Download South Dakota Personal Representative Deed of Distribution Legal Forms

South Dakota Personal Representative Deed of Distribution Overview

In South Dakota, title to a decedent's real property devolves upon death to the decedent's devisees (for testate estates) and heirs (for intestate estates) (SDCL 29A-3-101). Though the title transfers by operation of law, the estate is still subject to administration in probate. Probate is the legal process of settling the decedent's estate and distributing assets to those entitled to receive them.

In probate proceedings, governed by Title 29A of the South Dakota Codified Laws, a personal representative (PR) is appointed to the estate by the probate court to act as the estate's fiduciary. After paying valid claims on the estate, applicable taxes, and expenses of administration, the PR is responsible for making distributions of property. Any part of the estate not disposed of by will is transferred by South Dakota's laws of intestate succession, located at SDCL 29A-2.

The PR executes a deed of distribution "as evidence of the distributee's title" (29A-3-907). A recorded deed of distribution is "conclusive evidence that the distributee has succeeded to the interest of the decedent...as against all persons interested in the estate," though the PR may recover the assets in case of improper distribution (SDCL 29A-3-908, Title Standard 15-06). Since title devolves by process of law, a deed of distribution simply evidences that the distributee is the rightful owner, and maintains an accurate chain of title.

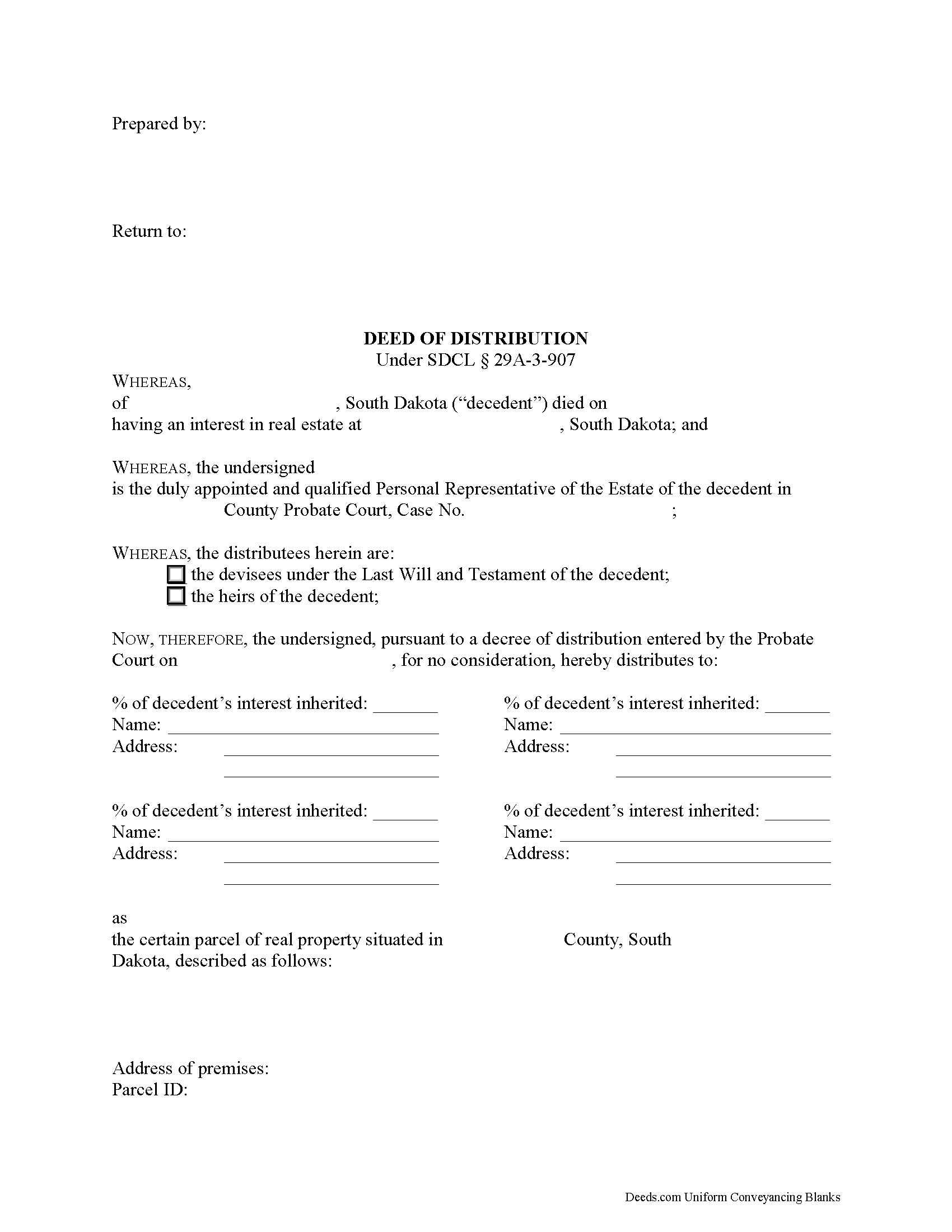

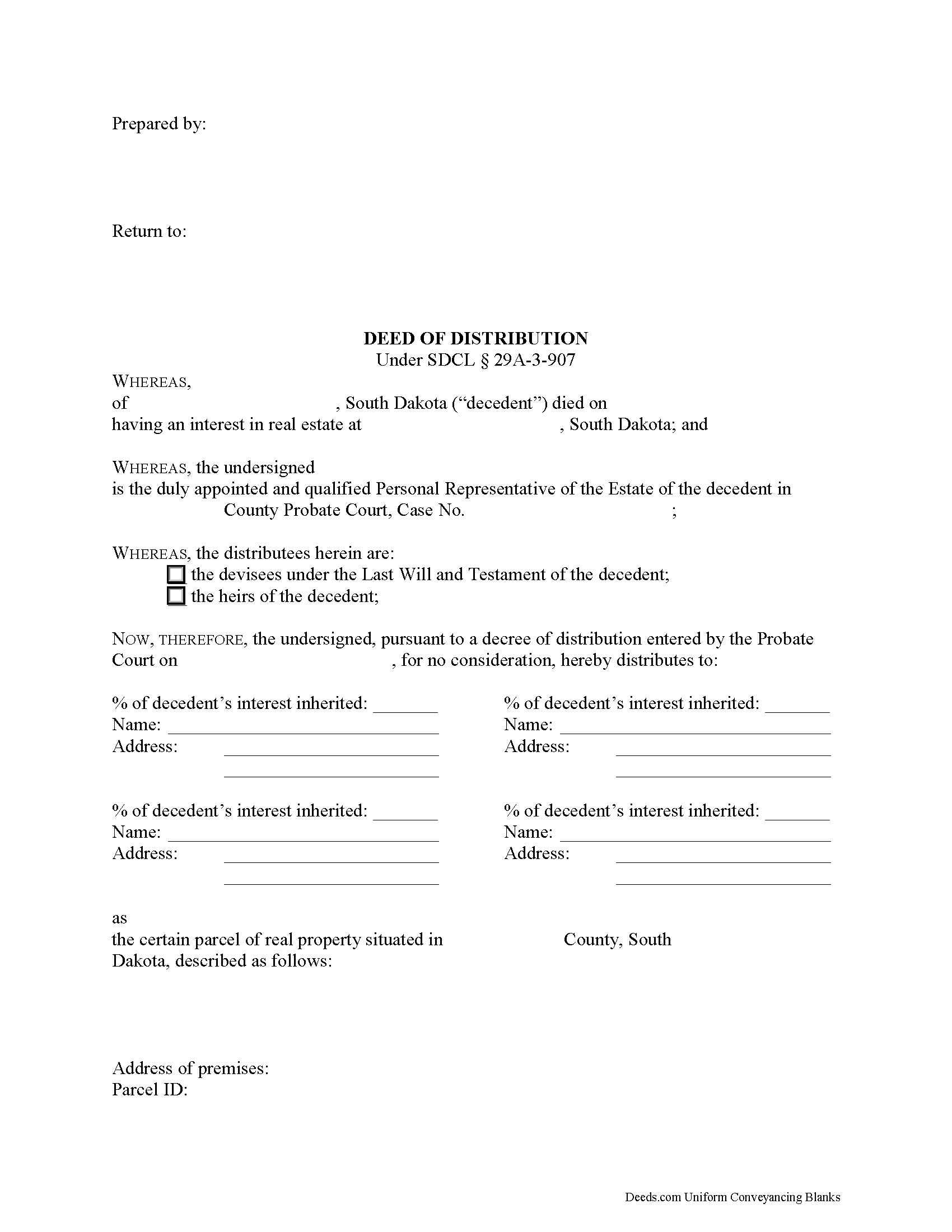

The document recites information concerning the probated estate, including the decedent's name, date of death, county of probate, and the case number assigned to the estate by the court. In addition, the deed names the duly qualified and acting personal representative. The deed should identify the classification of the named distributees (either devisees under a will or heirs in an intestate estate), and name each distributee and the percent of the decedent's interest in the subject property he or she is inheriting, along with each distributee's address.

As with any conveyance of an interest in real property, a full legal description of the subject parcel is required. Any restrictions of title should be noted on the face of the deed. Distributions from an estate are exempt from transfer fees pursuant to SDCL 43-4-22(10). Finally the form must meet all state and local standards for recorded documents.

The PR must sign the deed in the presence of a notary public before recording in the Register of Deeds office in the county where the property is situated.

Consult an attorney with questions regarding deeds of distribution, or for any other issues related to probate in South Dakota, as each situation is unique.

(South Dakota PRDOD Package includes form, guidelines, and completed example)