Hudspeth County Executor Deed Form (Texas)

All Hudspeth County specific forms and documents listed below are included in your immediate download package:

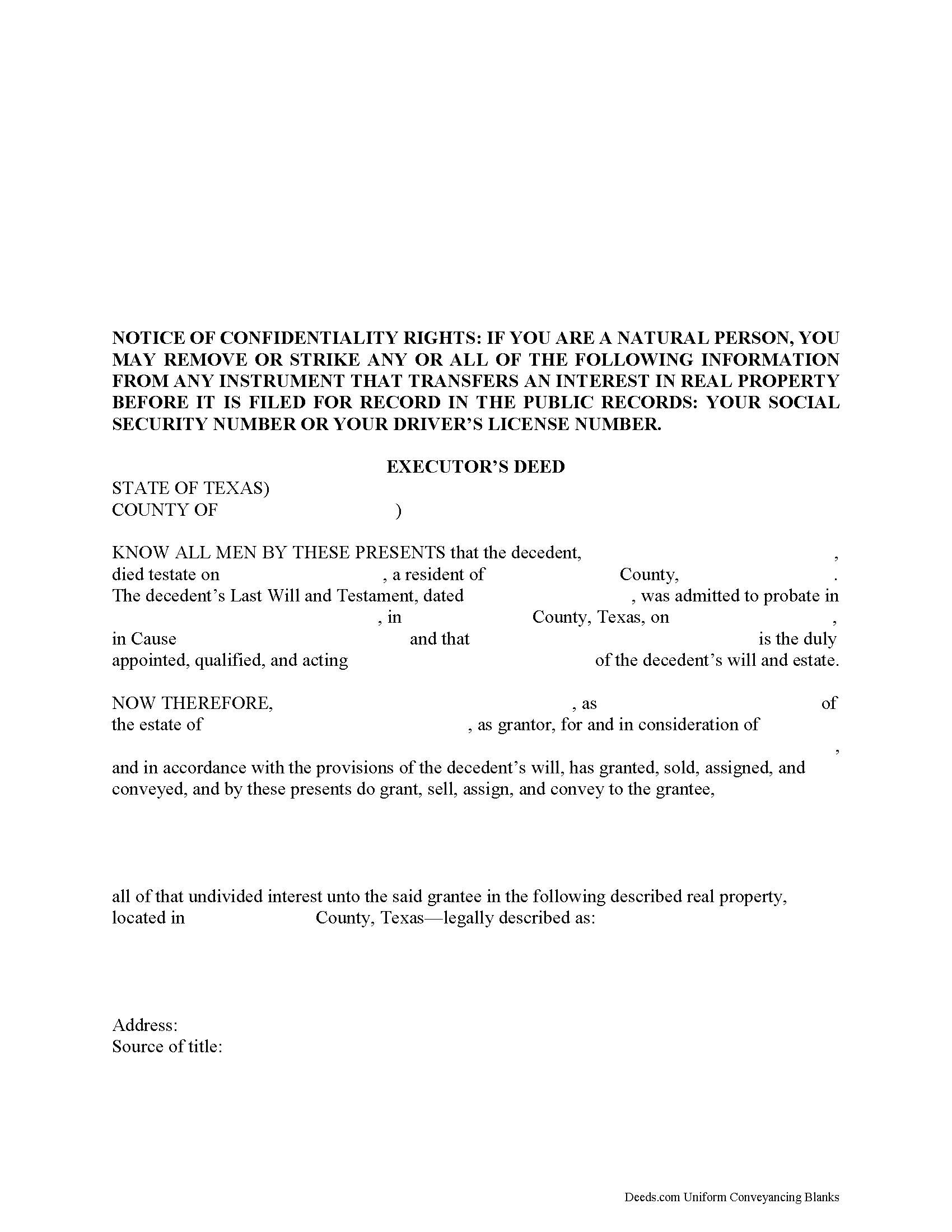

Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Hudspeth County compliant document last validated/updated 11/6/2024

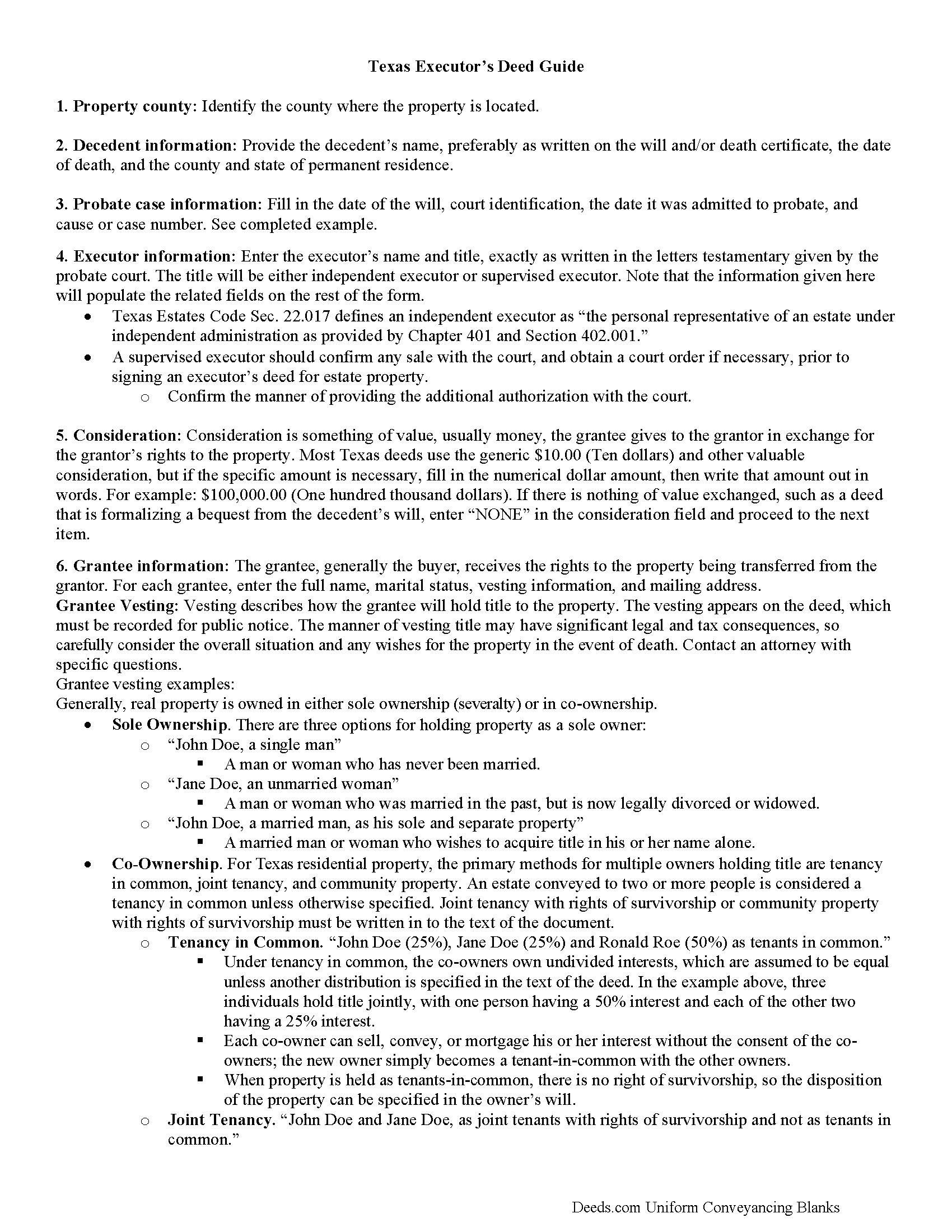

Executor Deed Guide

Line by line guide explaining every blank on the form.

Included Hudspeth County compliant document last validated/updated 10/28/2024

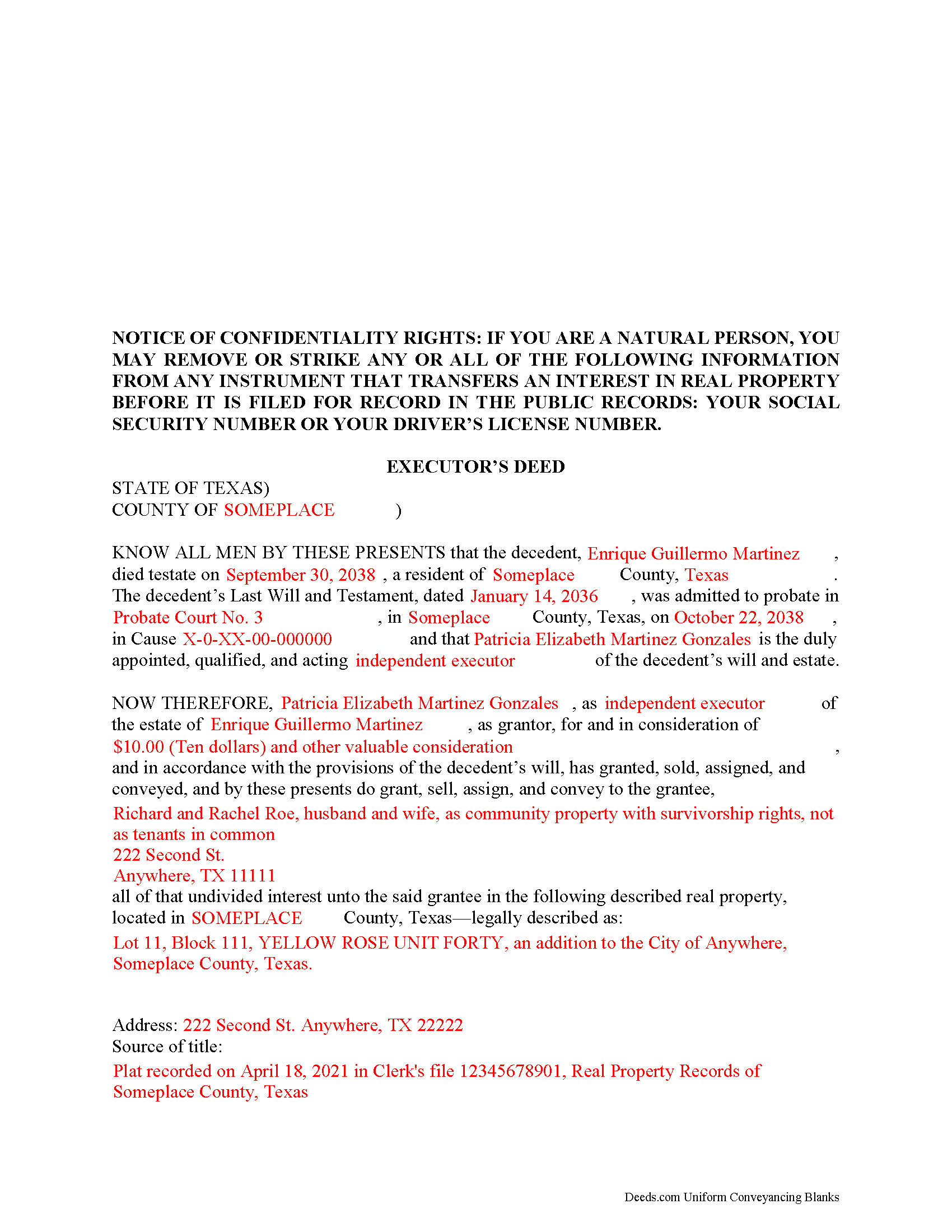

Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

Included Hudspeth County compliant document last validated/updated 12/25/2024

The following Texas and Hudspeth County supplemental forms are included as a courtesy with your order:

When using these Executor Deed forms, the subject real estate must be physically located in Hudspeth County. The executed documents should then be recorded in the following office:

Hudspeth County Clerk

Courthouse - 109 W Millican St, Sierra Blanca, Texas 79851

Hours: Monday - Friday 8:00 am - 5:00 pm

Phone: (915) 369-2301

Local jurisdictions located in Hudspeth County include:

- Dell City

- Fort Hancock

- Salt Flat

- Sierra Blanca

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Hudspeth County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Hudspeth County using our eRecording service.

Are these forms guaranteed to be recordable in Hudspeth County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hudspeth County including margin requirements, content requirements, font and font size requirements.

Can the Executor Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Hudspeth County that you need to transfer you would only need to order our forms once for all of your properties in Hudspeth County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Texas or Hudspeth County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Hudspeth County Executor Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The Texas Statutes cover the rules for selling a decedent's property from a probate estate in Chapter 356 of the Estates Code.

When a will is admitted to probate, the court officer authorizes an executor to manage, and eventually close, the estate. Among other duties, this involves identifying the assets and liabilities, paying the bills, and distributing property according to the terms specified in the will.

Many estates contain real property. Depending on the circumstances, the executor might transfer the title to heirs as directed in the decedent's will or sell the property outright. In any case, the executor must issue a deed for the transfer. Note that executor's deeds do NOT typically include a general warranty on the title. The executor may offer a special warranty, meaning that he has the right to sell the property, and will only defend the title against claims on his actions.

An executor's deed is used by executors who are authorized by the Probate Court to transfer real property out of an estate. These instruments must meet the same requirements as a warranty deed or quitclaim deed, plus include additional information about the probate case. Sometimes, the executor must also include supporting documentation such as copies of the letters testamentary, the will, signatures from heirs or beneficiaries, etc.

Settling probate estates can be complicated, so take the time to understand the issues. Before buying or selling real property from an estate, review all the risks and benefits, and contact an attorney with questions.

(Texas Executor Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Hudspeth County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hudspeth County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4449 Reviews )

Daniel B.

December 24th, 2024

easy to use and upload.

We are delighted to have been of service. Thank you for the positive review!

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

THEODORE P.

August 28th, 2024

You were very helpful and patient with me in learning your portal. I now understand your process.

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Rosa S.

June 6th, 2019

I am pleased with how easy it was to download the will. Now just have to get it filled in and filed at Tax Office. Thank you for making it simple to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Cassandra C.

February 7th, 2022

I was easy fast and easy to order and download.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen F.

June 6th, 2022

The documents' format contained information needed to complete the necessary paperwork for filing with Georgia. However, the fields were not large enough to put the legal description in, and there was no way to enlarge the area. These were only semi-helpful in providing what I needed per Georgia's filing requirement.

Thank you!

Traci K.

April 29th, 2021

Thk u for the forms I needed so badly I really appreciate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Irene G.

January 26th, 2021

Excellent service for anyone doing their own deed filing without the use of a title company or an attorney. I will definitely recommend deeds.com to my notary clients and will be personally using this service again! ;)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terry W.

September 10th, 2020

Loved it no recurring fees easy to use your app

Thank you!

James S.

January 21st, 2019

Order Process: 5 Stars - very easy

Material Received: 2 Stars

Issues:

1. Printing- Document would not print in format displayed. Format would continually shrink to approx 2/3 size thus not useable for formal doc submission to County Records office.

2. Document Format- Data insertion fields (addresses) were not of correct size for data input. I needed a 4 line input space but was limited to only 3 lines. Also, Date field (year) was mis-oriented in-so-much that the 3rd digit (inputted) overlapped on 2nd digit (pre-printed) and also was of noticeably different font.

3. Useability- Hand-written input space provided (for Notary) was deficient in space and spacing. It was a challenge to utilize the space available to complete fully and maintain legibility.

Overall - the document worked marginally as advertised, I did need to re-write the entire document myself. It is a good concept but I'd recommend that Deeds company improve the downloaded forms for actual useability, readability, functionability.

regards,

Jim S

Thank you for your feedback. We really appreciate it. Have a great day!

Donna B.

January 10th, 2019

Really liked the quick access to documents. Great service, thanks.

Thank you Donna, we appreciate you taken the time to leave your feedback. Have a great day!

cynthia k.

October 13th, 2021

Very easy thank you

Thank you!

JERRY M.

March 11th, 2020

Had to modify the document form fill field to accept the information required. Had limited number of characters.

Thank you for your feedback. We really appreciate it. Have a great day!

Matt G.

May 10th, 2019

The process went smoothly and gave me what I needed. As an improvement, I would recommend that deeds.com sends an email when there is a new message in the portal. I didn't get any updates and had to log in to track progress each time.

Thank you for your feedback. We really appreciate it. Have a great day!