Hocking County Correction Deed Form (Ohio)

All Hocking County specific forms and documents listed below are included in your immediate download package:

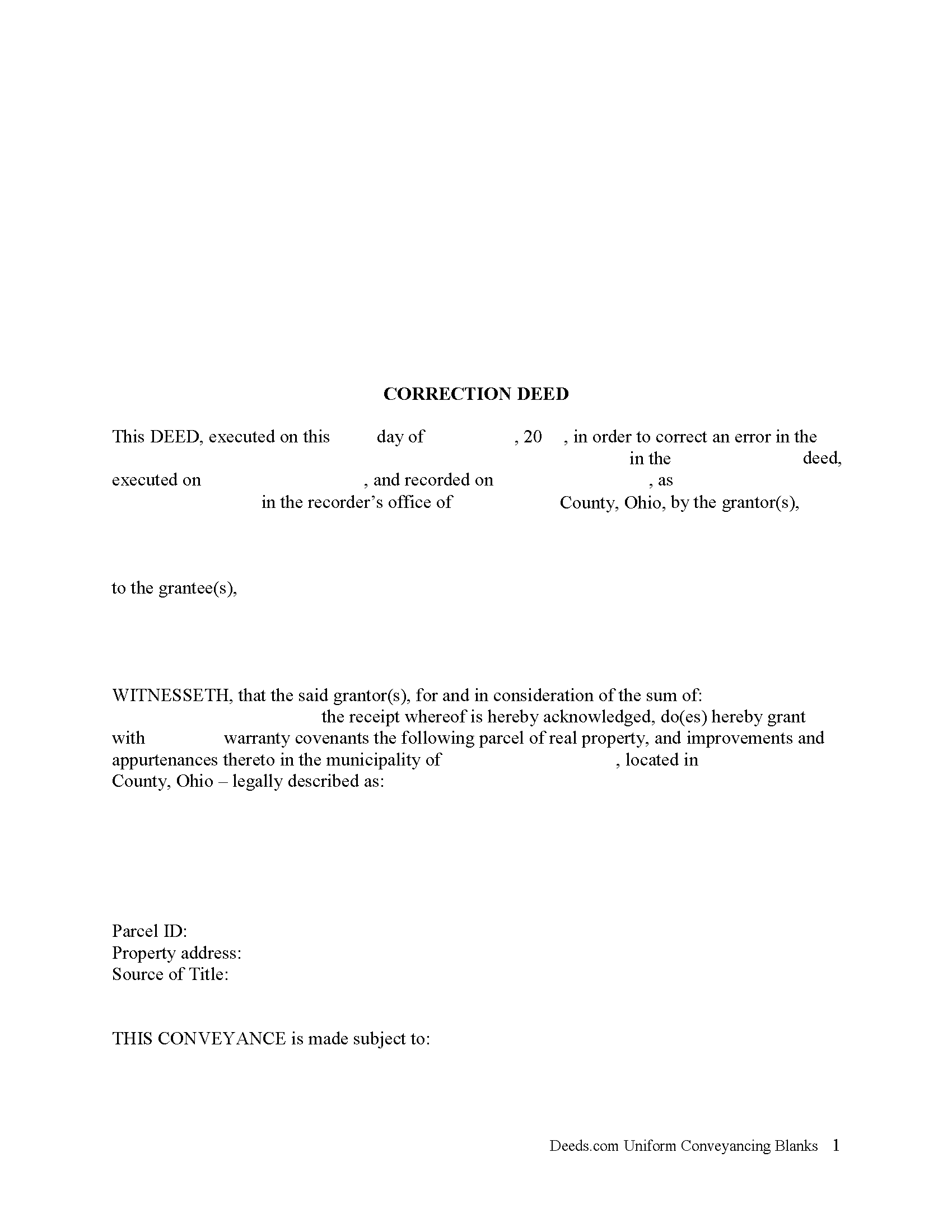

Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Hocking County compliant document last validated/updated 11/19/2024

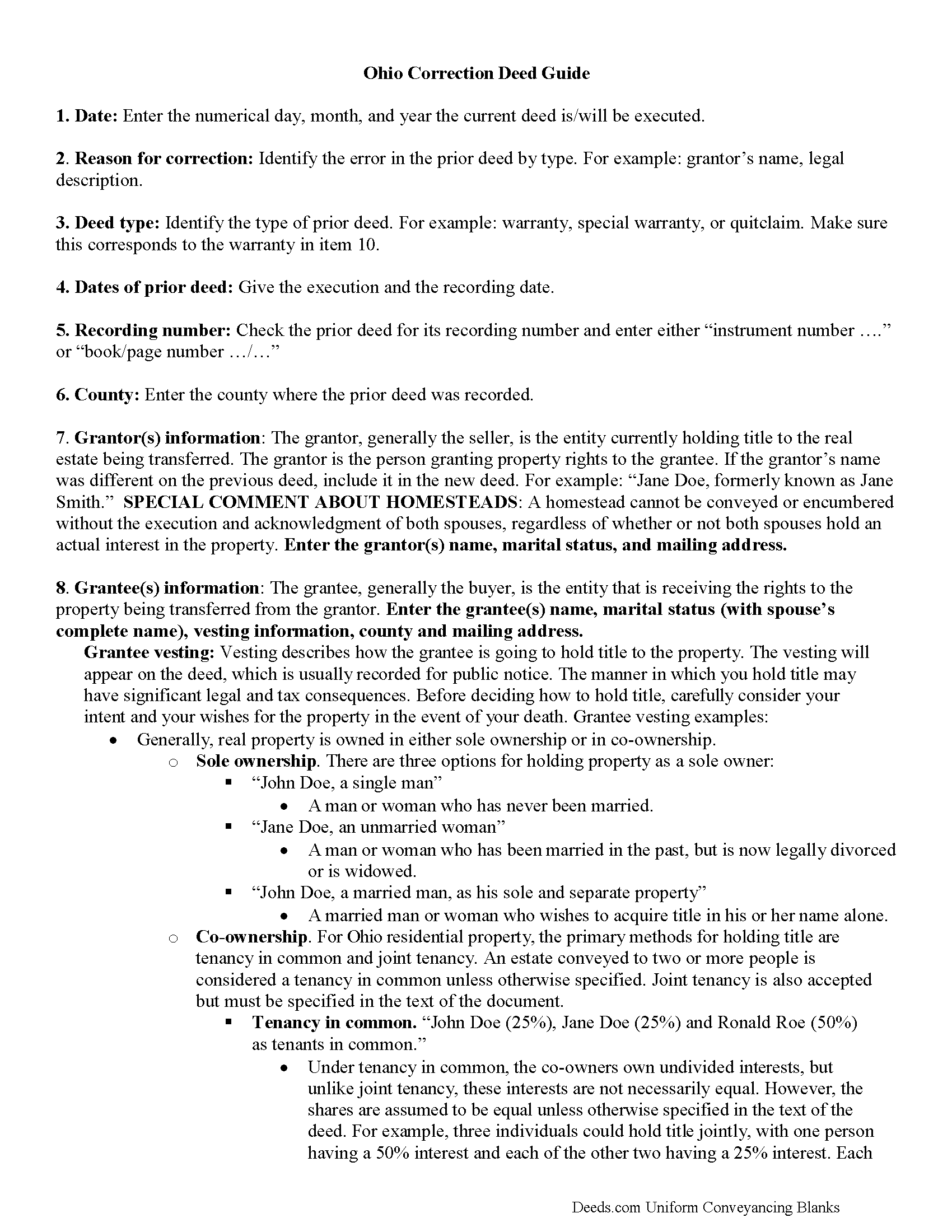

Correction Deed Guide

Line by line guide explaining every blank on the form.

Included Hocking County compliant document last validated/updated 4/23/2024

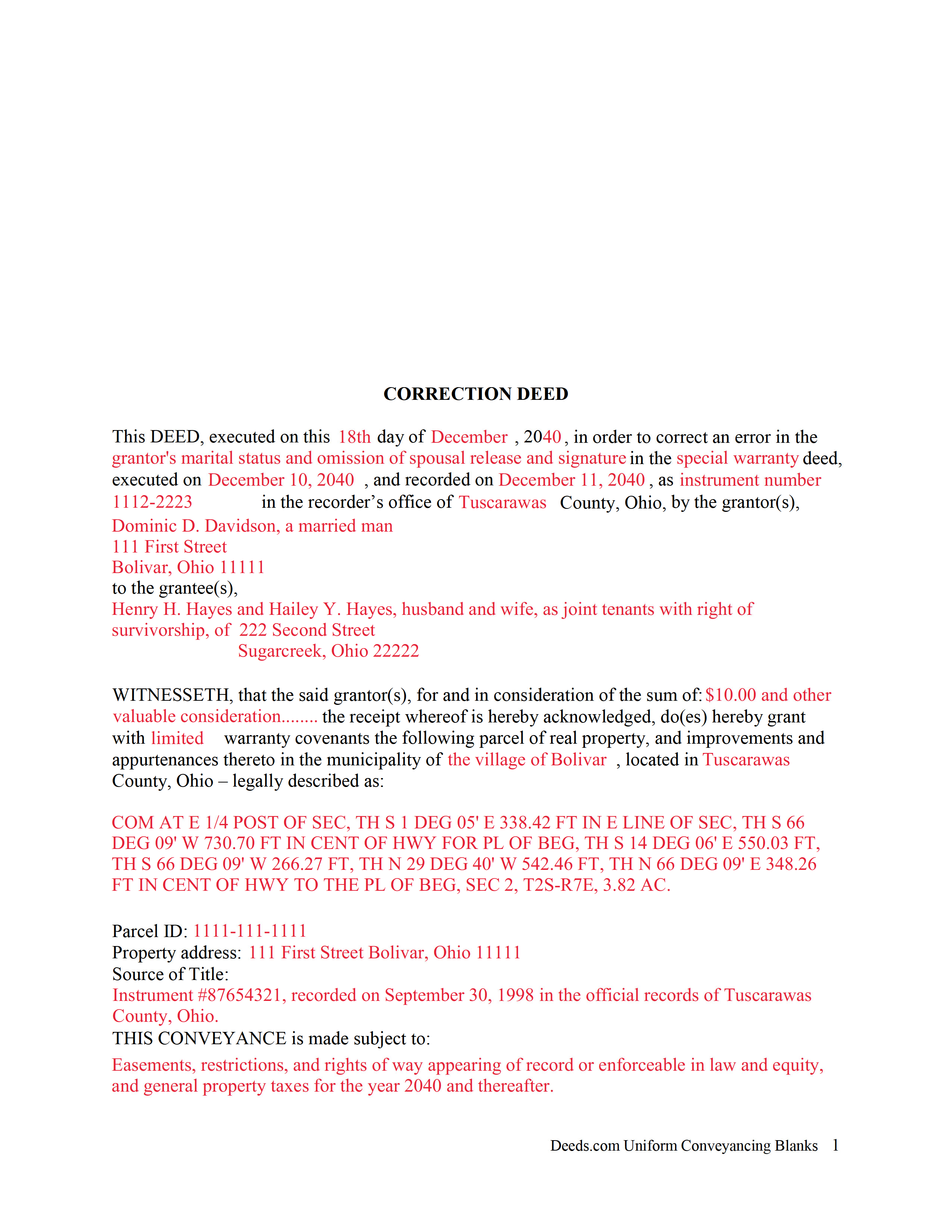

Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

Included Hocking County compliant document last validated/updated 11/11/2024

The following Ohio and Hocking County supplemental forms are included as a courtesy with your order:

When using these Correction Deed forms, the subject real estate must be physically located in Hocking County. The executed documents should then be recorded in the following office:

Hocking County Recorder

1 E Main St / PO Box 949, Logan, Ohio 43138

Hours: 8:30 a.m. - 4:00 p.m. Monday - Friday

Phone: 740-385-2031

Local jurisdictions located in Hocking County include:

- Carbon Hill

- Haydenville

- Laurelville

- Logan

- Murray City

- Rockbridge

- South Bloomingville

- Union Furnace

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Hocking County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Hocking County using our eRecording service.

Are these forms guaranteed to be recordable in Hocking County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hocking County including margin requirements, content requirements, font and font size requirements.

Can the Correction Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Hocking County that you need to transfer you would only need to order our forms once for all of your properties in Hocking County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Ohio or Hocking County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Hocking County Correction Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In Ohio, a deed can be corrected either by re-recording the prior deed with corrections made directly on it, or by recording a new deed, called correction or corrective deed. In both cases, the reason for the correction, the recording number and execution/recording dates need to be stated. The choice between the two options may depend on county preference or the nature of the defect. Correction in general is only effective when it clarifies or completes the title of the prior deed. Altering the nature of the document by means of a correction deed is not advisable.

Thus, correcting the name or missing initial in the grantor's or grantee's name, the grantee's tax address, a minor error in the acknowledgement or even in the legal description can all be achieved through a correction deed. If the grantor re-acknowledges the corrected deed, errors of omission can be resolved as well, as can the marital status and spousal release and more serious errors in the legal description.

The Ohio Bar Association publishes guidelines for title standards and advise to never use a correction deed in order to add or delete a grantee, to make major changes in the legal description, such as a changing the lot number, or to add or delete restrictive covenants or easements. Taking minimal requirements for sufficiency and definiteness as the standard for effective conveyances, they list and explain errors that may not impair the marketability of a title and indicate that "lapse of time, subsequent conveyances, the manifest or typographical nature of errors or omission, accepted rules of construction and other considerations should be relied upon to approve marginally sufficient or questionable descriptions" (Ohio Title Standards, section 3.2, 2012).

In many counties, submit all deeds to the assessor prior to recording. Sometimes, only changes to the legal description need to be approved by the auditor before they can be recorded. The statement of value form DTE 100-EX needs to accompany the correction deed and indicate the reason for exemption. Bear in mind, however, that any changes to the legal description may affect transfer tax assessment. Spend time considering the different outcomes of each option and contact the local authorities, either the recorder's or the auditor's office for specific requirements and practices.

(Ohio Correction Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Hocking County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hocking County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4434 Reviews )

James S.

November 21st, 2024

Forms used, created quitclaim deed that the county accepted without a second look (turns out they see deeds.com forms regularly via erecording and in person). Will be back for any real estate related forms I need and they carry. Will always be my first stop. Also, will use erecording next time, mad I didn't see it this time.

Thanks for the kind words James, glad we could help. Look forward to seeing you again.

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patrick U.

November 9th, 2023

Great product. They processed and transmitted the deed promptly. A small question I had was answered quickly and professionally. I would use again if the need arises and will recommend to friends.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Nick J.

March 16th, 2023

We aimed to handle a survivorship affidavit (deed change) without a lawyer following my dad's death. After some searching, deeds.com seemed to have the most comprehensive and "correct looking" form we could find for our locale, so we went with it, and it was accepted by our recorder's office.

I'm not sure why our local government office doesn't offer a standard form, but they don't, and deeds.com came through for us in a pinch.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William /.

January 10th, 2021

Great service would use again

Thank you!

Terri A.

April 3rd, 2019

So far so good --- I'm helping a friend with her property! Thanks!

Thank you Terri.

Marjorie D.

November 1st, 2021

The process was easy and efficient. I will definitely be using this service!

Thank you for your feedback. We really appreciate it. Have a great day!

Kathy B.

November 24th, 2020

Works easy enough and good directions on the form, however no help when I got locked out. Had to do a completely new account name and email address.

Thank you!

Marion B.

September 2nd, 2023

As far as I know all is in order as far as my transfer on death instrument for Illinois. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Sherri P.

May 6th, 2020

I thought it was easy, but I wish it were faster. I uploaded my document Monday night (after 5pm) and got my invoice the next morning Tuesday paid it right away. and my document was not sent to me as recorded until Wednesday morning even though it was recorded the day earlier at 8:30am. So there was a delay of almost 24 hours letting me know that my document was recorded. So if they could speed that up so that we knew exactly when it got recorded immediately I would give it a million stars

Thank you!

James S.

January 21st, 2019

Order Process: 5 Stars - very easy

Material Received: 2 Stars

Issues:

1. Printing- Document would not print in format displayed. Format would continually shrink to approx 2/3 size thus not useable for formal doc submission to County Records office.

2. Document Format- Data insertion fields (addresses) were not of correct size for data input. I needed a 4 line input space but was limited to only 3 lines. Also, Date field (year) was mis-oriented in-so-much that the 3rd digit (inputted) overlapped on 2nd digit (pre-printed) and also was of noticeably different font.

3. Useability- Hand-written input space provided (for Notary) was deficient in space and spacing. It was a challenge to utilize the space available to complete fully and maintain legibility.

Overall - the document worked marginally as advertised, I did need to re-write the entire document myself. It is a good concept but I'd recommend that Deeds company improve the downloaded forms for actual useability, readability, functionability.

regards,

Jim S

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline G.

May 2nd, 2019

Found just what I needed!!! Instructions were easy to follow and I accomplished the task like a professional. Thank you Deeds.com!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

George S.

June 24th, 2020

Very good, very expensive. I hope that this is what my lawyer needed for us to finish our wills.

George

Thank you!

Elaine S.

April 19th, 2021

Being new at this, the system was somewhat difficult to understand at first. It took a couple of tries before I got it. It seems to be somewhat slow as well. However, it's a wonderful idea to have documents recorded from the comfort of your home, especially in the times that we are in with COVID19. I definitely don't mind paying the fee which I thought was reasonable.

Thank you!