was performed or material delivered. Id. This notice is also known as a "Second Month Notice." The claimant must give the same notice to the owner or reputed owner and the original contractor NO LATER than the 15th day of the third month following each month in which all or part of the claimant's labor was performed or material or specially fabricated material was delivered. Id. This notice is called a "Third Month Notice."

The notice must be sent by registered or certified mail and must be addressed to the original contractor at his or her last known business or residence address. TEX. PROP. CODE 53.056(e).

Remember that each case is unique and the mechanic's lien law in Texas can be complicated and unforgiving of mistakes. Therefore, contact an attorney for complex situations, with specific questions the required preliminary notice, or any other issue related to mechanic's liens.

Our Promise

The documents you receive here will meet, or exceed, the Walker County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Walker County Preliminary Notice to Owner and Original Contractor form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Anita L.

January 22nd, 2020

Found this site very easy to navigate and customer service very supportive and quickly answers any questions you have regarding forms.

Best of all you can get the forms you need and only pay for those forms, not tied to some ongoing fee that you must cancel if you have no further need beyond forms you've already purchased.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Fred D.

August 31st, 2022

At first glance, explanations and guidance to fill out the grant deed seems quite direct and no too difficult. I did not see any reference to a mortgagee which I believe needs to be incorporated in a boundary line adjustment (BLA), though not sure

I'll do the actual filling out the form in the next couple of weeks and will be in a better position for a more complete review.

Thank you for your feedback. We really appreciate it. Have a great day!

Valarie H.

July 6th, 2022

Thank you for offering this service. We were getting several different answers on how to solve our problem, and all of them involved getting an attorney. You saved us a ton of money and using your document made everything super easy...no attorney needed! Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Byron M.

September 18th, 2023

Prompt service... provide thorough explanation of what is needed to complete the recording.

Thank you for your feedback. We really appreciate it. Have a great day!

Taylor M.

July 18th, 2020

Service is good. The website isn't very user friendly and could use some updating. Overall I'm happy with the service.

Thank you for your feedback. We really appreciate it. Have a great day!

Leslie S.

July 29th, 2020

After over a month of turmoil and feeling like "you can't get there from here",you solved my problem in a little over an hour. Thank you!!

Thank you for your feedback. We really appreciate it. Have a great day!

Darrell G.

October 14th, 2022

Very easy to work with.

Thank you!

Michael M.

June 19th, 2019

Deeds.com had what I needed at the time that I needed it. Thank you very much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Norman K.

August 13th, 2021

Easy to use, would like to convert to a Word doc though

Thank you!

George A. M.

August 10th, 2022

User friendly and fast to use. I was pleased with experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nello P.

January 4th, 2021

very satisfied, useful, and of great assistance

Thank you!

Harry C.

February 11th, 2019

I got the wrong state and now they want to charge me again for the proper state.

My fault, BUT!!!!

Sorry to hear that Harry. We've gone ahead and canceled the order you made in error. Have a wonderful day.