Washington County Disclaimer of Interest Form (Ohio)

All Washington County specific forms and documents listed below are included in your immediate download package:

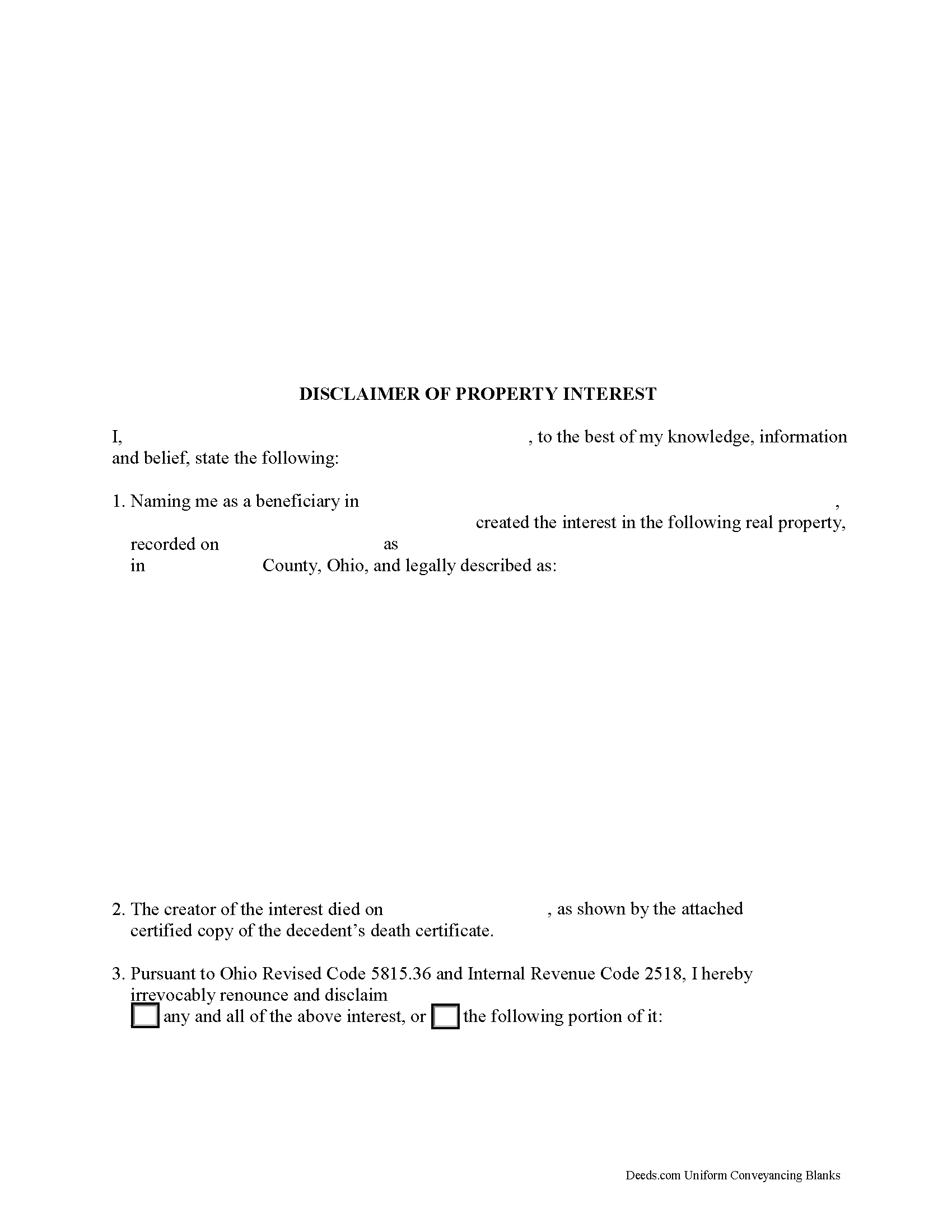

Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Washington County compliant document last validated/updated 12/18/2024

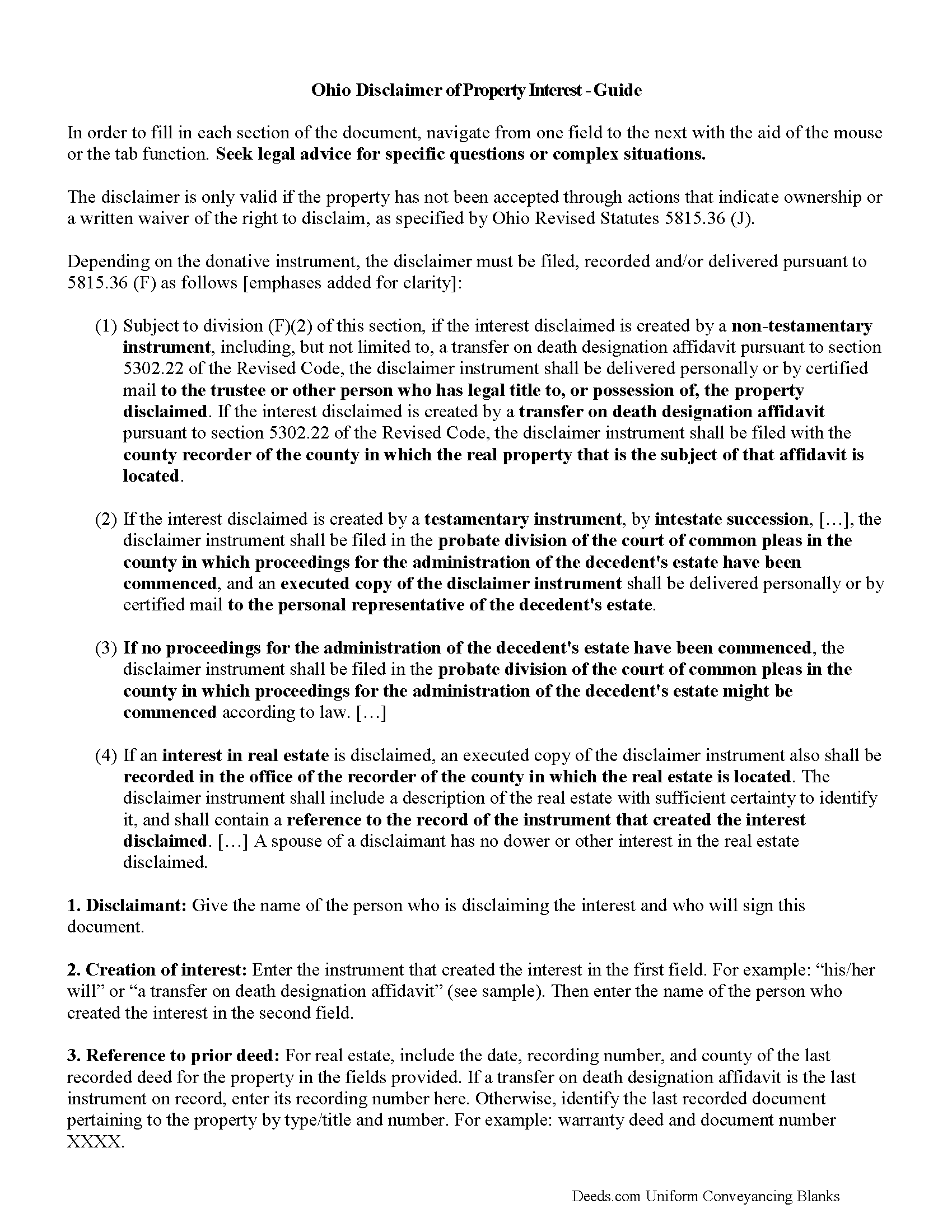

Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

Included Washington County compliant document last validated/updated 12/10/2024

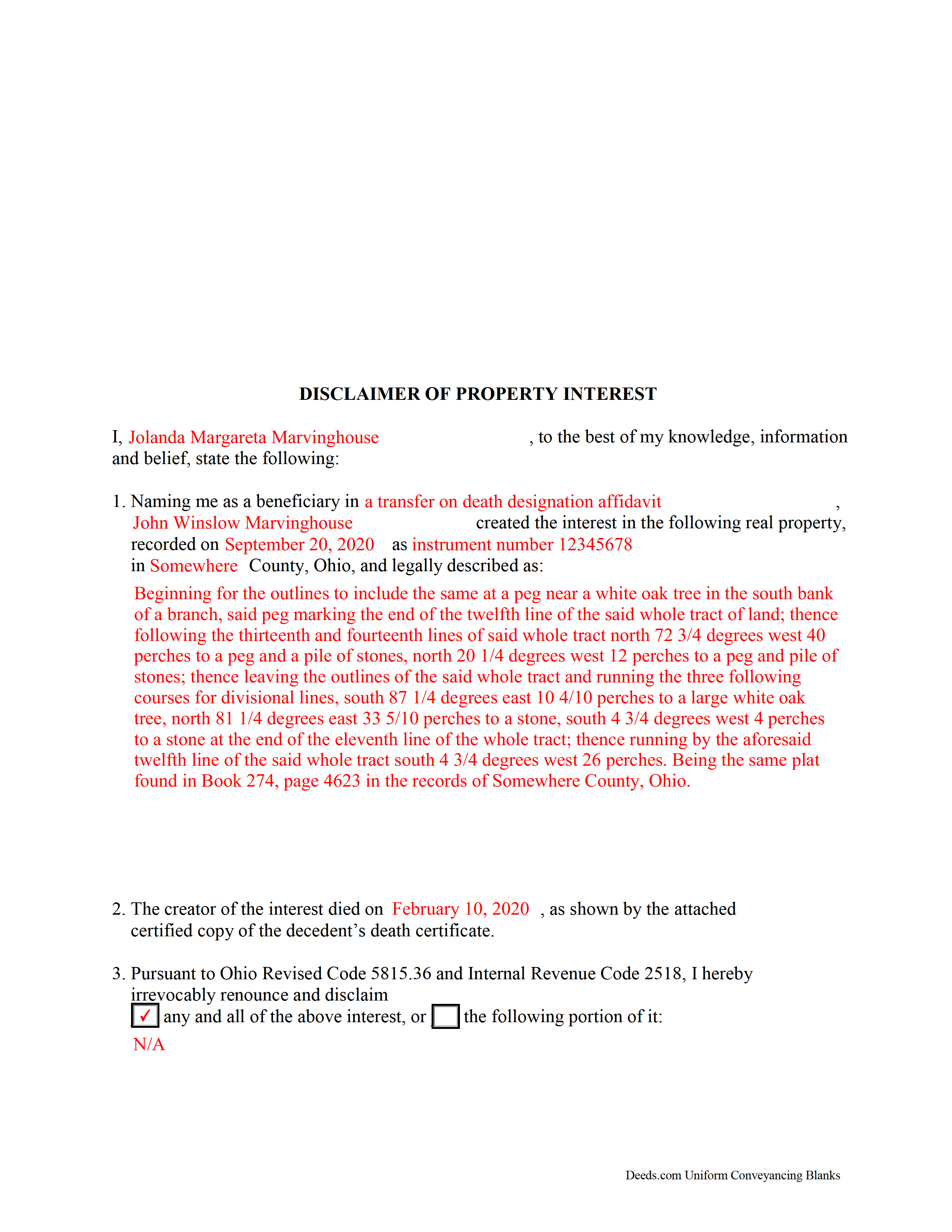

Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

Included Washington County compliant document last validated/updated 11/26/2024

The following Ohio and Washington County supplemental forms are included as a courtesy with your order:

When using these Disclaimer of Interest forms, the subject real estate must be physically located in Washington County. The executed documents should then be recorded in the following office:

Washington County Recorder

Courthouse - 205 Putnam St, Marietta, Ohio 45750

Hours: 8:00am to 5:00pm Monday through Friday / Recording until 4:15pm

Phone: 740-373-6623 Ext 235 or 236

Local jurisdictions located in Washington County include:

- Barlow

- Bartlett

- Belpre

- Beverly

- Coal Run

- Cutler

- Fleming

- Graysville

- Little Hocking

- Lowell

- Lower Salem

- Macksburg

- Marietta

- New Matamoras

- Newport

- Reno

- Vincent

- Waterford

- Watertown

- Whipple

- Wingett Run

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Washington County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Washington County using our eRecording service.

Are these forms guaranteed to be recordable in Washington County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Washington County including margin requirements, content requirements, font and font size requirements.

Can the Disclaimer of Interest forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Washington County that you need to transfer you would only need to order our forms once for all of your properties in Washington County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Ohio or Washington County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Washington County Disclaimer of Interest forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

A beneficiary of an interest in property in Ohio can disclaim all or part of a bequeathed interest in, or power over, that property under Ohio Revised Code 5815.36, as long as it has not been accepted through actions that indicate ownership or through a written waiver of the right to disclaim (Sec. J).

The written disclaimer must identify the donative instrument, which is the document that established the interest, such as a will or a transfer on death designation affidavit. The disclaimer also must contain a description of the disclaimed interest and a declaration of the disclaimer and its extent (Sec. B (3)). It must be signed by the disclaimant or a legally authorized representative

Depending on the donative instrument, the disclaimer must be filed, recorded and/or delivered pursuant to 5815.36 Sec. F as follows.

* If the interest is created by a non-testamentary instrument, including a transfer on death designation affidavit, the disclaimer must be delivered to the trustee or other person who holds legal title or possession of the property.

* In the case of an interest in real estate a transfer on death designation affidavit, the disclaimer must be filed with the recorder of the county in which the real property is located.

* If the interest is created by a testamentary instrument or by intestate succession, file the document in the probate division of the court of common pleas in the county in which proceedings for the administration of the decedent's estate have been commenced. In addition, deliver in person or send by certified mail an executed copy of the disclaimer instrument to the personal representative of the decedent's estate.

* If the interest is in real estate, execute a copy of the disclaimer and submit in the office of the recorder of the county in which the property is situated.

The Ohio statute is consistent with the Internal Revenue Code Section 2518, which requires that the disclaimer must be received no later than 9 months after the transfer is made (e.g. date of death). In order to be effective, the disclaimer must be irrevocable and binding to the disclaimant and all who claim under him or her (Sec. E). Be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property.

(Ohio Disclaimer of Trust Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Washington County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Washington County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4446 Reviews )

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Cathy S.

October 15th, 2022

Great forms! Repeat customer here, wouldn't go anywhere else.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deborah G.

June 4th, 2019

Great website and very easy to use

Thank you for your feedback Deborah, we really appreciate it. Have a great day!

Patricia C.

December 29th, 2021

Deeds.com saved me time and research by offering a beneficiary deed and full instructions for filling it out. My home will now pass directly to my only son without probate. This form and other complimentary forms was an excellent value.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert H.

April 18th, 2020

I am very pleased with your service.

Thank you!

Elizabeth J.

May 17th, 2019

It is very good and I would use the site again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

George D.

August 23rd, 2020

The TODD form has been notarized and registered with my county Register of Deeds office, so it works just fine.

My only quibble is that when I printed it out, it missed part of the last line of the notary's info and the fine print in the bottom corners. When I printed it at 90% scale, it included those things.

Thank you for your feedback. We really appreciate it. Have a great day!

Pamela B.

November 23rd, 2019

Fantastic system, so easy to use even for a simpleton like me.

Thank you!

Kimberly H.

April 24th, 2020

Very convenient, easy to use, and fast! I highly recommend Deeds.com!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JACQUELINE R.

March 23rd, 2021

We have been waiting for a Title Company to put a release of Lien together for the past 3 months. I figured it was taking way to long and decided to use template here instead. In less than hour I was able to add all the information on the template and provide forms to our Seller to use. We were buying and he didnt think they were necessary. But I refused to pay him in full until he agreed to sign papers at the bank, and of course in front of a notary. We turned around and filed the Release of lien paperwork at County Clerks office, we officially own our house. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

ROBERT W.

June 30th, 2019

Very good service .I recommend it if you need your documentation on a weekend or when offices are closed.Very fast service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dean L.

October 29th, 2019

The template isn't that easy to work with, with you have to type out large amounts of text. Also copy and paste doesn't seem to work. Furthermore, the code listed on the guide is out of date. However, the DQC is decent in that it has all the required fields you need.

Thank you for your feedback. We really appreciate it. Have a great day!

Ebony L.

July 14th, 2022

Very pleased with deeds.com. I highly recommend them to anyone, from clueless beginners like myself to the more advanced. Thank you for simplifying this process.

Thank you for your feedback. We really appreciate it. Have a great day!