Macon County Notice of Spousal Non-Responsibility Form (Tennessee)

All Macon County specific forms and documents listed below are included in your immediate download package:

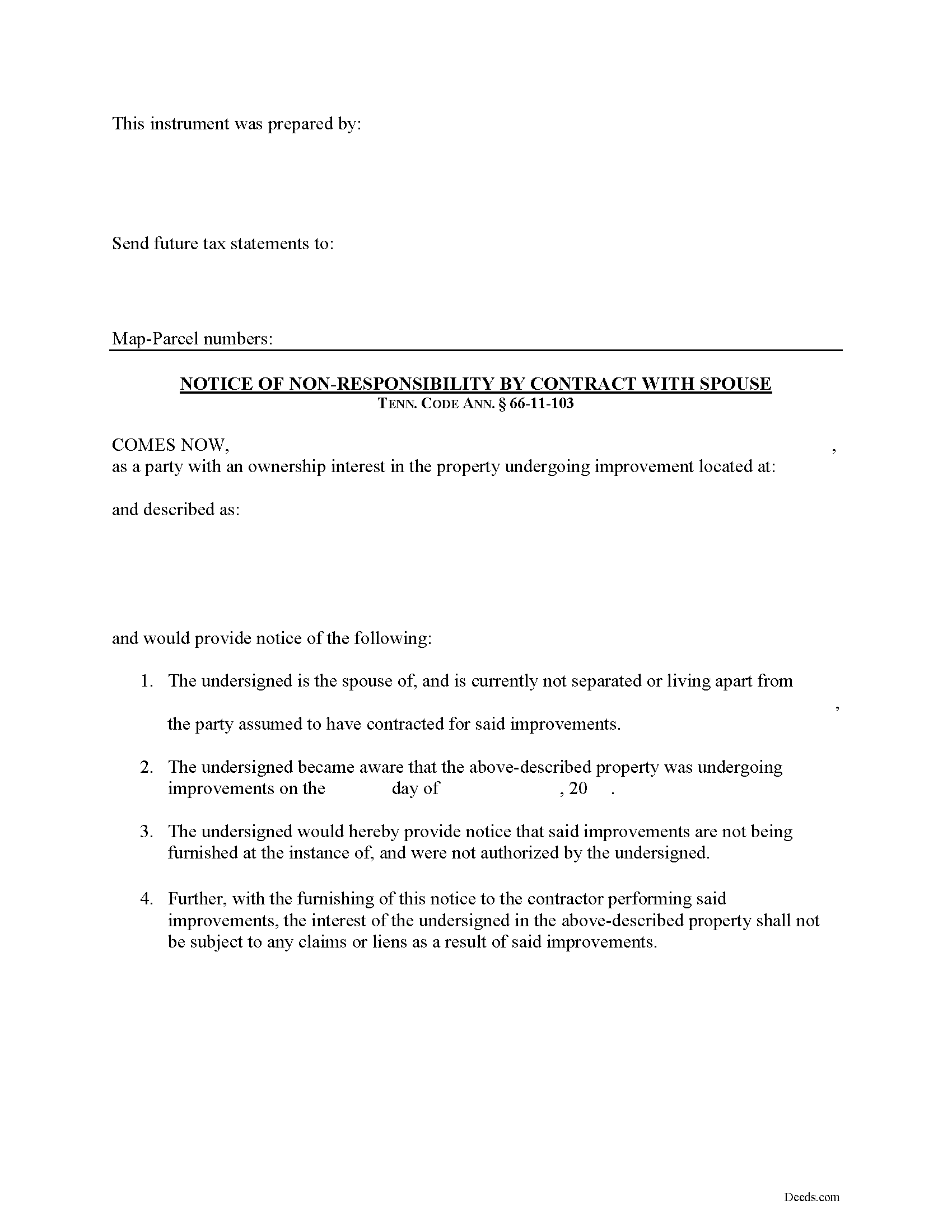

Notice of Spousal Non-Responsibility Form

Fill in the blank Notice of Spousal Non-Responsibility form formatted to comply with all Tennessee recording and content requirements.

Included Macon County compliant document last validated/updated 10/8/2024

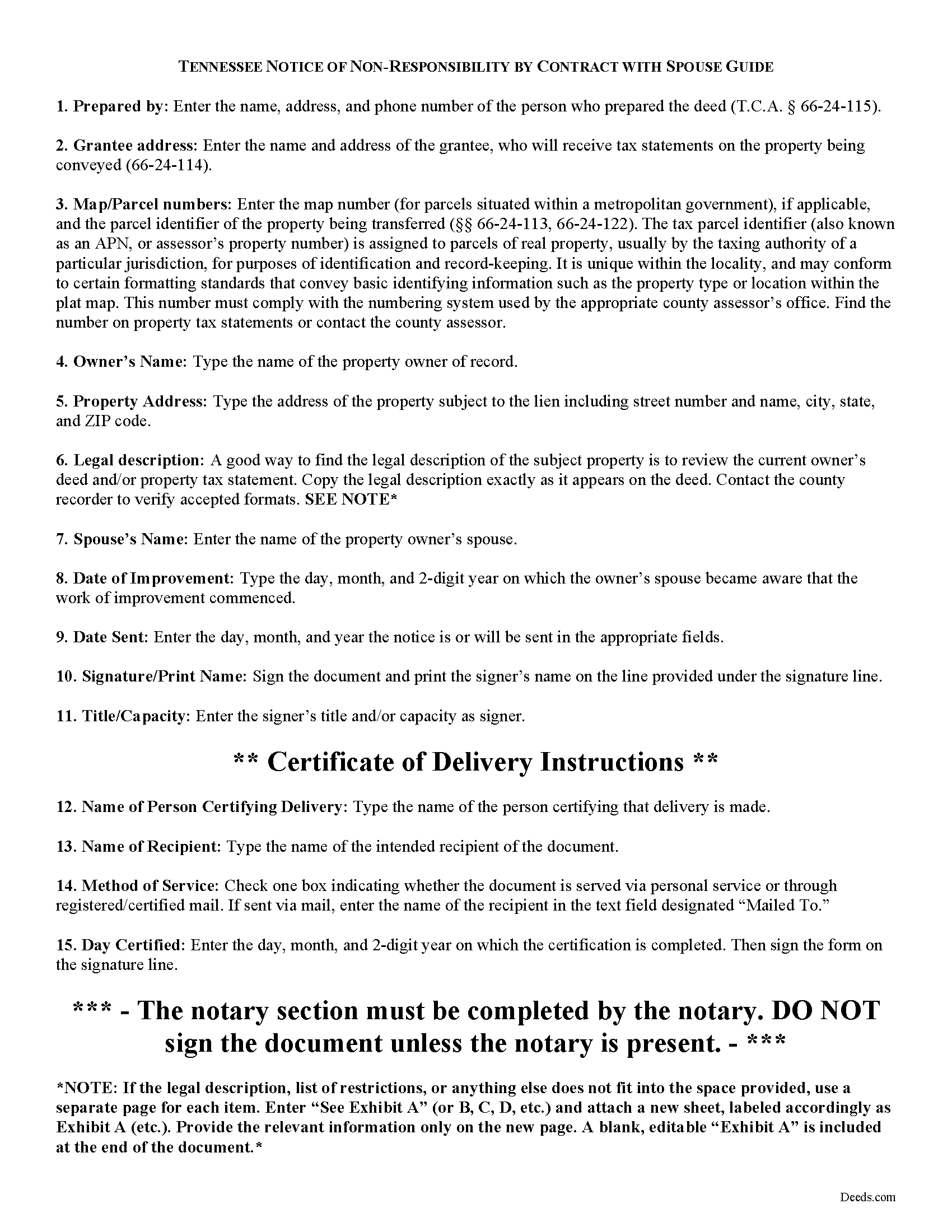

Notice of Non-Responsibility Guide

Line by line guide explaining every blank on the form.

Included Macon County compliant document last validated/updated 7/3/2024

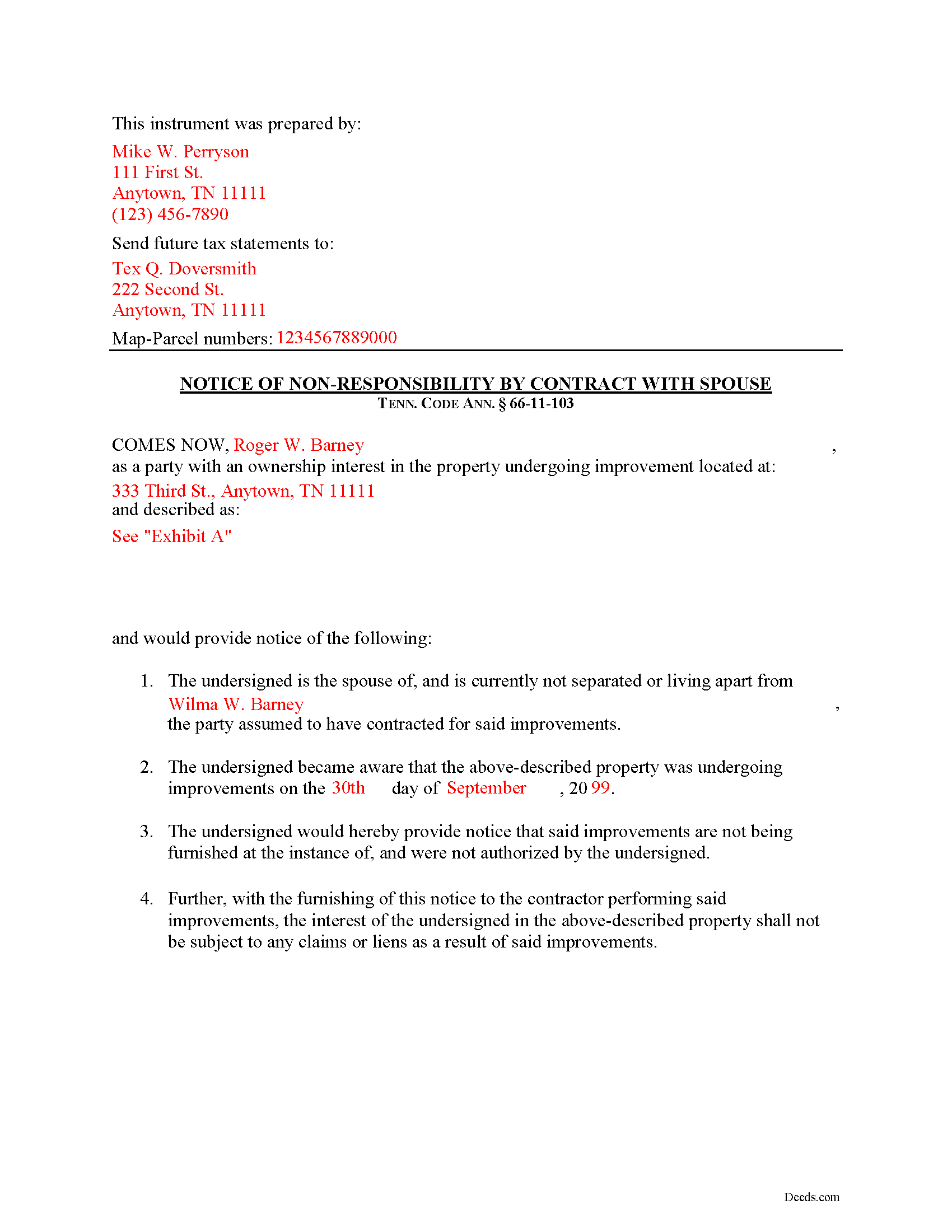

Completed Example of the Notice of Non-Responsibility Document

Example of a properly completed form for reference.

Included Macon County compliant document last validated/updated 5/6/2024

The following Tennessee and Macon County supplemental forms are included as a courtesy with your order:

When using these Notice of Spousal Non-Responsibility forms, the subject real estate must be physically located in Macon County. The executed documents should then be recorded in the following office:

Macon County Register of Deeds

102 County Courthouse, Lafayette, Tennessee 37083

Hours: 8:00 to 4:00 M-F

Phone: (615) 666-2353

Local jurisdictions located in Macon County include:

- Lafayette

- Red Boiling Springs

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Macon County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Macon County using our eRecording service.

Are these forms guaranteed to be recordable in Macon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Macon County including margin requirements, content requirements, font and font size requirements.

Can the Notice of Spousal Non-Responsibility forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Macon County that you need to transfer you would only need to order our forms once for all of your properties in Macon County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Tennessee or Macon County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Macon County Notice of Spousal Non-Responsibility forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Tennessee Notice of Non-Responsibility by Contract with Spouse

Under Tennessee Property Code section 66-11-103, spouses are awarded certain protections from mechanic's lien if a notice of objection to the contract is timely filed. The form of the notice is called a "Notice of Non-Responsibility by Contract with Spouse."

When the contract for improving real property is made with a husband or a wife who is not separated and living apart from that person's spouse, and the property is owned by the other spouse or by both spouses, the spouse who is the contracting party shall be deemed to be the agent of the other spouse unless the other spouse serves the prime contractor with written notice of that spouse's objection to the contract within ten (10) days after learning of the contract. Tenn. Prop. Code 66-11-103.

This document identifies the parties, the location and starting date of the project, and specifically states that the filing spouse accepts no obligations related to the improvement. If the notice is filed within the required ten-day period after learning of the contract, it can be a powerful tool to avoid any lien being placed on the spouse's property interest.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any questions about the Notice of Non-Responsibility or for any other issues regarding mechanic's liens.

Our Promise

The documents you receive here will meet, or exceed, the Macon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Macon County Notice of Spousal Non-Responsibility form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

A R M.

May 1st, 2021

Great so far. Just downloaded all the documents, and they seem to be easy to save and are fillable.

A R M

Thank you for your feedback. We really appreciate it. Have a great day!

Judy W.

May 12th, 2021

It would be helpful if the numbers on the instruction sheet were on the form. I was confused on page two if the signatures were for witnesses or buyer (grantee).

I do like the form and will use it in the future.

Also page one Grantee's signature only has one line and if there are two buyers need another line.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert B.

January 18th, 2019

Liked the fact that the forms were fill in the blank. Good to have the option of re-doing them if needed, and I needed ;)

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa A.

January 3rd, 2024

I am so thankful for the time saved by using Deeds.com. Not having to run downtown and stand in line is awesome!

We are delighted to have been of service. Thank you for the positive review!

Mary D.

January 21st, 2022

Gift Deed is exactly what was required. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

John C.

February 26th, 2024

Ease and speed of recording are remarkable. This is especially true of deeds with problems: I often get feedback within minutes and can correct problems immediately and still complete the filing in the same day. I wish more counties accepted electronic filing! It would be helpful to list counties that do/do not accept electronic filing so I would not have to upload documents to find out my effort was fruitless.

We are grateful for your feedback and looking forward to serving you again. Thank you!

John Z.

November 5th, 2021

Very easy to use. Straight forward. Am glad I found the tools to process an important document of property ownership. Thanks much. Will recommend to friends and family.

Thank you!

FRANK O.

March 1st, 2019

Easy to download and use the forms, however two forms needed for my county recording were not included.

Thank you for your feedback Frank. We'll look into finding and including the additional supplemental documents. Sometimes supplemental documents have to be generated by the county's system, specific to the transaction.

William S.

June 4th, 2021

Contents were well done. Could not remove and replace the "Deeds/" footer, rendering the form unusable for filing with a court and county deed records. This should be corrected.

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

July 1st, 2024

The service provided by the staff at Deeds.com is consistently excellent with prompt replies and smooth recording transactions. I am grateful to have their service available as driving to downtown Phoenix to record documents is always a daunting prospect. Their assistance in recording our firm's documents has been 100% accurate and a pleasure.

Thank you for your positive words! We’re thrilled to hear about your experience.

Steven H.

July 12th, 2019

Great Product!!! Used the more commonly known websites before, but never again. It was easy, great examples to follow so that I was sure and confident that I completed the document correctly. Thank You!

Thank you for your feedback. We really appreciate it. Have a great day!

Vicki G.

November 24th, 2020

Thank you for this service, saved me from driving down town. It was quick and very easy to navigate. Have a great Thanksgiving break.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!