Lake County Unconditional Lien Waiver on Final Payment Form (Oregon)

All Lake County specific forms and documents listed below are included in your immediate download package:

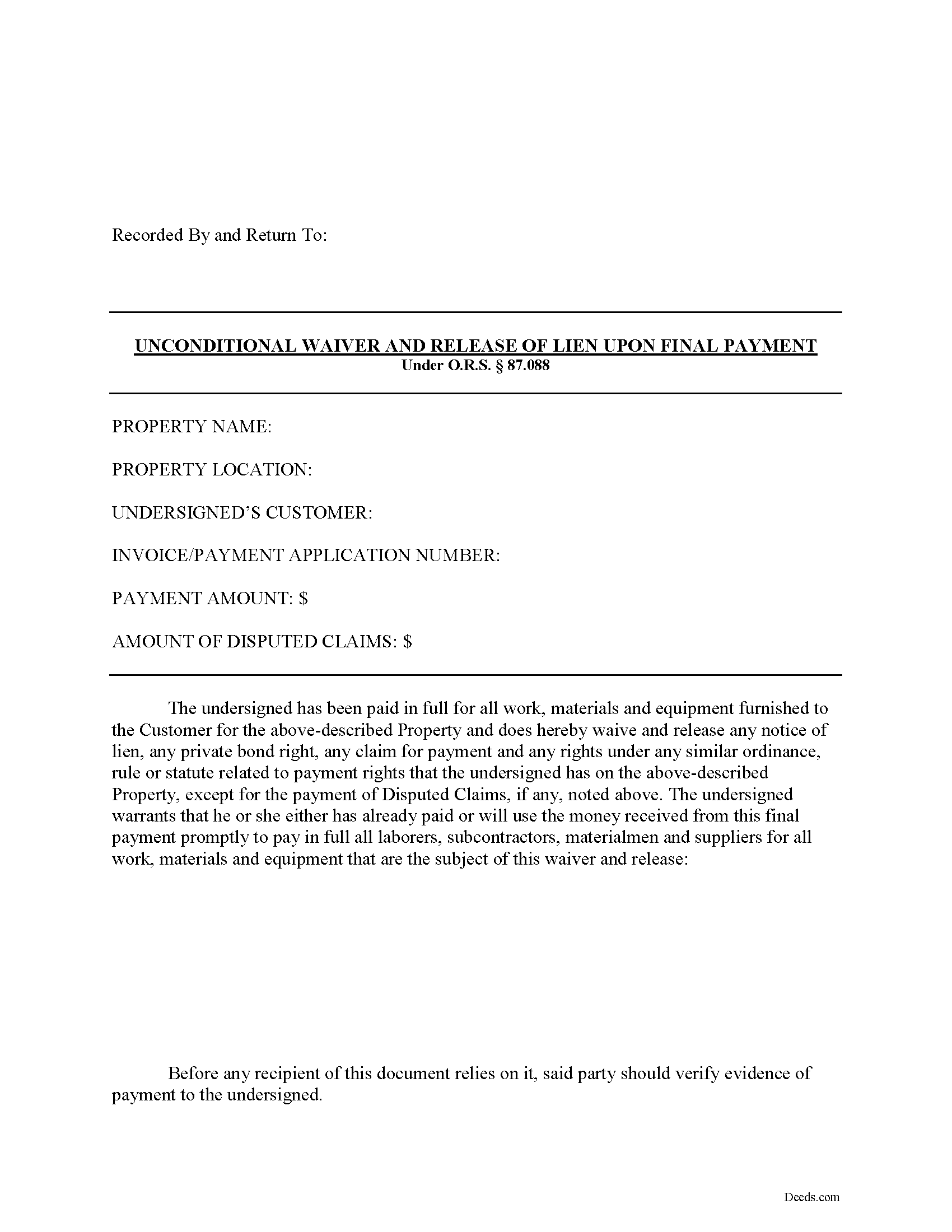

Unconditional Lien Waiver on Final Payment Form

Fill in the blank Unconditional Lien Waiver on Final Payment form formatted to comply with all Oregon recording and content requirements.

Included Lake County compliant document last validated/updated 10/28/2024

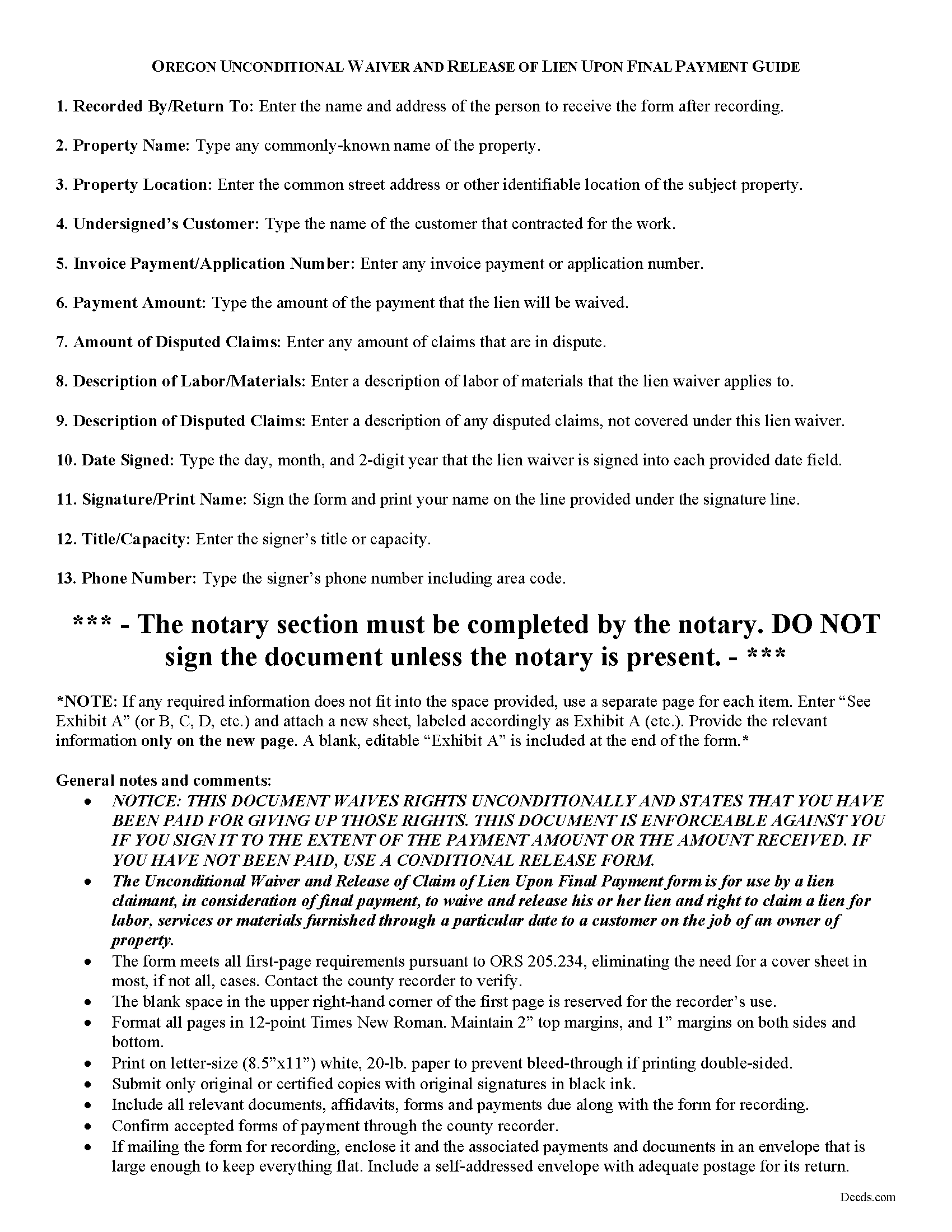

Unconditional Lien Waiver on Final Payment Guide

Line by line guide explaining every blank on the form.

Included Lake County compliant document last validated/updated 8/19/2024

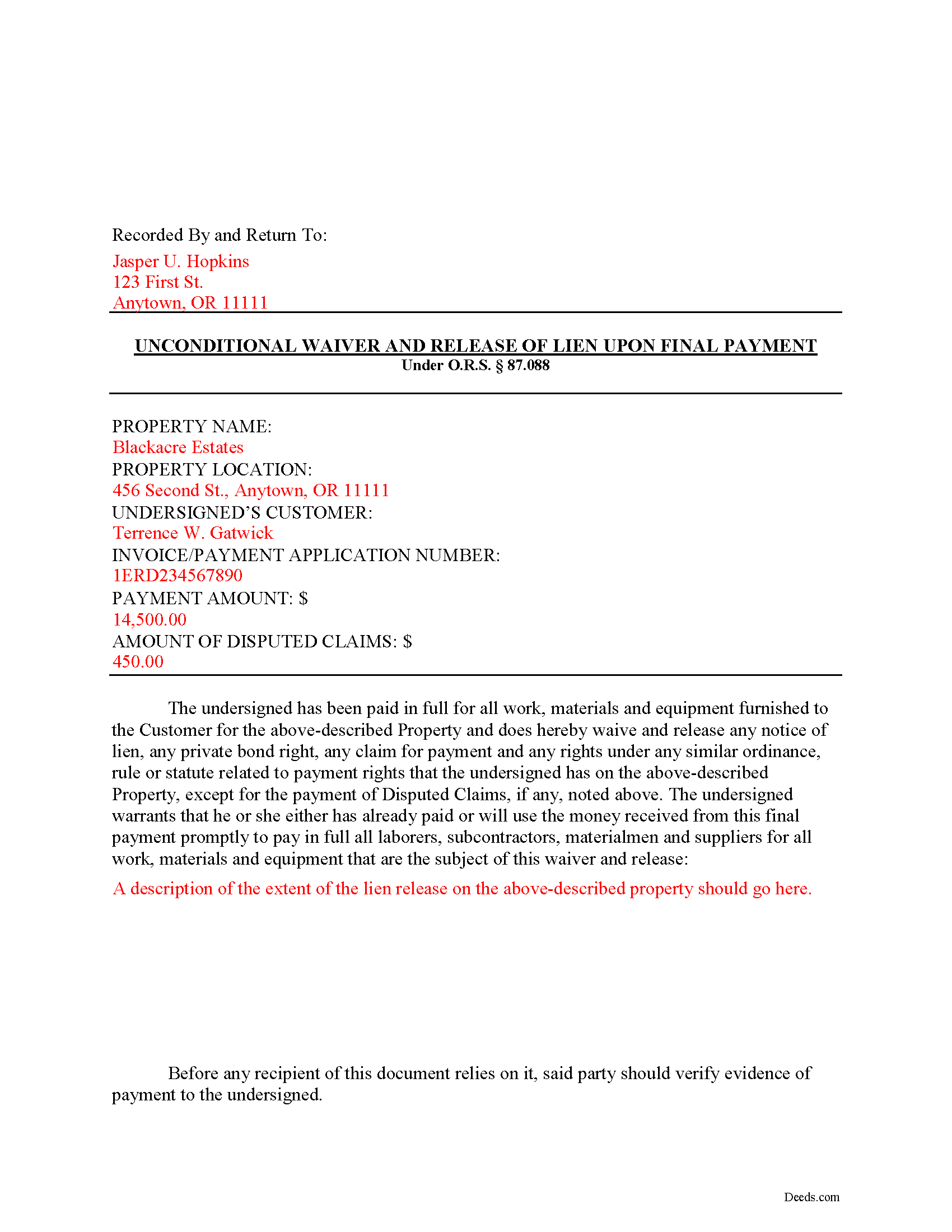

Completed Example of the Unconditional Lien Waiver on Final Payment Document

Example of a properly completed form for reference.

Included Lake County compliant document last validated/updated 11/14/2024

The following Oregon and Lake County supplemental forms are included as a courtesy with your order:

When using these Unconditional Lien Waiver on Final Payment forms, the subject real estate must be physically located in Lake County. The executed documents should then be recorded in the following office:

Lake County Clerk

513 Center St, Lakeview, Oregon 97630

Hours: 8:30am to 5:00pm M-F

Phone: (541) 947-6006

Local jurisdictions located in Lake County include:

- Adel

- Christmas Valley

- Fort Rock

- Lakeview

- New Pine Creek

- Paisley

- Plush

- Silver Lake

- Summer Lake

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Lake County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Lake County using our eRecording service.

Are these forms guaranteed to be recordable in Lake County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lake County including margin requirements, content requirements, font and font size requirements.

Can the Unconditional Lien Waiver on Final Payment forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Lake County that you need to transfer you would only need to order our forms once for all of your properties in Lake County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Oregon or Lake County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Lake County Unconditional Lien Waiver on Final Payment forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Oregon's Construction Lien Law is codified at ORS 87.001 to 87.060 and 87.075 to 87.093.

Liens are instruments, recorded with the land records for the locality where the relevant real property is situated, that document the agreement between the owner/customer and the contractor. They generally include a description of the work requested, a tentative schedule, and an information about charges and payments.

Contractors and other authorized parties (claimants) use construction liens to protect their interests while improving someone else's property. To encourage payment, the contractor may offer to waive lien rights up to a certain date or dollar amount.

Altogether, there are four separate lien waivers: partial conditional, partial unconditional, final conditional, and final unconditional. A conditional waiver offers more protection to the lien claimant, and depends on the payment clearing the bank, meaning that there are no bounced checks or other complications. An unconditional waiver offers more protection to the owner and is effective regardless of payment receipt.

For example, let's say a customer pays the total balance due. The contractor then releases the rights reserved by a recorded lien. Unconditional waivers do not require bank confirmation, so the claimant completes and records an unconditional waiver on final payment form, which identifies the parties, the nature of improvement, the property, and the relevant dates and payments applied.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of an attorney. Contact an Oregon lawyer with any questions about waivers or other issues related to construction liens.

Our Promise

The documents you receive here will meet, or exceed, the Lake County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lake County Unconditional Lien Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Jubal T.

November 27th, 2024

This is the most comprehensive, helpful real estate tool I have seen. I was at first worried because the 330# didn’t have live operators but I received messages in my account as quickly as a conversation had by text and was able to download a deed and record it the same day in a county 1,300 miles away. Highly recommended!

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Lanette H.

September 9th, 2020

I liked getting the forms but I was charged twice for some reason. I'm not sure what happened with that. Can you reimburse me? Thank you. Lanette

Thank you for your feedback Lanette. In review, it looks like your first payment was declined, second one was approved and processed. What you are seeing is one payment and a hold placed by your financial institution for the declined attempt. We are not sure why they do this but the hold usually falls off after a few day depending on their policy. If you have further questions about this you can contact your financial institution and they will explain. Have a great day.

Viola G.

November 2nd, 2023

no as easy as anticipated but convenient.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Kathy D.

November 4th, 2021

Thank You, I will be looking forward to printing these files, and getting this Ladybird deed in place.

Thank you!

Cyndi H.

December 9th, 2020

Excellent! Great communication through the process and quick response.

Thank you!

Vertina B.

June 14th, 2022

The website is well established and easy to use. I got everything I was supposed to get. I had no problem downloading the forms. All of the forms printed well.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joe W.

January 22nd, 2020

Effortless transaction and very thorough paperwork and explanations.

Thank you!

Deborah C.

July 13th, 2019

Good organization and guidance.

Thank you!

Barry N.

February 14th, 2019

The form was straight forward and very easy to complete. It took me less than 15 minutes to complete. Make sure you have the "current deed' available' when completing the form.

Thank you for your feedback Barry. Have a fantastic day!

Anita C.

November 3rd, 2021

I found this site when looking for help filing a quitclaim deed to change my property deed to my married name. I received the correct forms, an example filled out, and a guide specific to my state. I have already submitted it for review to my county assessor's office (they were extremely helpful also) and it looks as if it should sail through. Thank you Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Jose G.

April 12th, 2022

One of the best downloads ever. Very easy to do.

For the price, well worth it.

Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Diane W.

January 3rd, 2020

The forms were immediately available for download, which was nice. However, I was not impressed by the lack of several features: 1) there was no way to edit set text in the form, such as where it says you should consult an attorney. That is not necessary for recording the deed and I wanted to deleted it, but could not. 2) Also, under the "Notes" section, there is a limited area to write; I tried adding a fuller explanation of something, but the form would not accept or include it when I printed the final document. The form may do the job, but it's not very sophisticated or elegant.

Thank you for your feedback. We really appreciate it. Have a great day!