Grand Forks County Transfer of Death Deed Form (North Dakota)

All Grand Forks County specific forms and documents listed below are included in your immediate download package:

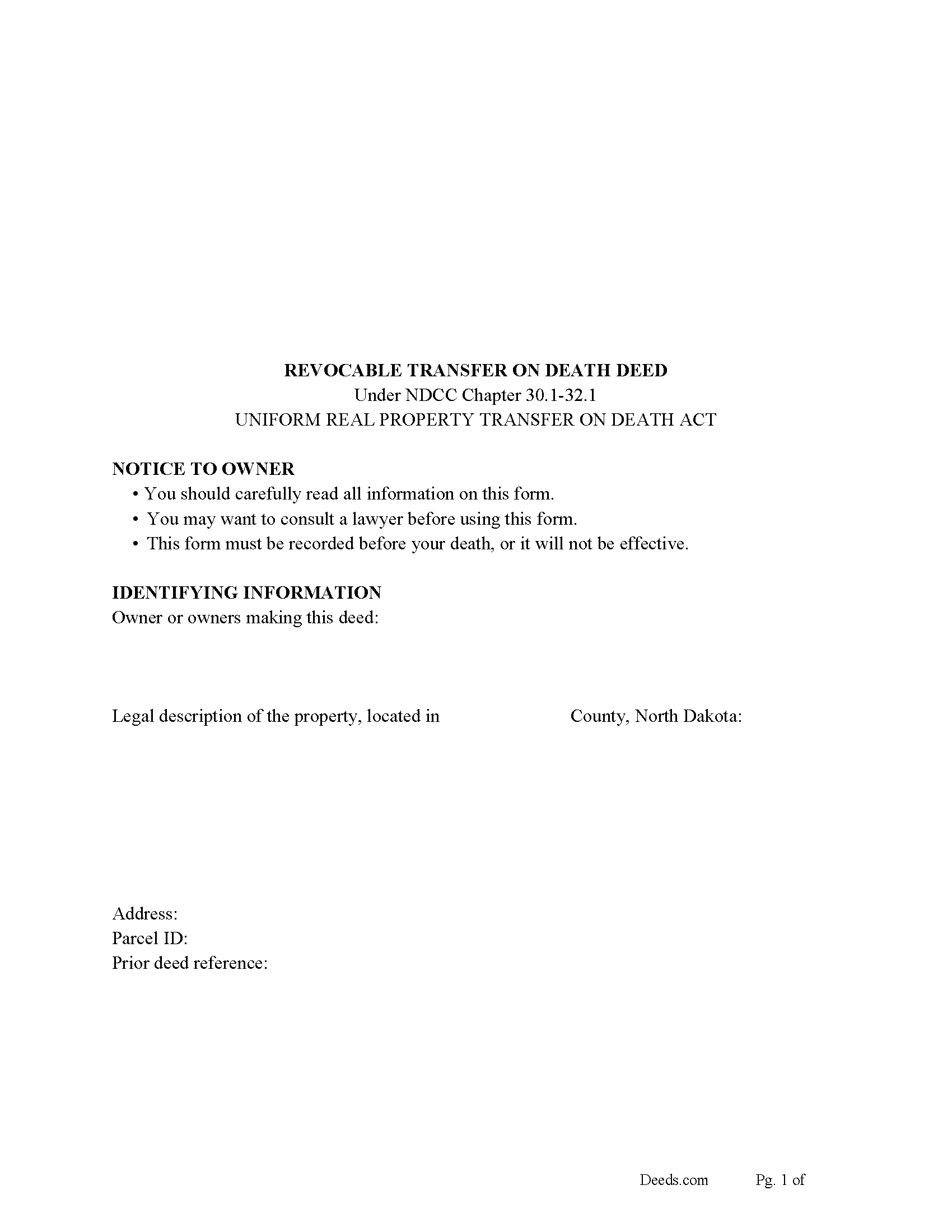

Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Grand Forks County compliant document last validated/updated 10/4/2024

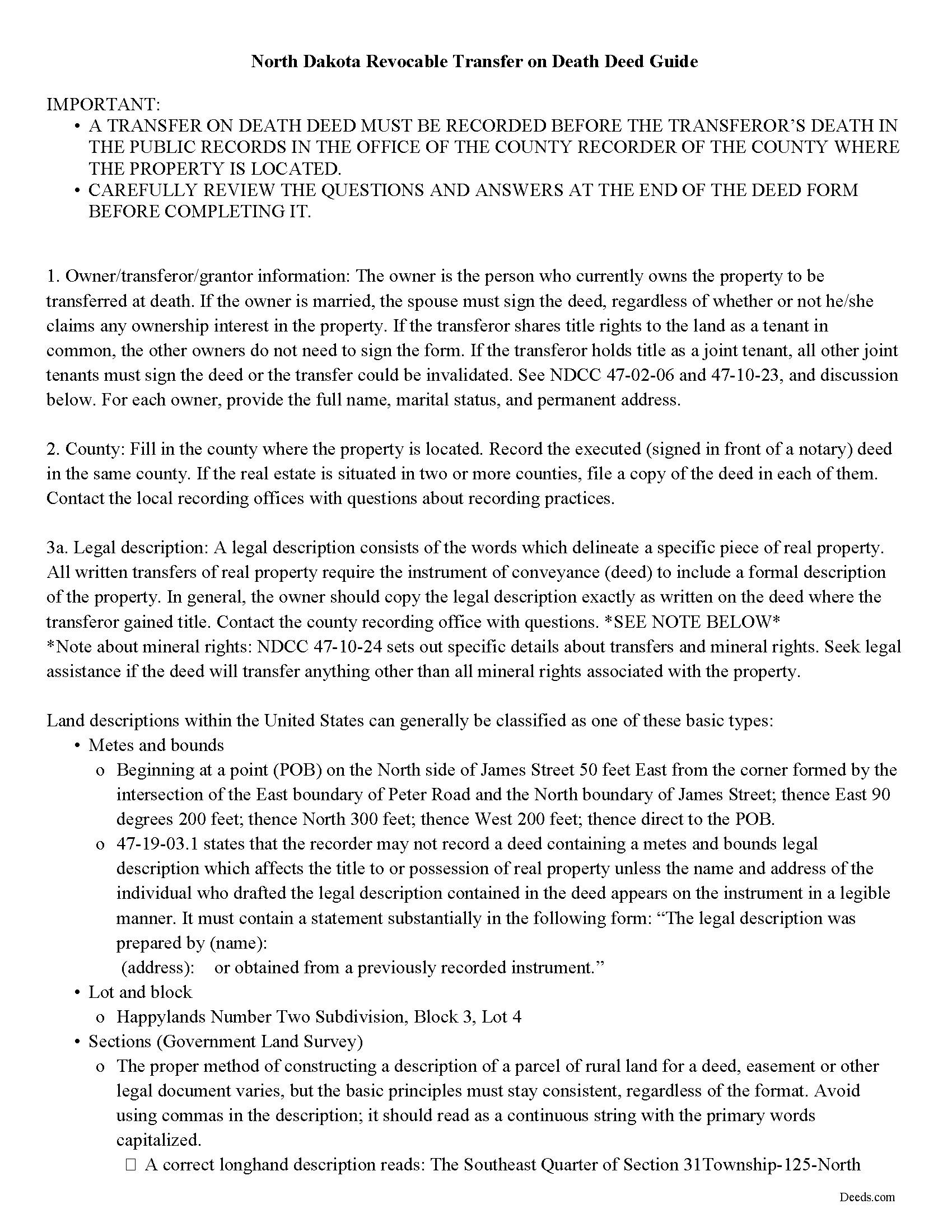

Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

Included Grand Forks County compliant document last validated/updated 11/20/2024

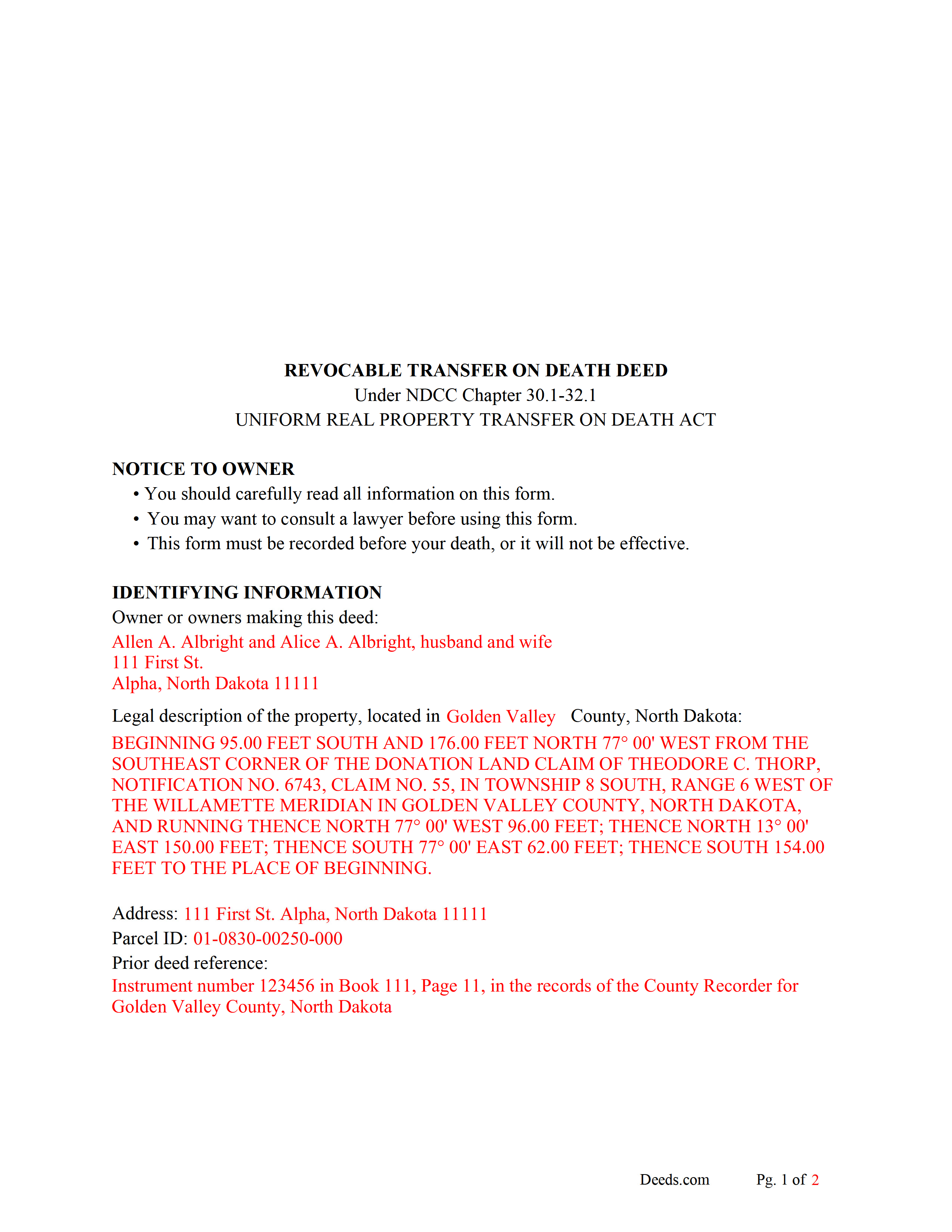

Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

Included Grand Forks County compliant document last validated/updated 12/4/2024

The following North Dakota and Grand Forks County supplemental forms are included as a courtesy with your order:

When using these Transfer of Death Deed forms, the subject real estate must be physically located in Grand Forks County. The executed documents should then be recorded in the following office:

Grand Forks County Recorder

County Office Building - 151 South 4th St / PO Box 5066, Grand Forks, North Dakota 58206-5066

Hours: 8:00 to 5:00 M-F / Recording until 4:30

Phone: (701) 780-8262, 8263, 8261

Local jurisdictions located in Grand Forks County include:

- Arvilla

- Emerado

- Gilby

- Grand Forks

- Grand Forks Afb

- Inkster

- Larimore

- Manvel

- Mekinock

- Niagara

- Northwood

- Reynolds

- Thompson

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Grand Forks County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Grand Forks County using our eRecording service.

Are these forms guaranteed to be recordable in Grand Forks County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Grand Forks County including margin requirements, content requirements, font and font size requirements.

Can the Transfer of Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Grand Forks County that you need to transfer you would only need to order our forms once for all of your properties in Grand Forks County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by North Dakota or Grand Forks County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Grand Forks County Transfer of Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Note that transfer on death deeds must be recorded during the owner's life or they have no effect.

In 2011, North Dakota enacted the Uniform Real Property Transfer on Death Act, found in the North Dakota Century Code (NDCC) at Chapter 30.1-32.1.

According to this statute, owners of North Dakota real property may transfer property to one or more beneficiaries effective, at the transferor's death, by lawfully executing and recording a transfer on death deed in the county or counties where the property is located (NDCC 32.1-02). The instruments must contain all the information required for traditional deeds, as well as a statement that the transfer will occur at the owner's death (30.1-32.1-06).

This transfer is nontestamentary, meaning it is not included in the owner's will (30.1-32.1-04). As a result, it does not require probate distribution. Even so, best practices dictate that the will and any other transfers should not contain any conflicting instructions.

Deeds under this law allow the owners to retain absolute ownership of and control over the land until death, including the ability to cancel or change the beneficiary designation, and to sell the property outright to someone else (30.1-32.1-09). Because the transfer is revocable (30.1-32.1-03), there is no obligation to notify the beneficiary or to collect consideration (money) for the potential future interest (30.1-32.1-07).

When the transferor dies, the beneficiary gains ownership of the property with no warranties of title, and subject to any mortgages, encumbrances, and agreements in place during the owner's life. (30.1-32.1-10).

Overall, transfer on death deeds are a convenient, flexible tool for a comprehensive estate plan.

(North Dakota TODD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Grand Forks County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Grand Forks County Transfer of Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4448 Reviews )

Dorothy N.

December 22nd, 2024

The mortgage and note were thorough and very satisfactory for my purposes. The accompanying forms were excellent. I am very pleased with my purchase.

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Edward E.

December 22nd, 2024

Easy to use.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Robert T.

September 23rd, 2019

Very quick thank you.

Thank you!

Shirley L.

April 19th, 2022

I am very happy with the results of my service received from Deeds.com. I found exactly what I needed in short order. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Joseph S.

November 27th, 2023

THIS IS MY FIRST EXPERIENCE WITH DEEDS.COM. I DLED THE ESTATE DEED FORM THAT I HOPE WILL GO THROUGH OK WITH THE COUNTY. IT WILL BE SOMETIME UNTIL I HAVE IT FILLED IN AND ALL THE NAMES IN, NORARIZED AND FILED. CAN I RECONTACT YOU FOLKS IF THERE IS A PROBLEM? THANK YOU, JOE SEUBERT

We are motivated by your feedback to continue delivering excellence. Thank you!

Larry T.

May 19th, 2023

Excellent service!!!!! A 5STAR

Thanks Larry! We appreciate you.

Lynda D S.

November 2nd, 2022

Sorry, I did not see that I was in the wrong review and just sent a review of a "product" I ordered online.

As for Deeds.com I was very happy with the process and speed of getting the forms.

I have used this site before.

Highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kim K.

December 11th, 2020

Your service was easy to use and fee was reasonable. I would recommend to other lawyers who are in private practice.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eugenia T.

August 9th, 2023

I am the Kent County Recorder of Deeds in Central Delaware. I am impressed by the accuracy of your website. All data you post is correct regarding forms, fees, etc. We have just spent several months researching Property Theft, using many cites from various sources. I just discovered your white paper on this subject, and it is excellent. It also covers a few things we did not, such as house flipping and immigrants. Congratulations!

Thank you for your kind words and thoughtful review! It's an honor to know that our resources have been valuable to the Kent County Recorder of Deeds. Your feedback is particularly meaningful to us, and we are glad that our white paper contributed to your research on Property Theft. We fully support your vital efforts to combat property theft and deed fraud, and if there's anything else we can assist you with or any further insights you'd like to share, please don't hesitate to reach out. Keep up the outstanding work!

Cynthia H.

January 12th, 2019

No review provided.

Thank you!

Shirley W.

August 26th, 2021

I found the form easy to file out. But everything else was confusing with very little direction and help.

Thank you!

Brett T.

July 22nd, 2022

Where have you been my whole life. I will join if I can afford it. Do you have a form for a Private Family Trust Company ....Irrevocable Trust ...Revocable Trust.....send me an email so I will have contact info.

Thank you!

KAREN I.

May 14th, 2024

it worked. fantastic. thanks!

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Susan K.

February 16th, 2019

Very helpful; information included on the form explanations about Colorado laws in regards to beneficiary deeds helped us understand the issues involved.

Thank you for your feedback. We really appreciate it. Have a great day!