Madison County Disclaimer of Interest Form (Texas)

All Madison County specific forms and documents listed below are included in your immediate download package:

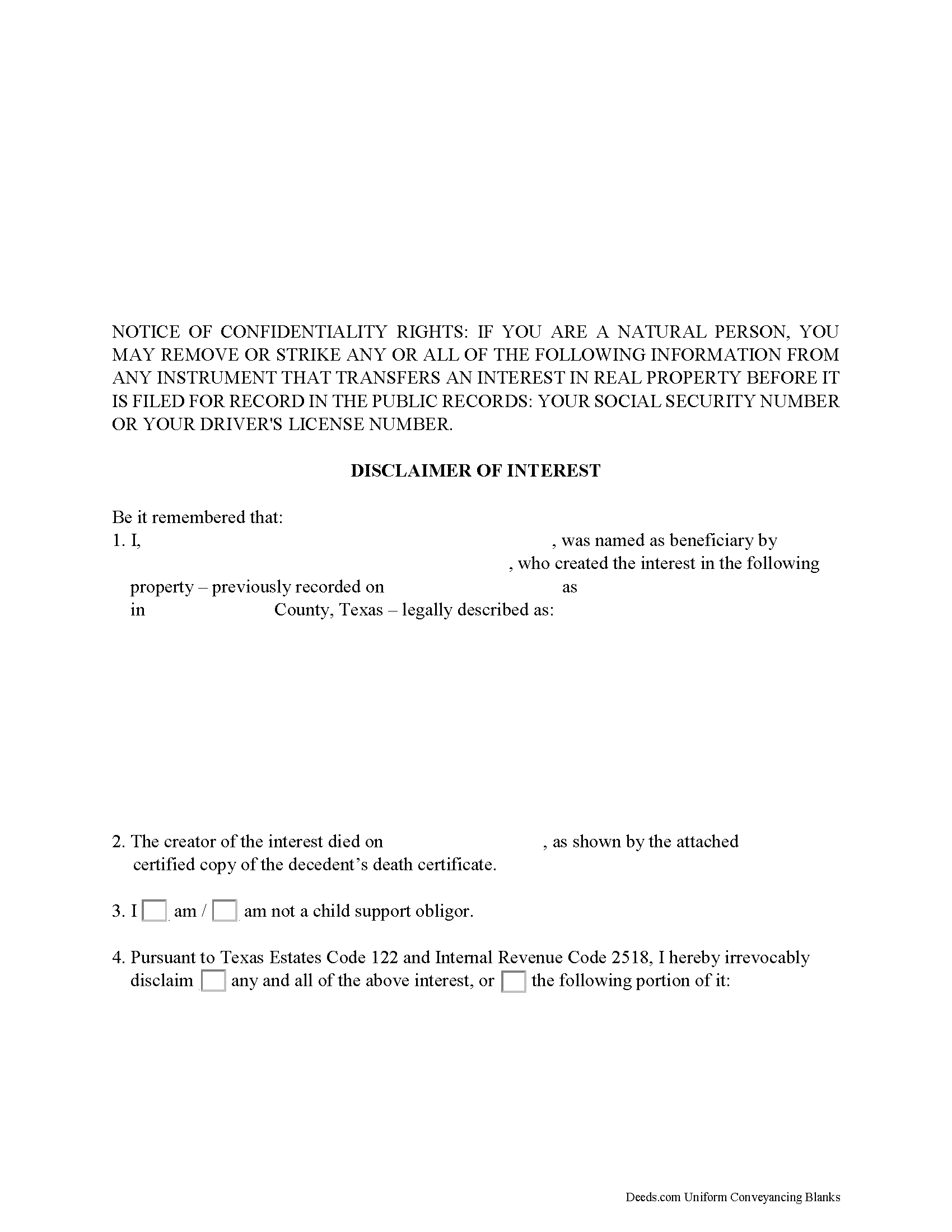

Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Madison County compliant document last validated/updated 11/12/2024

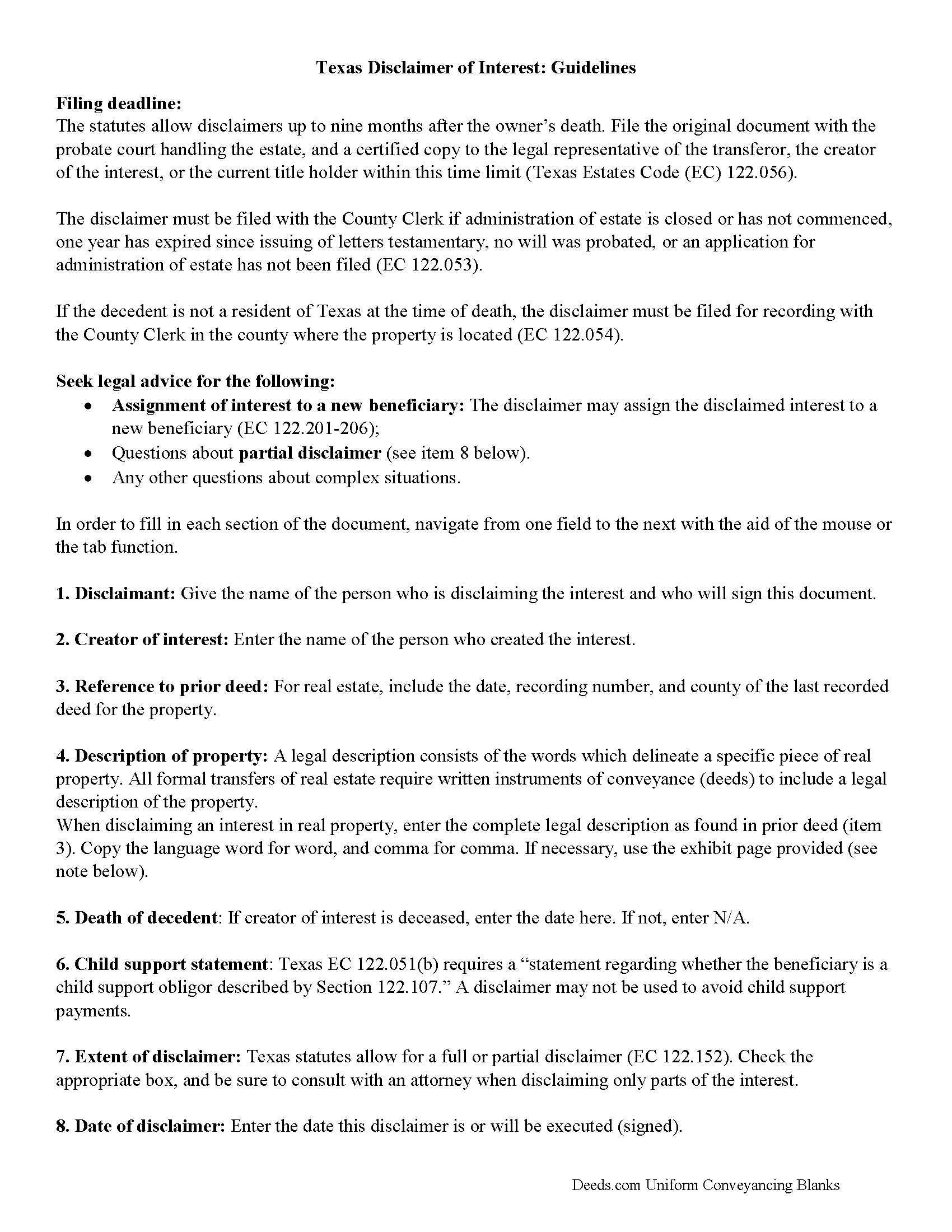

Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

Included Madison County compliant document last validated/updated 12/9/2024

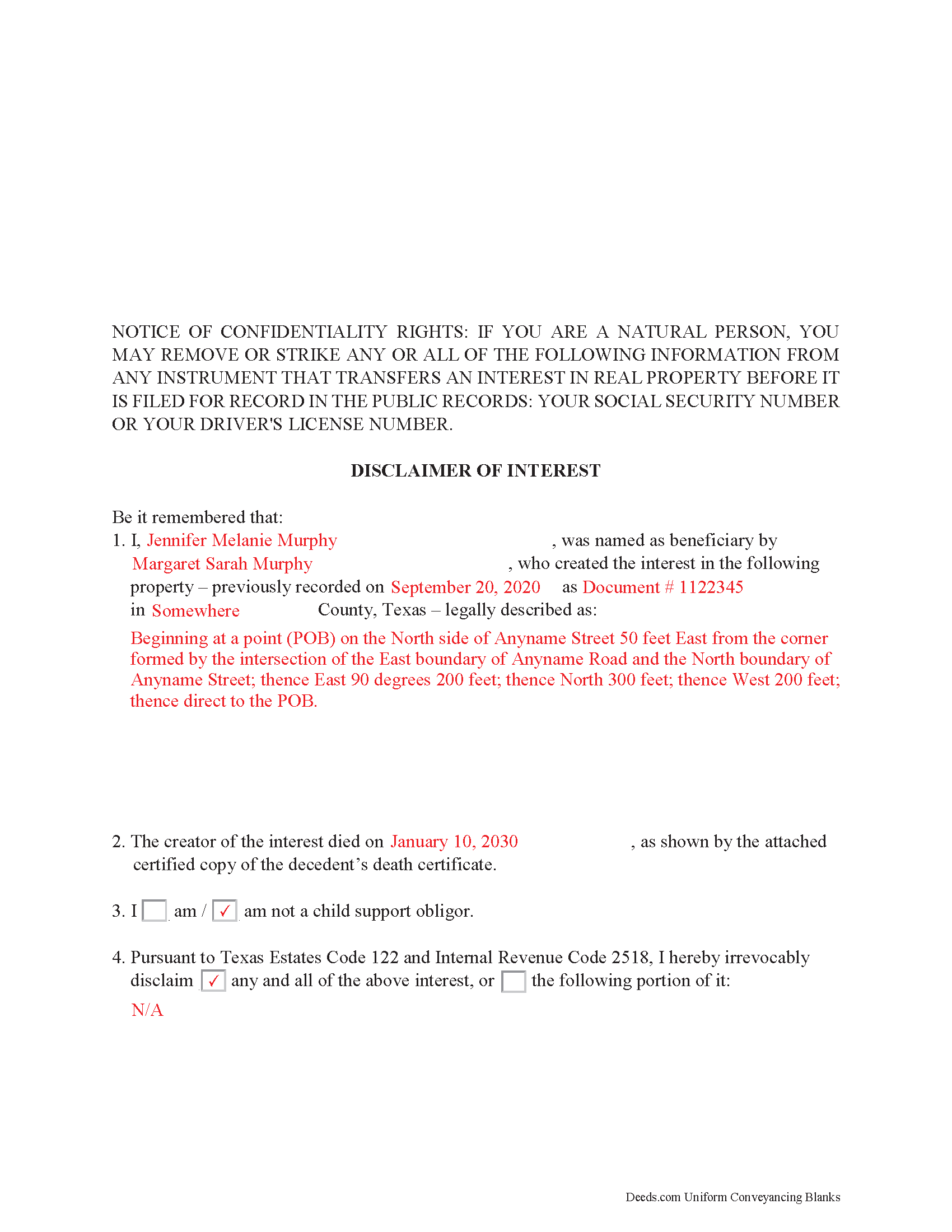

Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

Included Madison County compliant document last validated/updated 12/5/2024

The following Texas and Madison County supplemental forms are included as a courtesy with your order:

When using these Disclaimer of Interest forms, the subject real estate must be physically located in Madison County. The executed documents should then be recorded in the following office:

Madison County Clerk

103 West Trinity, Suite 104, Madisonville, Texas 77864

Hours: Monday - Friday 8:00am - 12:30 & 1:30 - 4:30pm

Phone: (936) 241-6210

Local jurisdictions located in Madison County include:

- Madisonville

- Midway

- North Zulch

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Madison County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Madison County using our eRecording service.

Are these forms guaranteed to be recordable in Madison County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Madison County including margin requirements, content requirements, font and font size requirements.

Can the Disclaimer of Interest forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Madison County that you need to transfer you would only need to order our forms once for all of your properties in Madison County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Texas or Madison County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Madison County Disclaimer of Interest forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Use the disclaimer to renounce an interest in real property in Texas.

A beneficiary in Texas can disclaim a bequeathed asset or power (Texas Estates Code, Chapter 122). Such a disclaimer, which must be in writing and signed by the beneficiary or a legally authorized representative, allows that beneficiary to renounce his or her interest in the property, either in full or partially (122.151-153). A beneficiary who is a child support obligor, however, must fulfill his obligations prior to any renunciation of an interest (122.107).

A disclaimer is irrevocable and binding for anyone who makes a claim against the beneficiary, for example, potential creditors (122.003-004). Unless the beneficiary is a charitable organization or governmental agency of the state, the document must be received within nine months after the decedent's death, or other qualifying event (122.055), and it is only valid if no actions have indicated prior acceptance of the property (122.104).

The document must be filed with the probate court in the county where the will or estate is being administered, or the county clerk if estate proceedings are closed (122.052-053). If the decedent is not a resident of the state, it must be filed with the county clerk for recording (122.054). It further must be delivered to the representative of the deceased or executor of the estate or the holder of legal title (122.056). When in doubt as to the drawbacks and benefits of renouncing the property, as well as assigning it to a subsequent beneficiary (122.201-206), consult with an attorney.

(Texas Disclaimer of Interest Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Madison County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Madison County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Nellie V.

October 14th, 2019

You guys make it so easy. Thank you for that! Hugs!

Thank you Nellie!

Thomas R.

June 21st, 2024

First time user. Was pleased with the easy of use and the step-by-step directions provided by the website.

We are motivated by your feedback to continue delivering excellence. Thank you!

Brett B.

July 12th, 2022

easy to use

Thank you!

Gary F.

October 6th, 2021

5 star review. Was able to order and download what I wanted in just a few minutes without any glitches.

Thank you for your feedback. We really appreciate it. Have a great day!

Melanie W.

October 23rd, 2022

I used deeds.com to complete a gift deed for transferring a house to our son. Finding the correct form and completing it correctly was extremely easy due to wonderful explanations and examples provided with the purchase of the form. The registrar filing the deed told me she was impressed with the work we did. An attorney would have charged $150 so the $28.00 was well worth the money.

Thank you for your feedback. We really appreciate it. Have a great day!

Tiffany Dawn J.

September 28th, 2019

Would be nice to have a better description on how to complete the forms if it is separated couple and one is signing the deed over to the other. I am still unsure how it should be worded. Disappointed that the guide didn't have better explanations.

Thank you for your feedback. We really appreciate it. Have a great day!

JOHN S.

October 16th, 2021

They had everything for a living trust but the form to transfer your house into the living trust

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

donald h.

January 26th, 2019

very informative and thank everyone involved,my deed needed to be changed and will adjusted.

Thank you!

Marlene B.

February 21st, 2024

I appreciated the fact that the forms were by Texas County and I knew I had the right form. The form were fairly easy to complete. I had trouble completing the form because the property description was long and kept disappearing and I had to re-type. It would also have helped it I could have saved and not had to start over every time.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Ray L.

February 8th, 2019

Thank you, I am very satisfied with the process and will provide a final review after the documents are completed and accepted by the state.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeremy C.

May 13th, 2021

Really impressed with the speed and professionalism of the service. I would recommend putting a grey background on the form field inputs as I had trouble seeing them in the user interface, but otherwise I was really impressed and would happily return as a customer.

Thank you for your feedback. We really appreciate it. Have a great day!

Darrell W.

November 10th, 2021

Fast and easy to use. Nice to have available online.

Thank you for your feedback. We really appreciate it. Have a great day!