Dillon County Personal Representative Deed of Sale Form (South Carolina)

All Dillon County specific forms and documents listed below are included in your immediate download package:

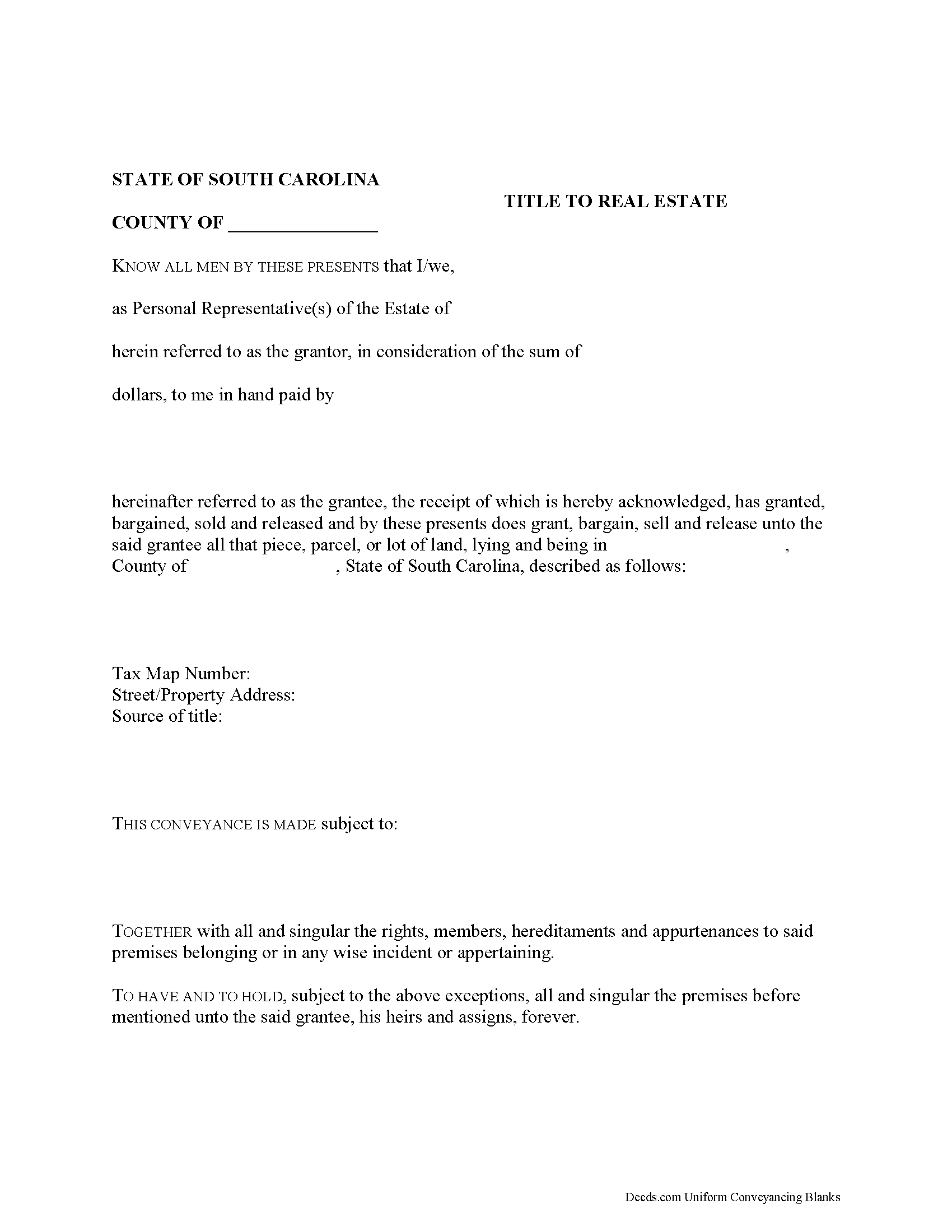

Personal Representative Deed of Sale Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Dillon County compliant document last validated/updated 11/18/2024

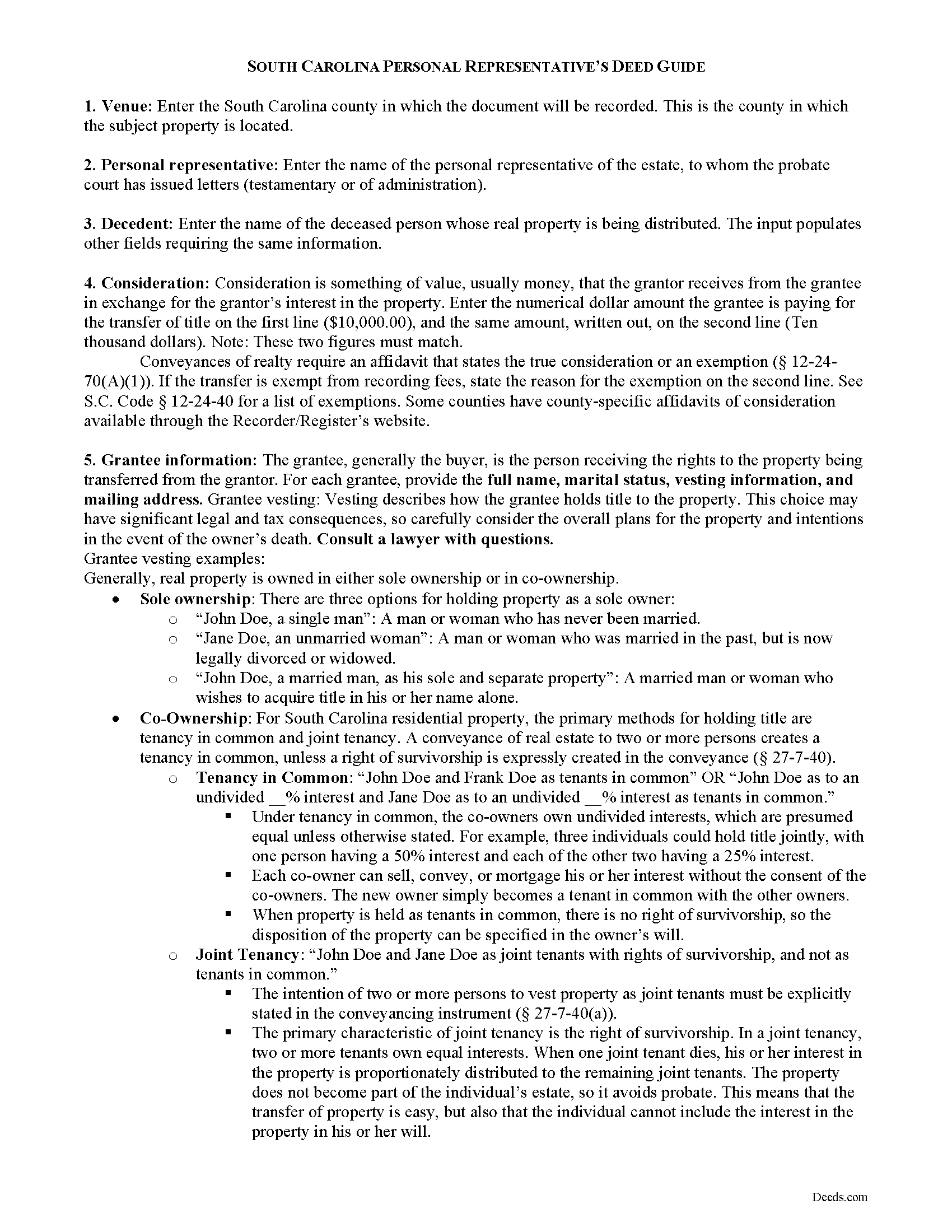

Personal Representative Deed of Sale Guide

Line by line guide explaining every blank on the form.

Included Dillon County compliant document last validated/updated 11/7/2024

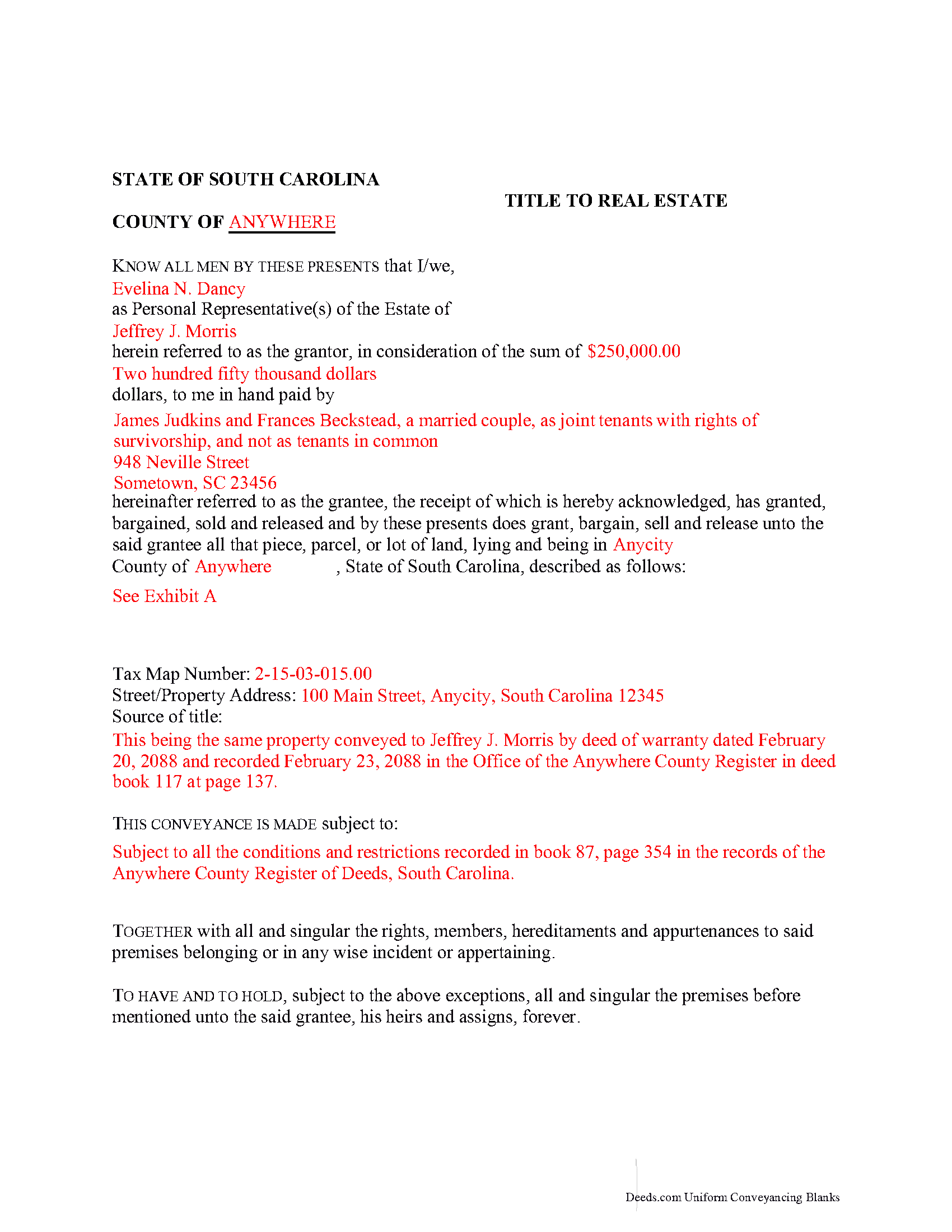

Completed Example of the Personal Representative Deed of Sale Document

Example of a properly completed form for reference.

Included Dillon County compliant document last validated/updated 11/19/2024

The following South Carolina and Dillon County supplemental forms are included as a courtesy with your order:

When using these Personal Representative Deed of Sale forms, the subject real estate must be physically located in Dillon County. The executed documents should then be recorded in the following office:

Dillon County Clerk of Court

301 W Main St / PO Drawer 1220, Dillon, South Carolina 29536

Hours: 8:30 am-5:00 pm Monday-Friday

Phone: (843) 774-1425

Local jurisdictions located in Dillon County include:

- Dillon

- Fork

- Hamer

- Lake View

- Latta

- Little Rock

- Minturn

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Dillon County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Dillon County using our eRecording service.

Are these forms guaranteed to be recordable in Dillon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Dillon County including margin requirements, content requirements, font and font size requirements.

Can the Personal Representative Deed of Sale forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Dillon County that you need to transfer you would only need to order our forms once for all of your properties in Dillon County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by South Carolina or Dillon County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Dillon County Personal Representative Deed of Sale forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In South Carolina, title to a decedent's real property devolves at death to the decedent's heirs (intestate estates) and devisees (testate estates) (S.C. Code 62-3-101). Though title passes by operation of law, the estate is still subject to administration in probate. Probate is the legal process of settling the decedent's estate and distributing assets to those entitled to receive it.

Unless empowered in the decedent's will, a personal representative (PR) may not sell property from the estate without the court's authorization (62-3-711(b)). The procedures for selling real property in probate are outlined at 62-3-1301 et seq., and are "the only procedure for the sale of lands by the court, except where the will of the decedent authorizes to the contrary" (62-3-1301). A PR may be required to sell real property to pay claims on the estate or for other expenses in the course of administration.

The process for a sale of realty involves filing inventory and appraisement with the court, submitting a petition for the sale of property, filing a lis pendens (a notice that the property is the subject of litigation) and serving summonses, hearing the petition, and the court issuing an order for either private or public sale.

To transfer title following a sale, the PR executes a deed. A PR deed follows the statutory form of conveyances in South Carolina, under S.C. Code 27-7-10. When recorded, the deed transfers an estate in fee simple to the grantee with full warranties of title.

A purchaser receiving a deed from a PR "takes title to the real property free of rights of any heirs or devisees or other interested person in the estate and incurs no personal liability to the estate or to any heir or devisee or other interested person in the estate" regardless of whether such sale was proper (62-3-910(B)). Purchasers dealing with personal representatives are also protected under 62-3-714, provided the estate is not administered under Part 5 of the Probate Code (estates in mediation; see 62-3-501 et seq.). Buyers may request a short certificate from the PR to determine whether the estate is under Part 5 administration.

The deed must meet all state and local requirements for documents affecting title to real property. The PR signs the deed in the presence of a notary public and two witnesses before recording in the Register of Deeds' office of the county where the subject property is situated. A certified copy should be delivered to the probate court.

Consult a lawyer with questions regarding probate and personal representative's deeds in South Carolina, as each situation is unique.

(South Carolina PRDOS Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Dillon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Dillon County Personal Representative Deed of Sale form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4447 Reviews )

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Hanne R.

November 17th, 2020

excellent

Thank you!

Melanie K.

December 27th, 2019

Great service! Super easy to use! I used the service to download a deed notice to do a TOD on a property in Fairfax County, VA. Just a heads up that Fairfax County required me to add the last deed book and page # onto the deed notice but otherwise all was just as they required!

Thank you!

Robson A.

June 15th, 2021

Very easy & efficient to use! I would have had to drive an hour to the county office. So glad this worked instead!

You should advertise more....if I hadn't done research I would never have known about your service.

Thank you!

Melody P.

January 29th, 2021

Thanks again for such expedient and excellent service!

Thank you!

Nicole T.

February 9th, 2021

Absolutely Amazing Service! I learned about Deeds.com, created my Account, uploaded my documents into my Recording Package, paid my Invoice and received my Three Recorded Deeds all in less than two hours! Awesome!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dianne J.

January 23rd, 2021

Thought we would just do a quit claim to remove a name on a deed but after read your instruction and all that is needed we decided to meet with a lawyer. Appreciate all the info that you supplied.

Glad to hear that Dianne. We always recommend seeking the advice of a professional if you are not completely sure of what you are doing. Have a great day!

Garrett R.

May 24th, 2022

I am a real estate attorney in CA. These Wyoming model deeds look too basic and barely adequate: no usual name and address at the top for tax statements and who recorded it. Some old fashioned legalese that only obfuscates. I won't use them. Your background info was good though.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan H.

November 10th, 2024

I used the quitclaim deed form, it was easy to fill out, had notarized and was accepted by the county's recorders office. Having a example form made it so much easier to fill out.

Thank you for your positive words! We’re thrilled to hear about your experience.

Anita M W.

May 17th, 2023

This process is outstanding, and it saved the hassle of going downtown and dealing with traffic.

Thank you for the kinds words Anita. Glad we could be of assistance. Have an amazing day!

GLENN A M.

November 26th, 2019

I loved the easy to understand and use system, very user friendly.

Thank you!

Shelly S.

January 20th, 2021

Was able to sell a property with the information obtained from your website without using an attorney!

Extremely happy.

Thank you!

Bohdan F.

June 23rd, 2023

Quick, efficient and the instructions were clear.

Thank you

Thank you!