Newport County Administrator Deed Form (Rhode Island)

All Newport County specific forms and documents listed below are included in your immediate download package:

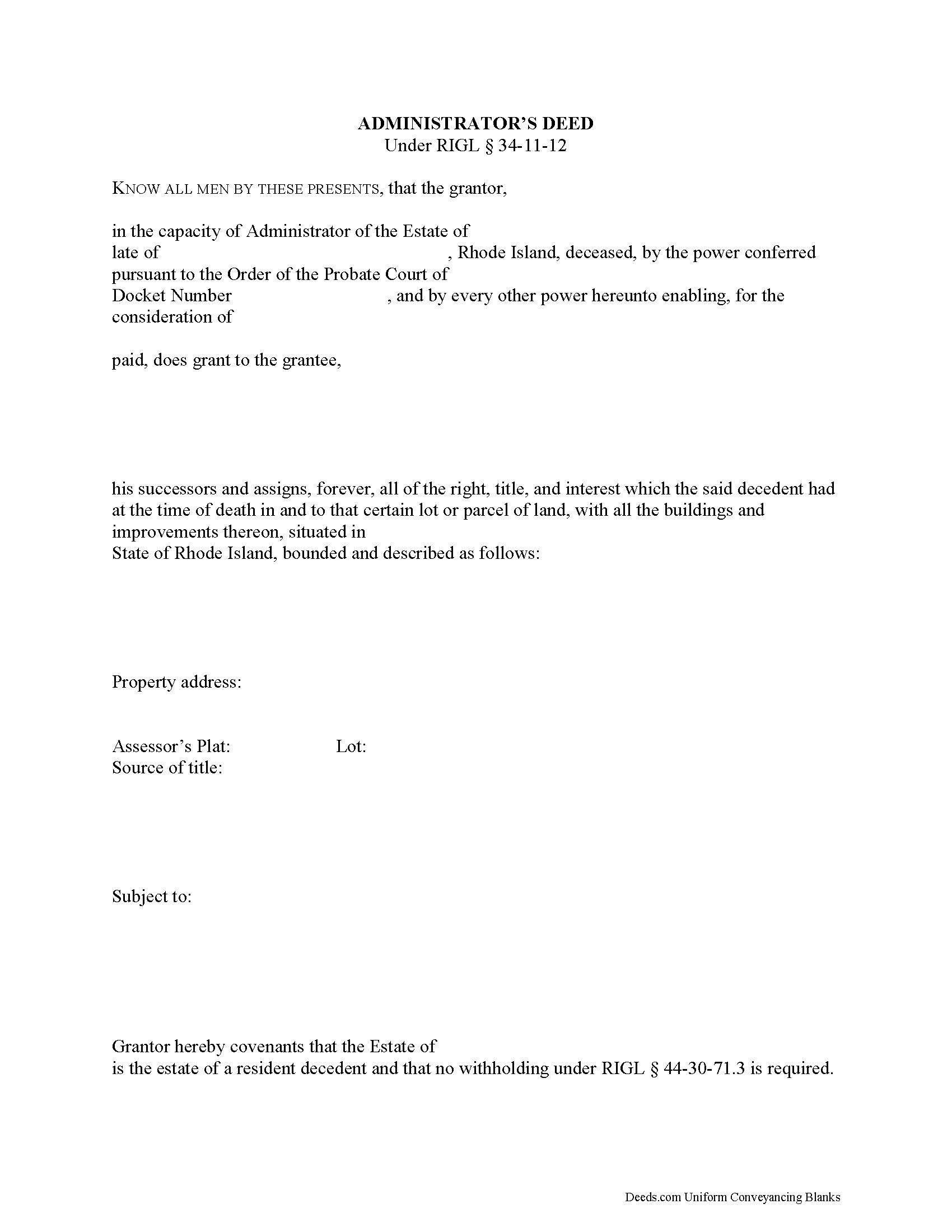

Administrator Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Newport County compliant document last validated/updated 11/7/2024

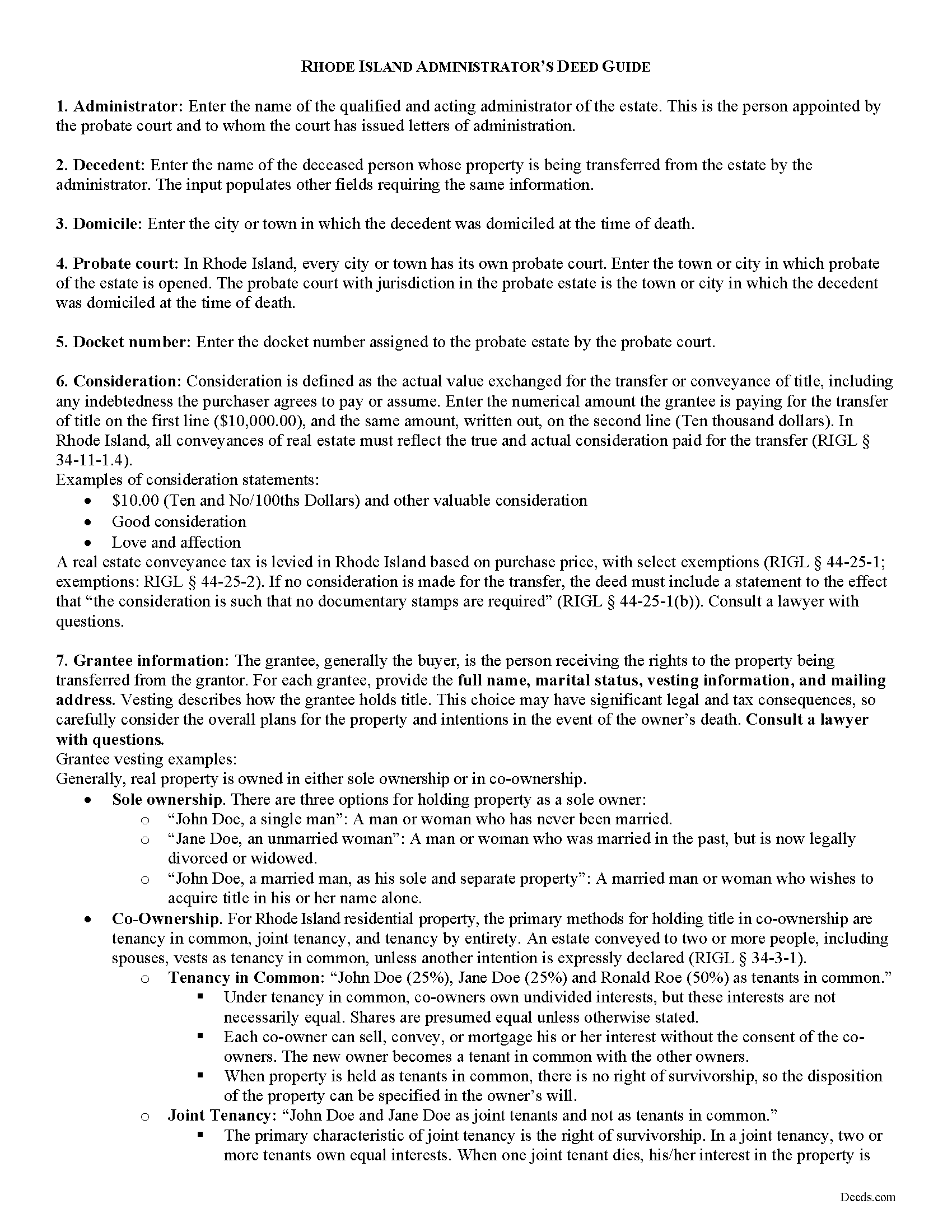

Administrator Deed Guide

Line by line guide explaining every blank on the form.

Included Newport County compliant document last validated/updated 4/24/2024

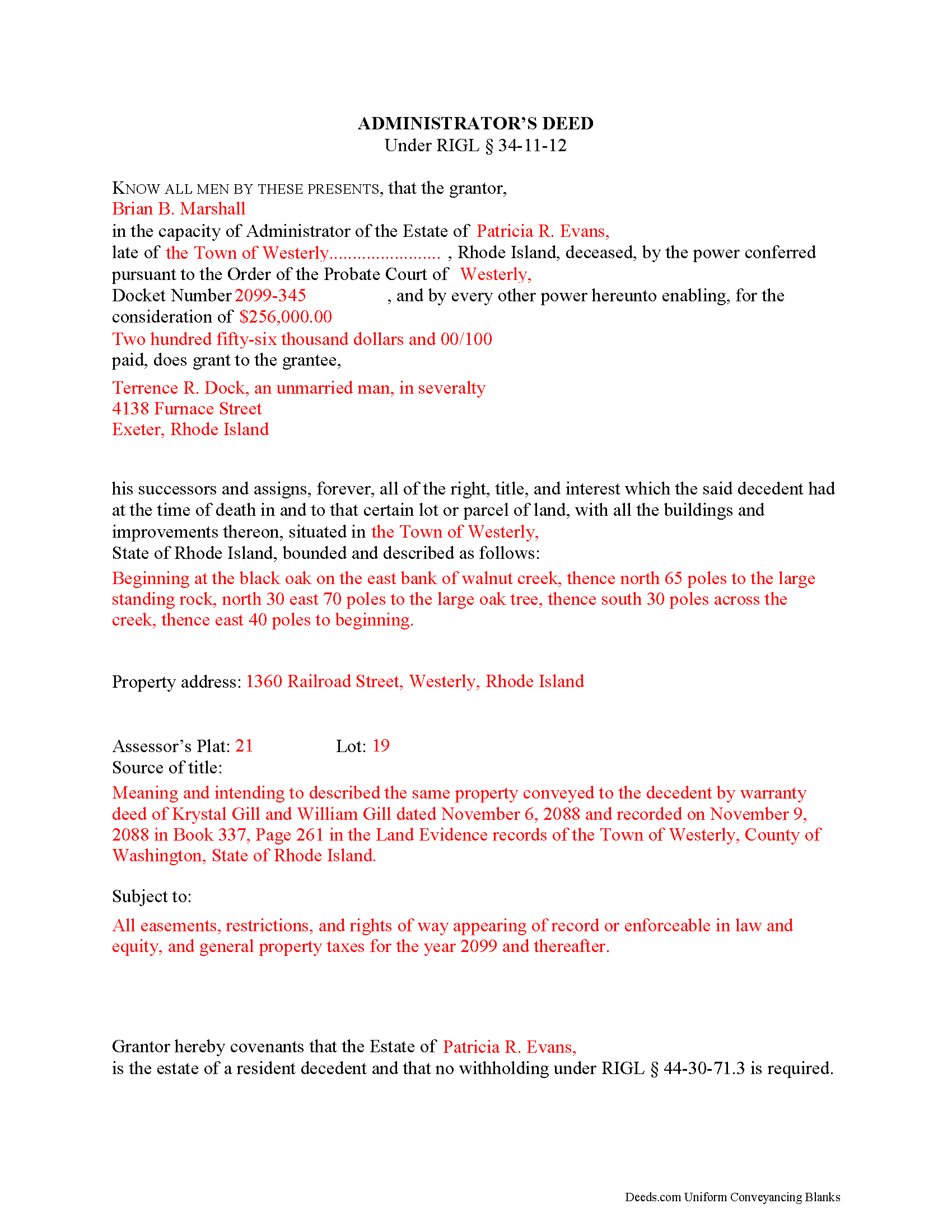

Completed Example of the Administrator Deed Document

Example of a properly completed form for reference.

Included Newport County compliant document last validated/updated 9/4/2024

The following Rhode Island and Newport County supplemental forms are included as a courtesy with your order:

When using these Administrator Deed forms, the subject real estate must be physically located in Newport County. The executed documents should then be recorded in one of the following offices:

Jamestown Town Clerk

93 Narragansett Ave, Jamestown, Rhode Island 02835

Hours: 8:00am and 4:30pm M-F

Phone: (401) 423-9801

Little Compton Town Clerk

40 Commons / PO Box 226, Little Compton, Rhode Island 02837

Hours: 8:00am and 4:00pm M-F

Phone: (401) 635-4400

Middletown Town Clerk

Town Hall, 1st Floor - 350 E Main Rd, Middletown, Rhode Island 02842

Hours: 8:00am and 4:00pm M-F

Phone: (401) 847-0009

Newport City Clerk

43 Broadway, Newport, Rhode Island 02840

Hours: 8:30 to 4:30 M-F

Phone: (401) 845-5334

Portsmouth Town Clerk

2200 E Main Rd, Portsmouth, Rhode Island 02871

Hours: 8:30 to 4:30 M-W; 8:30 to 6:30 Thu; 8:30 to 2:30 Fri

Phone: (401) 683-2101

Tiverton Town Clerk

343 Highland Rd, Tiverton, Rhode Island 02878

Hours: 8:30 to 4:00 M-F

Phone: (401) 625-6703

Local jurisdictions located in Newport County include:

- Adamsville

- Jamestown

- Little Compton

- Middletown

- Newport

- Portsmouth

- Tiverton

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Newport County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Newport County using our eRecording service.

Are these forms guaranteed to be recordable in Newport County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Newport County including margin requirements, content requirements, font and font size requirements.

Can the Administrator Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Newport County that you need to transfer you would only need to order our forms once for all of your properties in Newport County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Rhode Island or Newport County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Newport County Administrator Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

An administrator's deed is a statutory form under RIGL 34-11-12 for sales of real property from a probated estate. An administrator is a court-appointed fiduciary entrusted to administer a decedent's estate. He or she is the personal representative selected by the probate court when the decedent dies without a will, or the executor named in the will is unwilling or unable to serve.

Use an administrator's deed to transfer title to a purchaser with implied fiduciary covenants. Administrator's deeds contain covenants that the grantor is the duly qualified and acting administrator of the estate, that he or she has good right and lawful authority to convey the decedent's interest in the subject property, and that he or she, in his or her capacity, has given bond as required by law and has complied in all respects with the court's decree.

In Rhode Island, the probate court must authorize sales of realty from the estate (RIGL 33-19-3). Prior to the sale, the administrator files a petition for the sale of real estate with the court, which must include the reason for the sale. Valid reasons for petitioning for the sale of real property under RIGL 33-12-6 include enabling the payment of debts or facilitating efficient administration of the estate. This authority excludes sales of real property that is specifically devised by the decedent's will, unless the devisee(s) give consent to the sale (RIGL 33-12-6).

In addition to meeting the standard requirements for form and content of deeds in Rhode Island, the administrator's deed should reflect the true consideration paid by the grantee for the grantor's interest in the realty. Rhode Island levies a real estate conveyance tax based on purchase price, to be paid by the grantor, due upon recording (RIGL 44-25-1). Submit a conveyance tax return (CVYT-1) to the Rhode Island Division of Taxation.

Nonresident sellers of realty in Rhode Island must furnish a residency affidavit to the buyer at closing. The grantee deducts and withholds a percentage of the consideration paid to nonresident sellers (for more information on withholding of Rhode Island tax, see RIGL 44-30-71.3). Grantees may rely on the grantor's residency only if the grantor provides a residency affidavit [1]. If the transfer is exempt from the affidavit requirement, the deed should include a statement to the effect that the grantor is a resident, and that no withholding under RIGL 44-30-71.3 is required.

The administrator must sign the deed in the presence of a notary public for a valid transfer. Recording in Rhode Island is done at the municipal level in the town or city where the property is situated. Submit the completed, signed, and notarized deed, along with any supplemental documents, to the land evidence division of the town clerk in the municipality where the subject parcel is located.

The information provided here is not a substitute for legal advice. Consult an attorney licensed in the State of Rhode Island with questions regarding administrator's deeds, or for any other issues related to settling an estate, as each situation is unique.

(Rhode Island AD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Newport County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Newport County Administrator Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4435 Reviews )

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Eric D.

March 21st, 2019

Very helpful and informative. It has saved me time going to get the forms at county recorder / clerk (as my county and state websites dont offer forms on their sites) and also provided help understanding the uses of the specific deed I needed to use.

Thank you Eric. Have a great day!

Julie B.

April 23rd, 2020

I wish all the forms had been in a downloadable package so that it wasn't so difficult to make sure I had them all. Too many pages open on the click throughs. I haven't had a chance to fill them out but hope they are all there.

Thank you for your feedback. We really appreciate it. Have a great day!

Carl T.

February 23rd, 2021

Great site with good information and pricing. Let me know when you are able to record documents in California.

Thank you for your feedback. We really appreciate it. Have a great day!

Koko H.

July 12th, 2019

Five star. Prompt and easy way to obtain information. Good value.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

reed w.

February 26th, 2022

Great service that saved me a lot of time for under 30 bucks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

willie jr t.

November 23rd, 2020

Awesome! Thanks so so much!

Thank you!

susanne y.

July 13th, 2020

wonderful service, docs recorded with no issues.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael O.

April 18th, 2019

Received everything that was promised.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard V.

March 2nd, 2019

It was very easy to get the documents which I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert S.

January 23rd, 2019

The cost was well worth it. It was very easy to download, fill in the necessary information and then print the deed. I filed my need deed today and everything was complete and accurate because of the example you provided.

Thanks Robert, we appreciate your feedback!

Thoreson P.

June 7th, 2021

Top notch service.

Thank you!

Georgia R.

March 29th, 2023

Great experience, fast and efficient, no hassle. Will use again!

Thank you for your feedback. We really appreciate it. Have a great day!