Wheeler County Trustee Deed Form (Oregon)

All Wheeler County specific forms and documents listed below are included in your immediate download package:

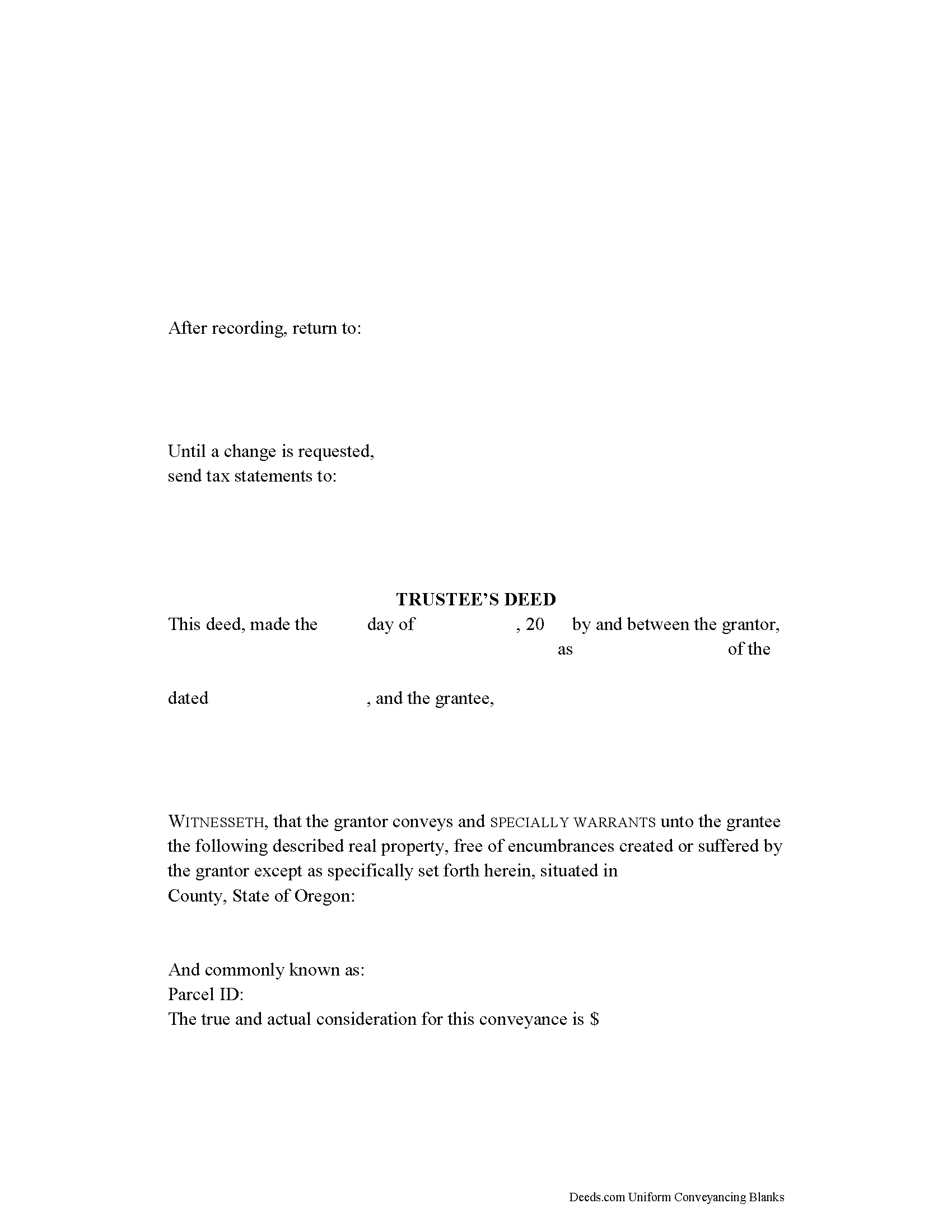

Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Wheeler County compliant document last validated/updated 10/30/2024

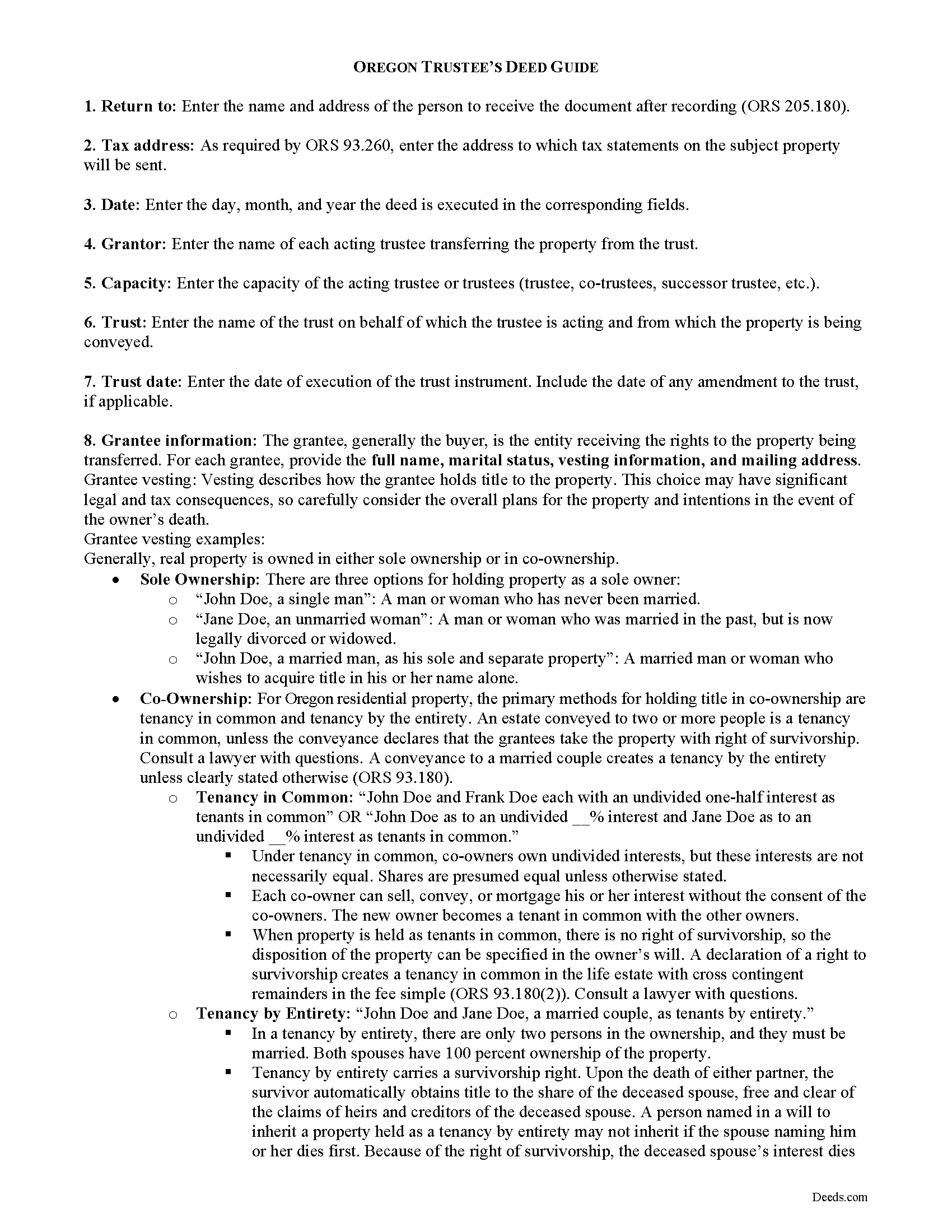

Trustee Deed Guide

Line by line guide explaining every blank on the form.

Included Wheeler County compliant document last validated/updated 12/6/2024

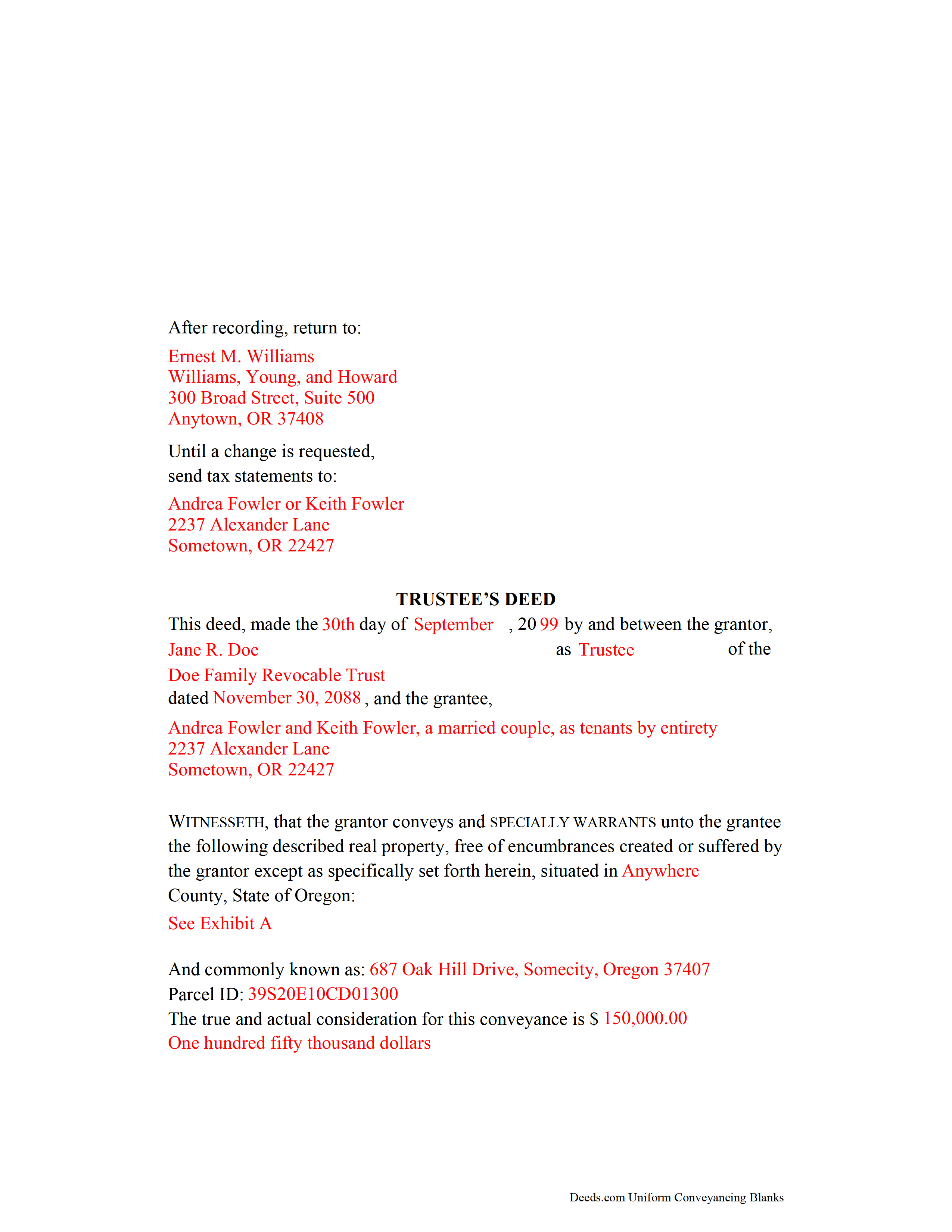

Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

Included Wheeler County compliant document last validated/updated 10/14/2024

The following Oregon and Wheeler County supplemental forms are included as a courtesy with your order:

When using these Trustee Deed forms, the subject real estate must be physically located in Wheeler County. The executed documents should then be recorded in the following office:

Wheeler County Clerk

701 Adams St, Rm 204 / PO Box 327, Fossil, Oregon 97830

Hours: M-F 8am - 12pm & 1pm - 4pm

Phone: (503) 763-2400, 763-2374, 763-2373

Local jurisdictions located in Wheeler County include:

- Fossil

- Mitchell

- Spray

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Wheeler County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Wheeler County using our eRecording service.

Are these forms guaranteed to be recordable in Wheeler County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wheeler County including margin requirements, content requirements, font and font size requirements.

Can the Trustee Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Wheeler County that you need to transfer you would only need to order our forms once for all of your properties in Wheeler County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Oregon or Wheeler County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Wheeler County Trustee Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Oregon Trustee's Deeds & Transfers from Living Trusts

NOTE: This article pertains to living trusts, a type of express trust as set forth in the Oregon Uniform Trust Code (ORS 130.005). Deeds titled "trustee's deed," which transfer real property by an express trust, should not be confused with deeds titled "trustee's deed upon sale," which are used to convey real property after foreclosure under a deed of trust (see ORS 86.775 for trustee's deeds upon sale).

Oregon is among the majority of states that has adopted or introduced for adoption some form of the Uniform Trust Code, "a set of basic default rules that fairly, consistently and clearly govern voluntary trusts," providing a more consistent and uniform (as the name would suggest) framework of rules to govern voluntary trusts across states. States generally adopt parts of the Uniform Trust Code to work alongside existing legislation. In Oregon, the Uniform Trust Code is codified at Chapter 130 of the Revised Statutes.

A trust is an arrangement whereby a settlor transfers property to another person, a trustee, who manages the assets for the benefit of another (the beneficiary). The Uniform Trust Code requires that the settlor has the capacity and expresses the intention to create a trust; that the trust has a clear beneficiary; that the trustee has duties to perform; and that the same individual is not both sole trustee and sole beneficiary (ORS 130.155). Trusts must be made for purposes that are both lawful and attainable, and for the benefit of the trust's beneficiary (ORS 130.165).

In Oregon, a settlor may create a living trust through a transfer of property to another person or to himself as trustee. The settlor conveys real property into trust by executing a deed that titles property in the name of the trustee as trustee of the trust. As with any transfer, it is important to understand the legal rights and responsibilities of vesting title in the name of a trust. For example, spouses holding property as tenants by the entirety who transfer the property into trust change their rights in the property. Consult an attorney with questions about titling trust assets.

The settlor determines how his assets will be managed and establishes plans for the distribution of the trust's contents after death by executing a trust instrument. This unrecorded document also designates the trustee and the trust beneficiaries. In a living trust, "Appointing a successor trustee is essential" when the settlor also serves as the original trustee; this ensures that the trust will continue to be managed pursuant to the settlor's intentions upon his death or incapacitation.

The Uniform Trust Code gives the trustee all the general powers over trust property "that an unmarried financially capable owner has over individually owned property" unless otherwise limited by the terms set forth in the trust instrument, and the specific power to sell trust property (ORS 130.720, 130.725(2)). In order to transfer real property held in a living trust, the trustee executes a trustee's deed.

The trustee's deed is one in a class of instruments named descriptively after the granting party, rather than the warranty of title conveyed (think administrator's deed, executor's deed, sheriff's deed). A trustee may use any statutory deed to convey interest; a lawyer can help determine the appropriate document for the situation.

In Oregon, there are four statutory short forms for deeds: warranty deed, special warranty deed, bargain and sale deed, and quitclaim deed. A warranty deed (ORS 93.850) conveys the grantor's interest and any and all after-acquired title, along with the covenants that the grantor is seized of the property and has good right to convey; that the property is free from any encumbrances apart from those indicated on the deed; and that he warrants and defends the title against the claims of all persons. A bargain and sale deed (ORS 93.860) conveys interest and any and all after-acquired title, but contains no covenants. A quitclaim deed (93.865) conveys only the interest a grantor may have at the time of the deed (and not any interest the grantor obtains after).

In Oregon, trustees most frequently use a special warranty deed to convey property. A special warranty deed (ORS 93.855) has the same effect as a warranty deed, except that the covenant of freedom from encumbrances is limited to "those created or suffered by the grantor." With a special warranty, the grantor warrants and defends the title more narrowly -- solely against persons claiming "by, through or under the grantor."

In addition to titling property in the name of the grantee, the granting clause of a trustee's deed names all executing trustees (as grantors), along with the trust and the trust date. All instruments pertaining to real property in Oregon also need a statement of the true consideration paid for the transfer, an adequate legal description of the property being conveyed, and the requisite mailing addresses to meet first-page requirements. All trustees involved in the transaction must sign the deed in the presence of a notary public before recording in the appropriate county. Grantees may request that the trustee provide a certification of trust (ORS 130.860) to confirm the trust's existence and the trustee's authority to enter the transaction.

Each case is unique, so consult a lawyer with specific questions or for complex situations relating to express trusts in Oregon and for guidance in preparing a trustee's deed.

(Oregon TD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Wheeler County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wheeler County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Eric M.

April 8th, 2021

Easy process and staff was very helpful

Thank you for your feedback. We really appreciate it. Have a great day!

Ann W.

July 13th, 2020

GREAT forms, easy to use and most importantly... compliant. Worth it and then some!

Thank you!

Christina H.

April 15th, 2021

The process was straightforward, quick and reasonably priced.

The agents provided updates every step of the way.

Thank you!

Narcedalia G.

December 4th, 2023

Easy to use quick responses with accurate information and great customer service. No need to say more!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Bruce J.

November 8th, 2019

Fast results

Thank you!

Michael L.

March 3rd, 2019

Perfect timely service! Will use again!

Thank you!

Lourdes O.

June 5th, 2020

Extremely efficient website. Beats going to Court House to record documents. My document was recorded in less then 24 hours! Amazing! I will be using deeds.com from now on.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tai H.

September 21st, 2019

Great service. Save me a time and effort in filling out LA County Quitclaim Deed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

michael o.

July 17th, 2019

After trying to get help locally I found your website. Very easy

Thank you for your feedback. We really appreciate it. Have a great day!

Debra P.

October 7th, 2020

Looked everywhere to find what I needed. Found your website and there it was. Very pleased with the speed that I received my documents in. Will definitely keep you in my go to.

Thank you!

Beth O.

January 15th, 2023

Easy peasy! Thank y'all so much.

Thank you!

Albert j.

June 3rd, 2020

Very easy site to use for a simple minded happy howmowner.

Very reasonable fee

Quick turn around

Good communication

Thank you!