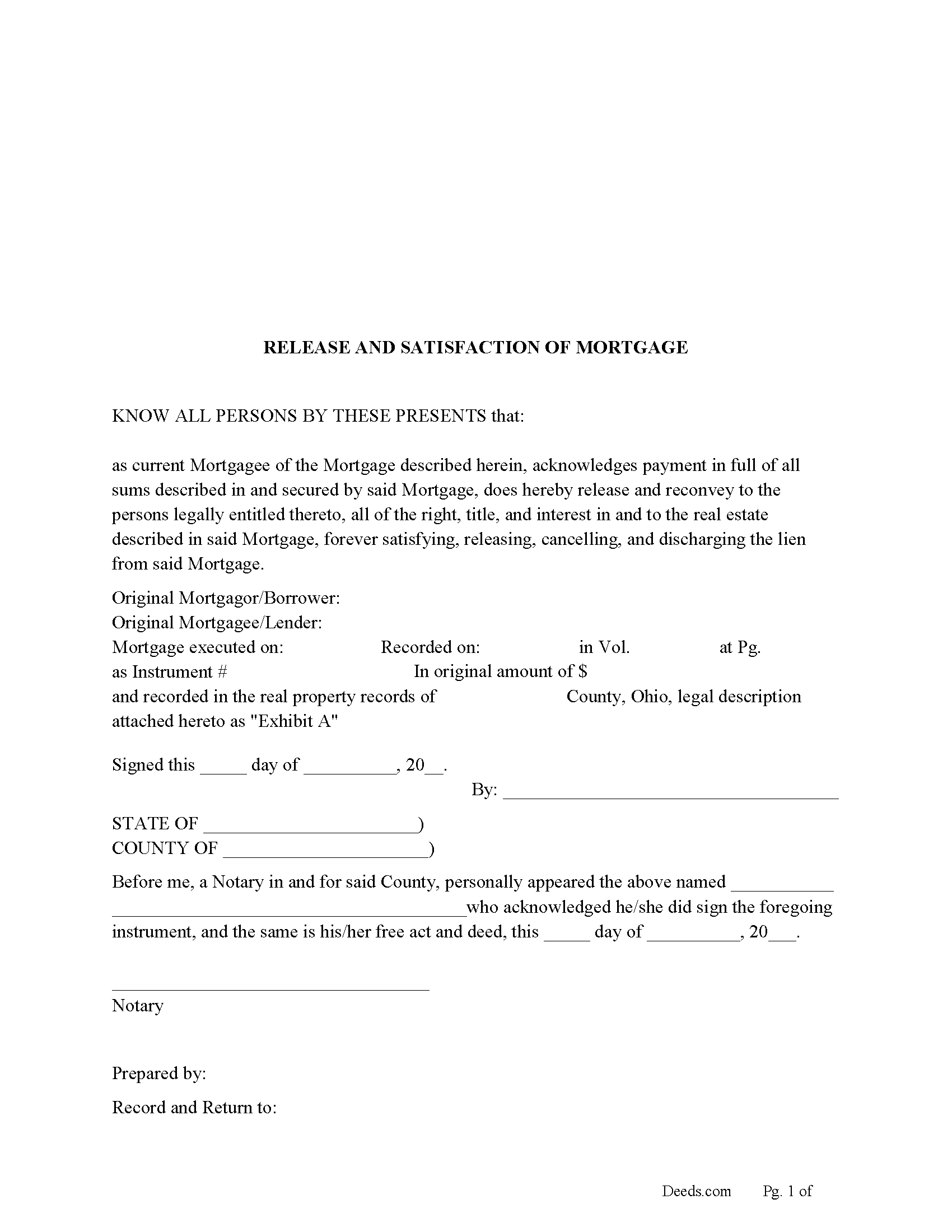

Download Ohio Release and Satisfaction of Mortgage Legal Forms

Ohio Release and Satisfaction of Mortgage Overview

Use this form to release a mortgage when it has been fully satisfied/paid in full. Ohio also allows marginal notations on the existing mortgage which also serves as a release. Some counties only allow the recording of separate instruments, such as a "release of mortgage" form or an original mortgage instrument bearing the proper endorsement. This form is considered a release by (separate instrument).

(5301.28 Release of mortgage - assignment.)

(When the mortgagee of property within this state, or the party to whom the mortgage has been assigned, either by a separate instrument, or in writing on that mortgage, or on the margin of the record of the mortgage, which assignment, if in writing on the mortgage or on the margin of the record of the mortgage, need not be acknowledged, receives payment of any part of the money due the holder of the mortgage, and secured by the mortgage, and enters satisfaction or a receipt for the payment, either on the mortgage or its record, that satisfaction or receipt, when entered on the record, or copied on the record from the original mortgage by the county recorder, will release the mortgage to the extent of the receipt. In all cases when a mortgage has been assigned in writing on that mortgage, the recorder shall copy the assignment from the original mortgage upon the margin of the record of the mortgage before the satisfaction or receipt is entered upon the record of the mortgage.)

(In a county in which the county recorder has determined to use the microfilm process as provided by section 9.01 of the Revised Code, the county recorder may require that all satisfactions of mortgages be made by separate instrument. The original instrument bearing the proper endorsement may be used as such a separate instrument. That separate instrument shall be recorded in the county recorder's official records. The county recorder shall charge the fee for the recording as provided by section 317.32 of the Revised Code for recording mortgages.)

Example: releasing a mortgage in Geauga County, Ohio.

- Mortgage Release (By separate instrument)

Must have Mortgage Volume and Page number.

Notary and Prepared By.

Legal description is NOT required.

Fee: $38.00 for the first 2 pages (includes one marginal notation) + $8.00 each additional page.

$4.00 for each additional marginal notation.

- Mortgage Release (On original Mortgage)

Must be signed and dated by Lender.

Fee: $38.00.

A marginal satisfaction may require the mortgagee/lender going to the County Recorder's Office in person.

NOTE- review county specific recording fees, most counties charge $34.00 for the first two pages + $8.00 each additional page.

In general, the mortgagee has 90 days in which to record a release to avoid damages up to $5,000.00.

A mortgage may also be release by certificate.

(A mortgage shall be discharged upon the record of the mortgage by the county recorder when there is presented to the county recorder a certificate executed by the mortgagee or the mortgagee's assigns, acknowledged as provided in section 5301.01 of the Revised Code, or when there is presented to the recorder a deed of release executed by the governor as provided in section 5301.19 of the Revised Code, certifying that the mortgage has been fully paid and satisfied. In addition to the discharge on the records by the county recorder, such certificate shall be recorded in the official records kept by the county recorder. The county recorder is entitled to the fees for such recording as provided by section 317.32 of the Revised Code for recording deeds.) (5301.34 Release of mortgage on certificate of mortgagee or assignee.)

(Ohio Release of Mortgage Package includes form, guidelines, and completed example)