Josephine County Conditional Lien Waiver on Final Payment Form (Oregon)

All Josephine County specific forms and documents listed below are included in your immediate download package:

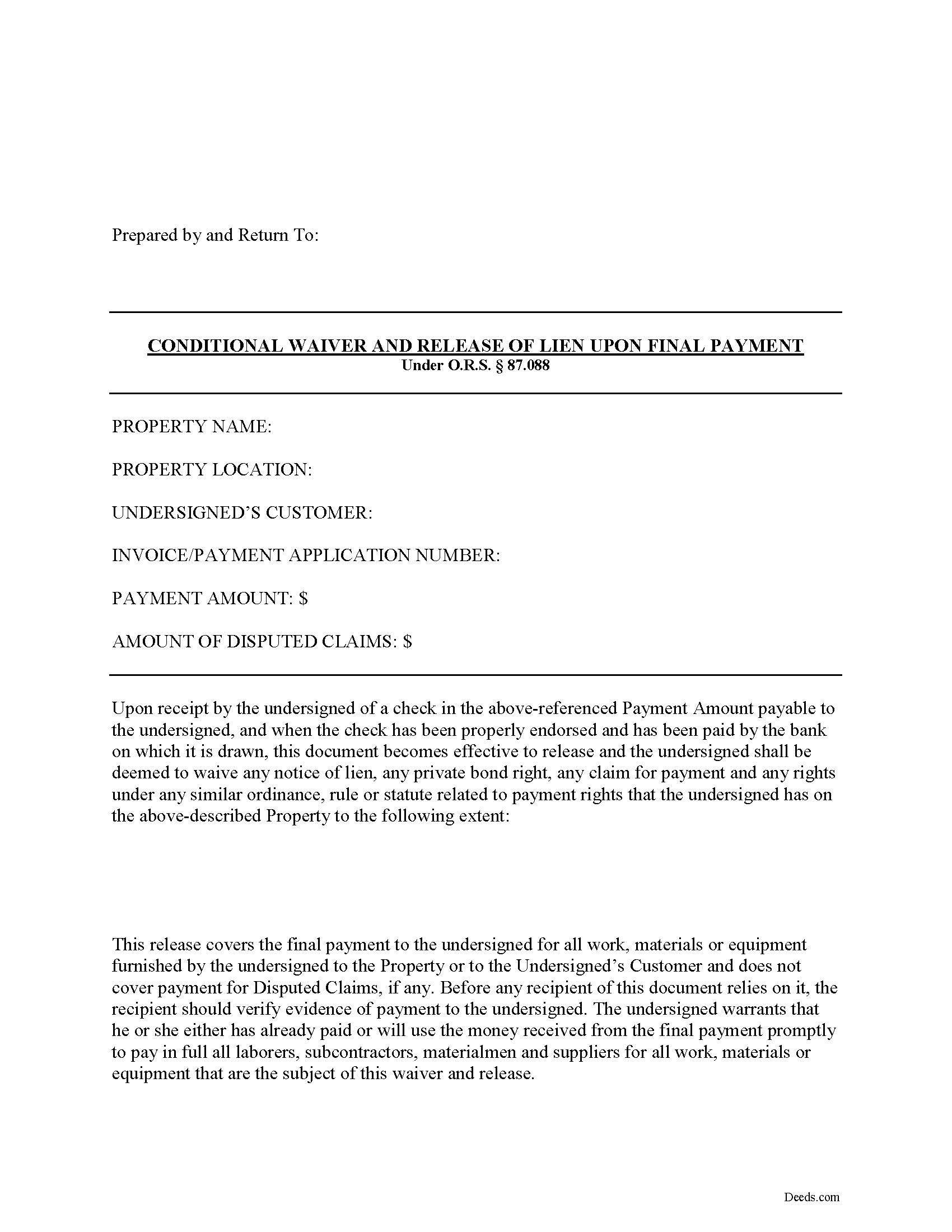

Conditional Lien Waiver on Final Payment Form

Fill in the blank Conditional Lien Waiver on Final Payment form formatted to comply with all Oregon recording and content requirements.

Included Josephine County compliant document last validated/updated 11/1/2024

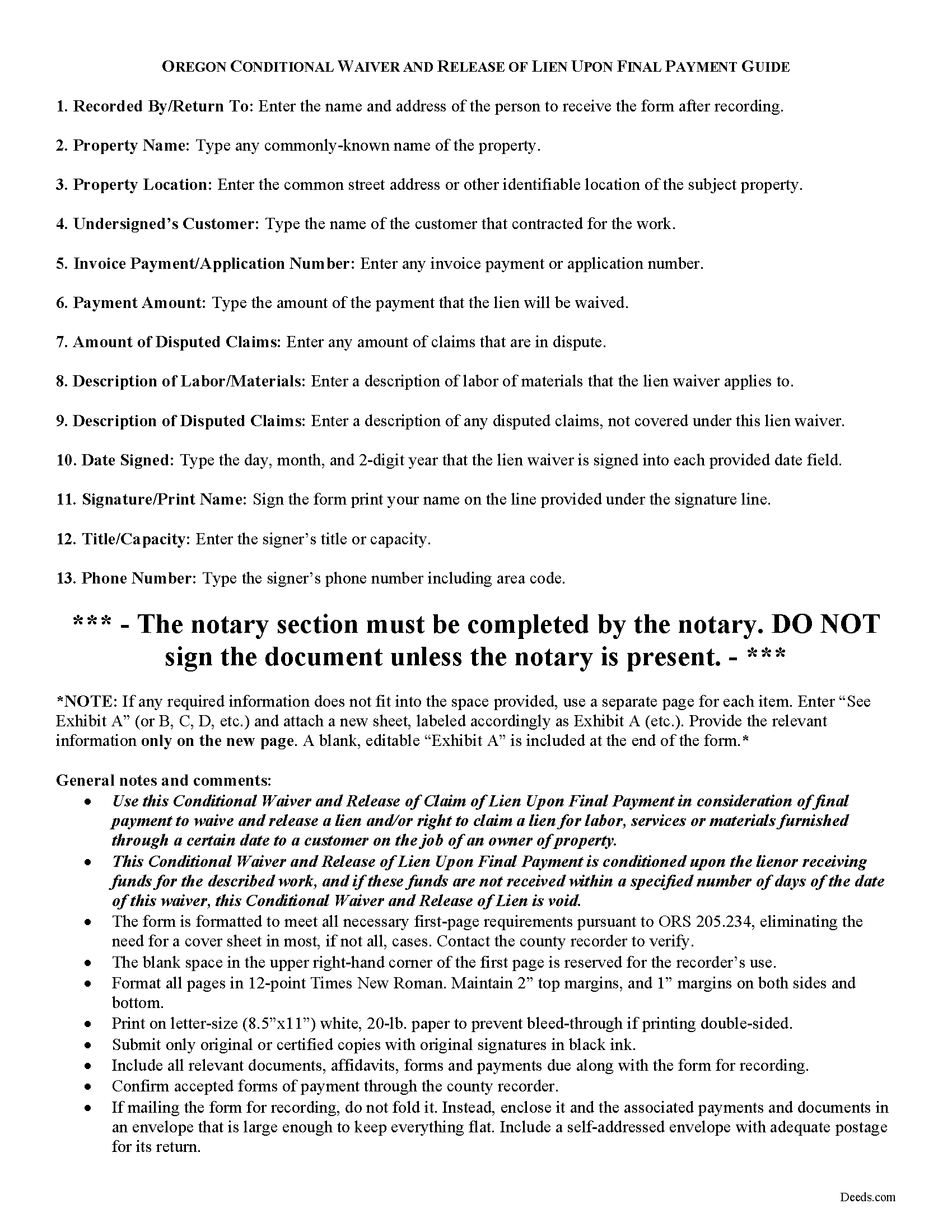

Conditional Lien Waiver on Final Payment Guide

Line by line guide explaining every blank on the form.

Included Josephine County compliant document last validated/updated 12/12/2024

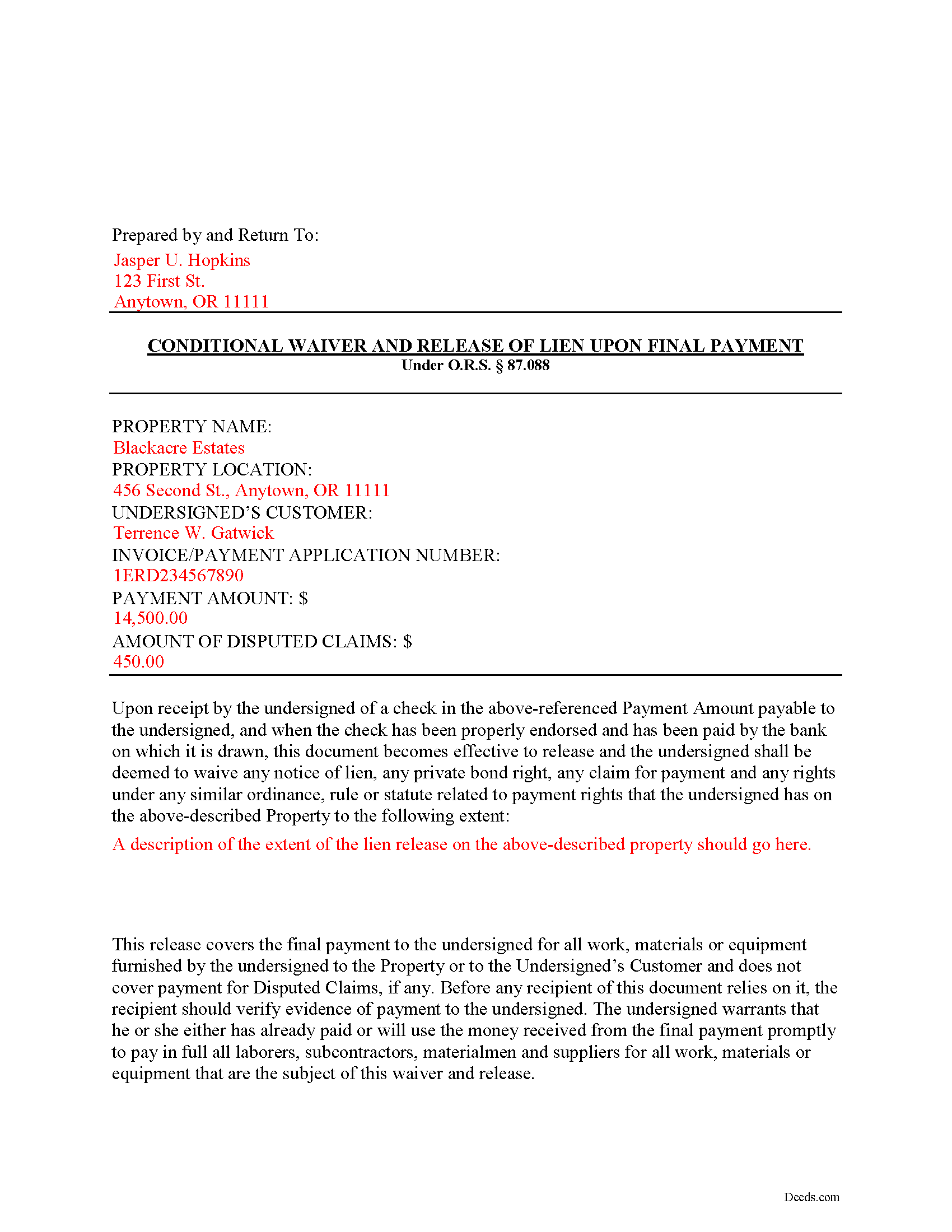

Completed Example of the Conditional Lien Waiver on Final Payment Document

Example of a properly completed form for reference.

Included Josephine County compliant document last validated/updated 12/4/2024

The following Oregon and Josephine County supplemental forms are included as a courtesy with your order:

When using these Conditional Lien Waiver on Final Payment forms, the subject real estate must be physically located in Josephine County. The executed documents should then be recorded in the following office:

Josephine County Clerk

Courthouse - 500 NW 6th St, Rm 170 / PO Box 69, Grants Pass, Oregon 97526 / 97528

Hours: 8:30 to 12:00 & 1:00 to 4:00 M-F

Phone: (541) 474-5240

Local jurisdictions located in Josephine County include:

- Cave Junction

- Grants Pass

- Kerby

- Merlin

- Murphy

- O Brien

- Selma

- Wilderville

- Williams

- Wolf Creek

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Josephine County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Josephine County using our eRecording service.

Are these forms guaranteed to be recordable in Josephine County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Josephine County including margin requirements, content requirements, font and font size requirements.

Can the Conditional Lien Waiver on Final Payment forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Josephine County that you need to transfer you would only need to order our forms once for all of your properties in Josephine County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Oregon or Josephine County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Josephine County Conditional Lien Waiver on Final Payment forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Oregon's Construction Lien Law is codified at ORS 87.001 to 87.060 and 87.075 to 87.093.

Liens are instruments, recorded with the land records for the locality where the relevant real property is situated, that document the agreement between the owner/customer and the contractor. They identify the primary parties and generally include a description of the work requested, a tentative schedule, and an information about charges and payments.

Contractors and other authorized parties (claimants) use construction liens to protect their interests while improving someone else's property. To encourage payment, the contractor may offer to waive lien rights.

Altogether, there are four separate lien waivers: partial conditional, partial unconditional, final conditional, and final unconditional. A conditional waiver offers more protection to the lien claimant, and depends on the payment clearing the bank, meaning that there are no bounced checks or other complications. An unconditional waiver offers more protection to the owner and is effective regardless of payment receipt.

For example, let's say a customer pays the total balance due. After the payment clears the bank, the claimant completes and records a conditional waiver on final payment form, which identifies the parties, the nature of improvement, the property, and the relevant dates and payments applied. By recording, the claimant releases all rights reserved by the earlier lien.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of an attorney. Please contact an Oregon lawyer with any questions about waivers or other issues related to construction liens.

Our Promise

The documents you receive here will meet, or exceed, the Josephine County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Josephine County Conditional Lien Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Betty S.

May 2nd, 2022

Thank you for the excellent and complete layout of all forms needed to complete the Affidavit of Death and Heirship, including the notarial officer and an example of how these forms should be completed. This method definitely saves time and money and an answer to my family's Prayers.

Thank you for your feedback. We really appreciate it. Have a great day!

Bernique C.

May 18th, 2022

Was very pleased to be referred by another user for needed documents. Add me to "satisfied customers"

Thank you for your feedback. We really appreciate it. Have a great day!

Joe B.

August 29th, 2022

Fantastic service -- very clear

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Arthur M.

December 8th, 2020

A good service that saves a lot of time and precludes making a trip to the County Assessors Office.

Valuable service.

Thank you!

Clay H.

July 11th, 2022

The provided docs and guide were very helpful. Well worth the price in my opinion.

Thank you for your feedback. We really appreciate it. Have a great day!

Elliot B.

January 31st, 2022

Outstanding forms and the recording service made a short day of what I needed to do. Will be back for the next one, thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Gina I.

June 14th, 2021

Found the forms I needed with no problem and easy to fill out thanks to the guide that is with it. Big help!

Thank you for your feedback. We really appreciate it. Have a great day!

Brett B.

July 12th, 2022

easy to use

Thank you!

Kevin & Kim S.

August 20th, 2020

So very easy to use and we're so glad we could do everything from our home office.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chris B.

March 3rd, 2023

Accurate information and easy to use website.

Thank you for your feedback. We really appreciate it. Have a great day!

Joy Lynn W.

December 31st, 2020

Timely response and helpful....good job!

Thank you!

Robert S B.

May 22nd, 2019

I would not have ordered this form had I realised how limited the fields are for details. There is no room for elaboration of terms. The language only allows one grantor and one grantee, and the gender and quantity default construction is a poor choice. Be basic, but leave room for more.

Thank you for your feedback. We really appreciate it. Have a great day!