Marshall County Preliminary Notice Form (Oklahoma)

All Marshall County specific forms and documents listed below are included in your immediate download package:

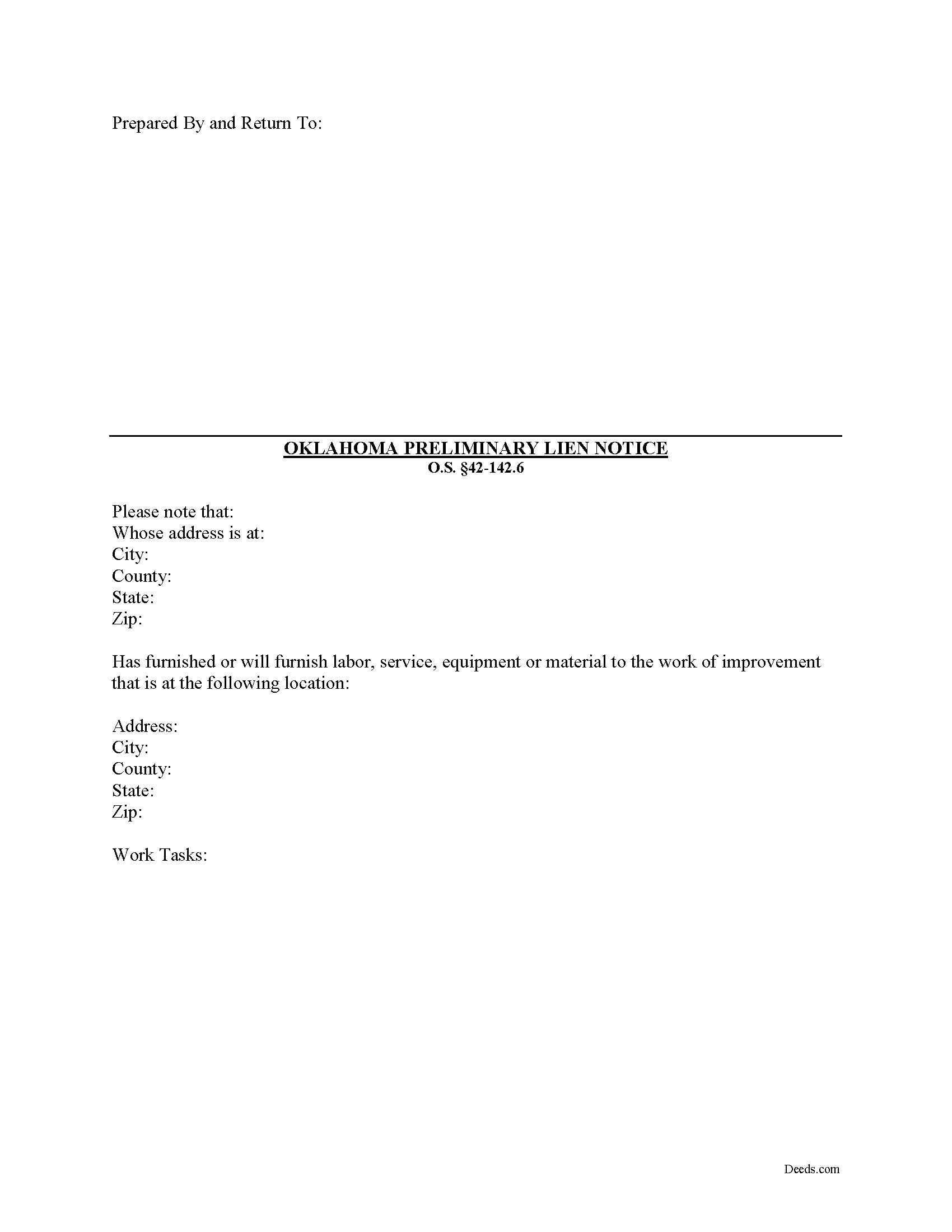

Preliminary Notice Form

Fill in the blank Preliminary Notice form formatted to comply with all Oklahoma recording and content requirements.

Included Marshall County compliant document last validated/updated 11/29/2024

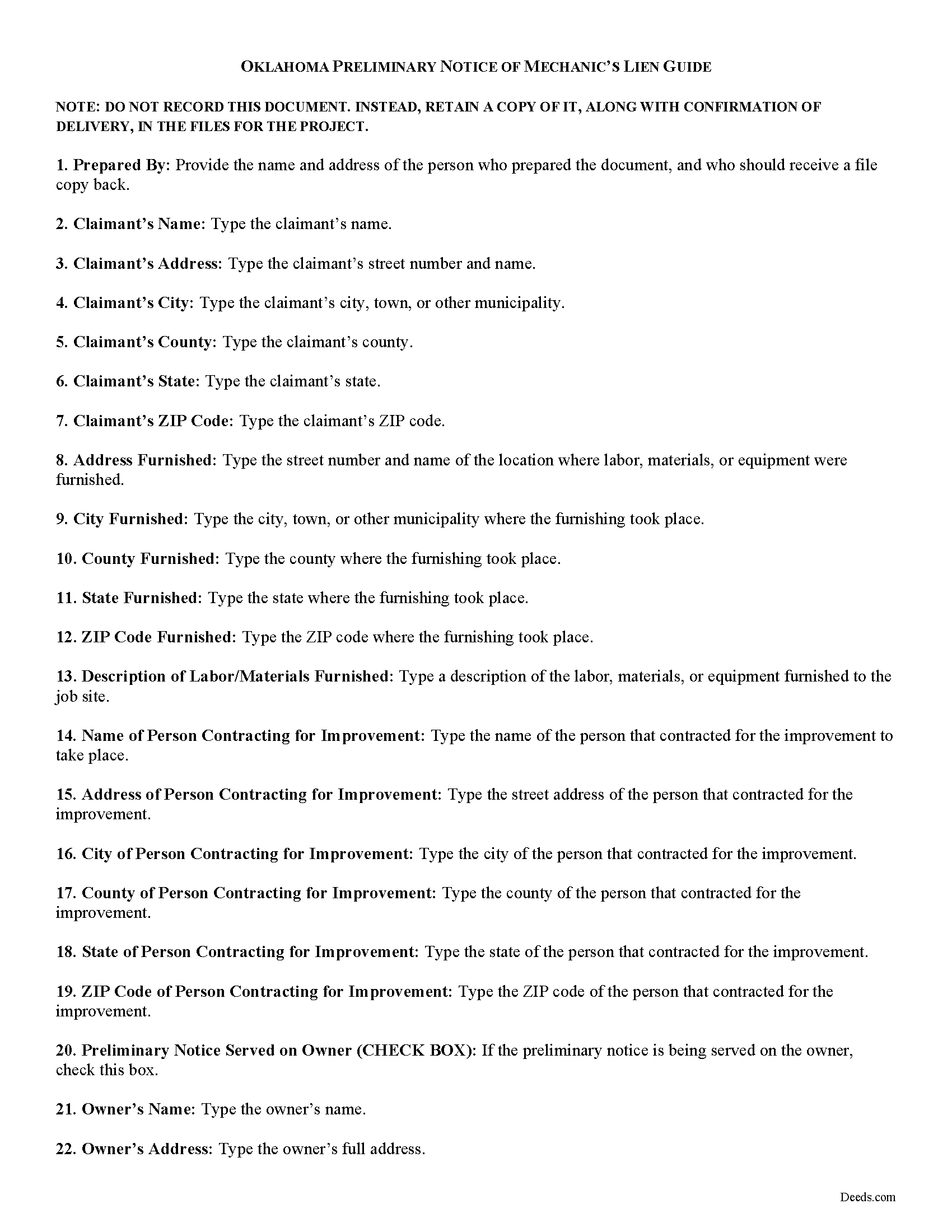

Preliminary Notice Guide

Line by line guide explaining every blank on the form.

Included Marshall County compliant document last validated/updated 10/9/2024

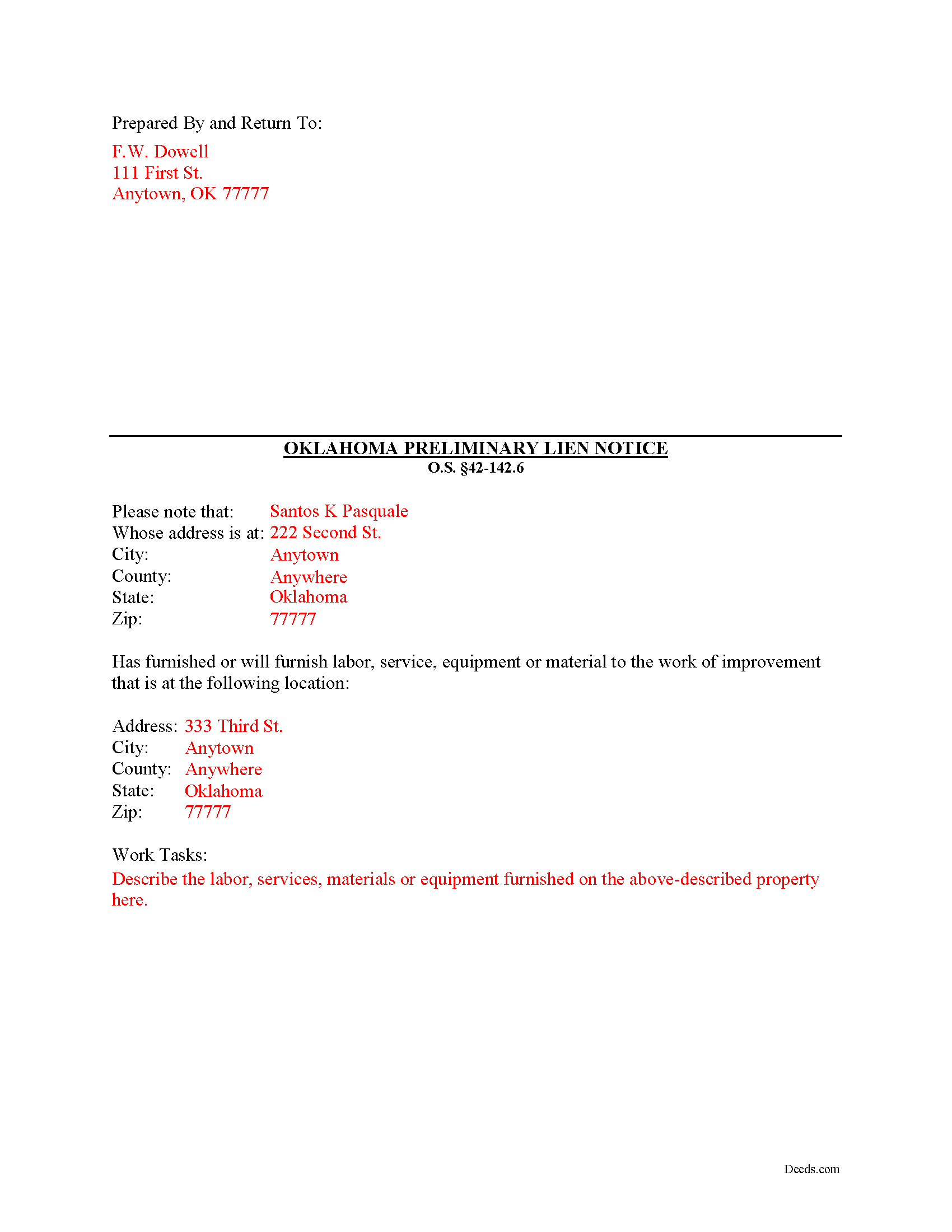

Completed Example of the Preliminary Notice Document

Example of a properly completed form for reference.

Included Marshall County compliant document last validated/updated 12/18/2024

The following Oklahoma and Marshall County supplemental forms are included as a courtesy with your order:

When using these Preliminary Notice forms, the subject real estate must be physically located in Marshall County. The executed documents should then be recorded in the following office:

Marshall County Clerk

219 Plaza / PO Box 824, Madill, Oklahoma 73446

Hours: 8:30am - 12:00 & 12:30 - 5:00pm

Phone: (580) 795-3220

Local jurisdictions located in Marshall County include:

- Kingston

- Lebanon

- Madill

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Marshall County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Marshall County using our eRecording service.

Are these forms guaranteed to be recordable in Marshall County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marshall County including margin requirements, content requirements, font and font size requirements.

Can the Preliminary Notice forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Marshall County that you need to transfer you would only need to order our forms once for all of your properties in Marshall County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Oklahoma or Marshall County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Marshall County Preliminary Notice forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Many states, including Oklahoma, mandate that a contractor, subcontractor, or other service provider first serve a preliminary notice on a property owner in order to preserve the rights to claim a mechanic's lien. The purpose of such notice is to make the owner aware of the parties involved in their construction job, which in turn protects the property from any "hidden liens" filed claimants who later come out of the woodwork. As is often the case in construction jobs, contractors employ persons below them who could have a lien claim even if the owner paid the first contractor in full.

In Oklahoma, prior to filing a lien statement, no later than seventy-five (75) days after the last date of supply of material, services, labor, or equipment in which the claimant is entitled or may be entitled to lien rights, the claimant must send to the last-known address of the original contractor and an owner of the property a pre-lien notice. O.S. 142.6(B)(1). No lien affecting property occupied as a dwelling by an owner will be valid unless the pre-lien notice was sent within seventy-five (75) days of the last furnishing of materials, services, labor or equipment by the claimant. Id.

The pre-lien notice must be in writing and contain the following: (1) a statement that the notice is a pre-lien notice, (2) the complete name, address, and telephone number of the claimant, or the claimant's representative, (3) the date of supply of material, services, labor, or equipment, (4) a description of the material, services, labor, or equipment, (5) the name and last-known address of the person who requested that the claimant provide the material, services, labor, or equipment, (6) the address, legal description, or location of the property to which the material, services, labor, or equipment has been supplied, (7) a statement of the dollar amount of the material, services, labor, or equipment furnished or to be furnished, and (8) the signature of the claimant, or the claimant's representative. O.S. 142.6(B)(4).

The claimant may also request in writing, that the original contractor provide to the claimant the name and last-known address of an owner of the property. O.S. 142.6(B)(6). Failure of the original contractor to provide the claimant with the information requested within five (5) days from the date of receipt of the request shall render the pre-lien notice requirement to the owner of the property unenforceable. Id.

The claimant must also furnish to the county clerk at the time of the filing of the lien statement a notarized affidavit verifying compliance with the pre-lien notice requirements. O.S. 142.6(C). Any claimant who falsifies the affidavit will be guilty of a misdemeanor, punished by a fine of not more than $5000, or by imprisonment for a maximum of thirty days. Id.

Sending the preliminary notice is vital to protect lien rights. Failure by the claimant to comply with the pre-lien notice requirements will invalidate that portion of the lien claim without notice. O.S. 142.6(D). Therefore, by complying with the notice statute, potential claimants ensure their lien rights will be available if ever needed.

This article is provided for informational purposes only and should not be relied upon a substitute for the advice of a legal professional. Please contact an attorney with questions about preliminary lien notice, or any other issues related to liens in Oklahoma.

Our Promise

The documents you receive here will meet, or exceed, the Marshall County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marshall County Preliminary Notice form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4446 Reviews )

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Susan H.

September 1st, 2020

Best idea ever for completing an on-line government form. And it came with instructions!!!!! Thank you, Gadsden County.

Thank you!

Gregory N.

September 10th, 2020

Good information guiding through filling out the product. Would like form to be more flexible in terms of spacing, but otherwise excellent.

Thank you for your feedback. We really appreciate it. Have a great day!

Randy R.

May 16th, 2019

Thank you

So far everything worked great. Got my downloads so I'm off and running. I hope the rest of the paperwork goes this easy.

Thank you Randy, we appreciate your feedback.

Michael W.

April 15th, 2020

I am generally pleased with your products. However, I found it difficult to return to the package after accessing one selected document. One other comment: Your Trustee's Deed package should include a Certificate of Trust form.

Thank you for your feedback. We really appreciate it. Have a great day!

Lillian F.

September 13th, 2019

Very well satisfy with my results. I could not ask for better service d

Thank you for your feedback. We really appreciate it. Have a great day!

CECIL E C.

June 27th, 2019

You made it easy to attain the documents I needed. The cost was very reasonable...thanks

Thank you for your feedback Cecil, we really appreciate it.

Beverly J. A.

November 27th, 2022

The forms where easy to follow with the directions showing how to fill out the forms that I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Ralph B.

November 25th, 2023

My needs were met quickly and efficiently with very little wait. Deeds.com made it easy to understand and use their program and I couldn't be more happy with the results!

It was a pleasure serving you. Thank you for the positive feedback!

Ronnie W T.

September 16th, 2022

Very fast and efficient as soon as we paid for the document, it was downloaded to us immediately.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Clarice O.

June 15th, 2020

It was very easy plus exactly what I neded.

Thank you!

catherine c.

August 22nd, 2020

very efficient with communication and follow-up(s) will be using again, thank you!:)

Thank you!

Audrey T.

August 18th, 2020

The info was good for the money, but not all that I needed.

Thank you for your feedback. We really appreciate it. Have a great day!