Coal County Preliminary Notice Form (Oklahoma)

All Coal County specific forms and documents listed below are included in your immediate download package:

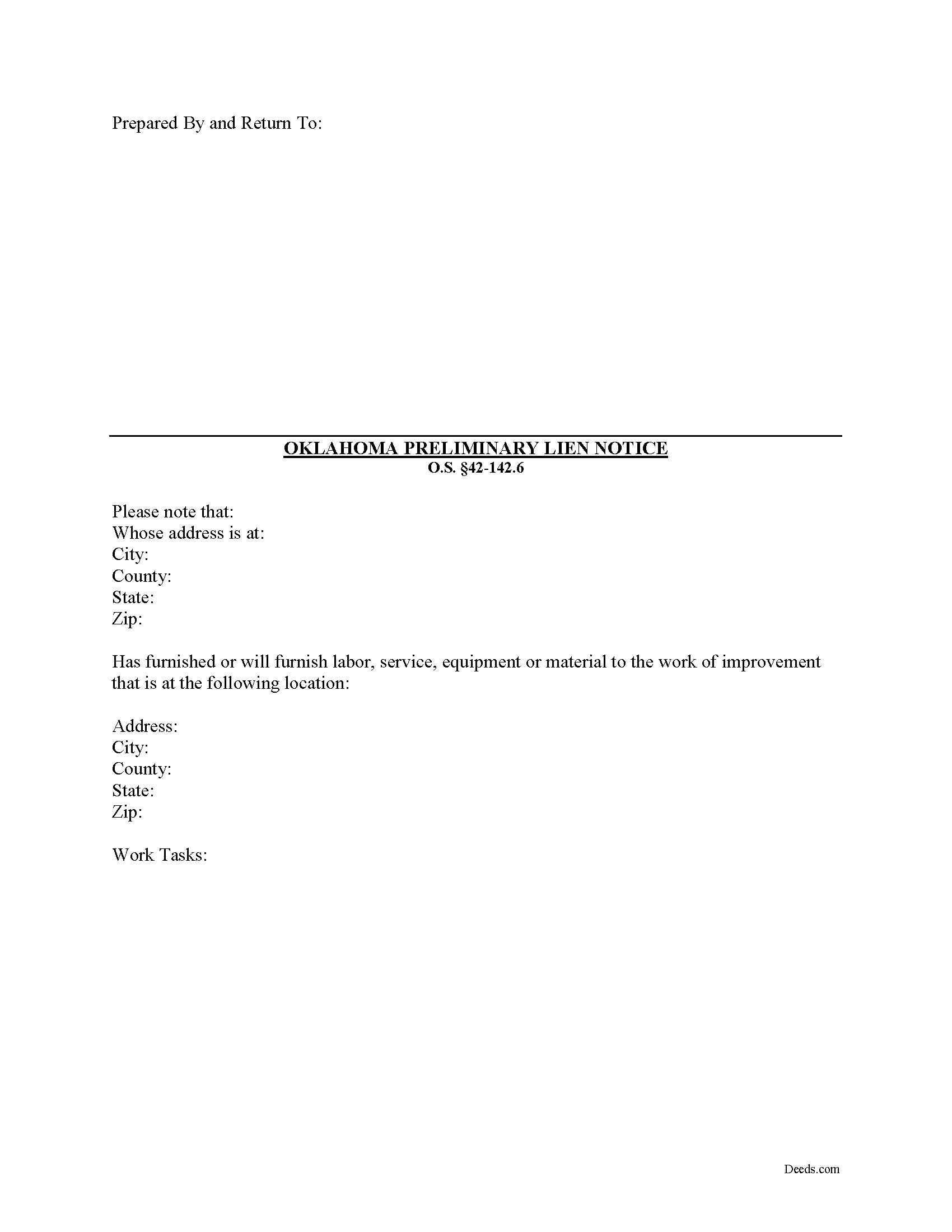

Preliminary Notice Form

Fill in the blank Preliminary Notice form formatted to comply with all Oklahoma recording and content requirements.

Included Coal County compliant document last validated/updated 8/5/2024

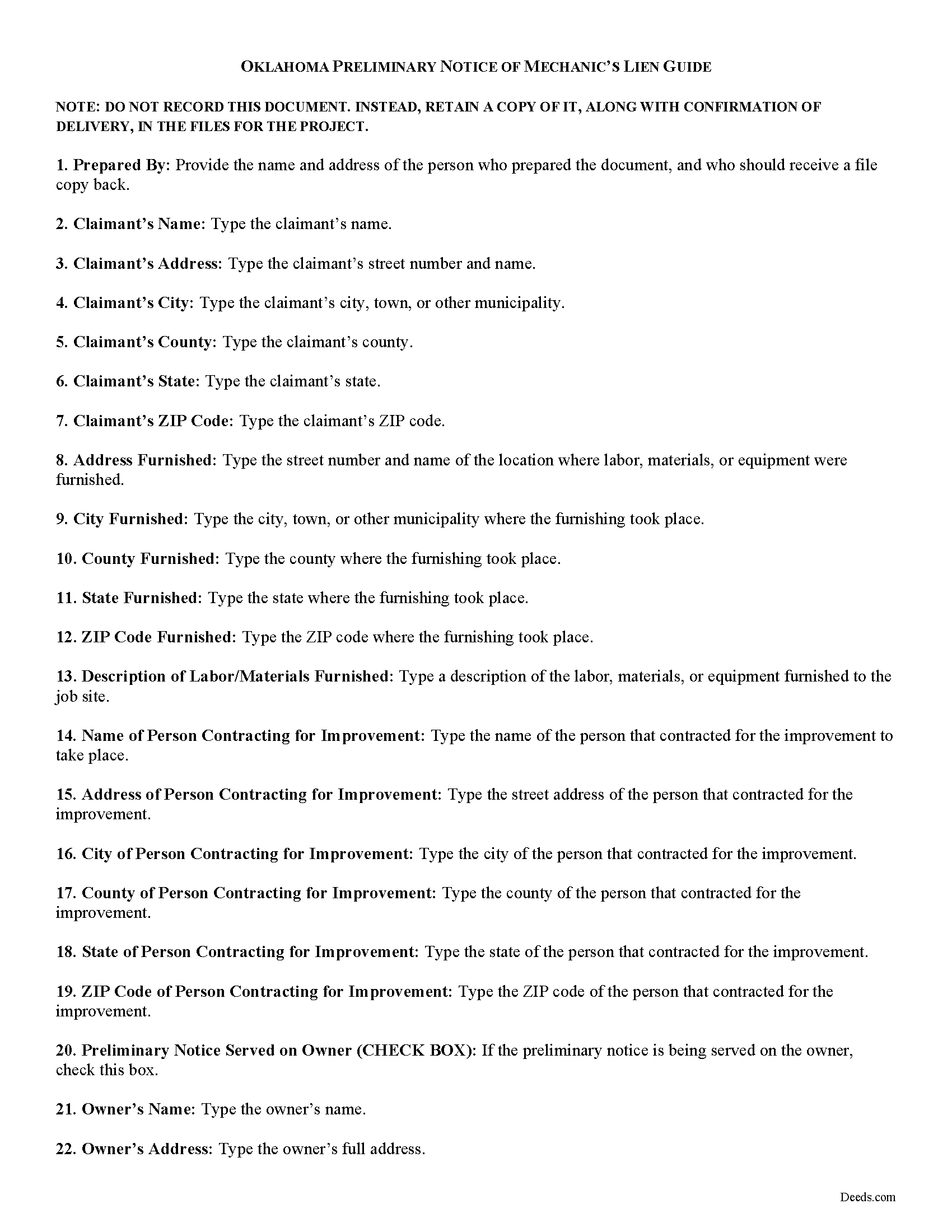

Preliminary Notice Guide

Line by line guide explaining every blank on the form.

Included Coal County compliant document last validated/updated 10/9/2024

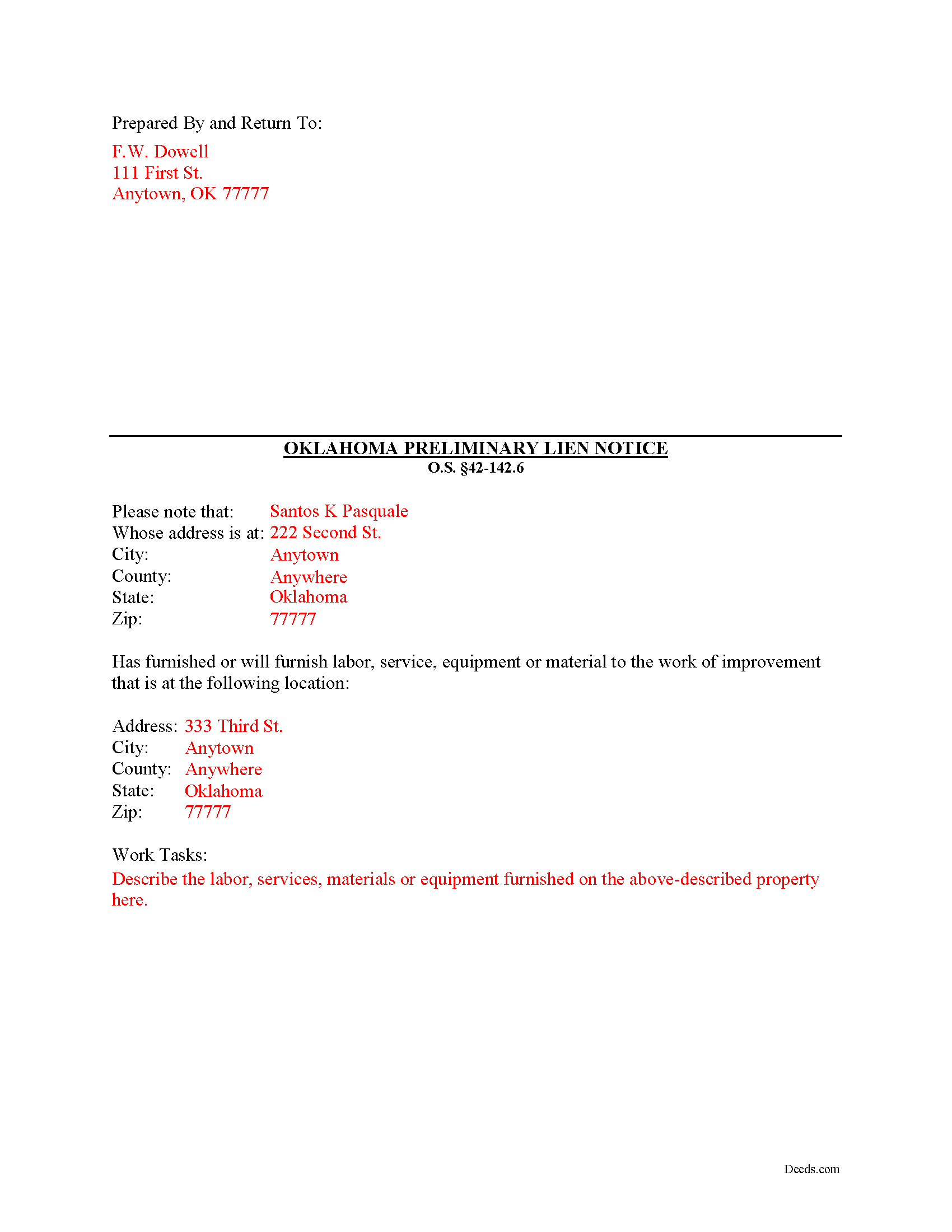

Completed Example of the Preliminary Notice Document

Example of a properly completed form for reference.

Included Coal County compliant document last validated/updated 11/14/2024

The following Oklahoma and Coal County supplemental forms are included as a courtesy with your order:

When using these Preliminary Notice forms, the subject real estate must be physically located in Coal County. The executed documents should then be recorded in the following office:

Coal County Clerk

Courthouse - 4 N Main St, Suite 1, Coalgate, Oklahoma 74538

Hours: 8:00 to 4:00 M-F

Phone: (580) 927-2103

Local jurisdictions located in Coal County include:

- Centrahoma

- Clarita

- Coalgate

- Lehigh

- Tupelo

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Coal County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Coal County using our eRecording service.

Are these forms guaranteed to be recordable in Coal County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Coal County including margin requirements, content requirements, font and font size requirements.

Can the Preliminary Notice forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Coal County that you need to transfer you would only need to order our forms once for all of your properties in Coal County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Oklahoma or Coal County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Coal County Preliminary Notice forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Many states, including Oklahoma, mandate that a contractor, subcontractor, or other service provider first serve a preliminary notice on a property owner in order to preserve the rights to claim a mechanic's lien. The purpose of such notice is to make the owner aware of the parties involved in their construction job, which in turn protects the property from any "hidden liens" filed claimants who later come out of the woodwork. As is often the case in construction jobs, contractors employ persons below them who could have a lien claim even if the owner paid the first contractor in full.

In Oklahoma, prior to filing a lien statement, no later than seventy-five (75) days after the last date of supply of material, services, labor, or equipment in which the claimant is entitled or may be entitled to lien rights, the claimant must send to the last-known address of the original contractor and an owner of the property a pre-lien notice. O.S. 142.6(B)(1). No lien affecting property occupied as a dwelling by an owner will be valid unless the pre-lien notice was sent within seventy-five (75) days of the last furnishing of materials, services, labor or equipment by the claimant. Id.

The pre-lien notice must be in writing and contain the following: (1) a statement that the notice is a pre-lien notice, (2) the complete name, address, and telephone number of the claimant, or the claimant's representative, (3) the date of supply of material, services, labor, or equipment, (4) a description of the material, services, labor, or equipment, (5) the name and last-known address of the person who requested that the claimant provide the material, services, labor, or equipment, (6) the address, legal description, or location of the property to which the material, services, labor, or equipment has been supplied, (7) a statement of the dollar amount of the material, services, labor, or equipment furnished or to be furnished, and (8) the signature of the claimant, or the claimant's representative. O.S. 142.6(B)(4).

The claimant may also request in writing, that the original contractor provide to the claimant the name and last-known address of an owner of the property. O.S. 142.6(B)(6). Failure of the original contractor to provide the claimant with the information requested within five (5) days from the date of receipt of the request shall render the pre-lien notice requirement to the owner of the property unenforceable. Id.

The claimant must also furnish to the county clerk at the time of the filing of the lien statement a notarized affidavit verifying compliance with the pre-lien notice requirements. O.S. 142.6(C). Any claimant who falsifies the affidavit will be guilty of a misdemeanor, punished by a fine of not more than $5000, or by imprisonment for a maximum of thirty days. Id.

Sending the preliminary notice is vital to protect lien rights. Failure by the claimant to comply with the pre-lien notice requirements will invalidate that portion of the lien claim without notice. O.S. 142.6(D). Therefore, by complying with the notice statute, potential claimants ensure their lien rights will be available if ever needed.

This article is provided for informational purposes only and should not be relied upon a substitute for the advice of a legal professional. Please contact an attorney with questions about preliminary lien notice, or any other issues related to liens in Oklahoma.

Our Promise

The documents you receive here will meet, or exceed, the Coal County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Coal County Preliminary Notice form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anabel H.

April 22nd, 2020

Everything went smoothly, quickly and efficiently.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David B.

January 27th, 2020

I'm not sure how a forms web-site could be so, but I find deeds.com to be sweet.

Thank you for your feedback. We really appreciate it. Have a great day!

Gloria H.

December 17th, 2020

Very content with the service received. The document was recorded in the city in no time. Will definitely use Deeds.com again in the near future.

Thank you!

Renu A.

September 30th, 2020

The service was very reliable and they even helped with filling out the paperwork properly. Very quick turn around and efficient!

Thank you!

Pietrina P.

December 18th, 2020

Recording with Deeds.com was a seamless experience. Communications were timely, clear and professional. When I had a question, I received a prompt email reply. Overall an excellent experience

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rebecca F.

November 4th, 2021

Forms were great. I wasn't able to find them anywhere. Even the county recorder didn't have them

Thank you for your feedback. We really appreciate it. Have a great day!

James B.

February 20th, 2020

Does everything I expected it to do. Very helpful. It is in compliance with applicable Nevada State regulations

Thank you for your feedback. We really appreciate it. Have a great day!

Jamie P.

July 28th, 2022

The forms are easy to download. Easy to fill out. The information on the site and on the web provided by Deeds.com have been immensely helpful.

Thank you!

Helen M.

April 13th, 2023

All forms were exactly what I needed.

Thank you

Immediate, smoothly downloaded and printed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Frank K.

July 27th, 2023

One thing I suggest is use the nomenclature Borrower / Lender / instead of Mortgatator / Mortgatee… Had to google which is which ? !

Thank you for your feedback. We really appreciate it. Have a great day!

Donna F.

March 4th, 2019

Straight forward easy to understand completing my document. The guide readily explained filing all portions of the document.

Thank you Donna, we appreciate your feedback.

Lydia E.

December 16th, 2021

Very intuitive to use and comprehensive enough for the most complex of cases.

Thank you!