Hidalgo County Conditional Waiver and Release on Progress Payment Form (Texas)

All Hidalgo County specific forms and documents listed below are included in your immediate download package:

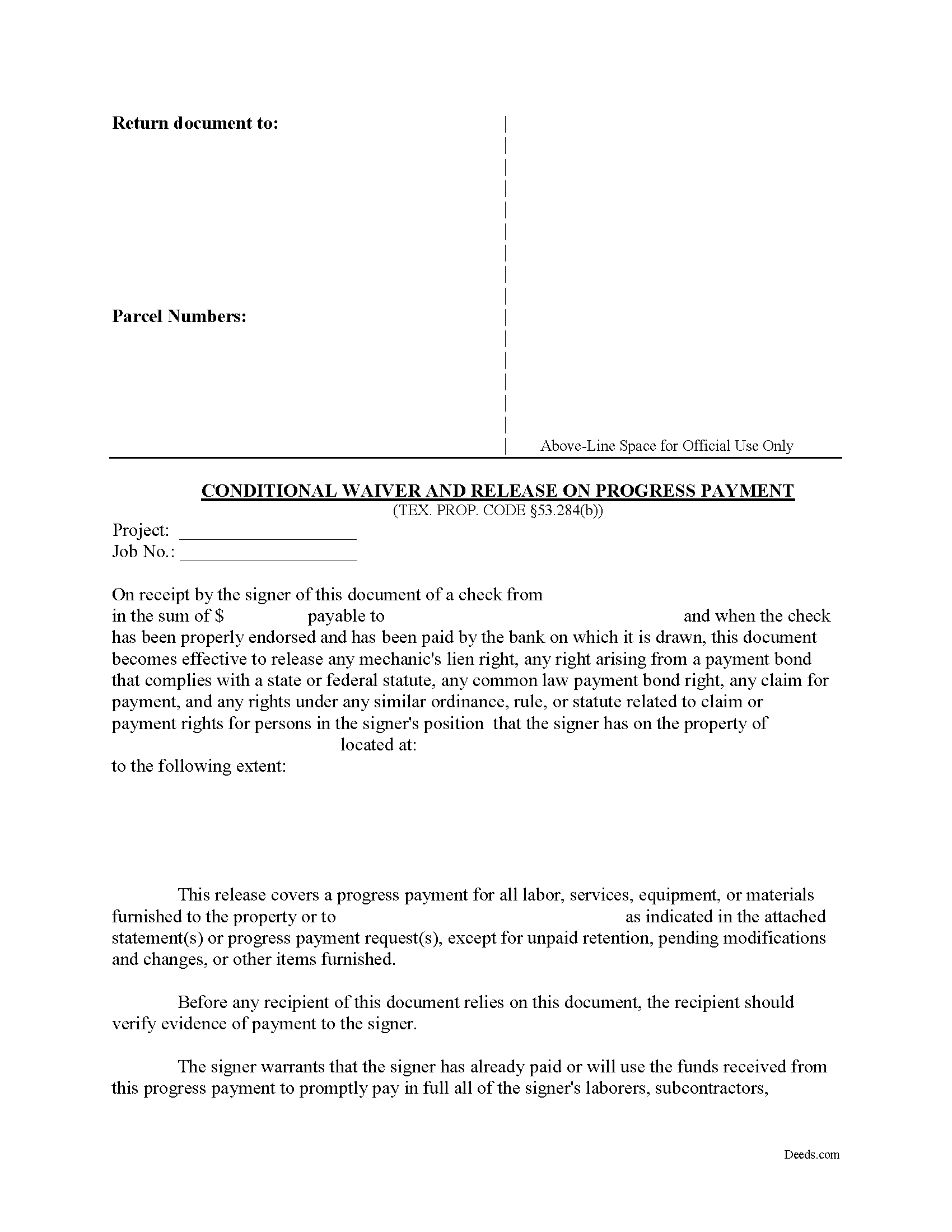

Conditional Waiver and Release on Progress Payment Form

Fill in the blank Conditional Waiver and Release on Progress Payment form formatted to comply with all Texas recording and content requirements.

Included Hidalgo County compliant document last validated/updated 11/18/2024

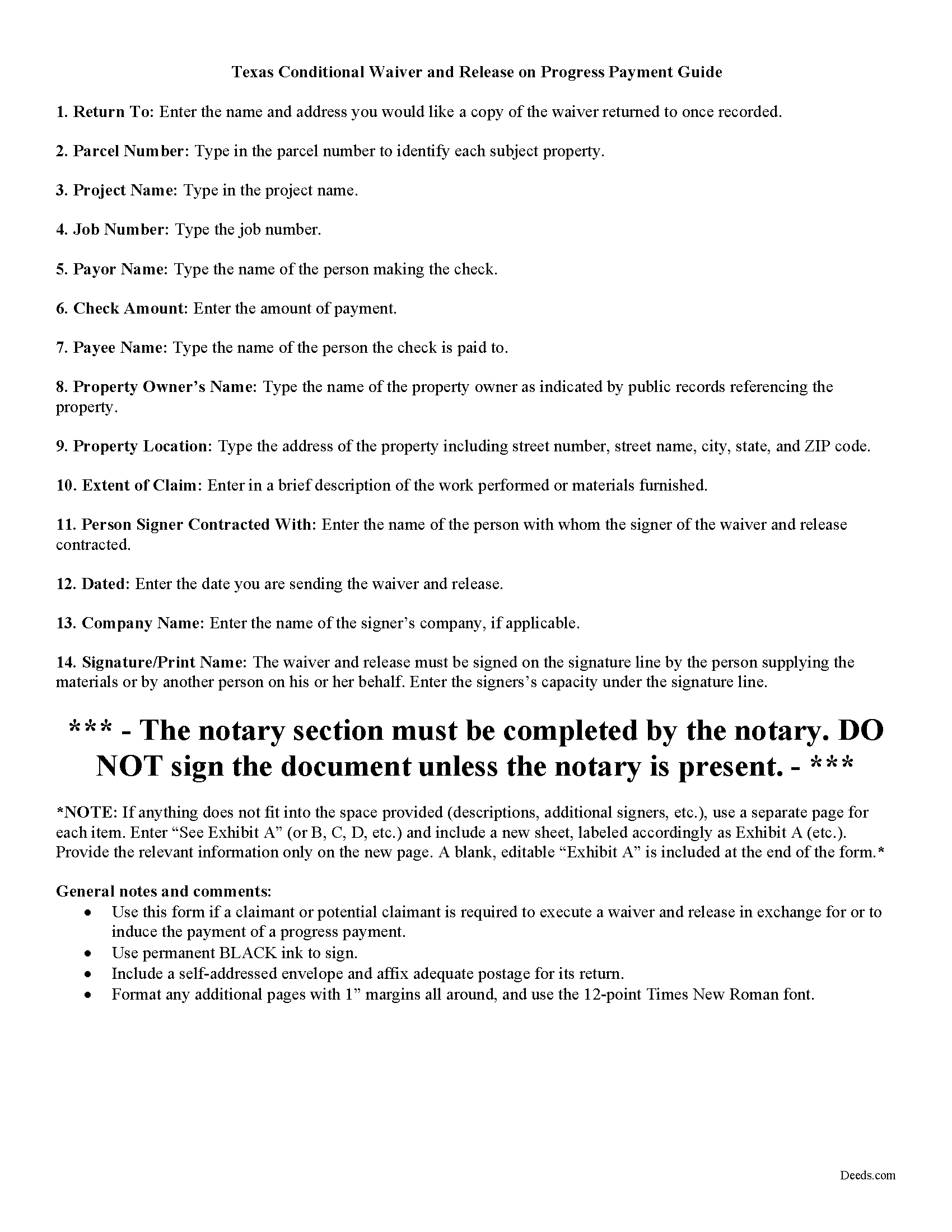

Conditional Waiver and Release on Progress Payment Guide

Line by line guide explaining every blank on the form.

Included Hidalgo County compliant document last validated/updated 12/6/2024

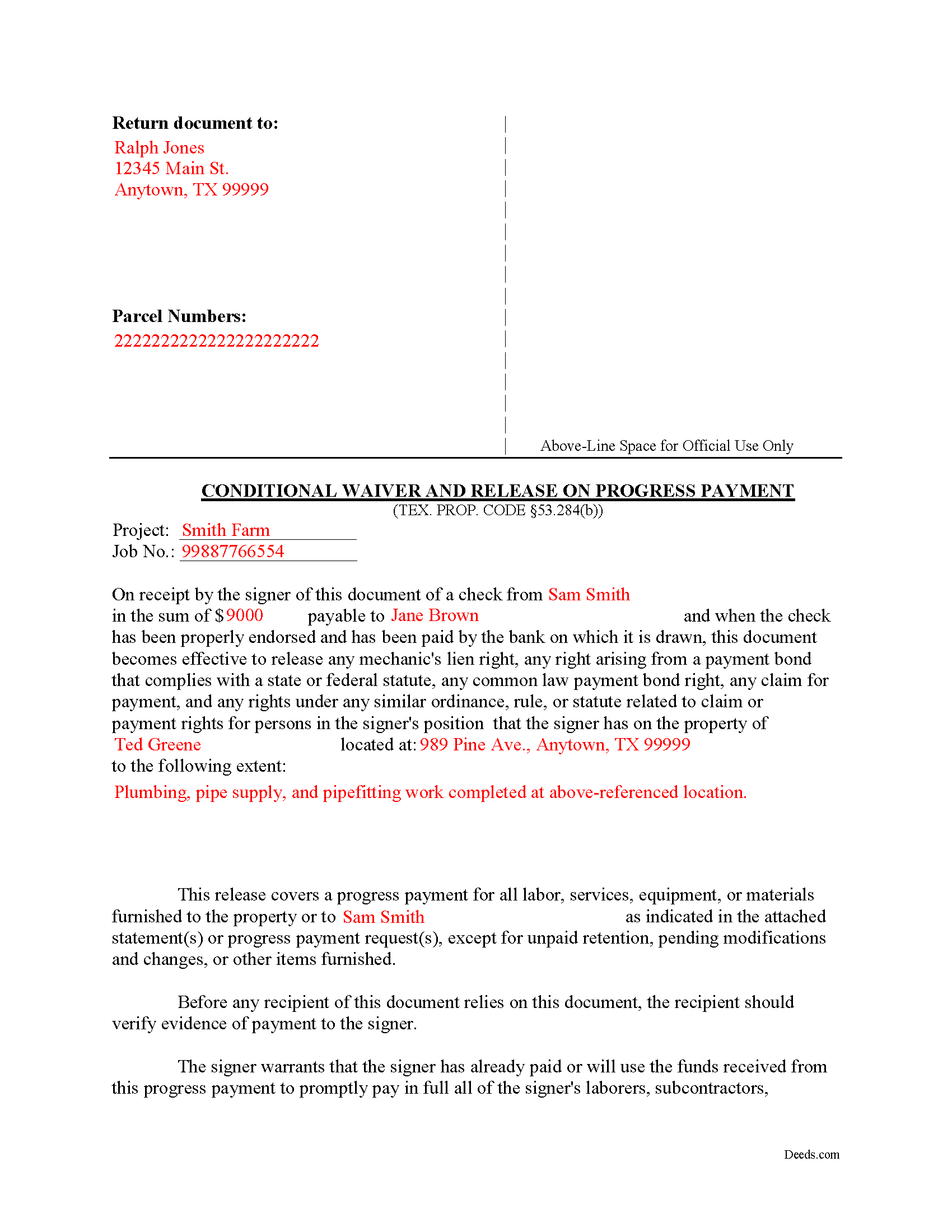

Completed Example of the Conditional Waiver and Release on Progress Payment Document

Example of a properly completed form for reference.

Included Hidalgo County compliant document last validated/updated 12/3/2024

The following Texas and Hidalgo County supplemental forms are included as a courtesy with your order:

When using these Conditional Waiver and Release on Progress Payment forms, the subject real estate must be physically located in Hidalgo County. The executed documents should then be recorded in one of the following offices:

Hidalgo County Clerk

100 N Closner, 1st floor / PO Box 58, Edinburg, Texas 78539

Hours: Monday - Friday 7:30am - 5:30pm

Phone: (956) 318-2100 & 2811

McAllen Substation

419 Nolana, Ste B, McAllen, Texas 78501

Hours: Monday - Friday 7:30am - 5:30pm

Phone: (956) 661-1009

Local jurisdictions located in Hidalgo County include:

- Alamo

- Donna

- Edcouch

- Edinburg

- Elsa

- Hargill

- Hidalgo

- La Blanca

- La Joya

- La Villa

- Linn

- Los Ebanos

- Mcallen

- Mercedes

- Mission

- Penitas

- Pharr

- Progreso

- San Juan

- Sullivan City

- Weslaco

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Hidalgo County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Hidalgo County using our eRecording service.

Are these forms guaranteed to be recordable in Hidalgo County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hidalgo County including margin requirements, content requirements, font and font size requirements.

Can the Conditional Waiver and Release on Progress Payment forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Hidalgo County that you need to transfer you would only need to order our forms once for all of your properties in Hidalgo County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Texas or Hidalgo County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Hidalgo County Conditional Waiver and Release on Progress Payment forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

A lien waiver is used by a lien claimant or potential claimant to forfeit his or her right to a lien upon a progress payment or final payment. The waiver can be conditional, meaning that the payment must clear the bank before the lien is released, or unconditional, meaning the lien is released upon the recording of the waiver regardless of whether or not the claimant is ever actually paid.

A waiver and release given by a claimant or potential claimant is unenforceable unless it substantially complies with the applicable form described in Sec. 53.284 of the Texas Property Code.

The four types of lien waivers in the State of Texas include:

- Conditional Waiver and Release on Progress Payment;

- Unconditional Waiver and Release on Progress Payment;

- Conditional Waiver and Release on Final Payment; and

- Unconditional Waiver and Release on Final Payment

Let's say a contractor reaches an agreed-upon point a project where she previously recorded a lien. The owner wants the lien released up to that point, and writes a check for the amount due on the work completed. The contractor offers a conditional waiver and release on progress payment, which protects her interests in case the bank refuses to honor the check. As long as the check is good, the lien gets released up to the date of the progress payment. Otherwise, the claimant retains the lien rights until the responsible party finds another way to pay the bill.

Under Sec. 53.284(b), if a claimant or potential claimant is required to execute a conditional waiver and release in exchange for or to induce a progress payment, the waiver becomes valid ONLY AFTER payment in good and sufficient funds, meaning that a single or joint payee check must clear the bank on which it's drawn.

The document identifies the parties, the project, the work and/or materials provided, and relevant dates and payment amounts. Sign it in front of a notary and submit it to the local recording office.

In summary, a lien waiver is an important tool, but take care to use the proper form. The wrong decision can lead to a loss of lien rights before receiving payment. Each case is unique, and Texas lien law can be complicated. Contact an attorney for complex situations, with questions about waivers, or any other issues related to mechanic's liens.

Our Promise

The documents you receive here will meet, or exceed, the Hidalgo County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hidalgo County Conditional Waiver and Release on Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Rebecca M.

December 28th, 2021

This was pretty easy to fill out. The directions on all of the forms was very good. This should make life much easier at the County Recorder.

Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard E.

August 10th, 2021

The QuitClaim deed does not provide enough space in the Grantor block at the top of the first page. In fact, all blocks should provide more space.

Thank you for your feedback. We really appreciate it. Have a great day!

Dallas S.

July 19th, 2023

Very easy

Thank you!

Judith F.

October 15th, 2021

Easy to understand and use!

Thank you!

Randall M.

March 31st, 2022

These forms worked fantastic!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas C.

April 12th, 2023

I got the right form but I waited too long to use it and Oregon changed the formatting. I should have checked and made sure the form was still good. Deeds responded quickly.

Thank you!

richard s.

March 26th, 2020

had exactly what i needed and good price

Thank you Richard! Have an amazing day.

MIchelle S.

June 18th, 2021

You had the generic document that I was looking for Yay!

The "example" page was helpful and reassuring.

The auto input sections of my document looked ok until i printed it and then it appeared to be out of alignment which is why my rating is lowered to 4 stars

it would be nice to have the ability to correct the title (created by me) when downloading PDFs for an e-filing

Thank you for your feedback. We really appreciate it. Have a great day!

Carolyn G.

September 1st, 2021

I was extremely pleased with this experience, which literally took a minimum amount of time. One recommendation: make certain that when documents are uploaded that they have been received in the appropriate file. The lack of clarity caused me to upload twice or three times. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

scott m.

February 21st, 2021

thanks- easy as pie.

Thank you!

James J.

October 4th, 2021

I couldn't be more pleased or more impressed with the e-recording services I received from deeds.com and from my service representative, KVH. I was able to record documents in approximately half a dozen different counties easily and seamlessly, with a minimum of fuss. The turn around time was incredibly fast. The pricing was incredibly reasonable. I know I have alternatives because, in the past, I have used a competitor service for my recording needs. I won't do that again -- this was an exceptional experience. Thank you for your help!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Doris S.

September 12th, 2021

Pleased with efficiency and expediency of website. Added value is the respective county requirements for Florida. I needed a quitclaim deed between family members. Highly recommended. We hope to record signed and executed document next week in Florida. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!