Cannon County Affidavit of Heirship Form (Tennessee)

All Cannon County specific forms and documents listed below are included in your immediate download package:

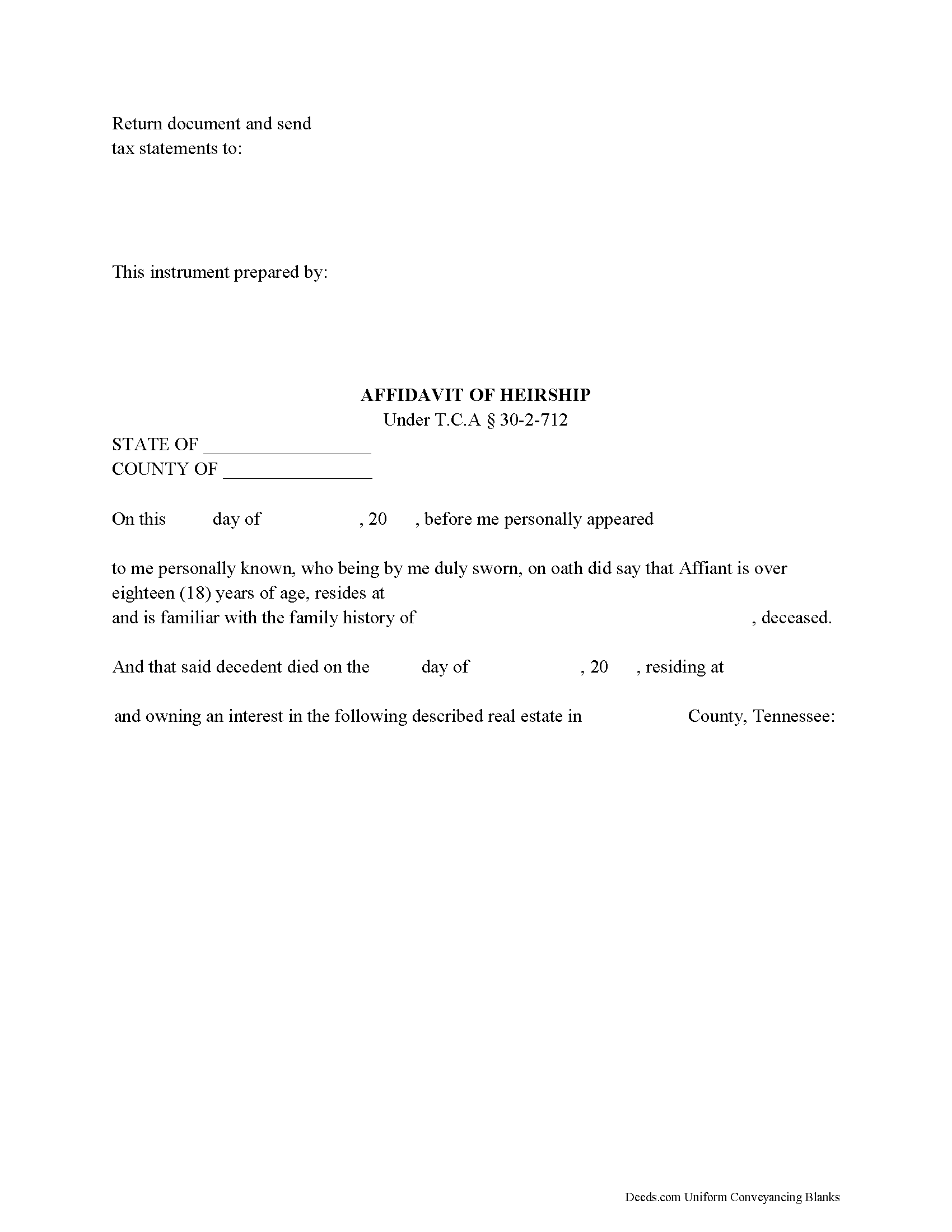

Affidavit of Heirship Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Cannon County compliant document last validated/updated 10/22/2024

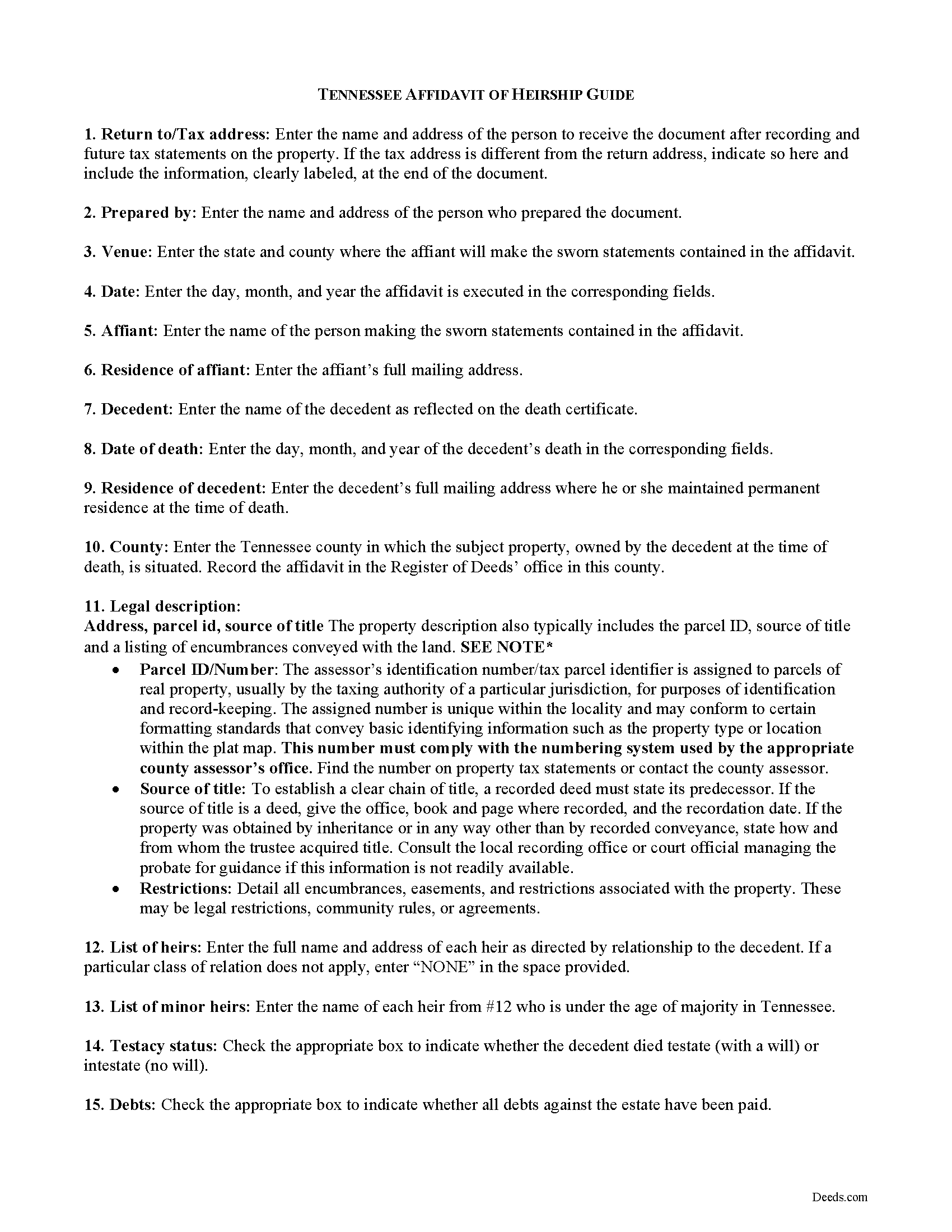

Affidavit of Heirship Guide

Line by line guide explaining every blank on the form.

Included Cannon County compliant document last validated/updated 12/16/2024

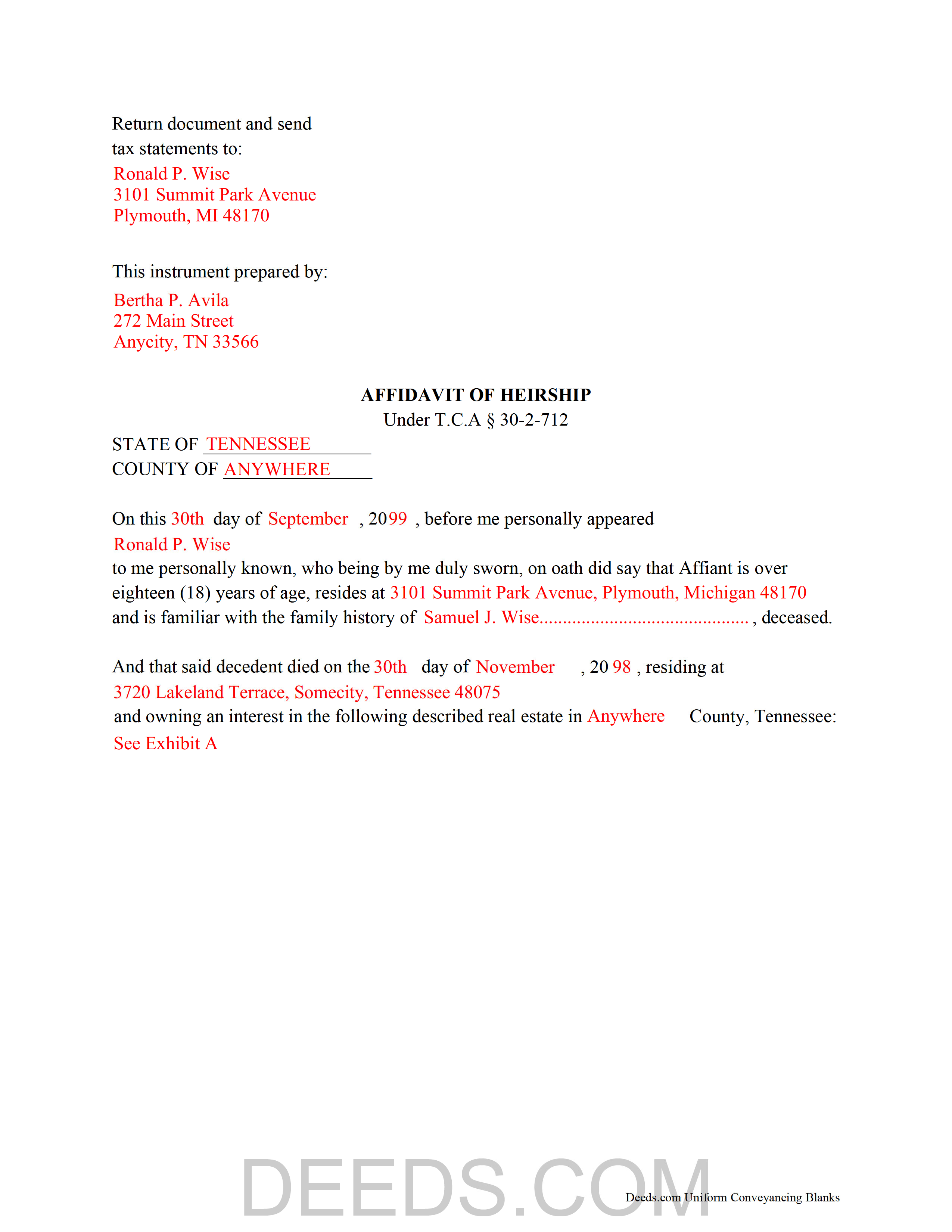

Completed Example of a Affidavit of Heirship Document

Example of a properly completed form for reference.

Included Cannon County compliant document last validated/updated 7/10/2024

The following Tennessee and Cannon County supplemental forms are included as a courtesy with your order:

When using these Affidavit of Heirship forms, the subject real estate must be physically located in Cannon County. The executed documents should then be recorded in the following office:

Cannon County Register Of Deeds

200 W Main, Woodbury, Tennessee 37190

Hours: 8:30 to 4:30 M-F

Phone: (615) 563-2041

Local jurisdictions located in Cannon County include:

- Auburntown

- Bradyville

- Readyville

- Woodbury

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Cannon County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Cannon County using our eRecording service.

Are these forms guaranteed to be recordable in Cannon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cannon County including margin requirements, content requirements, font and font size requirements.

Can the Affidavit of Heirship forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Cannon County that you need to transfer you would only need to order our forms once for all of your properties in Cannon County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Tennessee or Cannon County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Cannon County Affidavit of Heirship forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The affidavit of heirship, sometimes called an affidavit of inheritance, is a statutory form under T.C.A. 30-2-712.

An affidavit of heirship, when recorded, gives notice of a change in title following the death of a real property owner. It is typically recorded when the decedent has died intestate, or without a last will and testament. The affidavit names the decedent and the heirs who, by operation of law, are the current owners of the property.

The affiant, or person making the sworn statements contained in the affidavit, is anyone having knowledge of the facts contained within. A standard affidavit of heirship contains the legal description and map parcel number of the realty and lists the heirs by name, address, and relation to the decedent.

In addition, if not followed by a recorded deed from one or all heirs, the affidavit requires the tax bill address for tax statements on the property and a prior title reference stating the type of document and book, page, and recording date of the instrument granting title to the decedent.

This is a general affidavit of heirship. Your situation may require more specific information. Consult a lawyer when preparing the affidavit to ensure all necessary information is included and to understand the legal implications of the document.

(Tennessee AOH Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Cannon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cannon County Affidavit of Heirship form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

KAREN I.

May 14th, 2024

it worked. fantastic. thanks!

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Wendy S.

December 19th, 2019

Very easy and affordable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Craig P.

August 19th, 2019

Good

Thank you!

Douglas C.

July 24th, 2020

Even for a novice like me, this site was easy to use, with very clear & simple options and instructions. I wish every web site was as good!

Thank you for your feedback. We really appreciate it. Have a great day!

Ron B.

September 16th, 2020

Most complete and affordable documents that I was able to locate online. Excellent printed out presentation. Very professional. More than happy with results.

Thank you!

Fernando C.

April 13th, 2019

I was able to get what I needed!! Easy and fast!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Larry H.

March 29th, 2019

Wow! So easy and such a cost savings. Thanks

Thanks Larry, we appreciate your feedback.

Lan S.

November 23rd, 2020

extremely satisfied with the service. I could not get file size correctly at the beginning. I received quick responses pointing out specific problem, which was very helpful for me to correct the mistake. It took 5 or 6 times due to different errors to finally achieve the qualified version. The customer care team was very patient walking me through the process.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Valerie S.

July 16th, 2020

The service was easy, fast, and cheap and we were able to close our sale 2 days after we downloaded the deed! Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Jane D.

February 5th, 2021

Very easy to navigate and we get exactly what we need, when we need it! Also, they keep Tra k of previous purchases, so you don't have to repurchase! It's great!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carolyn D.

March 18th, 2022

The sight provided exactly what I needed and was easy to use. I was able to download the type of Deed I used and was completely satisfied with the website.

Thank you!

Jason B.

May 9th, 2019

Providing .doc versions would be much easier than trying to jam information into a non-editable PDF.

Thank you for your feedback. We really appreciate it. Have a great day!