Gregg County Collateral Assignment of Note and Liens (Security Agreement) Form (Texas)

All Gregg County specific forms and documents listed below are included in your immediate download package:

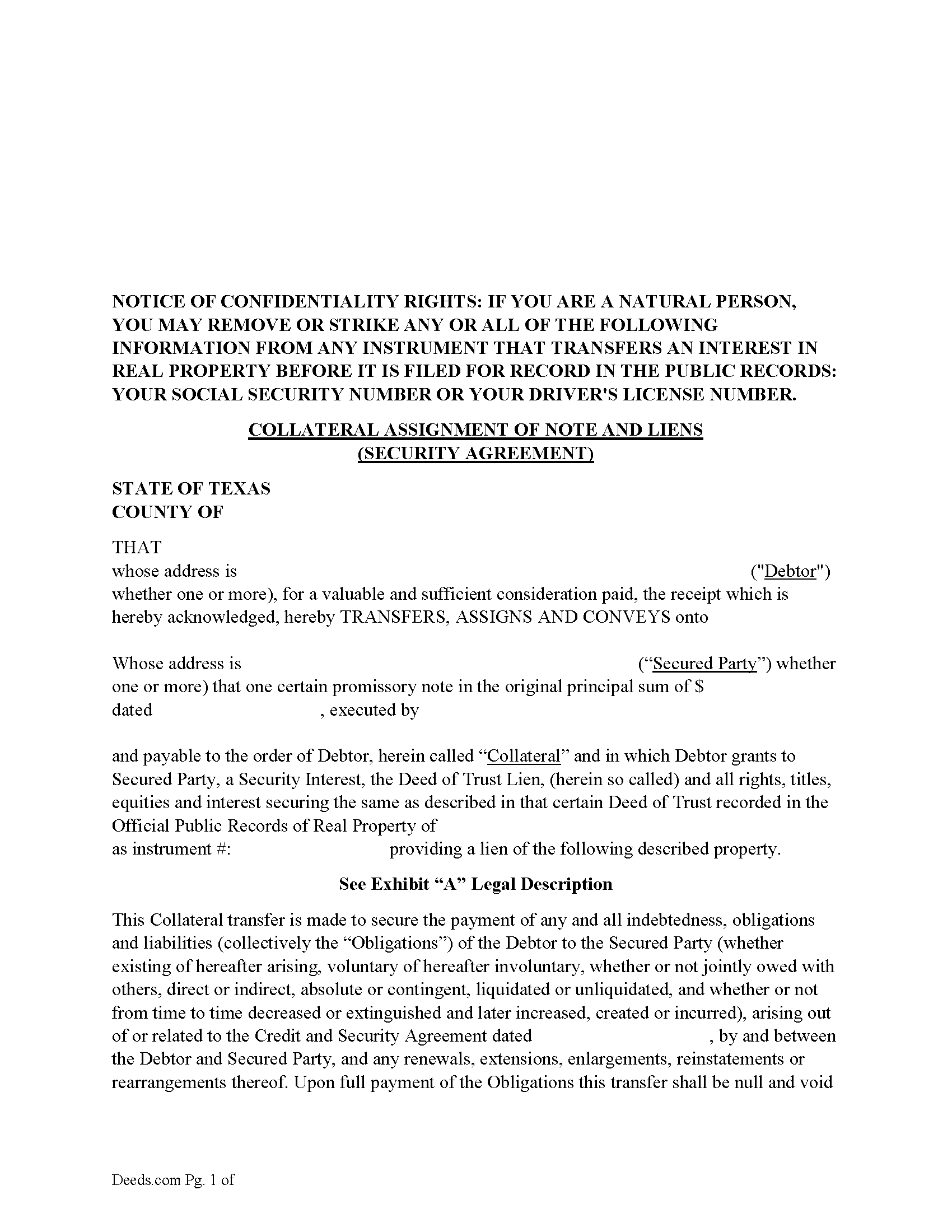

Collateral Assignment of Note and Liens Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Gregg County compliant document last validated/updated 8/6/2024

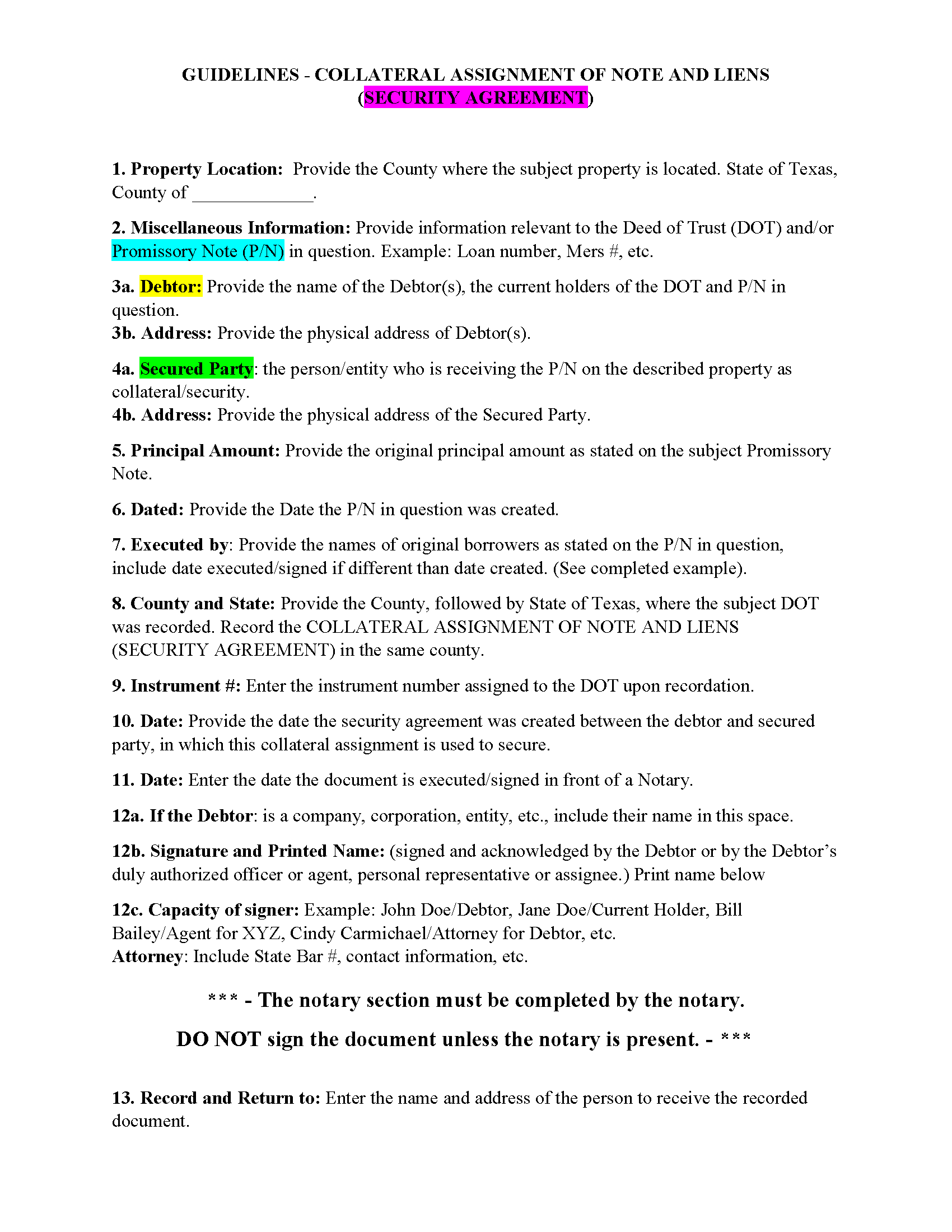

Guidelines - Collateral Assignment of Note and Liens

Line by line guide explaining every blank on the form.

Included Gregg County compliant document last validated/updated 10/29/2024

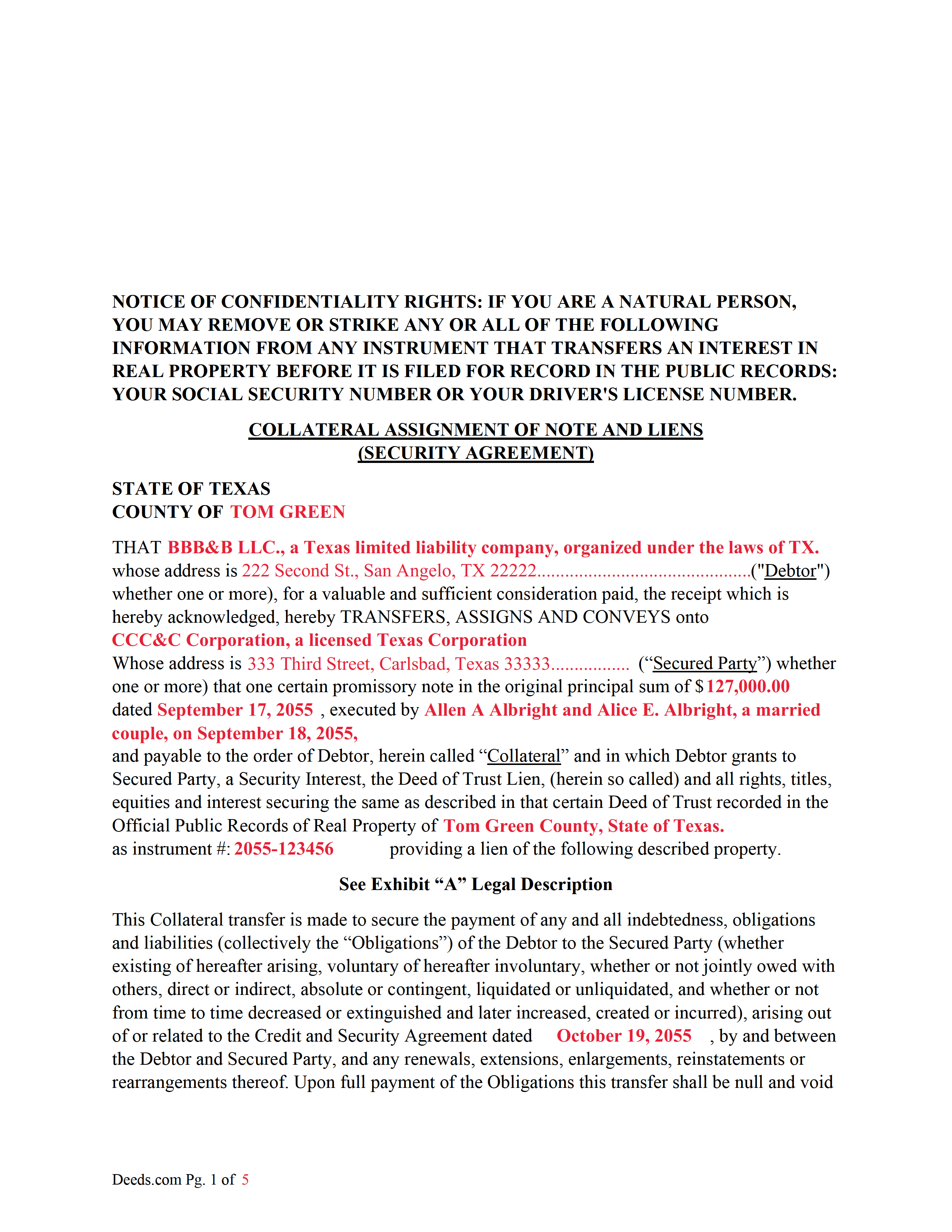

Completed Example of the Collateral Assignment of Note and Liens Document

Example of a properly completed form for reference.

Included Gregg County compliant document last validated/updated 11/20/2024

The following Texas and Gregg County supplemental forms are included as a courtesy with your order:

When using these Collateral Assignment of Note and Liens (Security Agreement) forms, the subject real estate must be physically located in Gregg County. The executed documents should then be recorded in the following office:

Gregg County Clerk - County Courthouse

101 East Methvin, Suite 200, Longview, Texas 75601

Hours: Monday - Friday 8:00am - 5:00pm

Phone: (903) 236-8430

Local jurisdictions located in Gregg County include:

- Easton

- Gladewater

- Judson

- Kilgore

- Longview

- White Oak

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Gregg County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Gregg County using our eRecording service.

Are these forms guaranteed to be recordable in Gregg County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Gregg County including margin requirements, content requirements, font and font size requirements.

Can the Collateral Assignment of Note and Liens (Security Agreement) forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Gregg County that you need to transfer you would only need to order our forms once for all of your properties in Gregg County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Texas or Gregg County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Gregg County Collateral Assignment of Note and Liens (Security Agreement) forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

1. Borrower/Obligor 2. Debtor/Original Lender 3. Secured Party(SP)/3rd Party/New Lender

This form assigns the current Debtors/lenders security interest in a promissory note backed by a previously recorded Deed of Trust Lien, with all rights, titles, equities and interest securing the same as described in that certain Deed of Trust. This collateral is assigned to a Secured Party to protect a Security Agreement made between the Debtor and Secured Party. A collateral assignment is a pledge that the Debtor will pay the Secured Party as agreed. Debtor authorizes Secured Party, at Secured Party's option, to collect any and all sums becoming due upon the Collateral, such sums to be held by Secured Party without liability for interest thereon and applied toward the payment of the Obligations as and when the same becomes payable, and Secured Party shall have the full control of the Collateral and the Deed of Trust Lien securing the same until the Obligations are fully paid and shall have the further right to release the Deed of Trust Lien securing the Collateral upon the full and final payment to Secured Party.

Typically used by Private Lenders/Debtors to borrow money on a property that they financed by a Deed of Trust Lien and Promissory Note.

Sec. 9.102. DEFINITIONS AND INDEX OF DEFINITIONS. (a) In this chapter:

(12) "Collateral" means the property subject to a security interest or agricultural lien. The term includes:

(A) proceeds to which a security interest attaches;

(B) accounts, chattel paper, payment intangibles, and promissory notes that have been sold; and

(C) goods that are the subject of a consignment.

(28) "Debtor" means:

(A) a person having an interest, other than a security interest or other lien, in the collateral, whether or not the person is an obligor;

(B) a seller of accounts, chattel paper, payment intangibles, or promissory notes; or

(C) a consignee.

(66) "Promissory note" means an instrument that evidences a promise to pay a monetary obligation, does not evidence an order to pay, and does not contain an acknowledgement by a bank that the bank has received for deposit a sum of money or funds.

(73) "Secured party" means:

(A) a person in whose favor a security interest is created or provided for under a security agreement, whether or not any obligation to be secured is outstanding;

(B) a person that holds an agricultural lien;

(C) a consignor;

(D) a person to which accounts, chattel paper, payment intangibles, or promissory notes have been sold;

(E) a trustee, indenture trustee, agent, collateral agent, or other representative in whose favor a security interest or agricultural lien is created or provided for; or

(F) a person that holds a security interest arising under Section 2.401, 2.505, 2.711(c), 2A.508(e), 4.210, or 5.118.

(74) "Security agreement" means an agreement that creates or provides for a security interest.

For use in Texas only.

Our Promise

The documents you receive here will meet, or exceed, the Gregg County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Gregg County Collateral Assignment of Note and Liens (Security Agreement) form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Pamela J.

January 7th, 2021

The form was short, and explainable.. so that is my feed back on that...but we have not received anything back to actually see if we filled the form out correctly. So I definitely can not say if I'm satisfied with it or not until I know that it is approved. I would recommend Coos County web site for Forms to people. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

NATALIE A.

January 6th, 2021

The form was very easy to use and the sample tool you had was very helpful. the only problem i had was saving the document and then trying to find it later. I finally was able to figure out how to save it. but i still cannot find the saved document on my computer. Luckily i printed it before i closed it and did not need to make any changes.

Thank you for your feedback. We really appreciate it. Have a great day!

Lutalo O.

December 26th, 2019

Great tool for finding the best real estate forms!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dawn M.

October 26th, 2020

So helpful and quick! The response time and kindness was amazing! The steps were easy to follow as well. We will definitely be using Deeds.com in the future!

Thank you for your feedback. We really appreciate it. Have a great day!

Marissa G.

March 4th, 2020

The NV Clark County deed upon death was perfect! Our county doesn't offer a template, but rather has a long list of rules and specifications where they expect you to make your own document. I didnt want to risk making an unacceptable form so I purchased the template from Deeds.com. It was easy to use and very thorough. Our deed upon death was notarized and filed with the county with no issue. Save yourselves the time and headache and get the template!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Margaret J.

July 27th, 2022

Forms were clear and understandable

Thank you!

Cathy W.

September 3rd, 2021

Just what I was looking for

Thank you!

Jennifer C.

January 8th, 2021

Fast turnaround. Very much appreciated!

Thank you!

Leo H.

May 26th, 2021

The deed was very easy to use and the material provided were helpful in completing the form. We haven't filed it yet, but I assume that all will go well.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Craig M.

August 24th, 2020

Fantastic! So much easier than going and recording it at the recorders office!

Glad we could help Craig, thanks for the kind words.

Lisa W.

May 25th, 2022

The easiest thing to use ever. Amazing and extremely prompt support. They get the job done with all the information you might need

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Garrett R.

May 24th, 2022

I am a real estate attorney in CA. These Wyoming model deeds look too basic and barely adequate: no usual name and address at the top for tax statements and who recorded it. Some old fashioned legalese that only obfuscates. I won't use them. Your background info was good though.

Thank you for your feedback. We really appreciate it. Have a great day!