Fairfield County Gift Deed Form (Ohio)

All Fairfield County specific forms and documents listed below are included in your immediate download package:

Gift Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Fairfield County compliant document last validated/updated 11/25/2024

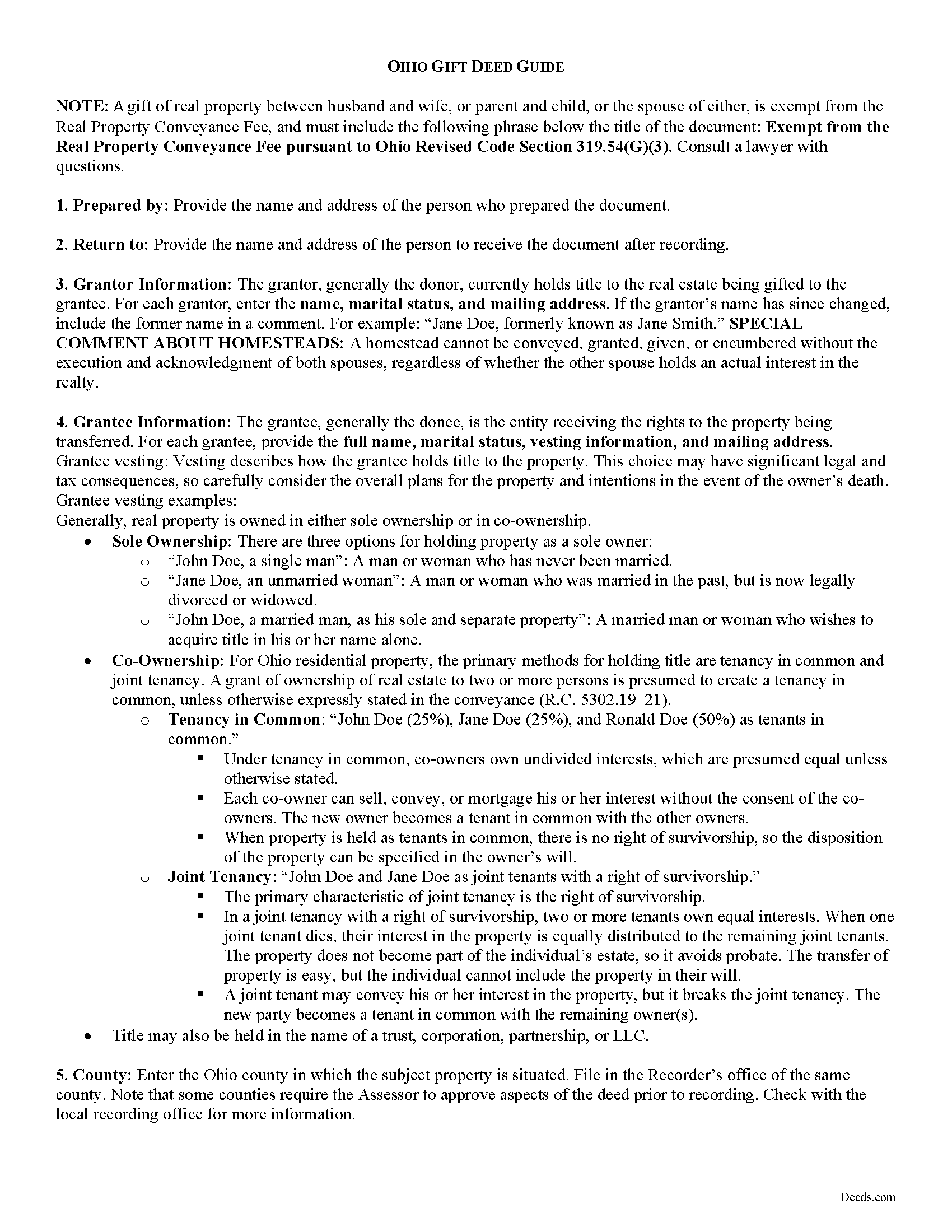

Quit Claim Deed Guide

Line by line guide explaining every blank on the form.

Included Fairfield County compliant document last validated/updated 9/20/2024

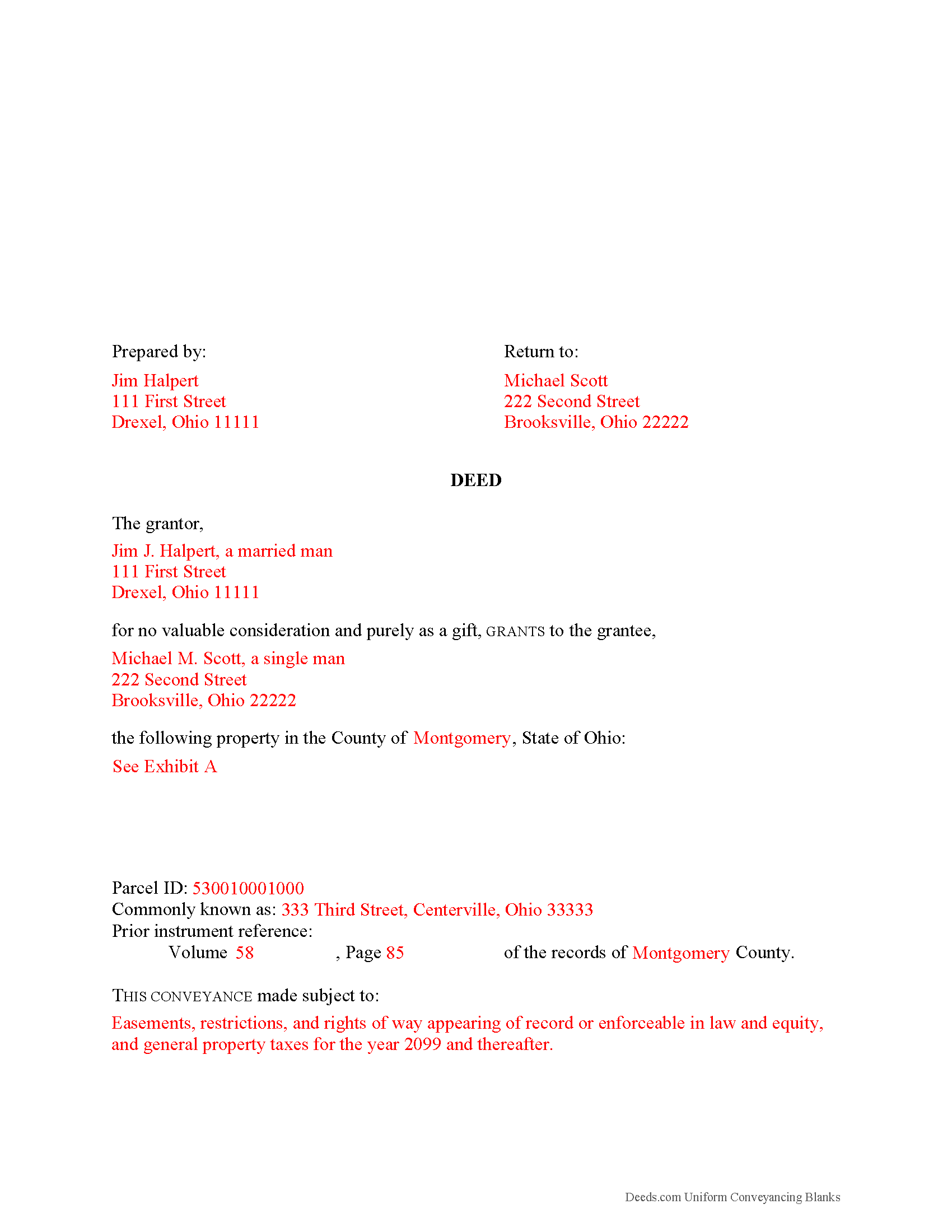

Completed Example of the Gift Deed Document

Example of a properly completed form for reference.

Included Fairfield County compliant document last validated/updated 12/13/2024

The following Ohio and Fairfield County supplemental forms are included as a courtesy with your order:

When using these Gift Deed forms, the subject real estate must be physically located in Fairfield County. The executed documents should then be recorded in the following office:

Fairfield County Recorder

210 E Main St, Rm 205 , Lancaster, Ohio 43130

Hours: 8:00 to 4:00 M-F

Phone: 740-652-7100

Local jurisdictions located in Fairfield County include:

- Amanda

- Baltimore

- Bremen

- Carroll

- Hideaway Hls

- Lancaster

- Lithopolis

- Millersport

- Pickerington

- Pleasantville

- Rushville

- Stoutsville

- Sugar Grove

- Thurston

- West Rushville

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Fairfield County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Fairfield County using our eRecording service.

Are these forms guaranteed to be recordable in Fairfield County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Fairfield County including margin requirements, content requirements, font and font size requirements.

Can the Gift Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Fairfield County that you need to transfer you would only need to order our forms once for all of your properties in Fairfield County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Ohio or Fairfield County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Fairfield County Gift Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Gifts of Real Property in Ohio

Gift deeds convey title to real property from one party to another with no exchange of consideration, monetary or otherwise. Often used to transfer property between family members or to gift property as a charitable act or donation, these conveyances occur during the grantor's lifetime. Gift deeds must contain language that explicitly states that no consideration is expected or required. Ambiguous language, or references to any type of consideration, can make the gift deed contestable in court.

A lawful gift deed includes the grantor's full name, marital status, and mailing address, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Ohio residential property, the primary methods for holding title are tenancy in common and survivorship tenancy. An estate conveyed to two or more people is considered a tenancy in common, unless a survivorship tenancy is declared (Ohio Rev. Code Section 5302.20(a)).

As with any conveyance of realty, a gift deed requires a complete legal description of the parcel. Contact the county auditor to verify the legal description prior to recording. In Ohio, any deeds that modify a legal description or contain a new legal description require the name and address of the surveyor who created the legal description (Ohio Rev. Code Section 5301.25(B)). All new metes and bounds descriptions prepared by a registered surveyor must be accompanied by a signed and sealed plat of survey.

Ohio law requires deeds to include a reference to the instrument granting title to the current grantor (Ohio Rev. Code Section 5301.011). That document's volume and page or instrument number should appear on the face of the deed, as well as the county where the document is filed.

Ohio recognizes dower rights, which means that if a married man or woman owns an interest in real property, his or her spouse automatically holds an interest in 1/3 of the real property, if they have not relinquished or been barred from it (Ohio Rev. Code Section 2103.02). As such, if the grantor is married and his or her spouse retains dower rights to the property being conveyed, the spouse must relinquish his or her dower rights. If applicable, the spouse's name should appear on the face of the deed. Consult a lawyer with questions regarding dower rights and release.

Detail any restrictions associated with the property and sign the deed in the presence of a notary public or other authorized official. Submit the deed to the appropriate county auditor's office prior to recording so that the owner's name can be transferred on the county's tax list (Ohio Rev. Code Section 319.20). Record the deed at the recorder's office in the county where the property is located for a valid transfer. Contact the same office to confirm accepted forms of payment. A Conveyance Fee Statement (Form DTE 100, or DTE 100EX if claiming an exemption) must be signed by the grantee and filed with the deed.

With gifts of real property, the recipient of the gift (grantee or donee) is not required to declare the amount of the gift as income, but if the property accrues income after the transaction, the grantee is responsible for paying the requisite state and federal income tax [1].

In Ohio, there is no state gift tax, but gifts of real property are subject to the federal gift tax. The person or entity making the gift (grantor or donor) is responsible for paying the federal gift tax; however, if the donor does not pay the gift tax, the donee (grantee) will be held liable [1]. For questions regarding state and federal tax laws, consult a tax specialist.

In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. This means that gifts valued below $15,000 do not require a federal gift tax return (Form 709). However, if the gift's value could possibly be disputed by the IRS, a donor may benefit from filing a Form 709 [2].

(Ohio Gift Deed Package includes form, guidelines, and completed example) This article is provided for informational purposes only and is not a substitute for legal advice. Contact an Ohio lawyer with any questions related to the transfer of real property.

[1] http://msuextension.org/publications/FamilyFinancialManagement/MT199105HR.pdf

[2] https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes

Our Promise

The documents you receive here will meet, or exceed, the Fairfield County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Fairfield County Gift Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Camille L.

January 20th, 2022

very user friendly!

Thank you!

Allan S.

September 19th, 2024

Using this sofftware was a piece of cake!rnDonload was fast and simple. Using the guide supplied I did the Beneficiary Deed in no time.rnWould certainly use this service again without hesitation.rn

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

steven L.

April 8th, 2020

download was fast and easy. if no problems with county recorder i will give 5 stars

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Helen A.

April 11th, 2022

Well not sure yet since I have only downloaded these forms but I read the reviews and this helped me determine if I will use your web site. I will gladly give a good review if this form serves me well!!!

Thank you for your feedback. We really appreciate it. Have a great day!

James V.

July 9th, 2020

Easy, quick and very proficient. I am glad I used Deeds.

Thank you!

Linda T.

November 18th, 2022

All downloaded now I just have to fill them out.

Will let you know how it does.

Thanks for the service.

Linda

Thank you for your feedback. We really appreciate it. Have a great day!

Joyce S.

November 5th, 2021

I am very pleased with Deeds.com. I have every form and information I need to meet Legal requirements. Thank You!

Thank you for your feedback. We really appreciate it. Have a great day!

Michael R.

April 11th, 2023

This process was so easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kerry H.

January 31st, 2019

Good experience - Just what I needed

Thank you Kerry, have an awesome day!

Kristi L.

May 11th, 2021

Fantastic Experience! I have been through several different companies offering to do the same thing but only offering subscriptions. I have no negative reviews, took 1 business day from submission, professional and timely updates and extremely fair pricing considering the amount of time it saves you.

Thank you!

Patricia J.

October 31st, 2021

No word "Download" so had a little trouble figuring out how to download, but finally figured it out.

Thank you for your feedback. We really appreciate it. Have a great day!

Katherine W.

January 24th, 2019

I was impressed by the completeness of the package of forms PLUS instructions. Particularly helpful is the filled in sample, which enables you to see what a correct, completed deed ought to look like.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!