Union County Trustee Deed Form (Tennessee)

All Union County specific forms and documents listed below are included in your immediate download package:

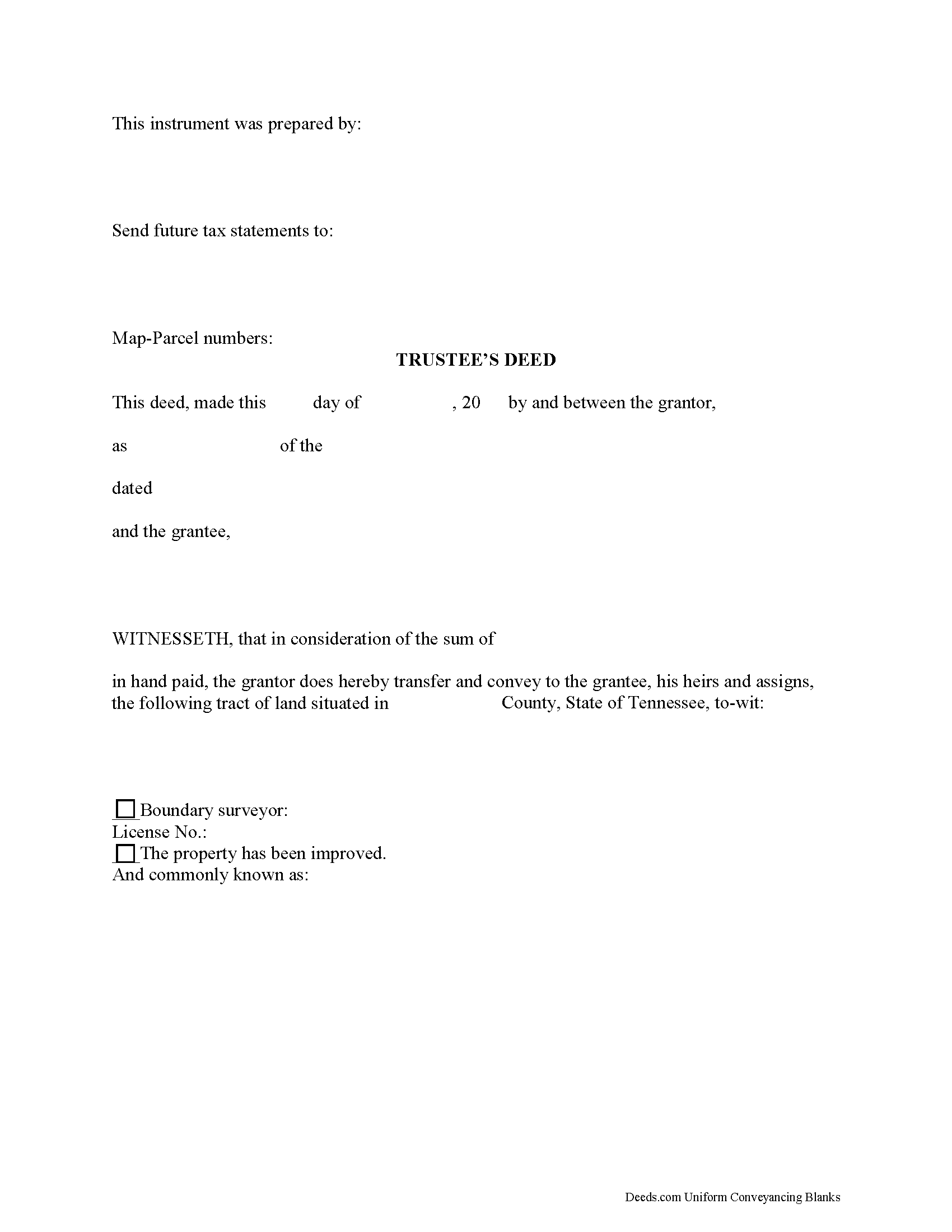

Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Union County compliant document last validated/updated 10/22/2024

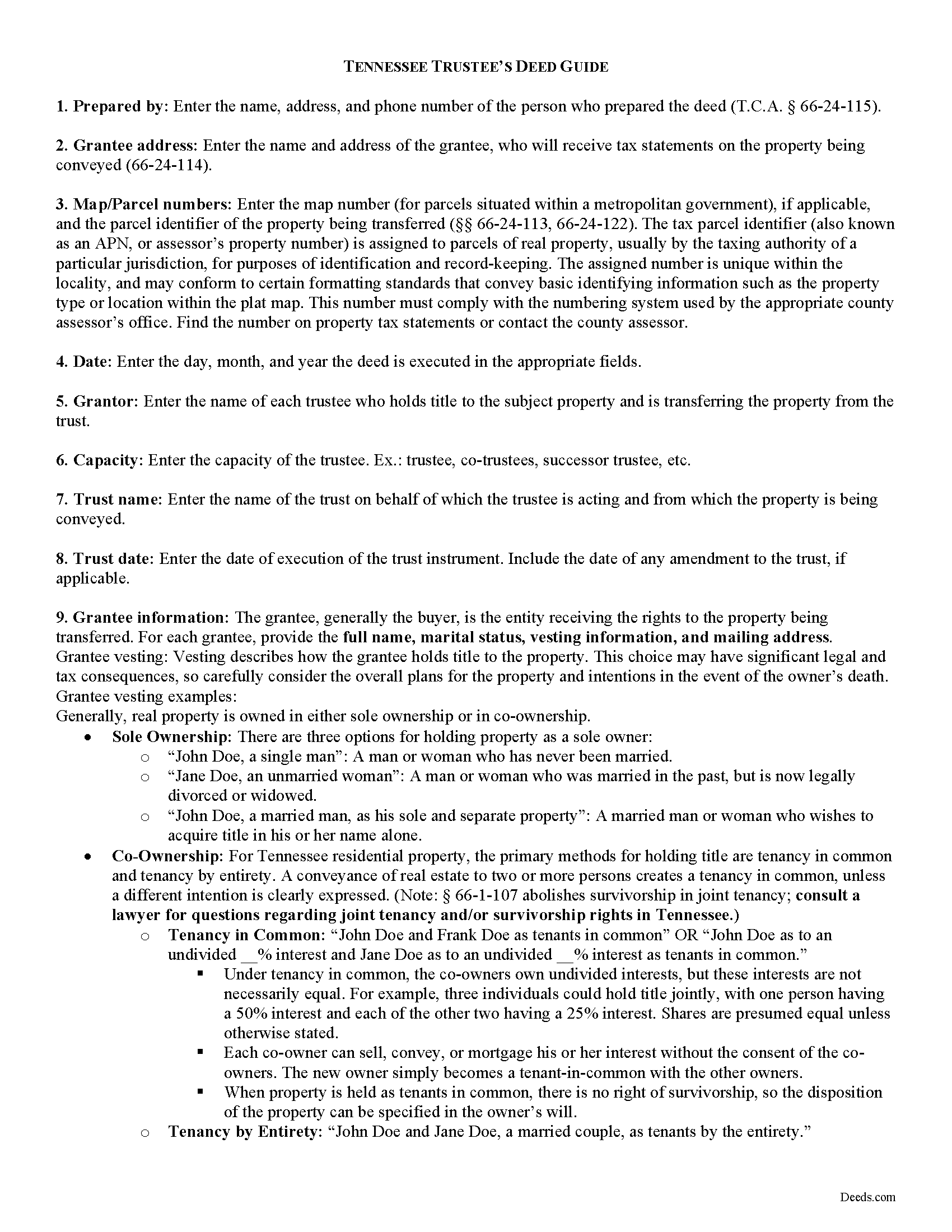

Trustee Deed Guide

Line by line guide explaining every blank on the form.

Included Union County compliant document last validated/updated 11/5/2024

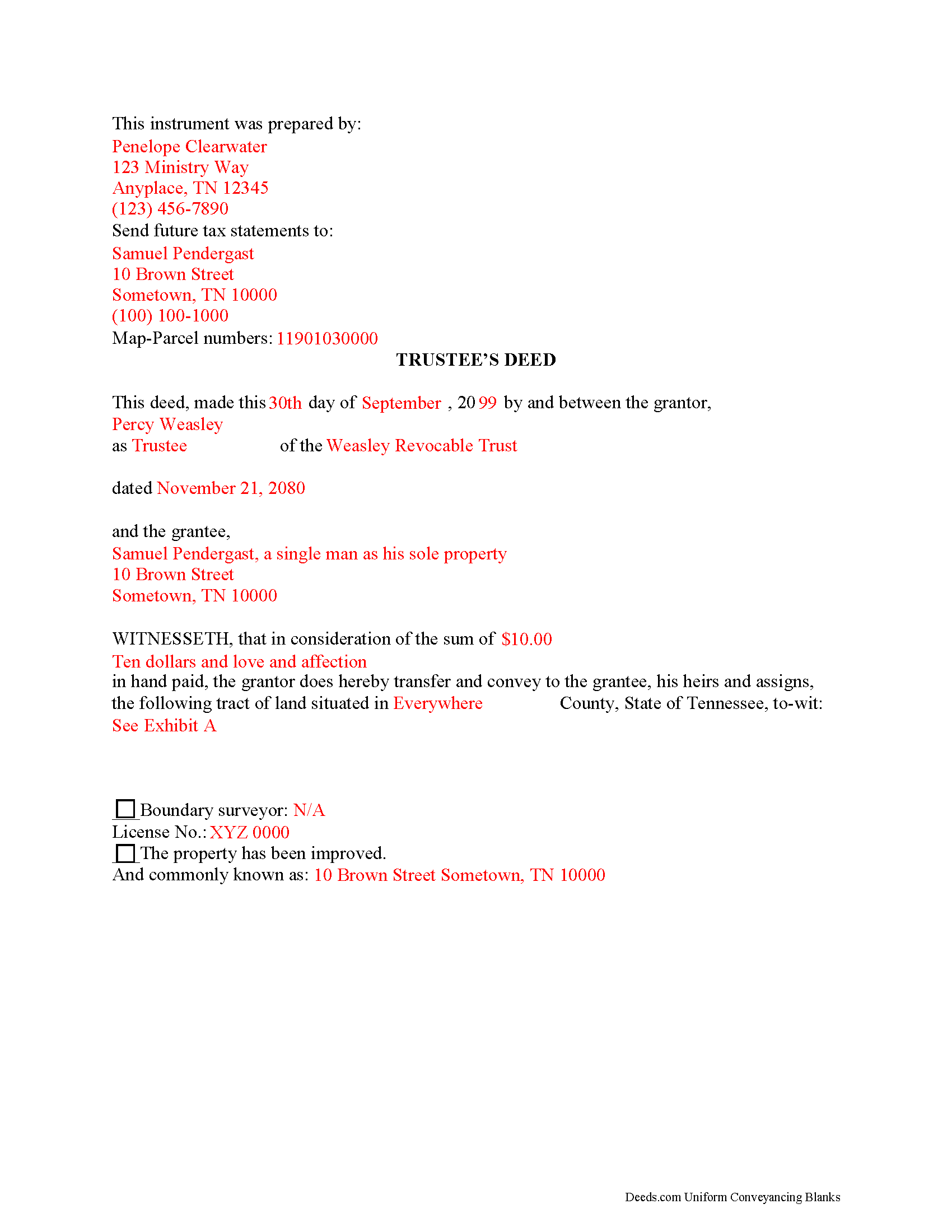

Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

Included Union County compliant document last validated/updated 10/29/2024

The following Tennessee and Union County supplemental forms are included as a courtesy with your order:

When using these Trustee Deed forms, the subject real estate must be physically located in Union County. The executed documents should then be recorded in the following office:

Union County Register of Deeds

901 Main St, Suite 105, Maynardville, Tennessee 37807

Hours: 8:00 to 4:00 Monday through Friday

Phone: (865) 992-8024

Local jurisdictions located in Union County include:

- Luttrell

- Maynardville

- Sharps Chapel

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Union County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Union County using our eRecording service.

Are these forms guaranteed to be recordable in Union County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Union County including margin requirements, content requirements, font and font size requirements.

Can the Trustee Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Union County that you need to transfer you would only need to order our forms once for all of your properties in Union County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Tennessee or Union County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Union County Trustee Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

A trustee's deed transfers interest in real property held in a living trust. A settlor (sometimes called a grantor) creates and funds the trust by transferring assets to another person, called the trustee (though these roles may be performed by the same person). The trustee administers the trust for the benefit of another party, called the beneficiary.

The requirements for a trust in Tennessee are that the settlor has a capacity to create a trust and indicates the intention to do so; the trust has a definite beneficiary; the trustee has duties to perform; and the same person is not the sole trustee and sole beneficiary (T.C.A. 35-15-402). A trust must have lawful purposes and its terms must be for the benefit of the trust beneficiaries ( 35-15-404).

The settlor of a living trust generally indicates the intention to create a trust by executing a trust instrument. This unrecorded document sets forth the terms of the trust, indicating how the settlor intends his assets to be administered (settlors of testamentary trusts, or testators, establish the trust's terms in their wills). The trust document also designates the trustee and his successors, if any, and identifies the trust's beneficiary.

Settlors may fund the trust with real property by executing a deed, titling the property in the name of the trustee on behalf of the trust. If the settlor wishes to convey the real estate from the trust as through sale, the trustee then executes a deed. The trustee's power to sell property held in the trust comes from T.C.A. 35-15-816, and is either fortified or restricted by any relevant powers outlined in the trust instrument.

The trustee's deed to convey real property held in a living trust is named after the executing grantor, rather than after the title warranty the grantor provides. In Tennessee, a trustee's deed is a type of special warranty deed, where warranty of title is limited to anyone claiming by, from, through, or under the grantor. This is a more limited warranty than a general warranty deed, in which the grantor promises to warrant and defend title against all claim. In offering a special warranty, the trustee does "not warrant against defects arising from conditions that existed before" he held title to the property.

The basic components of a trustee's deed are the same as any other deed conveying interest in real property in Tennessee. The document names all parties to the transaction and includes the property description, map and parcel numbers assigned to the property, a recitation of the derivation of title, and an oath of consideration stating the true value of the property conveyed. In addition, the trustee's deed references the trust and trust date, and may include a certification of trust under T.C.A. 35-15-1013 as an attachment to certify the trust's existence and the trustee's authority to enter into the transaction.

A trustee's deed should be acknowledged by the executing trustee in the presence of a notary public before it is recorded in the county in which the subject real property is located. Consult a lawyer in the preparation of a trustee's deed, and with any questions regarding living trusts in Tennessee.

(Tennessee TD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Union County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Union County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4435 Reviews )

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Ann E Grace S.

June 22nd, 2021

Forms and instructions are very easy to access.

Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret T.

May 6th, 2022

Had a difficult time finding my download after purchase. Thankfully I had printed the form and had. However it was read only and I'm not experienced enough to be able to change that. So I went into my word program and typed in the form. I should be able to use it for my purpose. Just glad I was finally able to find it after hours of searching online. I'm in my 70's and not real computer intelligent which may have been part of the problem

Sorry to hear of your struggle Margaret, we will try harder to make our forms easier for everyone.

Phyllis B.

May 24th, 2022

I saved a ton of money doing it on my own versus through legal counsel. When I took it to the auditor/recorder today, there was absolutely no problems.

Thank you for your feedback. We really appreciate it. Have a great day!

Gary K.

November 15th, 2019

Straightforward and pretty easy to use. The only downside is that there is no way to contact them directly. The number on the website is answered only by a voicemail with no return calls.

Pricing seems fair compared to other services and much more efficient that filing "over the counter."

Thank you for your feedback. We really appreciate it. Have a great day!

Phyllis M.

August 3rd, 2019

Using your site was very easy. I found what my friend said she wanted easily and downloaded it to retype her quitclaim deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Maryel T.

December 23rd, 2018

Good site, had the information I needed. Quicker than I expected. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

KATHLEEN S.

January 21st, 2021

Excellent service, great feedback and recommendations by the deed preparer, and I really appreciate the personalized service. The website is amazing, everything is well thought out, and all messages are saved, clear and easy to read. I wish my website was so easy to navigate!

Seriously, the person who worked on my account is awesome. They made recommendations about what to include and what not to include. They didn't make me feel dumb for asking questions about out-of-state service and filing procedures, and I will be using Deeds.com exclusively on my cases. Five stars !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christopher B.

January 13th, 2021

Process went smoothly and will use for my next recording. Only area for improvement would be to provide the ability for the user to delete and replace uploaded documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Brenda B.

March 4th, 2023

Disappointed. Did not get the information requested.

Sorry we were unable to pull the documents you requested. We do hope that you found what you were looking for elsewhere. Have a wonderful day.

MARIO D S.

March 7th, 2020

Well worth the $20.00 for the Transfer on Death Deed, if you are willing to do the leg work to notarize and record the deed. Money well spent and money well saved. The value is in the short, bullet type instructions and State specific forms and requirements.

Thank you!

Sarah A.

August 3rd, 2020

Uploading the document was simple, and it was recorded much faster than I thought! Deeds.com makes the process incredibly easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tracie R.

December 24th, 2019

Great company and very fast at getting deeds to me. :)5 star!!

Thank you!