Anderson County Notice of Mechanics Lien Form (Tennessee)

All Anderson County specific forms and documents listed below are included in your immediate download package:

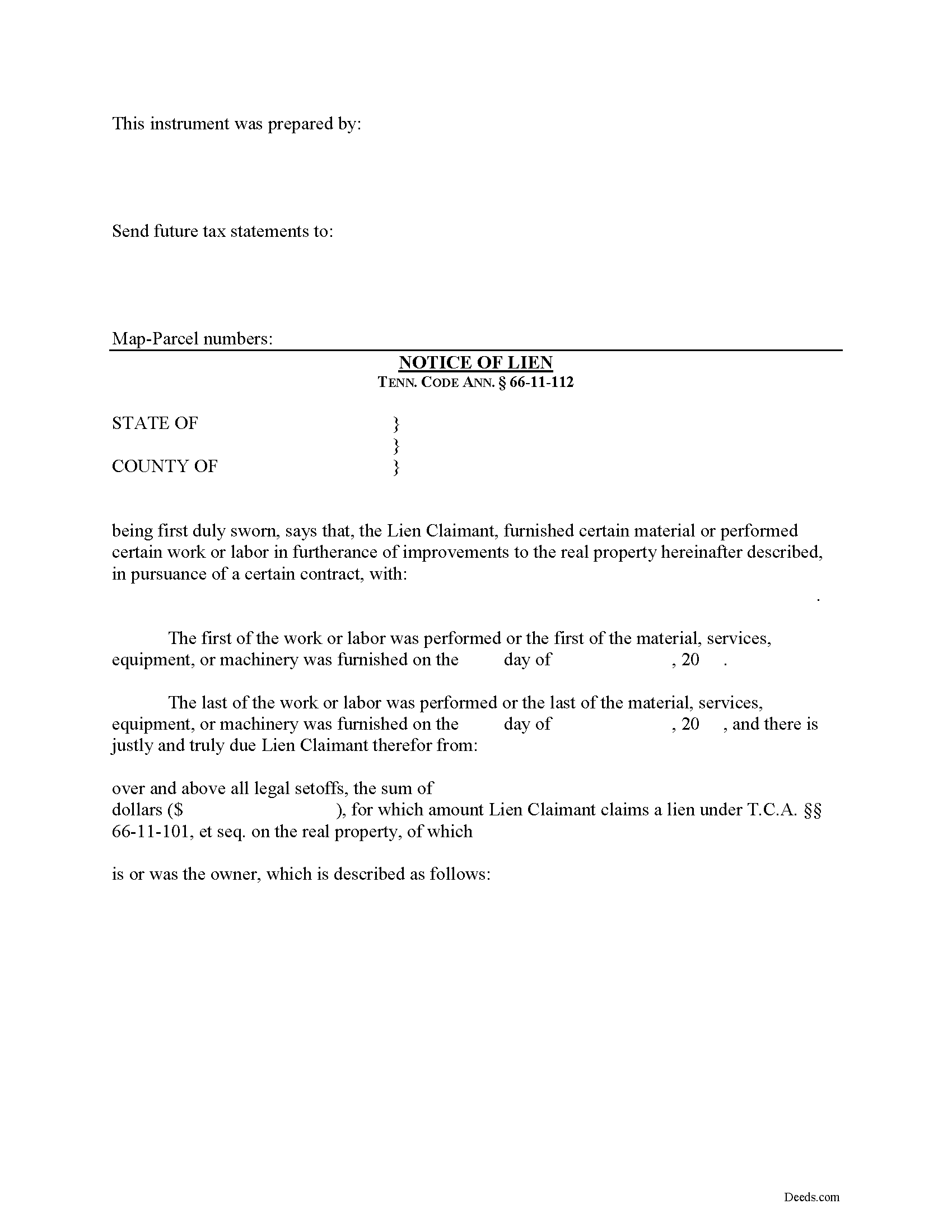

Notice of Mechanics Lien Form

Fill in the blank Notice of Mechanics Lien form formatted to comply with all Tennessee recording and content requirements.

Included Anderson County compliant document last validated/updated 11/26/2024

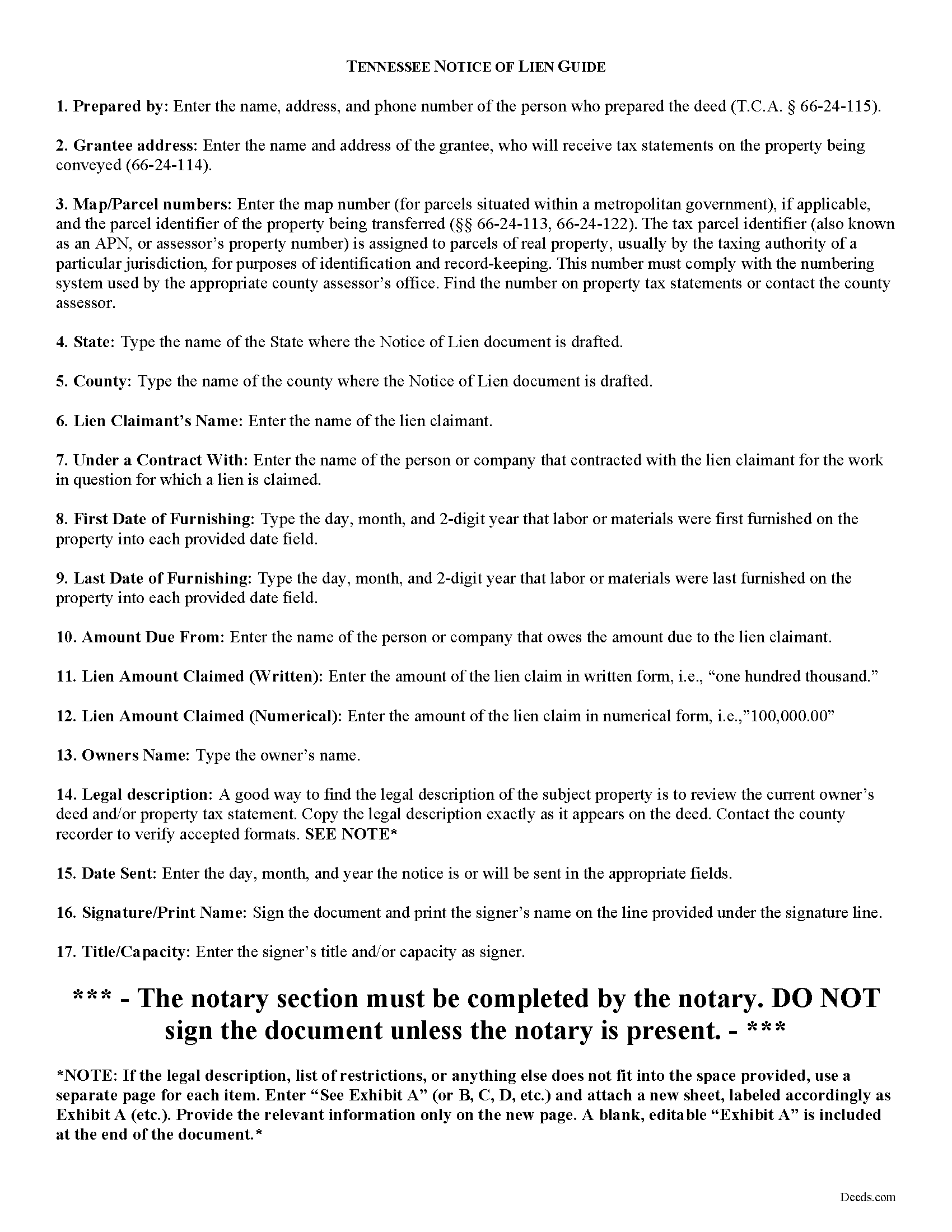

Notice of Mechanics Lien Guide

Line by line guide explaining every blank on the form.

Included Anderson County compliant document last validated/updated 10/29/2024

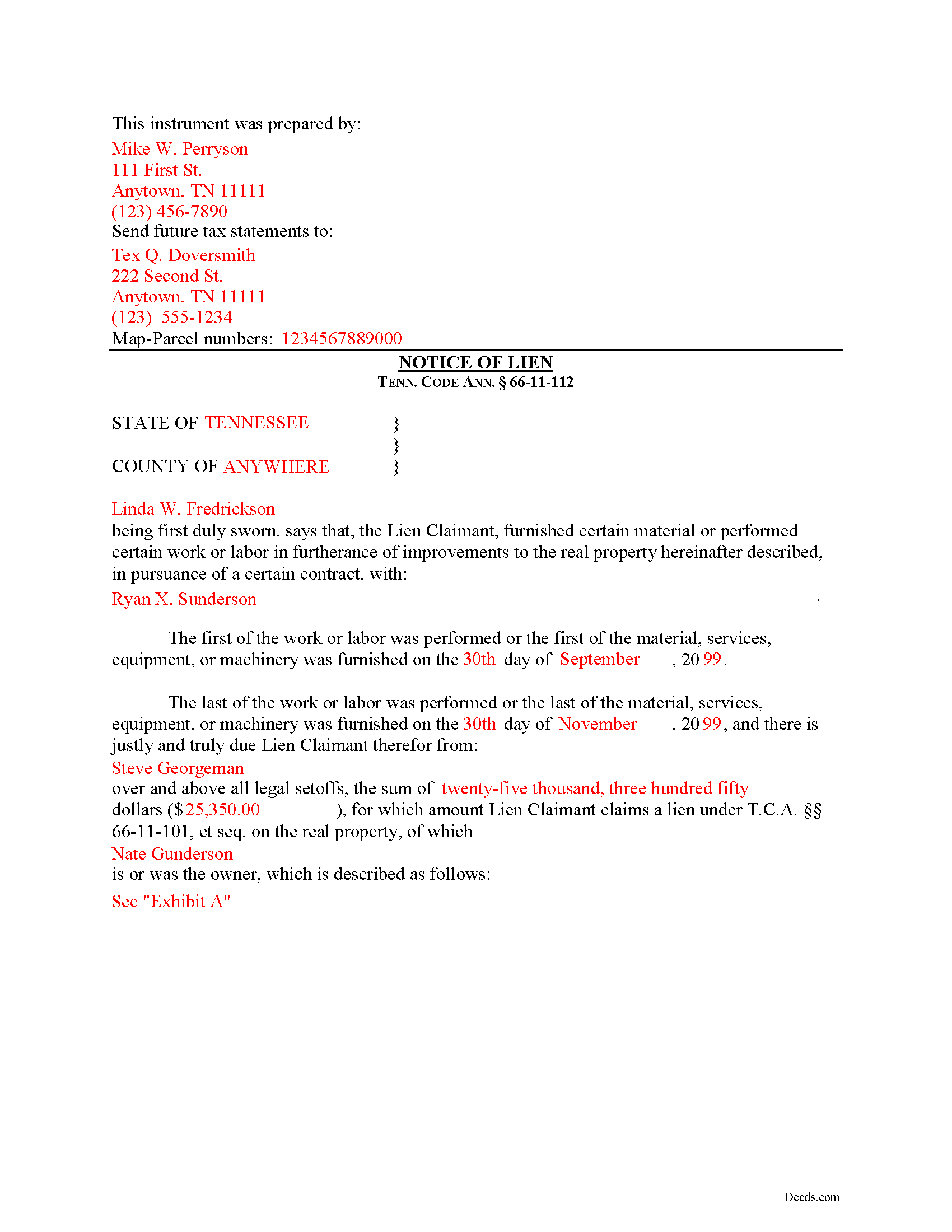

Completed Example of the Notice of Mechanics Lien Document

Example of a properly completed form for reference.

Included Anderson County compliant document last validated/updated 12/19/2024

The following Tennessee and Anderson County supplemental forms are included as a courtesy with your order:

When using these Notice of Mechanics Lien forms, the subject real estate must be physically located in Anderson County. The executed documents should then be recorded in the following office:

Anderson County Register of Deeds

100 North Main St, Suite 205, Clinton, Tennessee 37716

Hours: 8:00 to 5:00 M-F

Phone: (865) 457-6236

Local jurisdictions located in Anderson County include:

- Andersonville

- Briceville

- Clinton

- Lake City

- Norris

- Oak Ridge

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Anderson County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Anderson County using our eRecording service.

Are these forms guaranteed to be recordable in Anderson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Anderson County including margin requirements, content requirements, font and font size requirements.

Can the Notice of Mechanics Lien forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Anderson County that you need to transfer you would only need to order our forms once for all of your properties in Anderson County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Tennessee or Anderson County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Anderson County Notice of Mechanics Lien forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Filing a Mechanic's Lien Claim in Tennessee

Mechanic's Liens are used to place a block or burden on a property owner's title when a claimant (such as a contractor or materials supplier) has not been paid for labor, materials, or equipment provided. In Tennessee, mechanic's liens are governed under Chapter 11 of the Tennessee Property Code.

In order to preserve the priority of the lien, as it concerns subsequent purchasers or encumbrancers for a valuable consideration without notice of the lien, the lienor, is required to record in the office of the register of deeds of the county where the real property, or any part affected, lies, a sworn statement of the amount for, and a reasonably certain description of the real property on, which the lien is claimed. Tenn. Prop. Code 66-11-112(a).

The recording party shall pay filing fees, and shall be provided a receipt for the filing fees, which amount shall be part of the lien amount. Id. The recordation must be done no later than ninety (90) days after the date the improvement is complete or is abandoned, prior to which time the lien shall be effective as against the purchasers or encumbrancers without the recordation. Id.

The owner must serve thirty (30) days' notice on prime contractors and on all of those lienors who have served notice in accordance with Tenn. Prop. Code 66-11-145 (the notice of non-payment) prior to the owner's transfer of any interest to a subsequent purchaser or encumbrancer for a valuable consideration. Id.

If the sworn statement is not recorded within that time, the lien's priority as to subsequent purchasers or encumbrancers shall be determined as if it attached as of the time the sworn statement is recorded. Id. Therefore, timely recording is of the utmost importance to protect full lien rights.

According to Tennessee Prop. Code 66-11-112(b), a building, structure or improvement is deemed to have been abandoned for purposes of the lien law when there is a cessation of operation for a period of ninety (90) days and an intent on the part of the owner or prime contractor to cease operations permanently, or at least for an indefinite period. If either of these occur, it is time to file your lien.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any issues regarding mechanic's liens.

Our Promise

The documents you receive here will meet, or exceed, the Anderson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Anderson County Notice of Mechanics Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David H.

June 8th, 2020

Exceeded expectations; bundle included not only the form but also detailed instructions and definitions and a completed "John Doe" example.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donald P.

November 12th, 2019

Very fast and efficient. Easy to fill out but was upset the latest tax exemptions ruled in 2014 did not seem to be included. Exclusion of sale to blood relatives, etc. _ the one I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Lucus S.

May 19th, 2022

I tried to do it myself by copying an old deed and ended up with a bunch of headaches (expensive ones) wish I would have used these documents first. Live and learn.

Thank you!

Remi W.

April 13th, 2020

Submitting documents electronically through Deeds.com saved me time and provided the best possible service for me in the comfort of my own home. There's no faster, better way to record documents than e-recording with Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

M. TIMOTHY P.

February 17th, 2021

EXCELLENT service! Deed came back within minutes!

Thank you for your feedback. We really appreciate it. Have a great day!

Kelly L.

April 15th, 2019

So far so good. Please make the payment method easier after the information has been uploaded and submitted.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lucinda L.

December 29th, 2021

mostly good; however, you need to update the annual exclusion gift amount from $14,000 to $15,000 (where it has ben for several years), and you need to make your Gift Deed final paragraph be gender neutral like "they" or "he or she" rather than just"he". We women lawyers and our women clients appreciate that.

Thank you for your feedback. We really appreciate it. Have a great day!

George T.

August 10th, 2019

Very good. Thanks.

Thank you!

Gretchen N.

February 8th, 2019

The filled out form could have been placed on the real form then deleted with current info. Form quite simplified but example & help good.

Thank you for your feedback Gretchen.

Sandra N.

April 13th, 2019

Very quick and painless process!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rebecca H.

May 22nd, 2021

I thought the forms were reasonably priced, the instructions included in the packet were thorough, and the examples helpful. Thank you for the additional CDR forms too. I contacted the Recorder's office via email with a question and Jennifer Bowser answered promptly. Job well done! However, when I delivered the deed and Real Property Transfer Declaration to the Clerk's office in Lafayette, the clerk was unfamiliar with the Declaration document being submitted and it took some time to convince her to submit the form without charging the recording fee. She even tried to phone the recorder's office for clarification, but no one answered. There then was an additional form at that office that I had to complete called Recording Request/Transmittal Form. I would suggest including that form with instructions in your on-line packet to speed up the process when a Deed is delivered to the County Clerk's satellite office. I do not expect every clerk to know all the particulars of recording requirements but a little knowledge wouldn't hurt.

Thank you for your feedback. We really appreciate it. Have a great day!

Kelli M.

April 27th, 2020

It is easy to use but difficult to know when the document has been reviewed for recording and when the invoice is ready. It would be helpful for the website to send an email automatically once the document(s) are ready to be recorded to let you know what the time line is.....Thank you for your help.

Thank you for your feedback. We really appreciate it. Have a great day!