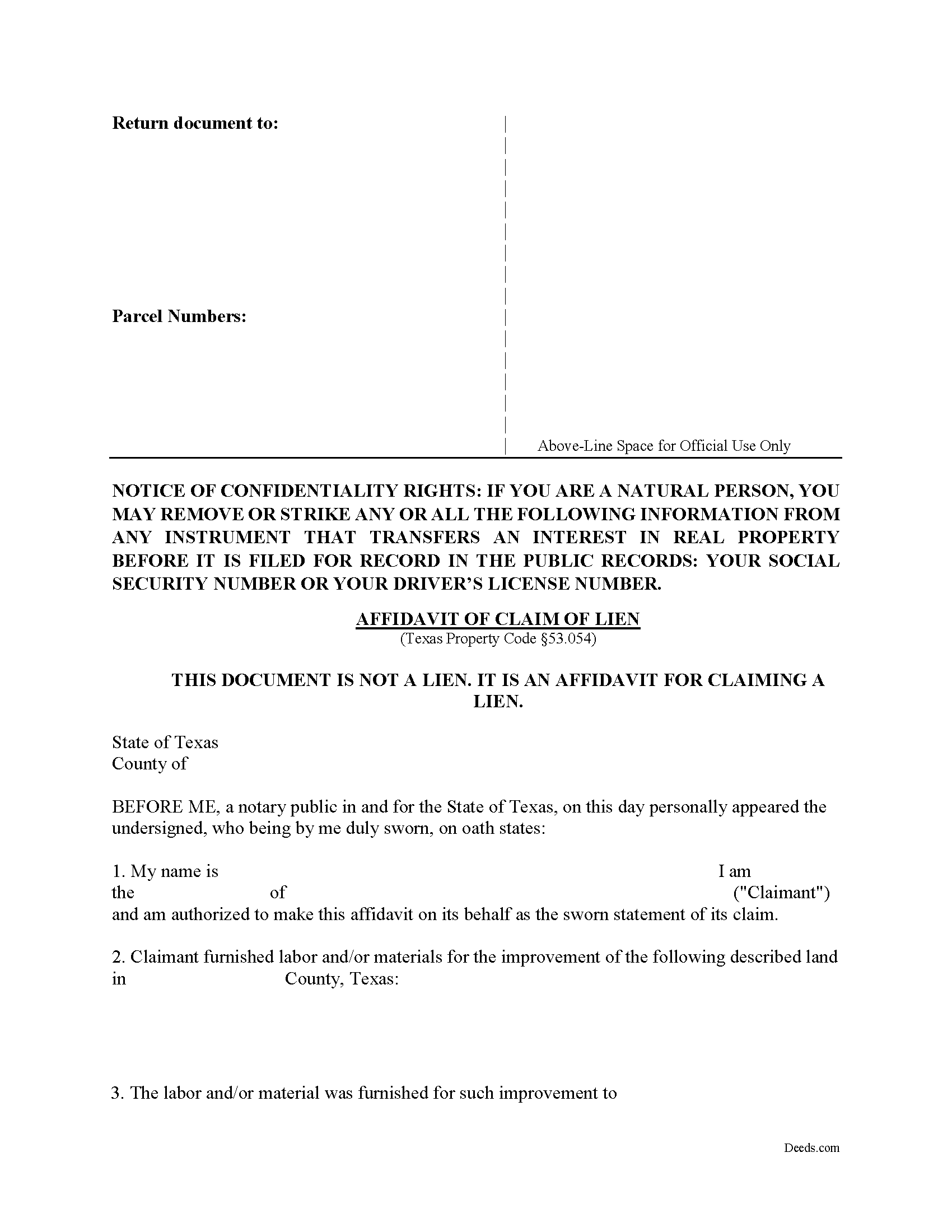

Download Texas Affidavit of Lien Legal Forms

Texas Affidavit of Lien Overview

An affidavit is a sworn statement of fact, in writing, made by an affiant under oath or affirmation, administered by a person lawfully authorized (such as a notary public). In this case, the affiant states that labor or equipment was furnished by the lien claimant and the balance owed remains unpaid. The affidavit is not a lien, but sets out sworn facts based on personal knowledge, that when recorded, will later become the lien. It is a necessary step to perfect (make effective against third parties) the lien.

To claim a lien for a commercial job, the affiant must file an affidavit with the county clerk of the county in which the property is located, not later than the 15th day of the fourth calendar month after the day on which the indebtedness accrues. TEX. PROP. CODE 53.052(a).

Note that for residential construction projects, the claimant must file the affidavit with the county clerk no later than the 15th day of the THIRD (3rd) calendar month after non-payment of the invoice. TEX. PROP. CODE 53.052(b).

The affidavit must substantially comply with the Texas Property Code. Therefore, the it must contain: 1) a signature by the person claiming the lien or by another person on the claimant's behalf; 2) a sworn statement of the amount of the claim; 3) the name and last known address of the owner or reputed owner; 4) a general statement of the kind of work done and materials furnished by the claimant and, for a claimant other than an original contractor, a statement of each month in which the work was done and materials furnished for which payment is requested; 5) the name and last known address of the person by whom the claimant was employed or to whom the claimant furnished the materials or labor; 6) the name and last known address of the original contractor; 7) legally sufficient description of the property to be charged with the lien; 8) the claimant's name, mailing address, physical address (if different); and 9) for a claimant other than an original contractor, a statement identifying the date each notice of the claim was sent to the owner and the method by which the notice was sent. TEX. PROP. CODE 53.054(a). Leave out amounts not related to the value of materials or labor furnished (such as attorney's fees), as these can void the entire lien claim.

When recording the affidavit, attach a copy of any applicable written agreement or contract and a copy of each notice sent to the owner. TEX. PROP. CODE 53.054(b). This is good practice and can help prove the claim by creating a paper trail. The affidavit is not required to set forth individual items of work done or material furnished or specially fabricated and the affiant may use any abbreviations or symbols that are customary in your trade. TEX. PROP. CODE 53.054(c).

After the affidavit is properly recorded it must be served. Send a copy of the affidavit by registered or certified mail to the owner (or reputed owner) at the owner's last known business or residence address not later than the fifth (5th) day after the date the affidavit is filed with the county clerk. TEX. PROP. CODE 53.055(a). If the claimant is not an original contractor, they must also send a copy of the affidavit to the original contractor at the original contractor's last known business or residence address within the same period. TEX. PROP. CODE 53.055(b).

Each case is unique, and the Texas lien law is complex, so contact an attorney with specific questions or for complex situations.