Fayette County Trustee Deed Form (Pennsylvania)

All Fayette County specific forms and documents listed below are included in your immediate download package:

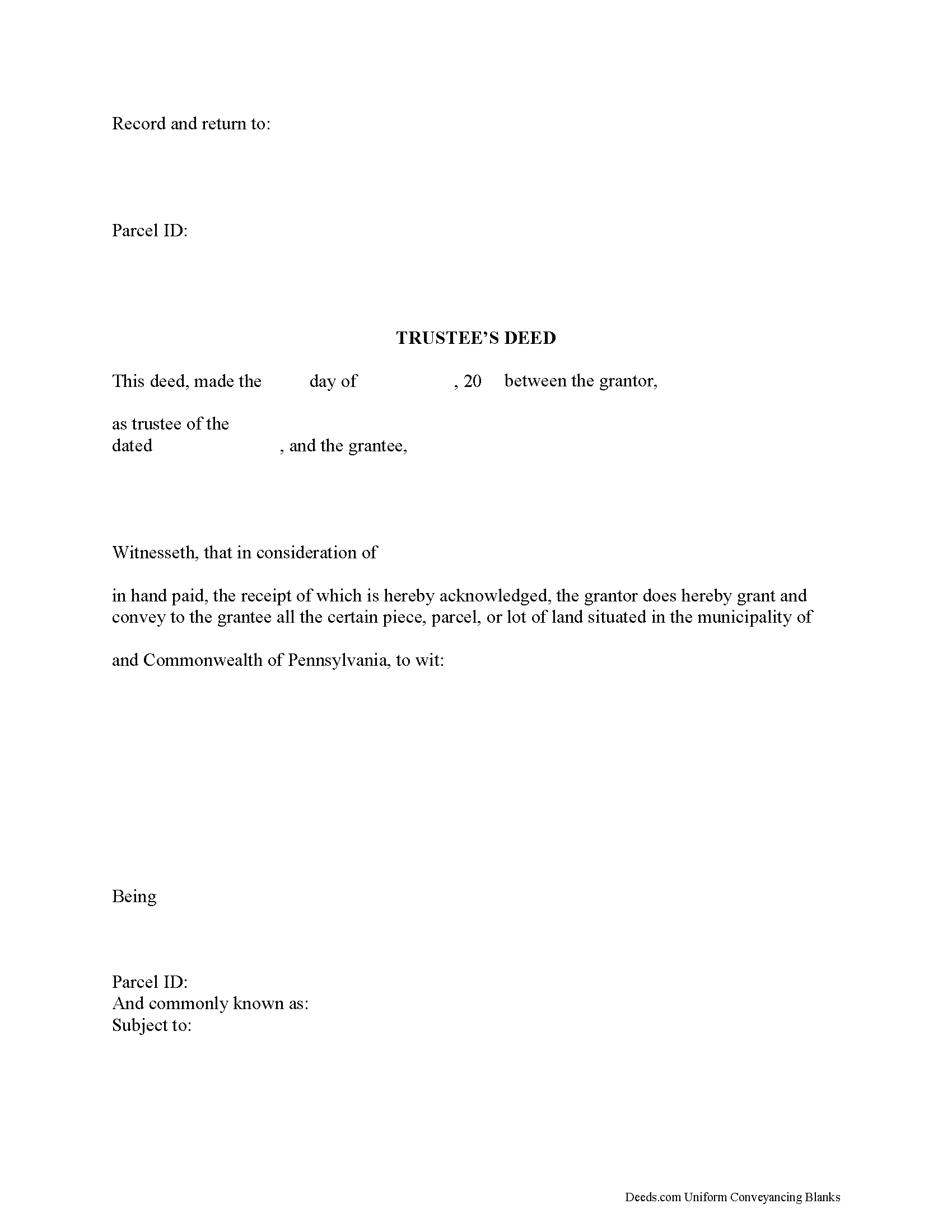

Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Fayette County compliant document last validated/updated 10/3/2024

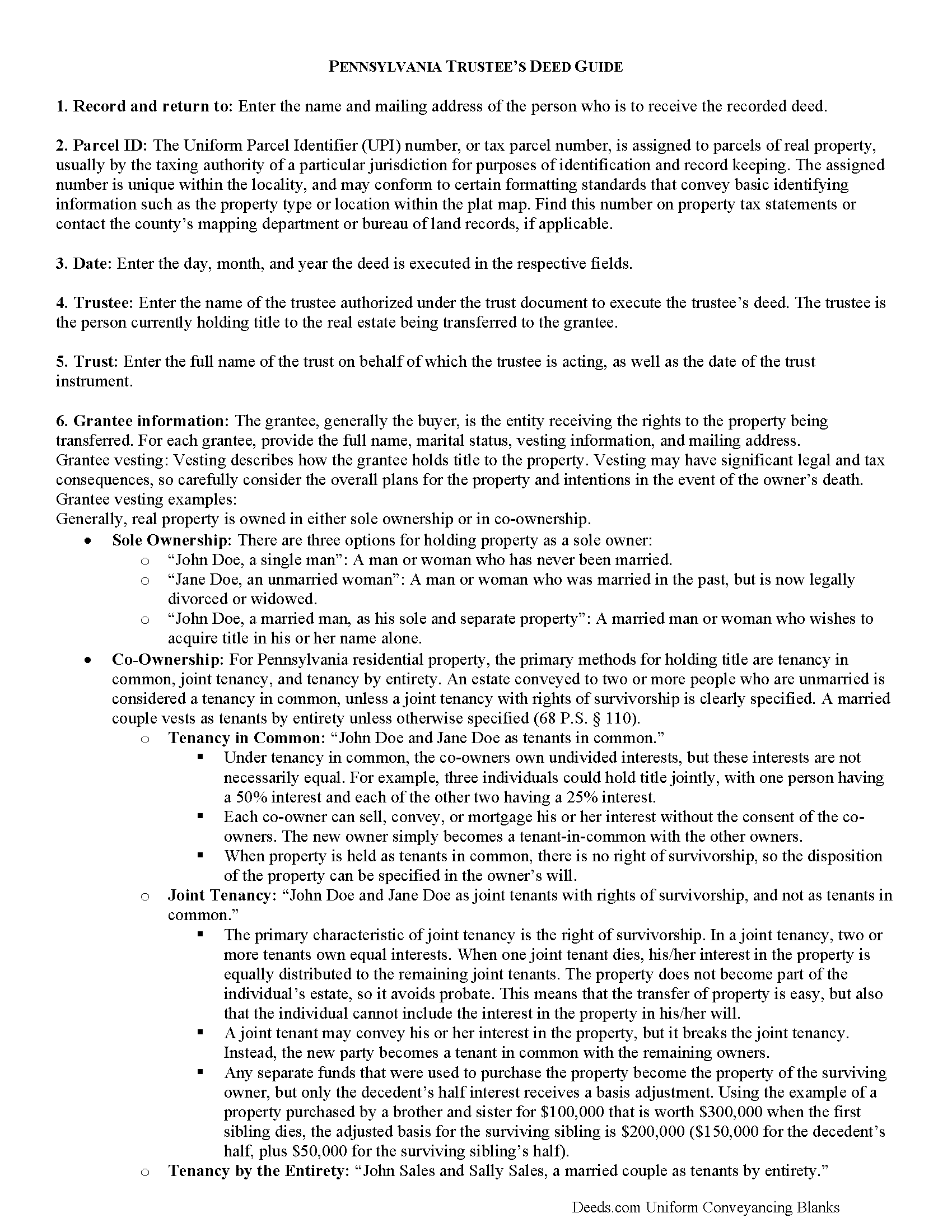

Trustee Deed Guide

Line by line guide explaining every blank on the form.

Included Fayette County compliant document last validated/updated 11/28/2024

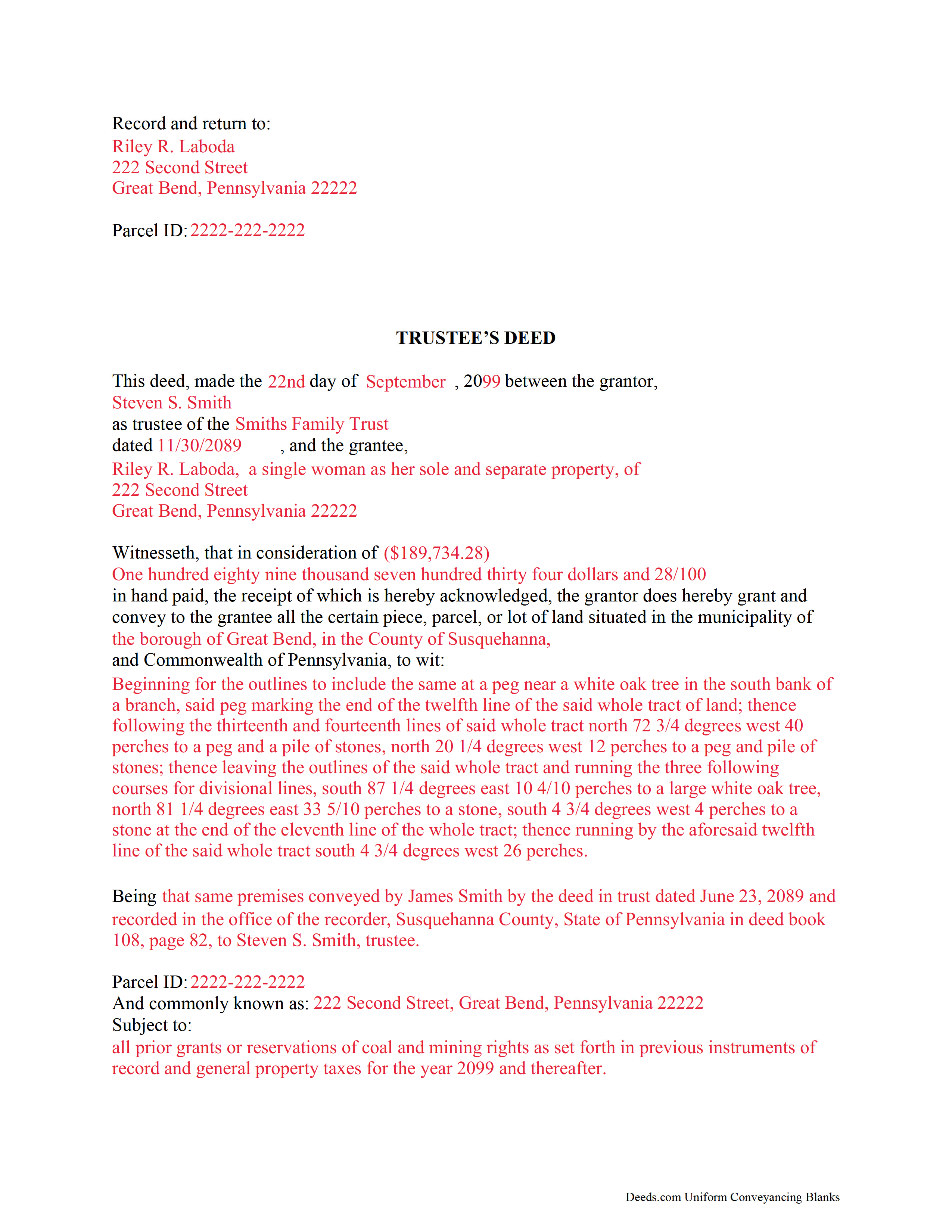

Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

Included Fayette County compliant document last validated/updated 11/19/2024

The following Pennsylvania and Fayette County supplemental forms are included as a courtesy with your order:

When using these Trustee Deed forms, the subject real estate must be physically located in Fayette County. The executed documents should then be recorded in the following office:

Recorder of Deeds - County Courthouse

61 East Main St, Uniontown, Pennsylvania 15401

Hours: 8:00am - 12:00 & 1:00 - 4:00pm

Phone: 724-430-1238

Local jurisdictions located in Fayette County include:

- Adah

- Allison

- Belle Vernon

- Brier Hill

- Brownfield

- Brownsville

- Cardale

- Chalk Hill

- Chestnut Ridge

- Connellsville

- Dawson

- Dickerson Run

- Dunbar

- East Millsboro

- Everson

- Fairbank

- Fairchance

- Farmington

- Fayette City

- Gans

- Gibbon Glade

- Grindstone

- Hibbs

- Hiller

- Hopwood

- Indian Head

- Isabella

- Keisterville

- La Belle

- Lake Lynn

- Leckrone

- Leisenring

- Lemont Furnace

- Markleysburg

- Martin

- Masontown

- Mc Clellandtown

- Melcroft

- Merrittstown

- Mill Run

- Mount Braddock

- New Geneva

- New Salem

- Newell

- Normalville

- Ohiopyle

- Oliver

- Perryopolis

- Point Marion

- Republic

- Ronco

- Smithfield

- Smock

- Star Junction

- Uledi

- Uniontown

- Vanderbilt

- Waltersburg

- West Leisenring

- White

- Wickhaven

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Fayette County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Fayette County using our eRecording service.

Are these forms guaranteed to be recordable in Fayette County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Fayette County including margin requirements, content requirements, font and font size requirements.

Can the Trustee Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Fayette County that you need to transfer you would only need to order our forms once for all of your properties in Fayette County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Pennsylvania or Fayette County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Fayette County Trustee Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Title 20, Chapter 77 of the Pennsylvania Statutes governs trusts in the State of Pennsylvania.

A trust is a wealth management tool commonly used in estate planning. There are three main parties to a trust: the settlor, who funds the trust by conveying assets into it; the trustee, who administers the trust and controls its assets; and the beneficiary, who has a present or future interest in the trust (P.S. 7703). Note that a sole trustee cannot also be the sole beneficiary (P.S. 7732(a)(5)).

Under a trust, the acting trustee manages the trust as directed by the settlor. This arrangement works, in part, because the trustee holds what amounts to a proxy title to the trust's assets. If the trust contains real property that the settlor wishes to sell, the trustee executes and records a document called a trustee's deed to transfer the title to the grantee/buyer -- the settlor is not identified in the transaction.

In most cases, trustee's deeds are modified quitclaim or special warranty deeds. Quitclaim deeds contain no warranties of title, and special warranty deeds only offer the grantee protection against title claims originating while grantor controlled the property. Generally, a trustee uses a quitclaim deed if the settlor and grantee are close relatives (spouses, parent to child, etc.). A trustee of a living trust might also use a quitclaim deed to transfer property out of the trust and to himself as an individual. Third-party purchasers might require a special warranty deed in order to obtain a mortgage or title insurance.

Besides fulfilling the requirements for all instruments affecting real property in the State of Pennsylvania (tax parcel number, legal description, prior deed information, certificate of residence, and so on), the trustee's deed names the trustee as the grantor and gives the date and the name of the trust under which the trustee is acting. A certificate of trust is sometimes included to verify the trust's existence and the trustee's authority to act on behalf of the trust. As with other instruments, the deed must be signed and acknowledged in the presence of a notary, then recorded in the county where the property is situated.

Trust law can be thorny, and each situation is unique. Consult an attorney with specific questions or for complicated circumstances.

(Pennsylvania TD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Fayette County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Fayette County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4437 Reviews )

Jubal T.

November 27th, 2024

This is the most comprehensive, helpful real estate tool I have seen. I was at first worried because the 330# didn’t have live operators but I received messages in my account as quickly as a conversation had by text and was able to download a deed and record it the same day in a county 1,300 miles away. Highly recommended!

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Michael S.

November 27th, 2024

Recording a Warranty Deed with Mohave County AZ was easy and efficient by using Deeds.com. I will be using their service for all of my e-filing going forward. Thank you Deeds.com!!!!

We are delighted to have been of service. Thank you for the positive review!

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

joseph p.

December 23rd, 2019

As i am not very computer ready,i had one heck of a time filling,printing,and copying this document.But with your patience and understanding of older ways,WE DID IT SUCCESSFULLY.Thank you for your time.I will recommend this site to all that inquire

Thank you for your feedback. We really appreciate it. Have a great day!

Sara W.

November 9th, 2020

Got the legal forms, they worked. Nothing exciting but that probably a good thing.

Thank you Sara, we appreciate you.

Robert W.

January 5th, 2019

The forms were as I expected them to be. The guide was very helpful. Overall very good.

Thanks Robert. We appreciate your feedback.

Mica M.

September 25th, 2020

Best Way EVER to record a warranty deed! It was nice to not have to drive anywhere and find the facility closed or "unable to process due to covid19 and buildings being closed". The correspondence between me and deeds.com was very timely in our back and forth email correspondence, and the processing was all finished in a timely manner. Totally worth the extra $15 that I paid in addition to the recording fee. I would use this again and again. My time and the efficiency of the job completed is worth the money.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary W.

June 9th, 2019

Great service. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert B.

August 14th, 2021

The forms were easy to download and fill.

Thank you!

Samuel M.

October 8th, 2020

it was convenient to have a starting place, however, though the property is in Colorado, the probate is in Iowa, so I had to create my own document because you locked my capacity to edit the form I paid for. If I pay for it, I should be able to edit everything including non fill in text. I could not open it in word, as I normally could.

Thank you for your feedback. We really appreciate it. Have a great day!

Rodney S.

October 7th, 2021

Good service; thank you.

Thank you!

virginia a.

May 15th, 2022

Thank you for the prompt instructions on the download and installation. The only problem I had was trying to input data into the form once I renamed the form.and saved it. I was unable to change the size of the font and was very frustrated. In the end I finally had to redo the entire form through Word using your format.

Thank you!

Sidney L.

July 22nd, 2022

Not a fan. Filling in the WI RE transfer return was simple enough. However, it downloaded as a DOR file and I can't find a program to open it. So, I have no way to print the form to complete the process.

Thank you for your feedback. We really appreciate it. Have a great day!

Karin H.

September 18th, 2021

Awesome same-day service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert B.

January 4th, 2021

Very easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!