Anderson County Mineral Deed Form (Texas)

All Anderson County specific forms and documents listed below are included in your immediate download package:

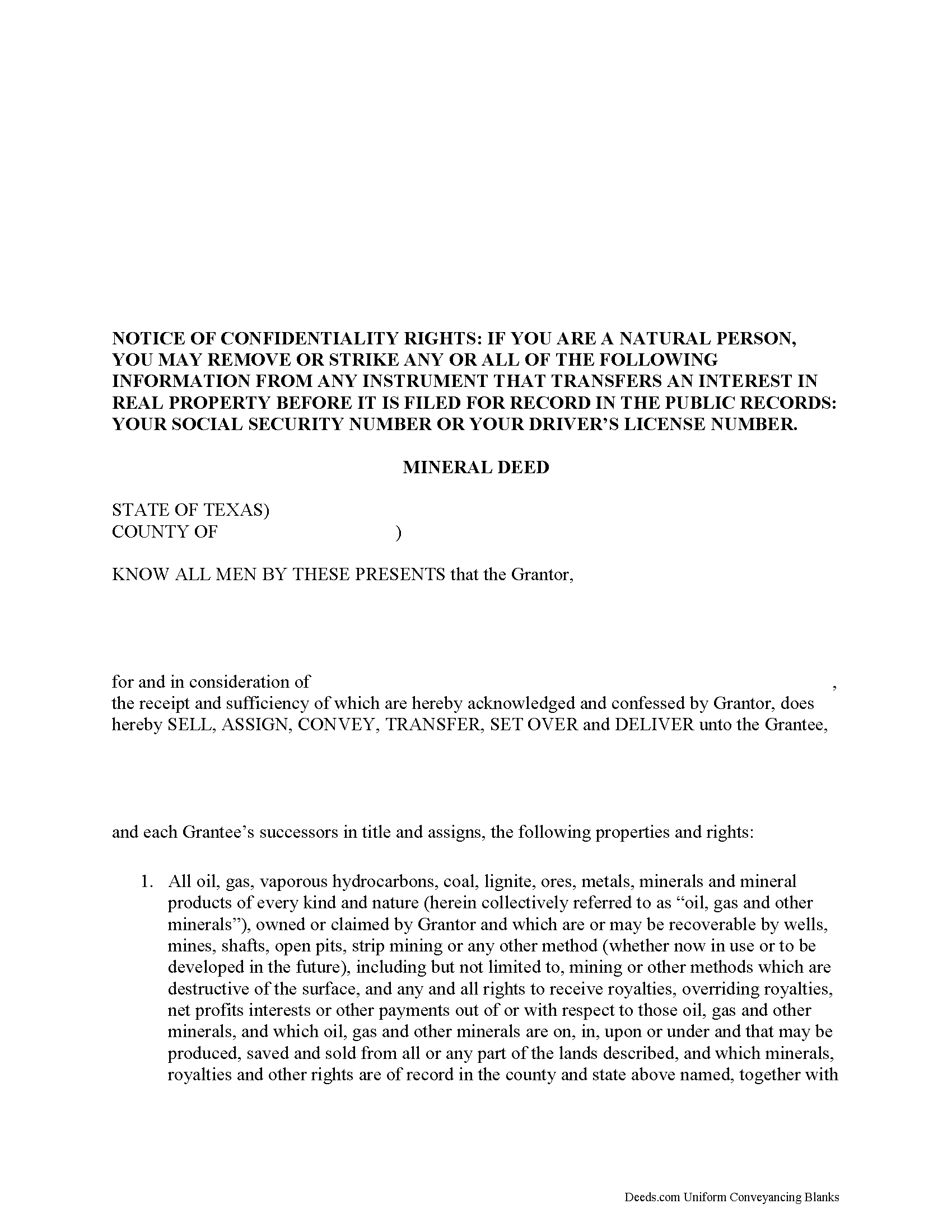

Mineral Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Anderson County compliant document last validated/updated 10/4/2024

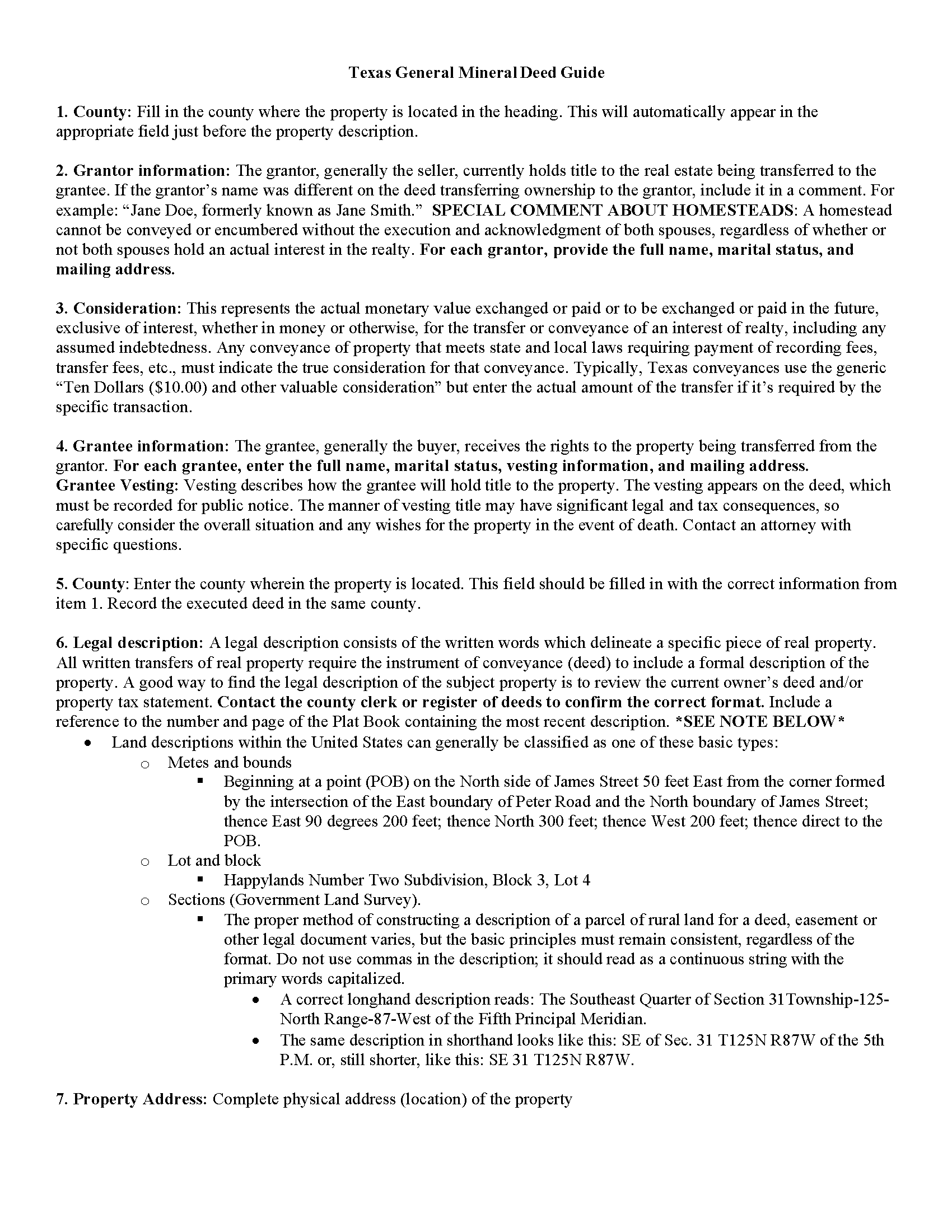

Mineral Deed Guide

Line by line guide explaining every blank on the form.

Included Anderson County compliant document last validated/updated 11/29/2024

Completed Example of the Mineral Deed Form

Example of a properly completed form for reference.

Included Anderson County compliant document last validated/updated 8/22/2024

The following Texas and Anderson County supplemental forms are included as a courtesy with your order:

When using these Mineral Deed forms, the subject real estate must be physically located in Anderson County. The executed documents should then be recorded in the following office:

Anderson County Clerk

500 N. Church St, Rm. 10, Palestine, Texas 75801

Hours: 8:00am to 12:00 & 1:00 to 5:00pm Monday - Friday (except holidays)

Phone: 903-723-7402

Local jurisdictions located in Anderson County include:

- Cayuga

- Elkhart

- Frankston

- Montalba

- Neches

- Palestine

- Tennessee Colony

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Anderson County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Anderson County using our eRecording service.

Are these forms guaranteed to be recordable in Anderson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Anderson County including margin requirements, content requirements, font and font size requirements.

Can the Mineral Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Anderson County that you need to transfer you would only need to order our forms once for all of your properties in Anderson County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Texas or Anderson County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Anderson County Mineral Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The General Mineral Deed in Texas transfers ALL oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes all oil, gas, vaporous hydrocarbons, coal, lignite, ores, metals, minerals and mineral products of every kind and nature. It also transfers any and all rights to receive royalties, overriding royalties, net profits interests or other payments out of or with respect to those oil, gas and other minerals.

This general mineral deed gives the grantee the right to extract by wells, mines, shafts, open pits, strip mining or any other method (whether now in use or to be developed in the future), including but not limited to, mining or other methods which are destructive of the surface.

Use of this document has a permanent effect on your rights to the property, if you are not completely sure of what you are executing seek the advice of a legal professional.

(Texas Mineral Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Anderson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Anderson County Mineral Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Gloria J.

July 23rd, 2021

I needed a Missouri Notice of Intent to Sell without a named designated buyer. Mo Statutes require notice be notarized and filed 45 days before any closing to protect buyer from liens. You do not have that document. We are flipping a house so it must be filed. Our lawyer was on vacation. Cannot find one anywhere on net. Finally got a template from our title company.

Thank you for your feedback Gloria.

David Y.

March 10th, 2020

Really great forms. Did the quitclaim, everything was perfect, recorded with no problems at all. Thanks!

Thank you!

Elaine D.

January 15th, 2021

Easement deed contract was easy to complete, however after additional research raises some concerns because the Ohio deed does not list a requirement for witness signatures and does not provide lines or an area for witness signatures. The document does provide the necessary area for the notary information and the grantor and grantee.

Thank you for your feedback. We really appreciate it. Have a great day!

Kate J.

January 10th, 2022

Easy to use.

Thank you!

Precious M.

June 23rd, 2020

great quick response

Thank you!

Debora E.

August 19th, 2020

I was amazed! This company is so incredibly fast! They promised 10 minutes, it was actually less and I had the exact info I was needing! Definitely worth the cost!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Annette L.

July 6th, 2023

Wow -- amazingly fast turnaround and excellent customer service and communication. Thank you for saving me hours of time and effort!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Galina K.

June 9th, 2023

Was fast and easy to get the forms with instructions on how to fill them out.

Thank you for the kind words Galina. We appreciate you. Have an amazing day!

Tracey T.

January 20th, 2022

I downloaded the Lady Bird deed. The process was quick and easy to download. Just select your county, fill out the form. You will need the property description from your original deed. In my case I had to go downtown Wayne County (Detroit). (Make an appt online). 1st you will have to get the property tax certified to ensure all taxes are paid to date (5th floor at the Wayne County Treasurer office). Give them the form you just filled out and they will stamp certified $5. After that take the form to the Register of Deeds (7th floor) appt needed. $18. Make sure it is properly notarized and all signatures completed. Once approved, they will scan it, stamp it, give it back with a receipt and mail a copy also. All Done. Worked beautifully. My co worker go a lawyer and paid over $250. I just used deeds.com and total for forms and going downtown with notarizing was less than $40 Yea!

Thank you for your feedback. We really appreciate it. Have a great day!

Edward M.

November 4th, 2021

Thank you for your excellence form services. I can download all the forms easily. If you have the guide on how to fill out all of those forms, that more helpful for me. I don't know how the use E-Recording?

Can you tell me how? If my friends ask me about the legal forms services, I will tell them to use your Website. If I wrote some words wrong, please correct them before display publicly.

Thank you for your feedback. We really appreciate it. Have a great day!

Sue D.

November 28th, 2019

Great program

Thank you!

Wanda B.

July 22nd, 2022

Great prompt and efficient service!

Thank you for your feedback. We really appreciate it. Have a great day!