Ellis County Notice of Bond to Discharge Lien Form (Oklahoma)

All Ellis County specific forms and documents listed below are included in your immediate download package:

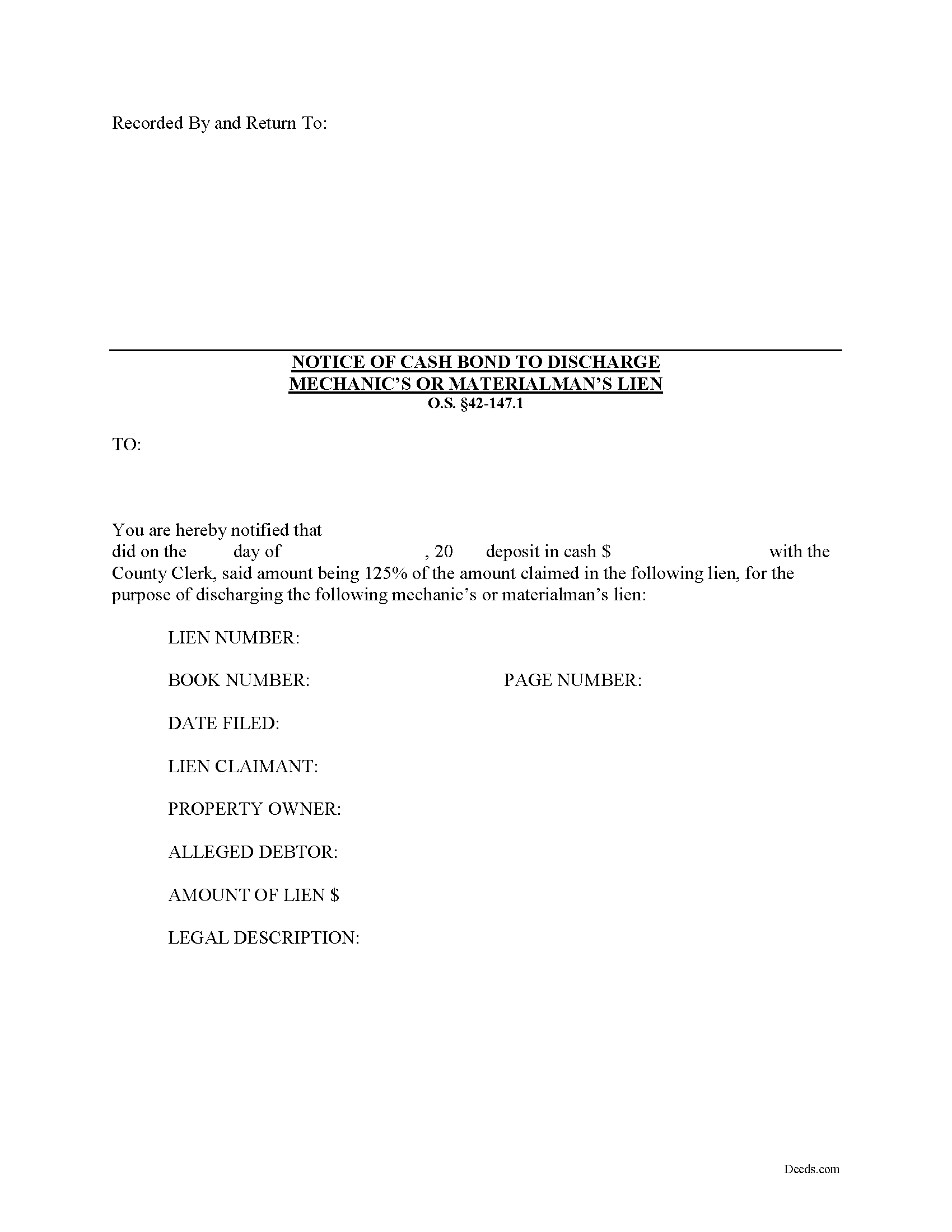

Notice of Bond to Discharge Lien Form

Fill in the blank Notice of Bond to Discharge Lien form formatted to comply with all Oklahoma recording and content requirements.

Included Ellis County compliant document last validated/updated 11/5/2024

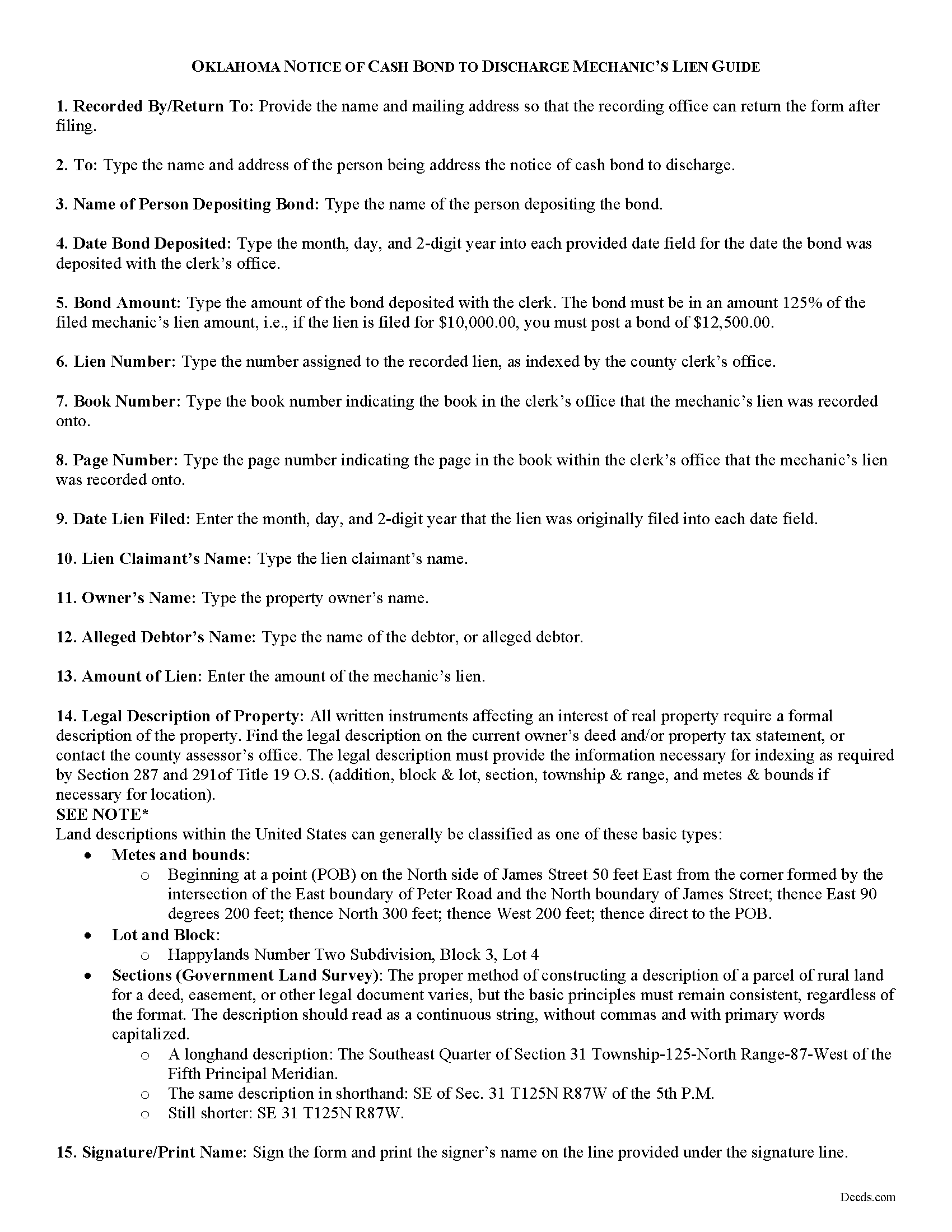

Notice of Bond to Discharge Lien Guide

Line by line guide explaining every blank on the form.

Included Ellis County compliant document last validated/updated 12/20/2024

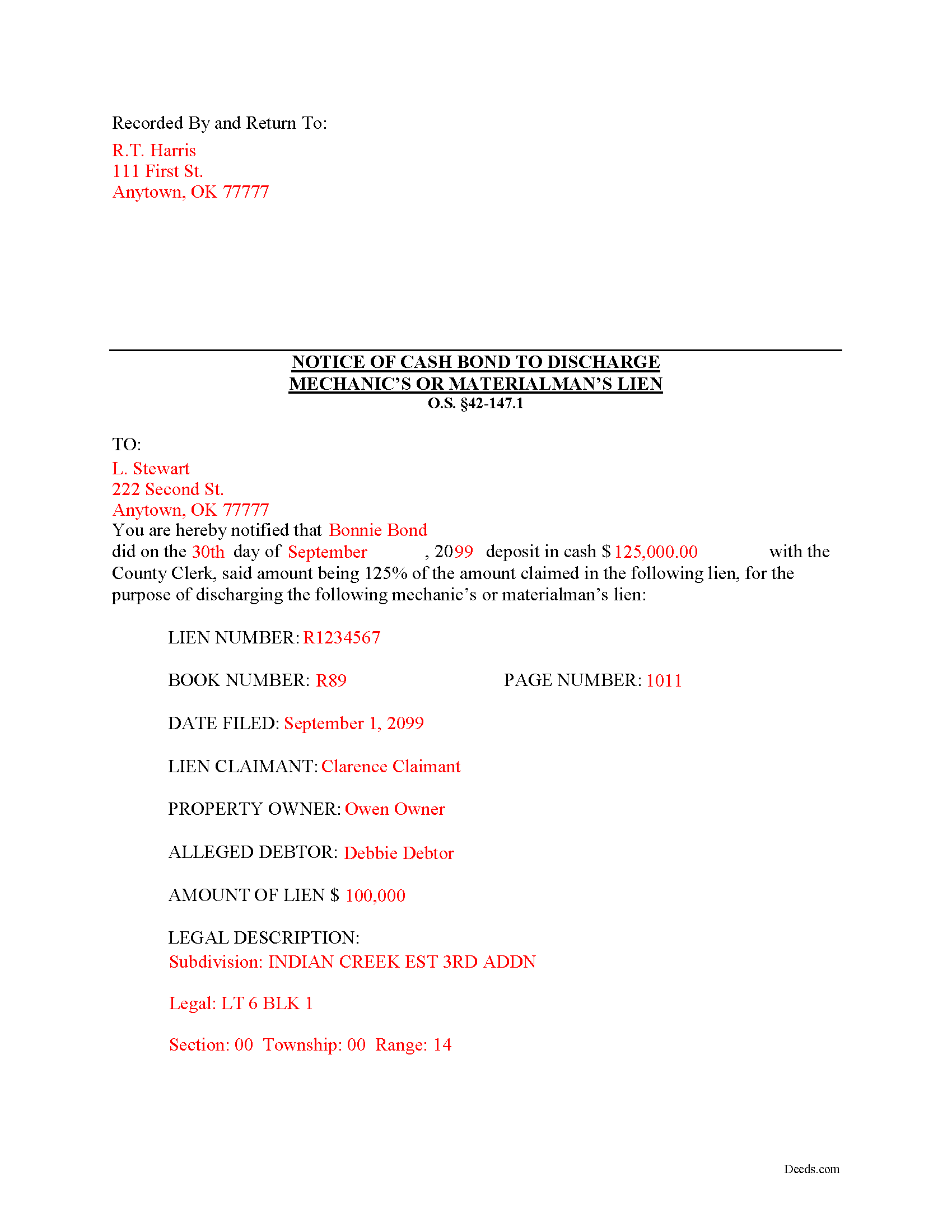

Completed Example of the Notice of Bond to Discharge Lien Document

Example of a properly completed form for reference.

Included Ellis County compliant document last validated/updated 12/20/2024

The following Oklahoma and Ellis County supplemental forms are included as a courtesy with your order:

When using these Notice of Bond to Discharge Lien forms, the subject real estate must be physically located in Ellis County. The executed documents should then be recorded in the following office:

Ellis County Clerk

Courthouse - 100 S Washington St / PO Box 197, Arnett, Oklahoma 73832

Hours: 8:30 to 4:30 M-F

Phone: (580) 885-7301

Local jurisdictions located in Ellis County include:

- Arnett

- Fargo

- Gage

- Shattuck

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Ellis County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Ellis County using our eRecording service.

Are these forms guaranteed to be recordable in Ellis County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Ellis County including margin requirements, content requirements, font and font size requirements.

Can the Notice of Bond to Discharge Lien forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Ellis County that you need to transfer you would only need to order our forms once for all of your properties in Ellis County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Oklahoma or Ellis County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Ellis County Notice of Bond to Discharge Lien forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Discharging an Oklahoma Lien by Posting Bond

Property owners feel a strong motivation to prevent and remove any liens from their land. Liens interfere with ownership interests and can interfere with obtaining refinancing, selling property, or using it as collateral for a loan. Therefore, in order to remove or prevent a lien from being placed on your land, owners may deposit a bond as security. The bond lets the lien claimant know that a lien won't be necessary because the bond is available if payment ever becomes an issue.

Any property owner or other interested party, including but not limited to mortgagees, contractors, subcontractors and others against whom a lien claim is filed under the provisions of the law relating to mechanics' and materialmen's liens, may at any time discharge the lien by depositing with the county clerk in whose office the lien claim has been filed either: an amount of money equal to one hundred twenty-five percent (125%) of the lien claim amount; or a corporate surety bond with a penal amount equal to one hundred twenty-five percent (125%) of the lien claim amount. O.S. 42-147.1.

Within three (3) business days after the deposit of money or bond is made, the county clerk must serve upon the lien claimant, at the address shown on the lien claim, written notice setting forth: (1) the assigned number of the lien claim; (2) the name of the lien claimant; (3) the name of the property owner; (4) the name of the alleged debtor, if someone other than the property owner; (5) the property description shown on the lien claim; and (6) the amount of cash deposited or, if a bond is filed, the names of the principal and surety and the bond penalty. Id.

The party seeking to discharge the lien must prepare and deliver the notice to the county clerk and pay the appropriate fee. Id. If cash is deposited, the county clerk must immediately show the lien released of record. Id. If a bond is deposited, the lien claimant will have ten (10) days after the notice is mailed within which to file a written objection with the county clerk and if a written objection is not timely filed, the county clerk shall immediately show the lien released of record. Id. If an objection is timely made, the county clerk will set a hearing within ten (10) days thereafter and notify by ordinary mail both the lien claimant and the party making the deposit of the date and time thereof. Id.

The only possible grounds for an objection include: (1) the surety is not authorized to transact business in this state; (2) the bond is not properly signed; (2) the penal amount is less than one hundred twenty-five percent (125%) of the claim; (3) the power of attorney of the surety's attorney-in-fact does not authorize the execution; (4) there is no power of attorney attached if the bond is executed by anyone other than the surety's president and attested by its secretary; or (5) a cease and desist order has been issued against the surety either by the Insurance Commissioner or a court of competent jurisdiction. Id.

Within two (2) business days following the hearing the county clerk will either sustain (grant) or overrule (deny) the objections and notify the parties of the county clerk's ruling by ordinary mail. Id. If the objections are granted, the ruling of the county clerk will be conclusive for lien release purposes unless appealed within ten (10) days to the district court. Id. If the objections are overruled, the county clerk shall immediately show the lien released of record. Id.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of a legal professional. Please consult with an Oklahoma attorney with questions about mechanic's liens or discharging a lien by posting a bond.

Our Promise

The documents you receive here will meet, or exceed, the Ellis County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Ellis County Notice of Bond to Discharge Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4449 Reviews )

Daniel B.

December 24th, 2024

easy to use and upload.

We are delighted to have been of service. Thank you for the positive review!

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

David C.

January 17th, 2020

Very fast service

Thank you!

Dreama R.

May 7th, 2019

Awesome! I had to correct a quit claim deed and the form on your site made it very easy.

Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brenda W.

June 30th, 2021

Good.

Thank you for your feedback. We really appreciate it. Have a great day!

Benjamin B.

November 10th, 2022

Your software was beneficial; facilitating preparation of a legal document and cover page in a state where I had limited legal experience.

Thank you for your feedback. We really appreciate it. Have a great day!

Kathleen M.

December 29th, 2023

I am very happy with this service

Your kind words have brightened our teams day! Thank you for the positive feedback.

SHERRILL B.

October 10th, 2024

I received prompt attention to the package I submitted. It was submitted promptly the recorders office with a quick turn around for the recorded document. Overall a very pleasant experience.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

gary c.

January 26th, 2022

process was easy and simple to do

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara E.

March 7th, 2023

The online forms were very helpful and self-explanatory. My husband and I used several as we completed our estate planning documents.

Thank you for these forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin A.

June 7th, 2019

I LOVE THIS SITE

KEEP UP THE GREAT WORK YOUR DOING THNKS KEVIN

Thank you!

Anthony P.

December 7th, 2021

Documents exactly as described, no complaints.

Thank you!

Maribel I.

September 15th, 2022

It would be helpful to be able to edit verbiage on the form. I was preparing a Deed of Distribution; therefore, there was no consideration paid. I had to type the language into a Word document instead.

Thank you for your feedback. We really appreciate it. Have a great day!

Deirdre M.

July 11th, 2022

Thank for you guidance to amend & correct & recover my home with evidence you provide in Dead Fraud. I'll keep you updated.

Thank you!