Fulton County Mortgage Instrument and Promissory Note Form (Pennsylvania)

All Fulton County specific forms and documents listed below are included in your immediate download package:

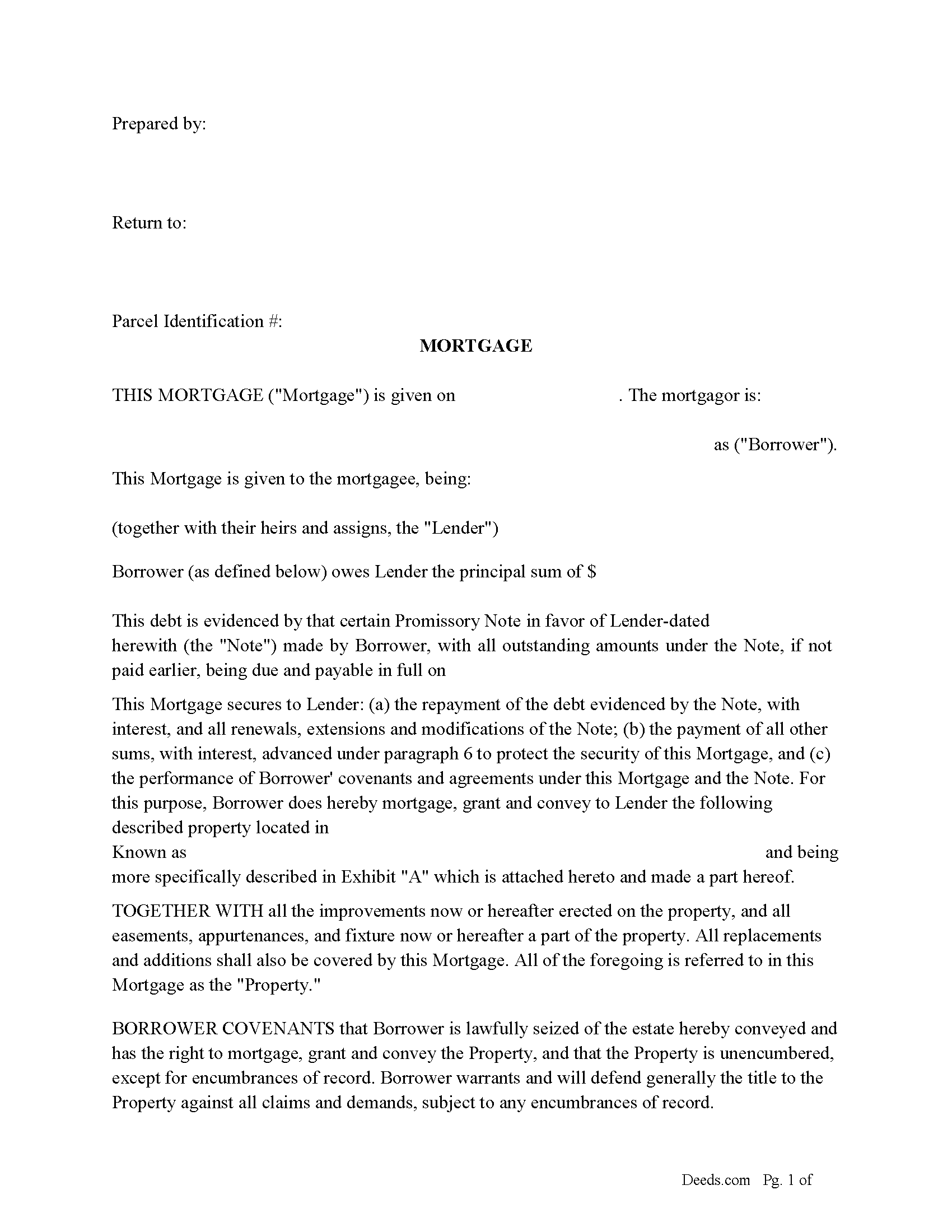

Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Fulton County compliant document last validated/updated 10/31/2024

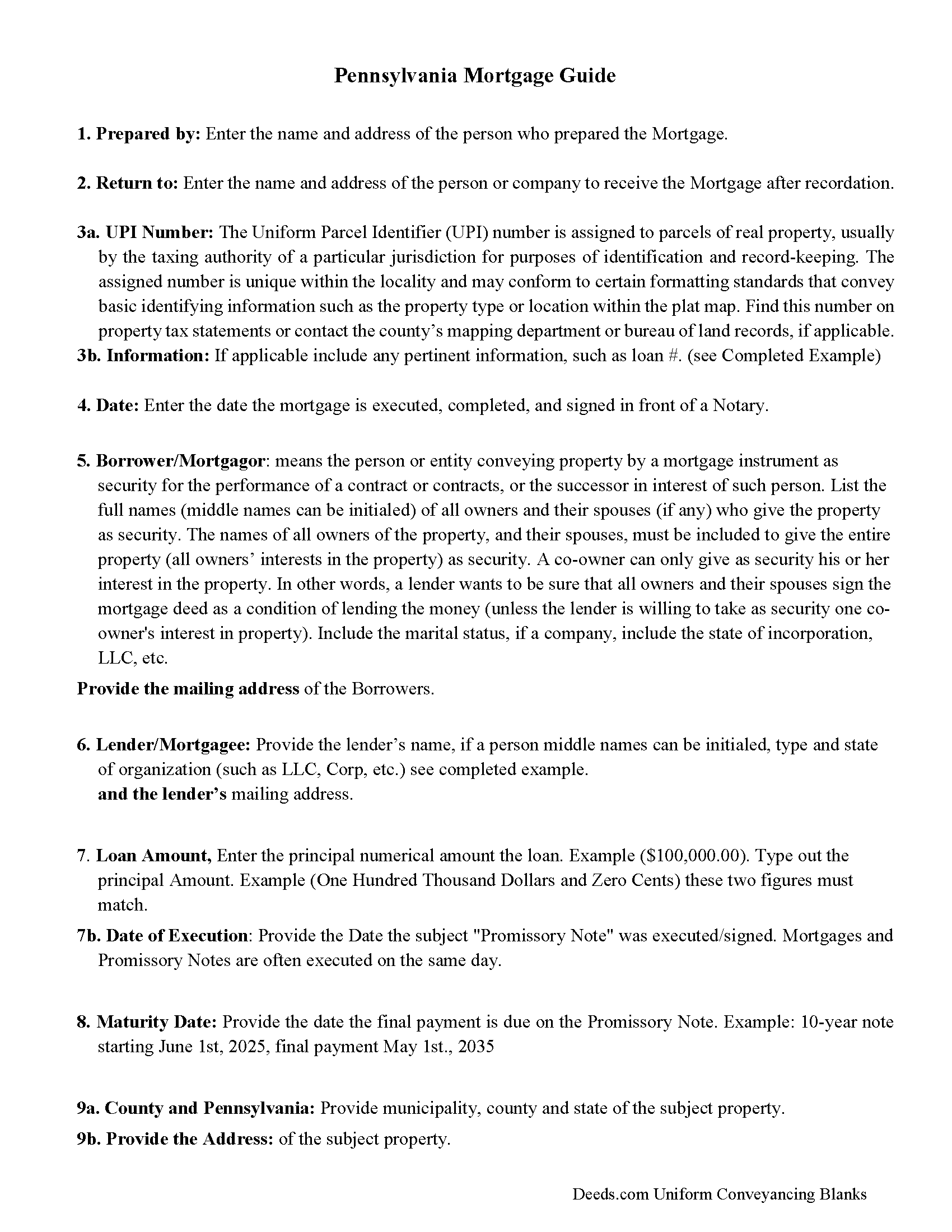

Mortgage Guidelines

Line by line guide explaining every blank on the form.

Included Fulton County compliant document last validated/updated 12/4/2024

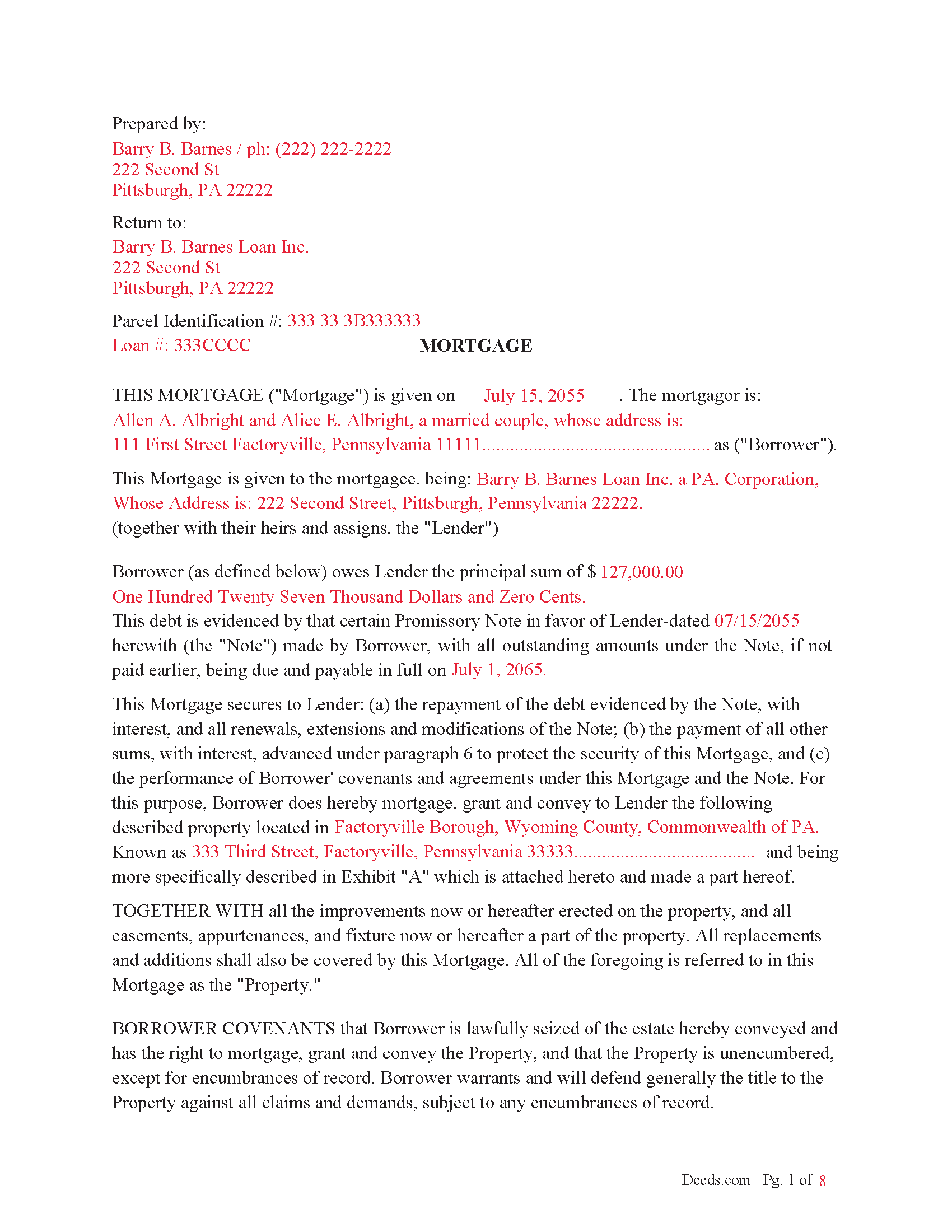

Completed Example of the Mortgage Document

Example of a properly completed form for reference.

Included Fulton County compliant document last validated/updated 11/28/2024

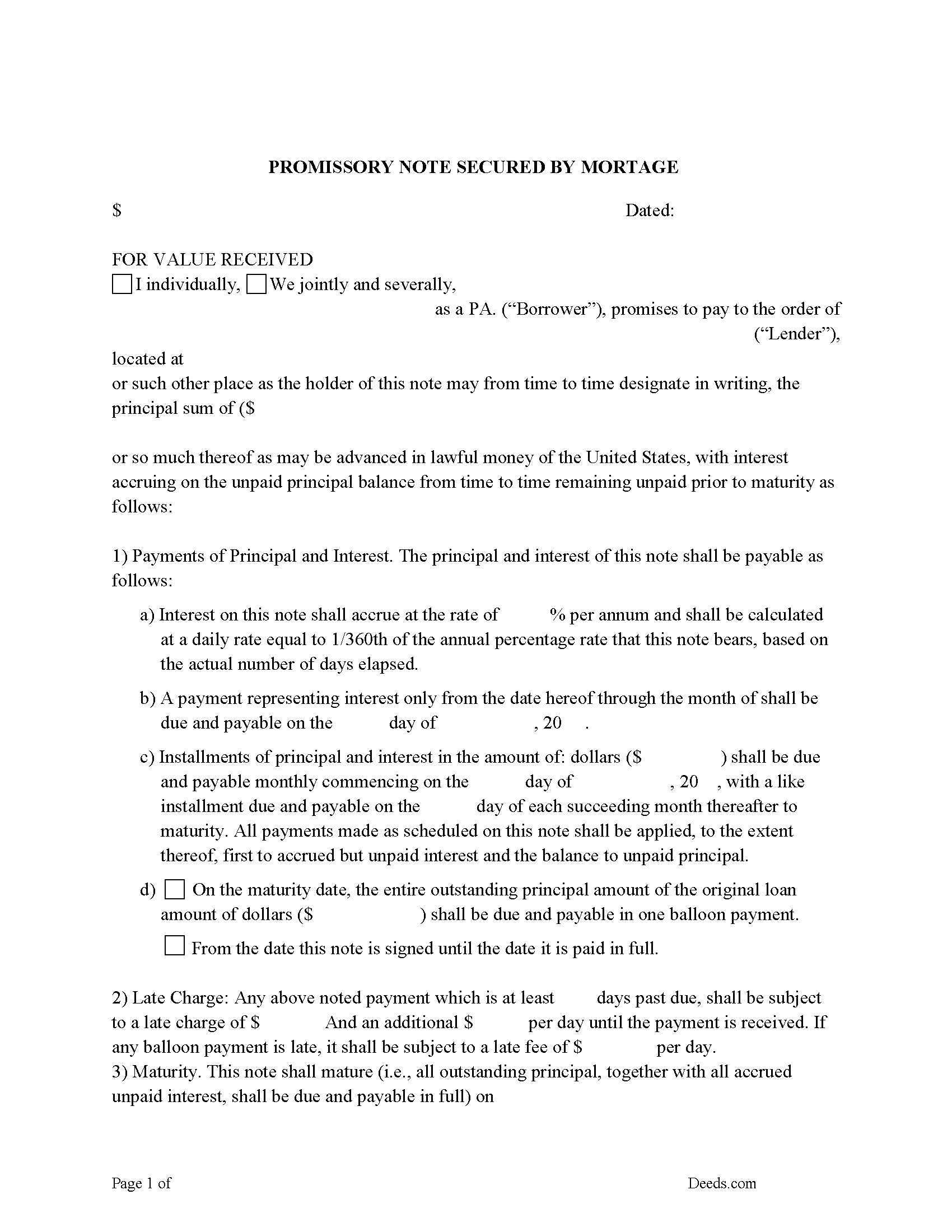

Promissory Note Form

Promissory Note secured by Mortgage.

Included Fulton County compliant document last validated/updated 8/5/2024

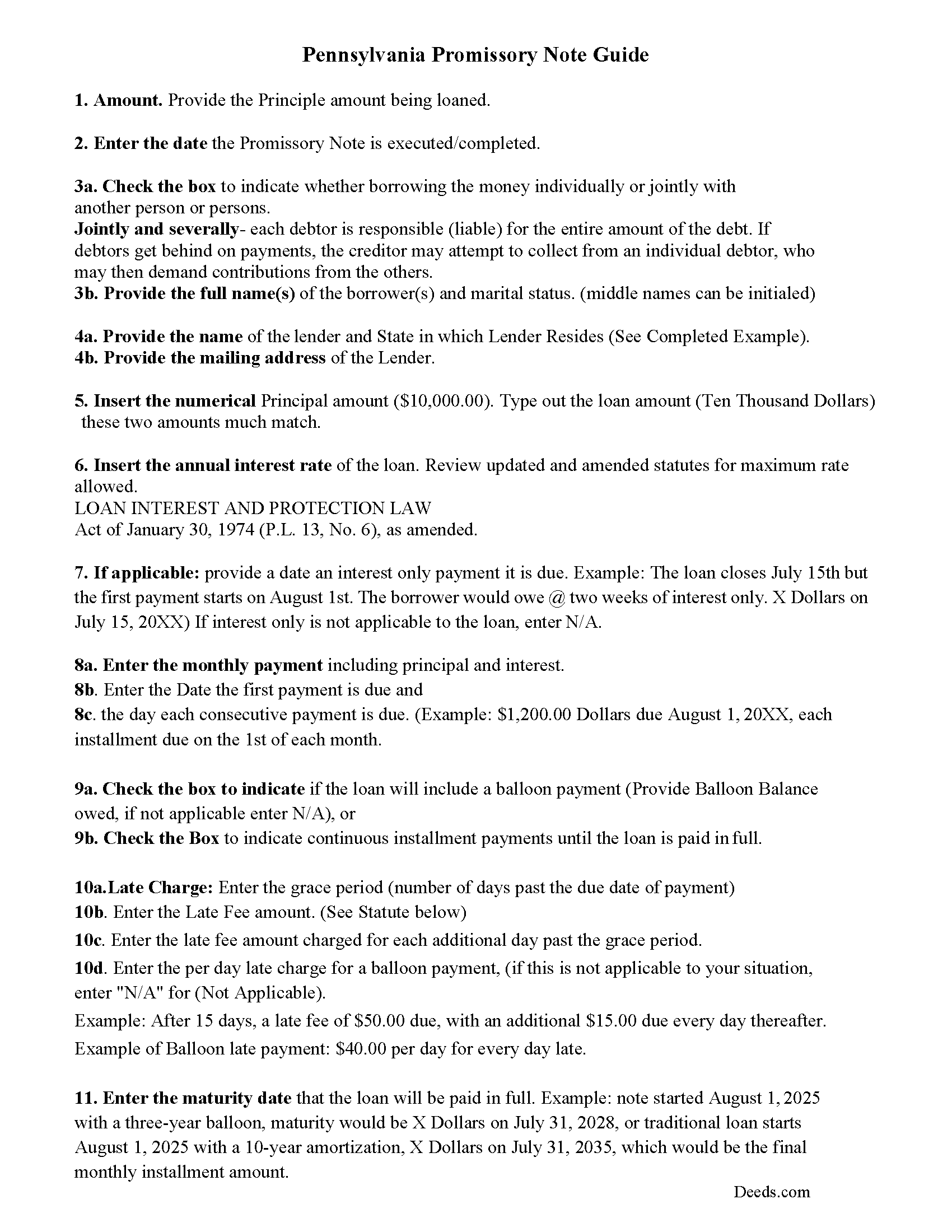

Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Included Fulton County compliant document last validated/updated 11/8/2024

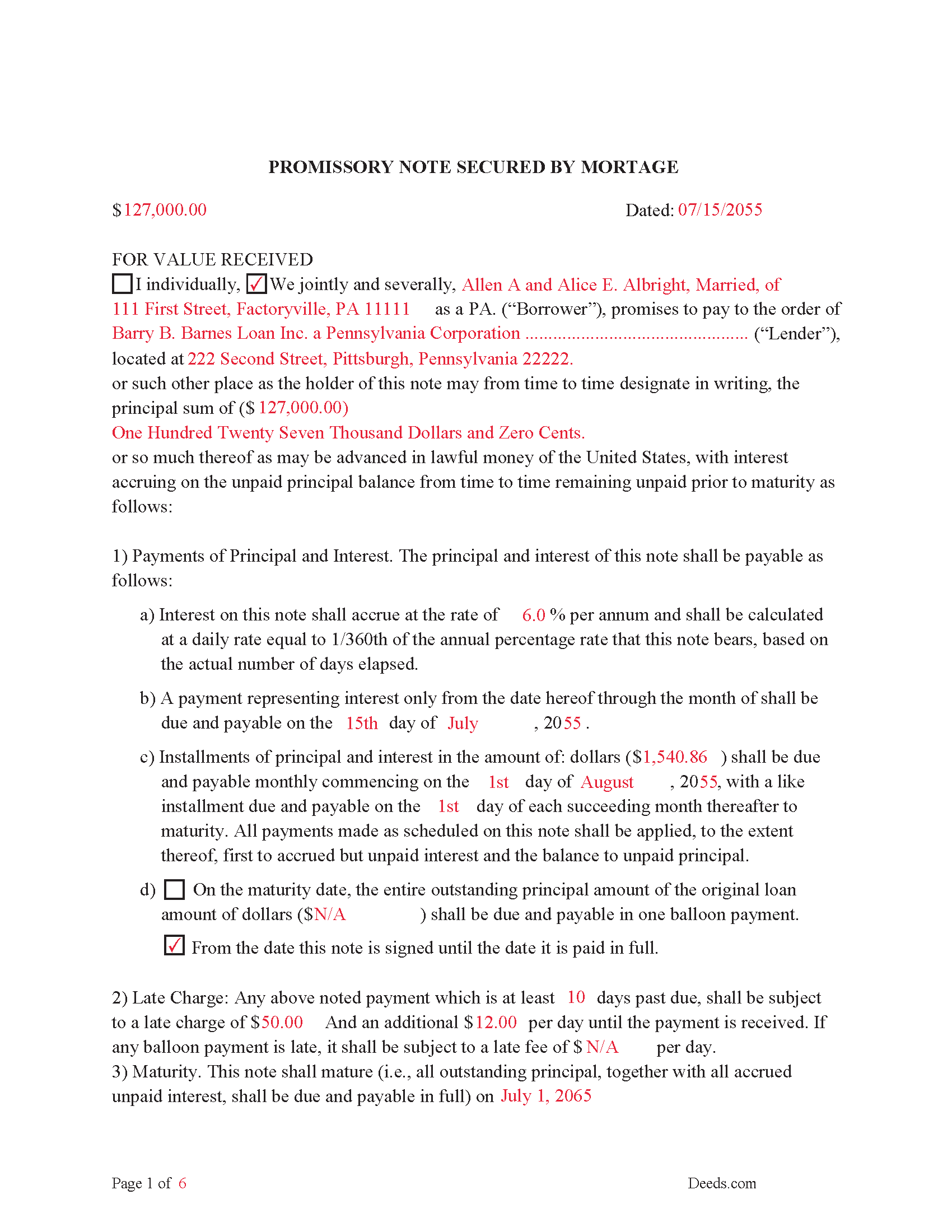

Completed Example of the Promissory Note Document

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

Included Fulton County compliant document last validated/updated 11/13/2024

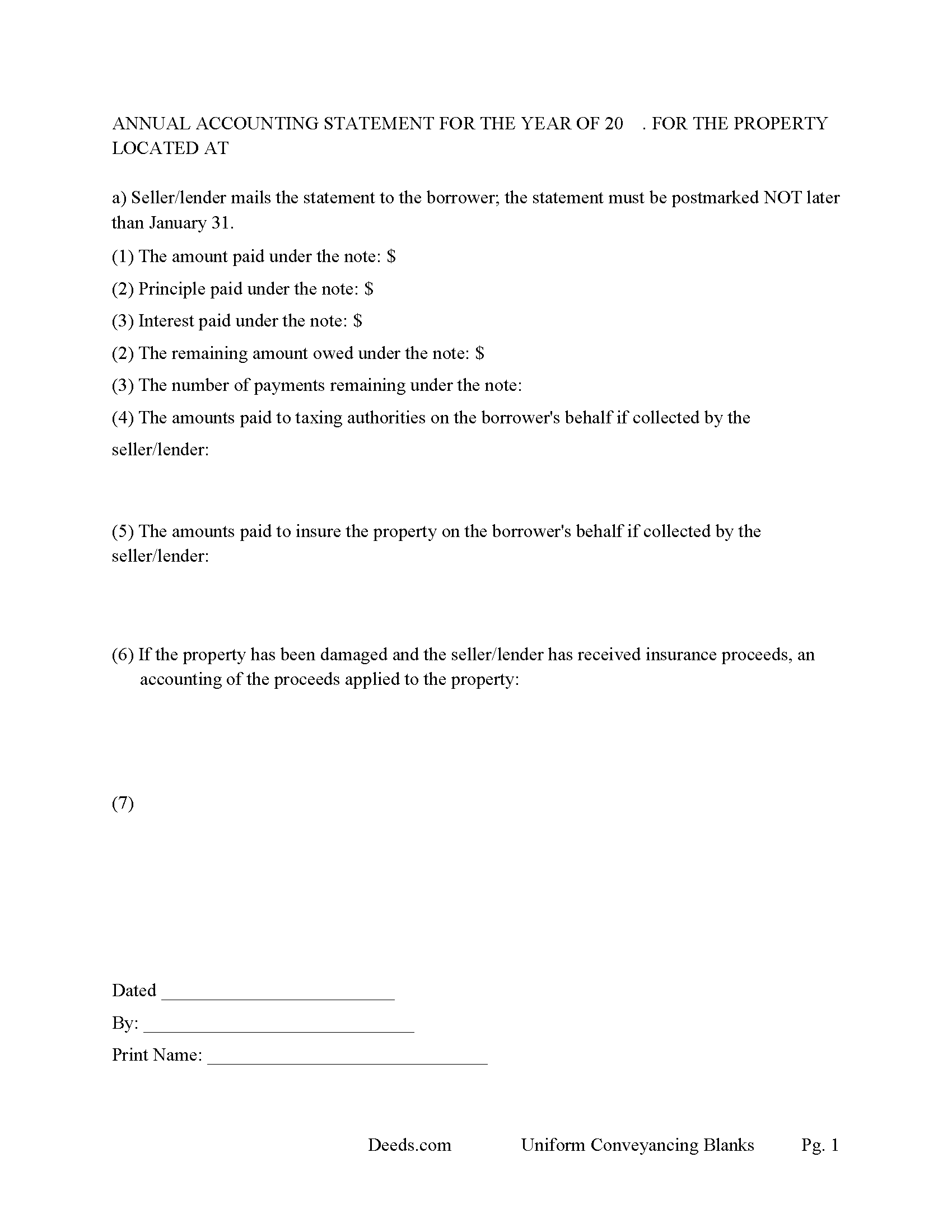

Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

Included Fulton County compliant document last validated/updated 10/9/2024

The following Pennsylvania and Fulton County supplemental forms are included as a courtesy with your order:

When using these Mortgage Instrument and Promissory Note forms, the subject real estate must be physically located in Fulton County. The executed documents should then be recorded in the following office:

Recorder of Deeds - County Courthouse

201 North 2nd St, McConnellsburg, Pennsylvania 17233

Hours: 8:30am to 4:30pm Monday through Friday

Phone: (717) 485-4212

Local jurisdictions located in Fulton County include:

- Big Cove Tannery

- Burnt Cabins

- Crystal Spring

- Fort Littleton

- Harrisonville

- Hustontown

- Mc Connellsburg

- Needmore

- Warfordsburg

- Waterfall

- Wells Tannery

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Fulton County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Fulton County using our eRecording service.

Are these forms guaranteed to be recordable in Fulton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Fulton County including margin requirements, content requirements, font and font size requirements.

Can the Mortgage Instrument and Promissory Note forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Fulton County that you need to transfer you would only need to order our forms once for all of your properties in Fulton County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Pennsylvania or Fulton County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Fulton County Mortgage Instrument and Promissory Note forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

This is a recordable Mortgage secured by a Promissory Note, used to finance real property - residential, small commercial, rental, vacant land, condominiums and planned unit developments. In general, a Pennsylvania mortgage must be recorded within six months, see Section 621 Mortgages to be recorded within six months.

(All mortgages or defeasible deeds in the nature of mortgages shall have priority according to the date of recording the same, without regard to the time of making or executing such deeds; and it shall be the duty of the recorder to endorse the time upon the mortgages.) (Section 622 - Priority according to date of recording)

Included is the required Certificate of Residence. (For the purpose of obtaining with accuracy the precise residence of all mortgagees, assignees, and persons to whom interest is payable on articles of agreement, it shall be the duty of the recorder of deeds in each county, whenever a mortgage, assignment, or agreement given to secure the payment of money, shall be presented to him for record, to refuse the same, unless the said mortgage, assignment, or agreement has attached thereto, and made part of said mortgage, assignment, or agreement, a certificate signed by said mortgagee, assignee, or person entitled to interest, or his, her or their duly authorized attorney or agent, setting forth the precise residence of such mortgagee, assignee, or person entitled to interest; said certificate to be recorded with said mortgage,) (Section 625 - Certificate of residence of mortgagee).

(Pennsylvania Mortgage Package includes forms, guidelines, and completed examples) For use in Pennsylvania only.

Our Promise

The documents you receive here will meet, or exceed, the Fulton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Fulton County Mortgage Instrument and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary D. B.

May 11th, 2023

BIG THANK YOU EXCELLENT WEBSITE

Thank you!

Sharon D.

December 29th, 2018

Very easy to understand forms...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Leatrice K.

February 24th, 2021

I am how simple this site is to use. I am so thankful to be able to do this and not have to worry about traveling downtown. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David P.

August 26th, 2020

Easy to use and very straight forward. Glad I used Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anita A.

February 10th, 2019

No review provided.

Thank you!

Maria-Luisa: M.

February 24th, 2021

So far so good!

Thank you!

Laurie D.

January 24th, 2024

Comforting that you include an example of a completed TOD Deed form. Just downloaded all forms for my state & county and I'm SURE this will save a paying for a massive attorney fee!rn

We are grateful for your feedback and looking forward to serving you again. Thank you!

Karl H.

January 5th, 2021

Still in process, but it is well explained. I would recommend it to anyone in Texas.

Thank you for your feedback. We really appreciate it. Have a great day!

DENNIS M.

January 18th, 2023

very simple and complete

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ronald R.

December 30th, 2022

first tinme use, good buy=t expensive

Thank you!

Betty S.

May 2nd, 2022

Thank you for the excellent and complete layout of all forms needed to complete the Affidavit of Death and Heirship, including the notarial officer and an example of how these forms should be completed. This method definitely saves time and money and an answer to my family's Prayers.

Thank you for your feedback. We really appreciate it. Have a great day!

Victor W.

March 9th, 2022

Once I was able to get the code Number, it all went well. I was able to easily download and print off what I needed for my lawyer.

thank you.

Thank you!