Kay County Mortgage and Promissory Note Form (Oklahoma)

All Kay County specific forms and documents listed below are included in your immediate download package:

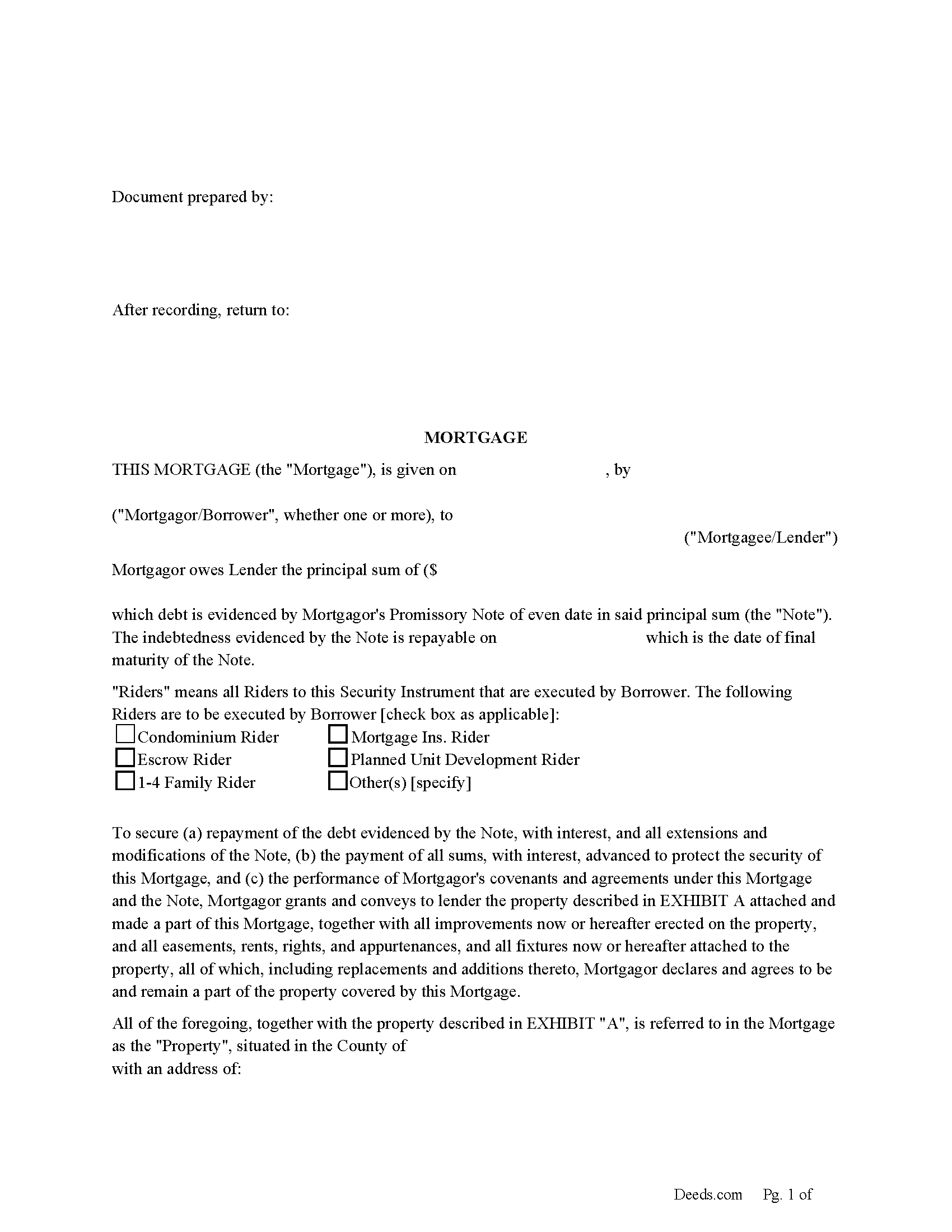

Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Kay County compliant document last validated/updated 12/13/2024

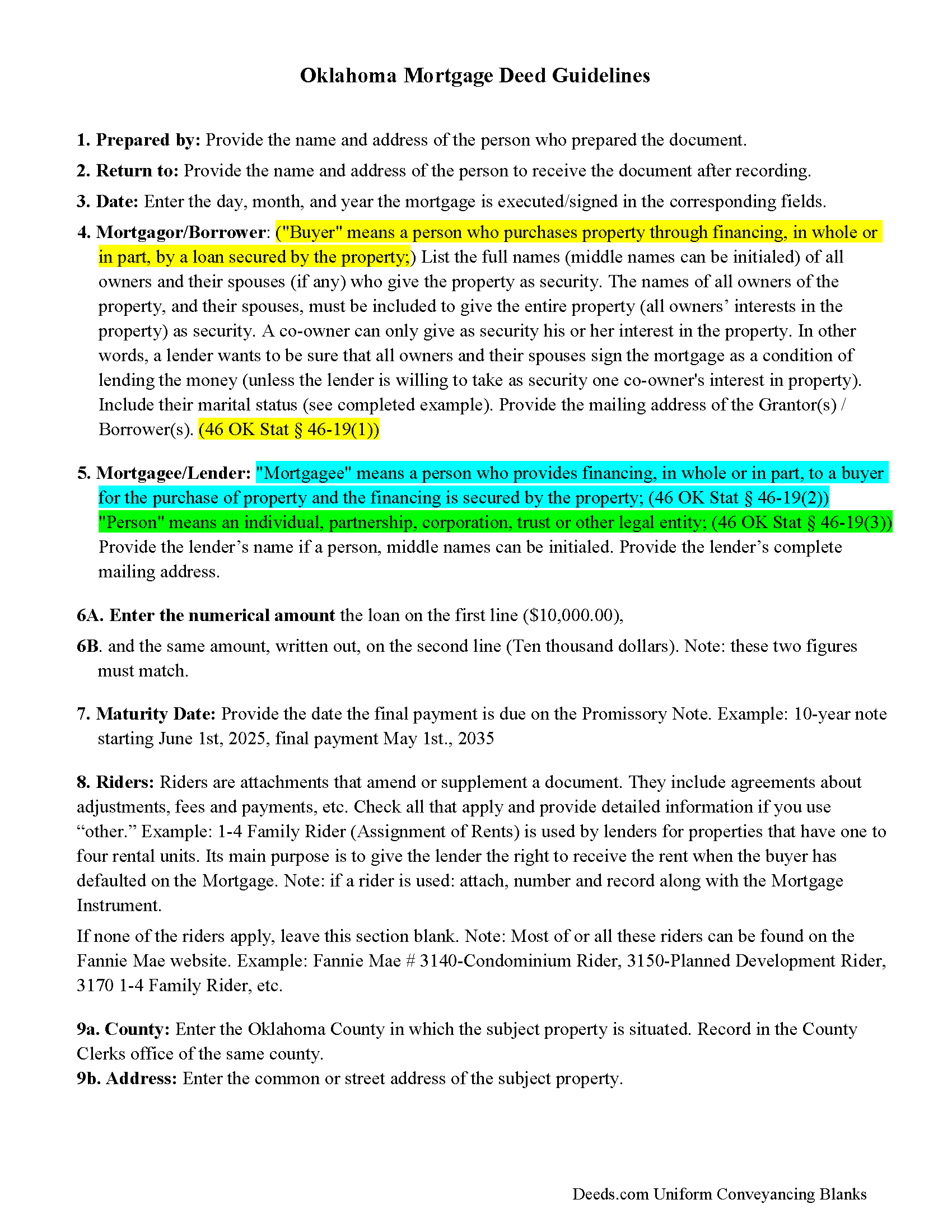

Mortgage Guidelines

Line by line guide explaining every blank on the form.

Included Kay County compliant document last validated/updated 10/17/2024

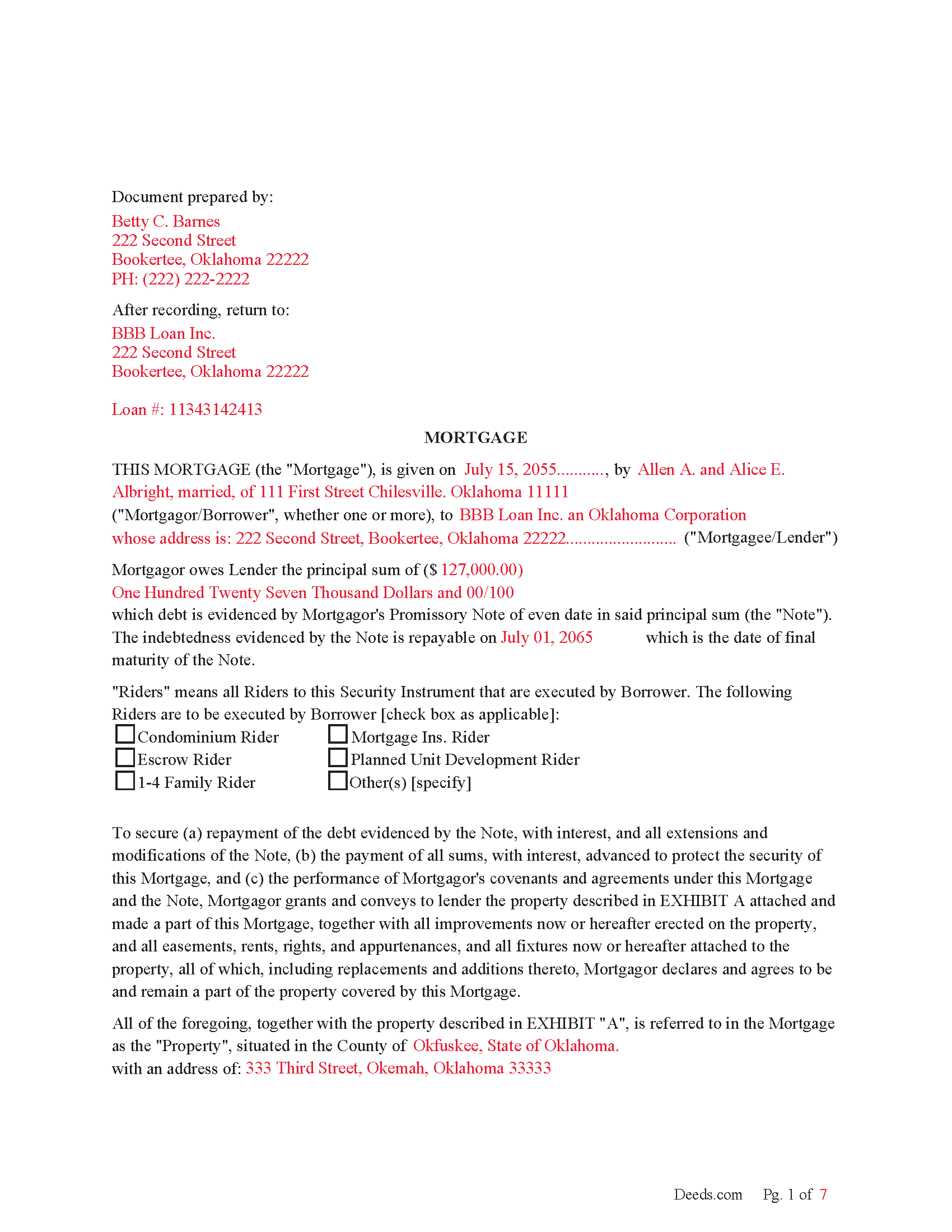

Completed Example of the Mortgage Document

Example of a properly completed form for reference.

Included Kay County compliant document last validated/updated 12/5/2024

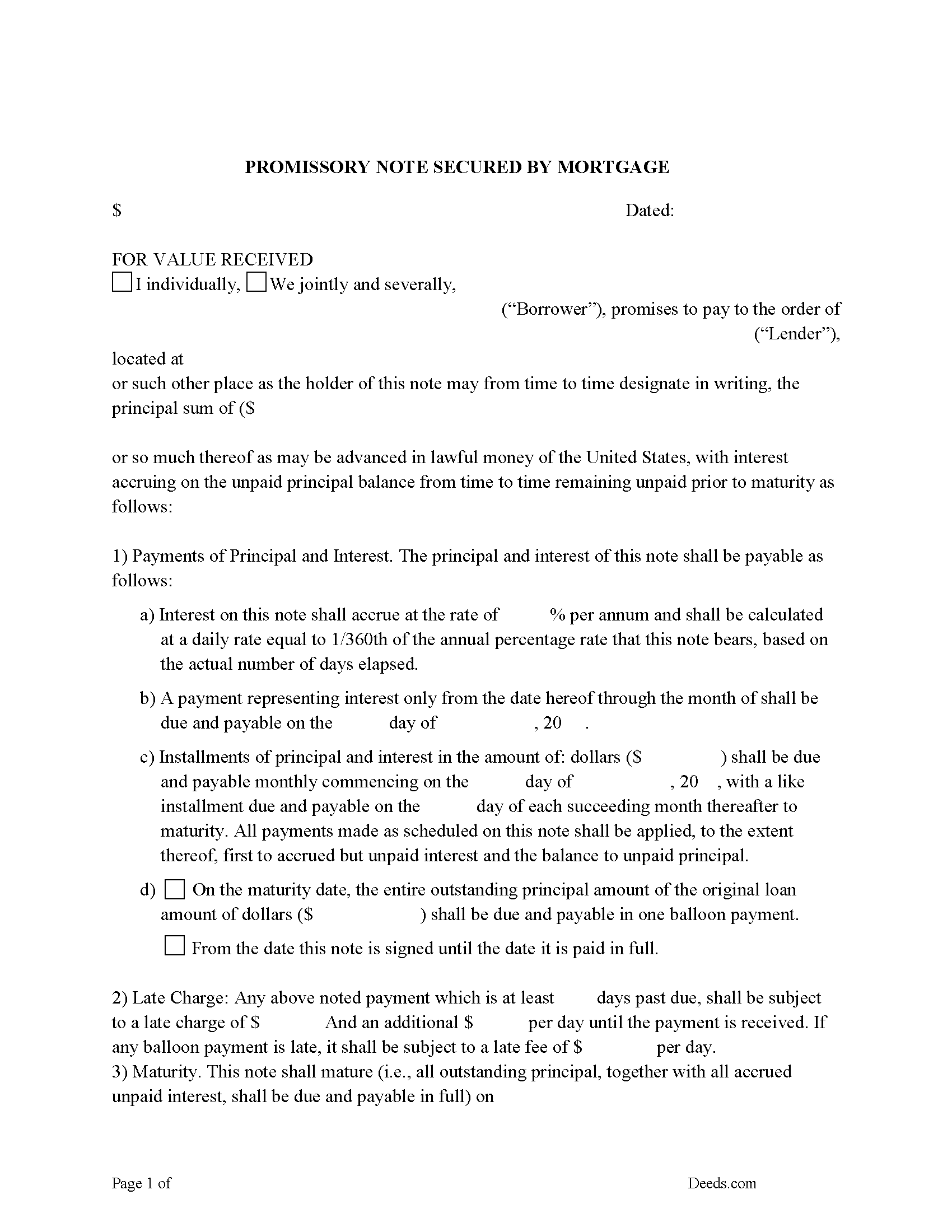

Promissory Note Form

Note that is secured by the Mortgage. Can be used for traditional installments or balloon payment.

Included Kay County compliant document last validated/updated 10/25/2024

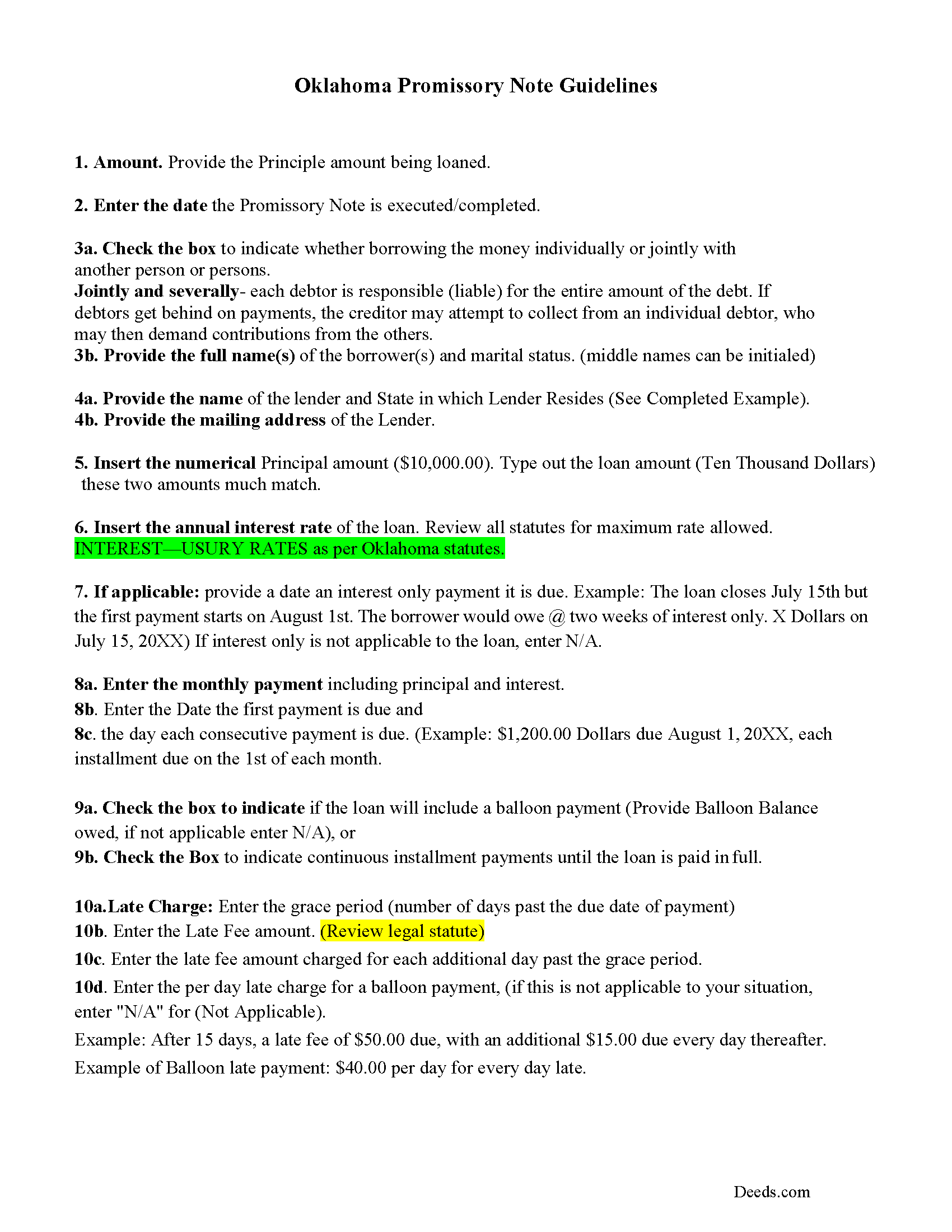

Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Included Kay County compliant document last validated/updated 12/19/2024

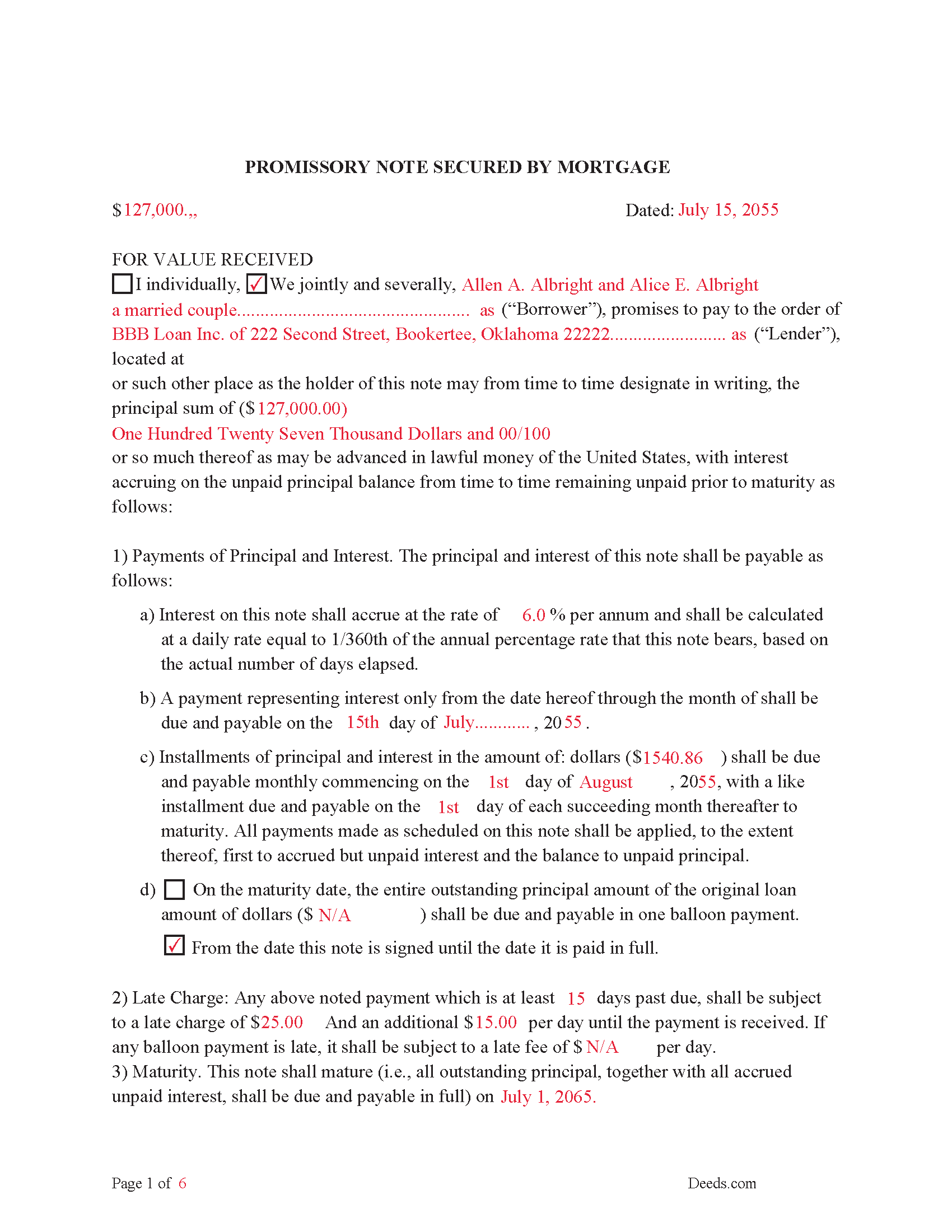

Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

Included Kay County compliant document last validated/updated 8/15/2024

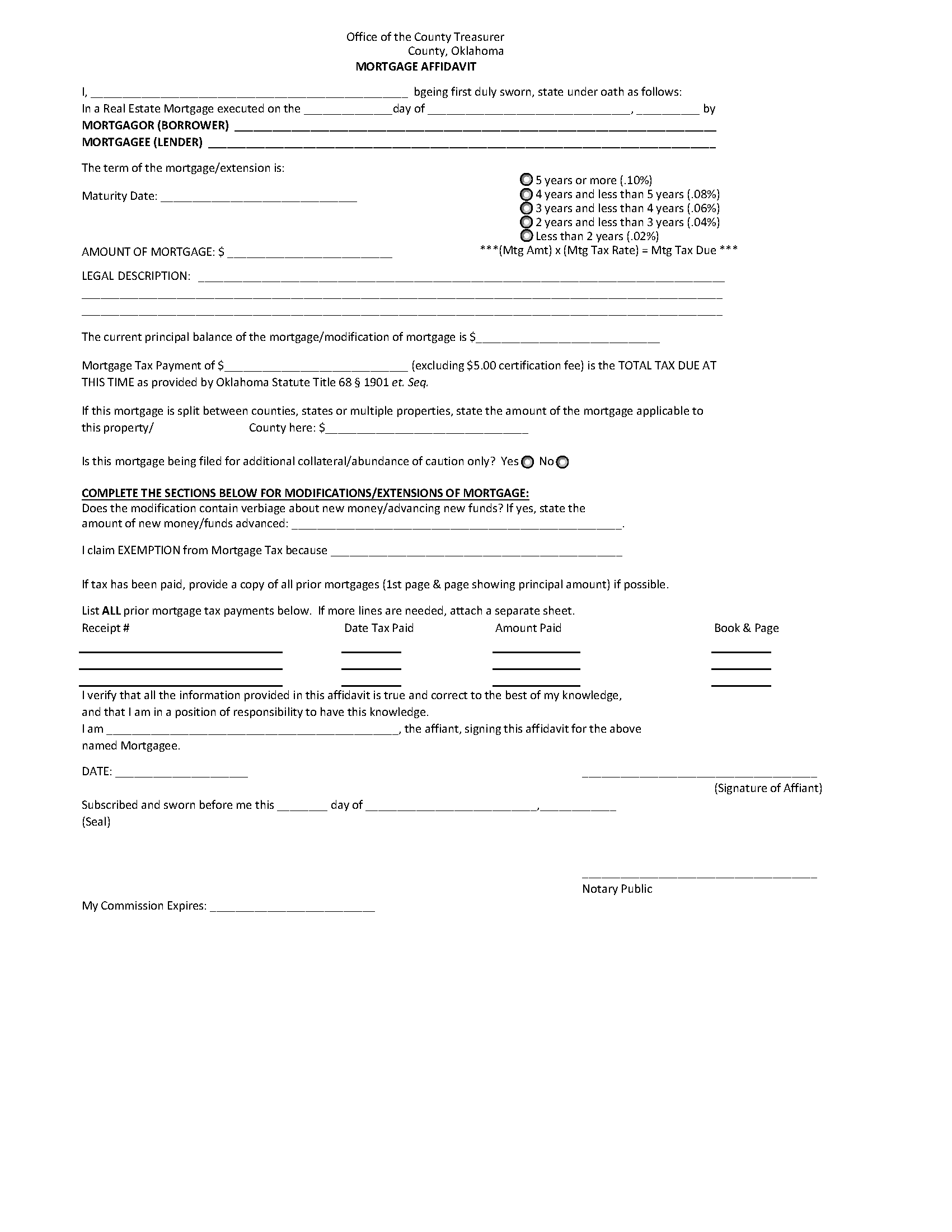

Mortgage Affidavit Form

Mortgage Tax Affidavit

Included Kay County compliant document last validated/updated 11/21/2024

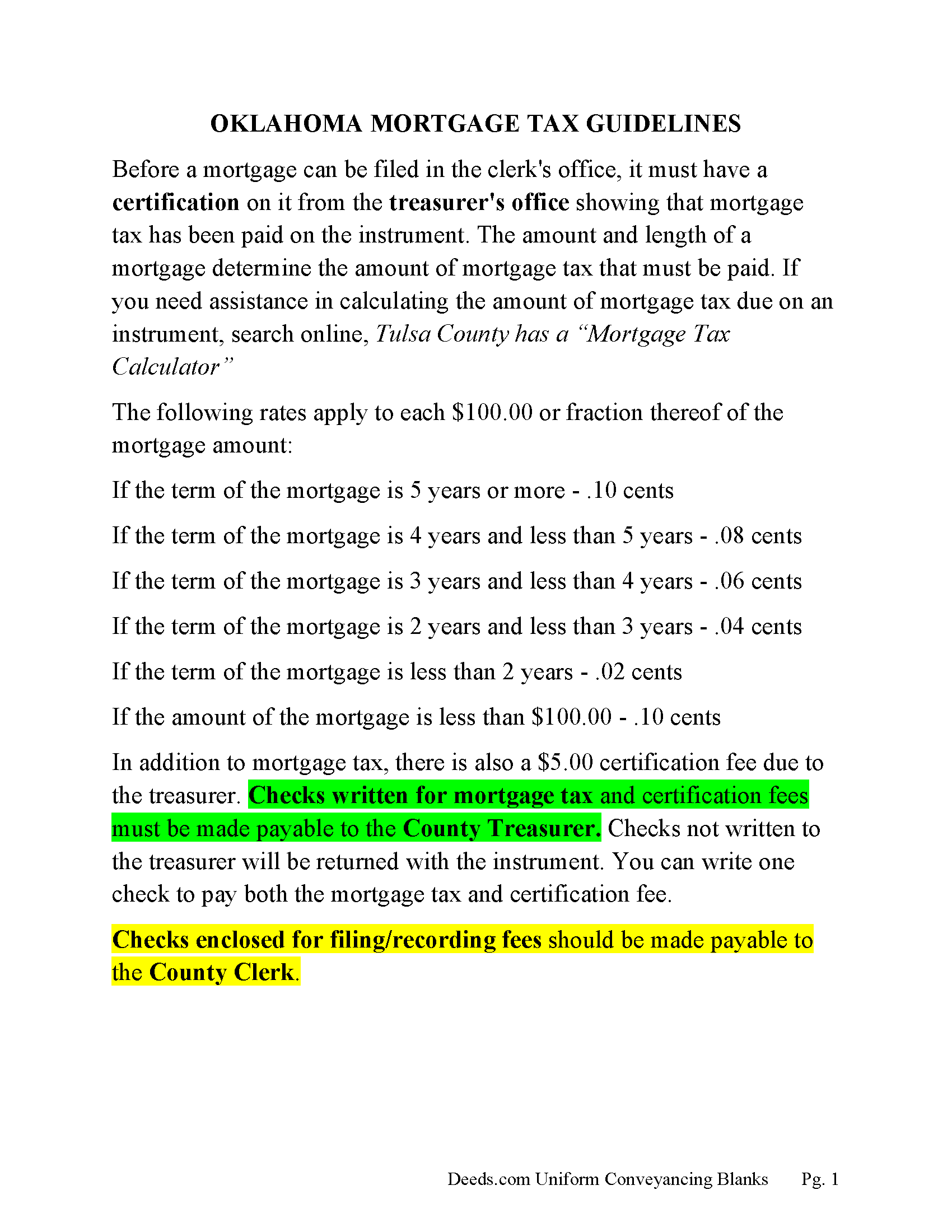

Mortgage Affidavit Information

Information explaining exemptions, how and where to pay mortgage tax.

Included Kay County compliant document last validated/updated 11/25/2024

Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

Included Kay County compliant document last validated/updated 4/25/2024

The following Oklahoma and Kay County supplemental forms are included as a courtesy with your order:

When using these Mortgage and Promissory Note forms, the subject real estate must be physically located in Kay County. The executed documents should then be recorded in the following office:

Kay County Clerk

201 South Main St / PO Box 450, Newkirk, Oklahoma 74647

Hours: 8:00 to 4:30 Monday through Friday

Phone: (580) 362-2537

Local jurisdictions located in Kay County include:

- Blackwell

- Braman

- Kaw City

- Nardin

- Newkirk

- Ponca City

- Tonkawa

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Kay County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Kay County using our eRecording service.

Are these forms guaranteed to be recordable in Kay County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kay County including margin requirements, content requirements, font and font size requirements.

Can the Mortgage and Promissory Note forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Kay County that you need to transfer you would only need to order our forms once for all of your properties in Kay County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Oklahoma or Kay County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Kay County Mortgage and Promissory Note forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Mortgages are liens against property when the property owner borrows money from a lending institution or individual. This form can be used for residential, rentals, small commercial, vacant land and planned unit developments. This form contains a power of sale clause which allows for a non-judicial foreclosure in the event of default.

(2. with respect to any mortgage in which a power of sale is granted: a. the mortgage shall state in bold and underlined language, substantially the following:

"A power of sale has been granted in this mortgage. A power of sale may allow the mortgagee to take the mortgaged property and sell it without going to court in a foreclosure action upon default by the mortgagor under this mortgage,") ( 46 OK Stat 46-43) Many lenders prefer a mortgage with power of sale, it can save time and expense if a foreclosure occurs.

Secured by the mortgage is a promissory note (promise to pay) form. The obligations of Borrower to Lender under this Note and the Additional Obligations heroin remain in full force and effect until Lender has received payment in full of all obligations. The note establishes, interest rates, default rates, late payments, balloon payments, maturity, etc. along with default terms and conditions. The form is County specific and the provisions thereof and all rights and obligations of the parties shall be governed by and construed in accordance with the internal laws of the State of Oklahoma.

A mortgage and promissory note that include power of sale and stringent default terms can be beneficial to the lender.

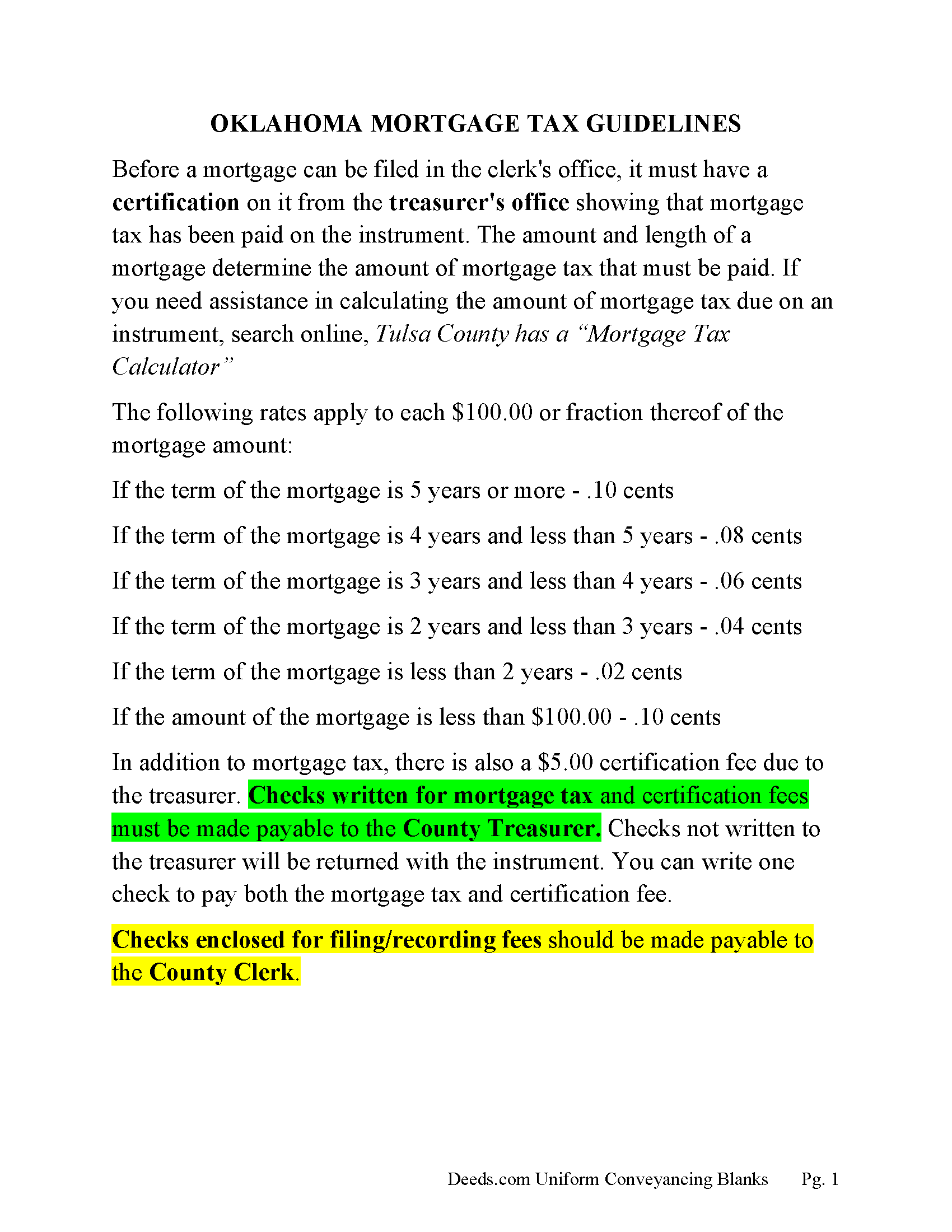

With a few exceptions mortgage tax is due before a mortgage is recorded.

(A. The following taxes are hereby levied on real estate mortgages:

1. A tax of ten cents ($0.10) for each One Hundred Dollars ($100.00) and each remaining fraction thereof where such mortgage is for five (5) years or more;

2. A tax of eight cents ($0.08) for each One Hundred Dollars ($100.00) for each mortgage where such mortgage is for four (4) years or more but less than five (5) years;

3. A tax of six cents ($0.06) for each One Hundred Dollars ($100.00) where such mortgage is for three (3) years or more but less than four (4) years;

4. A tax of four cents ($0.04) for each One Hundred Dollars ($100.00) where such mortgage is for two (2) years or more but less than three (3) years; and

5. A tax of two cents ($0.02) for each One Hundred Dollars ($100.00) where such mortgage is for less than two (2) years.

If the principal debt or obligation secured by the mortgage is less than One Hundred Dollars ($100.00), a tax of ten cents ($0.10) shall be levied on such mortgage and shall be collected and paid as provided for in this article.

B. In addition to the taxes levied pursuant to the provisions of subsection A of this section, the county treasurer shall collect a fee of Five Dollars ($5.00) on each mortgage presented to the county treasurer for certification. The fees collected pursuant to the provisions of this subsection shall be deposited into a cash account to be known as the "County Treasurer's Mortgage Certification Fee Account". Monies from the account shall be expended by the county treasurer in the lawful operation of the treasurer's office.

C. The tax provided for in subsection A of this section may be paid by the mortgagor, the mortgagee or any other interested party.) (68 OK Stat 68-1904)

Included are a mortgage tax information affidavit form and guidelines sheet, providing pertinent information on how to file.

(Oklahoma Mortgage Package includes forms, guidelines, and completed examples) For use in Oklahoma only.

Our Promise

The documents you receive here will meet, or exceed, the Kay County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kay County Mortgage and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JOHN L.

November 17th, 2020

Not just good, very good. Very intuitive and very responsive. It just works!

Thank you for your feedback. We really appreciate it. Have a great day!

LEON S.

November 16th, 2019

recorded deed space to small for corrective deed requirement

Thank you for your feedback. We really appreciate it. Have a great day!

Audra M.

December 28th, 2020

It was easy to e-record and will/would recommend it to everyone.

Thank you for your feedback. We really appreciate it. Have a great day!

Bobby V.

October 30th, 2019

Great

Thank you!

Carmen C.

August 23rd, 2021

Hassle free, easy access to form and instructions include on how to complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lucinda L.

December 29th, 2021

mostly good; however, you need to update the annual exclusion gift amount from $14,000 to $15,000 (where it has ben for several years), and you need to make your Gift Deed final paragraph be gender neutral like "they" or "he or she" rather than just"he". We women lawyers and our women clients appreciate that.

Thank you for your feedback. We really appreciate it. Have a great day!

Lynn H.

January 12th, 2023

A very informative WEB site. It was simple to access the forms I needed for my specific situation. I would highly recommend Deeds.com.

I will be back with future needs when they arise! I was left with a very positive impression.

Thank you so much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alexis B.

December 31st, 2018

Highly Pleased- Strongly Recommend Deeds.com Long review... sorry:-) Originally I was very skeptical due to the enormous amount of the scams going on now days and the number of online sources that "claim" to provide you with deed forms for free or for a few. Nothing that you need and want done is free. There is always a cost. So luckily I came across deeds.com. This was the only site that appeared to be simple, to the point, and made no crazy promises. So before selecting this site, I did a little more checking around/price checking to ensure I am getting the best price for the product I needed. I even checked Staples and Amazon to find that they do indeed sell these forms but I do not think the products they provide are specific for my state and county. They claim their forms provided are for all states but my state is specific and I prefer to have forms provided by Deeds.com that is based on Indiana statute that Deed.com clearly identifies on each form. Deeds.com price of $20 seemed a little high at first but when I saw the products provided, the $20 cost is more than reasonable and fair. You not only get the deed form specific for my state and my specific "county" but also the other various/supplemental forms that may be required. Being familiar with my state and knowing how tedious and anal my state is on everything, I was pleasantly please to see the info and extra supplemental forms provided. For example, a person new to the State who recently had property deeded to them, would not necessarily know about the Homestead tax exemption provided if property is your primary residents, over 65 exemption etc. I would highly recommend this site for anyone needing these documents because Deeds.com has you covered on any and all forms/info you could ever need! A bonus is that there is one flat fee and not monthly cost that you have to worry about canceling later unless you superficially select a monthly package. I love the fact that Deeds.com is nothing fancy. There is not a bunch of elaborate graphics etc. They only provide what you need and what they provide is very accurate. Deeds.com has a customer for life.

Thank you so much Alexis. We appreciate you, have a fantastic day.

Robert S.

December 21st, 2018

Were unable to help me because of the recorders office but credited my account promptly

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis O.

August 22nd, 2020

Everything I needed plus more. Great service!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Dana G.

July 22nd, 2021

This service is WONDERUL. I spent 14 years trying to get a deed recorded properly. Deeds.com kept submitting and resubmitting after corrections until it was finally accepted. They did in one day what I couldn't get done in 14 years!

Thank you!

Benjamin A.

November 27th, 2019

This method seems simple for me to complete. Wish me luck.

Thank you for your feedback. We really appreciate it. Have a great day!