De Witt County Executor Deed Form (Texas)

All De Witt County specific forms and documents listed below are included in your immediate download package:

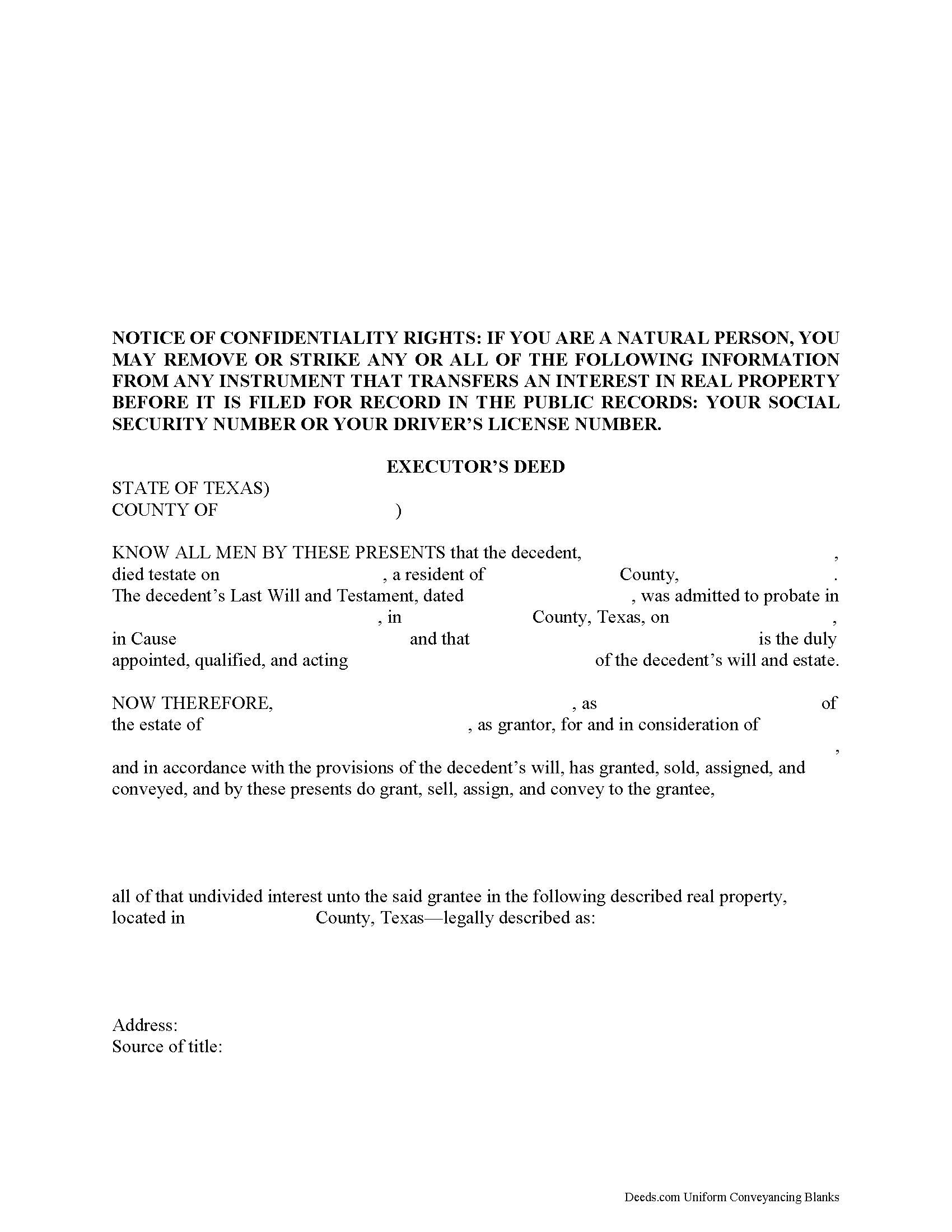

Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included De Witt County compliant document last validated/updated 11/6/2024

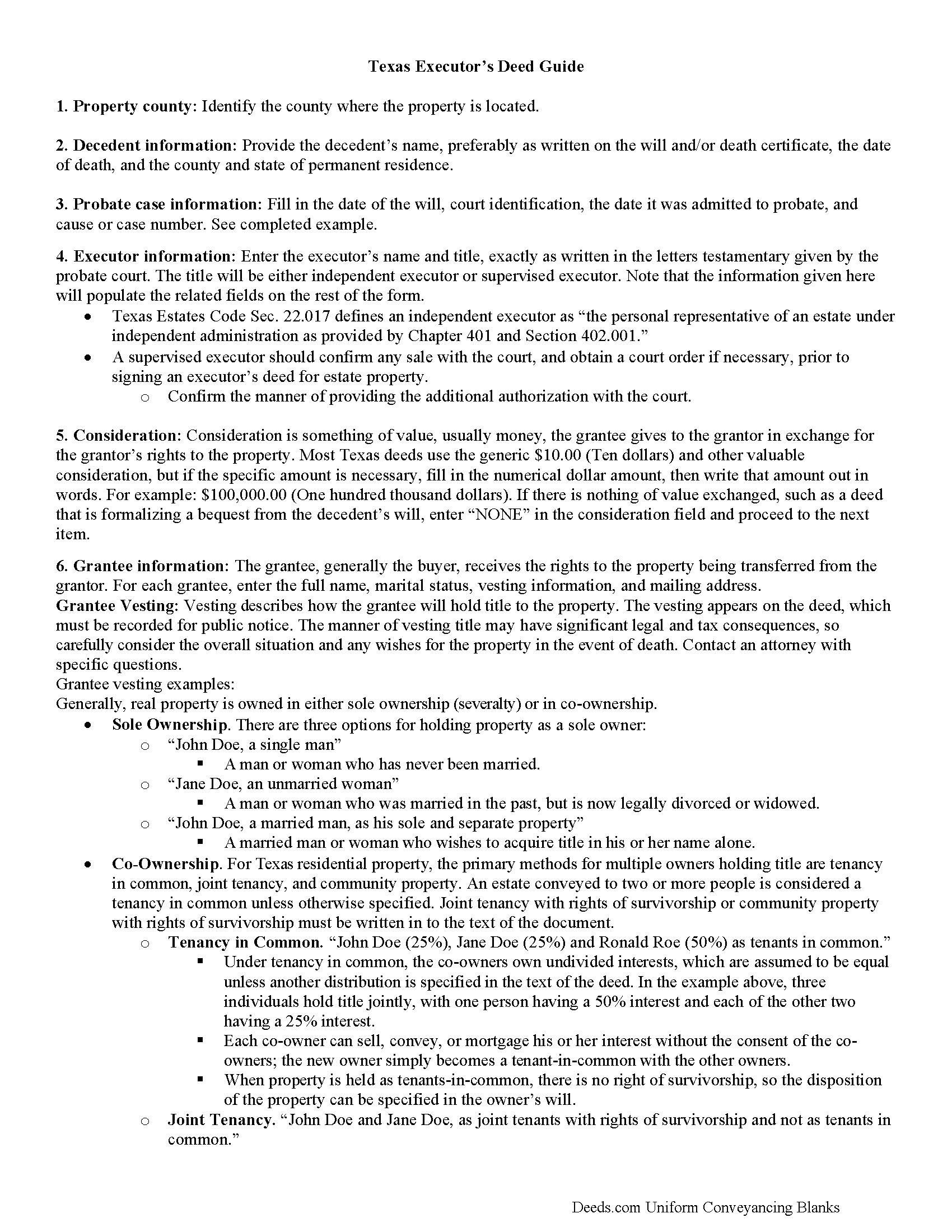

Executor Deed Guide

Line by line guide explaining every blank on the form.

Included De Witt County compliant document last validated/updated 10/28/2024

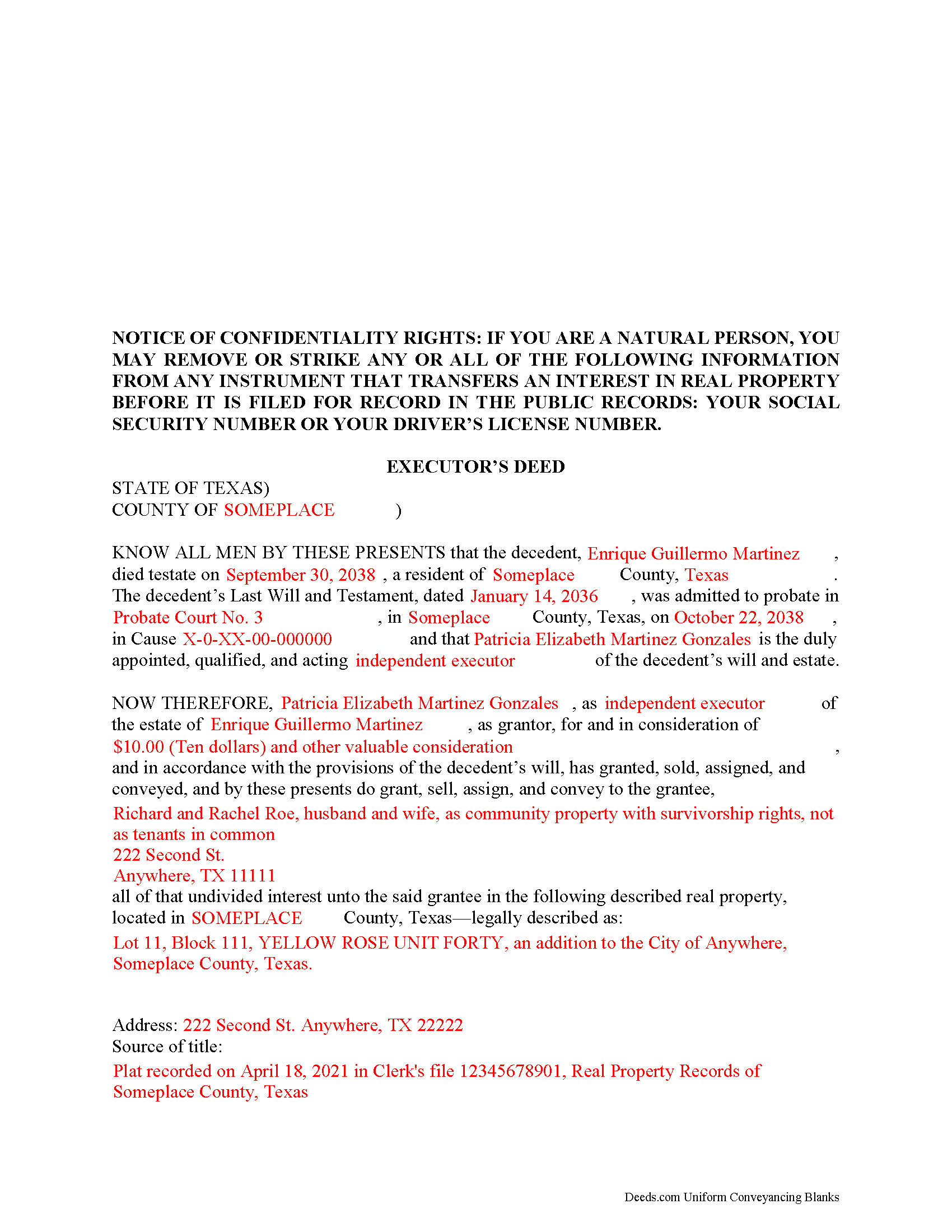

Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

Included De Witt County compliant document last validated/updated 11/22/2024

The following Texas and De Witt County supplemental forms are included as a courtesy with your order:

When using these Executor Deed forms, the subject real estate must be physically located in De Witt County. The executed documents should then be recorded in the following office:

DeWitt County Clerk

307 North Gonzales St, Cuero, Texas 77954

Hours: Monday - Friday 8:00am - 12:00 & 1:00 - 5:00pm

Phone: 361-275-0864

Local jurisdictions located in De Witt County include:

- Cuero

- Hochheim

- Meyersville

- Nordheim

- Thomaston

- Westhoff

- Yorktown

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the De Witt County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in De Witt County using our eRecording service.

Are these forms guaranteed to be recordable in De Witt County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by De Witt County including margin requirements, content requirements, font and font size requirements.

Can the Executor Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in De Witt County that you need to transfer you would only need to order our forms once for all of your properties in De Witt County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Texas or De Witt County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our De Witt County Executor Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The Texas Statutes cover the rules for selling a decedent's property from a probate estate in Chapter 356 of the Estates Code.

When a will is admitted to probate, the court officer authorizes an executor to manage, and eventually close, the estate. Among other duties, this involves identifying the assets and liabilities, paying the bills, and distributing property according to the terms specified in the will.

Many estates contain real property. Depending on the circumstances, the executor might transfer the title to heirs as directed in the decedent's will or sell the property outright. In any case, the executor must issue a deed for the transfer. Note that executor's deeds do NOT typically include a general warranty on the title. The executor may offer a special warranty, meaning that he has the right to sell the property, and will only defend the title against claims on his actions.

An executor's deed is used by executors who are authorized by the Probate Court to transfer real property out of an estate. These instruments must meet the same requirements as a warranty deed or quitclaim deed, plus include additional information about the probate case. Sometimes, the executor must also include supporting documentation such as copies of the letters testamentary, the will, signatures from heirs or beneficiaries, etc.

Settling probate estates can be complicated, so take the time to understand the issues. Before buying or selling real property from an estate, review all the risks and benefits, and contact an attorney with questions.

(Texas Executor Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the De Witt County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your De Witt County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jeff R.

December 4th, 2020

Great company. I had some issues with what I had prepared on my end but my contact at Deeds.com helped me with modifying the documents and submitted them successfully. Thanks for going the extra mile

Thank you for your feedback. We really appreciate it. Have a great day!

Brian R.

May 12th, 2020

Your website is very informative, and easy to use.The purchase and download process was clear and went well. I would add that your Virginia Quitclaim Deed Guide is very comprehensive and informative. This combined with the example form you provide is most helpful.

Thank You. Brian R

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara E.

March 7th, 2023

The online forms were very helpful and self-explanatory. My husband and I used several as we completed our estate planning documents.

Thank you for these forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Troy D.

October 9th, 2020

Excellent Service. Great time savings over having to send someone to the recording office. Am planning on utilizing this service for our recording needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathryn G.

December 21st, 2023

This was extremely helpful!

We are motivated by your feedback to continue delivering excellence. Thank you!

William S.

June 26th, 2022

The forms worked well for entering information. I have finished without much trouble. Since the forms are Adobe PDF files you need the free app to use them but you can't edit unless you have the paid Adobe program. And, it was a reasonable price.

Thank you for your feedback. We really appreciate it. Have a great day!

Suzanne D.

January 7th, 2019

Information found, thank you. I own Ground Rent on property and needed to know name of property owner and address for mailing bill.

Thank you!

Donald C.

January 7th, 2020

The service was VERY quick, simple and, easy. I would definetly use this service again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard W.

March 25th, 2019

Very nice web site with available forms. Being out of state we appreciated instruction sheet details.

Rick and Jean Weber, Chicago

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Douglas D.

March 18th, 2021

WOW! What a great service! Incredibly fast (just under 3 hours from creating the package to getting a receipt from the county recorder!) Will definitely use this service again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christine K.

March 26th, 2021

This site was fast and easy to use. I would highly recommend using them.

Thank you Deeds.com!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Samuel J M.

December 14th, 2018

I needed to prepare a Correction Warranty Deed and have not done so in years. I ordered your form and modified it to fit my situation. Saved me a lot of time.

Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!