Frio County Affidavit of Lien Form (Texas)

All Frio County specific forms and documents listed below are included in your immediate download package:

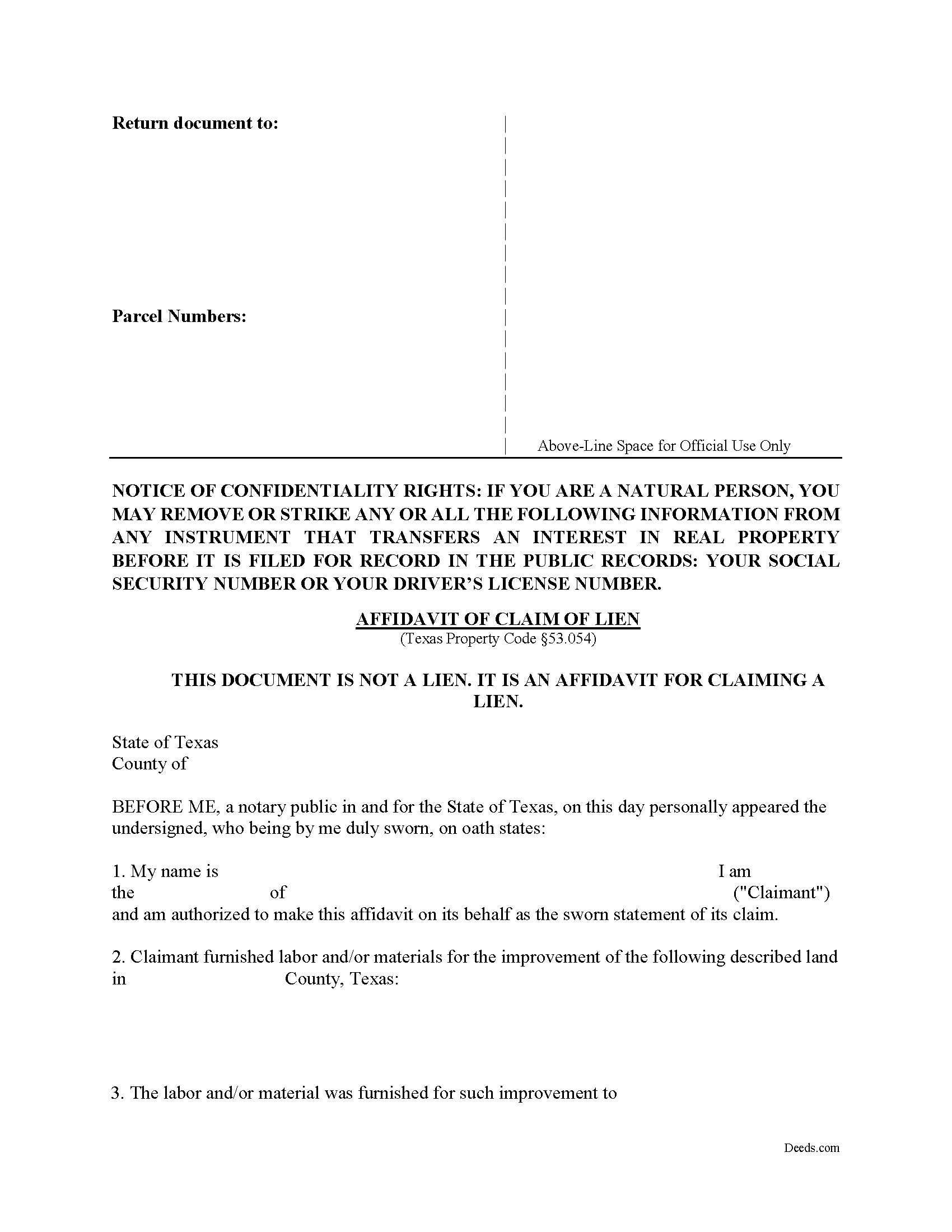

Affidavit of Lien Form

Fill in the blank Affidavit of Lien form formatted to comply with all Texas recording and content requirements.

Included Frio County compliant document last validated/updated 12/12/2024

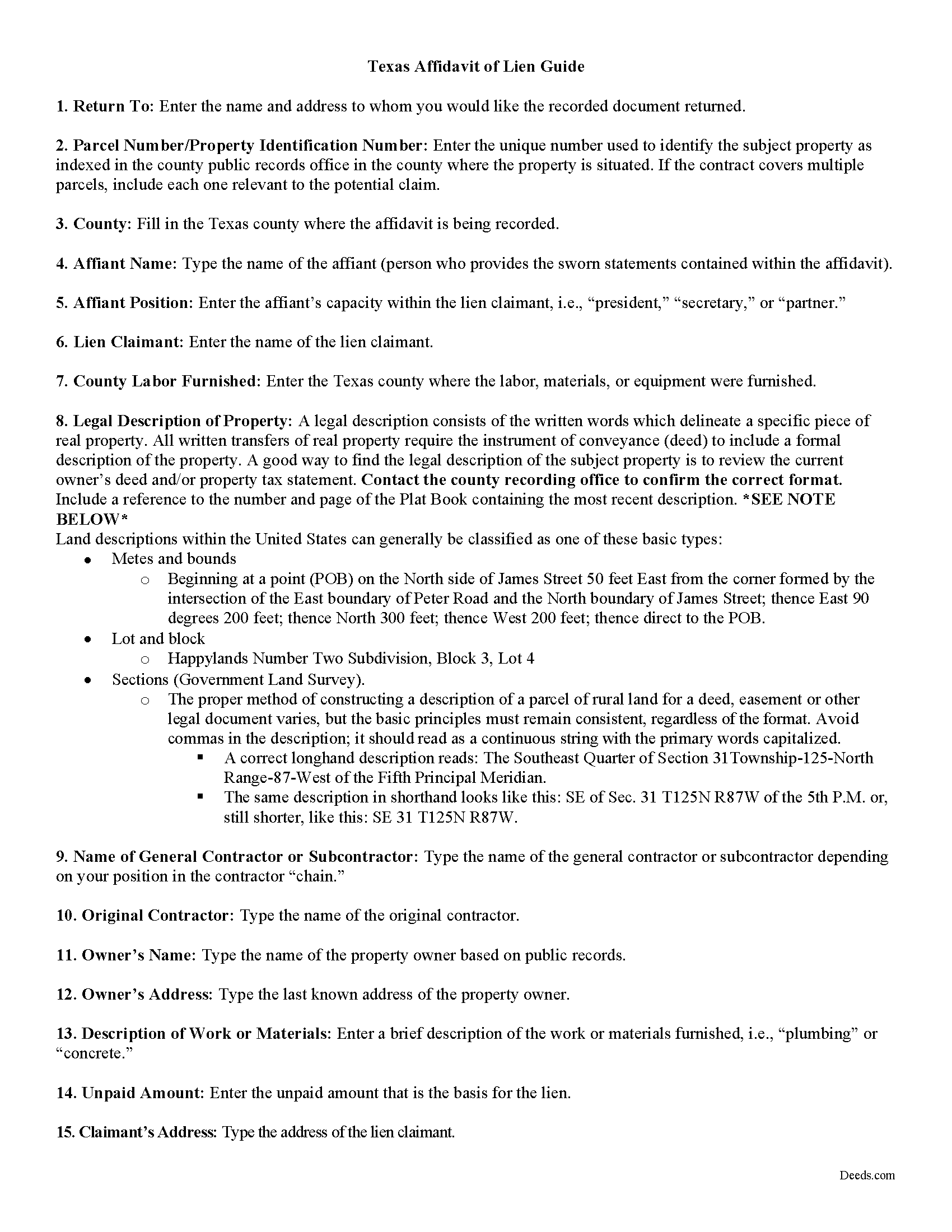

Affidavit of Lien Guide

Line by line guide explaining every blank on the form.

Included Frio County compliant document last validated/updated 12/20/2024

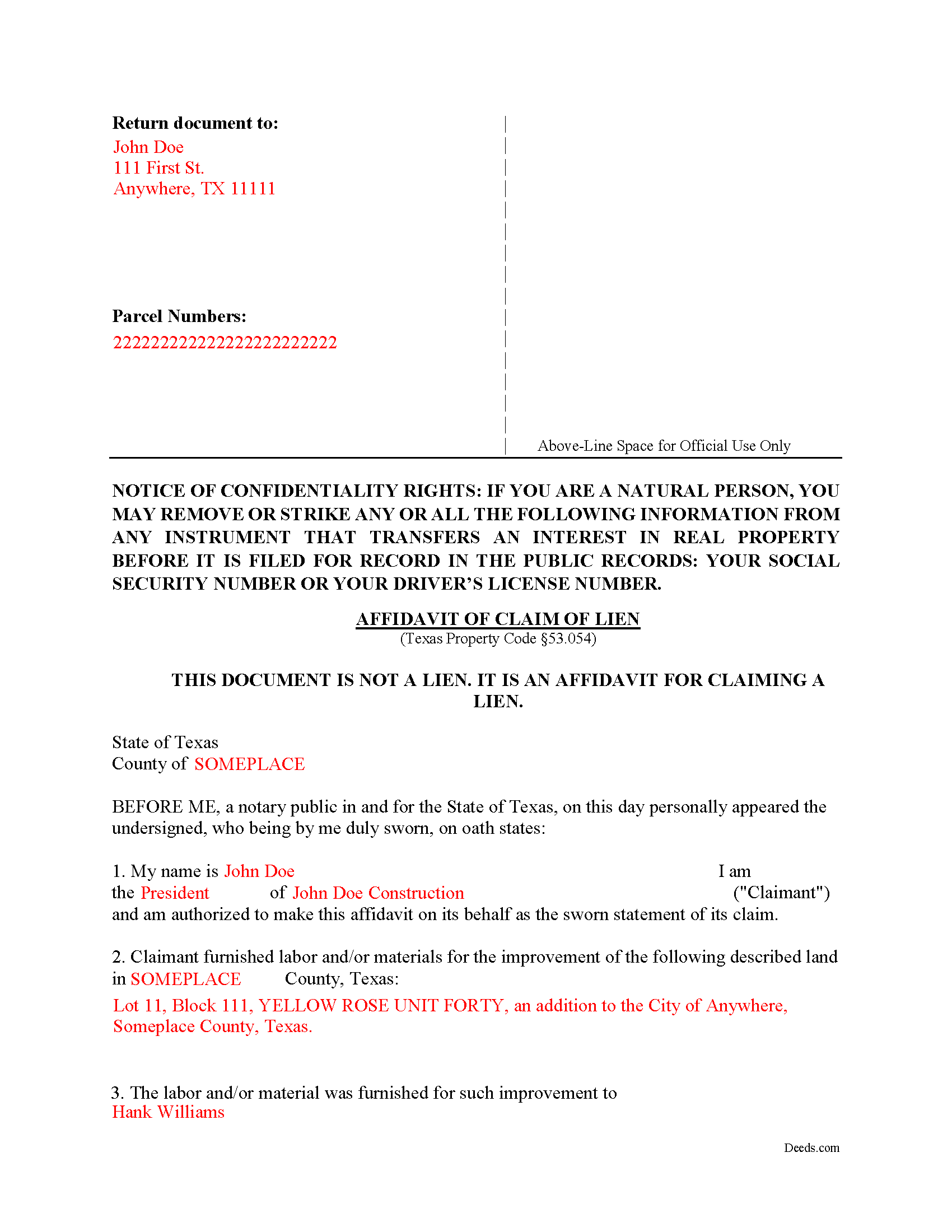

Completed Example of the Affidavit of Lien Document

Example of a properly completed form for reference.

Included Frio County compliant document last validated/updated 10/25/2024

The following Texas and Frio County supplemental forms are included as a courtesy with your order:

When using these Affidavit of Lien forms, the subject real estate must be physically located in Frio County. The executed documents should then be recorded in the following office:

Frio County Clerk Office

500 E San Antonio St / Box 6, Pearsall, Texas 78061

Hours: Mon - Thu 8:00am - 12:00 & 1:00 - 5:00pm, Fri until 4:30pm

Phone: 830-334-2214

Local jurisdictions located in Frio County include:

- Bigfoot

- Dilley

- Moore

- Pearsall

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Frio County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Frio County using our eRecording service.

Are these forms guaranteed to be recordable in Frio County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Frio County including margin requirements, content requirements, font and font size requirements.

Can the Affidavit of Lien forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Frio County that you need to transfer you would only need to order our forms once for all of your properties in Frio County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Texas or Frio County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Frio County Affidavit of Lien forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

An affidavit is a sworn statement of fact, in writing, made by an affiant under oath or affirmation, administered by a person lawfully authorized (such as a notary public). In this case, the affiant states that labor or equipment was furnished by the lien claimant and the balance owed remains unpaid. The affidavit is not a lien, but sets out sworn facts based on personal knowledge, that when recorded, will later become the lien. It is a necessary step to perfect (make effective against third parties) the lien.

To claim a lien for a commercial job, the affiant must file an affidavit with the county clerk of the county in which the property is located, not later than the 15th day of the fourth calendar month after the day on which the indebtedness accrues. TEX. PROP. CODE 53.052(a).

Note that for residential construction projects, the claimant must file the affidavit with the county clerk no later than the 15th day of the THIRD (3rd) calendar month after non-payment of the invoice. TEX. PROP. CODE 53.052(b).

The affidavit must substantially comply with the Texas Property Code. Therefore, the it must contain: 1) a signature by the person claiming the lien or by another person on the claimant's behalf; 2) a sworn statement of the amount of the claim; 3) the name and last known address of the owner or reputed owner; 4) a general statement of the kind of work done and materials furnished by the claimant and, for a claimant other than an original contractor, a statement of each month in which the work was done and materials furnished for which payment is requested; 5) the name and last known address of the person by whom the claimant was employed or to whom the claimant furnished the materials or labor; 6) the name and last known address of the original contractor; 7) legally sufficient description of the property to be charged with the lien; 8) the claimant's name, mailing address, physical address (if different); and 9) for a claimant other than an original contractor, a statement identifying the date each notice of the claim was sent to the owner and the method by which the notice was sent. TEX. PROP. CODE 53.054(a). Leave out amounts not related to the value of materials or labor furnished (such as attorney's fees), as these can void the entire lien claim.

When recording the affidavit, attach a copy of any applicable written agreement or contract and a copy of each notice sent to the owner. TEX. PROP. CODE 53.054(b). This is good practice and can help prove the claim by creating a paper trail. The affidavit is not required to set forth individual items of work done or material furnished or specially fabricated and the affiant may use any abbreviations or symbols that are customary in your trade. TEX. PROP. CODE 53.054(c).

After the affidavit is properly recorded it must be served. Send a copy of the affidavit by registered or certified mail to the owner (or reputed owner) at the owner's last known business or residence address not later than the fifth (5th) day after the date the affidavit is filed with the county clerk. TEX. PROP. CODE 53.055(a). If the claimant is not an original contractor, they must also send a copy of the affidavit to the original contractor at the original contractor's last known business or residence address within the same period. TEX. PROP. CODE 53.055(b).

Each case is unique, and the Texas lien law is complex, so contact an attorney with specific questions or for complex situations.

Our Promise

The documents you receive here will meet, or exceed, the Frio County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Frio County Affidavit of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Joyce S.

June 28th, 2019

The site was very easy to understand and to download the required documents I need to prepare a release. Response of the documents ready for my use was very efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rachelle S.

March 21st, 2021

Wow that was easy

Thank you!

Jay T.

August 6th, 2020

I filled out the deed, had it notarized, and recorded. No problems. I put this off for so long. Once I had the form it was recorded in one day.

Thank you for your feedback. We really appreciate it. Have a great day!

Carol H.

December 22nd, 2021

Great help

Quite useful

Thank you!

Julie S.

May 2nd, 2020

I am really impressed by this website. Not only is it affordable, but they give a detailed description, instructions, and an example to follow. Also there are additional forms included. And it's State, even county, specific. They do not require a subscription either as you can just order what you want. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph F.

June 10th, 2021

I Found Deeds.com to be fabulous. I had no idea how or where to start to get a quitclaim deed. deeds.com made it effortless and easy to complete the paperwork with great instructions and information. I highly recommend deeds.com

Thank you for your feedback. We really appreciate it. Have a great day!

Iva R.

August 20th, 2020

Great service. Fast, got everything done (form, recording) done in a couple of hours, lightning speed in the real estate world. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Sylvia B.

October 21st, 2020

What a wonderful resource! Forms are so easy to use, made the process a breeze. Deeds even helped with the recording. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard W.

March 25th, 2019

Very nice web site with available forms. Being out of state we appreciated instruction sheet details.

Rick and Jean Weber, Chicago

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melissa W.

July 29th, 2021

So easy to use!

Thank you!

Robert W.

March 26th, 2020

Easier than I thought.

No problem

Nice service

Thank you!

Frankie A.

February 19th, 2021

Deeds.com recorded documents for me without any issue. It's a good service and provides a lot of assistance on its web site. However, I asked for a printed receipt (i.e. an pdf copy of one), but after a staff provided me with an obvious answer, they simply ignored my follow up requests. I also asked a simple formatting question that they should have been able to answer; instead, they passed the buck and referred me to the recorder, which currently is a very time-consuming venture. They also have no telephone number for any issue. Generally, the service saves me the time and effort of physically recording a document, but when you think about $19.00 per recording seems like a steep price for the services rendered.

We appreciate your feedback Frankie. We are glad that we were able to submit your documents as requested. Sorry to hear that we let you down in other areas. We do encourage you to shop around for services that may better suit your needs. Have a wonderful day.