Lackawanna County Satisfaction of Mortgage Form (Pennsylvania)

All Lackawanna County specific forms and documents listed below are included in your immediate download package:

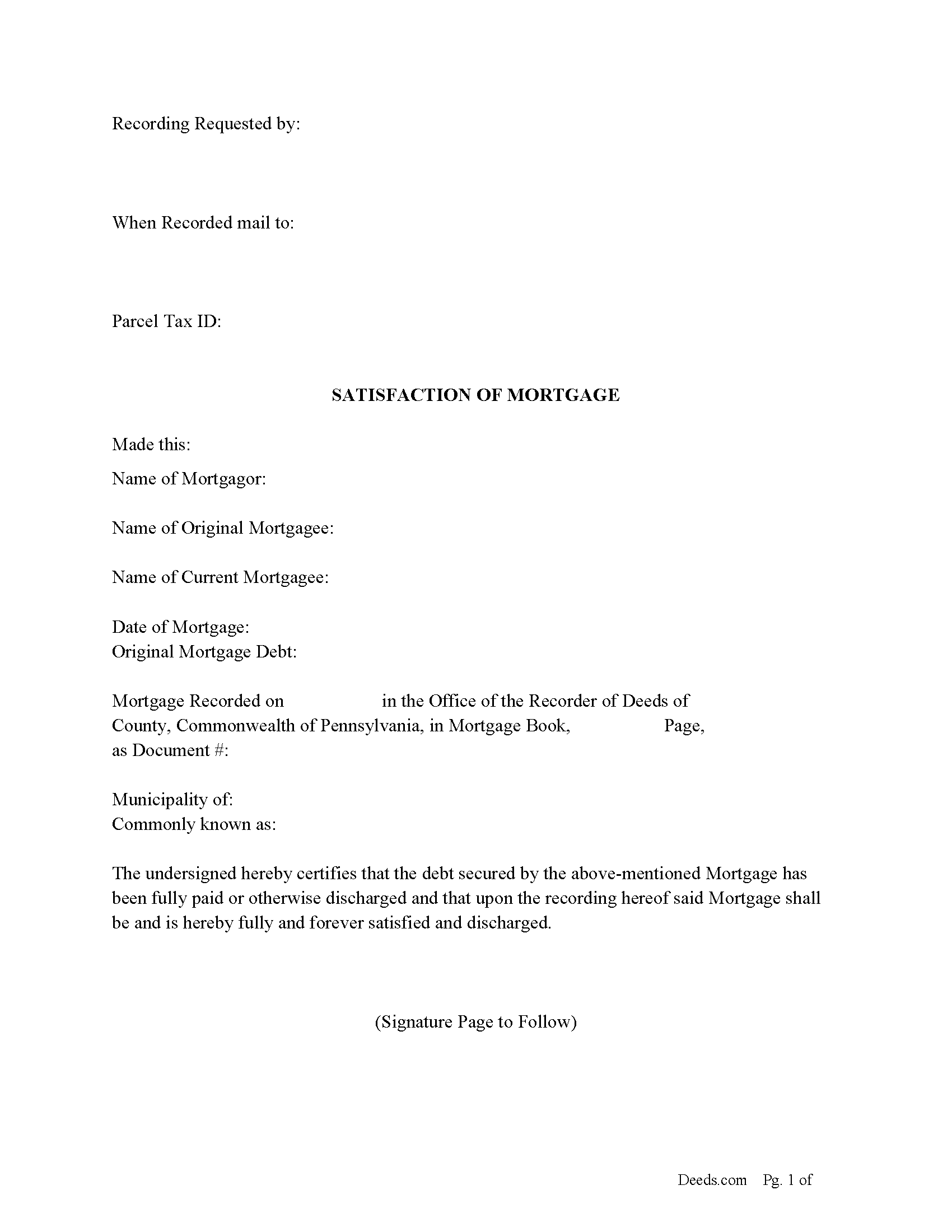

Satisfaction of Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Lackawanna County compliant document last validated/updated 12/5/2024

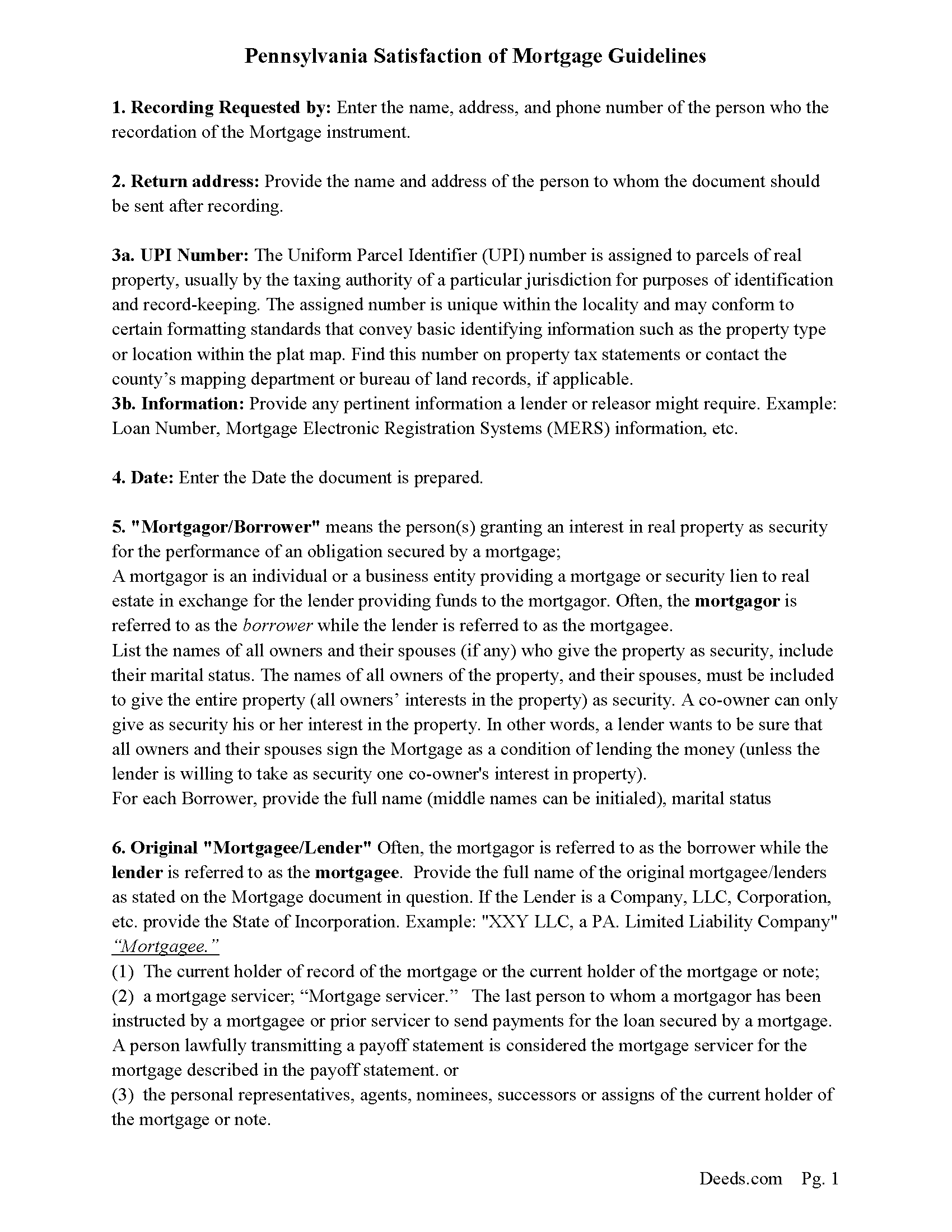

Satisfaction of Mortgage Guidelines

Line by line guide explaining every blank on the form.

Included Lackawanna County compliant document last validated/updated 11/21/2024

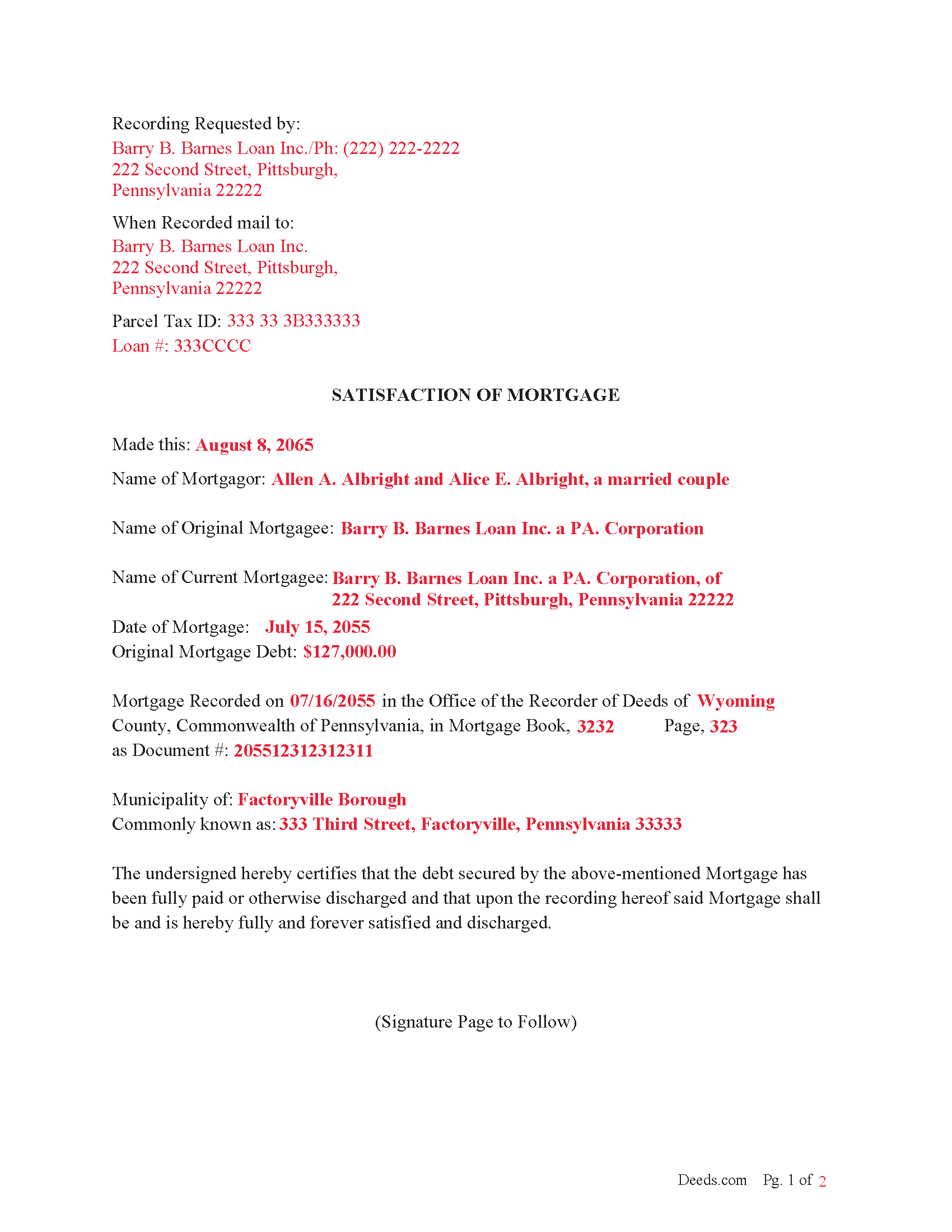

Completed Example of the Satisfaction of Mortgage Document

Example of a properly completed form for reference.

Included Lackawanna County compliant document last validated/updated 10/30/2024

The following Pennsylvania and Lackawanna County supplemental forms are included as a courtesy with your order:

When using these Satisfaction of Mortgage forms, the subject real estate must be physically located in Lackawanna County. The executed documents should then be recorded in the following office:

Recorder of Deeds

123 Wyoming Avenue, Suite 218, Scranton, Pennsylvania 18503

Hours: 9:00am to 3:45pm M-F

Phone: (570) 963-6775

Local jurisdictions located in Lackawanna County include:

- Archbald

- Carbondale

- Chinchilla

- Clarks Summit

- Dalton

- Dickson City

- Elmhurst

- Fleetville

- Jermyn

- Jessup

- La Plume

- Moosic

- Moscow

- Old Forge

- Olyphant

- Peckville

- Ransom

- Scranton

- Taylor

- Waverly

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Lackawanna County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Lackawanna County using our eRecording service.

Are these forms guaranteed to be recordable in Lackawanna County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lackawanna County including margin requirements, content requirements, font and font size requirements.

Can the Satisfaction of Mortgage forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Lackawanna County that you need to transfer you would only need to order our forms once for all of your properties in Lackawanna County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Pennsylvania or Lackawanna County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Lackawanna County Satisfaction of Mortgage forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

The Mortgagee/Lender generally has 60 days to record a satisfaction to avoid penalty.

((1)If, within 60 days of the mortgagee's receipt of:

(i)payment of the entire mortgage obligation and all required satisfaction and recording costs; and

(ii)the first written request by the mortgagor for the satisfaction piece delivered and in substantially the form described in this section,

the mortgagee fails to present for recording to the office where the mortgage was recorded a satisfaction piece as described in section 5-1 or the mortgage is not otherwise satisfied, the mortgagee shall forfeit and pay to the mortgagor a penalty in a sum not exceeding the original loan amount.

(2)In any successful action to recover penalties pursuant to this section, the mortgagee shall reimburse the mortgagor for costs of the action, including the mortgagor's reasonable attorney fees.

(3)Any action to enforce the provisions of this section, including any action to recover amounts due under this section, shall be brought and maintained in the individual names and shall be prosecuted by persons entitled to recover under the terms hereof and not in a representative capacity.

(4)An action under section 6-2 shall be the exclusive remedy for damages for failure of a mortgagee to issue and present for recording a satisfaction piece.

(5)The delivery of a second or subsequent written request by the mortgagor for a satisfaction piece shall not give rise to an additional cause of action under this section.)

(Pennsylvania Statutes Title 21 P.S. Deeds and Mortgages 721-6. Notice to satisfy; damages for failure to satisfy)

For use in Pennsylvania only by mortgagee, assignee, or person entitled to interest, or his, her or their duly authorized attorney or agent.

(Pennsylvania SOM Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Lackawanna County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lackawanna County Satisfaction of Mortgage form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Lorie S.

April 24th, 2024

It was available to download immediately

Thank you!

Timmy S.

December 18th, 2019

The form gave me a perfect place to start. I was looking for something regarding time-shares, so the form was not perfect, but the register of deeds worked with me to get it right. I would not have even been able to start without the form from deeds.com

Thank you for your feedback. We really appreciate it. Have a great day!

Janet J.

January 17th, 2020

The download process was quick and efficient. Here's hoping the printing process will be as easy. Appreciate this access to forms so much.

Thank you for your feedback. We really appreciate it. Have a great day!

Dianne J.

January 23rd, 2021

Thought we would just do a quit claim to remove a name on a deed but after read your instruction and all that is needed we decided to meet with a lawyer. Appreciate all the info that you supplied.

Glad to hear that Dianne. We always recommend seeking the advice of a professional if you are not completely sure of what you are doing. Have a great day!

Rebecca M.

February 22nd, 2023

Haven't used yet but I will check it out tomorrow

Thank you!

Jennifer S.

December 11th, 2019

Fabulous

Thank you!

Bernadette W.

April 11th, 2022

It was very easy to use the website. I wish there was an option to pay for multiple documents at once instead of having to pay for each one individually.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William U.

December 1st, 2020

Prompt service, reasonable price.

Thank you!

Pierre M.

October 13th, 2020

The form was very easy to fill out. The instructions were clear. Overall, a very user friendly product that made my job easier. Thanks you.

Thank you!

Ken S.

March 14th, 2019

Easy to downloand. Instructions were helpful and easy to follow. Made the process a lot easier for me.

Thanks Ken.

Nina F.

September 23rd, 2020

My experience could not have been better. Easy to communicate with, even though I'm largely ignorant of technical problem-solving. I may be addle-minded with 83 years on earth, but I think they actually cared about solving my problem and were sorry it was beyond their territory. Truly extra nice.

Thank you for your feedback. We really appreciate it. Have a great day!

CAROLYN H.

July 14th, 2022

Thanks. Was simple and easy to use.

Thank you!